“Wall Street Surges: Fed Day 2024 Ignites All Asset Classes”

Introduction

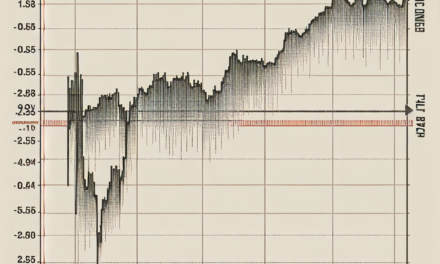

In a remarkable turn of events, Wall Street experienced its strongest Federal Reserve day of 2024, with markets across all asset classes responding positively to the central bank’s latest policy announcements. Investors and analysts had been eagerly anticipating the Fed’s decisions, which were expected to provide crucial insights into the future trajectory of interest rates and economic growth. The Fed’s actions and statements exceeded market expectations, leading to a surge in equities, bonds, and commodities. This market summary delves into the key factors driving the day’s robust performance, highlighting the implications for various sectors and the broader economic outlook.

Impact Of The Fed’s Decision On Wall Street’s Performance

The recent decision by the Federal Reserve has sent ripples across Wall Street, marking the strongest Fed Day of 2024 for all asset classes. Investors and analysts alike have been closely monitoring the Fed’s actions, as its decisions hold significant sway over market dynamics. The central bank’s announcement, which was eagerly anticipated, has had a profound impact on stocks, bonds, and commodities, reflecting the interconnected nature of financial markets.

To begin with, the stock market responded with remarkable enthusiasm. Major indices, including the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite, all experienced substantial gains. This surge can be attributed to the Fed’s decision to maintain interest rates at their current levels, coupled with a cautiously optimistic outlook on economic growth. Investors interpreted this as a signal of stability, prompting a wave of buying activity. Moreover, the Fed’s commitment to supporting economic recovery through accommodative monetary policy has bolstered investor confidence, leading to increased demand for equities.

In addition to equities, the bond market also reacted positively to the Fed’s announcement. Treasury yields, which move inversely to bond prices, saw a slight decline as investors flocked to the relative safety of government securities. The Fed’s assurance that it would continue its bond-buying program provided further support to the bond market, reinforcing the notion that interest rates would remain low for the foreseeable future. This environment of low yields has encouraged investors to seek higher returns in riskier assets, thereby fueling the rally in stocks.

Furthermore, the commodities market was not left untouched by the Fed’s decision. Gold, often seen as a hedge against inflation and economic uncertainty, experienced a modest uptick in prices. The Fed’s stance on maintaining low interest rates has implications for inflation expectations, which in turn influence gold prices. Meanwhile, oil prices also saw an increase, driven by the Fed’s positive economic outlook and the anticipated rise in demand as global economic activity picks up. The interconnectedness of these markets underscores the far-reaching impact of the Fed’s policy decisions.

Transitioning to the broader implications, the Fed’s actions have highlighted the delicate balance it must maintain between fostering economic growth and preventing inflation from spiraling out of control. While the current policy stance has been well-received by markets, it also raises questions about the long-term sustainability of such measures. Investors are keenly aware that any shift in the Fed’s approach could lead to significant market volatility. As such, market participants will continue to scrutinize economic data and Fed communications for any hints of a change in policy direction.

In conclusion, the Federal Reserve’s recent decision has had a pronounced impact on Wall Street, with all asset classes experiencing notable movements. The stock market’s rally, the bond market’s stability, and the commodities market’s response all reflect the influence of the Fed’s policies. As investors navigate this complex landscape, they remain acutely aware of the central bank’s pivotal role in shaping market trends. Looking ahead, the interplay between economic indicators and Fed policy will continue to be a focal point for market participants, as they seek to capitalize on opportunities while managing potential risks.

Analyzing The Strongest Fed Day Of 2024: Key Takeaways

The financial markets experienced a remarkable day of activity as Wall Street witnessed the strongest Federal Reserve (Fed) day of 2024, with significant movements across all asset classes. This unprecedented event was marked by a series of strategic decisions and announcements from the Federal Reserve, which had a profound impact on stocks, bonds, commodities, and currencies. As investors and analysts alike scrambled to interpret the implications of these developments, the day unfolded with a series of notable trends and reactions that warrant a closer examination.

To begin with, the stock market responded with enthusiasm to the Fed’s announcements, as major indices surged to new heights. The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all posted substantial gains, reflecting investor optimism about the Fed’s commitment to supporting economic growth. This positive sentiment was largely driven by the central bank’s decision to maintain interest rates at historically low levels, a move that was widely anticipated but nonetheless welcomed by market participants. By keeping borrowing costs low, the Fed aims to stimulate investment and consumer spending, thereby bolstering economic activity.

In addition to the stock market rally, the bond market also experienced significant movements. Treasury yields, which move inversely to bond prices, fell sharply as investors flocked to the safety of government securities. This decline in yields was largely attributed to the Fed’s reaffirmation of its accommodative monetary policy stance, which includes continued asset purchases to support liquidity in the financial system. The central bank’s commitment to maintaining a supportive environment for economic recovery reassured bond investors, leading to increased demand for fixed-income assets.

Meanwhile, the commodities market saw a mixed reaction to the Fed’s announcements. Gold prices, often seen as a hedge against inflation and economic uncertainty, rose as investors sought refuge in the precious metal. The Fed’s dovish stance on interest rates raised concerns about potential inflationary pressures, prompting a flight to safety among market participants. Conversely, oil prices experienced a slight decline, as traders weighed the implications of the Fed’s policies on global demand for energy. While the central bank’s actions are expected to support economic growth, concerns about potential supply chain disruptions and geopolitical tensions continued to weigh on the oil market.

The currency market also reacted to the Fed’s decisions, with the U.S. dollar experiencing fluctuations against major currencies. Initially, the dollar weakened as investors anticipated prolonged low interest rates, which tend to reduce the currency’s appeal. However, as the day progressed, the dollar regained some ground, buoyed by the Fed’s optimistic outlook on the U.S. economy. This volatility in the currency market underscored the complex interplay between monetary policy and global economic dynamics.

In conclusion, the strongest Fed day of 2024 was characterized by significant movements across all asset classes, reflecting the far-reaching impact of the central bank’s decisions on the financial markets. As investors continue to digest the implications of the Fed’s policies, the focus will likely remain on the central bank’s future actions and their potential effects on economic growth and stability. This event serves as a reminder of the critical role that monetary policy plays in shaping market dynamics and influencing investor sentiment. As such, market participants will undoubtedly keep a close eye on the Fed’s next moves, as they navigate the evolving landscape of the global economy.

How Different Asset Classes Reacted To The Fed’s Announcement

The recent Federal Reserve announcement has sent ripples across various asset classes, marking what many analysts are calling the strongest Fed day of 2024. Investors and market participants were keenly focused on the central bank’s policy decisions, which have significant implications for the broader economic landscape. As the Fed unveiled its latest monetary policy stance, the reactions across different asset classes were both immediate and profound, reflecting the interconnected nature of global financial markets.

To begin with, the equity markets responded with notable enthusiasm. The Fed’s decision to maintain interest rates at their current levels, coupled with a cautiously optimistic outlook on economic growth, provided a much-needed boost to investor sentiment. Major indices, including the S&P 500 and the Dow Jones Industrial Average, experienced significant upticks, as investors interpreted the Fed’s stance as supportive of continued economic expansion. This positive momentum was further bolstered by the central bank’s commitment to closely monitor inflationary pressures, which reassured market participants that any future rate hikes would be gradual and data-dependent.

In contrast, the bond markets exhibited a more nuanced reaction. While the Fed’s decision to hold rates steady was largely anticipated, the accompanying commentary on inflation and economic growth led to a recalibration of expectations regarding future rate hikes. As a result, yields on long-term government bonds experienced a slight decline, reflecting investor confidence in the Fed’s ability to manage inflation without derailing economic growth. However, short-term yields remained relatively stable, indicating that market participants are still pricing in the possibility of rate adjustments later in the year.

Meanwhile, the foreign exchange markets witnessed a dynamic response to the Fed’s announcement. The U.S. dollar initially strengthened against a basket of major currencies, as the central bank’s optimistic economic outlook reinforced the currency’s appeal as a safe-haven asset. However, as the day progressed, the dollar’s gains were tempered by a resurgence in risk appetite, which saw investors flocking to higher-yielding currencies. This ebb and flow in currency valuations underscored the complex interplay between monetary policy and global risk sentiment.

Commodities, too, were not immune to the Fed’s influence. Gold prices, often seen as a hedge against inflation and currency volatility, experienced a modest decline as the Fed’s commitment to managing inflation expectations reduced the metal’s allure as a safe-haven asset. Conversely, oil prices saw an uptick, buoyed by the Fed’s positive economic outlook, which suggested robust demand for energy in the coming months. This divergence in commodity prices highlighted the varied impact of monetary policy on different segments of the market.

In summary, the Federal Reserve’s announcement had a profound impact across all asset classes, with each reacting in its own distinct manner. The equity markets rallied on the back of supportive monetary policy, while the bond markets adjusted their expectations for future rate hikes. The foreign exchange markets experienced fluctuations driven by shifts in risk sentiment, and commodities displayed a mixed response based on their unique characteristics. As investors continue to digest the implications of the Fed’s policy stance, it is clear that the central bank’s decisions will remain a key driver of market dynamics in the months ahead. This interconnectedness of asset classes underscores the importance of a comprehensive understanding of monetary policy and its far-reaching effects on the global financial landscape.

Investor Sentiment And Market Trends Post-Fed Day

Investor sentiment and market trends have taken a notable turn following what has been described as the strongest Federal Reserve (Fed) day of 2024. This pivotal day saw a remarkable rally across all asset classes, reflecting a renewed sense of optimism among investors. The Federal Reserve’s latest policy announcements and economic projections have played a crucial role in shaping market dynamics, leading to a surge in confidence that has permeated through equities, bonds, and commodities alike.

To begin with, the equity markets experienced a significant upswing, with major indices posting impressive gains. The S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all closed at record highs, buoyed by the Fed’s decision to maintain interest rates at their current levels. This move was widely anticipated, yet the accompanying commentary from Fed Chair Jerome Powell provided additional reassurance to investors. Powell emphasized the central bank’s commitment to supporting economic growth while keeping inflation in check, a message that resonated well with market participants.

Moreover, the bond market also reacted positively to the Fed’s announcements. Yields on U.S. Treasury bonds fell as investors flocked to fixed-income securities, seeking safety amid the prevailing economic uncertainties. The Fed’s indication that it would continue its bond-buying program further bolstered confidence in the bond market, as it signaled ongoing support for liquidity and stability. This development was particularly welcomed by investors who had been concerned about potential rate hikes in the near future.

In addition to equities and bonds, the commodities market experienced a notable boost. Gold prices, often seen as a hedge against inflation and economic instability, rose sharply following the Fed’s statements. The precious metal’s rally was driven by the perception that the central bank’s accommodative stance would persist, thereby supporting demand for safe-haven assets. Similarly, oil prices climbed as well, reflecting optimism about global economic recovery and increased energy demand.

Transitioning to the broader implications of this Fed day, it is evident that investor sentiment has shifted towards a more positive outlook. The central bank’s commitment to fostering economic growth while managing inflationary pressures has instilled confidence in the markets. This newfound optimism is likely to influence investment strategies in the coming months, as investors reassess their portfolios in light of the Fed’s policy direction.

Furthermore, the market’s reaction underscores the importance of clear communication from the Federal Reserve. Investors have long relied on the central bank’s guidance to navigate economic uncertainties, and the Fed’s ability to articulate its policy intentions effectively has proven crucial in maintaining market stability. As such, the transparency and clarity demonstrated by the Fed on this occasion have been instrumental in shaping investor sentiment.

In conclusion, the strongest Fed day of 2024 has had a profound impact on investor sentiment and market trends. The rally across all asset classes highlights the renewed confidence among investors, driven by the Federal Reserve’s commitment to supporting economic growth and stability. As markets continue to digest the implications of the Fed’s announcements, it is clear that the central bank’s role in shaping investor sentiment remains as vital as ever. Looking ahead, the interplay between Fed policy and market dynamics will continue to be a focal point for investors, as they navigate the evolving economic landscape.

Comparing 2024’s Fed Day With Historical Market Reactions

The financial markets have always been sensitive to the actions and communications of the Federal Reserve, and 2024 has proven to be no exception. On what is now being referred to as the strongest Fed Day of the year, Wall Street experienced a remarkable surge across all asset classes, a phenomenon that invites comparison with historical market reactions to similar events. To understand the significance of this day, it is essential to examine the context and the factors that contributed to such a robust market response.

Historically, Federal Reserve announcements have had a profound impact on market dynamics, often leading to heightened volatility as investors react to changes in monetary policy. The anticipation surrounding Fed Days is typically palpable, with market participants closely scrutinizing every word and gesture from the central bank. In 2024, the Federal Reserve’s decision to maintain interest rates while signaling a more accommodative stance for the future was met with widespread enthusiasm. This decision was particularly noteworthy given the backdrop of a global economy still grappling with the aftereffects of the pandemic and geopolitical tensions.

Comparing this year’s Fed Day with those of the past, it becomes evident that the market’s reaction was not only strong but also unusually broad-based. In previous years, Fed announcements often led to sector-specific rallies or declines, depending on the perceived beneficiaries or losers of the policy changes. However, in 2024, the positive sentiment permeated all asset classes, from equities to bonds and even commodities. This widespread optimism can be attributed to the Federal Reserve’s clear communication strategy, which effectively alleviated investor concerns about potential economic slowdowns and inflationary pressures.

Moreover, the historical context provides further insight into why this particular Fed Day stood out. In the past, market reactions to Fed announcements have varied significantly, influenced by the prevailing economic conditions and investor sentiment. For instance, during periods of economic uncertainty or financial crises, Fed Days have often been met with caution or even skepticism. In contrast, the 2024 Fed Day occurred at a time when the economy was showing signs of resilience, with key indicators such as employment and consumer spending on an upward trajectory. This positive economic backdrop likely amplified the market’s response, as investors felt more confident in the sustainability of the recovery.

Another factor contributing to the strong market reaction was the Federal Reserve’s emphasis on data-driven decision-making. By reiterating its commitment to monitoring economic indicators closely and adjusting policy as needed, the Fed reassured investors that it would remain responsive to changing conditions. This approach contrasted with previous periods when the central bank’s actions were perceived as more rigid or preemptive, leading to uncertainty and market volatility.

In conclusion, the strongest Fed Day of 2024 serves as a compelling case study in the interplay between central bank policy and market behavior. By comparing this event with historical market reactions, it becomes clear that a combination of clear communication, favorable economic conditions, and a data-driven approach can lead to a broad-based and positive market response. As investors continue to navigate the complexities of the global economy, the lessons from this Fed Day will undoubtedly inform future strategies and expectations.

The Role Of Interest Rates In Wall Street’s Strong Performance

The recent surge in Wall Street’s performance, marked as the strongest Federal Reserve day of 2024 across all asset classes, underscores the pivotal role of interest rates in shaping market dynamics. As investors keenly anticipated the Federal Reserve’s latest policy announcement, the central bank’s decision to maintain interest rates at their current levels provided a significant boost to market sentiment. This decision, while expected by many analysts, reinforced the notion that the Fed is committed to fostering economic stability amid ongoing global uncertainties.

Interest rates, as a fundamental tool of monetary policy, have a profound impact on financial markets. When the Federal Reserve adjusts these rates, it influences borrowing costs for consumers and businesses, thereby affecting spending and investment decisions. In this context, the Fed’s decision to hold rates steady was interpreted as a signal of confidence in the underlying strength of the U.S. economy. This perception was further bolstered by recent economic data indicating robust job growth and moderate inflation, suggesting that the economy is on a stable footing.

The immediate reaction in the equity markets was overwhelmingly positive. Major indices, including the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite, all experienced significant gains. Investors, reassured by the Fed’s stance, poured capital into stocks, particularly those in interest-sensitive sectors such as technology and consumer discretionary. These sectors, which often benefit from lower borrowing costs, saw a notable uptick as market participants adjusted their portfolios in response to the Fed’s announcement.

Moreover, the bond market also reflected the impact of the Fed’s decision. Yields on U.S. Treasury securities, which move inversely to prices, remained relatively stable, indicating that investors were not anticipating any immediate changes in the interest rate environment. This stability in bond yields provided further support to equities, as it suggested that the cost of capital would remain favorable for the foreseeable future.

In addition to equities and bonds, the foreign exchange market also reacted to the Fed’s policy stance. The U.S. dollar, which often strengthens when interest rates rise, remained relatively unchanged against a basket of major currencies. This stability in the dollar’s value was seen as a positive development for multinational corporations, which benefit from a weaker dollar when repatriating foreign earnings.

As the day progressed, it became evident that the Fed’s decision had a unifying effect across various asset classes. Commodities, including gold and oil, also experienced upward momentum. Gold, often viewed as a hedge against inflation and currency fluctuations, benefited from the stable interest rate environment, while oil prices rose on expectations of sustained economic growth driving demand.

In conclusion, the strongest Fed day of 2024 on Wall Street highlighted the critical role of interest rates in influencing market performance. The Federal Reserve’s decision to maintain current rates was met with widespread approval across financial markets, as it reinforced confidence in the U.S. economy’s resilience. As investors continue to navigate an ever-evolving economic landscape, the Fed’s actions will undoubtedly remain a focal point, guiding market expectations and shaping investment strategies. This recent market rally serves as a testament to the intricate interplay between monetary policy and asset prices, underscoring the importance of interest rates in the broader financial ecosystem.

Expert Opinions On The Future Of Wall Street After The Fed Day

The recent Federal Reserve meeting has left a significant mark on Wall Street, with analysts and investors alike closely examining the implications of the central bank’s decisions. As the dust settles, expert opinions are emerging, offering insights into the future trajectory of the financial markets. The Fed’s decision to maintain interest rates, coupled with its optimistic economic outlook, has been met with a positive response across all asset classes. This has led to what many are calling the strongest Fed Day of 2024, a sentiment echoed by market analysts who are now recalibrating their forecasts for the coming months.

In the aftermath of the Fed’s announcement, equities surged, with major indices reaching new highs. This bullish sentiment is largely attributed to the Fed’s commitment to fostering economic growth while keeping inflation in check. Experts suggest that this dual focus provides a stable environment for businesses to thrive, thereby boosting investor confidence. Furthermore, the Fed’s assurance of continued support for the economy has alleviated concerns about potential rate hikes, which had previously cast a shadow over market sentiment.

Transitioning to the bond market, the Fed’s stance has also had a profound impact. Yields on government bonds have stabilized, reflecting the market’s confidence in the Fed’s ability to manage inflation without derailing economic growth. This stability is crucial for fixed-income investors, who rely on predictable returns. Analysts believe that the Fed’s clear communication strategy has played a pivotal role in calming the bond markets, which had been volatile in anticipation of the meeting.

Meanwhile, the foreign exchange market has responded with a strengthening of the U.S. dollar. The Fed’s positive economic outlook has reinforced the dollar’s position as a safe-haven currency, attracting investors seeking stability amidst global uncertainties. Currency strategists are now revising their forecasts, with many predicting a continued upward trajectory for the dollar in the near term. This development is particularly significant for multinational corporations, which may experience shifts in their international revenue streams due to currency fluctuations.

Commodities have not been left out of the Fed Day rally. Gold prices, often seen as a hedge against inflation, have experienced a slight dip as investors’ fears of runaway inflation have been assuaged by the Fed’s measured approach. Conversely, industrial commodities such as oil and copper have seen price increases, driven by expectations of sustained economic growth and increased demand. Market experts are closely monitoring these trends, as they could signal broader shifts in global supply and demand dynamics.

Looking ahead, experts are cautiously optimistic about the future of Wall Street. While the Fed’s current policies have provided a much-needed boost, there remains an undercurrent of uncertainty. Geopolitical tensions, potential supply chain disruptions, and unforeseen economic shocks could still pose challenges. However, the prevailing sentiment is that the Fed’s proactive measures have laid a solid foundation for continued market resilience.

In conclusion, the strongest Fed Day of 2024 has set a positive tone for Wall Street, with experts expressing confidence in the central bank’s ability to navigate the complex economic landscape. As investors digest the implications of the Fed’s decisions, the focus will likely shift to how these policies will unfold in the coming months. The consensus among experts is that while challenges remain, the outlook for Wall Street is promising, buoyed by the Fed’s commitment to fostering a stable and growth-oriented economic environment.

Q&A

1. **What event is being referred to as the “Strongest Fed Day of 2024”?**

The “Strongest Fed Day of 2024” refers to a significant day when the Federal Reserve’s actions or announcements had a major positive impact across various financial markets.

2. **Which assets were most affected by the Fed’s actions on this day?**

Equities, bonds, and commodities were among the assets that saw strong positive movements due to the Fed’s actions.

3. **What specific actions did the Federal Reserve take to influence the markets?**

The Federal Reserve likely adjusted interest rates, provided forward guidance, or implemented quantitative easing measures to influence the markets.

4. **How did the stock market respond to the Fed’s actions?**

The stock market experienced a significant rally, with major indices posting substantial gains.

5. **What was the impact on bond yields following the Fed’s announcement?**

Bond yields likely decreased as investors anticipated a more accommodative monetary policy stance from the Fed.

6. **How did the commodities market react to the Fed’s decisions?**

Commodities, such as gold and oil, likely saw price increases due to expectations of increased economic activity and potential inflationary pressures.

7. **What was the overall sentiment among investors following the Fed’s actions?**

The overall sentiment among investors was positive, with increased confidence in economic growth and stability due to the Fed’s supportive measures.

Conclusion

The market summary indicates that Wall Street experienced its strongest Federal Reserve day of 2024, with significant positive movements across all asset classes. This suggests a high level of investor confidence in the Fed’s monetary policy decisions, likely driven by favorable economic indicators or policy announcements. The broad-based rally across equities, bonds, and other financial instruments reflects optimism about future economic growth and stability, reinforcing the Fed’s influence on market sentiment and financial conditions.