“Maximize Your Nest Egg: Smart Roth Conversions for a Tax-Free Retirement”

Introduction

Roth conversion strategies in retirement without earned income involve converting traditional IRA or 401(k) funds into a Roth IRA to take advantage of tax-free growth and withdrawals. This approach can be particularly beneficial for retirees who anticipate being in a higher tax bracket in the future or who wish to minimize required minimum distributions (RMDs) from traditional retirement accounts. By strategically converting funds during years of lower taxable income, retirees can manage their tax liabilities effectively. Additionally, Roth conversions can provide greater flexibility in estate planning, as Roth IRAs are not subject to RMDs during the account holder’s lifetime, allowing for potential tax-free inheritance for beneficiaries.

Understanding Roth Conversion Basics in Retirement

Roth conversion strategies in retirement, particularly for individuals without earned income, can be a pivotal component of effective financial planning. Understanding the basics of Roth conversions is essential for retirees seeking to optimize their tax situation and ensure a stable financial future. A Roth conversion involves transferring funds from a traditional IRA or 401(k) into a Roth IRA. This process requires paying taxes on the converted amount, as traditional accounts are funded with pre-tax dollars, while Roth accounts are funded with after-tax dollars. The primary advantage of a Roth IRA is that it allows for tax-free withdrawals in retirement, provided certain conditions are met. This can be particularly beneficial for retirees who anticipate being in a higher tax bracket in the future or who wish to minimize the tax burden on their heirs.

In retirement, when earned income is no longer a factor, the decision to pursue a Roth conversion becomes more nuanced. Without the presence of a regular paycheck, retirees must carefully consider their current and projected future tax brackets. One of the key strategies involves taking advantage of lower tax brackets during retirement. For many, retirement income is lower than during their working years, potentially placing them in a lower tax bracket. This presents an opportunity to convert funds to a Roth IRA at a reduced tax cost. By strategically converting amounts that keep them within a lower tax bracket, retirees can minimize the immediate tax impact while setting the stage for tax-free withdrawals in the future.

Moreover, retirees should consider the impact of required minimum distributions (RMDs) on their tax situation. Traditional IRAs and 401(k)s mandate RMDs starting at age 72, which can significantly increase taxable income. By converting to a Roth IRA, which does not require RMDs, retirees can reduce their taxable income in later years. This strategy not only provides more control over their taxable income but also allows for greater flexibility in financial planning. Additionally, Roth conversions can be a valuable estate planning tool. Since Roth IRAs do not require RMDs, the account can continue to grow tax-free, potentially leaving a larger inheritance for beneficiaries. Furthermore, heirs can benefit from tax-free withdrawals, which can be a significant advantage in managing their own tax liabilities.

However, it is crucial for retirees to be mindful of the potential pitfalls associated with Roth conversions. One such consideration is the impact on Medicare premiums. Converting a large sum in a single year can increase modified adjusted gross income (MAGI), potentially leading to higher Medicare Part B and Part D premiums. Therefore, spreading conversions over several years may be a more prudent approach to avoid unintended increases in healthcare costs. Additionally, retirees should be aware of the five-year rule, which requires that converted funds remain in the Roth IRA for at least five years before they can be withdrawn tax-free. This rule applies to each conversion, so careful planning is necessary to ensure that funds are available when needed.

In conclusion, Roth conversion strategies in retirement without earned income require careful consideration and planning. By understanding the basics and evaluating individual financial circumstances, retirees can make informed decisions that align with their long-term goals. Whether the objective is to reduce future tax liabilities, manage RMDs, or enhance estate planning, a well-executed Roth conversion strategy can provide significant benefits. As with any financial decision, consulting with a financial advisor or tax professional is advisable to tailor strategies to individual needs and ensure compliance with tax regulations.

Benefits of Roth Conversions for Retirees Without Earned Income

Roth conversions can be a strategic financial maneuver for retirees who no longer have earned income. This approach involves converting traditional IRA or 401(k) funds into a Roth IRA, which can offer several benefits, particularly for those in retirement. Understanding these advantages is crucial for retirees seeking to optimize their financial portfolios and ensure long-term financial stability.

One of the primary benefits of a Roth conversion is the potential for tax-free growth. Unlike traditional IRAs, where withdrawals are taxed as ordinary income, Roth IRAs allow for tax-free withdrawals, provided certain conditions are met. This can be particularly advantageous for retirees who anticipate being in a higher tax bracket in the future or who wish to minimize their taxable income in retirement. By converting to a Roth IRA, retirees can lock in their current tax rate, potentially saving money in the long run.

Moreover, Roth conversions can help manage required minimum distributions (RMDs). Traditional IRAs mandate RMDs starting at age 73, which can increase taxable income and potentially push retirees into a higher tax bracket. In contrast, Roth IRAs do not require RMDs during the account holder’s lifetime, offering greater flexibility in managing withdrawals. This can be especially beneficial for retirees who do not need to access their retirement funds immediately and prefer to let their investments grow tax-free for a longer period.

In addition to tax-free growth and RMD management, Roth conversions can also provide estate planning advantages. Since Roth IRAs do not require RMDs, account holders can leave the entire balance to their heirs, who can then benefit from tax-free withdrawals. This can be a significant advantage for retirees looking to pass on wealth to their beneficiaries in a tax-efficient manner. Furthermore, the absence of RMDs allows the account to continue growing tax-free, potentially increasing the amount passed on to heirs.

Another consideration for retirees without earned income is the potential impact on Medicare premiums. Medicare Part B and Part D premiums are based on modified adjusted gross income (MAGI), and higher income levels can result in increased premiums. By strategically timing Roth conversions, retirees can manage their MAGI and potentially avoid higher Medicare premiums. This requires careful planning, as large conversions in a single year could inadvertently increase MAGI and result in higher costs.

While the benefits of Roth conversions are clear, it is essential for retirees to approach this strategy with careful consideration and planning. The decision to convert should be based on individual financial circumstances, including current and projected tax rates, income needs, and estate planning goals. Consulting with a financial advisor or tax professional can provide valuable insights and help retirees navigate the complexities of Roth conversions.

In conclusion, Roth conversions offer several benefits for retirees without earned income, including tax-free growth, RMD management, estate planning advantages, and potential Medicare premium savings. By understanding these benefits and strategically implementing Roth conversions, retirees can enhance their financial security and achieve greater flexibility in managing their retirement assets. As with any financial strategy, careful planning and professional guidance are essential to maximize the advantages of Roth conversions and ensure a secure and prosperous retirement.

Timing Your Roth Conversion for Maximum Tax Efficiency

Roth conversion strategies can be a pivotal component of retirement planning, particularly for those without earned income. The timing of these conversions is crucial for maximizing tax efficiency, as it can significantly impact the overall financial landscape of one’s retirement years. Understanding the nuances of Roth conversions and the tax implications involved is essential for retirees seeking to optimize their financial strategies.

To begin with, a Roth conversion involves transferring funds from a traditional IRA or 401(k) into a Roth IRA. This process requires paying taxes on the converted amount, as traditional retirement accounts are typically funded with pre-tax dollars. However, once the funds are in a Roth IRA, they grow tax-free, and qualified withdrawals are also tax-free. This tax-free growth and withdrawal feature make Roth IRAs an attractive option for many retirees, especially those anticipating higher tax rates in the future.

One of the primary considerations in timing a Roth conversion is the retiree’s current and projected tax bracket. Retirees without earned income often find themselves in a lower tax bracket, presenting an opportune moment to execute a Roth conversion. By converting during these lower-income years, retirees can potentially minimize the tax burden associated with the conversion. It is important to carefully evaluate one’s current tax situation and future income projections to determine the most advantageous time for a conversion.

Moreover, the timing of a Roth conversion can also be influenced by other income sources, such as Social Security benefits or required minimum distributions (RMDs) from traditional retirement accounts. For instance, before reaching the age of 73, when RMDs become mandatory, retirees might consider converting a portion of their traditional IRA to a Roth IRA. This strategy can help reduce the size of future RMDs, thereby lowering taxable income in later years. Additionally, delaying Social Security benefits can further create a window of opportunity for Roth conversions, as it allows retirees to manage their taxable income more effectively.

Another factor to consider is the impact of Roth conversions on Medicare premiums. Since Medicare premiums are based on modified adjusted gross income (MAGI), a large Roth conversion could inadvertently increase these premiums. Therefore, retirees should be mindful of the income thresholds that trigger higher Medicare costs and plan their conversions accordingly. Spreading conversions over several years, rather than executing a large conversion in a single year, can help mitigate this issue.

Furthermore, it is essential to consider the long-term benefits of Roth conversions. While the immediate tax implications are a significant factor, the potential for tax-free growth and withdrawals in the future can provide substantial financial advantages. This is particularly relevant for retirees who anticipate leaving a financial legacy for their heirs, as Roth IRAs do not have RMDs during the account holder’s lifetime, allowing the funds to grow tax-free for an extended period.

In conclusion, timing a Roth conversion for maximum tax efficiency requires a comprehensive understanding of one’s current and future financial situation. By carefully considering factors such as tax brackets, income sources, and potential impacts on Medicare premiums, retirees can strategically plan their conversions to optimize their retirement savings. Ultimately, a well-timed Roth conversion can enhance financial security and provide greater flexibility in managing retirement income, making it a valuable strategy for those without earned income.

Calculating the Tax Impact of Roth Conversions in Retirement

Roth conversion strategies in retirement, particularly when there is no earned income, require careful consideration of the tax implications involved. As retirees transition from their working years, they often seek ways to optimize their retirement savings and minimize tax liabilities. One such strategy is converting traditional Individual Retirement Accounts (IRAs) to Roth IRAs. This process, known as a Roth conversion, involves transferring funds from a traditional IRA, where contributions are typically tax-deferred, to a Roth IRA, where qualified withdrawals are tax-free. However, the conversion itself is a taxable event, and understanding the tax impact is crucial for effective financial planning.

To begin with, it is essential to recognize that the amount converted from a traditional IRA to a Roth IRA is added to the retiree’s taxable income for the year. This increase in taxable income can potentially push the retiree into a higher tax bracket, thereby increasing the overall tax liability. Therefore, calculating the tax impact of a Roth conversion involves assessing the current tax bracket and estimating how the conversion amount will affect it. Retirees should consider their current and projected future tax rates, as well as any other sources of income, such as Social Security benefits or pension distributions, which may also influence their tax situation.

Moreover, retirees without earned income may find themselves in a lower tax bracket, presenting an opportune time to execute a Roth conversion. By strategically converting smaller amounts over several years, retirees can manage their tax liability more effectively, avoiding a significant spike in taxable income in any single year. This approach, often referred to as “laddering” conversions, allows for a gradual transition of funds into a Roth IRA, thereby spreading the tax burden over multiple years and potentially reducing the overall tax impact.

In addition to considering tax brackets, retirees should also be mindful of other tax-related factors that may be affected by a Roth conversion. For instance, an increase in taxable income could impact the taxation of Social Security benefits. The IRS uses a formula to determine the portion of Social Security benefits that are taxable, and a higher income level could result in a greater percentage of benefits being subject to tax. Furthermore, a Roth conversion could influence Medicare premiums, as these are based on modified adjusted gross income (MAGI). Retirees should be aware that a higher MAGI could lead to increased Medicare Part B and Part D premiums.

To accurately calculate the tax impact of a Roth conversion, retirees may benefit from consulting with a financial advisor or tax professional. These experts can provide personalized guidance, taking into account the retiree’s unique financial situation and long-term goals. They can also assist in developing a comprehensive strategy that aligns with the retiree’s overall retirement plan, ensuring that the benefits of a Roth conversion are maximized while minimizing any adverse tax consequences.

In conclusion, while Roth conversions can be a valuable tool for managing retirement savings, understanding the tax implications is paramount. By carefully calculating the tax impact and considering factors such as tax brackets, Social Security benefits, and Medicare premiums, retirees can make informed decisions that enhance their financial security in retirement. With thoughtful planning and professional guidance, retirees can effectively navigate the complexities of Roth conversions, ultimately achieving a more tax-efficient retirement strategy.

Strategies for Minimizing Taxes on Roth Conversions

Roth conversions can be a strategic tool for retirees seeking to minimize taxes, even in the absence of earned income. As individuals transition into retirement, their financial landscape often shifts, presenting unique opportunities to optimize tax efficiency. One such opportunity is the conversion of traditional IRA assets into a Roth IRA, which, if executed thoughtfully, can lead to significant tax savings over the long term. Understanding the nuances of Roth conversions and implementing effective strategies is crucial for retirees aiming to preserve their wealth.

To begin with, it is essential to recognize the primary advantage of a Roth conversion: the potential for tax-free growth and withdrawals. Unlike traditional IRAs, which require mandatory distributions and are taxed upon withdrawal, Roth IRAs allow for tax-free distributions, provided certain conditions are met. This feature can be particularly beneficial for retirees who anticipate being in a higher tax bracket in the future or who wish to leave a tax-free inheritance to their heirs. However, the conversion process itself is a taxable event, as the amount converted is added to the retiree’s taxable income for the year. Therefore, careful planning is necessary to minimize the tax impact.

One effective strategy is to take advantage of low-income years. Retirees often experience a dip in taxable income immediately after leaving the workforce, before required minimum distributions (RMDs) from traditional IRAs begin at age 73. This window presents an ideal opportunity to execute Roth conversions at a lower tax rate. By spreading conversions over several years, retirees can avoid pushing themselves into higher tax brackets, thereby reducing the overall tax burden.

Moreover, retirees should consider the impact of Social Security benefits on their taxable income. Since up to 85% of Social Security benefits can be taxable, it is crucial to coordinate Roth conversions with the timing of these benefits. Delaying Social Security benefits until age 70 not only maximizes the benefit amount but also provides additional low-income years for executing Roth conversions. This approach can help manage the tax implications more effectively.

Additionally, retirees should be mindful of the Medicare income-related monthly adjustment amount (IRMAA). Roth conversions can increase modified adjusted gross income (MAGI), potentially leading to higher Medicare premiums. To mitigate this, retirees can strategically plan conversions to stay below IRMAA thresholds, thus avoiding unexpected increases in healthcare costs.

Furthermore, utilizing tax-loss harvesting can complement Roth conversion strategies. By selling investments at a loss, retirees can offset the taxable income generated by the conversion. This approach not only reduces the immediate tax liability but also aligns with a broader investment strategy aimed at optimizing portfolio performance.

In conclusion, while Roth conversions in retirement without earned income require careful consideration, they offer a valuable opportunity to minimize taxes and enhance financial security. By leveraging low-income years, coordinating with Social Security benefits, managing Medicare implications, and employing tax-loss harvesting, retirees can effectively navigate the complexities of Roth conversions. As with any financial strategy, it is advisable to consult with a tax professional or financial advisor to tailor these strategies to individual circumstances, ensuring that the benefits of Roth conversions are fully realized while minimizing potential pitfalls. Through thoughtful planning and execution, retirees can achieve greater tax efficiency and secure their financial future.

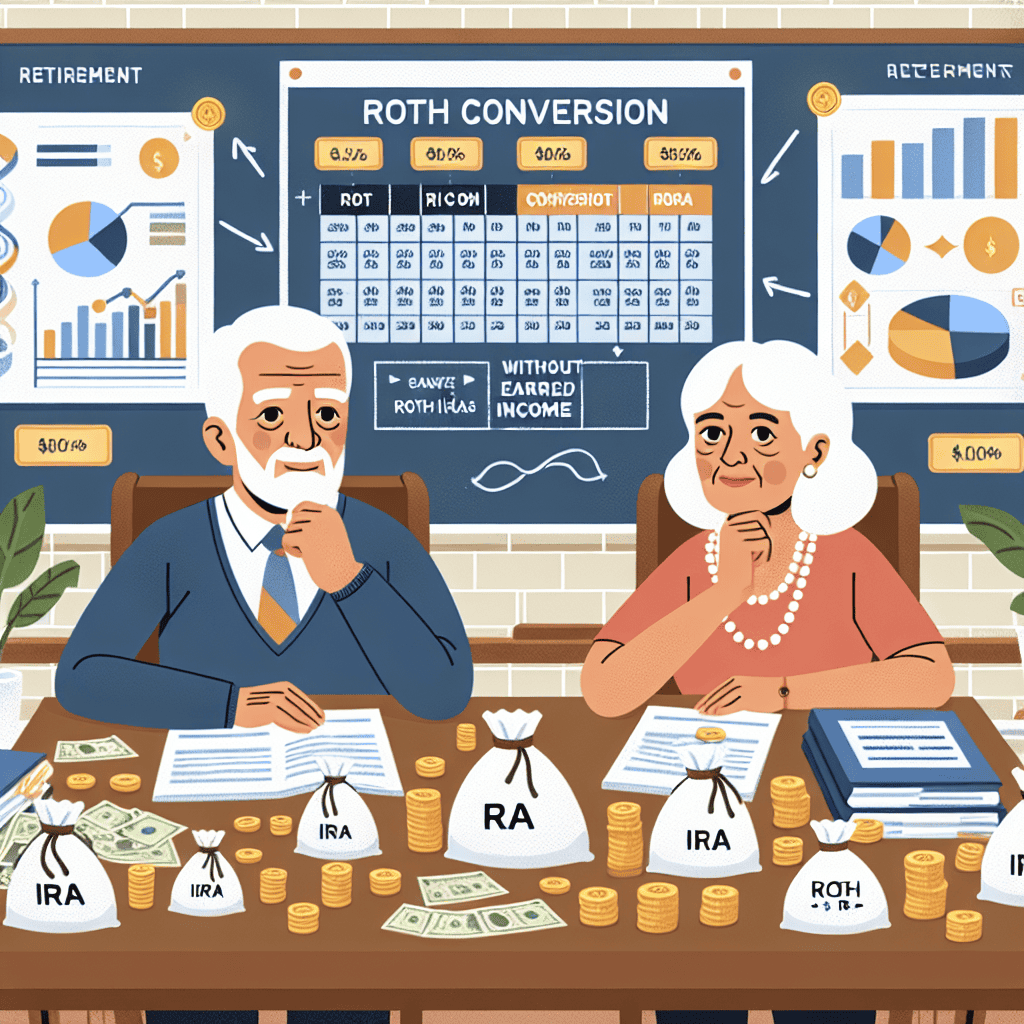

Roth Conversion Ladder: A Step-by-Step Guide for Retirees

Roth conversion strategies have become an increasingly popular topic among retirees, particularly those without earned income, as they seek to optimize their retirement savings. A Roth conversion ladder is a strategic approach that allows retirees to convert traditional IRA funds into a Roth IRA over several years, potentially minimizing tax liabilities and maximizing the benefits of tax-free withdrawals in the future. Understanding the intricacies of this strategy is crucial for retirees aiming to make informed decisions about their financial future.

The first step in implementing a Roth conversion ladder is to assess your current financial situation. This involves evaluating your existing retirement accounts, projected income needs, and tax bracket. Retirees without earned income often find themselves in a lower tax bracket, making it an opportune time to consider conversions. By converting a portion of your traditional IRA to a Roth IRA each year, you can spread out the tax burden over time, potentially keeping yourself in a lower tax bracket and avoiding a significant tax hit in any single year.

Once you have a clear understanding of your financial landscape, the next step is to determine the amount to convert each year. This decision should be based on your current and projected tax brackets, as well as your overall retirement goals. It is essential to strike a balance between converting enough to take advantage of lower tax rates and not converting so much that it pushes you into a higher tax bracket. Utilizing tax software or consulting with a financial advisor can provide valuable insights into the optimal conversion amount.

After deciding on the conversion amount, the next phase involves executing the conversion itself. This process typically requires contacting your IRA custodian to initiate the transfer of funds from your traditional IRA to your Roth IRA. It is important to note that taxes on the converted amount are due in the year of conversion, so planning for this tax liability is crucial. Retirees should ensure they have sufficient funds outside of their retirement accounts to cover the tax bill, as using retirement funds to pay taxes can negate some of the benefits of the conversion.

As you continue to implement your Roth conversion ladder, it is vital to monitor changes in tax laws and personal circumstances. Tax regulations can evolve, potentially impacting the effectiveness of your strategy. Additionally, changes in your financial situation, such as unexpected expenses or shifts in income, may necessitate adjustments to your conversion plan. Regularly reviewing your strategy with a financial advisor can help ensure that it remains aligned with your goals and the current tax landscape.

Finally, it is important to consider the long-term benefits of a Roth conversion ladder. By gradually converting your traditional IRA funds to a Roth IRA, you can enjoy tax-free withdrawals in retirement, providing greater flexibility in managing your income and expenses. This strategy can also be advantageous for estate planning, as Roth IRAs are not subject to required minimum distributions during the account holder’s lifetime, allowing for potential growth and tax-free inheritance for beneficiaries.

In conclusion, a Roth conversion ladder can be a powerful tool for retirees without earned income, offering a methodical approach to managing tax liabilities and enhancing retirement savings. By carefully assessing your financial situation, determining the appropriate conversion amounts, and staying informed about tax laws, you can effectively implement this strategy and secure a more financially stable retirement.

Common Mistakes to Avoid in Roth Conversion Planning

Roth conversion strategies can be a powerful tool for retirees seeking to optimize their tax situation and ensure a more financially secure future. However, without careful planning, these strategies can lead to unintended consequences. One common mistake is failing to consider the impact of a Roth conversion on one’s tax bracket. When converting a traditional IRA to a Roth IRA, the amount converted is treated as taxable income. This can inadvertently push retirees into a higher tax bracket, resulting in a larger tax bill than anticipated. To avoid this, it is crucial to calculate the potential tax implications and consider spreading conversions over several years to minimize the tax impact.

Another pitfall is neglecting the effect of Roth conversions on Medicare premiums. The income generated from a Roth conversion can increase a retiree’s modified adjusted gross income (MAGI), which is used to determine Medicare Part B and Part D premiums. Higher MAGI can lead to increased premiums, known as Income-Related Monthly Adjustment Amounts (IRMAA). Retirees should be mindful of these thresholds and plan conversions accordingly to avoid unexpected hikes in healthcare costs.

Additionally, some retirees overlook the importance of timing when executing Roth conversions. The decision of when to convert can significantly affect the overall tax efficiency of the strategy. For instance, converting during a year with unusually low income or during a market downturn can be advantageous. In such scenarios, the tax liability may be reduced, and the potential for future tax-free growth in the Roth IRA is maximized. Therefore, retirees should remain flexible and opportunistic, adjusting their conversion strategy based on their financial situation and market conditions.

Moreover, failing to consider the impact on Social Security benefits is another common oversight. Roth conversions can increase provisional income, which is used to determine the taxation of Social Security benefits. If not carefully managed, this can lead to a higher portion of benefits being taxed, diminishing the net benefit received. Retirees should evaluate how a conversion might affect their Social Security taxation and adjust their strategy to mitigate any negative effects.

Furthermore, some retirees mistakenly assume that Roth conversions are beneficial for everyone. While they offer significant advantages, such as tax-free withdrawals and no required minimum distributions, they may not be suitable for all retirees. For those who expect to be in a lower tax bracket in the future or who have limited non-retirement assets to pay the conversion tax, the benefits may not outweigh the costs. It is essential to conduct a thorough analysis of one’s financial situation and long-term goals before proceeding with a conversion.

Lastly, inadequate record-keeping can lead to complications down the road. Proper documentation of the conversion process is vital for tax reporting and future reference. Retirees should maintain detailed records of the amounts converted, the dates of conversion, and any taxes paid. This ensures compliance with IRS regulations and facilitates accurate tax filing.

In conclusion, while Roth conversions can be a valuable component of retirement planning, they require careful consideration and strategic execution. By avoiding these common mistakes, retirees can enhance their financial security and make the most of their retirement savings. It is advisable to consult with a financial advisor or tax professional to tailor a conversion strategy that aligns with individual circumstances and objectives.

Q&A

1. **What is a Roth conversion?**

A Roth conversion involves transferring funds from a traditional IRA or 401(k) into a Roth IRA, where future withdrawals are tax-free.

2. **Why consider a Roth conversion in retirement without earned income?**

Without earned income, retirees may be in a lower tax bracket, making it a strategic time to convert and pay taxes at a lower rate.

3. **How does the timing of a Roth conversion affect taxes?**

Converting during years with lower taxable income can minimize the tax impact, as the conversion amount is added to taxable income.

4. **What are the tax implications of a Roth conversion?**

The converted amount is subject to ordinary income tax in the year of conversion, but future withdrawals from the Roth IRA are tax-free.

5. **How can Roth conversions impact Social Security benefits?**

Converting large amounts can increase taxable income, potentially affecting the taxation of Social Security benefits.

6. **What is the role of Required Minimum Distributions (RMDs) in Roth conversions?**

Converting before RMDs begin can reduce future RMDs from traditional accounts, as Roth IRAs do not have RMDs for the original owner.

7. **How can Roth conversions be optimized with tax brackets?**

Retirees can convert amounts that keep them within their current tax bracket, avoiding a jump to a higher bracket and optimizing tax efficiency.

Conclusion

Roth conversion strategies in retirement without earned income can be a valuable tool for managing tax liabilities and optimizing retirement savings. By converting traditional IRA or 401(k) funds to a Roth IRA, retirees can take advantage of potentially lower tax rates, especially if they are in a lower tax bracket during retirement. This strategy allows for tax-free growth and withdrawals, providing more flexibility in managing retirement income. Additionally, Roth conversions can help reduce required minimum distributions (RMDs) from traditional retirement accounts, thereby lowering taxable income in later years. However, careful planning is essential to avoid pushing oneself into a higher tax bracket during the conversion process. Retirees should consider their current and projected future tax situations, potential changes in tax laws, and the impact on Social Security benefits and Medicare premiums. Consulting with a financial advisor or tax professional can help tailor a Roth conversion strategy to individual circumstances, ensuring it aligns with long-term financial goals and retirement plans.