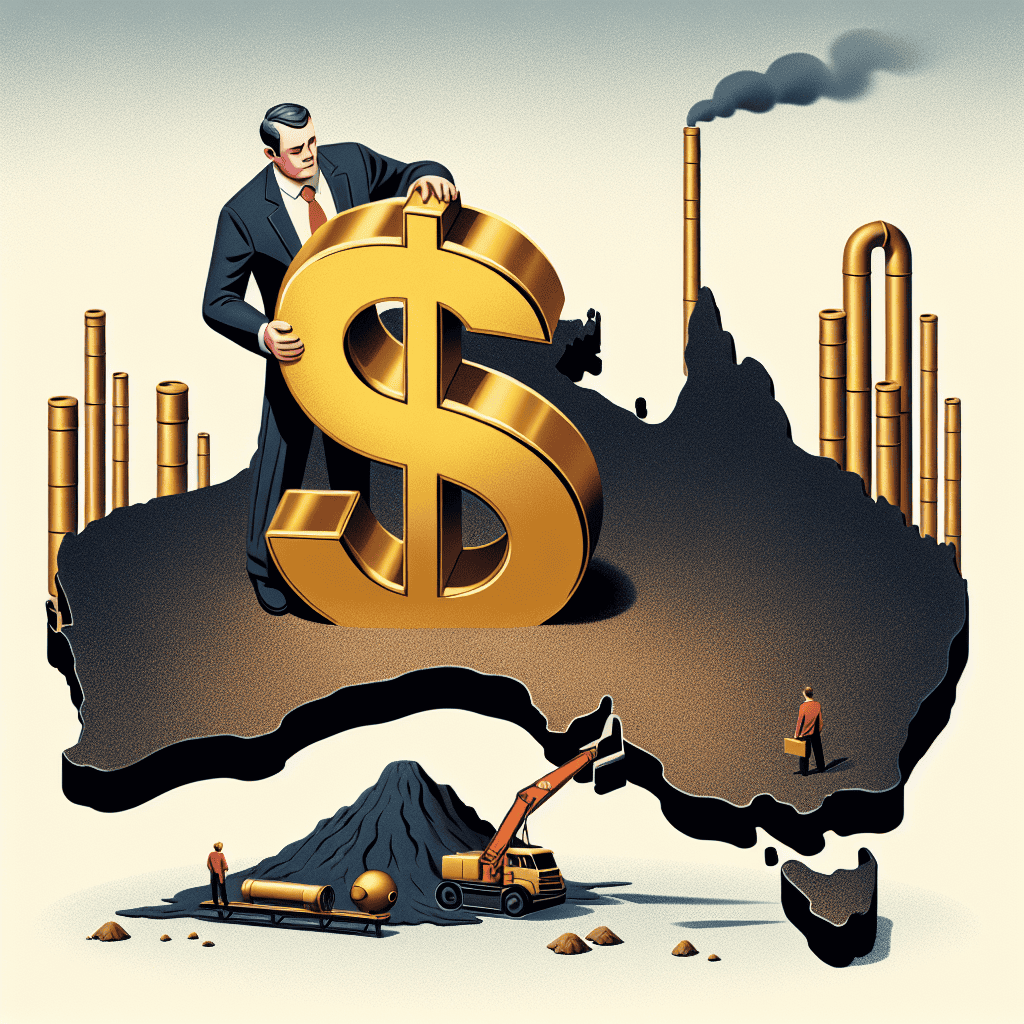

“Anglo American Shifts Focus: $1 Billion Australian Coal Stake Divested for a Greener Future”

Introduction

Anglo American, a leading global mining company, has announced the divestment of its $1 billion stake in Australian coal mines, marking a significant shift in its strategic focus. This move aligns with the company’s broader commitment to sustainability and reducing its carbon footprint, as it seeks to transition away from thermal coal operations. The divestment involves the sale of its interests in several key coal assets in Australia, reflecting Anglo American’s ongoing efforts to streamline its portfolio and concentrate on its core operations, including copper, platinum, and diamonds. This decision underscores the growing pressure on mining companies to adapt to the evolving energy landscape and the increasing demand for cleaner energy sources.

Impact Of Anglo American’s Divestment On The Australian Coal Industry

Anglo American’s recent decision to divest a $1 billion stake in its Australian coal mines marks a significant shift in the landscape of the Australian coal industry. This move, which aligns with the company’s broader strategy to transition towards more sustainable and environmentally friendly operations, is poised to have far-reaching implications for the industry. As Anglo American steps back from its coal assets, the ripple effects of this divestment will be felt across various facets of the sector, from market dynamics to employment and environmental considerations.

To begin with, the divestment is likely to alter the competitive dynamics within the Australian coal industry. Anglo American has been a major player in the sector, and its withdrawal could create opportunities for other companies to expand their market share. This shift may encourage both domestic and international players to reassess their positions and strategies in the Australian market. Consequently, the divestment could lead to increased competition as companies vie to fill the void left by Anglo American’s exit. This heightened competition might drive innovation and efficiency improvements as companies seek to differentiate themselves in a changing market landscape.

Moreover, the divestment is expected to have significant economic implications, particularly in regions heavily reliant on coal mining. The sale of Anglo American’s stake could lead to changes in ownership and management, potentially affecting local employment levels. While new owners may bring fresh investment and opportunities, there is also the risk of job losses or restructuring as operations are optimized for profitability. This uncertainty underscores the need for robust transition plans to support affected workers and communities, ensuring that they are not left behind in the wake of industry changes.

In addition to economic considerations, the environmental impact of Anglo American’s divestment cannot be overlooked. The company’s decision to reduce its coal exposure is part of a broader trend among major mining companies to align with global sustainability goals. As the world increasingly shifts towards cleaner energy sources, the coal industry faces mounting pressure to reduce its carbon footprint. Anglo American’s exit from coal mining in Australia may serve as a catalyst for other companies to accelerate their own sustainability initiatives. This could lead to increased investment in cleaner technologies and practices, ultimately contributing to a more sustainable future for the industry.

Furthermore, the divestment may influence policy discussions and regulatory frameworks surrounding the coal industry in Australia. As one of the world’s largest coal exporters, Australia plays a crucial role in global energy markets. The departure of a major player like Anglo American could prompt policymakers to reevaluate the country’s energy strategy and consider measures to support a transition towards more sustainable energy sources. This could include incentives for renewable energy development, stricter environmental regulations, or initiatives to support affected communities.

In conclusion, Anglo American’s divestment of its $1 billion stake in Australian coal mines represents a pivotal moment for the industry. The move is likely to reshape competitive dynamics, impact local economies, and influence environmental and policy considerations. As the industry navigates these changes, stakeholders must work collaboratively to ensure a smooth transition that balances economic, social, and environmental priorities. By doing so, the Australian coal industry can position itself for a sustainable future in an evolving global energy landscape.

Financial Implications Of The $1 Billion Stake Sale

Anglo American’s recent decision to divest a $1 billion stake in its Australian coal mines marks a significant shift in the company’s strategic focus and has substantial financial implications. This move is part of a broader trend among major mining companies to reassess their portfolios in response to evolving market dynamics and increasing pressure to address environmental concerns. By divesting from coal, Anglo American is aligning itself with the global transition towards cleaner energy sources, a shift that is reshaping the landscape of the mining industry.

The financial implications of this divestment are multifaceted. On one hand, the sale provides Anglo American with a substantial influx of capital, which can be strategically reinvested into more sustainable and profitable ventures. This aligns with the company’s long-term strategy to focus on commodities that are expected to benefit from the global shift towards decarbonization, such as copper and nickel. These metals are essential for the production of electric vehicles and renewable energy technologies, sectors that are poised for significant growth in the coming decades. By reallocating resources towards these areas, Anglo American is positioning itself to capitalize on emerging market opportunities.

Moreover, the divestment reduces Anglo American’s exposure to the coal sector, which has been facing increasing regulatory and financial challenges. Coal has become a less attractive investment due to its environmental impact and the growing emphasis on reducing carbon emissions. As governments worldwide implement stricter regulations and investors demand more sustainable practices, companies with significant coal assets may face increased costs and reduced access to capital. By divesting its coal assets, Anglo American mitigates these risks and enhances its appeal to environmentally conscious investors.

In addition to the immediate financial benefits, the divestment also has implications for Anglo American’s reputation and stakeholder relationships. As environmental, social, and governance (ESG) criteria become increasingly important in investment decisions, companies are under pressure to demonstrate their commitment to sustainability. By reducing its coal footprint, Anglo American can improve its ESG ratings, potentially attracting a broader base of investors who prioritize sustainable practices. This move also aligns with the expectations of stakeholders, including customers, employees, and communities, who are increasingly demanding that companies take meaningful action to address climate change.

However, the divestment is not without its challenges. The coal assets being sold are part of a complex supply chain that supports local economies and provides employment opportunities. Transitioning away from coal requires careful management to ensure that affected communities are supported and that economic disruptions are minimized. Anglo American will need to work closely with local stakeholders to develop strategies that promote economic diversification and create new opportunities for workers displaced by the transition.

In conclusion, Anglo American’s $1 billion divestment from its Australian coal mines represents a strategic realignment that reflects broader industry trends and the growing importance of sustainability. The financial implications of this move are significant, providing the company with capital to invest in future growth areas while reducing its exposure to the challenges facing the coal sector. As the global economy continues to evolve, companies like Anglo American that proactively adapt to changing market conditions and prioritize sustainability are likely to emerge as leaders in the new energy landscape.

Environmental Considerations In Anglo American’s Decision

Anglo American’s recent decision to divest a $1 billion stake in its Australian coal mines marks a significant shift in the company’s strategic direction, underscored by a growing emphasis on environmental considerations. This move aligns with the broader trend within the mining industry, where companies are increasingly prioritizing sustainability and environmental responsibility. As global awareness of climate change intensifies, stakeholders, including investors, governments, and consumers, are exerting pressure on corporations to adopt more sustainable practices. Consequently, Anglo American’s divestment can be seen as a response to these evolving expectations and a proactive step towards aligning its operations with global environmental goals.

The decision to divest from coal, a fossil fuel with a substantial carbon footprint, reflects Anglo American’s commitment to reducing its environmental impact. Coal mining and combustion are major contributors to greenhouse gas emissions, which are a primary driver of climate change. By reducing its involvement in coal production, Anglo American is taking a tangible step towards decreasing its carbon emissions. This move is consistent with the company’s broader sustainability strategy, which includes a commitment to achieving carbon neutrality by 2040. By divesting from coal, Anglo American is not only reducing its direct emissions but also signaling its intention to transition towards cleaner energy sources.

Moreover, this divestment aligns with the increasing regulatory pressures faced by mining companies worldwide. Governments are implementing stricter environmental regulations and policies aimed at curbing carbon emissions and promoting renewable energy. In Australia, where Anglo American’s coal mines are located, the government has introduced measures to reduce the country’s reliance on coal and transition towards more sustainable energy sources. By divesting from coal, Anglo American is positioning itself to better navigate these regulatory changes and mitigate potential risks associated with non-compliance.

In addition to regulatory pressures, the divestment is also influenced by shifting investor preferences. Investors are increasingly prioritizing environmental, social, and governance (ESG) factors when making investment decisions. Companies that demonstrate a commitment to sustainability and responsible environmental practices are more likely to attract investment. By divesting from coal, Anglo American is enhancing its ESG profile, which could improve its attractiveness to environmentally conscious investors. This strategic move not only aligns with investor expectations but also positions the company to capitalize on the growing demand for sustainable investment opportunities.

Furthermore, Anglo American’s decision is indicative of a broader industry trend towards diversification and innovation. As the global energy landscape evolves, mining companies are exploring opportunities in renewable energy and other sustainable sectors. By divesting from coal, Anglo American can redirect resources towards developing and expanding its portfolio in areas such as copper, nickel, and other minerals essential for renewable energy technologies. This strategic shift not only supports the company’s sustainability goals but also ensures its long-term competitiveness in a rapidly changing market.

In conclusion, Anglo American’s divestment of its $1 billion stake in Australian coal mines is a strategic decision driven by environmental considerations. By reducing its reliance on coal, the company is aligning itself with global sustainability goals, responding to regulatory pressures, and meeting investor expectations. This move reflects a broader industry trend towards sustainability and diversification, positioning Anglo American to thrive in an increasingly environmentally conscious world. As the company continues to evolve, its commitment to environmental responsibility will likely play a pivotal role in shaping its future endeavors.

Future Prospects For The Divested Australian Coal Mines

The recent divestment by Anglo American of its $1 billion stake in Australian coal mines marks a significant shift in the landscape of the global coal industry. This strategic move, while aligning with the company’s broader commitment to sustainability and reducing carbon emissions, opens up a myriad of future prospects for the divested assets. As the world increasingly pivots towards renewable energy sources, the future of these coal mines will largely depend on how they adapt to the evolving energy market and regulatory environment.

Firstly, the divestment presents an opportunity for new ownership to reassess and potentially revitalize the operations of these coal mines. With fresh investment and management, there is potential to enhance operational efficiency and implement more sustainable mining practices. This could involve the adoption of advanced technologies that reduce environmental impact, such as carbon capture and storage (CCS) systems, which could mitigate the carbon footprint of coal extraction and usage. Moreover, new owners might explore diversifying the mines’ output to include other minerals or resources, thereby reducing reliance on coal alone and aligning with global trends towards resource diversification.

Furthermore, the divestment could stimulate local economic growth by attracting new investors who are keen to capitalize on the existing infrastructure and workforce. This influx of investment could lead to job creation and community development initiatives, fostering a more resilient local economy. However, it is crucial for new stakeholders to engage with local communities and stakeholders to ensure that development plans are inclusive and address any social or environmental concerns. By doing so, they can build a strong social license to operate, which is increasingly important in today’s socially conscious business environment.

In addition to local economic implications, the divestment also has broader implications for the Australian coal industry. As one of the world’s largest coal exporters, Australia faces mounting pressure to transition towards cleaner energy sources. The divestment by a major player like Anglo American could signal a shift in the industry, encouraging other companies to reevaluate their portfolios and consider divestment or diversification strategies. This could accelerate the transition towards a more sustainable energy mix in Australia, with increased investment in renewable energy projects and technologies.

However, the future prospects of these coal mines are not without challenges. The global coal market is experiencing a decline in demand as countries implement stricter environmental regulations and commit to reducing carbon emissions. This trend is likely to continue, posing a risk to the profitability and viability of coal mining operations. To navigate these challenges, new owners will need to be innovative and forward-thinking, exploring ways to integrate sustainable practices and diversify their business models.

In conclusion, the divestment of Anglo American’s stake in Australian coal mines presents both opportunities and challenges for the future. While it offers a chance for new investment and revitalization, it also necessitates a strategic approach to address the evolving energy landscape and regulatory pressures. By embracing sustainability and innovation, the divested coal mines can carve out a viable future in a world that is increasingly moving away from fossil fuels. As the industry continues to evolve, the ability to adapt and innovate will be key to ensuring the long-term success and sustainability of these mining operations.

Market Reactions To Anglo American’s Strategic Shift

Anglo American’s recent decision to divest a $1 billion stake in its Australian coal mines has sent ripples through the market, prompting a range of reactions from investors, analysts, and industry stakeholders. This strategic shift marks a significant move for the multinational mining company, which has been gradually realigning its portfolio to focus on more sustainable and future-oriented resources. As the global energy landscape continues to evolve, Anglo American’s divestment is seen as a response to mounting pressure from environmental groups, regulatory bodies, and investors who are increasingly prioritizing sustainability.

The divestment aligns with Anglo American’s broader strategy to reduce its carbon footprint and transition towards greener energy sources. By shedding its coal assets, the company aims to enhance its environmental credentials and position itself as a leader in sustainable mining practices. This move is consistent with the growing trend among major mining companies to pivot away from fossil fuels and invest in minerals that are critical for the development of renewable energy technologies, such as copper, nickel, and lithium.

Market reactions to this divestment have been mixed. On one hand, environmental advocates and sustainability-focused investors have applauded Anglo American’s decision, viewing it as a positive step towards reducing the mining sector’s impact on climate change. They argue that by divesting from coal, Anglo American is not only aligning with global efforts to curb carbon emissions but also setting a precedent for other companies in the industry to follow suit.

On the other hand, some investors have expressed concerns about the potential financial implications of this divestment. Coal has historically been a significant revenue generator for Anglo American, and its decision to exit this market raises questions about the company’s future profitability. Critics argue that while the move may enhance Anglo American’s environmental image, it could also lead to short-term financial challenges as the company seeks to replace the revenue generated by its coal operations.

Despite these concerns, Anglo American’s management remains confident in the company’s ability to navigate this transition successfully. They emphasize that the divestment is part of a long-term strategy to focus on high-value assets that are aligned with global sustainability goals. By reallocating resources towards the development of metals and minerals essential for clean energy technologies, Anglo American aims to capitalize on the growing demand for these materials and secure its position in the evolving market landscape.

Furthermore, the divestment is expected to have broader implications for the coal industry in Australia. As one of the world’s largest coal exporters, Australia has been grappling with the challenge of balancing economic interests with environmental responsibilities. Anglo American’s exit from the Australian coal market may prompt other companies to reevaluate their positions and consider similar divestments, potentially accelerating the country’s transition towards a more sustainable energy future.

In conclusion, Anglo American’s $1 billion divestment from its Australian coal mines represents a significant strategic shift that reflects the company’s commitment to sustainability and its response to changing market dynamics. While the move has elicited varied reactions from different stakeholders, it underscores the growing importance of environmental considerations in shaping corporate strategies. As the mining industry continues to adapt to the demands of a low-carbon economy, Anglo American’s decision may serve as a catalyst for further change, encouraging other companies to embrace sustainability as a core component of their business models.

Analysis Of Anglo American’s Portfolio Realignment

Anglo American’s recent decision to divest a $1 billion stake in its Australian coal mines marks a significant step in the company’s ongoing portfolio realignment strategy. This move is not only indicative of the shifting dynamics within the global mining industry but also reflects the company’s strategic focus on sustainable growth and value creation. As the world increasingly turns towards cleaner energy sources, major mining companies like Anglo American are compelled to reassess their asset portfolios to align with evolving market demands and regulatory landscapes.

The divestment of the Australian coal assets is part of Anglo American’s broader strategy to reduce its exposure to thermal coal, a commodity that has faced mounting scrutiny due to its environmental impact. By shedding these assets, Anglo American is positioning itself to concentrate on its core operations, which include copper, platinum group metals, and diamonds. These commodities are not only more aligned with the company’s sustainability goals but also hold significant potential for growth in a world that is rapidly embracing green technologies.

Moreover, this strategic realignment allows Anglo American to reallocate capital towards projects that promise higher returns and are more resilient to future market fluctuations. The company’s focus on copper, for instance, is a calculated move given the metal’s critical role in the transition to renewable energy systems and electric vehicles. As demand for copper is projected to rise, Anglo American’s investments in this area could yield substantial long-term benefits.

In addition to enhancing its portfolio’s sustainability profile, Anglo American’s divestment strategy is also aimed at optimizing operational efficiency. By concentrating on fewer, high-quality assets, the company can streamline its operations, reduce costs, and improve overall productivity. This focus on operational excellence is crucial in an industry where margins are often squeezed by volatile commodity prices and increasing regulatory pressures.

Furthermore, the divestment aligns with Anglo American’s commitment to reducing its carbon footprint. By exiting thermal coal, the company is taking a proactive stance in addressing climate change, a move that is likely to resonate well with environmentally conscious investors and stakeholders. This commitment to sustainability is not only a moral imperative but also a strategic necessity in an era where environmental, social, and governance (ESG) criteria are becoming increasingly important in investment decisions.

While the divestment of the Australian coal assets represents a significant shift, it is not without its challenges. The company must carefully manage the transition to ensure that it does not disrupt its existing operations or alienate key stakeholders. Additionally, Anglo American must continue to innovate and adapt to remain competitive in a rapidly changing industry landscape.

In conclusion, Anglo American’s decision to divest a $1 billion stake in its Australian coal mines is a strategic move that underscores the company’s commitment to sustainable growth and operational efficiency. By realigning its portfolio to focus on commodities that are integral to the future of clean energy, Anglo American is positioning itself as a leader in the mining industry’s transition towards sustainability. This divestment not only enhances the company’s long-term value proposition but also reinforces its role as a responsible corporate citizen in the global effort to combat climate change. As the company navigates this transition, it will be crucial for Anglo American to maintain a balance between innovation, operational excellence, and stakeholder engagement to ensure continued success in the years to come.

The Role Of Stakeholders In The Divestment Process

In the complex landscape of corporate divestments, the recent decision by Anglo American to divest a $1 billion stake in its Australian coal mines underscores the intricate role of stakeholders in such processes. This strategic move, while primarily driven by financial and environmental considerations, highlights the multifaceted interactions between various stakeholders, each wielding significant influence over the outcome. Understanding the dynamics of these interactions is crucial to comprehending the broader implications of such divestments.

At the core of this divestment process are the shareholders of Anglo American, whose interests are paramount in guiding the company’s strategic decisions. Shareholders, particularly institutional investors, often exert pressure on companies to align with global sustainability trends and enhance long-term value. In recent years, there has been a marked shift towards environmentally responsible investing, with stakeholders increasingly advocating for reduced exposure to fossil fuels. This divestment aligns with such expectations, reflecting a broader industry trend towards sustainable practices.

Moreover, the role of regulatory bodies cannot be understated. In Australia, stringent environmental regulations and policies aimed at reducing carbon emissions have created a challenging operating environment for coal mining companies. Regulatory stakeholders, therefore, play a pivotal role in shaping the strategic decisions of companies like Anglo American. By divesting its coal assets, the company not only mitigates regulatory risks but also positions itself favorably in the eyes of policymakers and environmental advocates.

In addition to shareholders and regulators, employees and local communities represent critical stakeholders in the divestment process. The divestment of coal assets inevitably raises concerns about job security and economic stability in regions heavily reliant on mining activities. Anglo American must navigate these concerns delicately, ensuring that the divestment process includes measures to support affected employees and communities. This might involve retraining programs, community engagement initiatives, and collaboration with local governments to facilitate economic diversification.

Furthermore, potential buyers of the divested assets are key stakeholders whose interests and capabilities significantly influence the divestment process. Identifying buyers who are not only financially capable but also aligned with the strategic and ethical considerations of the divestment is crucial. The selection of suitable buyers ensures that the transition of ownership is smooth and that the new operators can maintain operational efficiency while adhering to environmental standards.

Financial institutions and analysts also play a significant role in the divestment process. Their assessments and recommendations can impact investor sentiment and, consequently, the market value of the divested assets. By providing insights into market trends and potential risks, these stakeholders help shape the strategic decisions of both sellers and buyers, ensuring that the divestment aligns with broader market dynamics.

In conclusion, the divestment of Anglo American’s $1 billion stake in Australian coal mines is a testament to the intricate interplay of various stakeholders in the divestment process. From shareholders and regulators to employees, local communities, potential buyers, and financial analysts, each stakeholder group brings unique perspectives and interests that influence the outcome. As companies navigate the complexities of divestment, understanding and addressing the concerns of these stakeholders is essential to achieving a successful and sustainable transition. This case exemplifies the importance of stakeholder engagement in shaping corporate strategies that align with evolving market and environmental imperatives.

Q&A

1. **What is the nature of the divestment by Anglo American?**

Anglo American divested a $1 billion stake in its Australian coal mines.

2. **Which assets were involved in the divestment?**

The divestment involved Anglo American’s stake in certain coal mining operations in Australia.

3. **What was the reason behind Anglo American’s divestment?**

The divestment aligns with Anglo American’s strategy to reduce its exposure to thermal coal and focus on more sustainable and profitable operations.

4. **Who acquired the stake from Anglo American?**

The stake was acquired by a consortium of investors or a specific company interested in expanding its coal mining operations.

5. **How does this divestment impact Anglo American’s portfolio?**

The divestment reduces Anglo American’s involvement in coal mining, allowing the company to reallocate resources to other areas of its portfolio.

6. **What are the expected financial implications for Anglo American?**

The divestment is expected to generate $1 billion in proceeds, which can be used for debt reduction, investment in other projects, or shareholder returns.

7. **How does this move align with global trends in the mining industry?**

The divestment reflects a broader industry trend of reducing reliance on fossil fuels and increasing focus on sustainability and environmental responsibility.

Conclusion

Anglo American’s decision to divest its $1 billion stake in Australian coal mines marks a significant step in the company’s strategic shift towards more sustainable and environmentally friendly operations. This move aligns with the broader industry trend of reducing reliance on fossil fuels and transitioning towards cleaner energy sources. By offloading its coal assets, Anglo American is likely aiming to enhance its environmental, social, and governance (ESG) profile, attract more sustainability-focused investors, and mitigate the financial risks associated with the declining coal market. This divestment could also provide the company with additional capital to invest in its core operations and growth areas, such as copper and other critical minerals essential for the green energy transition. Overall, this strategic realignment reflects the growing pressure on mining companies to adapt to the global push for decarbonization and sustainable resource management.