“Record Money Surge: Wall Street Braces for Uncharted Financial Waters”

Introduction

In recent times, the United States has witnessed an extraordinary surge in its money supply, reaching levels not seen since the Great Depression. This unprecedented expansion, driven by aggressive monetary policies and fiscal stimulus measures, has sparked widespread debate among economists and financial analysts. The rapid increase in money supply, while initially aimed at stabilizing the economy during periods of crisis, now poses potential challenges for Wall Street and the broader financial system. As liquidity floods the market, concerns about inflationary pressures, asset bubbles, and long-term economic stability have come to the forefront, prompting a reevaluation of monetary strategies and their implications for future economic health.

Historical Context: Comparing Current U.S. Money Supply Levels to the Great Depression

The current state of the U.S. money supply has reached levels not seen since the Great Depression, raising concerns about potential challenges for Wall Street. To understand the implications of this development, it is essential to examine the historical context and draw comparisons between the present situation and the economic conditions of the 1930s. During the Great Depression, the U.S. economy faced a severe contraction, leading to a significant reduction in the money supply. This contraction was primarily due to bank failures and a lack of confidence in the financial system, which resulted in decreased lending and spending. The Federal Reserve’s response at the time was limited, as monetary policy tools were not as developed or as aggressively employed as they are today.

Fast forward to the present, the U.S. money supply has expanded dramatically, driven by unprecedented monetary policy measures implemented in response to the COVID-19 pandemic. The Federal Reserve, in an effort to stabilize the economy, has engaged in extensive quantitative easing, purchasing large quantities of government securities to inject liquidity into the financial system. This has led to a significant increase in the money supply, as measured by metrics such as M1 and M2. While this approach has helped avert a deeper economic crisis, it has also raised concerns about potential inflationary pressures and asset bubbles.

In comparing the current situation to the Great Depression, it is important to note the differences in the economic landscape and policy responses. During the 1930s, the contraction of the money supply exacerbated the economic downturn, whereas today, the expansion of the money supply is intended to support economic recovery. However, the rapid increase in money supply also poses risks, particularly for Wall Street. The influx of liquidity has contributed to soaring asset prices, with stock markets reaching record highs. This has led to concerns about overvaluation and the potential for a market correction.

Moreover, the current environment of low interest rates, a byproduct of the Federal Reserve’s policies, has encouraged borrowing and risk-taking. While this can stimulate economic activity, it also raises the specter of financial instability if asset prices were to suddenly decline. The challenge for policymakers is to balance the need for continued economic support with the risk of creating financial imbalances. As the economy recovers, the Federal Reserve will need to carefully navigate the process of unwinding its monetary stimulus to avoid triggering market volatility.

In addition to domestic considerations, the global context also plays a role in shaping the impact of the U.S. money supply on Wall Street. The interconnectedness of global financial markets means that changes in U.S. monetary policy can have far-reaching effects. For instance, a tightening of monetary policy in the U.S. could lead to capital outflows from emerging markets, potentially destabilizing their economies and, in turn, affecting global financial stability.

In conclusion, while the current expansion of the U.S. money supply is a response to unprecedented economic challenges, it also presents potential risks for Wall Street. By examining the historical context of the Great Depression, we can gain insights into the complexities of managing monetary policy in times of economic uncertainty. As policymakers navigate these challenges, the lessons of history underscore the importance of maintaining a delicate balance between supporting economic growth and ensuring financial stability.

Economic Implications: How Unprecedented Money Supply Affects Inflation and Interest Rates

The unprecedented expansion of the U.S. money supply has become a focal point of economic discourse, drawing parallels to the financial landscape of the Great Depression. This surge in money supply, primarily driven by expansive fiscal policies and aggressive monetary interventions, has profound implications for inflation and interest rates, which are critical components of the broader economic framework. As the Federal Reserve continues to navigate the complexities of post-pandemic recovery, understanding the potential challenges posed by this monetary phenomenon is essential for policymakers and investors alike.

To begin with, the increase in money supply is largely attributed to the Federal Reserve’s response to the economic fallout from the COVID-19 pandemic. Through measures such as quantitative easing and near-zero interest rates, the Fed aimed to stimulate economic activity by making borrowing cheaper and encouraging spending. While these actions were necessary to avert a deeper recession, they have also led to an unprecedented influx of liquidity into the financial system. Consequently, this has raised concerns about inflationary pressures, as more money in circulation can lead to higher demand for goods and services, potentially driving up prices.

Moreover, the relationship between money supply and inflation is complex and influenced by various factors, including consumer behavior and supply chain dynamics. In recent months, inflation rates have indeed risen, prompting debates about whether this trend is transitory or indicative of a more persistent issue. Some economists argue that supply chain disruptions and pent-up consumer demand are temporary factors that will eventually stabilize. However, others caution that sustained high levels of money supply could embed inflationary expectations, making it more challenging to control price increases in the long term.

In addition to inflation, the burgeoning money supply has significant implications for interest rates. Traditionally, an increase in money supply would lead to lower interest rates, as banks have more funds to lend. However, the current economic environment presents a paradox. While the Federal Reserve has maintained low interest rates to support economic recovery, the specter of rising inflation could compel the central bank to adjust its policy stance. If inflation continues to climb, the Fed may be forced to raise interest rates to prevent the economy from overheating, a move that could have far-reaching consequences for financial markets and borrowing costs.

Furthermore, the potential for higher interest rates poses a challenge for Wall Street, where low borrowing costs have fueled a prolonged bull market. An increase in rates could lead to a reevaluation of asset valuations, as higher yields on bonds and other fixed-income securities might make equities less attractive. This shift could trigger volatility in stock markets, as investors reassess their portfolios in response to changing economic conditions.

In conclusion, the unprecedented levels of U.S. money supply since the Great Depression present a complex set of challenges for the economy. The interplay between money supply, inflation, and interest rates requires careful monitoring and strategic policy responses to ensure sustainable economic growth. As the Federal Reserve and other stakeholders navigate this intricate landscape, the decisions made in the coming months will be pivotal in shaping the future trajectory of the U.S. economy. Balancing the need for continued economic support with the risks of inflation and market instability will be crucial in maintaining financial stability and fostering long-term prosperity.

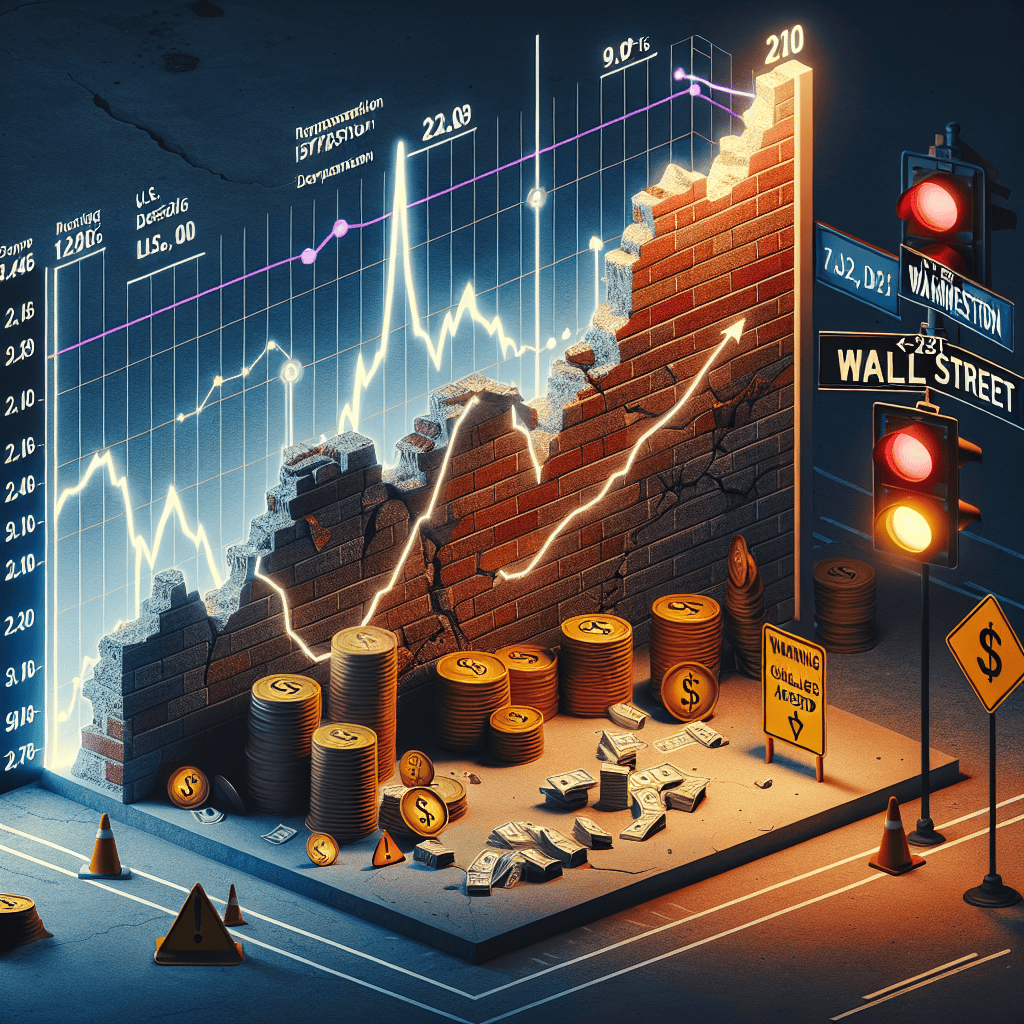

Wall Street’s Response: Analyzing Market Reactions to Surging Money Supply

The recent surge in the U.S. money supply has reached levels not seen since the Great Depression, raising concerns about potential challenges for Wall Street. This unprecedented increase in money supply, primarily driven by expansive fiscal policies and aggressive monetary interventions, has prompted a variety of reactions from market participants. As investors and analysts grapple with the implications of this monetary phenomenon, it is crucial to understand how Wall Street is responding and what this might mean for the broader financial landscape.

To begin with, the surge in money supply can be attributed to several factors, including the Federal Reserve’s commitment to maintaining low interest rates and its extensive bond-buying programs. These measures, aimed at stimulating economic growth and ensuring liquidity in the financial system, have resulted in a significant increase in the amount of money circulating in the economy. While these actions have been instrumental in supporting the recovery from the economic downturn caused by the COVID-19 pandemic, they have also led to concerns about potential inflationary pressures and asset bubbles.

In response to these developments, Wall Street has exhibited a range of reactions. On one hand, the influx of liquidity has fueled a rally in equity markets, with major indices reaching record highs. Investors, buoyed by the availability of cheap capital, have poured money into stocks, driving up valuations and creating a sense of optimism about future growth prospects. This bullish sentiment has been further reinforced by strong corporate earnings and positive economic indicators, which have helped to sustain the upward momentum in the markets.

However, not all market participants share this optimistic outlook. Some analysts have expressed concerns about the sustainability of the current market rally, warning that the excessive money supply could lead to overheating and eventual market corrections. The fear is that if inflation begins to rise more rapidly than anticipated, the Federal Reserve may be forced to tighten monetary policy sooner than expected, potentially triggering a sell-off in risk assets. This uncertainty has led to increased volatility in the markets, as investors weigh the potential risks and rewards of the current economic environment.

Moreover, the impact of the surging money supply is not limited to equity markets alone. The bond market has also been affected, with yields on government securities experiencing fluctuations as investors adjust their expectations for future interest rate movements. While the Federal Reserve’s commitment to maintaining low rates has kept yields relatively stable, any indication of a shift in policy could lead to significant disruptions in fixed-income markets.

In addition to these market dynamics, the increase in money supply has also raised questions about the long-term implications for the U.S. economy. Some economists argue that the current monetary environment could lead to structural imbalances, such as increased debt levels and reduced savings rates, which may pose challenges for sustainable economic growth. Furthermore, the potential for rising inflation could erode purchasing power and create additional pressures on consumers and businesses alike.

In conclusion, the unprecedented levels of money supply in the U.S. present both opportunities and challenges for Wall Street. While the influx of liquidity has supported market rallies and economic recovery, it has also introduced new risks and uncertainties that investors must navigate. As the situation continues to evolve, market participants will need to remain vigilant and adaptable, carefully assessing the potential impacts of monetary policy changes and economic developments on their investment strategies. Ultimately, the ability of Wall Street to effectively respond to these challenges will play a crucial role in shaping the future trajectory of the financial markets and the broader economy.

Federal Reserve’s Role: Strategies and Policies in Managing Excessive Money Supply

The unprecedented expansion of the U.S. money supply has become a focal point of economic discourse, drawing comparisons to the era of the Great Depression. This surge in liquidity, while initially a response to the economic disruptions caused by the COVID-19 pandemic, now presents a complex challenge for the Federal Reserve. As the central bank of the United States, the Federal Reserve plays a pivotal role in managing the nation’s monetary policy, and its strategies and policies are crucial in addressing the potential ramifications of an excessive money supply on Wall Street and the broader economy.

In the wake of the pandemic, the Federal Reserve implemented a series of aggressive monetary policies aimed at stabilizing the economy. These included slashing interest rates to near-zero levels and launching extensive quantitative easing programs. By purchasing large quantities of government securities and other financial assets, the Federal Reserve injected liquidity into the financial system, thereby increasing the money supply. While these measures were instrumental in averting a deeper economic crisis, they have also led to an unprecedented expansion of the money supply, raising concerns about inflationary pressures and asset bubbles.

As the economy transitions from recovery to growth, the Federal Reserve faces the delicate task of unwinding these policies without destabilizing financial markets. One of the primary tools at its disposal is the adjustment of interest rates. By gradually increasing rates, the Federal Reserve can help temper inflation and signal confidence in the economy’s resilience. However, this approach must be carefully calibrated to avoid triggering a sharp market correction or stifling economic growth. The timing and pace of rate hikes are therefore critical, requiring the Federal Reserve to closely monitor economic indicators and market reactions.

In addition to interest rate adjustments, the Federal Reserve can employ other strategies to manage the money supply. For instance, it can reduce its balance sheet by allowing securities to mature without reinvestment, effectively withdrawing liquidity from the financial system. This process, known as quantitative tightening, can help mitigate the risks associated with an excessive money supply. However, it also carries the risk of increasing volatility in financial markets, necessitating a cautious and transparent approach.

Moreover, the Federal Reserve’s communication strategy plays a vital role in managing market expectations and ensuring a smooth transition. By clearly articulating its policy intentions and the rationale behind its decisions, the Federal Reserve can help reduce uncertainty and foster confidence among investors. This transparency is essential in maintaining the delicate balance between supporting economic growth and preventing financial instability.

The challenges posed by the current monetary environment are further compounded by external factors, such as geopolitical tensions and global economic uncertainties. These elements can influence market dynamics and complicate the Federal Reserve’s policy decisions. Consequently, the central bank must remain vigilant and adaptable, ready to adjust its strategies in response to evolving conditions.

In conclusion, the Federal Reserve’s role in managing the excessive money supply is critical in navigating the potential challenges facing Wall Street and the broader economy. Through a combination of interest rate adjustments, balance sheet management, and effective communication, the Federal Reserve aims to strike a balance between fostering economic growth and maintaining financial stability. As the economic landscape continues to evolve, the central bank’s strategies and policies will be instrumental in shaping the future trajectory of the U.S. economy.

Investment Strategies: Navigating Wall Street Amidst Record Money Supply Levels

The U.S. money supply has reached unprecedented levels not seen since the Great Depression, a development that has significant implications for Wall Street and investment strategies. This surge in money supply, primarily driven by expansive fiscal policies and aggressive monetary interventions, has created a complex landscape for investors seeking to navigate the financial markets. Understanding the potential challenges and opportunities presented by this economic environment is crucial for making informed investment decisions.

To begin with, the increase in money supply is largely a result of the Federal Reserve’s efforts to stimulate the economy in response to recent economic disruptions. By lowering interest rates and implementing quantitative easing measures, the Fed has injected vast amounts of liquidity into the financial system. While these actions have been instrumental in supporting economic recovery, they have also led to concerns about inflationary pressures. As more money circulates in the economy, the purchasing power of the dollar may diminish, potentially eroding the real returns on investments.

In light of these developments, investors are faced with the challenge of preserving their capital while seeking growth opportunities. One potential strategy is to diversify portfolios by including assets that traditionally perform well during inflationary periods. Commodities, such as gold and silver, have historically been viewed as hedges against inflation, as their value tends to rise when the purchasing power of fiat currencies declines. Additionally, real estate investments can offer a buffer against inflation, as property values and rental incomes often increase in tandem with rising prices.

Moreover, equities remain a critical component of any investment strategy, but selecting the right sectors is essential. Companies with strong pricing power, such as those in the consumer staples and healthcare sectors, may be better positioned to maintain profitability in an inflationary environment. These firms can pass on higher costs to consumers without significantly affecting demand for their products. Conversely, sectors that are heavily reliant on raw materials or have limited ability to adjust prices may face margin pressures.

Furthermore, fixed-income investments present a unique set of challenges in the current economic climate. With interest rates at historically low levels, traditional bonds may offer limited returns. However, investors can explore alternative fixed-income options, such as inflation-protected securities, which are designed to provide returns that keep pace with inflation. Additionally, high-yield bonds, while riskier, may offer more attractive yields compared to their investment-grade counterparts.

In addition to asset allocation, investors must also consider the potential impact of fiscal policy changes on their portfolios. As the government continues to implement stimulus measures, the resulting fiscal deficits could lead to higher taxes or changes in regulatory frameworks. Staying informed about policy developments and adjusting investment strategies accordingly will be crucial for navigating this evolving landscape.

In conclusion, the unprecedented levels of money supply in the U.S. present both challenges and opportunities for investors. By adopting a diversified approach that includes inflation-resistant assets, carefully selected equities, and alternative fixed-income options, investors can better position themselves to weather potential market volatility. Moreover, staying attuned to fiscal policy changes and their implications will be essential for making informed investment decisions. As Wall Street grapples with these dynamics, a proactive and informed approach will be key to successfully navigating the complexities of the current financial environment.

Global Impact: How U.S. Money Supply Trends Influence International Markets

The unprecedented expansion of the U.S. money supply has become a focal point of global economic discourse, drawing parallels to the financial landscape of the Great Depression. This surge, driven by a combination of fiscal stimulus measures and monetary policy adjustments, has profound implications not only for Wall Street but also for international markets. As the U.S. economy grapples with the consequences of this monetary phenomenon, the ripple effects are being felt across the globe, influencing economic strategies and market dynamics in various countries.

To understand the global impact, it is essential to first consider the factors contributing to the increase in the U.S. money supply. In response to economic disruptions caused by the COVID-19 pandemic, the U.S. government implemented expansive fiscal policies, including direct stimulus payments and enhanced unemployment benefits. Concurrently, the Federal Reserve adopted an accommodative monetary stance, lowering interest rates and engaging in large-scale asset purchases. These measures, while aimed at stabilizing the domestic economy, have led to a significant increase in the money supply, reaching levels not seen since the Great Depression.

The implications of this monetary expansion extend far beyond U.S. borders. As the world’s largest economy, the United States plays a pivotal role in global trade and finance. Consequently, changes in its monetary policy and economic conditions can have a cascading effect on international markets. One of the most immediate impacts is on currency exchange rates. An increase in the U.S. money supply can lead to a depreciation of the dollar, affecting countries that rely heavily on exports to the United States. This depreciation can make U.S. goods more competitive abroad, but it also poses challenges for countries with dollar-denominated debt, as their repayment costs rise.

Moreover, the surge in the U.S. money supply has implications for global inflationary pressures. As more dollars circulate in the economy, there is a potential for increased inflation, which can spill over into other countries through trade and investment channels. Central banks worldwide are closely monitoring these developments, as they may need to adjust their own monetary policies to mitigate inflationary risks. This interconnectedness underscores the complexity of managing national economies in an increasingly globalized world.

In addition to these economic considerations, the expansion of the U.S. money supply has significant implications for international financial markets. Investors seeking higher returns may shift their focus to emerging markets, where growth prospects are more robust. However, this influx of capital can lead to asset bubbles and increased volatility in these markets, posing challenges for policymakers. Furthermore, the potential for interest rate hikes by the Federal Reserve in response to domestic inflationary pressures could lead to capital outflows from emerging markets, exacerbating financial instability.

In conclusion, the unprecedented levels of the U.S. money supply since the Great Depression present both opportunities and challenges for international markets. While the immediate focus may be on Wall Street, the global ramifications of these monetary trends cannot be overlooked. As countries navigate this complex economic landscape, collaboration and communication among policymakers will be crucial to ensuring stability and fostering sustainable growth. The interconnected nature of today’s global economy means that the actions taken by one nation can have far-reaching consequences, underscoring the importance of a coordinated approach to addressing the challenges posed by the current monetary environment.

Future Outlook: Predicting Long-term Economic Effects of Current Money Supply Trends

The unprecedented expansion of the U.S. money supply has become a focal point of economic discourse, drawing comparisons to the era of the Great Depression. This surge, driven by a combination of fiscal stimulus measures and monetary policy interventions, has raised questions about the long-term implications for the economy, particularly concerning Wall Street’s stability. As we delve into the future outlook, it is essential to consider the multifaceted effects of this monetary phenomenon.

To begin with, the increase in money supply has been largely attributed to the Federal Reserve’s response to economic disruptions, such as the COVID-19 pandemic. By implementing quantitative easing and maintaining low interest rates, the Fed aimed to stimulate economic activity and prevent a deeper recession. However, these measures have also led to an influx of liquidity in financial markets, which, while initially stabilizing, may pose risks if not managed carefully. The potential for asset bubbles is a significant concern, as excessive liquidity can drive up prices in stocks, real estate, and other investment vehicles beyond their intrinsic values.

Moreover, the relationship between money supply and inflation is a critical aspect to consider. Historically, an increase in money supply has been associated with rising inflationary pressures. While inflation remained relatively subdued in the immediate aftermath of the pandemic, recent trends indicate a gradual uptick. This development necessitates a careful balancing act by policymakers to ensure that inflation does not spiral out of control, which could erode purchasing power and destabilize the economy. The Federal Reserve faces the challenge of timing its policy adjustments to mitigate inflation without stifling economic growth.

In addition to inflationary concerns, the burgeoning money supply has implications for interest rates. As the economy recovers, there is an expectation that the Federal Reserve will eventually tighten monetary policy by raising interest rates. This shift could have profound effects on Wall Street, as higher borrowing costs may dampen corporate profits and reduce investment in growth opportunities. Furthermore, the transition to a higher interest rate environment could lead to increased volatility in financial markets, as investors adjust their portfolios in response to changing economic conditions.

Another dimension to consider is the impact on income inequality. The expansion of the money supply has disproportionately benefited those with significant investments in financial markets, exacerbating wealth disparities. As asset prices soar, individuals with substantial holdings in stocks and real estate have seen their wealth increase, while those without such investments have not experienced similar gains. This growing divide poses a challenge for policymakers, who must address the social and economic ramifications of inequality while fostering sustainable economic growth.

Looking ahead, the long-term effects of the current money supply trends will depend on a range of factors, including the Federal Reserve’s policy decisions, global economic conditions, and the pace of technological advancements. It is crucial for policymakers to remain vigilant and adaptable, employing a data-driven approach to navigate the complexities of the modern economy. By doing so, they can mitigate potential risks and harness opportunities to ensure a stable and prosperous future.

In conclusion, the unprecedented levels of the U.S. money supply present both challenges and opportunities for the economy. While the immediate focus may be on managing inflation and interest rates, the broader implications for Wall Street and income inequality cannot be overlooked. As we move forward, a nuanced understanding of these dynamics will be essential in predicting and shaping the long-term economic landscape.

Q&A

1. **What is the current state of the U.S. money supply?**

The U.S. money supply has reached unprecedented levels, comparable to those seen during the Great Depression.

2. **What are the potential implications of this increase in money supply?**

The increase in money supply could signal potential challenges for Wall Street, including inflationary pressures and market volatility.

3. **How does the current money supply compare to historical levels?**

The current money supply levels are among the highest since the Great Depression, indicating significant monetary expansion.

4. **What factors have contributed to the increase in money supply?**

Factors include expansive fiscal policies, quantitative easing, and government stimulus measures in response to economic challenges.

5. **What are the potential risks associated with high money supply levels?**

Risks include inflation, asset bubbles, and potential destabilization of financial markets.

6. **How might Wall Street be affected by these changes in money supply?**

Wall Street could face increased volatility, shifts in investment strategies, and potential reevaluation of asset valuations.

7. **What measures could be taken to address the challenges posed by high money supply?**

Measures could include tightening monetary policy, adjusting interest rates, and implementing fiscal policies to stabilize the economy.

Conclusion

The unprecedented increase in the U.S. money supply, reaching levels not seen since the Great Depression, suggests potential challenges for Wall Street. This surge in money supply can lead to inflationary pressures, eroding purchasing power and potentially prompting the Federal Reserve to implement tighter monetary policies. Such actions could increase borrowing costs, impact corporate profits, and create volatility in financial markets. Additionally, the excess liquidity might fuel asset bubbles, posing risks to financial stability. Investors and policymakers must navigate these complexities carefully to mitigate adverse economic impacts and ensure sustainable growth.