“Lost Fortune, Buried Battle: A Man’s Quest for Bitcoin Justice in the Depths of a Landfill.”

Introduction

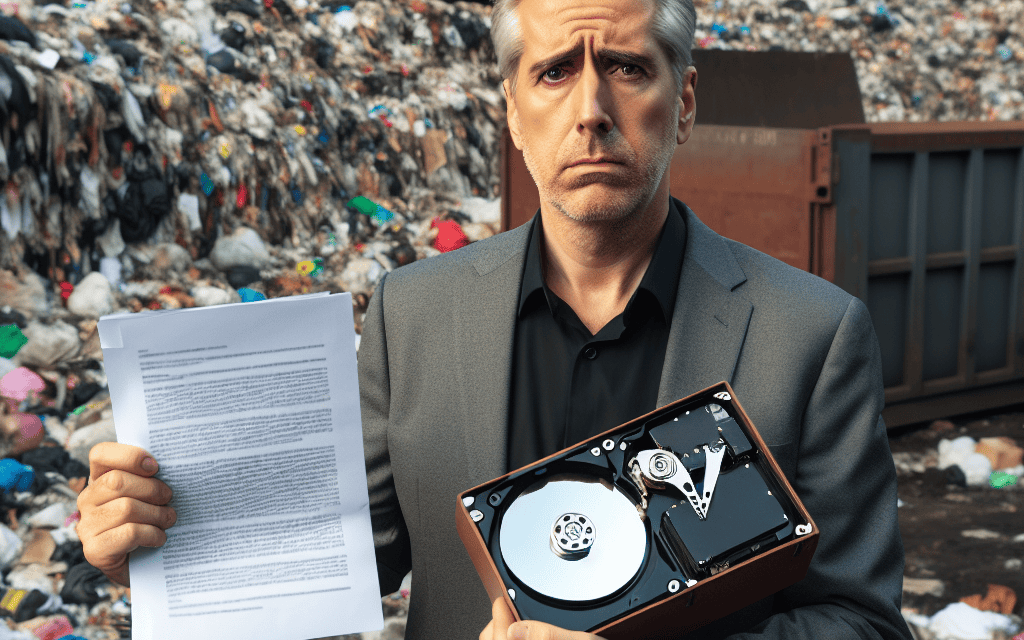

In a remarkable twist of fate, a man who inadvertently discarded a hard drive containing 8,000 Bitcoins—now valued at approximately half a billion dollars—has taken legal action against his local city council for their refusal to excavate the landfill where the device is believed to be buried. This extraordinary case highlights the dramatic rise in Bitcoin’s value over the years and underscores the challenges of recovering lost digital assets. The man’s quest to retrieve his lost fortune has captured global attention, raising questions about responsibility, technology, and the lengths to which individuals will go to reclaim what was once thought to be irretrievably lost.

Legal Battle Over Lost Fortune: The Man Who Sued For His Bitcoin Treasure

In a remarkable legal battle that has captured the attention of both the cryptocurrency community and the general public, a man who inadvertently discarded a hard drive containing 8,000 Bitcoins is now suing his local city council for their refusal to excavate the landfill where the device is believed to be buried. This case, which underscores the complexities and challenges associated with digital currencies, raises significant questions about responsibility, ownership, and the lengths to which individuals might go to recover lost fortunes.

The saga began in 2013 when James Howells, an IT worker from Newport, Wales, mistakenly threw away a hard drive during a routine clean-up of his home office. Unbeknownst to him at the time, this hard drive contained the private keys to a Bitcoin wallet holding 8,000 Bitcoins. At the time of disposal, the value of these Bitcoins was relatively modest, but as the cryptocurrency market surged over the years, the value of Howells’ lost digital treasure skyrocketed to an estimated half a billion dollars.

Faced with the staggering realization of his loss, Howells embarked on a mission to recover the hard drive. His efforts, however, were met with a significant obstacle: the local city council’s refusal to grant permission for an excavation of the landfill where the hard drive is presumed to be located. The council cited environmental concerns, logistical challenges, and the prohibitive costs associated with such an undertaking as reasons for their decision. Despite these objections, Howells remained undeterred, proposing a detailed excavation plan that he claimed would mitigate environmental risks and cover all associated costs.

As the impasse continued, Howells decided to take legal action against the city council, arguing that their refusal to allow the excavation constituted an unreasonable barrier to recovering his property. His lawsuit contends that the council’s decision effectively denies him access to his own assets, which he believes is a violation of his rights. The case has sparked a broader debate about the responsibilities of local authorities in situations involving lost digital assets and the extent to which they should accommodate efforts to retrieve them.

The legal proceedings have also highlighted the unique challenges posed by cryptocurrencies, which, unlike traditional assets, exist solely in digital form and are secured by cryptographic keys. The loss of these keys, as Howells’ case illustrates, can render the associated assets irretrievable. This has prompted discussions about the need for better education and awareness regarding the secure management of digital currencies, as well as potential regulatory measures to address such issues.

As the lawsuit unfolds, it remains to be seen how the court will balance the competing interests at play. On one hand, there is the individual’s right to access and recover their property; on the other, the legitimate concerns of the city council regarding environmental impact and public resources. The outcome of this case could set a precedent for how similar disputes are handled in the future, potentially influencing both legal frameworks and public policy related to digital assets.

In conclusion, the legal battle over James Howells’ lost Bitcoin fortune serves as a poignant reminder of the complexities and risks inherent in the world of cryptocurrencies. It underscores the importance of careful management and secure storage of digital assets, while also highlighting the evolving legal landscape surrounding this innovative yet challenging form of currency. As the case progresses, it will undoubtedly continue to generate interest and debate, offering valuable insights into the intersection of technology, law, and personal responsibility.

The High Stakes Of Digital Currency: A Hard Drive Buried In A Landfill

In the ever-evolving landscape of digital currency, the story of James Howells serves as a cautionary tale about the tangible consequences of virtual assets. Howells, a former IT worker from Newport, Wales, inadvertently discarded a hard drive in 2013 that contained 8,000 Bitcoins. At the time, the value of Bitcoin was relatively modest, but as the cryptocurrency’s value skyrocketed, the worth of Howells’ lost digital fortune surged to an astonishing half a billion dollars. This dramatic increase in value has led Howells to take legal action against the Newport City Council, seeking permission to excavate the landfill where he believes the hard drive is buried.

The case highlights the complex intersection of digital currency and real-world logistics. Howells’ predicament underscores the importance of safeguarding digital assets, which, despite their intangible nature, can hold immense value. The hard drive, now buried under years of waste, represents not just a personal loss for Howells but also a significant financial opportunity that remains tantalizingly out of reach. The legal battle he has embarked upon raises questions about the responsibilities of local authorities in facilitating the recovery of lost digital assets, especially when such assets have the potential to impact local economies.

Howells’ lawsuit against the Newport City Council is rooted in his belief that the council has a duty to assist in the retrieval of the hard drive. He argues that the potential economic benefits of recovering the Bitcoins could be substantial, not only for himself but also for the local community. However, the council has expressed concerns about the environmental and logistical challenges associated with excavating a landfill. The process of sifting through tons of waste to locate a single hard drive is fraught with difficulties, including the potential for environmental damage and the significant financial costs involved.

Despite these challenges, Howells remains determined to pursue his case, driven by the hope of reclaiming his lost fortune. His determination is fueled by the transformative potential of Bitcoin, which has become a symbol of financial innovation and disruption. The cryptocurrency’s decentralized nature and its ability to operate outside traditional financial systems have made it both a lucrative investment and a subject of intense debate. Howells’ situation serves as a stark reminder of the volatility and unpredictability inherent in the world of digital currency.

As the legal proceedings unfold, the case has attracted widespread attention, drawing interest from both the cryptocurrency community and the general public. It raises important questions about the future of digital assets and the role of local governments in addressing the unique challenges they present. The outcome of Howells’ lawsuit could set a precedent for how similar cases are handled in the future, potentially influencing policies related to the recovery of lost digital assets.

In conclusion, the saga of James Howells and his buried Bitcoins encapsulates the high stakes of digital currency in a rapidly changing world. It highlights the need for individuals to exercise caution and diligence in managing their digital assets while also prompting a broader discussion about the responsibilities of local authorities in navigating the complexities of the digital age. As the case progresses, it will undoubtedly continue to capture the imagination of those who are invested in the future of cryptocurrency and its impact on society.

The Environmental Impact Of Excavating Landfills For Lost Treasures

The case of the man who inadvertently discarded a hard drive containing 8,000 Bitcoins, now valued at approximately half a billion dollars, has sparked a legal battle with the local city council over the excavation of a landfill. This incident not only highlights the personal and financial stakes involved but also brings to the forefront the environmental implications of such an excavation. As the legal proceedings unfold, it is crucial to consider the broader environmental impact of disturbing landfill sites in search of lost treasures.

Landfills are complex ecosystems that, once established, undergo a series of biological and chemical processes. These processes are carefully managed to minimize environmental harm, such as the release of methane gas and leachate, a liquid that can contaminate groundwater. Excavating a landfill disrupts these processes, potentially leading to increased emissions and pollution. The act of unearthing buried waste can release trapped gases and expose decomposing materials to the air, accelerating decomposition and increasing the release of greenhouse gases. Consequently, the environmental cost of such an operation must be weighed against the potential financial gain.

Moreover, the excavation of a landfill is a resource-intensive endeavor. It requires heavy machinery, labor, and time, all of which contribute to a significant carbon footprint. The machinery used in excavation consumes fossil fuels, adding to the environmental burden. Additionally, the process generates noise and air pollution, affecting the surrounding community and wildlife. These factors raise questions about the sustainability of pursuing lost digital fortunes buried beneath layers of waste.

Furthermore, the potential for environmental contamination cannot be overlooked. Landfills often contain hazardous materials, including electronic waste, which can leach toxic substances into the soil and water if disturbed. The risk of contamination increases with the scale of the excavation, posing a threat to local ecosystems and public health. This underscores the need for stringent environmental assessments and mitigation strategies before any excavation is undertaken.

In light of these considerations, it is essential to explore alternative solutions that balance the pursuit of lost assets with environmental stewardship. One approach could involve the use of advanced technology, such as ground-penetrating radar or drones, to locate the precise position of the hard drive, thereby minimizing the area that needs to be excavated. Additionally, implementing a phased excavation plan with continuous environmental monitoring could help mitigate the impact on the landfill ecosystem.

The legal case against the city council also raises important questions about responsibility and accountability. Should local governments be obligated to undertake environmentally risky operations to recover lost private assets? Or should individuals bear the consequences of their actions, regardless of the potential financial loss? These questions highlight the need for clear policies and guidelines regarding the excavation of landfills for lost items, ensuring that environmental considerations are prioritized.

In conclusion, while the prospect of recovering a fortune from a landfill is undoubtedly enticing, it is imperative to consider the environmental ramifications of such an endeavor. The case of the discarded Bitcoin hard drive serves as a poignant reminder of the complex interplay between technological advancement, personal responsibility, and environmental sustainability. As society continues to grapple with these issues, it is crucial to develop strategies that protect our planet while addressing the challenges posed by our digital age.

The Value Of Bitcoin: How A Mistake Turned Into A Half-Billion-Dollar Lawsuit

In a remarkable turn of events that underscores the volatile yet potentially lucrative nature of cryptocurrency, a man who inadvertently discarded a hard drive containing 8,000 Bitcoins is now embroiled in a legal battle with his local city council. This case, which has captured the attention of both the legal and financial communities, highlights the profound impact that digital currencies can have on individuals’ lives and the complexities that arise when technology intersects with traditional systems.

The saga began in 2013 when James Howells, an IT worker from Newport, Wales, mistakenly threw away a hard drive during a routine clean-up of his home office. At the time, the value of Bitcoin was relatively modest, and the loss seemed inconsequential. However, as the years passed and Bitcoin’s value skyrocketed, the significance of that discarded hard drive became monumental. Today, with Bitcoin’s value fluctuating around $60,000 per coin, the lost digital fortune is estimated to be worth approximately half a billion dollars.

Howells’ predicament is not just a personal financial disaster but also a cautionary tale about the importance of digital asset management. As cryptocurrencies continue to gain mainstream acceptance, the need for secure storage solutions and meticulous record-keeping becomes increasingly apparent. The decentralized nature of Bitcoin, while offering unparalleled freedom and privacy, also means that once access to a wallet is lost, it is nearly impossible to recover the funds.

In an effort to retrieve his lost fortune, Howells has embarked on a legal crusade against the Newport City Council, seeking permission to excavate the landfill where he believes the hard drive resides. The council, however, has consistently denied his requests, citing environmental concerns and the logistical challenges of such an undertaking. Excavating a landfill is no small feat; it involves significant financial resources, potential environmental hazards, and the disruption of local waste management operations.

Despite these challenges, Howells remains undeterred. He has proposed a detailed excavation plan, complete with environmental safeguards and financial backing from investors who are willing to share in the potential recovery of the Bitcoins. His determination is fueled not only by the staggering value of the lost Bitcoins but also by a sense of responsibility to rectify his mistake and reclaim what he sees as rightfully his.

The legal battle between Howells and the Newport City Council raises important questions about the responsibilities of local governments in facilitating or hindering the recovery of lost digital assets. It also highlights the broader societal implications of cryptocurrency ownership, where the line between personal accountability and institutional support is often blurred. As the case unfolds, it may set a precedent for how similar situations are handled in the future, potentially influencing policy decisions regarding digital asset recovery.

In conclusion, the story of James Howells and his lost Bitcoins serves as a poignant reminder of the transformative power of cryptocurrency and the unforeseen challenges it can present. As digital currencies continue to reshape the financial landscape, individuals and institutions alike must navigate the delicate balance between embracing innovation and safeguarding against its inherent risks. Whether Howells will ultimately succeed in his quest remains uncertain, but his journey underscores the enduring allure and complexity of the digital age.

The Challenges Of Recovering Lost Digital Assets In Physical Spaces

In the ever-evolving landscape of digital currencies, the story of a man who inadvertently discarded a hard drive containing 8,000 Bitcoins has captured widespread attention. This incident, which has now escalated into a legal battle, underscores the complex challenges associated with recovering lost digital assets in physical spaces. As cryptocurrencies continue to gain prominence, the intersection of digital wealth and tangible recovery efforts presents a unique set of difficulties that are both technical and legal in nature.

The man in question, James Howells, inadvertently threw away a hard drive in 2013 that contained a digital wallet with 8,000 Bitcoins. At the time, the value of Bitcoin was relatively low, but as the cryptocurrency’s value surged, the worth of the lost Bitcoins skyrocketed to approximately half a billion dollars. This dramatic increase in value has intensified Howells’ efforts to recover the hard drive, which he believes is buried in a landfill in Newport, Wales. However, the task of retrieving the hard drive is fraught with challenges, not least of which is the cooperation of the local city council.

Howells has taken legal action against the Newport City Council, arguing that their refusal to excavate the landfill site has prevented him from recovering his lost fortune. The council, on the other hand, has cited environmental concerns and logistical difficulties as reasons for their reluctance to undertake such an excavation. The potential environmental impact of disturbing a landfill site is significant, as it could lead to the release of harmful substances and disrupt local ecosystems. Moreover, the sheer scale of the task, involving the sifting through thousands of tons of waste, presents a formidable logistical challenge.

This case highlights the broader issue of how digital assets, which exist in a virtual realm, can become entangled with physical realities. Unlike traditional forms of wealth, such as cash or gold, digital currencies are stored on electronic devices, making them susceptible to loss through hardware failure or accidental disposal. The recovery of such assets often requires not only technical expertise but also the cooperation of various stakeholders, including local authorities and environmental agencies.

Furthermore, the legal implications of such cases are complex. Howells’ lawsuit raises questions about the responsibilities of local governments in facilitating the recovery of lost digital assets. While individuals have a right to seek the return of their property, the potential costs and risks associated with such recovery efforts must also be considered. Balancing these competing interests is a delicate task that requires careful consideration of both legal and ethical factors.

In addition to the legal and environmental challenges, there is also the technical aspect of recovering data from a potentially damaged hard drive. Even if the hard drive is successfully retrieved, there is no guarantee that the data will be intact. The process of data recovery is intricate and requires specialized skills, further complicating the already daunting task.

In conclusion, the case of James Howells serves as a poignant reminder of the challenges associated with recovering lost digital assets in physical spaces. As the world continues to embrace digital currencies, it is imperative to develop strategies that address the unique challenges posed by the intersection of digital and physical realms. This includes not only advancing technical solutions for data recovery but also establishing clear legal frameworks that balance individual rights with broader societal concerns.

The Role Of Local Governments In Personal Financial Disasters

In recent years, the intersection of personal financial missteps and the responsibilities of local governments has become a topic of increasing interest, particularly as digital currencies gain prominence. A striking example of this is the case of a man who inadvertently discarded a hard drive containing 8,000 bitcoins, now valued at approximately half a billion dollars, into a landfill. This incident has sparked a legal battle, as the individual is suing the local city council for their refusal to excavate the site in search of the lost fortune. This case raises important questions about the role of local governments in personal financial disasters and the extent of their obligations to assist individuals in such predicaments.

To understand the complexities of this situation, it is essential to consider the nature of cryptocurrencies and their storage. Unlike traditional currencies, bitcoins are stored digitally, often on hard drives or other electronic devices. This method of storage, while convenient, also poses significant risks. A simple mistake, such as accidentally discarding a hard drive, can result in the irreversible loss of substantial wealth. In this context, the man’s predicament is not merely a personal oversight but a reflection of the broader challenges associated with managing digital assets.

The legal action against the city council highlights the tension between individual responsibility and public duty. On one hand, individuals are expected to exercise due diligence in managing their financial assets, including taking necessary precautions to safeguard them. On the other hand, local governments are tasked with serving the public interest, which sometimes involves assisting citizens in extraordinary circumstances. The question then arises: to what extent should a local government intervene in a personal financial disaster, especially one involving a novel and complex asset like cryptocurrency?

In this particular case, the city council’s refusal to excavate the landfill is based on several considerations. Firstly, the logistical and environmental challenges of such an operation are significant. Excavating a landfill is a costly and complex endeavor, with potential environmental repercussions that must be carefully managed. Additionally, there is no guarantee of success; the hard drive may be damaged beyond recovery or may not be located at all. These factors contribute to the council’s reluctance to undertake the excavation, as the potential benefits may not justify the substantial costs and risks involved.

Moreover, the precedent set by acceding to such a request could have far-reaching implications. If local governments were to assume responsibility for rectifying personal financial errors, it could lead to an unsustainable burden on public resources. This concern is particularly pertinent in the context of digital currencies, where the potential for similar incidents is likely to increase as more individuals invest in these assets.

Nevertheless, the man’s lawsuit underscores the need for a broader discussion about the role of local governments in the digital age. As cryptocurrencies become more integrated into the financial landscape, there may be a need for new policies and frameworks to address the unique challenges they present. This could involve public education initiatives to raise awareness about the risks of digital asset management or the development of guidelines for local governments to follow in similar situations.

In conclusion, the case of the man who lost his bitcoins in a landfill serves as a poignant reminder of the complexities at the intersection of personal responsibility and public duty. As digital currencies continue to evolve, so too must our understanding of the roles and responsibilities of individuals and local governments in managing financial disasters. This ongoing dialogue will be crucial in navigating the challenges and opportunities presented by the digital economy.

Lessons Learned: Protecting Your Digital Wealth From Accidental Loss

In an era where digital currencies are becoming increasingly integral to the global financial landscape, the story of a man who inadvertently discarded a hard drive containing 8,000 Bitcoins serves as a cautionary tale about the importance of safeguarding digital assets. This incident, which has culminated in a lawsuit against the local city council for their refusal to excavate the landfill where the hard drive is believed to be buried, underscores the critical need for individuals to implement robust strategies to protect their digital wealth from accidental loss.

The unfortunate saga began when the man, in a moment of oversight, disposed of a hard drive that held the keys to his Bitcoin fortune. At the time of disposal, the value of Bitcoin was relatively modest, but as the cryptocurrency’s value soared, the significance of the loss became painfully apparent. The hard drive, now worth half a billion dollars, lies somewhere beneath layers of waste, a stark reminder of the potential consequences of inadequate digital asset management.

This incident highlights several key lessons for cryptocurrency holders. First and foremost, it is imperative to maintain multiple backups of digital wallets. By storing copies in secure, geographically diverse locations, individuals can mitigate the risk of total loss due to accidental disposal or other unforeseen events. Additionally, employing both physical and digital security measures, such as encryption and secure storage devices, can further protect these valuable assets from unauthorized access or damage.

Moreover, the legal battle ensuing from this incident raises important questions about the responsibilities of local authorities in assisting individuals with the recovery of lost digital assets. While the man’s lawsuit against the city council seeks to compel them to excavate the landfill, the case also brings to light the broader issue of how municipalities should handle requests for assistance in retrieving lost digital wealth. This situation may set a precedent for future cases, potentially influencing how local governments balance environmental concerns with the economic interests of their constituents.

Furthermore, this case serves as a reminder of the volatile nature of digital currencies and the importance of staying informed about their market dynamics. As the value of cryptocurrencies can fluctuate dramatically, individuals must remain vigilant and proactive in managing their investments. This includes regularly reviewing and updating security protocols, as well as staying abreast of technological advancements that could enhance the protection of digital assets.

In addition to these practical measures, fostering a mindset of caution and diligence is crucial. The ease with which digital assets can be lost or compromised necessitates a heightened awareness of the potential risks involved. By cultivating a habit of regularly auditing and securing their digital holdings, individuals can better safeguard their investments against both accidental and intentional threats.

In conclusion, the story of the man who inadvertently discarded a hard drive containing a fortune in Bitcoins serves as a poignant reminder of the importance of protecting digital wealth. Through a combination of strategic planning, technological safeguards, and a proactive approach to asset management, individuals can significantly reduce the risk of accidental loss. As the world continues to embrace digital currencies, these lessons become ever more relevant, underscoring the need for vigilance and foresight in the stewardship of digital assets.

Q&A

1. **Who is the man involved in the incident?**

James Howells, a British IT worker.

2. **What did James Howells accidentally throw away?**

A hard drive containing 8,000 Bitcoins.

3. **What is the estimated value of the Bitcoins on the hard drive?**

Approximately half a billion dollars, depending on the current Bitcoin price.

4. **Where did the incident take place?**

In Newport, Wales.

5. **Why is James Howells suing the local city council?**

For not allowing him to excavate the landfill site to retrieve the hard drive.

6. **What has been the city council’s response to the excavation request?**

They have denied the request, citing environmental and logistical concerns.

7. **What are some challenges associated with retrieving the hard drive?**

The potential environmental impact, the cost and complexity of the excavation, and the uncertainty of the hard drive’s condition after years in the landfill.

Conclusion

The conclusion of the case involving the man who accidentally discarded a hard drive containing 8,000 Bitcoins, now worth half a billion dollars, and subsequently sued the local city council for not excavating the landfill site, hinges on several factors. Legally, the outcome would depend on the contractual and statutory obligations of the city council regarding waste management and excavation, as well as the man’s ability to prove negligence or breach of duty. The court would also consider the practicality, environmental impact, and cost of excavation against the speculative nature of recovering the hard drive intact. Ultimately, the case underscores the complexities of digital asset ownership and the challenges of recovering lost cryptocurrency, highlighting the importance of secure storage and backup practices.