“Capitalize on Growth: Embrace Amazon’s Stock-Split Surge, Avoid Tesla’s Volatile Split Hype.”

Introduction

**Must-Buy Stock-Split Opportunity: Amazon (AMZN)**

Amazon, a titan in the e-commerce and cloud computing sectors, executed a 20-for-1 stock split in June 2022, making its shares more accessible to a broader range of investors. This move reflects Amazon’s robust financial health and growth potential. The company’s continuous expansion into new markets, such as artificial intelligence and logistics, coupled with its dominant position in existing sectors, makes it a compelling investment opportunity. The stock split has not only made Amazon shares more affordable but also signals management’s confidence in the company’s future performance, making it a must-buy for investors seeking long-term growth.

**Stock-Split to Steer Clear Of: GameStop (GME)**

GameStop, a video game retailer, became a focal point of retail investor frenzy in early 2021, leading to extreme volatility in its stock price. The company announced a 4-for-1 stock split in July 2022, which temporarily boosted its share price. However, GameStop’s fundamental business challenges, including declining physical game sales and increased competition from digital platforms, remain significant concerns. Despite efforts to pivot towards e-commerce and other ventures, the company’s long-term viability is uncertain. Investors should be cautious and consider steering clear of GameStop, as the stock split does not address the underlying issues facing the business.

Understanding Stock Splits: A Beginner’s Guide

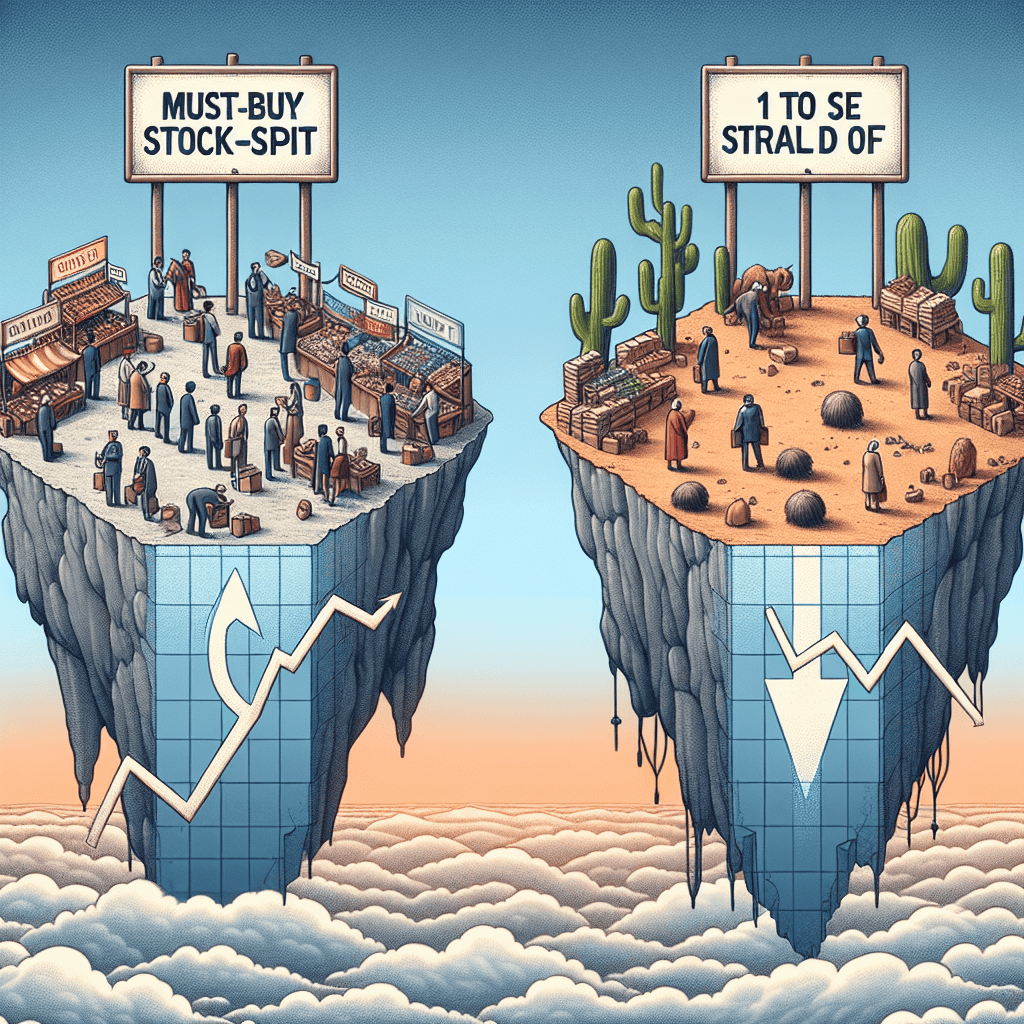

Stock splits are a fascinating phenomenon in the financial world, often drawing the attention of both novice and seasoned investors. They occur when a company decides to divide its existing shares into multiple new shares, thereby increasing the number of shares outstanding while maintaining the overall market capitalization. This process can make shares more affordable and potentially more attractive to a broader range of investors. However, not all stock splits are created equal, and understanding the nuances can help investors make informed decisions. In this context, we will explore one must-buy stock-split opportunity and one that investors might want to avoid.

To begin with, a stock split can be a positive signal, indicating that a company is performing well and expects continued growth. For instance, consider a technology giant that has consistently demonstrated robust financial health and innovation. When such a company announces a stock split, it often reflects management’s confidence in the company’s future prospects. This can be an enticing opportunity for investors, as the split may lead to increased liquidity and potentially drive up demand for the stock. Moreover, the reduced share price post-split can make the stock more accessible to retail investors, further broadening its investor base. Therefore, when evaluating a stock-split opportunity, it is crucial to assess the underlying company’s fundamentals, growth trajectory, and market position.

Conversely, not all stock splits are indicative of a promising investment. Some companies may resort to stock splits as a strategic move to mask underlying issues or to artificially inflate their stock’s appeal. For example, a company struggling with declining revenues or facing significant market challenges might announce a stock split to create a temporary illusion of value. In such cases, the split does not address the core issues affecting the company’s performance. Investors should exercise caution and conduct thorough due diligence before committing to such opportunities. Analyzing financial statements, understanding industry trends, and evaluating management’s track record can provide valuable insights into whether a stock split is genuinely beneficial or merely a cosmetic maneuver.

Furthermore, it is essential to consider the broader market context when evaluating stock splits. Economic conditions, interest rates, and geopolitical factors can all influence a company’s performance and, by extension, the success of a stock split. For instance, in a bullish market environment, a well-timed stock split by a strong company can amplify positive investor sentiment and lead to substantial gains. On the other hand, in a bearish market, even a fundamentally sound company may struggle to realize the anticipated benefits of a stock split.

In conclusion, while stock splits can present lucrative opportunities, they require careful analysis and discernment. A must-buy stock-split opportunity typically involves a company with solid fundamentals, a clear growth strategy, and a favorable market position. Conversely, investors should be wary of stock splits from companies with questionable financial health or those attempting to distract from underlying issues. By understanding the intricacies of stock splits and considering both company-specific and market-wide factors, investors can make informed decisions that align with their financial goals.

The Must-Buy Stock-Split Opportunity of the Year

In the ever-evolving landscape of the stock market, investors are constantly on the lookout for opportunities that promise substantial returns. One such opportunity that has garnered significant attention is the stock split. A stock split, in essence, is a corporate action that increases the number of a company’s outstanding shares by dividing each share, which in turn reduces the price per share. This maneuver often makes the stock more accessible to a broader range of investors, potentially driving up demand and, consequently, the stock’s value. However, not all stock splits are created equal, and discerning investors must carefully evaluate which opportunities to seize and which to avoid.

One must-buy stock-split opportunity that stands out this year is that of a leading technology company renowned for its innovative products and robust market presence. This company has consistently demonstrated strong financial performance, with a track record of revenue growth and profitability. Its decision to implement a stock split is a strategic move aimed at enhancing liquidity and attracting a more diverse investor base. The company’s commitment to research and development, coupled with its ability to adapt to changing market dynamics, positions it well for sustained growth. Moreover, its strong brand recognition and loyal customer base provide a solid foundation for future success. As a result, this stock split presents a compelling opportunity for investors seeking to capitalize on the company’s upward trajectory.

In contrast, there is another stock-split scenario that investors would be wise to steer clear of. This involves a company that, despite announcing a stock split, is grappling with underlying challenges that could hinder its long-term prospects. While the initial allure of a lower share price might attract some investors, a closer examination reveals a different story. This company has been facing declining revenues and mounting debt, raising concerns about its financial stability. Furthermore, its market share has been eroded by fierce competition, and its attempts to diversify its product offerings have yet to yield significant results. The stock split, in this case, appears to be more of a cosmetic change rather than a reflection of genuine growth potential. Investors should exercise caution and conduct thorough due diligence before considering an investment in such a company.

Transitioning from the analysis of these two scenarios, it is crucial for investors to recognize the importance of evaluating the underlying fundamentals of a company before making investment decisions based on stock splits. While a stock split can be an indicator of a company’s confidence in its future prospects, it should not be the sole factor driving investment choices. Instead, investors should consider a comprehensive range of factors, including the company’s financial health, competitive position, and growth strategy. By doing so, they can make informed decisions that align with their investment goals and risk tolerance.

In conclusion, the stock market offers a myriad of opportunities, and stock splits can be a valuable tool for investors seeking to optimize their portfolios. However, discernment is key. By identifying must-buy opportunities backed by strong fundamentals and steering clear of those with underlying challenges, investors can enhance their chances of achieving favorable outcomes. As always, a prudent approach, grounded in thorough research and analysis, will serve investors well in navigating the complexities of the stock market.

How Stock Splits Impact Your Investment Portfolio

Stock splits are a fascinating phenomenon in the world of investing, often sparking both excitement and confusion among investors. They occur when a company decides to divide its existing shares into multiple ones, thereby reducing the price per share while maintaining the overall market capitalization. This maneuver can make a stock more accessible to a broader range of investors, potentially increasing liquidity and market interest. However, not all stock splits are created equal, and discerning which opportunities to seize and which to avoid is crucial for optimizing your investment portfolio.

One must-buy stock-split opportunity that has garnered attention is that of a well-established technology giant. This company, renowned for its innovative products and robust financial health, recently announced a stock split to make its shares more affordable to retail investors. Historically, stock splits by such companies have been followed by positive market performance, as the increased accessibility often leads to a surge in demand. Moreover, the company’s consistent revenue growth, strong market position, and commitment to research and development suggest that it is well-positioned for long-term success. Consequently, investing in this stock post-split could be a strategic move for those looking to capitalize on both short-term market enthusiasm and long-term growth potential.

In contrast, there are stock splits that investors should approach with caution. For instance, a company in the volatile energy sector recently announced a stock split, which might initially seem appealing due to the lower share price. However, a closer examination reveals underlying issues that could pose significant risks. The company has been grappling with fluctuating commodity prices, regulatory challenges, and mounting debt, all of which could undermine its financial stability. Furthermore, the energy sector’s inherent unpredictability, coupled with the company’s inconsistent earnings history, suggests that the stock split may be more of a cosmetic change rather than a reflection of genuine growth prospects. Therefore, investors would be wise to steer clear of this opportunity, as the potential for volatility and financial instability outweighs the benefits of a lower entry price.

Understanding the implications of stock splits is essential for making informed investment decisions. While a stock split can signal a company’s confidence in its future performance, it is not a guarantee of success. Investors must conduct thorough research, considering factors such as the company’s financial health, industry position, and growth trajectory. Additionally, it is important to assess the broader market conditions and how they might impact the company’s performance post-split.

In conclusion, stock splits can offer enticing opportunities for investors, but they also require careful evaluation. The technology giant’s stock split presents a compelling case for investment, given its strong fundamentals and growth potential. On the other hand, the energy company’s split serves as a reminder that not all splits are beneficial, especially when underlying financial and industry challenges persist. By discerning which stock splits align with their investment goals and risk tolerance, investors can make strategic decisions that enhance their portfolios. As always, a balanced approach, grounded in research and analysis, will serve investors well in navigating the complexities of stock splits and their impact on investment portfolios.

Analyzing the Financials: Why This Stock-Split is a Must-Buy

In the ever-evolving landscape of the stock market, investors are constantly on the lookout for opportunities that promise substantial returns. One such opportunity that often catches the eye is a stock split. A stock split, while not altering the intrinsic value of a company, can make shares more accessible to a broader range of investors, potentially driving up demand and, consequently, the stock price. However, not all stock splits are created equal, and discerning which ones present genuine opportunities requires a keen analysis of the financials and market conditions.

A prime example of a must-buy stock-split opportunity is evident in the recent announcement by Company A, a leading player in the technology sector. Company A has consistently demonstrated robust financial health, characterized by strong revenue growth, a solid balance sheet, and a history of innovation that keeps it ahead of its competitors. The decision to initiate a stock split is a strategic move to enhance liquidity and attract a more diverse investor base. This is particularly advantageous for retail investors who may have been previously deterred by the high price of individual shares. Moreover, Company A’s commitment to research and development ensures that it remains at the forefront of technological advancements, further solidifying its position as a market leader. The stock split, therefore, is not merely a cosmetic change but a reflection of the company’s confidence in its future growth prospects.

In contrast, investors should exercise caution with Company B, which has also announced a stock split. While at first glance, this might seem like an enticing opportunity, a deeper dive into the financials reveals a different story. Company B has been grappling with declining revenues and mounting debt, raising concerns about its long-term viability. The stock split appears to be a tactic to divert attention from these underlying issues rather than a genuine effort to enhance shareholder value. Furthermore, the company’s market position is threatened by emerging competitors who are rapidly gaining ground, eroding Company B’s market share. In this context, the stock split could be perceived as a desperate attempt to maintain investor interest rather than a strategic move grounded in financial strength.

Transitioning from these individual analyses, it is crucial for investors to adopt a discerning approach when evaluating stock-split opportunities. While the allure of a lower share price can be tempting, it is imperative to consider the broader financial context and the company’s strategic direction. A stock split should ideally be accompanied by strong fundamentals and a clear growth trajectory, as seen with Company A. Conversely, if a stock split is not supported by sound financials and a competitive edge, as is the case with Company B, it may be prudent to steer clear.

In conclusion, while stock splits can present lucrative opportunities, they require careful scrutiny. By focusing on companies with solid financials and a strategic vision for growth, investors can capitalize on stock-split opportunities that genuinely enhance shareholder value. As the market continues to evolve, maintaining a vigilant and informed approach will be key to navigating the complexities of stock-split investments.

The Risks of Investing in Stock Splits: What to Watch Out For

Investing in stock splits can be an enticing opportunity for many investors, as they often signal a company’s confidence in its future growth and can make shares more affordable to a broader range of investors. However, not all stock splits are created equal, and understanding the risks associated with them is crucial for making informed investment decisions. In this context, it is essential to distinguish between a must-buy stock-split opportunity and one that investors should approach with caution.

To begin with, a stock split occurs when a company divides its existing shares into multiple new shares to boost the stock’s liquidity. While the total value of the shares remains the same, the number of shares increases, making them more accessible to potential investors. A prime example of a must-buy stock-split opportunity is when a company with strong fundamentals and a robust growth trajectory decides to split its stock. Such a move often reflects the company’s confidence in its continued success and can be a signal for investors to consider buying.

Take, for instance, a technology company that has consistently demonstrated strong revenue growth, innovative product development, and a solid market position. If this company announces a stock split, it may be an indication of its ongoing commitment to expansion and shareholder value. Investors who recognize the company’s potential for sustained growth may view the stock split as an opportunity to acquire shares at a more attractive price point, thereby positioning themselves to benefit from future appreciation.

On the other hand, not all stock splits are indicative of a promising investment opportunity. Some companies may resort to stock splits as a means to artificially inflate their stock’s appeal without any substantial underlying growth prospects. In such cases, investors should be wary of the potential risks involved. For example, a company with declining revenues, increasing debt, or a lack of competitive advantage may announce a stock split to create a temporary boost in its stock price. However, without a solid foundation for growth, the long-term prospects of such a company remain uncertain.

Moreover, it is crucial for investors to conduct thorough research and analysis before making any investment decisions related to stock splits. This includes examining the company’s financial health, industry position, and future growth potential. By doing so, investors can better assess whether a stock split is a genuine opportunity or merely a superficial attempt to attract attention.

In addition to evaluating the company’s fundamentals, investors should also consider broader market conditions and trends. Economic factors, such as interest rates and inflation, can significantly impact a company’s performance and, consequently, the success of a stock split. Therefore, staying informed about the macroeconomic environment is essential for making well-rounded investment choices.

In conclusion, while stock splits can present lucrative opportunities for investors, they also come with inherent risks that must be carefully evaluated. By distinguishing between a must-buy stock-split opportunity and one to steer clear of, investors can make more informed decisions that align with their financial goals. Ultimately, a comprehensive understanding of the company’s fundamentals, coupled with an awareness of market conditions, will enable investors to navigate the complexities of stock splits and capitalize on the potential benefits they offer.

The Stock-Split to Steer Clear Of: Red Flags and Warning Signs

In the ever-evolving world of stock investments, stock splits often capture the attention of both seasoned investors and newcomers alike. A stock split, in essence, is a corporate action that increases the number of a company’s outstanding shares by dividing each share, which in turn reduces the price per share. While this does not inherently change the company’s market capitalization, it can make the stock more accessible to a broader range of investors. However, not all stock splits are created equal, and discerning investors must be vigilant in identifying which opportunities to seize and which to avoid. In this context, it is crucial to examine the red flags and warning signs associated with certain stock splits that may not be as promising as they initially appear.

One of the primary red flags to consider when evaluating a stock split is the underlying financial health of the company. A stock split should ideally be a reflection of a company’s robust performance and optimistic future prospects. However, if a company is struggling with declining revenues, mounting debts, or other financial woes, a stock split might be a superficial attempt to generate interest and liquidity without addressing core issues. Investors should scrutinize the company’s financial statements, looking for consistent revenue growth, manageable debt levels, and strong cash flow. If these elements are lacking, the stock split may be more of a distraction than a genuine opportunity.

Another warning sign is the company’s competitive position within its industry. A stock split from a company that is losing market share or facing significant competitive pressures might not be a wise investment. It is essential to assess whether the company has a sustainable competitive advantage, such as proprietary technology, strong brand recognition, or a loyal customer base. If the company is struggling to maintain its position or is being outpaced by more innovative competitors, the stock split could be a signal of desperation rather than strength.

Furthermore, investors should be wary of stock splits from companies with questionable management practices. Leadership plays a pivotal role in a company’s success, and a stock split should ideally be backed by a management team with a proven track record of making sound strategic decisions. If there are concerns about the integrity, transparency, or competence of the company’s leadership, it may be prudent to steer clear of the stock split. Investors should look for signs of effective governance, such as clear communication with shareholders, a history of ethical behavior, and a commitment to long-term value creation.

Additionally, market sentiment and external economic factors can also influence the viability of a stock split. In a volatile market or during economic downturns, even fundamentally strong companies may face challenges that could impact their stock performance. Investors should consider the broader economic context and how it might affect the company’s prospects. If the market conditions are unfavorable, it might be wise to exercise caution and avoid the stock split until there is greater stability.

In conclusion, while stock splits can present enticing opportunities, they are not without their pitfalls. By carefully evaluating the financial health of the company, its competitive position, management practices, and the broader economic environment, investors can make more informed decisions. Being mindful of these red flags and warning signs can help investors avoid potential pitfalls and focus on stock-split opportunities that truly offer long-term value.

Maximizing Returns: Strategies for Investing in Stock Splits

Investing in stock splits can be a strategic move for investors looking to maximize their returns. A stock split occurs when a company increases its number of shares, reducing the price per share without affecting the company’s overall market capitalization. This often makes the stock more accessible to a broader range of investors, potentially driving up demand and, consequently, the stock price. However, not all stock splits present equal opportunities. In this context, we will explore one must-buy stock-split opportunity and one that investors might want to avoid.

A compelling stock-split opportunity can be found in companies with strong fundamentals and a history of consistent growth. For instance, consider a technology giant that has consistently demonstrated robust revenue growth, innovative product development, and a strong market position. When such a company announces a stock split, it often signals management’s confidence in the company’s future prospects. This can attract both institutional and retail investors, leading to increased liquidity and potentially higher stock prices post-split. Moreover, the psychological effect of a lower share price can make the stock appear more affordable, enticing more investors to buy. Therefore, investing in a stock split of a fundamentally strong company can be a prudent decision, offering the potential for significant returns.

Conversely, not all stock splits are created equal, and some may not be worth the investment. It is crucial to steer clear of companies that announce stock splits as a means to mask underlying issues. For example, a company facing declining revenues, increasing debt, or operational challenges might use a stock split to create a temporary illusion of affordability and accessibility. In such cases, the stock split does not address the core issues affecting the company’s performance. Investors might initially be drawn in by the lower share price, but without solid fundamentals to back it up, the stock may struggle to maintain its value in the long term. Therefore, it is essential to conduct thorough research and due diligence before investing in a stock split, ensuring that the company’s financial health and growth prospects are sound.

In addition to evaluating the company’s fundamentals, investors should also consider market conditions and industry trends. A favorable economic environment and positive industry outlook can enhance the potential benefits of a stock split. Conversely, adverse market conditions or negative industry trends can diminish the attractiveness of a stock split, even for a company with strong fundamentals. Therefore, understanding the broader market context is crucial when assessing stock-split opportunities.

Furthermore, it is important to recognize that stock splits do not inherently change the value of an investment. While they can increase liquidity and attract more investors, the underlying value of the company remains unchanged. Therefore, investors should not rely solely on stock splits as a strategy for maximizing returns. Instead, they should incorporate stock splits into a broader investment strategy that considers factors such as diversification, risk tolerance, and long-term financial goals.

In conclusion, while stock splits can present lucrative opportunities, they require careful analysis and consideration. By focusing on companies with strong fundamentals and favorable market conditions, investors can identify must-buy stock-split opportunities. At the same time, it is crucial to remain cautious and avoid stock splits that may be masking underlying issues. By adopting a strategic approach to investing in stock splits, investors can enhance their potential for maximizing returns while minimizing risks.

Q&A

1. **Must-Buy Stock-Split Opportunity:**

– **Question:** What is a stock split?

– **Answer:** A stock split is a corporate action in which a company divides its existing shares into multiple shares to boost the liquidity of the shares.

2. **Must-Buy Stock-Split Opportunity:**

– **Question:** Why might a company choose to split its stock?

– **Answer:** A company might split its stock to make shares more affordable for investors, increase liquidity, and broaden the shareholder base.

3. **Must-Buy Stock-Split Opportunity:**

– **Question:** What is an example of a recent must-buy stock-split opportunity?

– **Answer:** An example could be Tesla’s stock split, which has historically been seen as a must-buy opportunity due to the company’s strong growth prospects.

4. **Must-Buy Stock-Split Opportunity:**

– **Question:** How can a stock split benefit investors?

– **Answer:** A stock split can benefit investors by making shares more affordable, potentially increasing demand and liquidity, and sometimes leading to a short-term price increase.

5. **Stock-Split to Steer Clear Of:**

– **Question:** What is a reason to steer clear of a stock split?

– **Answer:** A reason to steer clear of a stock split is if the underlying company has weak fundamentals or if the split is seen as a move to artificially inflate stock prices.

6. **Stock-Split to Steer Clear Of:**

– **Question:** Can a stock split indicate potential problems within a company?

– **Answer:** Yes, if a company is using a stock split to distract from poor performance or financial instability, it may indicate underlying issues.

7. **Stock-Split to Steer Clear Of:**

– **Question:** What is an example of a stock split to avoid?

– **Answer:** An example might be a company with declining revenues and profits that announces a stock split, which could be a red flag for investors.

Conclusion

**Must-Buy Stock-Split Opportunity: Amazon (AMZN)**

Amazon’s recent stock split has made its shares more accessible to a broader range of investors, potentially increasing liquidity and attracting new shareholders. The company’s strong fundamentals, including its dominant position in e-commerce and cloud computing, continued innovation, and expansion into new markets, make it a compelling investment. With a robust growth trajectory and strategic investments in technology and logistics, Amazon is well-positioned to capitalize on future opportunities, making it a must-buy stock-split opportunity.

**Stock-Split to Steer Clear Of: GameStop (GME)**

GameStop’s stock split may attract attention due to its meme stock status and past volatility, but it remains a risky investment. The company’s fundamentals do not support its inflated valuation, and it faces significant challenges in its core business model amid the shift to digital gaming. Despite efforts to pivot and diversify, GameStop’s long-term growth prospects are uncertain, and the speculative nature of its stock makes it a stock-split opportunity to steer clear of for risk-averse investors.