“Zoetis Shines in Q3, Yet Market Shadows Persist”

Introduction

In the third quarter, Zoetis, a leading global animal health company, reported financial results that exceeded market expectations, showcasing robust performance across its diverse portfolio of products and services. Despite this strong showing, the company’s shares experienced a decline, reflecting a complex interplay of market dynamics and investor sentiment. This paradoxical situation highlights the challenges companies face in maintaining investor confidence amidst broader economic uncertainties and sector-specific pressures. As Zoetis continues to navigate these complexities, its strategic initiatives and operational resilience remain focal points for stakeholders assessing its long-term growth trajectory.

Market Reaction: Understanding the Disconnect Between Performance and Share Price

In the third quarter, Zoetis, a leading global animal health company, reported financial results that exceeded market expectations. Despite this strong performance, the company’s shares experienced a decline, leaving investors and analysts puzzled by the apparent disconnect between the company’s operational success and its stock market performance. This phenomenon, while not uncommon, underscores the complexities of market dynamics and investor sentiment.

To begin with, Zoetis demonstrated robust growth in its revenue and earnings, driven by increased demand for its veterinary products and services. The company’s strategic focus on innovation and expansion into emerging markets has paid off, contributing to its impressive financial results. Furthermore, Zoetis has successfully navigated supply chain challenges that have plagued many industries, ensuring a steady flow of products to meet customer needs. These factors combined to create a positive outlook for the company’s future growth prospects.

However, despite these favorable indicators, Zoetis shares declined following the earnings announcement. This paradox can be attributed to several factors that often influence investor behavior. One possible explanation is the broader market environment. During periods of economic uncertainty or volatility, investors may react more cautiously, prioritizing risk aversion over potential gains. Consequently, even companies with strong fundamentals like Zoetis can experience share price declines if market sentiment is bearish.

Additionally, investor expectations play a crucial role in determining stock price movements. In some cases, even when a company reports better-than-expected results, if those results do not significantly surpass the already high expectations set by analysts and investors, the market may react negatively. This phenomenon, known as “buy the rumor, sell the news,” can lead to a sell-off as investors lock in profits or adjust their portfolios based on perceived future risks.

Moreover, external factors such as interest rate changes, geopolitical tensions, or shifts in regulatory policies can also impact investor sentiment and stock prices. For instance, if there are concerns about potential regulatory changes affecting the animal health industry, investors might become wary, leading to a decline in share prices despite strong company performance. Similarly, macroeconomic factors such as inflation or currency fluctuations can influence investor decisions, further contributing to the disconnect between a company’s operational success and its stock market valuation.

It is also important to consider the role of institutional investors and their trading strategies. Large institutional investors often have significant influence over stock prices due to the volume of shares they trade. If these investors decide to rebalance their portfolios or shift their focus to other sectors, it can lead to substantial price movements, irrespective of a company’s individual performance.

In conclusion, the decline in Zoetis shares despite its strong third-quarter performance highlights the multifaceted nature of stock market dynamics. While the company’s operational success is undeniable, various external and internal factors can influence investor sentiment and lead to seemingly contradictory market reactions. Understanding these complexities is essential for investors seeking to navigate the ever-changing landscape of financial markets. As Zoetis continues to build on its strengths and adapt to evolving market conditions, it remains to be seen how these factors will shape its future stock performance.

Financial Highlights: Key Metrics from Zoetis’ Q3 Earnings Report

In the third quarter of the fiscal year, Zoetis, a leading global animal health company, reported financial results that exceeded market expectations, yet paradoxically, its shares experienced a decline. This intriguing scenario underscores the complex dynamics of investor sentiment and market reactions, which can sometimes diverge from a company’s financial performance. Delving into the key metrics from Zoetis’ Q3 earnings report provides a clearer understanding of the company’s current standing and future prospects.

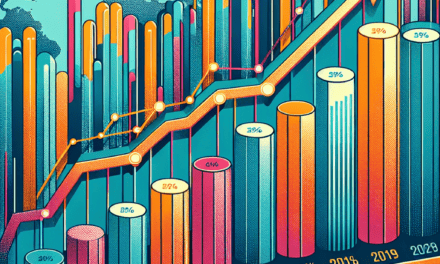

To begin with, Zoetis reported a robust increase in revenue, driven primarily by strong sales in its companion animal segment. This segment has consistently been a significant growth driver for the company, reflecting the increasing global demand for pet healthcare products. The company’s innovative product offerings and strategic market expansions have played a crucial role in capturing a larger market share. Furthermore, Zoetis’ livestock segment also contributed positively, albeit to a lesser extent, as it faced challenges from fluctuating commodity prices and varying demand across different regions.

In terms of profitability, Zoetis demonstrated impressive operational efficiency, resulting in a notable improvement in its operating margin. This was achieved through a combination of cost management initiatives and strategic investments in high-growth areas. The company’s focus on research and development has been instrumental in maintaining its competitive edge, as evidenced by the successful launch of several new products during the quarter. These efforts have not only bolstered Zoetis’ current financial performance but also positioned it well for sustained growth in the future.

Despite these positive financial indicators, Zoetis’ shares experienced a decline following the earnings announcement. This unexpected market reaction can be attributed to several factors. Firstly, investor expectations were exceptionally high, given the company’s strong track record and the overall positive sentiment in the animal health industry. Consequently, even a slight deviation from these lofty expectations can lead to a negative market response. Additionally, broader market conditions, including concerns about global economic uncertainties and potential regulatory changes, may have contributed to the cautious investor sentiment.

Moreover, some analysts have pointed to Zoetis’ valuation as a potential reason for the share price decline. With the company’s stock trading at a premium relative to its peers, any perceived risks or uncertainties can prompt investors to reassess their positions. This highlights the delicate balance between a company’s financial performance and market perceptions, where even strong earnings can be overshadowed by external factors.

Looking ahead, Zoetis remains well-positioned to capitalize on the growing demand for animal health products. The company’s strategic focus on innovation, coupled with its robust pipeline of new products, provides a solid foundation for future growth. Additionally, Zoetis’ global presence and diversified portfolio offer resilience against regional market fluctuations and economic uncertainties.

In conclusion, while Zoetis’ Q3 earnings report showcased strong financial performance, the subsequent decline in its share price serves as a reminder of the complex interplay between market expectations and investor sentiment. As the company continues to navigate these challenges, its commitment to innovation and operational excellence will be key to sustaining its leadership position in the animal health industry. Investors and stakeholders alike will be closely monitoring Zoetis’ strategic initiatives and market developments in the coming quarters, as they seek to align their expectations with the company’s long-term growth trajectory.

Industry Trends: How External Factors Impacted Zoetis’ Stock Performance

In the third quarter, Zoetis, a leading global animal health company, reported financial results that exceeded market expectations, showcasing robust growth in both revenue and profit margins. Despite this strong performance, the company’s stock experienced a decline, a phenomenon that can be attributed to a confluence of external factors impacting investor sentiment. Understanding these dynamics requires a closer examination of the broader industry trends and economic conditions that have influenced Zoetis’ stock performance.

To begin with, the animal health industry has been experiencing significant shifts, driven by evolving consumer preferences and advancements in veterinary medicine. Zoetis has adeptly navigated these changes, capitalizing on increased demand for pet healthcare products and services. The company’s strategic investments in research and development have resulted in a steady pipeline of innovative products, further solidifying its market position. However, while these internal strengths have bolstered Zoetis’ financial results, external factors have played a pivotal role in shaping investor perceptions.

One of the primary external influences on Zoetis’ stock performance is the broader economic environment. The global economy has been grappling with inflationary pressures, supply chain disruptions, and geopolitical tensions, all of which have contributed to market volatility. Investors, wary of these uncertainties, have adopted a cautious approach, often reacting to macroeconomic indicators rather than company-specific achievements. Consequently, even companies like Zoetis, which demonstrate strong fundamentals, are not immune to the broader market sentiment.

Moreover, the animal health sector is not isolated from regulatory changes and policy shifts that can impact business operations. Recent discussions around pharmaceutical pricing and regulatory scrutiny have introduced an element of unpredictability for companies in this space. Zoetis, while maintaining compliance and adapting to these changes, faces the challenge of navigating an increasingly complex regulatory landscape. This uncertainty can weigh on investor confidence, as potential policy shifts could affect future profitability.

In addition to economic and regulatory factors, the competitive landscape within the animal health industry has intensified. New entrants and existing players are vying for market share, leading to increased competition. Zoetis, with its established brand and comprehensive product portfolio, remains a formidable competitor. However, the pressure to innovate and maintain market leadership is ever-present. Investors, cognizant of this competitive pressure, may exhibit caution, impacting stock performance despite positive quarterly results.

Furthermore, the global focus on sustainability and ethical business practices has influenced investor behavior. Companies are increasingly evaluated on their environmental, social, and governance (ESG) criteria. Zoetis has made strides in this area, committing to sustainable practices and ethical sourcing. Nevertheless, the heightened scrutiny on ESG factors means that any perceived shortcomings can affect investor sentiment, regardless of financial performance.

In conclusion, while Zoetis has demonstrated commendable financial results in the third quarter, the decline in its stock price underscores the impact of external factors on investor sentiment. The interplay of economic uncertainties, regulatory challenges, competitive pressures, and ESG considerations has created a complex environment for companies in the animal health industry. As Zoetis continues to navigate these challenges, its ability to adapt and innovate will be crucial in maintaining investor confidence and achieving long-term growth.

Investor Sentiment: Analyzing Shareholder Concerns Despite Strong Results

In the third quarter, Zoetis, a leading global animal health company, reported financial results that exceeded market expectations, showcasing robust growth and operational efficiency. Despite this impressive performance, the company’s shares experienced a decline, prompting investors and analysts to delve deeper into the underlying factors influencing shareholder sentiment. This paradox of strong results yet declining share prices highlights the complexities of market dynamics and investor behavior.

To begin with, Zoetis reported a significant increase in revenue, driven by strong sales across its diverse portfolio of animal health products. The company’s innovative solutions in both the livestock and companion animal segments have continued to capture market share, reflecting its commitment to research and development. Furthermore, Zoetis has successfully navigated supply chain challenges that have plagued many industries, ensuring timely delivery of its products to meet growing demand. These operational achievements underscore the company’s resilience and strategic foresight.

However, despite these positive indicators, Zoetis shares have not mirrored the company’s financial success. One potential reason for this disconnect is the broader market environment, which has been characterized by volatility and uncertainty. Investors, wary of macroeconomic factors such as inflation and interest rate hikes, may be exercising caution, leading to a more conservative approach to stock valuations. Consequently, even companies with strong fundamentals like Zoetis are not immune to the ripple effects of market sentiment.

Moreover, some investors may be concerned about the sustainability of Zoetis’s growth trajectory. While the company has demonstrated consistent performance, questions linger about the long-term impact of external pressures, such as regulatory changes and competitive dynamics within the animal health industry. These factors could potentially affect future profitability, prompting investors to reassess their positions. Additionally, the global push towards sustainability and ethical practices in animal health may require Zoetis to adapt its strategies, which could entail increased costs and investment in new technologies.

Another aspect influencing investor sentiment is the company’s valuation. Zoetis has enjoyed a premium valuation relative to its peers, reflecting its market leadership and growth prospects. However, in a climate where investors are increasingly scrutinizing valuations, there may be concerns about whether the current stock price accurately reflects the company’s intrinsic value. This scrutiny can lead to a reevaluation of investment strategies, particularly among institutional investors who play a significant role in influencing share prices.

Furthermore, the recent decline in Zoetis shares could also be attributed to profit-taking behavior among investors. After a period of strong performance, some shareholders may choose to lock in gains, leading to selling pressure that impacts the stock price. This is a common occurrence in the stock market, where short-term fluctuations do not necessarily align with a company’s long-term fundamentals.

In conclusion, while Zoetis has delivered exceptional results in the third quarter, the decline in its share price underscores the multifaceted nature of investor sentiment. Factors such as market volatility, concerns about future growth, valuation considerations, and profit-taking behavior all contribute to the current scenario. For investors, understanding these dynamics is crucial in making informed decisions. As Zoetis continues to navigate the evolving landscape of the animal health industry, maintaining transparency and effectively communicating its strategic vision will be key to restoring investor confidence and aligning share performance with its operational success.

Competitive Landscape: Zoetis’ Position in the Animal Health Market

In the competitive landscape of the animal health market, Zoetis has long been recognized as a formidable player, consistently demonstrating robust performance and innovation. In the third quarter, Zoetis once again outperformed expectations, showcasing its resilience and strategic acumen. Despite this impressive performance, the company’s shares experienced a decline, a phenomenon that warrants a closer examination of the market dynamics and investor sentiment influencing Zoetis’ position.

Zoetis’ success in the third quarter can be attributed to several key factors. The company has maintained a strong focus on research and development, continually bringing new and effective products to market. This commitment to innovation has allowed Zoetis to address the evolving needs of veterinarians and pet owners, thereby solidifying its reputation as a leader in the industry. Moreover, Zoetis has effectively leveraged its global presence, capitalizing on growth opportunities in emerging markets where demand for animal health products is on the rise. This strategic expansion has not only bolstered the company’s revenue streams but also enhanced its competitive edge.

However, despite these positive developments, Zoetis’ shares have experienced a decline, reflecting a broader trend in the market where investor sentiment is influenced by various external factors. One possible explanation for this decline is the overall volatility in the stock market, which has been impacted by macroeconomic uncertainties and geopolitical tensions. Investors may be exercising caution, opting to reassess their portfolios in light of these broader economic conditions. Additionally, the animal health market itself is becoming increasingly competitive, with new entrants and existing players vying for market share. This heightened competition may have contributed to investor concerns about Zoetis’ ability to maintain its leadership position in the long term.

Furthermore, regulatory challenges and changes in consumer behavior are also shaping the competitive landscape. As governments worldwide implement stricter regulations on animal health products, companies like Zoetis must navigate these complexities to ensure compliance and sustain growth. At the same time, consumer preferences are shifting towards more sustainable and ethical products, prompting companies to adapt their offerings accordingly. Zoetis has been proactive in addressing these trends, but the pace of change in the market necessitates continuous adaptation and innovation.

In light of these challenges, Zoetis’ strategic initiatives remain crucial to its continued success. The company has been investing in digital technologies to enhance its operational efficiency and customer engagement. By harnessing data analytics and digital platforms, Zoetis aims to provide more personalized and effective solutions to its clients, thereby strengthening its market position. Additionally, partnerships and collaborations with other industry leaders and research institutions are enabling Zoetis to stay at the forefront of scientific advancements and expand its product portfolio.

In conclusion, while Zoetis has demonstrated strong performance in the third quarter, the decline in its shares underscores the complexities of the competitive landscape in the animal health market. The company’s ability to navigate these challenges and capitalize on emerging opportunities will be pivotal in maintaining its leadership position. As Zoetis continues to innovate and adapt to changing market dynamics, its strategic focus on research, global expansion, and digital transformation will be key drivers of its future success.

Future Outlook: What Zoetis’ Q3 Results Mean for Long-Term Growth

Zoetis, a leading global animal health company, recently reported its third-quarter results, showcasing impressive financial performance. Despite surpassing market expectations, the company’s shares experienced a decline, prompting investors and analysts to ponder the implications for its long-term growth trajectory. As we delve into the future outlook for Zoetis, it is essential to consider the factors contributing to its recent success and the challenges that may lie ahead.

In the third quarter, Zoetis reported robust revenue growth, driven by strong demand for its innovative products and services. The company’s diverse portfolio, which includes vaccines, medicines, diagnostics, and genetic tests, has positioned it well to capitalize on the increasing global demand for animal healthcare solutions. This demand is fueled by several factors, including the rising pet ownership rates, the growing importance of livestock health in ensuring food security, and the heightened awareness of zoonotic diseases. Consequently, Zoetis has been able to leverage its expertise and market presence to deliver impressive financial results.

Moreover, Zoetis’ commitment to research and development has played a crucial role in its success. By investing significantly in R&D, the company has been able to introduce new and improved products that address the evolving needs of its customers. This focus on innovation not only strengthens Zoetis’ competitive edge but also enhances its ability to capture a larger share of the market. Furthermore, strategic acquisitions and partnerships have enabled Zoetis to expand its capabilities and reach, further solidifying its position as a leader in the animal health industry.

Despite these positive developments, the decline in Zoetis’ share price following the Q3 results suggests that investors may have concerns about the company’s future growth prospects. One potential factor contributing to this sentiment is the broader economic environment, which remains uncertain due to ongoing geopolitical tensions, inflationary pressures, and supply chain disruptions. These challenges could impact Zoetis’ operations and profitability, particularly if they lead to increased costs or reduced demand for its products.

Additionally, the competitive landscape in the animal health sector is intensifying, with new entrants and existing players vying for market share. This heightened competition could pressure Zoetis to maintain its growth momentum and protect its market position. To address these challenges, the company will need to continue focusing on innovation, operational efficiency, and strategic expansion.

Looking ahead, Zoetis’ long-term growth prospects remain promising, provided it can navigate the challenges and capitalize on emerging opportunities. The company’s strong financial foundation, coupled with its commitment to innovation and customer-centric approach, positions it well to adapt to changing market dynamics. Furthermore, the increasing emphasis on sustainability and animal welfare presents new avenues for growth, as Zoetis can leverage its expertise to develop solutions that align with these trends.

In conclusion, while Zoetis’ Q3 results highlight its ability to outperform expectations, the subsequent decline in its share price underscores the importance of addressing investor concerns and demonstrating resilience in the face of external challenges. By continuing to prioritize innovation, strategic growth, and operational excellence, Zoetis can reinforce its leadership position in the animal health industry and drive long-term growth. As the company navigates the complexities of the current economic landscape, its ability to adapt and evolve will be crucial in ensuring sustained success and value creation for its stakeholders.

Strategic Initiatives: How Zoetis Plans to Address Market Challenges

In the third quarter, Zoetis, a leading global animal health company, reported financial results that exceeded market expectations. Despite this strong performance, the company’s shares experienced a decline, reflecting broader market challenges and investor concerns. To address these challenges and sustain its growth trajectory, Zoetis has outlined several strategic initiatives aimed at reinforcing its market position and enhancing shareholder value.

One of the primary strategies Zoetis is focusing on is innovation in product development. The company recognizes that continuous innovation is crucial in maintaining its competitive edge in the dynamic animal health industry. By investing heavily in research and development, Zoetis aims to introduce new and improved products that cater to the evolving needs of veterinarians and pet owners. This commitment to innovation not only helps in expanding its product portfolio but also strengthens its brand reputation as a leader in animal health solutions.

In addition to product innovation, Zoetis is also concentrating on expanding its global footprint. The company is actively seeking opportunities to enter new markets and increase its presence in existing ones. By leveraging its extensive distribution network and forming strategic partnerships, Zoetis plans to tap into emerging markets where demand for animal health products is on the rise. This geographical expansion is expected to drive revenue growth and mitigate risks associated with market saturation in developed regions.

Moreover, Zoetis is placing a strong emphasis on digital transformation as part of its strategic initiatives. The company is investing in digital tools and technologies to enhance its operational efficiency and customer engagement. By adopting advanced data analytics and digital platforms, Zoetis aims to streamline its supply chain, improve decision-making processes, and offer personalized solutions to its customers. This digital shift not only positions Zoetis as a forward-thinking company but also enables it to respond swiftly to market changes and customer demands.

Furthermore, Zoetis is committed to sustainability and corporate responsibility, recognizing the growing importance of environmental, social, and governance (ESG) factors in business operations. The company is implementing sustainable practices across its value chain, from sourcing raw materials to manufacturing and distribution. By reducing its environmental footprint and promoting animal welfare, Zoetis aims to align its business objectives with societal expectations, thereby enhancing its corporate image and attracting socially conscious investors.

In response to the declining share prices, Zoetis is also focusing on shareholder engagement and communication. The company is actively engaging with its investors to provide transparency about its strategic plans and financial performance. By fostering open communication and addressing investor concerns, Zoetis seeks to build trust and confidence among its shareholders, which is crucial for stabilizing its stock performance.

In conclusion, while Zoetis faces market challenges that have impacted its share prices, the company is proactively implementing strategic initiatives to address these issues. Through innovation, global expansion, digital transformation, sustainability efforts, and shareholder engagement, Zoetis is well-positioned to navigate the complexities of the animal health industry and achieve long-term success. As these initiatives take effect, the company remains optimistic about its ability to deliver value to its customers and shareholders alike.

Q&A

1. **Q:** What were Zoetis’ financial results for Q3?

– **A:** Zoetis reported better-than-expected earnings and revenue for Q3.

2. **Q:** How did Zoetis’ earnings compare to analysts’ expectations?

– **A:** Zoetis’ earnings exceeded analysts’ expectations.

3. **Q:** What was the market reaction to Zoetis’ Q3 performance?

– **A:** Despite outperforming in Q3, Zoetis’ shares declined.

4. **Q:** What reasons were cited for the decline in Zoetis’ share price?

– **A:** The decline in share price was attributed to broader market trends or investor concerns not directly related to the company’s performance.

5. **Q:** Did Zoetis provide any guidance for future quarters?

– **A:** Zoetis may have provided guidance, but specific details would need to be checked in their official report or press release.

6. **Q:** How did Zoetis’ revenue perform in Q3?

– **A:** Zoetis’ revenue was higher than expected, contributing to the overall positive financial results.

7. **Q:** What sector does Zoetis operate in?

– **A:** Zoetis operates in the animal health sector.

Conclusion

Zoetis reported strong financial performance in the third quarter, surpassing market expectations with robust revenue growth and increased profitability. Despite these positive results, the company’s shares experienced a decline, likely due to broader market conditions, investor profit-taking, or concerns about future growth sustainability. This paradox highlights the complex dynamics of stock market reactions, where even strong earnings can be overshadowed by external factors or investor sentiment.