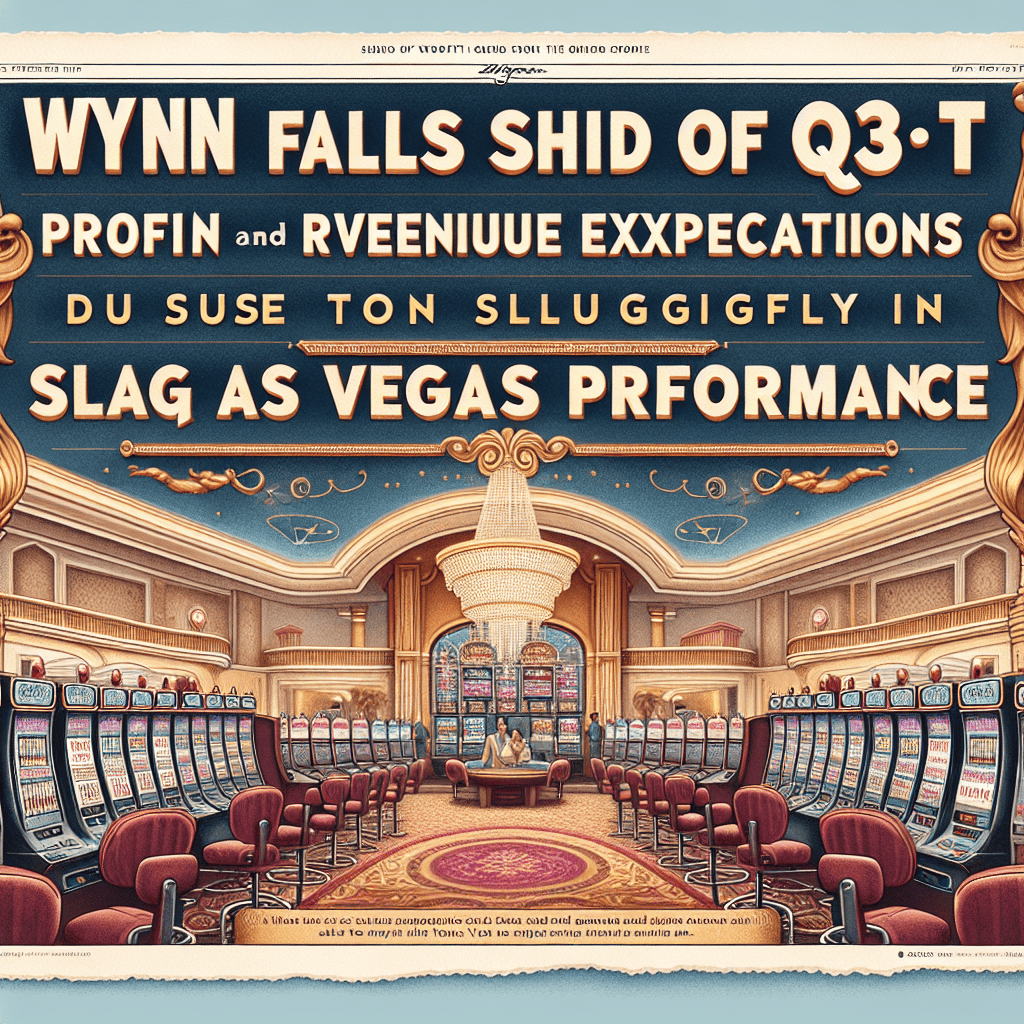

“Wynn’s Q3 Gamble: Las Vegas Lull Leads to Profit and Revenue Miss.”

Introduction

In the third quarter, Wynn Resorts reported financial results that fell short of market expectations, primarily due to underwhelming performance in its Las Vegas operations. Despite efforts to revitalize its offerings and attract visitors, the company faced challenges in boosting revenue and profit margins in the competitive Las Vegas market. This shortfall highlights the ongoing difficulties in the hospitality and gaming sectors, as Wynn grapples with fluctuating demand and economic uncertainties. The company’s performance in Las Vegas, a critical component of its overall business strategy, underscores the need for strategic adjustments to navigate the evolving landscape and meet investor expectations.

Impact Of Las Vegas Market On Wynn’s Q3 Financial Results

In the third quarter of 2023, Wynn Resorts faced a challenging financial landscape, as the company reported earnings that fell short of analysts’ expectations. This underperformance was primarily attributed to a sluggish performance in the Las Vegas market, which has historically been a significant contributor to Wynn’s overall financial health. As the company navigates these turbulent waters, it becomes crucial to understand the factors influencing the Las Vegas market and their subsequent impact on Wynn’s financial results.

To begin with, the Las Vegas market has been experiencing a period of stagnation, marked by a decline in tourist numbers and a shift in consumer spending patterns. This downturn can be attributed to several factors, including increased competition from other entertainment destinations and changing consumer preferences. As a result, Wynn Resorts, which relies heavily on its Las Vegas operations, has seen a decrease in both occupancy rates and average daily revenue per available room. This decline in core metrics has inevitably led to a shortfall in the company’s overall revenue and profit figures for the quarter.

Moreover, the broader economic environment has also played a role in shaping the Las Vegas market’s performance. With rising inflation and interest rates, consumers have become more cautious with their discretionary spending, opting to prioritize essential expenses over luxury experiences. This shift in consumer behavior has had a direct impact on the hospitality and gaming sectors, which are integral to Wynn’s business model. Consequently, the company’s Las Vegas properties have struggled to attract the same level of high-spending clientele that they have traditionally relied upon.

In addition to these external factors, Wynn Resorts has faced internal challenges that have further compounded its financial difficulties. The company has been investing heavily in renovations and expansions to enhance its Las Vegas offerings, aiming to attract a broader demographic and stay competitive in a rapidly evolving market. While these investments are expected to yield long-term benefits, they have temporarily strained the company’s financial resources, contributing to the shortfall in quarterly profits.

Despite these challenges, Wynn Resorts remains optimistic about its future prospects. The company is actively exploring strategies to revitalize its Las Vegas operations and regain its competitive edge. This includes leveraging technology to enhance customer experiences, diversifying its entertainment offerings, and implementing targeted marketing campaigns to attract new visitors. By focusing on innovation and adaptability, Wynn aims to navigate the current market challenges and position itself for sustained growth.

Furthermore, Wynn’s performance in other markets, such as Macau, has shown resilience, providing a buffer against the downturn in Las Vegas. The company’s diversified portfolio allows it to mitigate risks associated with regional market fluctuations, underscoring the importance of a balanced approach to growth and expansion.

In conclusion, while Wynn Resorts’ third-quarter financial results have been adversely affected by the sluggish performance of the Las Vegas market, the company is taking proactive steps to address these challenges. By understanding the underlying factors contributing to the market’s stagnation and implementing strategic initiatives, Wynn is poised to overcome its current obstacles and achieve long-term success. As the company continues to adapt to changing market dynamics, its ability to innovate and remain competitive will be crucial in shaping its future trajectory.

Analyzing Wynn’s Q3 Revenue Miss: Key Factors

In the third quarter of the fiscal year, Wynn Resorts Ltd. reported financial results that fell short of analysts’ expectations, primarily due to a lackluster performance in its Las Vegas operations. This unexpected shortfall has prompted a closer examination of the factors contributing to the company’s underwhelming financial performance. While Wynn’s international ventures, particularly in Macau, have shown signs of recovery, the domestic market has not mirrored this positive trend. Consequently, the company’s overall revenue and profit figures have been adversely affected.

To begin with, the Las Vegas market, a significant revenue driver for Wynn, has faced several challenges in recent months. Despite the gradual return of tourists and the easing of pandemic-related restrictions, consumer spending patterns have not rebounded to pre-pandemic levels. This sluggish recovery can be attributed to a combination of factors, including inflationary pressures that have curtailed discretionary spending and a competitive landscape that has intensified as other entertainment options vie for consumer attention. As a result, Wynn’s Las Vegas properties have struggled to attract the volume of visitors necessary to boost their financial performance.

Moreover, the labor market in Las Vegas has presented additional hurdles for Wynn. The hospitality industry, in particular, has been grappling with staffing shortages, which have impacted service levels and operational efficiency. Wynn has had to navigate these challenges by increasing wages and offering incentives to attract and retain employees, thereby exerting pressure on profit margins. This situation has been further exacerbated by supply chain disruptions, which have led to increased costs for goods and services essential to the operation of Wynn’s resorts.

In contrast, Wynn’s operations in Macau have shown resilience, benefiting from a gradual recovery in the region’s gaming industry. The easing of travel restrictions and the resumption of group tours have contributed to a steady increase in visitor numbers. However, the pace of recovery in Macau has not been sufficient to offset the underperformance in Las Vegas. Additionally, regulatory uncertainties in the region continue to pose a risk to future growth prospects, necessitating a cautious approach to investment and expansion.

Another factor influencing Wynn’s Q3 performance is the broader economic environment. The global economy has been marked by volatility, with fluctuating consumer confidence and market uncertainties impacting spending behavior. This has been particularly evident in the luxury segment, where Wynn operates, as consumers have become more selective in their spending choices. Consequently, Wynn has had to adapt its marketing strategies to appeal to a more value-conscious clientele, which has required additional investment in promotional activities and customer engagement initiatives.

In light of these challenges, Wynn Resorts is actively exploring strategies to enhance its financial performance and regain investor confidence. The company is focusing on diversifying its revenue streams by expanding its non-gaming offerings, such as dining, entertainment, and retail experiences, to attract a broader customer base. Additionally, Wynn is investing in technology and innovation to improve operational efficiency and enhance the customer experience, which is expected to drive long-term growth.

In conclusion, Wynn Resorts’ Q3 revenue miss can be attributed to a confluence of factors, with the sluggish performance of its Las Vegas operations playing a pivotal role. While the company faces significant challenges, it is taking proactive steps to address these issues and position itself for future success. As the global economic landscape continues to evolve, Wynn’s ability to adapt and innovate will be crucial in navigating the complexities of the hospitality and gaming industries.

Strategies For Wynn To Overcome Las Vegas Slump

Wynn Resorts, a prominent name in the luxury hospitality and gaming industry, recently reported its third-quarter financial results, which fell short of analysts’ expectations. The underperformance was primarily attributed to a sluggish performance in its Las Vegas operations. As the company navigates these challenges, it is imperative to explore strategic avenues that could potentially revitalize its Las Vegas segment and bolster overall profitability.

To begin with, Wynn Resorts could benefit from diversifying its entertainment offerings. Las Vegas is renowned for its vibrant entertainment scene, and by expanding its portfolio to include a wider array of shows, concerts, and events, Wynn could attract a broader audience. This diversification would not only enhance the guest experience but also create additional revenue streams. Moreover, collaborating with high-profile artists and performers could elevate the brand’s prestige and draw in visitors who might not typically frequent casino resorts.

In addition to diversifying entertainment, Wynn could focus on enhancing its customer loyalty programs. By offering personalized experiences and exclusive benefits to repeat visitors, the company can foster a sense of loyalty and encourage return visits. Implementing advanced data analytics to understand customer preferences and tailor offerings accordingly could significantly improve customer satisfaction and retention. This approach would not only strengthen relationships with existing patrons but also attract new customers through positive word-of-mouth and brand reputation.

Furthermore, Wynn Resorts might consider investing in cutting-edge technology to enhance the overall guest experience. In an era where digital innovation is transforming industries, integrating technology into the hospitality sector can provide a competitive edge. For instance, implementing mobile apps that allow guests to seamlessly book rooms, make dining reservations, and access entertainment options can streamline the customer journey. Additionally, utilizing virtual reality and augmented reality experiences within the resort could offer unique attractions that set Wynn apart from its competitors.

Another strategic avenue for Wynn is to capitalize on the growing trend of wellness tourism. By expanding its wellness and spa offerings, the company can tap into a lucrative market segment that prioritizes health and well-being. Developing comprehensive wellness programs that include fitness classes, spa treatments, and healthy dining options can attract health-conscious travelers seeking relaxation and rejuvenation. This focus on wellness not only aligns with current consumer trends but also enhances the overall appeal of the resort as a holistic destination.

Moreover, Wynn Resorts should consider strengthening its partnerships with local businesses and attractions. By collaborating with nearby restaurants, shops, and cultural sites, Wynn can create comprehensive packages that encourage guests to explore the broader Las Vegas area. This approach not only supports the local economy but also enriches the guest experience by offering a more diverse range of activities and attractions.

In conclusion, while Wynn Resorts faces challenges in its Las Vegas operations, there are several strategic initiatives that could help overcome the current slump. By diversifying entertainment offerings, enhancing customer loyalty programs, investing in technology, focusing on wellness tourism, and strengthening local partnerships, Wynn can position itself for renewed growth and success. These strategies, if effectively implemented, have the potential to revitalize the Las Vegas segment and contribute to the company’s overall profitability in the long term. As the hospitality industry continues to evolve, Wynn’s ability to adapt and innovate will be crucial in maintaining its status as a leader in luxury gaming and hospitality.

Wynn’s Q3 Performance: A Closer Look At Las Vegas Operations

In the third quarter of the fiscal year, Wynn Resorts reported financial results that fell short of analysts’ expectations, primarily due to underwhelming performance in its Las Vegas operations. This development has raised concerns among investors and industry analysts, as Las Vegas has traditionally been a stronghold for the company. While Wynn’s operations in other regions, such as Macau, showed resilience and even growth, the sluggish performance in Las Vegas has cast a shadow over the company’s overall financial health.

To understand the factors contributing to this shortfall, it is essential to examine the broader economic context and specific challenges faced by Wynn in Las Vegas. The city, known for its vibrant entertainment and gaming industry, has been grappling with a slower-than-expected recovery from the pandemic-induced downturn. Although tourism numbers have been gradually improving, they have not yet returned to pre-pandemic levels. This has had a direct impact on Wynn’s ability to attract and retain high-spending visitors, which are crucial for driving revenue in its luxury resorts.

Moreover, the competitive landscape in Las Vegas has intensified, with new entrants and existing players vying for a share of the market. This increased competition has put pressure on Wynn to innovate and enhance its offerings to maintain its market position. However, the company has faced challenges in executing its strategic initiatives, partly due to supply chain disruptions and labor shortages that have affected the broader hospitality industry. These operational hurdles have hindered Wynn’s ability to fully capitalize on the gradual recovery in visitor numbers.

In addition to these external factors, internal dynamics have also played a role in Wynn’s underperformance in Las Vegas. The company has been undergoing a leadership transition, which, while necessary for long-term strategic realignment, has created short-term uncertainties. The new leadership team is tasked with steering the company through this challenging period, balancing the need for immediate operational improvements with the pursuit of long-term growth opportunities.

Despite these challenges, there are reasons for cautious optimism. Wynn has been investing in enhancing its digital and online gaming platforms, recognizing the growing importance of these channels in the post-pandemic world. This strategic pivot could open new revenue streams and mitigate some of the pressures faced in the traditional brick-and-mortar operations. Furthermore, Wynn’s strong brand equity and reputation for luxury and excellence continue to be significant assets that can be leveraged to attract high-value customers.

Looking ahead, Wynn’s ability to navigate the complexities of the Las Vegas market will be crucial in determining its financial trajectory. The company will need to focus on operational efficiencies, innovative marketing strategies, and customer experience enhancements to regain its competitive edge. Additionally, maintaining a flexible and adaptive approach will be vital in responding to the evolving economic landscape and consumer preferences.

In conclusion, while Wynn Resorts’ third-quarter performance has highlighted vulnerabilities in its Las Vegas operations, it also underscores the importance of strategic agility and innovation in overcoming these challenges. As the company works to address these issues, stakeholders will be closely monitoring its progress and the impact of its initiatives on future financial results. The path forward may be fraught with challenges, but with a clear focus and strategic execution, Wynn has the potential to reclaim its position as a leader in the luxury gaming and hospitality industry.

How Las Vegas Trends Affected Wynn’s Q3 Profitability

In the third quarter of 2023, Wynn Resorts faced a challenging financial landscape, as the company reported earnings that fell short of analysts’ expectations. This underperformance was primarily attributed to sluggish activity in its Las Vegas operations, a key market for the luxury hotel and casino operator. As the company navigated through a period marked by fluctuating consumer behavior and economic uncertainties, the trends in Las Vegas played a pivotal role in shaping its financial outcomes.

To understand the impact of Las Vegas trends on Wynn’s profitability, it is essential to consider the broader economic context. The third quarter of 2023 was characterized by a mix of economic signals, with inflationary pressures and interest rate hikes influencing consumer spending patterns. In this environment, discretionary spending, particularly in the leisure and hospitality sectors, experienced volatility. Las Vegas, a city heavily reliant on tourism and entertainment, was not immune to these challenges. Visitor numbers, while recovering from the pandemic-induced lows, did not reach the anticipated levels, affecting the revenue streams of major players like Wynn Resorts.

Moreover, the competitive landscape in Las Vegas intensified during this period. New entrants and existing competitors alike sought to capture market share by offering attractive promotions and innovative experiences. This heightened competition put pressure on Wynn to maintain its premium positioning while also appealing to a broader audience. Consequently, the company faced the dual challenge of sustaining its brand image and adapting to the evolving preferences of a diverse clientele.

In addition to these external factors, internal dynamics within Wynn’s Las Vegas operations also contributed to the financial shortfall. The company had invested significantly in refurbishments and new attractions, aiming to enhance its appeal and drive foot traffic. While these investments are expected to yield long-term benefits, the immediate impact on profitability was less favorable. The costs associated with these initiatives, coupled with the slower-than-expected recovery in visitor numbers, weighed on the company’s bottom line.

Furthermore, Wynn’s reliance on high-end clientele, including international visitors, posed another challenge. Travel restrictions and geopolitical tensions in certain regions affected the flow of international tourists, a demographic that traditionally contributes significantly to Wynn’s revenue. The absence of these high-spending guests further compounded the difficulties faced by the company in achieving its financial targets.

Despite these setbacks, Wynn Resorts remains optimistic about its future prospects. The company is actively exploring strategies to enhance its resilience and adaptability in the face of changing market dynamics. Initiatives such as diversifying its offerings, leveraging technology to enhance customer experiences, and expanding its presence in emerging markets are part of Wynn’s broader strategy to mitigate the impact of localized challenges in Las Vegas.

In conclusion, the third quarter of 2023 presented Wynn Resorts with a complex set of challenges, primarily driven by sluggish performance in its Las Vegas operations. The interplay of economic uncertainties, competitive pressures, and internal strategic decisions all contributed to the company’s inability to meet profit and revenue expectations. However, with a focus on innovation and strategic adaptation, Wynn is poised to navigate these challenges and capitalize on future opportunities. As the company continues to refine its approach, the lessons learned from this period will undoubtedly inform its path forward, ensuring that it remains a formidable player in the global hospitality and gaming industry.

Wynn’s Q3 Earnings: Lessons From Las Vegas Challenges

In the third quarter of the fiscal year, Wynn Resorts reported earnings that fell short of analysts’ expectations, primarily due to a lackluster performance in its Las Vegas operations. This development has prompted a closer examination of the factors contributing to the company’s underwhelming financial results and the broader implications for the gaming and hospitality industry. As Wynn Resorts navigates these challenges, it is essential to understand the dynamics at play in Las Vegas, a city that has long been a bellwether for the sector.

To begin with, Wynn Resorts’ third-quarter earnings report revealed a notable shortfall in both profit and revenue. Analysts had anticipated stronger results, given the gradual recovery of the travel and leisure industry following the disruptions caused by the COVID-19 pandemic. However, Wynn’s Las Vegas properties did not perform as expected, which significantly impacted the company’s overall financial performance. This underperformance can be attributed to several interrelated factors that have been affecting the Las Vegas market.

One of the primary reasons for the sluggish performance in Las Vegas is the slower-than-expected return of international tourists. Las Vegas has traditionally relied heavily on international visitors, who contribute significantly to the city’s gaming and hospitality revenues. However, ongoing travel restrictions and varying levels of comfort with international travel have resulted in a more gradual return of this crucial demographic. Consequently, Wynn Resorts, like many of its competitors, has faced challenges in attracting the same level of international patronage that it enjoyed prior to the pandemic.

Moreover, the domestic market, while showing signs of recovery, has not fully compensated for the shortfall in international visitors. Although there has been an uptick in domestic travel, the competitive landscape in Las Vegas has intensified, with numerous resorts vying for a share of the returning customer base. This increased competition has put pressure on Wynn Resorts to offer more attractive promotions and incentives, which, in turn, has affected profit margins.

In addition to these market dynamics, operational challenges have also played a role in Wynn’s third-quarter performance. Labor shortages, a common issue across various industries, have impacted the company’s ability to maintain optimal service levels. The hospitality sector, in particular, has struggled to attract and retain staff, leading to increased operational costs and, in some cases, a diminished guest experience. Wynn Resorts has had to navigate these challenges while striving to uphold its reputation for luxury and excellence.

Despite these setbacks, there are valuable lessons to be learned from Wynn’s experience in Las Vegas. The company’s response to these challenges will likely involve a strategic reassessment of its operations and marketing efforts. By focusing on enhancing the guest experience and exploring innovative ways to attract both domestic and international visitors, Wynn Resorts can position itself for a more robust recovery. Additionally, the company may need to explore diversification strategies to reduce its reliance on any single market.

In conclusion, Wynn Resorts’ third-quarter earnings report underscores the complexities of operating in the current Las Vegas market. While the company has faced significant challenges, these difficulties also present opportunities for growth and adaptation. By addressing the factors that have contributed to its recent performance, Wynn Resorts can not only improve its financial outlook but also set a precedent for resilience and innovation in the gaming and hospitality industry. As the sector continues to evolve, the lessons learned from Wynn’s experience will be invaluable for other industry players navigating similar challenges.

Future Outlook For Wynn Amid Las Vegas Market Slowdown

Wynn Resorts recently reported its third-quarter financial results, revealing a shortfall in both profit and revenue expectations, primarily attributed to a sluggish performance in the Las Vegas market. This development has raised concerns about the company’s future outlook, particularly as the Las Vegas Strip, a key revenue driver, faces a slowdown. As Wynn navigates these challenges, it is essential to examine the factors contributing to this downturn and explore potential strategies for future growth.

The Las Vegas market, traditionally a robust source of revenue for Wynn, has been experiencing a deceleration in visitor numbers and spending. Several factors have contributed to this trend, including increased competition from other entertainment destinations and changing consumer preferences. Additionally, the lingering effects of the COVID-19 pandemic have altered travel behaviors, with many potential visitors opting for destinations closer to home or those perceived as safer. Consequently, Wynn’s Las Vegas operations have struggled to maintain the momentum seen in previous years.

Despite these challenges, Wynn Resorts remains a formidable player in the global hospitality and gaming industry. The company’s diversified portfolio, which includes properties in Macau and Boston, provides a buffer against localized downturns. However, the Las Vegas market’s significance cannot be understated, as it remains a critical component of Wynn’s overall business strategy. Therefore, addressing the slowdown in this market is imperative for the company’s long-term success.

In response to the current market conditions, Wynn is exploring several strategies to revitalize its Las Vegas operations. One potential avenue is enhancing the customer experience through innovative offerings and personalized services. By leveraging technology and data analytics, Wynn can better understand customer preferences and tailor its offerings to meet evolving demands. This approach not only enhances customer satisfaction but also fosters loyalty, encouraging repeat visits and increased spending.

Moreover, Wynn is considering strategic partnerships and collaborations to expand its reach and attract new customer segments. By aligning with complementary brands and businesses, Wynn can tap into new markets and diversify its revenue streams. This strategy not only mitigates the risks associated with a single market but also positions Wynn as a versatile and adaptive player in the industry.

Furthermore, Wynn is investing in sustainability initiatives to appeal to environmentally conscious consumers. By implementing eco-friendly practices and promoting sustainable tourism, Wynn can differentiate itself from competitors and attract a growing segment of eco-aware travelers. This commitment to sustainability not only enhances Wynn’s brand image but also aligns with global trends towards responsible tourism.

In addition to these strategies, Wynn is closely monitoring economic indicators and market trends to make informed decisions. By staying attuned to shifts in consumer behavior and economic conditions, Wynn can proactively adjust its strategies to capitalize on emerging opportunities. This agility is crucial in an industry characterized by rapid changes and intense competition.

In conclusion, while Wynn Resorts faces challenges in the Las Vegas market, the company’s proactive approach and strategic initiatives offer a promising path forward. By focusing on enhancing customer experiences, forming strategic partnerships, and investing in sustainability, Wynn is well-positioned to navigate the current slowdown and emerge stronger in the future. As the company continues to adapt to changing market dynamics, its commitment to innovation and excellence will be key drivers of its long-term success.

Q&A

1. **What company is the article about?**

Wynn Resorts.

2. **Which quarter’s financial performance is being discussed?**

The third quarter (Q3).

3. **What were the main financial metrics that fell short of expectations?**

Profit and revenue.

4. **What was the primary reason for the underperformance?**

Sluggish performance in Las Vegas.

5. **How did the Las Vegas performance impact the overall results?**

It contributed significantly to the shortfall in profit and revenue expectations.

6. **Were there any other regions or factors mentioned that affected the results?**

The focus was primarily on Las Vegas, but other factors may have been mentioned in the full report.

7. **What might investors be concerned about following this report?**

Investors might be concerned about the company’s ability to meet future financial expectations and the ongoing performance in key markets like Las Vegas.

Conclusion

Wynn Resorts’ third-quarter financial results fell short of profit and revenue expectations, primarily due to underperformance in its Las Vegas operations. Despite efforts to boost revenue streams, the sluggish demand and competitive pressures in the Las Vegas market significantly impacted the company’s overall financial performance. This shortfall highlights the challenges Wynn faces in maintaining its market position and profitability amidst fluctuating consumer trends and economic conditions in one of its key markets. Moving forward, Wynn may need to reassess its strategies in Las Vegas to better align with market demands and improve its financial outcomes.