“Market Volatility Hits AI Giants: Nvidia, AMD, and Arm Holdings Tumble Amid Investor Concerns.”

Introduction

On Tuesday, shares of prominent artificial intelligence (AI) companies, including Nvidia, AMD, and Arm Holdings, experienced a notable decline. This downturn in AI stocks can be attributed to a confluence of factors impacting the broader technology sector. Market analysts point to investor concerns over potential regulatory challenges, geopolitical tensions, and shifts in consumer demand as key drivers behind the sell-off. Additionally, fluctuations in global economic indicators and interest rate adjustments have contributed to heightened market volatility, prompting investors to reassess their positions in high-growth tech stocks. As a result, these leading AI companies, which have been at the forefront of technological innovation, faced a challenging trading session, reflecting broader uncertainties in the financial markets.

Market Volatility Impacting AI Stocks

On Tuesday, the stock market witnessed a notable downturn, with artificial intelligence (AI) stocks such as Nvidia, AMD, and Arm Holdings experiencing significant declines. This drop can be attributed to a confluence of factors that have heightened market volatility, impacting investor sentiment and leading to a sell-off in these high-profile technology stocks. Understanding the reasons behind this market movement requires a closer examination of both macroeconomic conditions and industry-specific developments.

To begin with, broader economic concerns have played a pivotal role in the recent market volatility. Inflationary pressures continue to loom large, with central banks around the world adopting more aggressive monetary policies to curb rising prices. The U.S. Federal Reserve, for instance, has signaled its intent to maintain higher interest rates for an extended period, a move that has historically led to increased borrowing costs and reduced consumer spending. Consequently, investors are becoming more risk-averse, opting to divest from high-growth sectors like technology, which are particularly sensitive to interest rate fluctuations.

Moreover, geopolitical tensions have further exacerbated market instability. The ongoing conflict in Eastern Europe, coupled with trade uncertainties between major economies, has created an environment of unpredictability. These geopolitical factors have disrupted global supply chains, leading to increased production costs and delays in the delivery of critical components. For AI companies, which rely heavily on advanced semiconductors and other specialized hardware, these disruptions pose significant challenges, potentially affecting their ability to meet market demand and maintain profit margins.

In addition to these macroeconomic and geopolitical influences, industry-specific developments have also contributed to the decline in AI stock prices. The AI sector, while promising, is characterized by rapid technological advancements and intense competition. Companies like Nvidia and AMD are constantly innovating to maintain their competitive edge, investing heavily in research and development. However, the pace of innovation also means that any perceived slowdown in technological breakthroughs or product rollouts can lead to investor apprehension. Recent reports suggesting potential delays in the release of next-generation AI chips have likely fueled concerns about the future growth prospects of these companies.

Furthermore, regulatory scrutiny is increasingly becoming a focal point for AI companies. Governments worldwide are grappling with the ethical and societal implications of AI technologies, leading to discussions about stricter regulations and oversight. While these measures aim to ensure responsible AI development, they also introduce an element of uncertainty for companies operating in this space. Investors, wary of potential regulatory hurdles, may be adjusting their portfolios accordingly, contributing to the downward pressure on AI stocks.

Despite these challenges, it is important to recognize that the long-term outlook for AI remains robust. The transformative potential of AI technologies across various industries continues to drive interest and investment. However, in the short term, market participants are likely to remain cautious, closely monitoring economic indicators, geopolitical developments, and industry trends. As the market navigates this period of heightened volatility, AI companies will need to demonstrate resilience and adaptability to reassure investors and regain their confidence.

In conclusion, the decline in AI stocks on Tuesday can be attributed to a combination of macroeconomic pressures, geopolitical uncertainties, and industry-specific challenges. While these factors have contributed to increased market volatility, the underlying potential of AI technologies remains undiminished. As the sector continues to evolve, companies like Nvidia, AMD, and Arm Holdings will play a crucial role in shaping the future of AI, even as they navigate the complexities of the current market environment.

Investor Concerns Over Valuation

On Tuesday, shares of prominent artificial intelligence (AI) companies, including Nvidia, AMD, and Arm Holdings, experienced a notable decline, raising concerns among investors about the valuation of these stocks. This downturn can be attributed to a confluence of factors that have prompted market participants to reassess the lofty valuations that these companies have enjoyed in recent months. As the AI sector has been a focal point of investor enthusiasm, driven by the transformative potential of AI technologies across various industries, the recent dip in stock prices underscores the inherent volatility and uncertainty that accompany high-growth sectors.

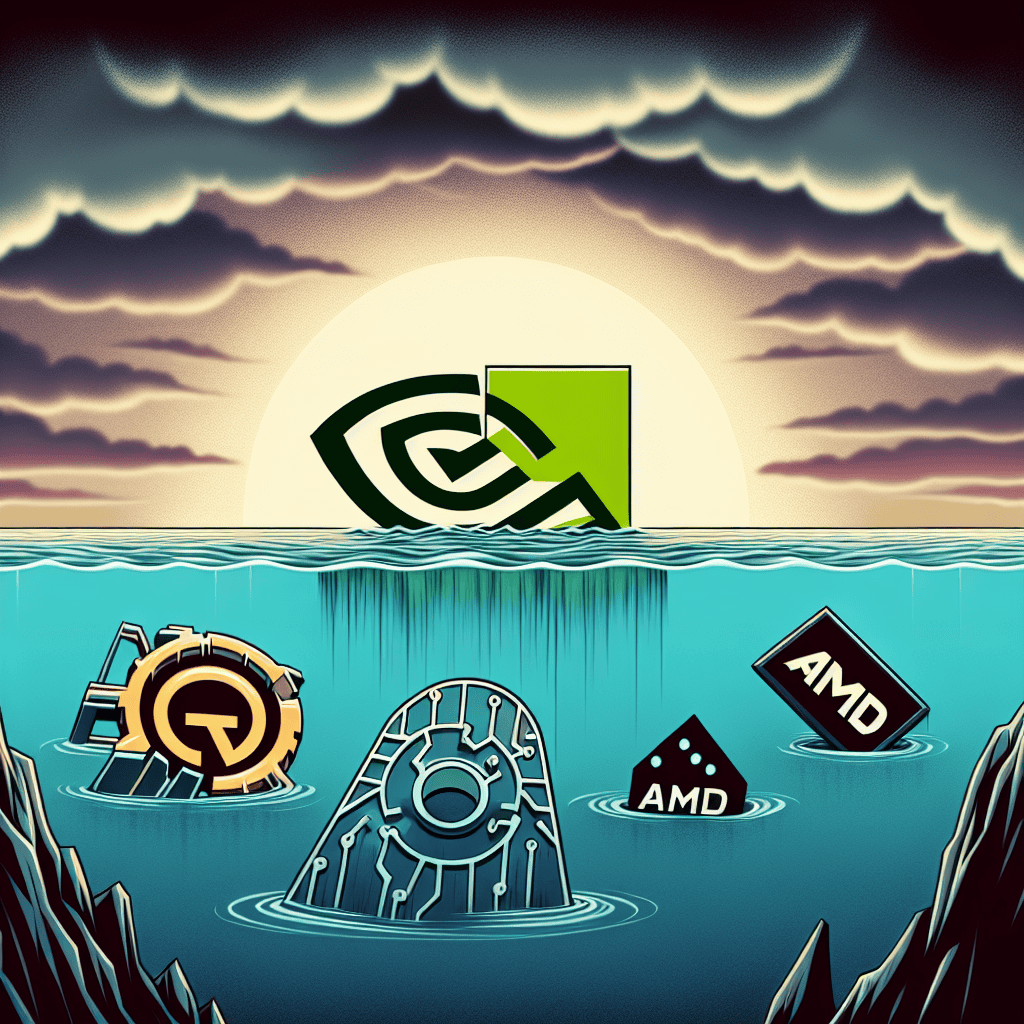

To begin with, the AI industry has been characterized by rapid advancements and significant investments, leading to substantial stock price appreciation for companies at the forefront of AI innovation. Nvidia, for instance, has been a key player in the development of AI hardware, particularly with its graphics processing units (GPUs) that are essential for AI computations. Similarly, AMD has made strides in AI through its advanced processors, while Arm Holdings has been instrumental in designing energy-efficient chips that power AI applications. These companies have benefited from the growing demand for AI solutions, which has been reflected in their soaring stock prices.

However, the recent decline in AI stocks can be attributed to growing investor concerns over valuation. As stock prices surged, questions arose about whether these valuations were justified by the companies’ current and projected earnings. The high price-to-earnings ratios of these stocks have led some investors to worry that the market may have overestimated the near-term growth potential of AI technologies. This sentiment has been exacerbated by broader market conditions, including rising interest rates and geopolitical uncertainties, which have prompted investors to adopt a more cautious approach.

Moreover, the competitive landscape within the AI sector has intensified, with numerous companies vying for market share and technological supremacy. This heightened competition has raised questions about the sustainability of profit margins and the ability of leading companies to maintain their competitive edge. As a result, investors are increasingly scrutinizing the long-term growth prospects of AI companies, considering factors such as innovation pipelines, strategic partnerships, and the ability to scale operations effectively.

In addition to these industry-specific concerns, macroeconomic factors have also played a role in the recent decline of AI stocks. The global economic environment remains uncertain, with inflationary pressures and supply chain disruptions posing challenges to businesses across sectors. These factors have contributed to a more risk-averse sentiment among investors, leading to a reevaluation of high-growth stocks, including those in the AI sector.

Furthermore, regulatory scrutiny of AI technologies has intensified, as governments around the world grapple with the ethical and societal implications of AI deployment. This increased regulatory focus has introduced an additional layer of uncertainty for AI companies, as potential regulatory changes could impact their operations and growth trajectories.

In conclusion, the recent decline in AI stocks such as Nvidia, AMD, and Arm Holdings reflects a confluence of factors, including investor concerns over valuation, intensified competition, macroeconomic uncertainties, and regulatory scrutiny. While the long-term potential of AI technologies remains promising, the current market environment has prompted investors to adopt a more cautious stance, leading to a reassessment of the valuations of AI companies. As the sector continues to evolve, it will be crucial for investors to carefully evaluate the risks and opportunities associated with AI investments, balancing the promise of innovation with the realities of market dynamics.

Regulatory Challenges in the Tech Sector

On Tuesday, shares of prominent artificial intelligence (AI) companies, including Nvidia, AMD, and Arm Holdings, experienced a notable decline, reflecting growing investor concerns over regulatory challenges in the tech sector. This downturn can be attributed to a confluence of factors, primarily centered around increasing scrutiny from global regulatory bodies. As AI technology continues to advance at a rapid pace, governments worldwide are grappling with the implications of these innovations, leading to heightened regulatory pressures that are now impacting market dynamics.

To begin with, the tech sector, particularly companies involved in AI, has been under the microscope due to concerns about data privacy, ethical considerations, and the potential for monopolistic practices. Regulators in the United States, Europe, and Asia have been actively exploring ways to ensure that AI technologies are developed and deployed responsibly. This has resulted in a series of proposed regulations and guidelines aimed at curbing potential abuses and ensuring transparency in AI applications. Consequently, investors are becoming increasingly wary of the potential financial implications these regulations could have on AI companies, leading to a sell-off in stocks.

Moreover, the recent decline in AI stocks can also be linked to specific regulatory developments. For instance, the European Union has been at the forefront of implementing stringent data protection laws, such as the General Data Protection Regulation (GDPR), and is now considering additional measures specifically targeting AI. These proposed regulations aim to establish a framework for AI that prioritizes human rights and ethical standards, which could impose significant compliance costs on companies like Nvidia, AMD, and Arm Holdings. As these companies navigate the evolving regulatory landscape, investors are concerned about the potential impact on their profitability and growth prospects.

In addition to European regulatory efforts, the United States has also intensified its focus on AI governance. The Federal Trade Commission (FTC) and other agencies have been vocal about the need for robust oversight to prevent anti-competitive practices and ensure consumer protection. This has led to increased scrutiny of mergers and acquisitions within the tech sector, further contributing to market uncertainty. As a result, companies that are heavily invested in AI research and development are facing a more challenging environment, which is reflected in their stock performance.

Furthermore, geopolitical tensions have added another layer of complexity to the regulatory challenges faced by AI companies. The ongoing trade disputes between major economies, particularly the United States and China, have raised concerns about the global supply chain for AI technologies. Restrictions on technology transfers and export controls have the potential to disrupt operations and limit market access for companies like Nvidia and AMD, which rely on international collaboration and sales. This geopolitical backdrop has exacerbated investor apprehension, leading to a broader sell-off in AI stocks.

In conclusion, the decline in AI stocks on Tuesday can be attributed to a combination of regulatory challenges and geopolitical uncertainties. As governments around the world seek to establish comprehensive frameworks for AI governance, companies in this sector are facing increased scrutiny and potential compliance burdens. These factors, coupled with geopolitical tensions, have created a complex environment that is influencing investor sentiment and impacting stock performance. As the regulatory landscape continues to evolve, AI companies will need to adapt to these challenges to maintain their competitive edge and reassure investors of their long-term viability.

Global Economic Uncertainty

On Tuesday, shares of prominent artificial intelligence (AI) companies such as Nvidia, AMD, and Arm Holdings experienced a notable decline, reflecting broader concerns about global economic uncertainty. This downturn in AI stocks can be attributed to a confluence of factors that have heightened investor anxiety, leading to a reevaluation of the growth prospects for these technology giants. As the global economic landscape becomes increasingly complex, market participants are grappling with a range of issues that have collectively contributed to the recent dip in AI stock valuations.

To begin with, the specter of rising interest rates has cast a shadow over the technology sector, which is particularly sensitive to changes in borrowing costs. Central banks around the world, including the Federal Reserve, have signaled their intent to continue tightening monetary policy in response to persistent inflationary pressures. Higher interest rates tend to increase the cost of capital, which can dampen investment in high-growth sectors like AI. Consequently, investors are recalibrating their expectations for future earnings growth, leading to a sell-off in AI stocks.

Moreover, geopolitical tensions have further exacerbated market volatility, with ongoing conflicts and trade disputes creating an unpredictable environment for global commerce. The semiconductor industry, which is integral to AI development, has been particularly affected by these geopolitical dynamics. Supply chain disruptions and export restrictions have raised concerns about the availability of critical components, potentially hindering the production capabilities of companies like Nvidia and AMD. As a result, investors are wary of the potential impact on revenue streams and profit margins, prompting a reassessment of stock valuations.

In addition to these macroeconomic and geopolitical factors, regulatory scrutiny has emerged as another headwind for AI companies. Governments worldwide are increasingly focused on the ethical implications and societal impact of AI technologies, leading to calls for stricter regulations. While these measures aim to ensure responsible AI development, they also introduce an element of uncertainty for companies operating in this space. Compliance with new regulations may require significant investments in research and development, as well as adjustments to business models, which could weigh on profitability in the short term.

Furthermore, the competitive landscape within the AI sector is intensifying, as established players and new entrants vie for market share. This heightened competition is driving innovation but also pressuring profit margins as companies invest heavily in research and development to maintain their technological edge. Investors are closely monitoring these dynamics, as the ability to sustain competitive advantages will be crucial for long-term success in the AI industry.

Despite these challenges, it is important to recognize that the long-term growth potential of AI remains robust. The transformative impact of AI technologies across various industries, from healthcare to finance, continues to drive demand for advanced computing solutions. However, in the current environment of global economic uncertainty, investors are exercising caution and reassessing their risk exposure to AI stocks.

In conclusion, the recent decline in AI stock prices can be attributed to a combination of rising interest rates, geopolitical tensions, regulatory scrutiny, and increased competition. While these factors have created headwinds for companies like Nvidia, AMD, and Arm Holdings, the underlying growth potential of AI technologies remains intact. As the global economy navigates these uncertainties, investors will continue to closely monitor developments in the AI sector, balancing short-term challenges with long-term opportunities.

Competitive Pressures in the AI Industry

On Tuesday, shares of prominent artificial intelligence (AI) companies such as Nvidia, AMD, and Arm Holdings experienced a notable decline, reflecting the competitive pressures that are increasingly shaping the AI industry. This downturn can be attributed to several interrelated factors that are influencing investor sentiment and market dynamics. As the AI sector continues to evolve, companies within this space are facing intensified competition, technological advancements, and shifting market demands, all of which contribute to the fluctuating stock performance.

To begin with, the AI industry is characterized by rapid technological advancements and innovation, which, while driving growth, also create an environment of heightened competition. Companies like Nvidia and AMD are at the forefront of developing cutting-edge AI technologies, particularly in the realm of graphics processing units (GPUs) and other hardware essential for AI computations. However, as more players enter the market, the competitive landscape becomes increasingly crowded. New entrants, often backed by significant venture capital, are challenging established firms by offering innovative solutions and competitive pricing. This influx of competition exerts pressure on existing companies to continuously innovate and maintain their market share, which can lead to increased operational costs and narrower profit margins.

Moreover, the AI industry is not immune to the broader economic factors that influence global markets. Recent macroeconomic uncertainties, including fluctuating interest rates and geopolitical tensions, have contributed to a cautious investment climate. Investors are becoming more risk-averse, leading to a reevaluation of high-growth sectors like AI. As a result, stocks of companies heavily invested in AI technologies are experiencing increased volatility. This is compounded by the fact that AI companies often operate with high valuations based on future growth potential, making them particularly sensitive to shifts in investor confidence.

In addition to these economic factors, regulatory challenges are also playing a role in shaping the competitive pressures within the AI industry. Governments around the world are increasingly scrutinizing AI technologies, focusing on issues such as data privacy, ethical use, and potential biases in AI algorithms. This regulatory landscape is evolving rapidly, and companies must navigate a complex web of compliance requirements. The uncertainty surrounding future regulations can deter investment and slow down the pace of innovation, as companies may need to allocate resources to ensure compliance rather than focusing solely on technological development.

Furthermore, strategic partnerships and collaborations are becoming crucial for companies aiming to maintain a competitive edge in the AI sector. Firms are increasingly seeking alliances to leverage complementary strengths, access new markets, and share the burden of research and development costs. However, forming and maintaining these partnerships can be challenging, as they require alignment of goals and effective management of joint ventures. The success or failure of such collaborations can significantly impact a company’s market position and investor perception.

In conclusion, the decline in AI stocks on Tuesday underscores the multifaceted competitive pressures that companies like Nvidia, AMD, and Arm Holdings face in the rapidly evolving AI industry. As technological advancements continue to accelerate, firms must navigate a complex landscape of competition, economic uncertainties, regulatory challenges, and strategic partnerships. These factors collectively influence investor sentiment and contribute to the volatility observed in the stock market. As the AI sector matures, companies that can effectively adapt to these pressures are likely to emerge as leaders, while those that struggle may face further challenges in maintaining their market position.

Profit-Taking by Investors

On Tuesday, the stock market witnessed a notable decline in the shares of prominent artificial intelligence (AI) companies, including Nvidia, AMD, and Arm Holdings. This downturn can be primarily attributed to profit-taking by investors, a common phenomenon in financial markets where investors sell off shares to lock in gains after a period of significant price appreciation. Understanding the dynamics behind this trend requires a closer examination of the recent performance of these stocks and the broader market context.

In recent months, AI stocks have experienced a remarkable surge, driven by growing optimism about the transformative potential of artificial intelligence technologies across various industries. Companies like Nvidia and AMD have been at the forefront of this technological revolution, providing the essential hardware and software solutions that power AI applications. As a result, their stock prices have soared, reflecting investor confidence in their future growth prospects. However, such rapid appreciation often leads to overvaluation concerns, prompting investors to reassess their positions.

The decision to engage in profit-taking is influenced by several factors. Firstly, the impressive gains in AI stocks have led to elevated valuations, which some investors perceive as unsustainable in the short term. As stock prices climb to new heights, the risk of a market correction increases, prompting cautious investors to secure their profits before any potential downturn. This behavior is particularly prevalent among institutional investors, who manage large portfolios and are keenly aware of the need to balance risk and reward.

Moreover, the broader economic environment plays a crucial role in shaping investor sentiment. Recent macroeconomic indicators, such as inflationary pressures and interest rate hikes, have introduced an element of uncertainty into the market. These factors can lead to increased volatility, prompting investors to adopt a more conservative approach. In such scenarios, profit-taking becomes a strategic move to mitigate potential losses and preserve capital.

Additionally, the competitive landscape within the AI sector is evolving rapidly. While Nvidia and AMD have established themselves as leaders, new entrants and technological advancements continually reshape the industry. This dynamic environment can create uncertainty about the long-term dominance of any single company, encouraging investors to diversify their portfolios and reduce exposure to individual stocks. Consequently, profit-taking becomes a prudent strategy to manage risk in a sector characterized by rapid innovation and intense competition.

Furthermore, the psychological aspect of investing cannot be overlooked. The fear of missing out (FOMO) often drives investors to buy into rising stocks, but once they achieve substantial gains, the fear of losing those profits can be equally compelling. This emotional cycle can lead to waves of selling, as investors seek to capitalize on their gains before market sentiment shifts.

In conclusion, the decline in AI stocks on Tuesday can be largely attributed to profit-taking by investors. This behavior is driven by a combination of factors, including elevated valuations, macroeconomic uncertainties, competitive dynamics, and psychological influences. While the short-term impact may be negative, it is essential to recognize that profit-taking is a natural part of market cycles. For long-term investors, these fluctuations present opportunities to reassess their investment strategies and potentially acquire shares at more attractive valuations. As the AI sector continues to evolve, maintaining a balanced perspective and a focus on fundamental growth prospects will be crucial for navigating the complexities of this dynamic market.

Supply Chain Disruptions Affecting Tech Companies

On Tuesday, shares of prominent technology companies such as Nvidia, AMD, and Arm Holdings experienced a notable decline, a movement that can be largely attributed to ongoing supply chain disruptions. These disruptions have been a persistent issue for the tech industry, exacerbated by a combination of geopolitical tensions, pandemic-related challenges, and evolving market demands. As the global economy continues to grapple with these multifaceted challenges, the tech sector finds itself particularly vulnerable due to its reliance on complex, interconnected supply chains.

To begin with, the semiconductor industry, which forms the backbone of companies like Nvidia and AMD, has been significantly impacted by supply chain bottlenecks. The production of semiconductors is a highly intricate process that requires a steady supply of raw materials and components from various parts of the world. However, the pandemic has led to factory shutdowns, labor shortages, and transportation delays, all of which have contributed to a scarcity of these critical components. Consequently, companies are struggling to meet the soaring demand for chips, which are essential for a wide range of products, from consumer electronics to advanced AI systems.

Moreover, geopolitical tensions have further complicated the situation. Trade disputes and regulatory changes have introduced additional layers of uncertainty, making it difficult for companies to plan and execute their supply chain strategies effectively. For instance, restrictions on exports and imports, particularly between major economies, have disrupted the flow of goods and materials, leading to increased costs and delays. This has had a ripple effect across the tech industry, affecting not only the availability of components but also the pricing and delivery timelines of finished products.

In addition to these challenges, the rapid pace of technological advancement has placed additional pressure on supply chains. As companies race to develop and deploy cutting-edge AI technologies, the demand for specialized components has surged. This has intensified competition for limited resources, further straining supply chains that are already under duress. Companies are now faced with the daunting task of balancing the need for innovation with the realities of supply chain constraints, a challenge that has been reflected in their stock performance.

Furthermore, the impact of these supply chain disruptions is not limited to production and logistics. Financial markets have also reacted to the uncertainty, with investors growing increasingly cautious about the prospects of tech companies. The recent decline in stock prices for Nvidia, AMD, and Arm Holdings can be seen as a reflection of these concerns. Investors are wary of the potential for prolonged disruptions to affect the profitability and growth trajectories of these companies, leading to a reevaluation of their market positions.

In response to these challenges, tech companies are exploring various strategies to mitigate the impact of supply chain disruptions. Some are investing in diversifying their supplier base to reduce dependency on specific regions or partners. Others are exploring technological solutions, such as AI-driven supply chain management systems, to enhance visibility and responsiveness. While these efforts may offer some relief, the path to stabilization remains uncertain, as the underlying issues are complex and multifaceted.

In conclusion, the decline in AI stocks on Tuesday underscores the significant impact of supply chain disruptions on the tech industry. As companies navigate this challenging landscape, they must contend with a range of factors, from geopolitical tensions to evolving market demands. While efforts to address these issues are underway, the road ahead is fraught with uncertainty, and the ability of tech companies to adapt will be crucial in determining their future success.

Q&A

1. **Market Volatility**: The stock market experienced overall volatility, affecting tech stocks, including AI companies.

2. **Interest Rate Concerns**: Rising interest rates led to investor concerns about the future profitability of tech companies, impacting AI stocks.

3. **Profit-Taking**: After significant gains in AI stocks, investors may have engaged in profit-taking, leading to a decline in stock prices.

4. **Geopolitical Tensions**: Ongoing geopolitical tensions, particularly involving China and the U.S., may have contributed to uncertainty and affected AI stocks.

5. **Regulatory Concerns**: Potential regulatory changes or scrutiny in the tech sector could have influenced investor sentiment negatively.

6. **Earnings Reports**: Disappointing earnings reports or guidance from key companies in the sector might have led to a sell-off.

7. **Sector Rotation**: Investors might have rotated out of tech and AI stocks into other sectors perceived as safer or more stable.

Conclusion

Nvidia, AMD, Arm Holdings, and other AI-related stocks experienced a decline on Tuesday due to a combination of factors, including investor concerns over high valuations, potential regulatory challenges, and broader market volatility. The tech sector, particularly AI stocks, has been under pressure as investors reassess growth prospects amid rising interest rates and geopolitical tensions. Additionally, any negative news or earnings reports from key companies in the sector can exacerbate sell-offs, leading to a broader decline in AI-related stocks.