“Maximize Your Future: Choose 401(k) for Higher Contribution Limits and Employer Match Benefits!”

Introduction

When planning for retirement, selecting the right savings vehicle is crucial to ensuring financial security in the golden years. Among the various options available, the 401(k) plan often stands out as a preferred choice over an Individual Retirement Account (IRA) for several compelling reasons. A 401(k) typically offers higher contribution limits, allowing individuals to set aside more money each year compared to an IRA. Additionally, many employers provide matching contributions to 401(k) plans, effectively offering free money that can significantly boost retirement savings. The convenience of automatic payroll deductions also makes it easier to consistently contribute to a 401(k), fostering disciplined saving habits. Furthermore, 401(k) plans often come with a diverse range of investment options, enabling individuals to tailor their portfolios according to their risk tolerance and financial goals. These advantages make the 401(k) an attractive and strategic choice for those looking to maximize their retirement savings potential.

Employer Matching Benefits in a 401(k)

When planning for retirement, selecting the right savings vehicle is crucial to ensuring financial security in one’s later years. Among the myriad of options available, the 401(k) and the Individual Retirement Account (IRA) stand out as two of the most popular choices. While both have their merits, the 401(k) offers a distinct advantage that often tips the scales in its favor: employer matching benefits. This feature not only enhances the potential growth of retirement savings but also underscores the strategic advantage of choosing a 401(k) over an IRA.

To begin with, employer matching is a benefit offered by many companies as part of their employee compensation package. Essentially, it involves the employer contributing a certain amount to the employee’s 401(k) account, typically matching the employee’s own contributions up to a specified percentage of their salary. This matching contribution is akin to receiving free money, which can significantly boost the overall retirement savings. For instance, if an employer offers a 50% match on contributions up to 6% of an employee’s salary, an employee earning $60,000 annually could receive an additional $1,800 in their 401(k) simply by contributing $3,600 themselves. This immediate return on investment is a compelling reason to prioritize a 401(k) over an IRA, which does not offer such matching benefits.

Moreover, the impact of employer matching extends beyond the initial contribution. Over time, the matched funds, along with the employee’s contributions, benefit from compound interest, which can exponentially increase the retirement nest egg. The power of compounding means that the earlier one starts contributing to a 401(k), the more significant the growth potential. This long-term advantage is particularly beneficial in a 401(k) plan, where the combination of personal contributions, employer matches, and compound interest can lead to substantial savings by the time retirement approaches.

In addition to the financial benefits, employer matching in a 401(k) also encourages disciplined saving habits. Knowing that contributions are effectively doubled by the employer can motivate employees to consistently contribute a portion of their salary towards retirement. This regular saving behavior is crucial in building a robust financial foundation for the future. Furthermore, many employers offer automatic enrollment and automatic escalation features in their 401(k) plans, which can further enhance savings by gradually increasing the contribution rate over time without requiring active decision-making from the employee.

While IRAs offer certain advantages, such as a wider range of investment options and potentially lower fees, they lack the immediate financial incentive provided by employer matching. This absence can make it more challenging for individuals to maximize their retirement savings, especially if they are not disciplined savers. Additionally, the contribution limits for IRAs are generally lower than those for 401(k) plans, which can further restrict the growth potential of retirement savings.

In conclusion, while both 401(k) plans and IRAs have their respective benefits, the employer matching feature of a 401(k) provides a compelling reason to prioritize it as a primary retirement savings vehicle. The combination of immediate financial gain, compounded growth over time, and the encouragement of consistent saving habits makes the 401(k) an attractive option for those looking to secure their financial future. By taking full advantage of employer matching, individuals can significantly enhance their retirement savings and work towards achieving a comfortable and financially stable retirement.

Higher Contribution Limits in a 401(k)

When planning for retirement, one of the most critical decisions involves choosing the right savings vehicle. Among the popular options are the 401(k) and the Individual Retirement Account (IRA). While both have their merits, I have chosen to prioritize a 401(k) for my retirement savings, primarily due to its higher contribution limits. This decision is not made lightly, as it involves careful consideration of various factors that influence long-term financial security.

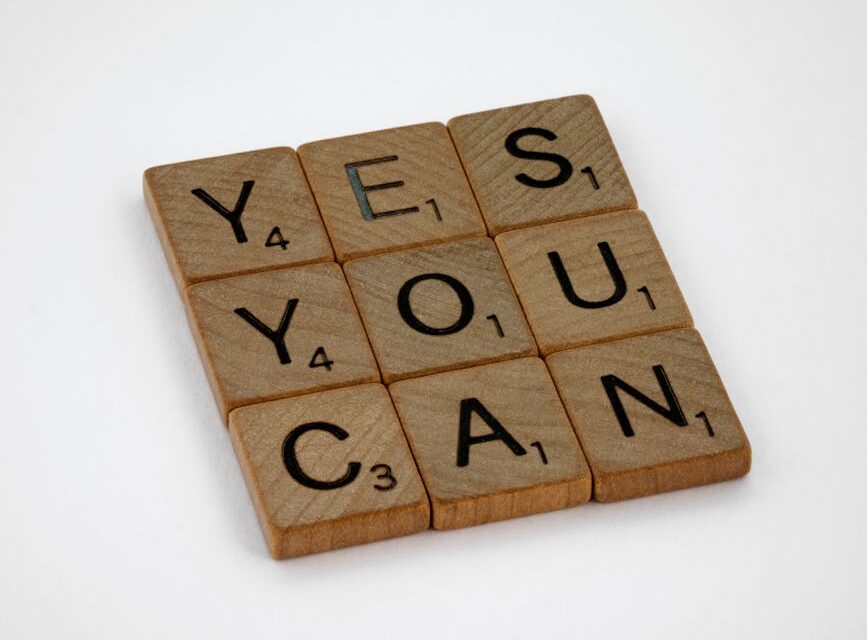

To begin with, the most compelling advantage of a 401(k) is its significantly higher contribution limits compared to an IRA. For the year 2023, the maximum contribution limit for a 401(k) is $22,500, with an additional catch-up contribution of $7,500 for those aged 50 and above. In contrast, the IRA allows a maximum contribution of only $6,500, with a catch-up contribution of $1,000. This substantial difference in contribution limits means that a 401(k) offers a greater opportunity to accumulate wealth over time, which is crucial for ensuring a comfortable retirement.

Moreover, the higher contribution limits of a 401(k) allow for more aggressive savings strategies. By maximizing contributions, individuals can take full advantage of the power of compounding interest, which can significantly enhance the growth of retirement funds. This is particularly important in an era where life expectancy is increasing, and individuals need to ensure that their savings will last throughout their retirement years. The ability to contribute more each year provides a buffer against inflation and other economic uncertainties that may erode the purchasing power of retirement savings.

In addition to the contribution limits, another factor that sways my preference towards a 401(k) is the potential for employer matching contributions. Many employers offer to match a portion of employee contributions, effectively providing free money that can further boost retirement savings. This employer match is an invaluable benefit that is not available with an IRA, making the 401(k) an even more attractive option for those looking to maximize their retirement funds. By taking full advantage of employer matching, individuals can significantly increase their savings without additional personal financial strain.

Furthermore, the structure of a 401(k) often includes automatic payroll deductions, which simplifies the savings process and encourages consistent contributions. This automatic feature helps instill a disciplined savings habit, ensuring that retirement contributions are prioritized and not overlooked in the hustle and bustle of daily financial obligations. In contrast, contributing to an IRA requires more proactive management, which can sometimes lead to inconsistent savings patterns.

While it is true that IRAs offer certain advantages, such as a wider range of investment options and potentially lower fees, the higher contribution limits of a 401(k) provide a more substantial foundation for building a robust retirement portfolio. The ability to save more each year, combined with the potential for employer matching, makes the 401(k) an indispensable tool in my retirement planning strategy.

In conclusion, the decision to choose a 401(k) over an IRA for retirement savings is driven by the desire to maximize contributions and take full advantage of employer benefits. The higher contribution limits of a 401(k) offer a significant advantage in building a secure financial future, ensuring that I am well-prepared for the years ahead. By prioritizing a 401(k), I am confident in my ability to achieve my retirement goals and enjoy a financially stable retirement.

Access to Professional Management in a 401(k)

When considering retirement savings options, the choice between a 401(k) and an Individual Retirement Account (IRA) often arises. While both have their merits, one compelling reason to favor a 401(k) is the access to professional management it typically offers. This aspect can significantly influence the growth and security of one’s retirement funds, providing a structured and potentially more lucrative path to financial stability in later years.

To begin with, 401(k) plans are often managed by professional financial advisors or investment firms. These professionals bring a wealth of experience and expertise to the table, which can be invaluable for individuals who may not have the time or knowledge to manage their investments effectively. By leveraging their skills, participants in a 401(k) plan can benefit from strategic asset allocation, risk management, and market analysis, all of which are crucial for optimizing returns and minimizing losses over time.

Moreover, the professional management associated with 401(k) plans often includes regular monitoring and rebalancing of the investment portfolio. This proactive approach ensures that the portfolio remains aligned with the participant’s long-term financial goals and risk tolerance. In contrast, an IRA typically requires the account holder to take a more hands-on approach, which can be daunting for those unfamiliar with investment strategies or market trends. The peace of mind that comes with knowing one’s retirement savings are being actively managed by experts cannot be overstated.

In addition to professional management, 401(k) plans often provide access to a curated selection of investment options. These options are chosen by the plan’s managers to offer a balanced mix of asset classes, such as stocks, bonds, and mutual funds, which can help diversify the portfolio and reduce risk. This curated selection simplifies the decision-making process for participants, allowing them to focus on their retirement goals rather than getting bogged down in the complexities of investment choices. On the other hand, an IRA offers a broader range of investment options, which, while potentially advantageous for seasoned investors, can be overwhelming for those less experienced.

Furthermore, many 401(k) plans offer target-date funds, which are designed to automatically adjust the asset allocation as the participant approaches retirement age. These funds are managed by professionals who gradually shift the investment mix from higher-risk, higher-return assets to more conservative options as the target date nears. This automatic adjustment can be particularly beneficial for individuals who prefer a set-it-and-forget-it approach to retirement savings, as it reduces the need for constant oversight and decision-making.

Another advantage of professional management in a 401(k) is the potential for lower fees compared to managing an IRA independently. While both types of accounts may incur fees, the economies of scale associated with 401(k) plans can lead to reduced costs for participants. This is because plan managers can negotiate lower fees with investment providers due to the larger pool of assets under management. Lower fees mean more of the participant’s money remains invested, which can compound over time and lead to a more substantial retirement nest egg.

In conclusion, while both 401(k) plans and IRAs have their respective benefits, the access to professional management offered by a 401(k) can provide a significant advantage for many individuals. The expertise, strategic oversight, and curated investment options available through a 401(k) can help ensure that one’s retirement savings are managed effectively and efficiently, ultimately leading to greater financial security in retirement.

Loan Options Available in a 401(k)

When considering retirement savings options, the decision between a 401(k) and an Individual Retirement Account (IRA) often hinges on various factors, including contribution limits, tax implications, and investment choices. However, one aspect that frequently tips the scale in favor of a 401(k) is the availability of loan options. While both 401(k) plans and IRAs serve the primary purpose of securing financial stability in retirement, the ability to borrow from a 401(k) can provide a unique financial flexibility that IRAs do not offer.

To begin with, a 401(k) loan allows participants to borrow a portion of their retirement savings, typically up to 50% of their vested account balance or $50,000, whichever is less. This feature can be particularly advantageous in times of financial need, such as unexpected medical expenses, home repairs, or educational costs. Unlike traditional loans, a 401(k) loan does not require a credit check, making it accessible to individuals who might face challenges securing loans through conventional means. Furthermore, the interest paid on a 401(k) loan is credited back to the borrower’s account, essentially allowing individuals to pay interest to themselves rather than to a financial institution.

Moreover, the repayment terms of a 401(k) loan are generally more flexible compared to other loan types. Borrowers typically have up to five years to repay the loan, with the option to extend the term if the loan is used for purchasing a primary residence. This flexibility can ease the financial burden on borrowers, allowing them to manage their cash flow more effectively. Additionally, the repayment process is often streamlined through automatic payroll deductions, reducing the risk of missed payments and potential penalties.

In contrast, IRAs do not offer loan provisions, which can limit their appeal for individuals seeking liquidity options. While it is possible to withdraw funds from an IRA before retirement age, such withdrawals are usually subject to taxes and penalties, unless specific conditions are met. This lack of borrowing capability can make IRAs less attractive for those who anticipate needing access to their funds before retirement.

It is important to note, however, that borrowing from a 401(k) should be approached with caution. While the loan option provides immediate access to funds, it also carries the risk of reducing the overall growth potential of the retirement account. The borrowed amount is temporarily removed from the investment pool, potentially missing out on market gains. Additionally, if a borrower leaves their job, the outstanding loan balance may become due in full, often within a short timeframe, which could lead to financial strain.

Despite these considerations, the loan feature of a 401(k) remains a compelling reason for choosing this retirement savings vehicle over an IRA. It offers a level of financial flexibility that can be invaluable in managing life’s uncertainties. By providing a means to access funds without incurring immediate tax penalties, a 401(k) loan can serve as a financial safety net, allowing individuals to address pressing financial needs while continuing to build their retirement savings. In conclusion, while both 401(k) plans and IRAs have their respective merits, the loan options available in a 401(k) present a distinct advantage for those seeking both long-term savings and short-term financial flexibility.

Simplified Payroll Deductions with a 401(k)

When planning for retirement, choosing the right savings vehicle is crucial. Among the most popular options are the 401(k) and the Individual Retirement Account (IRA). While both have their merits, I have found that the 401(k) offers distinct advantages, particularly when it comes to simplified payroll deductions. This feature not only streamlines the savings process but also enhances the overall efficiency of managing retirement funds.

To begin with, the convenience of payroll deductions in a 401(k) plan cannot be overstated. Contributions are automatically deducted from an employee’s paycheck before taxes, which means that the process is seamless and requires minimal effort on the part of the employee. This automatic deduction ensures that saving for retirement becomes a consistent habit, rather than an occasional decision. In contrast, an IRA requires the individual to actively transfer funds from their bank account to the retirement account, which can be cumbersome and easy to overlook amidst the demands of daily life.

Moreover, the pre-tax nature of 401(k) contributions offers immediate tax benefits. By reducing taxable income, employees can potentially lower their tax bracket, resulting in significant tax savings. This advantage is realized with each paycheck, providing a tangible incentive to contribute regularly. While traditional IRAs also offer tax-deferred growth, the immediate impact on take-home pay is less pronounced, as contributions are made with after-tax dollars and deductions are claimed when filing annual tax returns.

In addition to tax benefits, employer-sponsored 401(k) plans often come with the added advantage of employer matching contributions. This feature can significantly boost retirement savings, as employers typically match a percentage of the employee’s contributions up to a certain limit. This essentially amounts to free money, enhancing the growth potential of the retirement fund. While some employers may offer similar incentives for IRAs, it is far less common, making the 401(k) a more attractive option for those seeking to maximize their savings.

Furthermore, the structure of a 401(k) plan often includes a diverse range of investment options, curated by financial professionals. This allows employees to tailor their investment strategy to align with their risk tolerance and retirement goals. The guidance provided by plan administrators can be invaluable, particularly for those who may not have the expertise or time to manage their investments actively. On the other hand, IRAs typically require individuals to research and select their own investments, which can be daunting and time-consuming.

While both 401(k) plans and IRAs have their respective benefits, the streamlined process of payroll deductions in a 401(k) offers a level of simplicity and efficiency that is hard to match. The automatic nature of contributions, coupled with immediate tax advantages and potential employer matching, makes the 401(k) an appealing choice for many. Additionally, the professional management of investment options within a 401(k) plan provides a level of reassurance and support that can be particularly beneficial for those less familiar with financial markets.

In conclusion, while personal circumstances and financial goals will ultimately dictate the best retirement savings strategy, the simplified payroll deductions and associated benefits of a 401(k) make it a compelling option for those seeking a straightforward and effective way to prepare for their future. By leveraging these advantages, individuals can build a robust retirement fund with minimal hassle, ensuring financial security in their later years.

Potential for Lower Fees in a 401(k)

When planning for retirement, choosing the right savings vehicle is crucial to maximizing your financial security in later years. Among the most popular options are the 401(k) and the Individual Retirement Account (IRA). While both have their merits, one compelling reason to favor a 401(k) over an IRA is the potential for lower fees, which can significantly impact the growth of your retirement savings over time.

To begin with, 401(k) plans often benefit from economies of scale due to the large number of participants involved. Employers typically negotiate with financial service providers to manage these plans, leveraging the collective bargaining power of their workforce to secure lower administrative and management fees. This contrasts with IRAs, where individuals are responsible for setting up and managing their accounts, often resulting in higher fees due to the lack of negotiating power. Consequently, the reduced fees associated with 401(k) plans can lead to substantial savings over the long term, allowing more of your contributions to be invested and grow.

Moreover, many 401(k) plans offer access to institutional-class funds, which are generally not available to individual investors. These funds typically have lower expense ratios compared to retail-class funds found in IRAs. The lower expense ratios mean that a smaller percentage of your investment is consumed by fees, leaving more money in your account to compound over time. This advantage can be particularly beneficial when considering the long-term horizon of retirement savings, where even small differences in fees can lead to significant differences in the final account balance.

In addition to lower fees, 401(k) plans often provide the added benefit of employer matching contributions. While this feature is not directly related to fees, it enhances the overall value of the 401(k) as a retirement savings vehicle. Employer matches can effectively double your contributions up to a certain percentage, accelerating the growth of your retirement savings. This is an advantage that IRAs do not offer, making the 401(k) a more attractive option for many individuals.

Furthermore, the automatic payroll deductions associated with 401(k) plans simplify the savings process, ensuring consistent contributions without the need for manual transfers or additional effort. This convenience can lead to more disciplined saving habits, which are essential for building a robust retirement fund. While IRAs also allow for automatic contributions, the integration with payroll systems in 401(k) plans often makes the process more seamless and less prone to oversight.

It is important to acknowledge that 401(k) plans are not without their drawbacks. For instance, they may offer a more limited selection of investment options compared to IRAs, which can restrict an individual’s ability to tailor their investment strategy. However, for many, the trade-off of potentially lower fees and the benefit of employer matching contributions outweigh these limitations.

In conclusion, while both 401(k) plans and IRAs have their respective advantages, the potential for lower fees in a 401(k) can make it a more appealing choice for retirement savings. By minimizing the impact of fees on your investments, you can maximize the growth of your retirement fund, ensuring greater financial security in your later years. As with any financial decision, it is essential to consider your individual circumstances and consult with a financial advisor to determine the best strategy for your retirement planning needs.

Greater Investment Options in a 401(k)

When planning for retirement, selecting the right investment vehicle is crucial to ensuring financial security in one’s later years. Among the most popular options are the 401(k) and the Individual Retirement Account (IRA). While both have their merits, I have chosen to prioritize a 401(k) for my retirement savings, primarily due to the greater investment options it offers. This decision is not made lightly, as it involves careful consideration of various factors that influence long-term financial growth and stability.

To begin with, a 401(k) plan typically provides a broader range of investment choices compared to an IRA. Employers often offer a selection of mutual funds, including stock funds, bond funds, and target-date funds, which are professionally managed and diversified. This variety allows me to tailor my investment strategy to align with my risk tolerance and retirement goals. In contrast, while IRAs also offer a wide array of investment options, including individual stocks and bonds, the onus of managing these investments falls entirely on the individual. This can be daunting for those who may not have the time or expertise to actively manage their portfolio.

Moreover, the potential for employer matching contributions in a 401(k) plan significantly enhances its appeal. Many employers match a portion of the employee’s contributions, effectively providing free money that can substantially boost retirement savings. This feature is not available with IRAs, making the 401(k) a more attractive option for maximizing investment growth. The additional funds from employer matches can be invested in the diverse options available within the 401(k), further amplifying the benefits of this retirement savings plan.

Additionally, 401(k) plans often come with the advantage of higher contribution limits compared to IRAs. For 2023, the contribution limit for a 401(k) is $22,500, with an additional catch-up contribution of $7,500 for those aged 50 and above. In contrast, the IRA contribution limit is $6,500, with a $1,000 catch-up contribution. The higher limits of a 401(k) allow for more substantial tax-deferred savings, which can lead to a larger retirement nest egg over time. This is particularly beneficial for individuals who are in their peak earning years and wish to maximize their retirement contributions.

Furthermore, 401(k) plans often include access to financial advisors or retirement planning tools provided by the plan administrator. These resources can be invaluable in helping participants make informed decisions about their investment choices and retirement strategies. While some IRAs may offer similar services, they are not as commonly included, potentially leaving IRA holders without the same level of guidance.

In conclusion, while both 401(k) plans and IRAs have their respective advantages, the greater investment options available in a 401(k) make it my preferred choice for retirement savings. The combination of diverse investment choices, employer matching contributions, higher contribution limits, and access to professional guidance creates a compelling case for prioritizing a 401(k). By leveraging these benefits, I am confident in my ability to build a robust and secure financial future, ensuring peace of mind as I approach retirement.

Q&A

1. **Employer Match**: Many employers offer a matching contribution to a 401(k), which is essentially free money added to your retirement savings, making it a compelling choice over an IRA.

2. **Higher Contribution Limits**: A 401(k) typically has higher annual contribution limits compared to an IRA, allowing you to save more money each year for retirement.

3. **Convenience and Automation**: Contributions to a 401(k) are often automatically deducted from your paycheck, making it easier to consistently save without having to manually transfer funds.

4. **Loan Options**: Some 401(k) plans offer the ability to take out a loan against your balance, providing a potential source of funds in emergencies, which IRAs do not offer.

5. **No Income Limits for Contributions**: Unlike IRAs, 401(k) plans do not have income limits for making contributions, allowing high earners to continue saving in a tax-advantaged account.

6. **Potential for Lower Fees**: Large 401(k) plans may offer institutional investment options with lower fees compared to retail investment options typically available in IRAs.

7. **Access to Professional Management**: Many 401(k) plans offer access to professional investment management and advice, which can be beneficial for those who prefer guidance in managing their retirement savings.

Conclusion

Choosing a 401(k) over an IRA for retirement savings can be advantageous due to several key factors. Firstly, 401(k) plans often come with higher contribution limits compared to IRAs, allowing for more substantial retirement savings each year. Additionally, many employers offer matching contributions to 401(k) plans, effectively providing free money that can significantly boost retirement savings. 401(k) plans also offer the convenience of automatic payroll deductions, making it easier to consistently save for retirement. Furthermore, 401(k) plans may offer a wider range of investment options and professional management, which can be beneficial for those who prefer a more hands-off approach to investing. While IRAs offer certain benefits, such as potentially more investment choices and flexibility, the combination of higher contribution limits, employer matching, and ease of use often makes 401(k) plans a more attractive option for many individuals seeking to maximize their retirement savings.