“Unlock the Secrets: Discover Where Millionaires Safeguard Their Wealth!”

Introduction

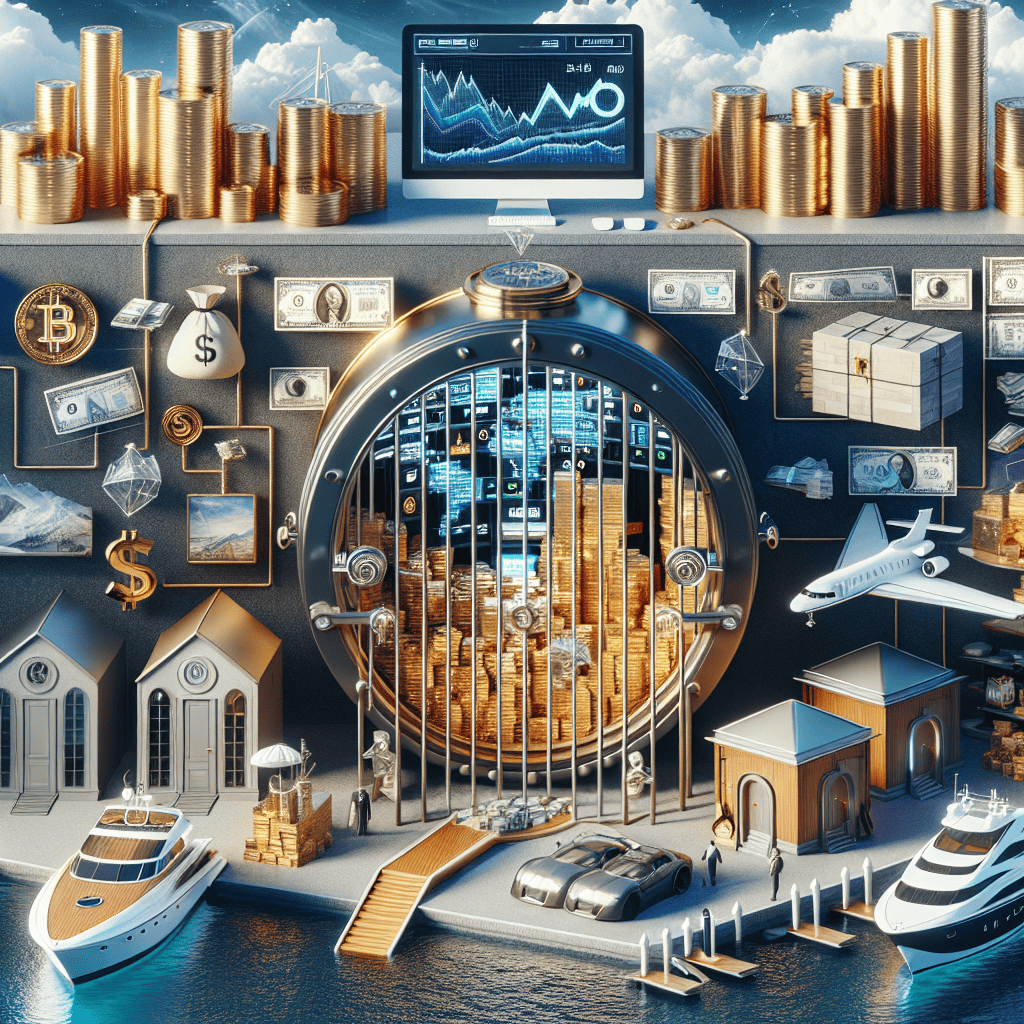

Millionaires often employ a diverse range of strategies to store and grow their wealth, balancing risk and return while ensuring liquidity and security. A significant portion of their wealth is typically invested in financial markets, including stocks, bonds, and mutual funds, which offer the potential for substantial returns. Real estate is another popular asset class, providing both income through rentals and long-term appreciation. Additionally, many millionaires allocate funds to private equity and venture capital, seeking high returns from emerging businesses. To preserve wealth, they may also invest in tangible assets like gold, art, and collectibles. Offshore accounts and trusts are sometimes used for tax optimization and estate planning. By diversifying their portfolios across various asset classes and geographies, millionaires aim to protect their wealth from market volatility and economic downturns while capitalizing on growth opportunities.

Real Estate Investments

In the realm of wealth management, real estate investments have long been a favored avenue for millionaires seeking to preserve and grow their wealth. This preference is not without reason, as real estate offers a unique combination of stability, potential for appreciation, and income generation. As we delve into the intricacies of why millionaires gravitate towards real estate, it becomes evident that this asset class provides a multifaceted approach to wealth storage and growth.

To begin with, real estate is often perceived as a tangible asset, offering a sense of security that is not always present in more volatile investment vehicles such as stocks or cryptocurrencies. The physical nature of real estate means that it is less susceptible to the whims of market fluctuations, providing a stable foundation for wealth preservation. Moreover, real estate has historically shown a tendency to appreciate over time, making it an attractive option for those looking to increase their net worth. This appreciation is often driven by factors such as population growth, urbanization, and economic development, which can lead to increased demand for property and, consequently, higher property values.

In addition to its potential for appreciation, real estate also offers the opportunity for income generation through rental properties. Millionaires often invest in residential or commercial properties that can be leased to tenants, providing a steady stream of passive income. This income can be particularly appealing as it offers a degree of financial independence and can be reinvested to further grow one’s wealth. Furthermore, rental income can serve as a hedge against inflation, as rental rates tend to increase over time, thereby preserving the purchasing power of the income generated.

Another compelling reason why millionaires invest in real estate is the tax advantages it offers. Real estate investors can benefit from various tax deductions, such as mortgage interest, property taxes, and depreciation. These deductions can significantly reduce the overall tax burden, allowing investors to retain more of their earnings. Additionally, the use of strategies such as 1031 exchanges enables investors to defer capital gains taxes when selling a property and reinvesting the proceeds into another property, further enhancing the tax efficiency of real estate investments.

Moreover, real estate provides an opportunity for diversification within an investment portfolio. By allocating a portion of their wealth to real estate, millionaires can reduce their exposure to the volatility of the stock market and other financial instruments. This diversification can help mitigate risk and ensure a more balanced approach to wealth management. Furthermore, real estate investments can be tailored to suit individual preferences and risk tolerances, with options ranging from residential properties to commercial real estate and even real estate investment trusts (REITs).

In conclusion, the allure of real estate investments for millionaires lies in their ability to offer a stable, appreciating, and income-generating asset class that is complemented by tax advantages and diversification benefits. As millionaires continue to seek ways to preserve and grow their wealth, real estate remains a cornerstone of their investment strategies. By understanding the multifaceted benefits of real estate, investors can make informed decisions that align with their financial goals and aspirations. As such, real estate will likely continue to be a preferred choice for wealth storage among the affluent, providing a reliable and rewarding avenue for long-term financial success.

Stock Market Portfolios

In the realm of wealth management, the stock market has long been a favored avenue for millionaires seeking to store and grow their wealth. This preference is not without reason, as the stock market offers a dynamic platform for investment, characterized by its potential for high returns and diversification. Millionaires, with their substantial financial resources, are uniquely positioned to leverage the stock market’s opportunities, employing sophisticated strategies to maximize their portfolios’ performance.

To begin with, millionaires often allocate a significant portion of their wealth to equities, recognizing the stock market’s historical ability to outpace inflation and generate substantial returns over the long term. This approach is underpinned by a deep understanding of market dynamics and a willingness to embrace calculated risks. By investing in a diverse array of stocks, ranging from blue-chip companies to emerging market opportunities, millionaires can mitigate risks while capitalizing on growth prospects across different sectors and geographies.

Moreover, millionaires frequently engage in active portfolio management, either personally or through professional advisors. This involves continuously monitoring market trends, economic indicators, and company performance to make informed investment decisions. By staying attuned to market fluctuations and adjusting their portfolios accordingly, millionaires can optimize their asset allocation, ensuring that their investments align with their financial goals and risk tolerance.

In addition to traditional stock investments, millionaires often explore alternative investment vehicles within the stock market, such as exchange-traded funds (ETFs) and mutual funds. These instruments offer diversification benefits and professional management, allowing investors to gain exposure to a broad range of assets without the need for direct stock selection. By incorporating these vehicles into their portfolios, millionaires can achieve a balanced mix of growth and stability, further enhancing their wealth preservation strategies.

Furthermore, millionaires are increasingly turning to technology-driven investment platforms and tools to enhance their stock market portfolios. The advent of algorithmic trading, robo-advisors, and data analytics has revolutionized the way investors approach the stock market. By leveraging these technologies, millionaires can access real-time market insights, execute trades with precision, and optimize their investment strategies with greater efficiency. This technological edge enables them to stay ahead of market trends and capitalize on emerging opportunities, thereby enhancing their overall portfolio performance.

It is also worth noting that millionaires often adopt a long-term investment horizon when it comes to their stock market portfolios. This patient approach allows them to weather short-term market volatility and capitalize on the compounding effect of returns over time. By maintaining a disciplined investment strategy and resisting the temptation to react impulsively to market fluctuations, millionaires can achieve sustainable wealth growth and preservation.

In conclusion, the stock market serves as a vital component of millionaires’ wealth storage strategies, offering a platform for growth, diversification, and innovation. Through a combination of strategic asset allocation, active portfolio management, and technological advancements, millionaires are able to navigate the complexities of the stock market and secure their financial futures. As the financial landscape continues to evolve, the stock market remains a cornerstone of wealth management for those with the means and acumen to harness its potential.

Private Equity Funds

Private equity funds have long been a favored investment vehicle for millionaires seeking to store and grow their wealth. These funds, which pool capital from high-net-worth individuals and institutional investors, are managed by professional investment firms that aim to generate substantial returns by investing in private companies or by acquiring stakes in public companies with the intent of taking them private. The allure of private equity lies in its potential for high returns, diversification benefits, and the opportunity to invest in companies that are not accessible through public markets.

One of the primary reasons millionaires are drawn to private equity funds is the potential for outsized returns. Unlike traditional investments in stocks and bonds, private equity investments are typically long-term and involve active management strategies. This hands-on approach allows private equity managers to implement operational improvements, strategic realignments, and financial restructuring within the companies they invest in, thereby enhancing their value. As a result, private equity funds have historically delivered higher returns compared to public equity markets, albeit with higher risk and less liquidity.

Moreover, private equity funds offer diversification benefits that are particularly appealing to wealthy investors. By investing in a range of companies across different industries and geographies, these funds can reduce the overall risk of an investment portfolio. This diversification is crucial for millionaires who seek to preserve their wealth while still achieving growth. Additionally, private equity investments are less correlated with public markets, providing a hedge against market volatility and economic downturns.

Another factor contributing to the popularity of private equity among millionaires is the access to exclusive investment opportunities. Private equity funds often invest in companies that are not available to the general public, allowing investors to participate in unique growth stories and innovative business models. This exclusivity is attractive to high-net-worth individuals who are looking for ways to differentiate their investment portfolios and capitalize on emerging trends.

Furthermore, private equity funds provide a level of control and influence that is not typically available in public market investments. Investors in private equity funds often have the opportunity to engage with management teams, participate in strategic decision-making, and contribute to the overall direction of the companies in which they invest. This active involvement can be particularly appealing to millionaires who have a background in business and wish to leverage their expertise to drive value creation.

However, it is important to note that investing in private equity funds is not without its challenges. These investments are generally illiquid, with capital typically locked up for several years until the fund exits its investments. This lack of liquidity can be a drawback for investors who may need access to their capital in the short term. Additionally, private equity investments carry a higher level of risk, as the success of these investments is heavily dependent on the skill and expertise of the fund managers.

In conclusion, private equity funds represent a compelling option for millionaires seeking to store and grow their wealth. The potential for high returns, diversification benefits, access to exclusive opportunities, and the ability to exert influence over investments make private equity an attractive choice for high-net-worth individuals. However, the illiquid nature and inherent risks of these investments necessitate careful consideration and due diligence. As such, millionaires often rely on experienced advisors and investment professionals to navigate the complexities of private equity and ensure that their wealth is managed effectively.

Offshore Bank Accounts

Offshore bank accounts have long been a subject of intrigue and speculation, often associated with the wealthy elite and their financial strategies. These accounts, located outside the account holder’s country of residence, offer a range of benefits that attract millionaires seeking to store and manage their wealth. Understanding the allure of offshore banking requires an exploration of the advantages it provides, as well as the legal and ethical considerations involved.

One of the primary reasons millionaires opt for offshore bank accounts is the potential for enhanced privacy and confidentiality. Many offshore jurisdictions have stringent privacy laws that protect account holders’ identities and financial information. This level of discretion is particularly appealing to high-net-worth individuals who wish to shield their wealth from public scrutiny or potential threats. By maintaining a low profile, they can safeguard their assets from potential legal disputes, political instability, or even personal security risks.

In addition to privacy, offshore bank accounts offer significant tax advantages. Certain jurisdictions, often referred to as tax havens, impose little to no taxes on income, capital gains, or inheritance. This favorable tax environment allows millionaires to legally minimize their tax liabilities, thereby preserving more of their wealth. However, it is crucial to note that while offshore accounts can provide tax benefits, they must be used in compliance with international tax laws and regulations. Failure to do so can result in severe penalties and legal repercussions.

Moreover, offshore banking provides diversification opportunities that are not always available domestically. By holding assets in multiple currencies and jurisdictions, millionaires can mitigate risks associated with economic fluctuations or political instability in their home countries. This diversification strategy not only protects their wealth but also offers potential for higher returns on investment. Offshore accounts often provide access to a broader range of financial products and services, including international investment opportunities that may not be available in the account holder’s home country.

Furthermore, the global nature of offshore banking facilitates ease of access to funds and financial services. Millionaires with international business interests or those who frequently travel benefit from the ability to manage their finances across borders seamlessly. Offshore banks often offer sophisticated online banking platforms and personalized services tailored to the needs of high-net-worth clients, ensuring that they can efficiently manage their wealth from anywhere in the world.

However, it is essential to address the ethical considerations surrounding offshore bank accounts. While they offer legitimate benefits, these accounts have also been associated with illicit activities such as money laundering and tax evasion. Consequently, international efforts to combat financial crimes have led to increased scrutiny and regulation of offshore banking. Transparency initiatives, such as the Common Reporting Standard (CRS) developed by the Organisation for Economic Co-operation and Development (OECD), aim to ensure that offshore accounts are used responsibly and in compliance with global tax laws.

In conclusion, offshore bank accounts serve as a strategic tool for millionaires seeking to store and manage their wealth. The benefits of privacy, tax advantages, diversification, and global accessibility make them an attractive option for high-net-worth individuals. However, it is imperative that these accounts are used ethically and in accordance with international regulations to avoid legal complications. As the global financial landscape continues to evolve, the role of offshore banking in wealth management remains a topic of significant interest and debate.

Art And Collectibles

In the realm of wealth management, millionaires often seek diverse avenues to store and grow their wealth, with art and collectibles emerging as a prominent choice. This trend is not merely a reflection of personal taste or aesthetic appreciation but is also driven by strategic financial considerations. Art and collectibles offer a unique blend of tangible and intangible benefits, making them an attractive option for affluent individuals looking to diversify their portfolios.

To begin with, art and collectibles serve as a hedge against inflation and economic volatility. Unlike traditional financial assets such as stocks and bonds, which are susceptible to market fluctuations, art pieces and rare collectibles often retain or even increase in value over time. This is particularly true for works by renowned artists or items with historical significance, which tend to appreciate as they become scarcer. Consequently, millionaires view these assets as a stable store of value, providing a sense of security in uncertain economic climates.

Moreover, the art market has demonstrated impressive growth over the past few decades, further enticing wealthy investors. Auction houses and galleries have reported record-breaking sales, with some artworks fetching prices in the tens of millions. This upward trajectory is fueled by a growing global demand for art, driven by emerging markets and an increasing number of high-net-worth individuals. As a result, art and collectibles have become a lucrative investment opportunity, offering the potential for substantial returns.

In addition to financial benefits, art and collectibles offer a level of prestige and cultural capital that other asset classes cannot match. Owning a masterpiece or a rare artifact not only enhances one’s social status but also provides access to exclusive networks and events. For many millionaires, the ability to showcase their collections in private exhibitions or lend them to museums is a source of pride and recognition. This cultural cachet adds an intangible value to their investments, further solidifying their appeal.

Furthermore, the art and collectibles market is characterized by its diversity, offering a wide range of options to suit different tastes and investment strategies. From contemporary paintings and sculptures to vintage cars and rare coins, the possibilities are virtually endless. This variety allows millionaires to tailor their collections to their personal interests while also aligning with their financial goals. Additionally, the market’s global nature provides opportunities for geographical diversification, enabling investors to tap into different cultural and economic landscapes.

However, investing in art and collectibles is not without its challenges. The market is notoriously opaque, with prices often determined by subjective factors such as provenance, condition, and market trends. As a result, it requires a high level of expertise and due diligence to navigate successfully. Many millionaires enlist the help of art advisors and specialists to guide their acquisitions and ensure they are making informed decisions. Furthermore, the costs associated with maintaining and insuring these assets can be significant, necessitating careful financial planning.

In conclusion, art and collectibles represent a compelling option for millionaires seeking to store and grow their wealth. By offering a combination of financial stability, cultural prestige, and diverse investment opportunities, these assets have carved out a unique niche in the world of wealth management. While challenges exist, the potential rewards make art and collectibles an enduringly attractive choice for the affluent, underscoring their importance in the broader landscape of asset diversification.

Cryptocurrency Holdings

In recent years, the financial landscape has undergone a significant transformation, with cryptocurrencies emerging as a prominent asset class. As digital currencies gain traction, an increasing number of millionaires are turning to cryptocurrencies as a means of storing and growing their wealth. This shift is driven by several factors, including the potential for high returns, the desire for diversification, and the appeal of decentralized finance. Understanding why millionaires are gravitating towards cryptocurrency holdings requires an exploration of these underlying motivations and the unique characteristics of digital assets.

To begin with, the potential for substantial returns is a primary factor attracting millionaires to cryptocurrencies. Unlike traditional investments, such as stocks and bonds, cryptocurrencies have demonstrated the ability to yield exponential gains over relatively short periods. Bitcoin, for instance, has experienced remarkable growth since its inception, transforming early adopters into millionaires. This potential for high returns is particularly appealing to wealthy individuals who are willing to take calculated risks in pursuit of significant financial rewards. Consequently, many millionaires allocate a portion of their portfolios to cryptocurrencies, hoping to capitalize on the volatility and upward momentum of the market.

Moreover, diversification is another compelling reason why millionaires are investing in cryptocurrencies. In an era of economic uncertainty and fluctuating markets, diversification serves as a crucial strategy for preserving wealth. By incorporating digital assets into their investment portfolios, millionaires can mitigate risks associated with traditional financial instruments. Cryptocurrencies, with their low correlation to conventional asset classes, offer a unique opportunity for diversification. This allows wealthy individuals to spread their investments across a broader spectrum, reducing the impact of market downturns on their overall wealth.

In addition to potential returns and diversification, the appeal of decentralized finance cannot be overlooked. Cryptocurrencies operate on blockchain technology, which enables peer-to-peer transactions without the need for intermediaries such as banks. This decentralization offers a level of financial autonomy and privacy that is particularly attractive to millionaires. By holding wealth in cryptocurrencies, individuals can maintain greater control over their assets, free from the constraints and fees imposed by traditional financial institutions. Furthermore, the global nature of cryptocurrencies allows for seamless cross-border transactions, providing millionaires with the flexibility to move their wealth across jurisdictions with ease.

However, it is important to acknowledge the inherent risks associated with cryptocurrency holdings. The market is characterized by high volatility, regulatory uncertainties, and the potential for security breaches. Millionaires, therefore, must exercise caution and conduct thorough due diligence before investing in digital assets. Many choose to work with financial advisors who specialize in cryptocurrencies to navigate this complex landscape effectively. Additionally, employing secure storage solutions, such as hardware wallets, is essential to safeguarding their digital wealth from cyber threats.

In conclusion, the allure of cryptocurrencies as a means of storing wealth is undeniable for many millionaires. The potential for high returns, coupled with the benefits of diversification and decentralized finance, makes digital assets an attractive addition to their investment portfolios. Nevertheless, the volatile nature of the cryptocurrency market necessitates a careful and informed approach. As the financial world continues to evolve, it is likely that cryptocurrencies will play an increasingly significant role in the wealth management strategies of millionaires, shaping the future of finance in unprecedented ways.

Luxury Assets And Commodities

In the realm of wealth management, millionaires often seek to diversify their portfolios beyond traditional financial instruments such as stocks and bonds. This diversification strategy frequently leads them to invest in luxury assets and commodities, which not only serve as a hedge against market volatility but also offer the potential for significant appreciation over time. As we delve into the world of luxury assets, it becomes evident that these investments are not merely about financial gain but also about personal passion and prestige.

One of the most popular categories of luxury assets is fine art. Art collections have long been a symbol of wealth and sophistication, with masterpieces by renowned artists fetching astronomical prices at auctions. The allure of art lies in its dual nature as both a tangible asset and a cultural treasure. Moreover, the art market has shown resilience in times of economic uncertainty, making it an attractive option for those looking to preserve their wealth. However, investing in art requires a keen eye and an understanding of market trends, as the value of art can be highly subjective and influenced by factors such as provenance and historical significance.

In addition to art, classic cars have emerged as a favored investment among millionaires. These vehicles are not only admired for their aesthetic appeal and engineering excellence but also for their potential to appreciate in value. The classic car market has seen remarkable growth, driven by a limited supply of vintage models and an increasing demand from collectors worldwide. Owning a classic car is often seen as a status symbol, and for many, it represents a passion that transcends mere financial considerations. However, it is essential to note that maintaining and storing these vehicles can be costly, and their value can fluctuate based on market trends and the condition of the car.

Another avenue for wealth storage is in the form of precious metals, such as gold and silver. These commodities have been considered safe havens for centuries, particularly during periods of economic instability. Gold, in particular, is prized for its ability to retain value over time and its role as a hedge against inflation. While the prices of precious metals can be volatile in the short term, they have historically provided a stable store of value in the long run. For millionaires, investing in gold and silver can offer a sense of security and diversification, complementing their broader investment strategies.

Luxury real estate also plays a significant role in the portfolios of the wealthy. High-end properties in prime locations are not only seen as valuable assets but also as lifestyle choices that reflect personal taste and status. The appeal of luxury real estate lies in its potential for capital appreciation and rental income, as well as the prestige associated with owning exclusive properties. However, the real estate market can be subject to fluctuations, and factors such as location, economic conditions, and geopolitical events can impact property values.

In conclusion, millionaires often turn to luxury assets and commodities as a means of storing and growing their wealth. These investments offer a unique blend of financial potential, personal enjoyment, and social status. While they come with their own set of risks and challenges, the allure of owning tangible assets that can appreciate over time continues to captivate the affluent. As such, luxury assets and commodities remain an integral part of wealth management strategies for those seeking to preserve and enhance their fortunes.

Q&A

1. **Real Estate**: Many millionaires invest in residential, commercial, and rental properties to diversify their portfolios and generate passive income.

2. **Stocks and Bonds**: A significant portion of millionaire wealth is often held in the stock market, including individual stocks, mutual funds, and exchange-traded funds (ETFs), as well as in bonds for more stable returns.

3. **Private Equity and Venture Capital**: Millionaires often invest in private companies or startups, seeking higher returns through private equity and venture capital investments.

4. **Business Ownership**: Many millionaires own businesses, either as entrepreneurs or through investments in existing companies, which can provide substantial income and growth potential.

5. **Commodities and Precious Metals**: Investments in commodities like gold, silver, and other precious metals are common for wealth preservation and as a hedge against inflation.

6. **Art and Collectibles**: High-net-worth individuals often invest in art, antiques, and other collectibles, which can appreciate over time and provide cultural value.

7. **Cash and Cash Equivalents**: Millionaires maintain a portion of their wealth in cash or cash equivalents, such as savings accounts, money market funds, and short-term government securities, for liquidity and security.

Conclusion

Millionaires typically store their wealth in a diversified portfolio to manage risk and maximize returns. This often includes a mix of assets such as stocks, bonds, real estate, private equity, and alternative investments like hedge funds or commodities. They may also hold cash or cash equivalents for liquidity and to take advantage of investment opportunities. Additionally, millionaires often use trusts and other estate planning tools to protect and transfer wealth efficiently. This diversified approach helps them preserve and grow their wealth over time while mitigating potential losses.