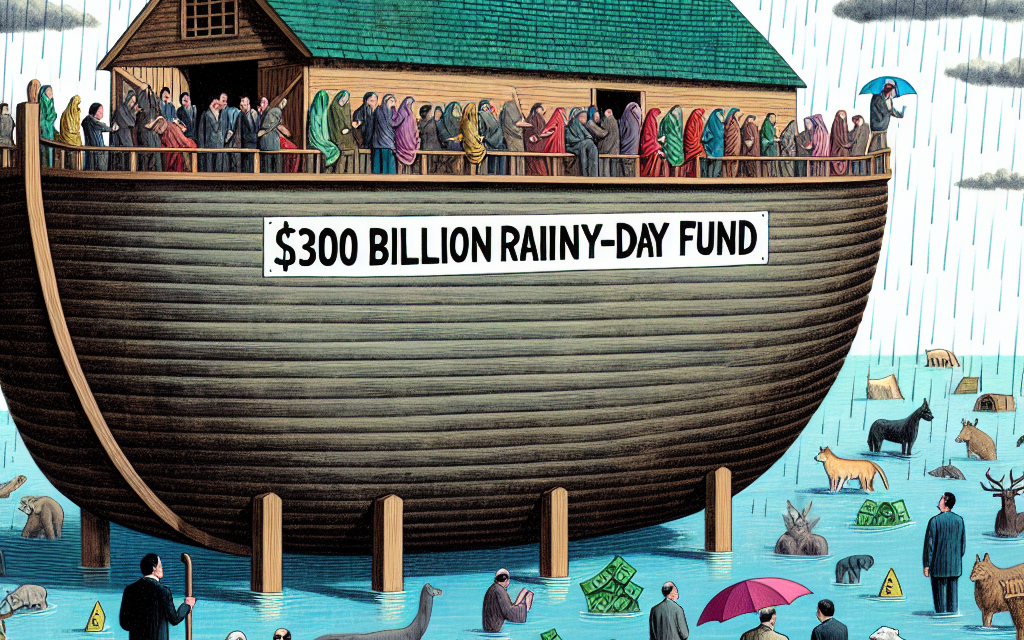

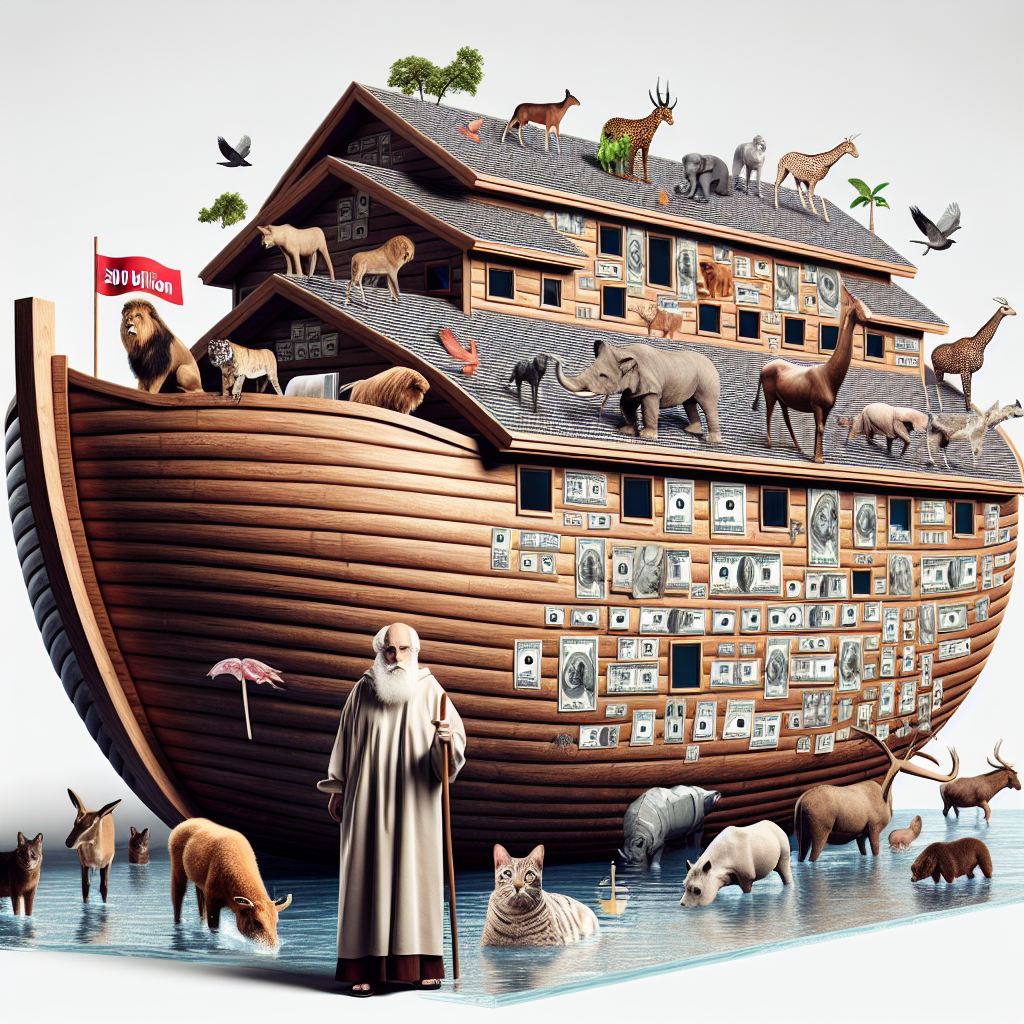

“Safeguarding Wealth: Warren Buffett’s $300 Billion Rainy-Day Fund – The Modern Noah’s Ark of Finance.”

Introduction

Warren Buffett’s $300 Billion Rainy-Day Fund, often likened to a modern Noah’s Ark, represents a strategic financial reserve designed to weather economic storms and seize opportunities in turbulent markets. This substantial cash hoard, amassed by Buffett’s Berkshire Hathaway, underscores his investment philosophy of patience, prudence, and preparedness. By maintaining such a significant cash reserve, Buffett ensures the ability to act decisively when market conditions are favorable, allowing for acquisitions and investments at opportune moments. This approach not only safeguards Berkshire Hathaway against unforeseen economic downturns but also positions it to capitalize on market dislocations, embodying Buffett’s long-standing belief in the power of liquidity and strategic foresight.

Understanding Warren Buffett’s Investment Philosophy: The Foundation of the $300 Billion Rainy-Day Fund

Warren Buffett, often hailed as one of the most successful investors of all time, has long been a subject of fascination for financial analysts and enthusiasts alike. His investment philosophy, characterized by patience, prudence, and a keen eye for value, has been instrumental in building Berkshire Hathaway into a financial powerhouse. Central to this philosophy is the concept of a “rainy-day fund,” a substantial cash reserve that Buffett has meticulously maintained over the years. This fund, which has now swelled to an impressive $300 billion, serves as a modern-day Noah’s Ark, safeguarding Berkshire Hathaway against economic downturns and providing the flexibility to seize opportunities when they arise.

To understand the foundation of this formidable rainy-day fund, one must first appreciate Buffett’s adherence to value investing principles. Inspired by his mentor Benjamin Graham, Buffett has consistently sought to invest in companies that are undervalued relative to their intrinsic worth. This approach requires a deep understanding of a company’s fundamentals, including its earnings potential, competitive advantages, and management quality. By focusing on long-term value rather than short-term market fluctuations, Buffett has been able to identify investment opportunities that others might overlook.

Moreover, Buffett’s investment philosophy emphasizes the importance of financial discipline and risk management. He is known for his aversion to excessive debt and his preference for maintaining a strong balance sheet. This conservative approach ensures that Berkshire Hathaway remains resilient in the face of economic uncertainty. The $300 billion rainy-day fund is a testament to this philosophy, providing a buffer against unforeseen challenges and enabling the company to weather financial storms without compromising its core operations.

In addition to serving as a protective measure, the rainy-day fund also positions Berkshire Hathaway to capitalize on market dislocations. During periods of economic turmoil, when asset prices are depressed and liquidity is scarce, Buffett’s cash reserves allow him to act decisively. This was evident during the 2008 financial crisis when Berkshire Hathaway made several high-profile investments in distressed companies, reaping substantial rewards as the economy recovered. By maintaining a substantial cash reserve, Buffett ensures that he is never forced to sell assets at unfavorable prices, thereby preserving the long-term value of his investments.

Furthermore, Buffett’s commitment to a rainy-day fund reflects his broader investment philosophy of patience and long-term thinking. Unlike many investors who are swayed by short-term market trends, Buffett remains focused on the enduring value of his holdings. This patient approach allows him to ride out market volatility and avoid the pitfalls of reactive decision-making. The $300 billion fund is not merely a financial safeguard; it is a strategic asset that aligns with Buffett’s vision of sustainable, long-term growth.

In conclusion, Warren Buffett’s $300 billion rainy-day fund is a cornerstone of his investment philosophy, embodying the principles of value investing, financial discipline, and long-term thinking. By maintaining this substantial cash reserve, Buffett not only protects Berkshire Hathaway from economic uncertainties but also positions the company to seize opportunities in times of market distress. As a modern-day Noah’s Ark, the fund exemplifies Buffett’s unwavering commitment to prudent risk management and his belief in the enduring power of patience and foresight in the world of investing.

The Role of Cash Reserves in Berkshire Hathaway’s Strategy: Lessons from the Modern Noah’s Ark

Warren Buffett, often hailed as one of the most astute investors of our time, has long been a proponent of maintaining substantial cash reserves. His investment conglomerate, Berkshire Hathaway, is renowned for its impressive portfolio, yet it is the company’s significant cash reserves that have garnered considerable attention. With a cash pile that has recently approached $300 billion, Buffett’s strategy has been likened to a modern-day Noah’s Ark, prepared to weather any financial storm. This approach underscores the critical role that cash reserves play in Berkshire Hathaway’s overarching strategy, offering valuable lessons for investors and businesses alike.

To understand the rationale behind such a substantial cash reserve, one must first appreciate Buffett’s investment philosophy. At its core, this philosophy emphasizes patience, discipline, and the ability to capitalize on opportunities when they arise. Cash reserves provide the flexibility to act decisively in times of market turbulence, allowing Berkshire Hathaway to acquire undervalued assets or invest in promising ventures when others may be constrained by financial limitations. This strategic liquidity is akin to a safety net, ensuring that the company can navigate economic downturns without being forced into unfavorable decisions.

Moreover, cash reserves serve as a buffer against uncertainty, a concept that has become increasingly relevant in today’s volatile economic landscape. The global economy is subject to a myriad of unpredictable factors, from geopolitical tensions to technological disruptions. In such an environment, having a substantial cash reserve is not merely a defensive measure but a proactive strategy that positions Berkshire Hathaway to thrive amidst uncertainty. This approach reflects Buffett’s belief in the importance of being prepared for unforeseen challenges, much like Noah’s Ark was built to withstand the deluge.

In addition to providing a cushion against economic fluctuations, cash reserves also afford Berkshire Hathaway the ability to maintain its independence. Unlike companies that rely heavily on debt financing, Berkshire’s robust cash position allows it to operate without the constraints imposed by creditors. This financial autonomy is a cornerstone of Buffett’s strategy, enabling the company to pursue long-term growth without succumbing to short-term pressures. It also allows Berkshire to take advantage of unique investment opportunities that may require swift action, further reinforcing the value of maintaining a substantial cash reserve.

Furthermore, the presence of significant cash reserves can instill confidence among investors and stakeholders. It signals financial stability and prudent management, qualities that are highly valued in the investment community. By demonstrating a commitment to maintaining a strong cash position, Berkshire Hathaway reassures its shareholders that the company is well-equipped to navigate future challenges and capitalize on opportunities as they arise.

In conclusion, Warren Buffett’s $300 billion rainy-day fund serves as a testament to the enduring importance of cash reserves in a comprehensive investment strategy. By prioritizing liquidity and financial independence, Berkshire Hathaway is not only prepared to weather economic storms but is also poised to seize opportunities that others may overlook. This modern-day Noah’s Ark exemplifies the wisdom of maintaining a robust cash reserve, offering a timeless lesson for investors and businesses seeking to navigate the complexities of the financial world. As economic uncertainties continue to loom, the role of cash reserves in ensuring stability and enabling strategic growth remains as relevant as ever.

How Warren Buffett’s Rainy-Day Fund Prepares for Economic Downturns

Warren Buffett, often hailed as one of the most astute investors of our time, has long been a beacon of financial wisdom. His investment strategies and philosophies have been dissected and emulated by countless individuals and institutions. Among his many financial maneuvers, one of the most intriguing is his creation of a substantial rainy-day fund, which has now amassed a staggering $300 billion. This fund, often likened to a modern Noah’s Ark, is designed to weather economic downturns and ensure the stability of his conglomerate, Berkshire Hathaway.

The concept of a rainy-day fund is not new; it is a fundamental principle of financial planning. However, Buffett’s approach to this concept is on a scale that few can comprehend. His strategy is rooted in the belief that economic downturns are inevitable, and preparation is paramount. By maintaining a significant cash reserve, Buffett ensures that Berkshire Hathaway is not only protected during financial storms but also positioned to seize opportunities that arise in such times. This foresight allows the company to acquire undervalued assets and businesses when others are forced to sell, thereby strengthening its portfolio.

Transitioning from the theoretical to the practical, Buffett’s rainy-day fund serves multiple purposes. Firstly, it acts as a buffer against unforeseen economic challenges. In times of recession or market volatility, having a substantial cash reserve allows Berkshire Hathaway to maintain its operations without the need for drastic measures such as layoffs or asset liquidation. This stability is crucial for maintaining investor confidence and ensuring the long-term health of the company.

Moreover, the fund provides a strategic advantage in the competitive landscape. During economic downturns, many companies face liquidity issues, leading to distressed sales and undervalued assets. Buffett’s cash reserve enables him to act swiftly and decisively, acquiring valuable assets at a fraction of their intrinsic value. This opportunistic approach not only enhances Berkshire Hathaway’s asset base but also positions it for accelerated growth when the economy rebounds.

Furthermore, Buffett’s rainy-day fund underscores his commitment to prudent financial management. By prioritizing liquidity and maintaining a conservative approach to debt, he ensures that Berkshire Hathaway remains resilient in the face of economic uncertainty. This conservative financial posture is a hallmark of Buffett’s investment philosophy, emphasizing the importance of capital preservation and risk management.

In addition to its practical benefits, the rainy-day fund also reflects Buffett’s long-term vision. He understands that economic cycles are a natural part of the financial landscape, and preparation is key to navigating these cycles successfully. By maintaining a robust cash reserve, Buffett not only safeguards Berkshire Hathaway’s future but also reinforces his reputation as a prudent and forward-thinking investor.

In conclusion, Warren Buffett’s $300 billion rainy-day fund is a testament to his unparalleled financial acumen and strategic foresight. By preparing for economic downturns with such a substantial reserve, he ensures that Berkshire Hathaway remains resilient and opportunistic in the face of adversity. This modern Noah’s Ark is not just a safeguard against financial storms but a powerful tool for capitalizing on opportunities that arise in their wake. Through this approach, Buffett continues to exemplify the principles of sound financial management and long-term investment success.

The Impact of Warren Buffett’s Cash Hoard on the Stock Market and Economy

Warren Buffett, often hailed as one of the most astute investors of our time, has long been known for his cautious yet strategic approach to investing. His company, Berkshire Hathaway, has amassed a staggering $300 billion in cash reserves, a sum that has drawn significant attention from financial analysts and investors alike. This enormous cash hoard, often likened to a modern-day Noah’s Ark, serves as a buffer against economic downturns and market volatility. However, its impact on the stock market and the broader economy is multifaceted and warrants a closer examination.

To begin with, the sheer size of Buffett’s cash reserve has a stabilizing effect on the stock market. In times of economic uncertainty or market turbulence, the presence of such a substantial cash reserve can act as a confidence booster for investors. Knowing that a seasoned investor like Buffett is prepared to deploy capital when opportunities arise can reassure market participants, potentially mitigating panic selling and excessive volatility. This stabilizing influence is particularly crucial during periods of economic downturns, when investor sentiment tends to be fragile.

Moreover, Buffett’s cash hoard provides him with unparalleled flexibility to seize investment opportunities as they arise. In a market characterized by rapid fluctuations and unpredictable shifts, having a significant cash reserve allows Berkshire Hathaway to act swiftly and decisively. This ability to capitalize on undervalued assets or distressed companies during market downturns not only enhances Berkshire’s portfolio but also injects liquidity into the market. Consequently, this can lead to a ripple effect, encouraging other investors to follow suit and invest in undervalued assets, thereby contributing to market recovery.

However, the impact of Buffett’s cash reserve is not solely confined to the stock market. It also has broader implications for the economy. By holding such a large sum in reserve, Buffett effectively removes a significant amount of capital from active circulation. While this conservative approach is prudent from a risk management perspective, it also means that a substantial portion of potential investment capital is not being utilized to stimulate economic growth. In an economy that thrives on investment and consumption, the withholding of such a large sum can have a dampening effect on economic expansion.

Furthermore, Buffett’s cash hoard can influence corporate behavior. Companies may perceive the presence of such a significant reserve as a signal to adopt more conservative financial strategies, such as increasing their own cash reserves or reducing debt. While this can lead to greater financial stability for individual companies, it may also result in reduced capital expenditure and innovation, potentially slowing down economic growth in the long term.

In conclusion, Warren Buffett’s $300 billion cash reserve serves as a modern-day Noah’s Ark, providing a safeguard against economic storms and market volatility. Its impact on the stock market is largely positive, offering stability and liquidity during turbulent times. However, the broader economic implications are more nuanced, as the withholding of such a substantial sum from active investment can have both stabilizing and dampening effects. As the global economy continues to navigate uncertain waters, the strategic deployment of this cash reserve will undoubtedly be a subject of keen interest and scrutiny among investors and economists alike.

Comparing Warren Buffett’s Rainy-Day Fund to Historical Financial Strategies

Warren Buffett, often hailed as one of the most astute investors of our time, has amassed a staggering $300 billion rainy-day fund through his conglomerate, Berkshire Hathaway. This financial strategy, akin to a modern Noah’s Ark, is designed to weather economic storms and capitalize on opportunities that arise during market downturns. To understand the significance of Buffett’s approach, it is essential to compare it with historical financial strategies that have been employed by other notable figures and institutions throughout history.

Historically, the concept of a rainy-day fund is not new. Ancient civilizations, such as the Egyptians, stored surplus grain to prepare for years of famine. Similarly, during the Renaissance, the Medici family, renowned for their banking prowess, maintained reserves to safeguard against economic fluctuations. These early examples underscore the timeless wisdom of preparing for unforeseen circumstances. However, Buffett’s strategy is distinguished by its scale and the strategic foresight that underpins it.

Transitioning to the 20th century, we observe that financial titans like J.P. Morgan and John D. Rockefeller also embraced the principle of maintaining reserves. Morgan, for instance, played a pivotal role in stabilizing the American economy during the Panic of 1907 by using his resources to inject liquidity into the banking system. Rockefeller, on the other hand, was known for his conservative approach to cash management, ensuring that his enterprises could withstand economic volatility. These strategies, while effective in their time, were primarily reactive, addressing crises as they arose.

In contrast, Buffett’s $300 billion fund is a proactive measure, meticulously crafted to seize opportunities during economic downturns. This approach is reminiscent of the biblical story of Noah’s Ark, where preparation and foresight were key to survival. Buffett’s strategy is not merely about safeguarding assets; it is about positioning Berkshire Hathaway to acquire undervalued companies and assets when others are forced to sell. This opportunistic mindset is a hallmark of Buffett’s investment philosophy, which emphasizes patience and long-term value creation.

Moreover, Buffett’s rainy-day fund reflects a deep understanding of market cycles and human psychology. During periods of economic exuberance, when optimism is rampant, Buffett often refrains from making significant investments, preferring instead to accumulate cash. This contrarian approach allows him to act decisively when fear grips the market, and prices plummet. By maintaining a substantial cash reserve, Buffett ensures that Berkshire Hathaway is not only resilient in the face of economic adversity but also poised to thrive when others falter.

In comparing Buffett’s strategy to historical financial practices, it becomes evident that his approach is both an evolution and a refinement of age-old principles. While the fundamental idea of preparing for economic uncertainty remains constant, Buffett’s execution is marked by a strategic acumen that leverages both patience and opportunism. His $300 billion rainy-day fund serves as a testament to the enduring value of foresight and preparation in the ever-changing landscape of global finance.

In conclusion, Warren Buffett’s modern Noah’s Ark is a masterclass in financial strategy, blending historical wisdom with contemporary insight. By maintaining a substantial rainy-day fund, Buffett not only safeguards Berkshire Hathaway against economic storms but also positions it to capitalize on the opportunities that such storms inevitably bring. This approach, rooted in a deep understanding of market dynamics, sets a benchmark for financial prudence and strategic foresight in the modern era.

The Influence of Warren Buffett’s Cash Strategy on Modern Investment Practices

Warren Buffett, often hailed as one of the most successful investors of all time, has long been a subject of fascination for financial analysts and investors alike. His investment strategies, characterized by a blend of patience, prudence, and foresight, have consistently yielded impressive returns. Among these strategies, Buffett’s penchant for maintaining a substantial cash reserve stands out as particularly noteworthy. This approach, often likened to a modern-day Noah’s Ark, serves as a safeguard against economic downturns and market volatility. With Berkshire Hathaway’s cash reserves recently surpassing $300 billion, this strategy has garnered significant attention and has begun to influence modern investment practices.

The rationale behind Buffett’s substantial cash reserve is rooted in his investment philosophy, which emphasizes the importance of having liquidity to seize opportunities when they arise. In times of economic uncertainty or market corrections, having a large cash reserve allows investors to purchase undervalued assets at a discount. This approach not only mitigates risk but also positions investors to capitalize on potential gains when the market rebounds. Buffett’s strategy underscores the importance of patience and discipline, as it requires investors to resist the temptation to deploy capital hastily in pursuit of short-term gains.

Moreover, Buffett’s cash strategy serves as a buffer against unforeseen economic challenges. In an era marked by geopolitical tensions, fluctuating interest rates, and unpredictable market dynamics, maintaining a robust cash reserve provides a sense of security and stability. This approach is particularly relevant in today’s investment landscape, where uncertainty often reigns supreme. By holding substantial cash reserves, investors can weather economic storms without being forced to liquidate assets at unfavorable prices.

The influence of Buffett’s cash strategy on modern investment practices is becoming increasingly evident. Institutional investors and asset managers are beginning to recognize the value of maintaining liquidity as a means of managing risk and enhancing portfolio resilience. This shift in perspective is reflected in the growing trend of allocating a portion of investment portfolios to cash or cash-equivalent assets. By doing so, investors can better navigate market fluctuations and capitalize on opportunities that arise during periods of economic turbulence.

Furthermore, Buffett’s approach has prompted a reevaluation of traditional investment strategies that prioritize full capital deployment. While the pursuit of maximum returns remains a primary objective for many investors, the emphasis on maintaining liquidity highlights the importance of balancing risk and reward. This nuanced approach encourages investors to adopt a more holistic view of portfolio management, one that considers both short-term performance and long-term sustainability.

In addition to influencing institutional investors, Buffett’s cash strategy has also resonated with individual investors seeking to emulate his success. The concept of maintaining a rainy-day fund, akin to Buffett’s cash reserve, has gained traction among retail investors who recognize the value of having liquidity in uncertain times. This trend reflects a broader shift towards more conservative investment practices, as individuals prioritize financial security and stability over speculative gains.

In conclusion, Warren Buffett’s $300 billion cash reserve serves as a testament to the enduring wisdom of his investment philosophy. By prioritizing liquidity and maintaining a substantial cash reserve, Buffett has not only safeguarded Berkshire Hathaway against economic uncertainties but also positioned the company to capitalize on future opportunities. As modern investors increasingly adopt similar strategies, the influence of Buffett’s cash strategy on contemporary investment practices is likely to continue growing, shaping the way investors approach risk management and portfolio resilience in an ever-changing financial landscape.

Analyzing the Long-Term Benefits of Warren Buffett’s $300 Billion Cash Reserve Strategy

Warren Buffett, the legendary investor and chairman of Berkshire Hathaway, has long been known for his prudent and strategic approach to investing. One of the most intriguing aspects of his strategy is the substantial cash reserve that Berkshire Hathaway maintains, often referred to as a “rainy-day fund.” As of recent reports, this reserve has swelled to an impressive $300 billion, a figure that has sparked considerable discussion and analysis within the financial community. This cash reserve, akin to a modern Noah’s Ark, is designed to weather financial storms and seize opportunities when they arise, offering a multitude of long-term benefits.

To understand the rationale behind this strategy, it is essential to consider Buffett’s investment philosophy, which emphasizes patience, discipline, and the ability to act decisively when the time is right. By maintaining a significant cash reserve, Buffett ensures that Berkshire Hathaway is well-positioned to capitalize on market downturns. During periods of economic uncertainty or market volatility, many companies may find themselves constrained by limited liquidity. In contrast, Berkshire’s substantial cash holdings allow it to acquire undervalued assets at attractive prices, thereby enhancing its long-term growth prospects.

Moreover, this cash reserve provides a buffer against unforeseen economic challenges. In an era where global markets are increasingly interconnected, economic shocks can arise from a myriad of sources, ranging from geopolitical tensions to pandemics. By having a robust cash reserve, Berkshire Hathaway can navigate these challenges with greater ease, ensuring stability and continuity in its operations. This financial resilience not only protects the company but also instills confidence among its shareholders, who can rest assured that their investments are safeguarded against potential downturns.

In addition to serving as a protective measure, the cash reserve strategy aligns with Buffett’s value investing principles. By holding cash, Berkshire Hathaway is not pressured to invest in overvalued markets or chase short-term gains. Instead, the company can wait patiently for opportunities that align with its long-term objectives. This disciplined approach allows Berkshire to maintain its focus on acquiring high-quality businesses with strong fundamentals, rather than succumbing to the whims of market speculation.

Furthermore, the cash reserve strategy enhances Berkshire Hathaway’s ability to engage in strategic acquisitions. In a competitive business landscape, having readily available capital can be a significant advantage. It enables Berkshire to act swiftly and decisively when attractive acquisition targets emerge, without the need to secure external financing. This agility not only facilitates growth but also strengthens Berkshire’s position as a formidable player in various industries.

While some critics argue that holding such a large cash reserve may result in opportunity costs, Buffett’s track record suggests otherwise. His ability to deploy capital effectively during market downturns has consistently generated substantial returns for Berkshire Hathaway. By maintaining a cash reserve, Buffett ensures that the company is not only prepared for adverse conditions but also poised to thrive in the long run.

In conclusion, Warren Buffett’s $300 billion cash reserve strategy serves as a testament to his investment acumen and foresight. By prioritizing financial resilience and strategic flexibility, Berkshire Hathaway is well-equipped to navigate the complexities of the modern financial landscape. This approach not only safeguards the company’s future but also underscores the enduring wisdom of Buffett’s investment philosophy, offering valuable lessons for investors and businesses alike.

Q&A

1. **What is Warren Buffett’s $300 Billion Rainy-Day Fund?**

Warren Buffett’s $300 billion rainy-day fund refers to the substantial cash reserves held by Berkshire Hathaway, which Buffett manages. This fund is intended to provide financial stability and flexibility during economic downturns or market volatility.

2. **Why is it called the “Modern Noah’s Ark”?**

The fund is metaphorically referred to as the “Modern Noah’s Ark” because, like Noah’s Ark, it is designed to weather financial storms and ensure survival during challenging times, preserving capital and allowing for strategic opportunities.

3. **How does Buffett use this fund during economic downturns?**

During economic downturns, Buffett uses the fund to make strategic investments, acquire undervalued companies, or provide liquidity to struggling businesses, capitalizing on opportunities that arise when others are constrained.

4. **What is the significance of maintaining such a large cash reserve?**

Maintaining a large cash reserve allows Berkshire Hathaway to remain financially flexible, avoid debt, and take advantage of investment opportunities without being pressured by market conditions or economic cycles.

5. **How does this strategy align with Buffett’s investment philosophy?**

This strategy aligns with Buffett’s investment philosophy of value investing, patience, and long-term thinking. It emphasizes the importance of having cash on hand to seize opportunities and mitigate risks.

6. **What impact does this fund have on Berkshire Hathaway’s shareholders?**

For shareholders, the fund provides a sense of security and confidence in Berkshire Hathaway’s ability to navigate economic challenges, potentially leading to stable or enhanced returns over the long term.

7. **Has Buffett faced criticism for holding such a large cash reserve?**

Yes, Buffett has faced criticism for holding a large cash reserve, as some investors believe it could be better utilized in higher-yielding investments. However, Buffett argues that the reserve is crucial for maintaining financial strength and flexibility.

Conclusion

Warren Buffett’s $300 billion rainy-day fund, often likened to a modern Noah’s Ark, represents a strategic financial reserve designed to navigate economic uncertainties and capitalize on market opportunities. This substantial cash reserve underscores Buffett’s investment philosophy of patience, prudence, and preparedness, allowing Berkshire Hathaway to act decisively during market downturns or crises. By maintaining such a significant cash position, Buffett ensures the company’s resilience and flexibility, reinforcing its ability to weather financial storms and emerge stronger. This approach not only highlights the importance of liquidity in risk management but also exemplifies Buffett’s long-term vision and commitment to safeguarding shareholder value.