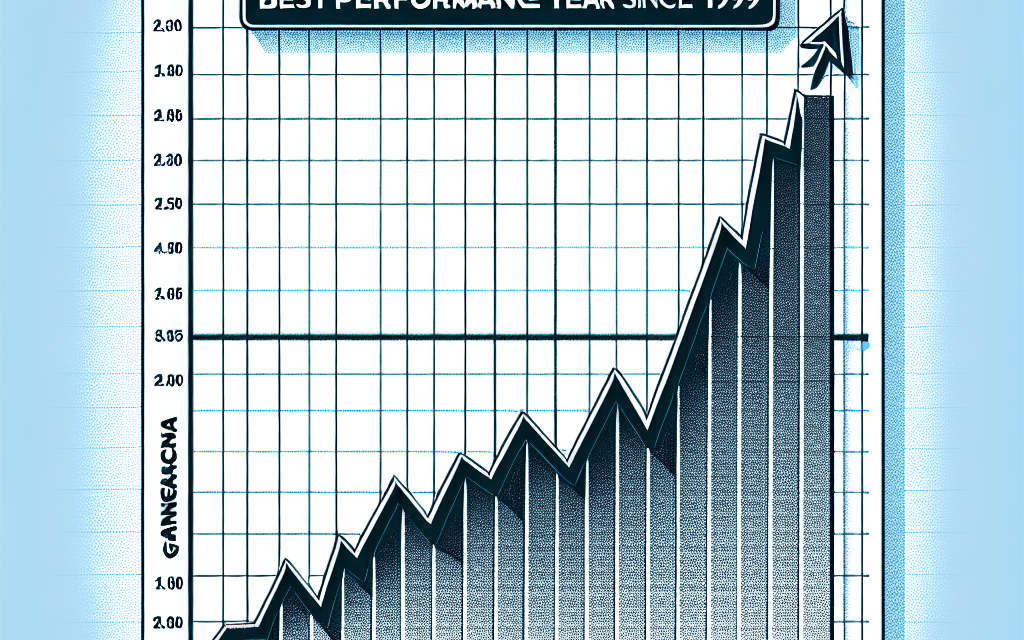

“Walmart Stock Soars: 2023 Set to Outshine 1999 with Record-Breaking Profits!”

Introduction

In 2023, Walmart’s stock is on track to achieve its most impressive performance since 1999, driven by a significant surge in profits. The retail giant has successfully navigated a challenging economic landscape, leveraging its expansive global footprint and innovative strategies to capture increased market share. Key factors contributing to this financial upswing include robust e-commerce growth, strategic cost management, and an enhanced focus on customer experience. As a result, Walmart has not only solidified its position as a leader in the retail sector but also delivered substantial returns to its shareholders, marking a pivotal year in its storied history.

Analyzing Walmart’s Financial Performance in 2023

In 2023, Walmart has demonstrated remarkable financial performance, positioning its stock for potentially the best year since 1999. This impressive trajectory can be attributed to a confluence of strategic initiatives, robust consumer demand, and effective cost management. As the retail giant navigates the complexities of a dynamic economic landscape, its ability to adapt and innovate has been pivotal in driving surging profits and enhancing shareholder value.

To begin with, Walmart’s strategic focus on e-commerce and digital transformation has played a crucial role in its financial success. Over the past few years, the company has invested heavily in its online platform, enhancing user experience and expanding its digital offerings. This investment has paid off handsomely, as evidenced by the significant growth in online sales. By leveraging technology to streamline operations and improve customer engagement, Walmart has effectively captured a larger share of the digital retail market. Consequently, this has not only bolstered its revenue streams but also strengthened its competitive position against other retail giants.

Moreover, Walmart’s ability to adapt to changing consumer preferences has been instrumental in its financial performance. In 2023, the company has placed a strong emphasis on sustainability and ethical sourcing, aligning its business practices with the values of environmentally conscious consumers. By offering a wider range of sustainable products and reducing its carbon footprint, Walmart has attracted a growing segment of eco-conscious shoppers. This strategic alignment with consumer values has not only enhanced its brand image but also contributed to increased sales and profitability.

In addition to its focus on sustainability, Walmart has also capitalized on the growing demand for convenience and value. The expansion of its grocery delivery and pickup services has been a key driver of growth, catering to the needs of time-strapped consumers seeking efficient shopping solutions. By offering competitive pricing and a seamless shopping experience, Walmart has successfully retained its customer base while attracting new shoppers. This focus on convenience and value has been a significant factor in the company’s robust financial performance.

Furthermore, effective cost management has been a cornerstone of Walmart’s success in 2023. The company has implemented various initiatives to optimize its supply chain and reduce operational expenses. By leveraging data analytics and automation, Walmart has improved inventory management and minimized waste, resulting in cost savings that have positively impacted its bottom line. These efforts have enabled the company to maintain competitive pricing while preserving profit margins, a critical factor in its financial success.

As Walmart continues to execute its strategic initiatives, the outlook for its stock remains promising. The company’s ability to adapt to market trends, coupled with its focus on innovation and efficiency, positions it well for sustained growth. Investors have taken note of Walmart’s strong financial performance, driving its stock price to new heights. If current trends persist, 2023 could indeed mark the best year for Walmart’s stock since 1999.

In conclusion, Walmart’s financial performance in 2023 is a testament to its strategic foresight and operational excellence. By embracing digital transformation, aligning with consumer values, and optimizing costs, the company has achieved surging profits and positioned itself for continued success. As the retail landscape evolves, Walmart’s ability to navigate challenges and seize opportunities will be crucial in maintaining its upward trajectory and delivering value to shareholders.

Key Factors Driving Walmart’s Stock Surge

Walmart’s stock is on track to achieve its best performance since 1999, driven by a confluence of strategic initiatives and favorable market conditions. This remarkable surge in stock value can be attributed to several key factors that have positioned the retail giant for unprecedented growth. As the company continues to adapt to the evolving retail landscape, its ability to leverage technology, optimize supply chains, and expand its product offerings has been instrumental in driving profitability and investor confidence.

One of the primary factors contributing to Walmart’s stock surge is its successful integration of e-commerce into its traditional retail model. In recent years, Walmart has made significant investments in its online platform, enhancing its digital capabilities to compete with e-commerce giants like Amazon. By offering a seamless shopping experience that combines the convenience of online shopping with the reliability of its brick-and-mortar stores, Walmart has managed to capture a larger share of the market. This strategic shift has not only increased sales but also improved customer loyalty, as consumers appreciate the flexibility and variety that Walmart provides.

Moreover, Walmart’s focus on supply chain optimization has played a crucial role in boosting its profitability. The company has implemented advanced technologies such as artificial intelligence and machine learning to streamline its logistics operations. These innovations have enabled Walmart to reduce costs, improve inventory management, and enhance delivery efficiency. As a result, the company has been able to maintain competitive pricing while ensuring product availability, which has been particularly important in the face of global supply chain disruptions.

In addition to technological advancements, Walmart’s expansion into new product categories has further fueled its growth. The company has strategically diversified its offerings to include a wider range of products, from groceries to electronics and apparel. This diversification has not only attracted a broader customer base but also increased the average transaction value, contributing to higher overall sales. Furthermore, Walmart’s private label brands have gained significant traction, offering consumers high-quality alternatives at competitive prices. This has not only driven sales but also improved profit margins, as private label products typically yield higher returns.

Another critical factor in Walmart’s stock performance is its commitment to sustainability and corporate responsibility. The company has made substantial efforts to reduce its environmental impact, setting ambitious goals for carbon reduction and waste management. By prioritizing sustainability, Walmart has not only enhanced its brand image but also attracted socially conscious investors who value companies with strong environmental, social, and governance (ESG) practices. This focus on sustainability has become increasingly important in today’s investment landscape, where ESG considerations play a significant role in decision-making.

Furthermore, Walmart’s strategic partnerships and acquisitions have bolstered its market position and growth prospects. By collaborating with technology firms and acquiring innovative startups, Walmart has been able to enhance its digital capabilities and expand its reach into new markets. These strategic moves have not only strengthened Walmart’s competitive edge but also provided new avenues for revenue generation.

In conclusion, Walmart’s stock surge is the result of a multifaceted approach that combines technological innovation, supply chain optimization, product diversification, sustainability efforts, and strategic partnerships. As the company continues to execute its growth strategy, it remains well-positioned to capitalize on emerging opportunities and navigate the challenges of the retail industry. With these key factors driving its success, Walmart is poised to achieve its best year since 1999, delivering substantial value to its shareholders and solidifying its status as a leader in the global retail market.

Walmart’s Strategic Initiatives Boosting Profits

Walmart, the retail giant known for its vast network of stores and competitive pricing, is on track to achieve its best stock performance since 1999, driven by a series of strategic initiatives that have significantly boosted its profits. This remarkable financial trajectory can be attributed to a combination of factors, including an enhanced focus on e-commerce, strategic partnerships, and a commitment to sustainability, all of which have positioned Walmart as a formidable player in the retail sector.

To begin with, Walmart’s investment in e-commerce has been a pivotal factor in its recent success. Recognizing the shifting consumer preferences towards online shopping, Walmart has made substantial investments in its digital infrastructure. By expanding its online marketplace and improving its delivery logistics, the company has been able to offer a seamless shopping experience that rivals even the most established e-commerce platforms. This strategic pivot has not only attracted a broader customer base but has also increased the frequency of purchases, thereby driving up sales and profits.

In addition to bolstering its e-commerce capabilities, Walmart has also formed strategic partnerships that have further enhanced its market position. Collaborations with tech companies have allowed Walmart to integrate cutting-edge technology into its operations, improving efficiency and customer satisfaction. For instance, partnerships with firms specializing in artificial intelligence and data analytics have enabled Walmart to optimize its supply chain, reduce costs, and ensure that products are available when and where customers need them. These alliances have been instrumental in maintaining Walmart’s competitive edge in a rapidly evolving retail landscape.

Moreover, Walmart’s commitment to sustainability has resonated well with consumers who are increasingly conscious of environmental issues. The company has set ambitious goals to reduce its carbon footprint and promote sustainable practices across its supply chain. By investing in renewable energy, reducing waste, and sourcing products responsibly, Walmart has not only enhanced its brand image but has also realized cost savings that contribute to its bottom line. This focus on sustainability has attracted environmentally conscious consumers, further boosting sales and reinforcing customer loyalty.

Furthermore, Walmart’s ability to adapt to changing market conditions has been a key driver of its financial success. The company has demonstrated resilience in the face of economic uncertainties, such as inflationary pressures and supply chain disruptions. By leveraging its vast resources and expertise, Walmart has been able to mitigate these challenges and continue delivering value to its customers. This adaptability has instilled confidence among investors, contributing to the surge in Walmart’s stock price.

In conclusion, Walmart’s strategic initiatives have been instrumental in propelling its stock towards its best performance in over two decades. The company’s focus on e-commerce, strategic partnerships, sustainability, and adaptability has not only boosted its profits but has also solidified its position as a leader in the retail industry. As Walmart continues to innovate and respond to market dynamics, it is well-positioned to sustain its growth trajectory and deliver long-term value to its shareholders. This remarkable achievement underscores the effectiveness of Walmart’s strategic vision and its ability to thrive in an increasingly competitive and complex retail environment.

Comparing Walmart’s 2023 Success to 1999

In the annals of retail history, few companies have demonstrated the resilience and adaptability of Walmart. As 2023 unfolds, Walmart’s stock is on track to achieve its best performance since 1999, a year that marked a significant milestone in the company’s growth trajectory. This remarkable resurgence in 2023 is driven by surging profits, strategic innovations, and a keen understanding of evolving consumer behaviors. To appreciate the significance of this achievement, it is essential to compare the current landscape with the conditions that propelled Walmart to success in 1999.

In 1999, Walmart was riding a wave of expansion and innovation. The company had successfully capitalized on its “Everyday Low Prices” strategy, which resonated with a broad consumer base. This approach, coupled with an aggressive expansion into new markets, allowed Walmart to dominate the retail sector. The late 1990s were characterized by a robust economy, and Walmart’s ability to offer value to cost-conscious consumers positioned it as a leader in the industry. The company’s stock performance during this period reflected its operational success and investor confidence.

Fast forward to 2023, and Walmart finds itself in a vastly different retail environment. The digital revolution has transformed consumer expectations, with e-commerce becoming a critical component of retail strategy. Walmart’s ability to adapt to these changes has been instrumental in its recent success. The company has invested heavily in its online platform, enhancing its digital presence and offering a seamless shopping experience that integrates both physical and digital channels. This omnichannel approach has allowed Walmart to capture a larger share of the market, appealing to tech-savvy consumers who value convenience and efficiency.

Moreover, Walmart’s strategic focus on sustainability and social responsibility has resonated with a new generation of consumers who prioritize ethical considerations in their purchasing decisions. By committing to reducing its carbon footprint and promoting fair labor practices, Walmart has strengthened its brand image and fostered customer loyalty. This commitment to corporate responsibility not only enhances Walmart’s reputation but also contributes to its financial performance, as consumers increasingly align their spending with their values.

In addition to these strategic initiatives, Walmart’s financial discipline has played a crucial role in its 2023 success. The company has maintained a strong balance sheet, enabling it to invest in growth opportunities while returning value to shareholders. This financial prudence, combined with operational efficiencies, has resulted in surging profits that have buoyed its stock performance.

While the economic conditions of 2023 differ from those of 1999, Walmart’s ability to navigate challenges and seize opportunities remains a constant. The company’s success this year is a testament to its adaptability and foresight, qualities that have been hallmarks of its long-standing dominance in the retail sector. As Walmart continues to innovate and evolve, it is well-positioned to maintain its leadership and deliver value to both consumers and investors.

In conclusion, the parallels between Walmart’s achievements in 1999 and 2023 underscore the company’s enduring strength and strategic acumen. By embracing change and prioritizing customer needs, Walmart has not only weathered the challenges of a dynamic retail landscape but has also emerged stronger, poised for continued success in the years to come.

Investor Insights: Why Walmart is a Strong Buy

Walmart, the retail giant that has long been a staple in the American economy, is on track to achieve its best stock performance since 1999, driven by surging profits and strategic initiatives that have captured the attention of investors. As the company continues to adapt to the evolving retail landscape, it has demonstrated resilience and innovation, making it a compelling option for those looking to invest in a stable yet dynamic enterprise. The company’s recent financial results have been nothing short of impressive, with significant growth in both revenue and net income. This robust performance can be attributed to several key factors that have positioned Walmart as a strong buy in the current market.

One of the primary drivers of Walmart’s success is its ability to effectively integrate e-commerce with its traditional brick-and-mortar operations. In recent years, the company has made substantial investments in its online platform, enhancing its digital capabilities to compete with other major players in the e-commerce space. This strategic focus has paid off, as evidenced by the impressive growth in online sales, which have consistently outpaced the industry average. By leveraging its vast network of physical stores as distribution hubs, Walmart has been able to offer customers a seamless shopping experience that combines the convenience of online shopping with the immediacy of in-store pickup.

Moreover, Walmart’s commitment to innovation extends beyond its e-commerce strategy. The company has been at the forefront of adopting new technologies to improve operational efficiency and customer satisfaction. For instance, Walmart has implemented advanced data analytics to optimize inventory management, ensuring that products are available when and where customers need them. Additionally, the company has embraced automation in its supply chain, reducing costs and enhancing productivity. These technological advancements have not only contributed to Walmart’s bottom line but have also reinforced its competitive edge in the retail sector.

Another factor contributing to Walmart’s strong financial performance is its focus on expanding its product offerings and services. The company has made strategic acquisitions and partnerships to diversify its portfolio, entering new markets and catering to a broader customer base. For example, Walmart’s foray into the healthcare sector, through initiatives such as Walmart Health, has opened up new revenue streams and positioned the company as a leader in providing affordable healthcare services. Furthermore, Walmart’s emphasis on sustainability and corporate responsibility has resonated with consumers, enhancing its brand reputation and customer loyalty.

In addition to these strategic initiatives, Walmart’s financial health is bolstered by its strong balance sheet and prudent fiscal management. The company has maintained a disciplined approach to capital allocation, ensuring that investments are aligned with long-term growth objectives. This financial stability provides Walmart with the flexibility to navigate economic uncertainties and capitalize on emerging opportunities.

As investors consider the potential of Walmart stock, it is important to recognize the company’s ability to adapt and thrive in a rapidly changing retail environment. With a proven track record of innovation, a diversified business model, and a commitment to delivering value to shareholders, Walmart is well-positioned to continue its upward trajectory. As such, for those seeking a reliable investment with the potential for significant returns, Walmart presents a compelling case as a strong buy.

The Role of E-commerce in Walmart’s Growth

Walmart’s stock is on track to achieve its best performance since 1999, a remarkable feat driven by surging profits and strategic adaptations in the ever-evolving retail landscape. Central to this success is the pivotal role of e-commerce in Walmart’s growth strategy. As consumer preferences shift towards online shopping, Walmart has adeptly positioned itself to capitalize on this trend, leveraging its vast resources and infrastructure to enhance its digital presence. This transformation is not merely a response to changing consumer behavior but a proactive approach to redefine the retail experience.

In recent years, Walmart has made significant investments in its e-commerce capabilities, recognizing the potential of online platforms to drive sales and expand its customer base. By integrating cutting-edge technology and data analytics, Walmart has optimized its supply chain and inventory management, ensuring that products are readily available to meet consumer demand. This seamless integration of online and offline operations has allowed Walmart to offer a comprehensive shopping experience, where customers can effortlessly transition between digital and physical stores.

Moreover, Walmart’s strategic acquisitions have played a crucial role in bolstering its e-commerce portfolio. The acquisition of Jet.com in 2016 marked a turning point, providing Walmart with valuable insights and expertise in the digital retail space. This move not only enhanced Walmart’s technological capabilities but also expanded its reach to a younger, tech-savvy demographic. Building on this foundation, Walmart has continued to innovate, launching initiatives such as Walmart+, a subscription service that offers benefits like free delivery and discounts on fuel, further enticing customers to engage with its online platform.

In addition to these strategic moves, Walmart’s commitment to enhancing the customer experience has been instrumental in its e-commerce success. By prioritizing user-friendly interfaces and personalized shopping experiences, Walmart has cultivated a loyal customer base that values convenience and efficiency. The implementation of advanced algorithms and machine learning has enabled Walmart to offer tailored recommendations, creating a more engaging and satisfying shopping journey for consumers.

Furthermore, Walmart’s focus on sustainability and ethical practices has resonated with environmentally conscious consumers, further driving its e-commerce growth. By promoting sustainable products and reducing its carbon footprint, Walmart has positioned itself as a responsible retailer, appealing to a growing segment of consumers who prioritize ethical considerations in their purchasing decisions. This alignment with consumer values has not only enhanced Walmart’s brand image but also contributed to its financial success.

As Walmart continues to expand its e-commerce operations, it faces the challenge of maintaining its competitive edge in a rapidly changing market. However, with its robust infrastructure, strategic partnerships, and commitment to innovation, Walmart is well-equipped to navigate these challenges and sustain its growth trajectory. The integration of emerging technologies, such as artificial intelligence and augmented reality, presents new opportunities for Walmart to further enhance its e-commerce offerings and deliver unparalleled value to its customers.

In conclusion, the role of e-commerce in Walmart’s growth cannot be overstated. By embracing digital transformation and prioritizing customer-centric strategies, Walmart has positioned itself as a leader in the retail industry, poised for its best year since 1999. As the company continues to evolve and adapt to the dynamic retail environment, its focus on e-commerce will undoubtedly remain a key driver of its success, ensuring that Walmart remains at the forefront of the industry for years to come.

Future Outlook: Sustaining Walmart’s Momentum

As Walmart’s stock appears poised for its best year since 1999, the retail giant’s future outlook is a topic of considerable interest among investors and analysts alike. The company’s surging profits have been a key driver of its stock performance, reflecting a combination of strategic initiatives and favorable market conditions. To sustain this momentum, Walmart must continue to adapt to the evolving retail landscape while leveraging its strengths to maintain its competitive edge.

One of the primary factors contributing to Walmart’s recent success is its robust e-commerce growth. The company has made significant investments in its online platform, enhancing its digital capabilities to meet the increasing demand for online shopping. By expanding its product offerings and improving the user experience, Walmart has effectively captured a larger share of the e-commerce market. This strategic focus on digital transformation has not only boosted sales but also positioned Walmart as a formidable competitor to other online retail giants.

In addition to its e-commerce advancements, Walmart’s ability to optimize its supply chain has played a crucial role in its profitability. The company has implemented innovative technologies and data analytics to streamline operations, reduce costs, and improve inventory management. These efforts have enabled Walmart to respond swiftly to changing consumer preferences and market dynamics, ensuring that its shelves remain stocked with the products customers want. As a result, Walmart has been able to maintain its reputation for offering a wide selection of goods at competitive prices, further solidifying its market position.

Moreover, Walmart’s focus on sustainability and corporate responsibility has resonated with consumers and investors alike. The company has set ambitious goals to reduce its carbon footprint, promote sustainable sourcing, and support local communities. By aligning its business practices with the growing demand for environmentally and socially responsible products, Walmart has enhanced its brand image and strengthened customer loyalty. This commitment to sustainability not only benefits the environment but also contributes to long-term financial performance by attracting a broader customer base.

However, sustaining this momentum will require Walmart to navigate several challenges. The retail industry is highly competitive, with new entrants and existing players constantly vying for market share. To stay ahead, Walmart must continue to innovate and differentiate itself from competitors. This may involve exploring new business models, such as expanding its subscription services or enhancing its omnichannel capabilities to provide a seamless shopping experience across online and physical stores.

Furthermore, Walmart must remain vigilant in addressing potential risks, such as supply chain disruptions, regulatory changes, and economic uncertainties. By proactively managing these risks and maintaining operational resilience, Walmart can safeguard its profitability and sustain its growth trajectory.

In conclusion, Walmart’s stock is poised for a remarkable year, driven by surging profits and strategic initiatives that have strengthened its market position. To sustain this momentum, the company must continue to focus on e-commerce growth, supply chain optimization, and sustainability efforts. By navigating industry challenges and capitalizing on emerging opportunities, Walmart can maintain its competitive edge and deliver long-term value to shareholders. As the retail landscape continues to evolve, Walmart’s ability to adapt and innovate will be crucial in sustaining its success and ensuring a prosperous future.

Q&A

1. **What is the main reason for Walmart’s stock performance in 2023?**

Surging profits have been a key driver for Walmart’s stock performance in 2023.

2. **How does Walmart’s 2023 stock performance compare to previous years?**

Walmart’s stock is poised for its best year since 1999.

3. **What factors have contributed to Walmart’s increased profits?**

Factors include strong sales growth, effective cost management, and strategic investments in e-commerce and technology.

4. **How has Walmart’s e-commerce strategy impacted its stock performance?**

Walmart’s successful e-commerce strategy has significantly contributed to its stock performance by expanding its market reach and increasing sales.

5. **What role has cost management played in Walmart’s financial success?**

Effective cost management has helped improve profit margins, contributing to the company’s financial success.

6. **How have market conditions in 2023 affected Walmart’s stock?**

Favorable market conditions, including consumer spending trends and economic recovery, have positively impacted Walmart’s stock.

7. **What are analysts’ expectations for Walmart’s future performance?**

Analysts generally have a positive outlook on Walmart’s future performance, expecting continued growth and profitability.

Conclusion

Walmart’s stock is on track for its best performance since 1999, driven by surging profits and strategic initiatives that have strengthened its market position. The company’s focus on expanding its e-commerce capabilities, enhancing supply chain efficiency, and leveraging its vast physical store network has contributed to robust financial results. Additionally, Walmart’s ability to adapt to changing consumer preferences and economic conditions has allowed it to capture a larger share of the retail market. As a result, investor confidence has been bolstered, reflecting in the stock’s impressive performance. This momentum suggests that Walmart is well-positioned to sustain its growth trajectory in the coming years.