“Navigate the AI Stock Showdown: Super Micro’s Surge vs. Lumen’s Long Game”

Introduction

In the rapidly evolving landscape of artificial intelligence, investors are keenly observing which companies will emerge as leaders and which may falter. Wall Street analysts have recently turned their attention to two prominent players in the tech industry: Super Micro Computer and Lumen Technologies. As the AI revolution continues to reshape markets, these companies find themselves at a critical juncture. Analysts have issued a decisive verdict: sell one and hold the other. This analysis delves into the factors influencing these recommendations, examining the strategic positions, financial health, and growth prospects of Super Micro Computer and Lumen Technologies. Understanding the rationale behind Wall Street’s guidance can provide valuable insights for investors navigating the complexities of AI-driven market dynamics.

Analyzing Wall Street’s Perspective on Super Micro Computer and Lumen Technologies

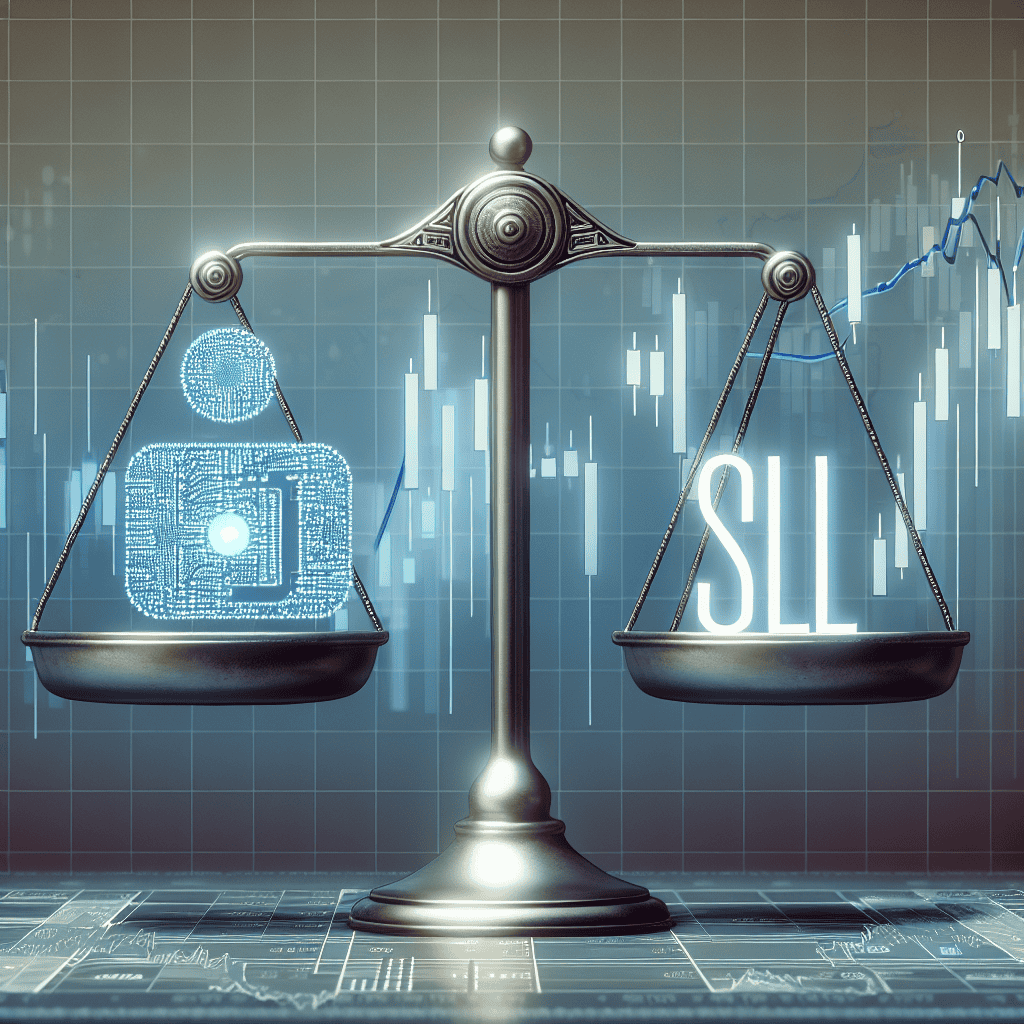

In the ever-evolving landscape of technology, Wall Street analysts continuously assess the potential of companies to adapt and thrive. Two companies that have recently captured the attention of investors are Super Micro Computer and Lumen Technologies. Both firms are involved in the burgeoning field of artificial intelligence (AI), yet Wall Street’s verdict on these companies diverges significantly. While Super Micro Computer is seen as a promising entity worth holding, Lumen Technologies is viewed with caution, prompting a recommendation to sell.

Super Micro Computer, a company specializing in high-performance computing solutions, has positioned itself as a key player in the AI sector. Its focus on providing advanced server and storage solutions has allowed it to capitalize on the increasing demand for AI infrastructure. The company’s robust financial performance, characterized by consistent revenue growth and strong profit margins, has bolstered investor confidence. Furthermore, Super Micro’s strategic partnerships with leading tech giants have enhanced its credibility and market reach. These collaborations have not only expanded its customer base but also facilitated the integration of cutting-edge AI technologies into its offerings. Consequently, Wall Street analysts have maintained a favorable outlook on Super Micro Computer, advising investors to hold onto their shares as the company continues to demonstrate resilience and growth potential.

In contrast, Lumen Technologies, a telecommunications company with a focus on network services and cloud solutions, has faced challenges that have led to a more cautious stance from Wall Street. Despite its efforts to pivot towards AI and digital transformation, Lumen has struggled to achieve the same level of success as its peers. The company’s financial performance has been marred by declining revenues and profitability, raising concerns about its ability to compete effectively in the fast-paced tech industry. Additionally, Lumen’s substantial debt burden has further complicated its financial outlook, limiting its capacity to invest in innovation and expansion. These factors have contributed to a less optimistic view from analysts, who recommend selling Lumen Technologies’ stock in light of its uncertain future.

The contrasting perspectives on Super Micro Computer and Lumen Technologies underscore the importance of financial health and strategic positioning in the tech sector. While Super Micro has successfully leveraged its strengths to capture market opportunities, Lumen’s struggles highlight the challenges faced by companies attempting to reinvent themselves in a rapidly changing environment. This divergence also reflects broader trends in the AI industry, where companies with strong foundations and strategic foresight are better equipped to navigate the complexities of technological advancement.

Moreover, the differing recommendations from Wall Street analysts serve as a reminder of the critical role that financial metrics and market positioning play in investment decisions. Investors are encouraged to consider not only the current performance of a company but also its long-term potential and ability to adapt to industry shifts. As the AI landscape continues to evolve, companies that can effectively harness the power of innovation while maintaining financial stability are likely to emerge as leaders.

In conclusion, Wall Street’s verdict on Super Micro Computer and Lumen Technologies highlights the nuanced nature of investment analysis in the tech sector. While Super Micro’s strong performance and strategic alliances make it a stock worth holding, Lumen’s financial challenges and uncertain prospects suggest a more cautious approach. As investors navigate the complexities of the AI market, these insights provide valuable guidance in making informed decisions.

Key Factors Influencing Wall Street’s Sell Recommendation for Super Micro Computer

In the ever-evolving landscape of technology investments, Wall Street analysts are constantly evaluating companies to provide investors with insights into potential opportunities and risks. Recently, two companies have come under scrutiny: Super Micro Computer and Lumen Technologies. While both are involved in the burgeoning field of artificial intelligence (AI), Wall Street’s verdict is to sell Super Micro Computer and hold Lumen Technologies. This recommendation is influenced by several key factors that investors should consider when making decisions about their portfolios.

To begin with, Super Micro Computer, a company known for its high-performance computing solutions, has been a significant player in the AI hardware market. However, despite its strong market presence, analysts have raised concerns about its current valuation. The company’s stock price has surged in recent months, driven by the increasing demand for AI infrastructure. Yet, this rapid appreciation has led to a valuation that some experts believe is unsustainable in the long term. The price-to-earnings ratio, a critical metric for assessing a company’s valuation, suggests that Super Micro Computer may be overvalued compared to its peers. Consequently, Wall Street’s sell recommendation is partly based on the belief that the stock’s current price does not accurately reflect its intrinsic value.

Moreover, another factor influencing the sell recommendation is the competitive landscape in which Super Micro Computer operates. The AI hardware market is highly competitive, with numerous well-established players vying for market share. Companies like NVIDIA and Intel are investing heavily in research and development to maintain their competitive edge, which poses a significant challenge for Super Micro Computer. The company’s ability to innovate and differentiate its products will be crucial in sustaining its growth trajectory. However, given the intense competition, analysts are cautious about the company’s prospects in maintaining its market position.

In contrast, Lumen Technologies, a company that provides communication and network services, has been recommended as a hold. While not as directly involved in AI hardware as Super Micro Computer, Lumen Technologies is strategically positioned to benefit from the growing demand for AI-driven solutions. The company’s extensive network infrastructure and focus on edge computing make it a critical enabler of AI applications. As businesses increasingly rely on AI to drive efficiency and innovation, Lumen Technologies’ services are expected to play a vital role in supporting these initiatives.

Furthermore, Lumen Technologies has been actively investing in its network capabilities to enhance its service offerings. This strategic focus on infrastructure development is seen as a positive indicator of the company’s long-term growth potential. Unlike Super Micro Computer, Lumen Technologies’ valuation appears more aligned with its growth prospects, making it a more attractive option for investors seeking exposure to the AI sector without the risk of overvaluation.

In conclusion, Wall Street’s differing recommendations for Super Micro Computer and Lumen Technologies highlight the importance of careful evaluation when investing in the AI sector. While Super Micro Computer’s current valuation and competitive challenges warrant a sell recommendation, Lumen Technologies’ strategic positioning and infrastructure investments make it a hold. Investors should consider these factors, along with their risk tolerance and investment goals, when making decisions about their portfolios. As the AI landscape continues to evolve, staying informed about market dynamics and company fundamentals will be crucial for making sound investment choices.

Why Wall Street Advises Holding Lumen Technologies Amidst Market Fluctuations

In the ever-evolving landscape of technology and finance, Wall Street analysts are constantly evaluating companies to provide investors with insights into potential opportunities and risks. Recently, two companies have come under the spotlight: Super Micro Computer and Lumen Technologies. While the former has been met with a recommendation to sell, the latter has been advised as a hold amidst market fluctuations. Understanding the rationale behind these recommendations requires a closer look at the factors influencing Wall Street’s verdict.

Lumen Technologies, a company that provides communication and network services, has been navigating a challenging market environment. Despite these challenges, Wall Street’s advice to hold Lumen Technologies stems from several key considerations. Firstly, the company has been making strategic investments in its infrastructure to enhance its service offerings. By focusing on expanding its fiber network and improving its digital capabilities, Lumen is positioning itself to meet the growing demand for high-speed internet and cloud services. This strategic direction is crucial as businesses and consumers increasingly rely on robust digital connectivity.

Moreover, Lumen Technologies has been actively working to streamline its operations and reduce costs. Through initiatives aimed at improving operational efficiency, the company is striving to enhance its profitability. This focus on cost management is particularly important in a volatile market, where maintaining a healthy balance sheet can provide a buffer against economic uncertainties. Consequently, Wall Street analysts see potential in Lumen’s efforts to optimize its operations, which could lead to improved financial performance in the long term.

In addition to its operational strategies, Lumen Technologies benefits from a stable customer base. The company’s extensive network infrastructure and comprehensive service offerings have enabled it to secure long-term contracts with various enterprises and government entities. This stability in revenue streams provides a degree of predictability, which is appealing to investors seeking to mitigate risks in uncertain market conditions. Furthermore, Lumen’s commitment to innovation and its focus on emerging technologies, such as edge computing and cybersecurity, position it well to capitalize on future growth opportunities.

While Lumen Technologies faces challenges, including competitive pressures and regulatory hurdles, Wall Street’s hold recommendation reflects a belief in the company’s ability to navigate these obstacles. The telecommunications industry is characterized by rapid technological advancements and evolving consumer preferences, necessitating adaptability and resilience. Lumen’s strategic initiatives and its emphasis on customer-centric solutions demonstrate its commitment to staying relevant in this dynamic environment.

In contrast, Super Micro Computer, a company specializing in high-performance computing solutions, has been advised as a sell. This recommendation is influenced by concerns over its valuation and market positioning. Despite its strong product portfolio, Super Micro Computer faces intense competition from larger players in the industry. Additionally, the company’s reliance on specific market segments exposes it to potential vulnerabilities, particularly in times of economic uncertainty.

In conclusion, Wall Street’s advice to hold Lumen Technologies amidst market fluctuations is rooted in the company’s strategic investments, operational efficiency, and stable customer base. While challenges remain, Lumen’s focus on innovation and its ability to adapt to changing market dynamics provide a foundation for potential growth. Investors are encouraged to consider these factors when evaluating their investment decisions, recognizing that the telecommunications landscape is both complex and promising. As the market continues to evolve, Lumen Technologies’ commitment to enhancing its capabilities and delivering value to its customers positions it as a company worth holding in a diversified investment portfolio.

Comparing Financial Performance: Super Micro Computer vs. Lumen Technologies

In the rapidly evolving landscape of artificial intelligence, investors are keenly observing the financial performance of companies that are at the forefront of this technological revolution. Among these, Super Micro Computer and Lumen Technologies have garnered significant attention. As Wall Street analysts weigh in on these two companies, a clear distinction emerges in their financial trajectories, prompting a recommendation to sell one and hold the other.

Super Micro Computer, a prominent player in the AI hardware sector, has demonstrated robust financial performance in recent quarters. The company’s strategic focus on high-performance computing solutions has positioned it well to capitalize on the growing demand for AI infrastructure. Super Micro’s revenue growth has been impressive, driven by its ability to deliver cutting-edge products that cater to the needs of data centers and cloud service providers. Moreover, the company’s commitment to innovation and its agile response to market trends have further solidified its competitive edge. As a result, analysts have maintained a favorable outlook on Super Micro, suggesting that investors hold onto their shares as the company continues to expand its market presence.

In contrast, Lumen Technologies, which operates in the telecommunications and network services sector, has faced challenges that have impacted its financial performance. Despite its efforts to pivot towards AI-driven solutions, Lumen has struggled to achieve the same level of growth as its peers. The company’s revenue has been relatively stagnant, and its attempts to diversify its offerings have not yielded the anticipated results. Furthermore, Lumen’s high debt levels have raised concerns among investors, as they could potentially hinder the company’s ability to invest in future growth opportunities. Consequently, Wall Street analysts have recommended selling Lumen Technologies’ stock, citing the company’s inability to effectively leverage AI to drive substantial financial gains.

Transitioning from the individual performance of these companies, it is essential to consider the broader market dynamics that influence their financial outcomes. The AI industry is characterized by rapid technological advancements and intense competition, which necessitate continuous innovation and strategic investments. Super Micro’s success can be attributed to its proactive approach in adapting to these market conditions, whereas Lumen’s struggles highlight the challenges faced by companies that are unable to keep pace with the evolving landscape.

Moreover, the financial health of these companies is also shaped by their respective business models and operational efficiencies. Super Micro’s focus on high-margin products and its ability to optimize its supply chain have contributed to its strong financial performance. On the other hand, Lumen’s reliance on traditional telecommunications services, coupled with its high operational costs, has constrained its profitability.

In conclusion, the financial performance of Super Micro Computer and Lumen Technologies presents a compelling case for investors. While Super Micro’s strategic positioning and robust growth prospects make it a stock worth holding, Lumen’s financial challenges and inability to capitalize on AI opportunities suggest that selling its stock may be a prudent decision. As the AI industry continues to evolve, investors must remain vigilant and assess the financial health and strategic direction of companies to make informed investment decisions. By doing so, they can navigate the complexities of the market and capitalize on the opportunities presented by this transformative technology.

The Role of AI in Shaping Wall Street’s Verdict on Tech Stocks

In recent years, the rapid advancement of artificial intelligence (AI) has significantly influenced the landscape of technology stocks on Wall Street. Investors and analysts alike are keenly observing how AI is reshaping the prospects of various companies, leading to divergent opinions on which stocks to buy, hold, or sell. Two companies that have recently come under scrutiny are Super Micro Computer and Lumen Technologies. While both are involved in the tech sector, their differing approaches to AI and market positioning have led to contrasting recommendations from Wall Street experts.

Super Micro Computer, a company specializing in high-performance computing solutions, has been at the forefront of integrating AI into its product offerings. The company’s focus on AI-driven innovations has positioned it as a key player in the data center and cloud computing markets. By leveraging AI, Super Micro Computer has been able to enhance the efficiency and performance of its hardware, making it an attractive option for businesses looking to optimize their IT infrastructure. Consequently, Wall Street analysts have generally been optimistic about the company’s future prospects, suggesting that investors hold onto their shares as the demand for AI-enhanced computing solutions continues to grow.

In contrast, Lumen Technologies, a telecommunications company, has faced challenges in effectively capitalizing on AI to drive growth. Despite its efforts to incorporate AI into its operations, Lumen has struggled to demonstrate a clear path to leveraging AI for substantial competitive advantage. The company’s focus on traditional telecommunications services has overshadowed its AI initiatives, leading to skepticism among investors and analysts. As a result, Wall Street’s verdict has been less favorable, with many experts recommending that investors sell their shares in Lumen Technologies.

The differing recommendations for these two companies can be attributed to several factors. Firstly, Super Micro Computer’s strategic emphasis on AI aligns well with current market trends, as businesses increasingly seek advanced computing solutions to handle complex data processing tasks. This alignment has allowed Super Micro to capture a significant share of the market, thereby boosting investor confidence. On the other hand, Lumen Technologies’ inability to clearly articulate its AI strategy has left investors uncertain about its long-term growth potential.

Moreover, the financial performance of these companies further underscores Wall Street’s contrasting views. Super Micro Computer has reported robust revenue growth, driven by strong demand for its AI-enhanced products. This financial success has reinforced the positive sentiment among investors, who see the company as well-positioned to capitalize on the growing AI market. Conversely, Lumen Technologies has faced stagnant revenue growth, partly due to its struggles in effectively integrating AI into its core business operations. This lackluster performance has contributed to the prevailing recommendation to sell Lumen’s stock.

In conclusion, the role of AI in shaping Wall Street’s verdict on tech stocks is evident in the contrasting recommendations for Super Micro Computer and Lumen Technologies. While Super Micro’s strategic focus on AI has garnered a hold recommendation, Lumen’s challenges in leveraging AI have led to a sell recommendation. As AI continues to evolve and influence the tech industry, investors will need to closely monitor how companies adapt to these changes and position themselves for future growth. Ultimately, the ability to effectively harness AI will be a key determinant of success in the competitive landscape of technology stocks.

Investor Insights: Navigating Wall Street’s Recommendations on AI Stocks

In the ever-evolving landscape of artificial intelligence (AI), investors are constantly seeking guidance on which stocks to buy, hold, or sell. Wall Street analysts, with their in-depth research and market insights, play a crucial role in shaping these investment decisions. Recently, two AI-related companies, Super Micro Computer and Lumen Technologies, have been the focus of such analysis, with contrasting recommendations emerging from the financial experts. Understanding the rationale behind these recommendations can provide valuable insights for investors navigating the complex world of AI stocks.

Super Micro Computer, a company specializing in high-performance computing solutions, has been a standout performer in the AI sector. Its robust product offerings, which include servers optimized for AI workloads, have positioned it as a key player in the industry. Analysts have noted that Super Micro’s strategic partnerships with leading AI chip manufacturers have further strengthened its market position. As AI continues to permeate various sectors, the demand for powerful computing infrastructure is expected to rise, benefiting companies like Super Micro. Consequently, Wall Street’s consensus leans towards holding Super Micro Computer stock, reflecting confidence in its long-term growth potential.

On the other hand, Lumen Technologies, a telecommunications company with a focus on providing network solutions, has faced a more challenging environment. While Lumen has made efforts to integrate AI into its service offerings, analysts have expressed concerns about its ability to effectively capitalize on the AI boom. The company’s financial performance has been under scrutiny, with some experts pointing to its high debt levels and competitive pressures as potential obstacles. As a result, Wall Street’s recommendation for Lumen Technologies is to sell, indicating a lack of confidence in its current trajectory within the AI space.

Transitioning from the individual company analysis to broader market trends, it is essential to consider the factors influencing these recommendations. The AI industry is characterized by rapid technological advancements and intense competition. Companies that can innovate and adapt quickly are more likely to succeed. Super Micro’s focus on cutting-edge technology and strategic alliances has positioned it well in this dynamic environment. In contrast, Lumen’s challenges highlight the importance of financial stability and strategic clarity in navigating the AI landscape.

Moreover, investor sentiment plays a significant role in shaping stock recommendations. Super Micro’s consistent performance and growth prospects have garnered positive sentiment, reinforcing the hold recommendation. Conversely, Lumen’s struggles have led to a more cautious outlook, prompting the sell recommendation. This divergence underscores the importance of aligning investment strategies with market realities and company fundamentals.

In conclusion, Wall Street’s verdict on Super Micro Computer and Lumen Technologies reflects a nuanced understanding of the AI sector’s opportunities and challenges. For investors, these recommendations serve as a guide to making informed decisions in a rapidly changing market. While Super Micro’s strong market position and growth potential warrant a hold, Lumen’s financial and strategic hurdles suggest a more cautious approach. As the AI industry continues to evolve, staying attuned to expert insights and market trends will be crucial for investors seeking to navigate the complexities of AI stocks successfully.

Future Outlook: What Wall Street’s Verdict Means for AI Stock Investors

In the rapidly evolving landscape of artificial intelligence (AI), investors are constantly seeking opportunities to capitalize on technological advancements. Wall Street analysts have recently turned their attention to two prominent players in the AI sector: Super Micro Computer and Lumen Technologies. While both companies are involved in AI, their trajectories and market positions have led to differing recommendations from financial experts. Understanding these recommendations can provide valuable insights for investors looking to navigate the complexities of AI stock investments.

Super Micro Computer, a company known for its high-performance computing solutions, has been at the forefront of AI hardware development. Its focus on delivering cutting-edge server technology has positioned it as a key player in the AI infrastructure market. Analysts have noted that Super Micro’s robust product lineup, which includes AI-optimized servers and storage solutions, aligns well with the increasing demand for AI-driven applications across various industries. This alignment has resulted in a favorable outlook from Wall Street, with many analysts recommending a “hold” position on the stock. The rationale behind this recommendation is rooted in the company’s strong market presence and its potential for sustained growth as AI adoption continues to expand.

On the other hand, Lumen Technologies, a telecommunications company with a growing interest in AI, has received a less optimistic verdict from Wall Street. Despite its efforts to integrate AI into its service offerings, Lumen has faced challenges in effectively capitalizing on the AI boom. Analysts have pointed out that the company’s core business model, which is heavily reliant on traditional telecommunications services, may not be as well-suited to leverage AI advancements as other tech-focused firms. Consequently, the recommendation to “sell” Lumen Technologies’ stock reflects concerns about its ability to compete in the rapidly changing AI landscape.

The contrasting recommendations for Super Micro Computer and Lumen Technologies highlight the importance of strategic positioning in the AI sector. For investors, these insights underscore the need to carefully evaluate a company’s core competencies and its ability to adapt to technological shifts. Super Micro’s focus on hardware solutions that directly support AI applications positions it favorably, while Lumen’s struggle to integrate AI into its existing framework raises questions about its long-term viability in the AI market.

Moreover, these recommendations also emphasize the broader trend of specialization within the AI industry. Companies that can effectively align their products and services with the specific needs of AI applications are more likely to succeed. This trend suggests that investors should prioritize firms with a clear strategic vision for AI integration, as well as those with a proven track record of innovation in this space.

In conclusion, Wall Street’s verdict on Super Micro Computer and Lumen Technologies serves as a valuable guide for AI stock investors. By recommending a “hold” for Super Micro and a “sell” for Lumen, analysts are signaling the importance of strategic alignment and specialization in the AI sector. As the AI landscape continues to evolve, investors should remain vigilant, focusing on companies that demonstrate a strong commitment to innovation and a clear understanding of the market dynamics. This approach will be crucial in navigating the opportunities and challenges presented by the ever-expanding world of artificial intelligence.

Q&A

1. **What is Wall Street’s recommendation for Super Micro Computer?**

Wall Street generally recommends holding Super Micro Computer due to its strong performance and growth potential in the AI sector.

2. **What is Wall Street’s recommendation for Lumen Technologies?**

Wall Street suggests selling Lumen Technologies because of its financial struggles and uncertain future in the AI market.

3. **Why is Super Micro Computer favored over Lumen Technologies?**

Super Micro Computer is favored due to its robust financial health, consistent growth, and strategic positioning in the AI hardware market.

4. **What are the financial concerns associated with Lumen Technologies?**

Lumen Technologies faces financial concerns such as declining revenues, high debt levels, and challenges in effectively capitalizing on AI opportunities.

5. **How has Super Micro Computer performed in the market recently?**

Super Micro Computer has shown strong market performance with significant revenue growth and positive investor sentiment.

6. **What strategic advantages does Super Micro Computer have?**

Super Micro Computer benefits from a strong product lineup, strategic partnerships, and a focus on high-performance computing solutions for AI applications.

7. **What challenges does Lumen Technologies face in the AI sector?**

Lumen Technologies struggles with integrating AI into its core business, competition from more agile tech companies, and a lack of clear strategic direction.

Conclusion

In evaluating Wall Street’s stance on Super Micro Computer and Lumen Technologies, the consensus suggests a strategic divergence in investment approaches. Super Micro Computer, with its robust growth trajectory and strong market positioning in the AI hardware sector, is recommended as a “hold,” reflecting confidence in its continued performance and potential for future gains. Conversely, Lumen Technologies faces challenges that have led to a “sell” recommendation, driven by concerns over its ability to effectively capitalize on AI opportunities and improve its financial outlook. Investors are advised to maintain their positions in Super Micro Computer while reconsidering their stakes in Lumen Technologies, aligning with the broader market sentiment that favors stability and growth potential in the AI industry.