“Wall Street Dips: High Flyers Like Nvidia Lose Altitude in a Shifting Market.”

Introduction

Wall Street experienced a notable dip as shares of Nvidia and other recent high-flying stocks lost momentum, reflecting growing concerns over market sustainability and economic conditions. Investors are grappling with the implications of rising interest rates, inflationary pressures, and potential regulatory changes, leading to a reevaluation of tech stocks that had previously driven market gains. This shift highlights the volatility inherent in the market, as traders reassess their positions in light of changing economic indicators and the performance of key players in the technology sector.

Wall Street Dips: Analyzing Nvidia’s Recent Decline

In recent trading sessions, Wall Street has experienced a notable dip, primarily driven by the decline of Nvidia and other high-flying technology stocks that have dominated the market in recent months. Nvidia, a leader in graphics processing units (GPUs) and artificial intelligence (AI) technology, has been a significant contributor to the market’s upward trajectory. However, as investor sentiment shifts, the stock has begun to lose momentum, prompting a broader reevaluation of tech stocks that had previously been considered safe bets.

The decline in Nvidia’s stock price can be attributed to several factors, including profit-taking by investors who have seen substantial gains over the past year. After a remarkable surge fueled by the AI boom, many investors are now reassessing their positions, leading to increased selling pressure. This profit-taking is not isolated to Nvidia; it reflects a broader trend among high-growth technology stocks that have seen their valuations soar to unprecedented levels. As a result, the market is witnessing a recalibration of expectations, with investors becoming more cautious about the sustainability of such rapid growth.

Moreover, Nvidia’s recent earnings report, while still impressive, raised concerns among analysts regarding future growth prospects. Although the company reported strong revenue and earnings, some investors were disappointed by guidance that suggested a potential slowdown in demand for its products. This cautious outlook has led to increased volatility in Nvidia’s stock, as market participants grapple with the implications of a cooling demand environment. Consequently, the stock’s decline has had a ripple effect across the technology sector, as other companies that benefited from similar trends are also experiencing downward pressure.

In addition to company-specific factors, macroeconomic conditions are also playing a crucial role in shaping investor sentiment. Rising interest rates and inflationary pressures have created an environment of uncertainty, prompting investors to reassess their risk exposure. As the Federal Reserve continues to signal its commitment to combating inflation, the prospect of higher borrowing costs looms large over growth-oriented stocks. This shift in monetary policy has led to a flight to safety, with investors gravitating towards more stable, dividend-paying stocks rather than high-growth technology names that are more sensitive to interest rate fluctuations.

Furthermore, geopolitical tensions and supply chain disruptions have added another layer of complexity to the market landscape. As companies navigate these challenges, the potential for earnings misses or downward revisions has increased, further contributing to the cautious sentiment among investors. In this context, Nvidia’s recent decline serves as a reminder of the inherent volatility in the technology sector, where rapid growth can quickly give way to sharp corrections.

As Wall Street grapples with these dynamics, it is essential for investors to remain vigilant and informed. The recent dip in Nvidia’s stock and the broader technology sector underscores the importance of diversification and a balanced investment approach. While high-growth stocks can offer significant upside potential, they also come with heightened risks, particularly in an environment characterized by uncertainty. As the market continues to evolve, investors must carefully consider their strategies and be prepared for potential fluctuations in stock prices.

In conclusion, the recent decline of Nvidia and other high-flying technology stocks has contributed to a broader dip in Wall Street, reflecting a complex interplay of profit-taking, macroeconomic factors, and geopolitical challenges. As the market navigates these turbulent waters, investors are reminded of the importance of maintaining a diversified portfolio and staying attuned to changing market conditions.

High Flyers Losing Momentum: The Impact on Market Trends

In recent weeks, Wall Street has experienced a notable dip, primarily driven by the waning momentum of several high-flying stocks, particularly Nvidia. As a leader in the semiconductor industry, Nvidia has been a significant contributor to the market’s upward trajectory over the past few years, largely due to its pivotal role in artificial intelligence and gaming technologies. However, as the stock begins to lose its luster, it raises questions about the broader implications for market trends and investor sentiment.

The decline in Nvidia’s stock price is emblematic of a larger trend affecting other high-growth companies that have dominated the market in recent times. These stocks, often characterized by their rapid growth and high valuations, have been under pressure as investors reassess their risk appetite in an environment marked by rising interest rates and inflationary concerns. Consequently, as these high flyers lose momentum, the market is witnessing a shift in investor focus, moving away from growth-oriented stocks toward more stable, value-oriented investments.

This transition is not merely a reaction to Nvidia’s performance; it reflects a broader recalibration of market expectations. Investors are increasingly wary of the sustainability of the extraordinary growth rates that many tech companies have enjoyed. As a result, there is a growing sentiment that the market may have been overly optimistic about the future earnings potential of these high-flying stocks. This skepticism is further compounded by macroeconomic factors, including tightening monetary policy and geopolitical uncertainties, which have contributed to a more cautious investment climate.

Moreover, the decline in high-flying stocks has implications for market indices that are heavily weighted toward technology. The Nasdaq Composite, for instance, has seen significant volatility as it grapples with the fallout from these losses. As tech stocks falter, the overall market sentiment can shift, leading to broader sell-offs and increased volatility across various sectors. This phenomenon underscores the interconnectedness of the market, where the performance of a few key players can significantly influence the trajectory of the entire market.

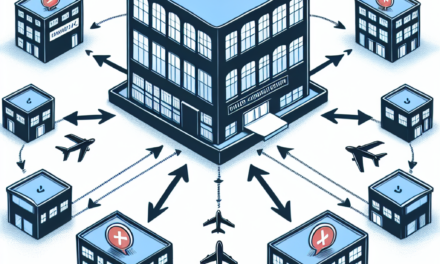

In light of these developments, investors are increasingly seeking diversification to mitigate risks associated with concentrated positions in high-growth stocks. This shift toward a more balanced portfolio may involve reallocating funds to sectors that are perceived as more resilient in the face of economic headwinds, such as consumer staples, utilities, and healthcare. These sectors tend to offer more stable earnings and dividends, making them attractive alternatives during periods of market uncertainty.

Furthermore, as high flyers like Nvidia lose momentum, it is essential for investors to remain vigilant and adaptable. The market is inherently cyclical, and while current trends may suggest a downturn for certain stocks, opportunities for growth may arise in unexpected places. By maintaining a long-term perspective and focusing on fundamental analysis, investors can navigate the complexities of the market more effectively.

In conclusion, the recent dip in Wall Street, driven by the loss of momentum among high-flying stocks like Nvidia, serves as a reminder of the dynamic nature of the financial markets. As investors reassess their strategies in light of changing market conditions, the focus is likely to shift toward more stable investments. This evolution not only reflects a response to immediate challenges but also highlights the importance of adaptability in an ever-changing economic landscape. Ultimately, the ability to pivot and identify new opportunities will be crucial for investors seeking to thrive in this environment.

Understanding the Factors Behind Wall Street’s Volatility

Wall Street’s recent fluctuations can be attributed to a confluence of factors that have contributed to the volatility observed in the markets. As investors closely monitor the performance of high-profile stocks, such as Nvidia, which has been a significant driver of market enthusiasm, the recent dip underscores the fragility of investor sentiment. The decline in these high-flying stocks signals a broader concern regarding the sustainability of their meteoric rises, prompting a reevaluation of their valuations in light of changing economic conditions.

One of the primary factors influencing Wall Street’s volatility is the shifting landscape of interest rates. The Federal Reserve’s monetary policy decisions play a crucial role in shaping investor expectations. As inflationary pressures persist, the central bank has signaled its intent to maintain a hawkish stance, which has led to increased speculation about future rate hikes. Higher interest rates typically dampen consumer spending and business investment, creating a ripple effect that can negatively impact corporate earnings. Consequently, as investors grapple with the implications of a tightening monetary policy, they may become more risk-averse, leading to sell-offs in previously high-flying stocks.

Moreover, the broader economic environment is also a significant contributor to market fluctuations. Recent economic data has shown signs of slowing growth, raising concerns about a potential recession. For instance, indicators such as consumer confidence and manufacturing output have exhibited weakness, prompting investors to reassess their outlook for corporate profitability. In this context, stocks that have enjoyed substantial gains in recent months, like Nvidia, may be viewed with increased skepticism. As a result, the market’s reaction to economic data releases has become more pronounced, with investors reacting swiftly to any signs of deterioration.

In addition to macroeconomic factors, geopolitical tensions have also played a role in shaping market sentiment. Ongoing conflicts and trade disputes can create uncertainty, leading investors to adopt a more cautious approach. For instance, tensions between major economies can disrupt supply chains and impact global trade, which in turn affects corporate earnings. As companies navigate these challenges, investors may become wary of the potential for negative surprises, prompting them to reevaluate their positions in high-growth stocks.

Furthermore, the recent surge in interest rates has led to a recalibration of risk across various sectors. Investors are increasingly discerning when it comes to growth prospects, favoring companies with solid fundamentals over those that have relied heavily on speculative growth narratives. This shift in focus can lead to a rotation out of high-flying tech stocks and into more stable, value-oriented investments. As a result, the market may experience heightened volatility as investors adjust their portfolios in response to changing economic realities.

In conclusion, the recent dip in Wall Street, particularly among stocks like Nvidia, can be attributed to a complex interplay of factors, including interest rate dynamics, economic indicators, geopolitical tensions, and shifts in investor sentiment. As the market continues to navigate these challenges, it is essential for investors to remain vigilant and adaptable. Understanding the underlying factors driving volatility can provide valuable insights into market behavior, enabling investors to make informed decisions in an ever-changing landscape. Ultimately, the ability to anticipate and respond to these fluctuations will be crucial for navigating the uncertainties that lie ahead.

Nvidia’s Performance: A Case Study in Market Fluctuations

Nvidia’s recent performance serves as a compelling case study in the broader context of market fluctuations, particularly as it reflects the volatility experienced by high-flying stocks. Over the past few years, Nvidia has emerged as a leader in the semiconductor industry, driven by its pivotal role in powering artificial intelligence (AI) applications and gaming technologies. However, as the market evolves, even the most robust companies can experience significant dips, highlighting the unpredictable nature of stock performance.

In the wake of Nvidia’s meteoric rise, fueled by soaring demand for its graphics processing units (GPUs), investors have been closely monitoring its stock price. The company’s innovative products have positioned it at the forefront of the AI revolution, leading to unprecedented growth and a surge in market capitalization. Yet, despite these achievements, Nvidia’s stock has recently encountered headwinds, reflecting a broader trend among technology stocks that have previously enjoyed substantial gains. This shift raises questions about the sustainability of such rapid growth and the factors that contribute to market corrections.

One of the primary drivers behind Nvidia’s recent decline can be attributed to changing investor sentiment. As the market grapples with concerns over inflation, interest rates, and potential economic slowdowns, investors are becoming increasingly cautious. This shift in sentiment has led to a reevaluation of high-growth stocks, which are often perceived as riskier investments in uncertain economic climates. Consequently, Nvidia, despite its strong fundamentals, has not been immune to this broader market trend, illustrating how external factors can significantly impact even the most successful companies.

Moreover, Nvidia’s performance is also influenced by competitive pressures within the semiconductor industry. As more companies enter the AI and gaming markets, the competitive landscape becomes increasingly crowded. This influx of competition can lead to pricing pressures and reduced margins, which may affect investor confidence. As a result, Nvidia’s stock price has experienced fluctuations that reflect not only its internal performance but also the dynamics of the industry as a whole.

Additionally, the cyclical nature of the technology sector plays a crucial role in Nvidia’s stock performance. Historically, technology stocks have experienced boom-and-bust cycles, often driven by shifts in consumer demand and technological advancements. As the market transitions from a period of rapid growth to a more cautious phase, Nvidia’s stock may be subject to the same cyclical pressures that have affected its peers. This cyclical behavior underscores the importance of understanding market trends and the potential for volatility, even among industry leaders.

In conclusion, Nvidia’s recent performance exemplifies the complexities of market fluctuations and the myriad factors that can influence stock prices. While the company has established itself as a key player in the semiconductor industry, its stock is not immune to the broader economic landscape and competitive pressures. As investors navigate these turbulent waters, it becomes increasingly clear that even high-flying stocks like Nvidia can experience significant dips. This reality serves as a reminder of the inherent risks associated with investing in the stock market, particularly in sectors characterized by rapid innovation and change. Ultimately, Nvidia’s case highlights the importance of a nuanced understanding of market dynamics and the need for investors to remain vigilant in their assessments of both individual stocks and the broader economic environment.

The Role of Investor Sentiment in Wall Street Dips

Investor sentiment plays a crucial role in the fluctuations of Wall Street, particularly during periods when high-flying stocks, such as Nvidia, begin to lose momentum. As market participants react to news, earnings reports, and broader economic indicators, their collective mood can significantly influence stock prices and overall market performance. When investor sentiment turns negative, even fundamentally strong companies can experience declines, as fear and uncertainty overshadow their potential for growth.

In recent weeks, the decline in stocks like Nvidia has been emblematic of a broader shift in investor sentiment. Initially, these companies enjoyed a surge in stock prices driven by optimism surrounding technological advancements and robust earnings. However, as the market began to digest the implications of rising interest rates and potential economic slowdowns, the mood shifted. Investors, once eager to chase high-growth stocks, became more cautious, leading to a reevaluation of their portfolios. This shift is often exacerbated by external factors, such as geopolitical tensions or inflationary pressures, which can further dampen investor confidence.

Moreover, the psychological aspect of investing cannot be understated. When stocks that were once considered safe bets begin to falter, it can trigger a wave of selling as investors rush to minimize losses. This herd mentality often leads to a self-fulfilling prophecy, where the mere perception of weakness in a stock can lead to actual declines in its price. Consequently, as Nvidia and similar stocks faced headwinds, the resulting dip in their valuations contributed to a broader downturn on Wall Street, as investors reassessed their risk tolerance and sought to protect their capital.

Additionally, the role of social media and instant communication cannot be overlooked in today’s investment landscape. News spreads rapidly, and investor sentiment can shift almost overnight based on the latest headlines or social media trends. This immediacy can amplify market reactions, as seen in the recent volatility surrounding high-profile tech stocks. When negative news or sentiment circulates, it can lead to panic selling, further exacerbating the downward pressure on stock prices. Conversely, positive news can lead to rapid rebounds, highlighting the fickle nature of investor sentiment.

As Wall Street grapples with these dynamics, it becomes evident that understanding investor sentiment is essential for navigating market fluctuations. Analysts and investors alike must pay close attention to the mood of the market, as it can provide valuable insights into potential trends and reversals. For instance, indicators such as the Fear and Greed Index can offer a glimpse into the prevailing sentiment, helping investors make informed decisions about when to enter or exit positions.

In conclusion, the recent dips on Wall Street, particularly in high-flying stocks like Nvidia, underscore the significant impact of investor sentiment on market dynamics. As fear and uncertainty take hold, even the most promising companies can experience declines, driven by the collective actions of market participants. Understanding this interplay between sentiment and stock performance is vital for investors seeking to navigate the complexities of the financial markets. By recognizing the psychological factors at play, investors can better position themselves to respond to market shifts and make informed decisions in an ever-evolving landscape.

Strategies for Navigating Market Corrections

In the ever-evolving landscape of financial markets, investors often find themselves grappling with the challenges posed by market corrections. As Wall Street experiences dips, particularly following the decline of high-flying stocks like Nvidia, it becomes imperative for investors to adopt effective strategies to navigate these turbulent waters. Understanding the nature of market corrections is crucial, as they can serve as both a risk and an opportunity for those who are prepared.

One of the first strategies to consider during a market correction is diversification. By spreading investments across various asset classes, sectors, and geographic regions, investors can mitigate the impact of a downturn in any single area. This approach not only reduces risk but also positions investors to capitalize on potential rebounds in other sectors. For instance, while technology stocks may be experiencing a downturn, sectors such as consumer staples or utilities may remain resilient, providing a buffer against losses.

In addition to diversification, maintaining a long-term perspective is essential. Market corrections can evoke emotional responses, leading to impulsive decisions that may not align with an investor’s overall strategy. By focusing on long-term goals and adhering to a well-defined investment plan, individuals can avoid the pitfalls of panic selling. Historical data shows that markets tend to recover over time, and those who remain committed to their investment strategies often reap the benefits of eventual rebounds.

Moreover, investors should consider employing dollar-cost averaging as a strategy during market corrections. This technique involves consistently investing a fixed amount of money at regular intervals, regardless of market conditions. By doing so, investors can take advantage of lower prices during downturns, ultimately lowering their average cost per share. This disciplined approach not only helps to mitigate the effects of volatility but also fosters a sense of routine and stability in an otherwise unpredictable environment.

Another important strategy is to conduct thorough research and reassess the fundamentals of the investments in one’s portfolio. Market corrections can reveal underlying weaknesses in certain stocks or sectors, prompting investors to evaluate whether their holdings still align with their investment thesis. By staying informed about market trends, economic indicators, and company performance, investors can make more informed decisions about whether to hold, sell, or buy additional shares during a correction.

Furthermore, it is crucial to maintain liquidity during market corrections. Having readily accessible cash or cash-equivalents allows investors to take advantage of buying opportunities that may arise when prices are depressed. This flexibility can be particularly beneficial for those looking to acquire high-quality assets at a discount, positioning themselves for future growth as the market recovers.

Lastly, seeking professional advice can be invaluable during periods of market volatility. Financial advisors can provide insights tailored to individual circumstances, helping investors navigate complex decisions and develop strategies that align with their risk tolerance and financial goals. By leveraging the expertise of professionals, investors can enhance their ability to weather market corrections and emerge stronger on the other side.

In conclusion, while market corrections can be unsettling, they also present opportunities for those who are prepared. By diversifying investments, maintaining a long-term perspective, employing dollar-cost averaging, conducting thorough research, ensuring liquidity, and seeking professional guidance, investors can effectively navigate these challenging periods. Ultimately, a proactive and informed approach can help individuals not only survive market corrections but also thrive in the long run.

Future Outlook: Will Nvidia and Other High Flyers Rebound?

As Wall Street grapples with recent fluctuations, the question of whether Nvidia and other high-flying stocks will rebound looms large in the minds of investors and analysts alike. The recent dip in the market, particularly among technology stocks that had previously soared, raises concerns about the sustainability of their growth trajectories. Nvidia, a leader in graphics processing units and artificial intelligence technology, has been a focal point of this discussion, given its remarkable ascent over the past few years. However, as the stock experiences a pullback, it prompts a broader examination of the factors influencing its future performance.

To begin with, it is essential to consider the underlying fundamentals that have propelled Nvidia and similar companies to their current heights. The surge in demand for AI technologies and advanced computing solutions has been a significant driver of growth. Nvidia’s innovations in these areas have positioned it as a key player in the tech landscape. Nevertheless, as the market adjusts to changing economic conditions, including rising interest rates and inflationary pressures, the sustainability of such growth becomes increasingly uncertain. Investors are now tasked with evaluating whether the current valuation levels of these high-flying stocks are justified in light of potential economic headwinds.

Moreover, the competitive landscape is evolving rapidly. While Nvidia has maintained a strong market position, other companies are aggressively entering the AI and semiconductor sectors, seeking to capture market share. This intensifying competition could impact Nvidia’s growth prospects, particularly if rivals introduce compelling alternatives or if technological advancements shift the focus away from Nvidia’s core offerings. Consequently, investors must remain vigilant and consider how these dynamics may influence Nvidia’s ability to maintain its competitive edge.

In addition to competitive pressures, macroeconomic factors play a crucial role in shaping the future outlook for Nvidia and its peers. The Federal Reserve’s monetary policy decisions, particularly regarding interest rates, will significantly impact investor sentiment and market liquidity. If the Fed continues to raise rates to combat inflation, it could lead to a tightening of financial conditions, which may disproportionately affect growth stocks like Nvidia. As a result, the market’s appetite for riskier assets could diminish, leading to further volatility in stock prices.

Furthermore, the global supply chain disruptions that have plagued various industries, including semiconductors, cannot be overlooked. Nvidia’s ability to meet demand for its products hinges on a stable supply chain, and any disruptions could hinder its growth potential. As companies worldwide strive to mitigate these challenges, the effectiveness of their strategies will be critical in determining how quickly they can return to pre-pandemic levels of production and efficiency.

In light of these considerations, the future outlook for Nvidia and other high flyers remains uncertain. While the potential for a rebound exists, it is contingent upon several factors, including the company’s ability to innovate, navigate competitive pressures, and adapt to changing economic conditions. Investors must weigh these elements carefully, recognizing that the path forward may be fraught with challenges. Ultimately, the resilience of Nvidia and its peers will be tested in the coming months, and their ability to respond to these challenges will be pivotal in shaping their trajectories in an ever-evolving market landscape. As such, the question of whether these high flyers will rebound is not merely a matter of speculation but rather a complex interplay of various economic and competitive factors that will unfold over time.

Q&A

1. **What caused the recent dip in Wall Street?**

– The dip was primarily driven by a loss of momentum in high-flying stocks like Nvidia, which had previously seen significant gains.

2. **Which sectors were most affected by the dip?**

– Technology and growth sectors were most affected, particularly companies that had experienced rapid price increases.

3. **How did Nvidia’s performance impact the market?**

– Nvidia’s decline in stock price contributed to broader market concerns, as it was seen as a bellwether for tech stocks.

4. **What economic factors contributed to the market’s downturn?**

– Rising interest rates, inflation concerns, and potential economic slowdown contributed to investor anxiety and market volatility.

5. **Were there any specific events that triggered the sell-off?**

– Earnings reports and guidance from major tech companies, including Nvidia, indicated slower growth, prompting investors to reassess valuations.

6. **How did investors react to the dip?**

– Many investors shifted to safer assets, leading to increased volatility and a flight to quality in the bond market.

7. **What is the outlook for Wall Street following this dip?**

– Analysts suggest that while some volatility may continue, long-term fundamentals remain strong, and a recovery could be on the horizon if economic conditions stabilize.

Conclusion

The recent dip in Wall Street, driven by Nvidia and other high-flying stocks losing momentum, highlights the volatility and shifting investor sentiment in the market. As these previously strong performers face challenges, it underscores the importance of diversification and caution in investment strategies. The market’s reaction suggests a potential recalibration of expectations, emphasizing the need for investors to remain vigilant and adaptable in a rapidly changing economic landscape.