“UST and LUNA: From Blockchain Brilliance to Crypto Catastrophe”

Introduction

The story of UST and LUNA is a compelling narrative of ambition, innovation, and volatility within the cryptocurrency landscape. TerraUSD (UST) and LUNA were integral components of the Terra blockchain ecosystem, which aimed to revolutionize digital finance by offering a stablecoin solution that was algorithmically pegged to the US dollar. UST was designed to maintain its value through a unique mechanism involving LUNA, the native token of the Terra network, which absorbed market volatility and ensured price stability. This innovative approach initially garnered significant attention and investment, propelling the Terra ecosystem to the forefront of the crypto world. However, the rapid ascent was met with unforeseen challenges, as market dynamics and systemic vulnerabilities led to a dramatic collapse. The fall of UST and LUNA serves as a cautionary tale about the complexities and risks inherent in the burgeoning field of decentralized finance.

Understanding UST: The Stablecoin That Promised Stability

In the rapidly evolving world of cryptocurrencies, stablecoins have emerged as a crucial component, offering a semblance of stability in an otherwise volatile market. Among these, UST, or TerraUSD, was introduced with the promise of maintaining a stable value pegged to the US dollar. Unlike traditional stablecoins that rely on fiat reserves, UST was part of an innovative algorithmic model designed to maintain its peg through a symbiotic relationship with another cryptocurrency, LUNA. This unique mechanism was intended to provide a decentralized solution to the stability issues faced by other stablecoins, thereby attracting significant attention from investors and developers alike.

The underlying principle of UST’s stability was its algorithmic relationship with LUNA, the native token of the Terra blockchain. Essentially, the system allowed users to mint UST by burning an equivalent value of LUNA, and vice versa. This arbitrage mechanism was designed to ensure that the supply and demand of UST remained balanced, thereby maintaining its peg to the dollar. For instance, if UST’s price fell below one dollar, users could profit by buying UST at a lower price and exchanging it for LUNA, which would then be burned, reducing the supply of UST and driving its price back up. Conversely, if UST’s price exceeded one dollar, users could mint more UST by burning LUNA, increasing the supply and bringing the price back down.

This innovative approach initially garnered significant success, with UST becoming one of the most popular stablecoins in the market. Its decentralized nature and the promise of stability without the need for traditional fiat reserves appealed to a wide range of users, from individual investors to large-scale decentralized finance (DeFi) platforms. Moreover, the Terra ecosystem, with its suite of applications and services, further bolstered the adoption of UST, as it became an integral part of various financial products and services.

However, despite its initial success, the algorithmic model that underpinned UST’s stability also posed inherent risks. The reliance on market dynamics and arbitrage opportunities meant that the system was vulnerable to extreme market conditions. In times of significant market stress or speculative attacks, the delicate balance between UST and LUNA could be disrupted, leading to a potential de-pegging of UST from the dollar. This risk was exacerbated by the fact that the value of LUNA itself was subject to market volatility, which could undermine the stability of UST.

As the market continued to evolve, these vulnerabilities became increasingly apparent. The collapse of UST’s peg in May 2022 served as a stark reminder of the challenges faced by algorithmic stablecoins. A combination of market panic and speculative attacks led to a rapid devaluation of LUNA, which in turn triggered a downward spiral for UST. The failure of the arbitrage mechanism to restore the peg resulted in significant losses for investors and raised questions about the viability of algorithmic stablecoins as a whole.

In conclusion, while UST’s innovative approach to stability offered a glimpse into the potential future of decentralized finance, its eventual downfall highlighted the inherent risks associated with algorithmic models. The rise and fall of UST and LUNA serve as a cautionary tale for the cryptocurrency industry, emphasizing the need for robust mechanisms and safeguards to ensure stability in an ever-changing market landscape. As the industry continues to mature, the lessons learned from UST’s journey will undoubtedly shape the development of future stablecoin models, as developers and investors seek to balance innovation with stability and security.

The Birth of LUNA: A Vision for Decentralized Finance

The inception of LUNA, the native cryptocurrency of the Terra blockchain, marked a significant milestone in the realm of decentralized finance (DeFi). Conceived by Terraform Labs, LUNA was designed to support a suite of stablecoins, with TerraUSD (UST) being the most prominent. The vision behind LUNA was to create a decentralized financial ecosystem that could offer stability and scalability, addressing the volatility issues that plagued many cryptocurrencies. This vision was rooted in the belief that a decentralized stablecoin could facilitate seamless transactions and foster broader adoption of blockchain technology.

LUNA’s role within the Terra ecosystem was multifaceted. Primarily, it served as a collateral asset to maintain the stability of UST. The mechanism was ingeniously simple yet complex in its execution: when the demand for UST increased, LUNA would be burned to mint more UST, and conversely, when the demand decreased, UST would be burned to mint LUNA. This algorithmic approach aimed to keep UST pegged to the US dollar, ensuring its utility as a stable medium of exchange. The dual-token model was lauded for its innovative approach to achieving price stability without relying on traditional collateral reserves.

As the Terra ecosystem expanded, LUNA gained traction among investors and developers alike. The promise of a decentralized stablecoin that could operate efficiently across various blockchain applications attracted significant interest. Moreover, the Terra blockchain’s ability to facilitate fast and low-cost transactions further bolstered its appeal. This growing interest was reflected in LUNA’s market performance, as its value surged, capturing the attention of the broader crypto community. The rise of LUNA was emblematic of the burgeoning DeFi movement, which sought to democratize finance by eliminating intermediaries and empowering users.

However, the rapid ascent of LUNA and UST was not without challenges. The algorithmic stability mechanism, while innovative, was inherently risky. It relied heavily on market confidence and the continuous interplay between LUNA and UST. Any disruption in this delicate balance could lead to significant volatility, undermining the very stability that UST was designed to provide. Despite these risks, the Terra ecosystem continued to grow, with new projects and partnerships further solidifying its position in the DeFi landscape.

Nevertheless, the vulnerabilities of the algorithmic model eventually came to the fore. As market conditions shifted and external pressures mounted, the stability mechanism faced unprecedented stress. The intricate balance between LUNA and UST began to falter, leading to a cascade of events that ultimately resulted in the de-pegging of UST from the US dollar. This de-pegging triggered a loss of confidence, causing a sharp decline in the value of both UST and LUNA. The once-promising crypto empire faced a dramatic fall, highlighting the inherent risks associated with algorithmic stablecoins.

In retrospect, the rise and fall of LUNA and UST serve as a cautionary tale for the DeFi sector. While the vision of a decentralized financial ecosystem remains compelling, the challenges encountered by Terra underscore the need for robust mechanisms to ensure stability and resilience. As the crypto industry continues to evolve, the lessons learned from the Terra saga will undoubtedly inform future innovations, guiding the development of more secure and sustainable decentralized financial solutions.

The UST-LUNA Mechanism: How It Was Supposed to Work

The UST-LUNA mechanism was designed as an innovative approach to creating a stable and decentralized cryptocurrency ecosystem. At its core, the system aimed to maintain the stability of TerraUSD (UST), a stablecoin pegged to the US dollar, through a symbiotic relationship with LUNA, the native token of the Terra blockchain. This mechanism was intended to address the volatility often associated with cryptocurrencies, offering a reliable medium of exchange and store of value. To understand how this mechanism was supposed to work, it is essential to delve into the intricacies of its design and the roles played by both UST and LUNA.

The primary function of UST was to serve as a stable digital currency, maintaining a 1:1 peg with the US dollar. This stability was crucial for fostering trust and encouraging widespread adoption. The mechanism to achieve this stability relied on the dynamic interplay between UST and LUNA. Essentially, the system was designed to use market forces to maintain the peg, with LUNA acting as a buffer to absorb volatility. When the price of UST deviated from its peg, arbitrage opportunities would arise, incentivizing market participants to restore balance.

For instance, if the price of UST fell below one dollar, users could purchase UST at a discount and exchange it for one dollar’s worth of LUNA. This process would reduce the supply of UST, driving its price back up to the desired level. Conversely, if UST traded above one dollar, users could exchange one dollar’s worth of LUNA for UST, increasing its supply and bringing the price back down. This arbitrage mechanism was designed to be self-correcting, leveraging the decentralized nature of the blockchain to ensure stability without the need for centralized intervention.

Moreover, the relationship between UST and LUNA was further reinforced by the staking and governance features of the Terra blockchain. LUNA holders could stake their tokens to participate in network governance and earn rewards, creating an incentive to support the ecosystem’s stability. This alignment of interests was intended to foster a robust and resilient community, capable of weathering market fluctuations and external shocks.

However, the success of this mechanism was contingent upon several assumptions. It relied on the continuous demand for UST and the willingness of market participants to engage in arbitrage activities. Additionally, the system assumed that the value of LUNA would remain sufficiently robust to absorb fluctuations in UST demand. These assumptions, while theoretically sound, were ultimately put to the test in the real world.

In practice, the UST-LUNA mechanism faced significant challenges. Market dynamics, regulatory pressures, and unforeseen events exposed vulnerabilities in the system, leading to a loss of confidence and a subsequent collapse. The intricate balance between UST and LUNA, once seen as a strength, became a point of fragility. As the value of LUNA plummeted, the mechanism designed to stabilize UST faltered, resulting in a downward spiral that eroded trust and value.

In conclusion, the UST-LUNA mechanism was an ambitious attempt to create a stable and decentralized cryptocurrency ecosystem. While its design was innovative, the real-world complexities and inherent risks ultimately led to its downfall. The rise and fall of this crypto empire serve as a cautionary tale, highlighting the challenges of maintaining stability in a volatile and rapidly evolving market.

Market Dynamics: Factors Leading to UST and LUNA’s Popularity

The rise and fall of UST and LUNA, two prominent cryptocurrencies, serve as a compelling case study in the volatile world of digital assets. Understanding the factors that contributed to their initial popularity requires an examination of the market dynamics that propelled them to the forefront of the crypto space. At the heart of their ascent was the innovative approach to decentralized finance (DeFi) that these cryptocurrencies embodied, capturing the imagination of investors and developers alike.

Initially, UST, a stablecoin, and LUNA, its sister token, were part of the Terra blockchain ecosystem, which aimed to create a more efficient and scalable financial infrastructure. The allure of UST lay in its promise of stability, pegged to the US dollar, which provided a reliable medium of exchange in the otherwise volatile crypto market. This stability was achieved through an algorithmic mechanism involving LUNA, which absorbed market volatility and maintained UST’s peg. Consequently, this innovative approach attracted a significant number of users seeking a stable yet decentralized alternative to traditional fiat currencies.

Moreover, the Terra ecosystem’s focus on real-world applications further fueled the popularity of UST and LUNA. By facilitating seamless cross-border transactions and offering lower fees compared to traditional financial systems, Terra positioned itself as a viable solution for global commerce. This practical utility resonated with businesses and consumers, driving adoption and increasing demand for both UST and LUNA. Additionally, the ecosystem’s integration with various DeFi platforms and decentralized applications (dApps) expanded its reach, attracting a diverse user base interested in leveraging the benefits of blockchain technology.

Another critical factor contributing to the rise of UST and LUNA was the strategic partnerships and collaborations that Terra forged within the crypto industry. By aligning with prominent exchanges and financial institutions, Terra enhanced its credibility and visibility, making it easier for users to access and trade its tokens. These partnerships also facilitated liquidity, a crucial component for any cryptocurrency’s success, ensuring that UST and LUNA could be easily bought and sold across multiple platforms.

Furthermore, the community-driven nature of the Terra ecosystem played a significant role in its initial success. The active involvement of developers, investors, and users in governance and decision-making processes fostered a sense of ownership and commitment to the project’s growth. This collaborative environment encouraged innovation and experimentation, leading to the development of new features and improvements that kept the ecosystem dynamic and competitive.

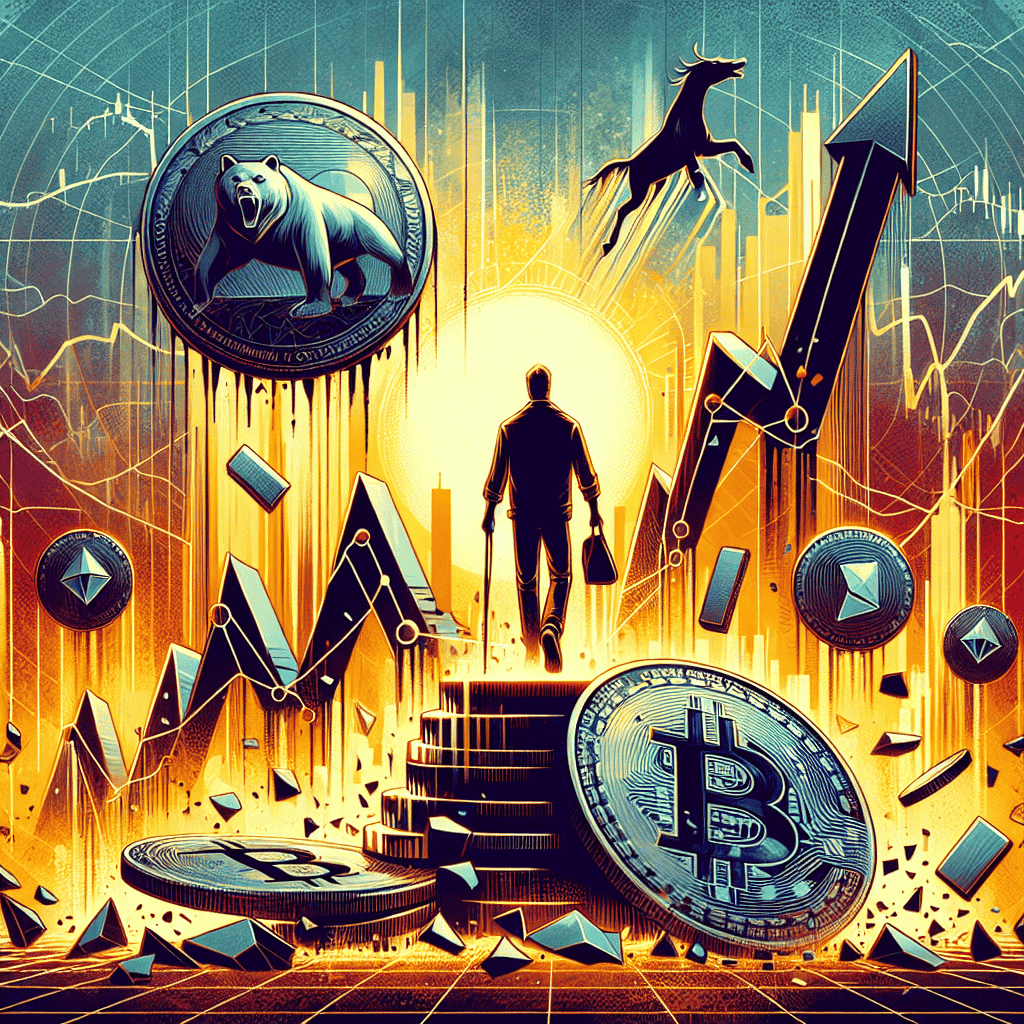

However, despite these favorable market dynamics, the very mechanisms that contributed to UST and LUNA’s rise also sowed the seeds of their downfall. The algorithmic stability model, while innovative, was inherently risky and vulnerable to market fluctuations. As the crypto market experienced increased volatility, the mechanisms designed to maintain UST’s peg came under immense pressure, ultimately leading to a loss of confidence among investors. This loss of confidence triggered a downward spiral, as users rushed to exit their positions, exacerbating the instability and leading to a dramatic collapse in value.

In conclusion, the rise and fall of UST and LUNA highlight the complex interplay of innovation, market dynamics, and risk in the cryptocurrency space. While their initial popularity was driven by a combination of technological advancements, practical applications, strategic partnerships, and community engagement, the inherent risks of their stability model ultimately led to their downfall. This case serves as a poignant reminder of the challenges and uncertainties that accompany the pursuit of innovation in the rapidly evolving world of digital finance.

The Collapse: Key Events That Led to the Downfall

The collapse of the Terra ecosystem, particularly its native tokens UST and LUNA, marked a significant turning point in the cryptocurrency landscape. This downfall was not a sudden event but rather the culmination of a series of key events and decisions that ultimately led to the unraveling of what was once considered a promising crypto empire. Understanding these events provides valuable insights into the vulnerabilities and challenges inherent in the rapidly evolving world of digital currencies.

The Terra ecosystem, founded by Do Kwon and Daniel Shin, initially gained traction due to its innovative approach to creating a stablecoin, UST, which was algorithmically pegged to the US dollar. Unlike traditional stablecoins backed by fiat reserves, UST relied on a complex algorithmic mechanism involving its sister token, LUNA, to maintain its peg. This mechanism was designed to absorb market volatility and ensure stability, a concept that attracted significant attention and investment.

However, the first signs of trouble emerged when the broader cryptocurrency market began to experience heightened volatility. As the market fluctuated, the demand for UST increased, leading to a corresponding increase in the supply of LUNA. This expansion in LUNA’s supply was intended to stabilize UST’s value, but it inadvertently set the stage for a potential crisis. The reliance on LUNA’s market value to maintain UST’s peg created a feedback loop that was vulnerable to external shocks.

The situation worsened when a series of large-scale withdrawals from the Anchor Protocol, a decentralized finance platform offering high yields on UST deposits, triggered a liquidity crisis. Anchor had been a major driver of UST’s adoption, but its unsustainable interest rates raised concerns about the long-term viability of the ecosystem. As investors rushed to withdraw their funds, the pressure on UST’s peg intensified, leading to a loss of confidence in the stablecoin’s ability to maintain its value.

Compounding these issues was the lack of transparency and communication from Terra’s leadership during the crisis. As UST began to de-peg from the dollar, panic spread among investors, exacerbating the sell-off of both UST and LUNA. The algorithmic mechanism, which was supposed to stabilize UST, failed to cope with the rapid outflows, resulting in a downward spiral that saw LUNA’s value plummet to near-zero levels.

In the aftermath of the collapse, regulatory scrutiny intensified, with authorities questioning the viability and safety of algorithmic stablecoins. The Terra debacle highlighted the risks associated with complex financial engineering in the crypto space, prompting calls for stricter oversight and clearer guidelines to protect investors. Moreover, the incident underscored the importance of transparency and effective communication from project leaders, as the lack of timely information contributed to the panic and subsequent market collapse.

In conclusion, the downfall of UST and LUNA serves as a cautionary tale for the cryptocurrency industry. It illustrates the potential pitfalls of relying on algorithmic mechanisms without adequate safeguards and the critical need for robust risk management strategies. As the crypto market continues to evolve, the lessons learned from Terra’s collapse will likely shape future developments and regulatory approaches, emphasizing the importance of stability, transparency, and investor protection in building a sustainable digital financial ecosystem.

Lessons Learned: What the Crypto Community Can Take Away

The dramatic rise and fall of UST and LUNA serve as a poignant case study for the cryptocurrency community, offering a wealth of lessons that can guide future endeavors in the digital asset space. The story of these two intertwined cryptocurrencies is a testament to both the potential and the pitfalls inherent in the rapidly evolving world of decentralized finance. As the crypto community reflects on this saga, several key takeaways emerge that are crucial for the sustainable development of blockchain-based projects.

First and foremost, the collapse of UST and LUNA underscores the importance of robust risk management strategies. The algorithmic stablecoin model employed by UST, which relied on the minting and burning of LUNA to maintain its peg to the US dollar, was innovative but ultimately flawed. The model’s vulnerability to market volatility and speculative attacks became evident when UST lost its peg, leading to a catastrophic downward spiral. This highlights the necessity for crypto projects to incorporate comprehensive risk assessments and contingency plans to withstand market fluctuations and external pressures.

Moreover, transparency and communication are critical components in maintaining investor trust and confidence. During the crisis, the lack of clear communication from the developers and the absence of timely updates exacerbated the situation, leading to panic and further destabilization. This experience serves as a reminder that open lines of communication and transparency are essential in fostering a resilient and informed community. Projects must prioritize regular updates and clear explanations of their mechanisms and strategies to build and maintain trust among stakeholders.

Additionally, the UST and LUNA debacle illustrates the need for regulatory engagement and compliance. As the crypto industry matures, regulatory scrutiny is inevitable, and projects must be prepared to navigate this landscape. Engaging proactively with regulators and adhering to compliance standards can not only mitigate legal risks but also enhance the legitimacy and acceptance of crypto projects in the broader financial ecosystem. The downfall of UST and LUNA serves as a cautionary tale of the potential consequences of operating in a regulatory gray area.

Furthermore, the incident highlights the importance of diversification and resilience in investment strategies. The collapse of LUNA, which was heavily intertwined with UST, resulted in significant losses for investors who had concentrated their holdings in these assets. This underscores the age-old investment principle of diversification, which remains relevant even in the context of digital assets. Investors and developers alike must recognize the value of spreading risk across a variety of assets and projects to safeguard against unforeseen events.

Finally, the rise and fall of UST and LUNA emphasize the need for continuous innovation and adaptation. The crypto landscape is characterized by rapid technological advancements and shifting market dynamics. Projects must remain agile and open to innovation, constantly evaluating and refining their models to stay competitive and resilient. The lessons learned from the UST and LUNA saga should inspire the crypto community to pursue sustainable growth through innovation, while remaining vigilant to the challenges that lie ahead.

In conclusion, the story of UST and LUNA offers invaluable insights for the crypto community. By prioritizing risk management, transparency, regulatory compliance, diversification, and innovation, future projects can navigate the complexities of the digital asset space more effectively. As the industry continues to evolve, these lessons will be instrumental in shaping a more robust and sustainable crypto ecosystem.

The Future of Stablecoins: Post-UST and LUNA Era

The collapse of UST and LUNA marked a significant turning point in the cryptocurrency landscape, prompting a reevaluation of the mechanisms underpinning stablecoins. As the dust settles, the future of stablecoins in the post-UST and LUNA era is being shaped by lessons learned from their dramatic rise and fall. This period of reflection and innovation is crucial for the development of more resilient and reliable digital currencies.

Initially, UST and LUNA captured the imagination of the crypto community with their ambitious algorithmic approach to maintaining stability. Unlike traditional stablecoins, which are typically backed by fiat reserves, UST relied on a complex algorithmic relationship with LUNA to maintain its peg to the US dollar. This innovative model promised decentralization and efficiency, attracting significant attention and investment. However, the inherent risks of such a system became apparent when market conditions shifted, leading to a catastrophic de-pegging event that sent shockwaves through the crypto ecosystem.

In the aftermath, the stability and reliability of algorithmic stablecoins have come under intense scrutiny. The failure of UST and LUNA highlighted the vulnerabilities of relying solely on algorithmic mechanisms without sufficient collateral backing. Consequently, the industry is now exploring hybrid models that combine algorithmic elements with collateral reserves to enhance stability. This approach aims to strike a balance between decentralization and security, offering a more robust solution to the challenges faced by purely algorithmic stablecoins.

Moreover, regulatory bodies worldwide have taken note of the UST and LUNA debacle, prompting discussions on the need for clearer guidelines and oversight in the stablecoin sector. The absence of a regulatory framework contributed to the unchecked growth and subsequent collapse of these digital assets. In response, regulators are now working towards establishing comprehensive policies that ensure transparency, accountability, and consumer protection. This regulatory evolution is expected to foster greater trust and confidence in stablecoins, paving the way for their broader adoption in the financial system.

In addition to regulatory developments, technological advancements are playing a pivotal role in shaping the future of stablecoins. Blockchain technology continues to evolve, offering new possibilities for enhancing the security and efficiency of stablecoin transactions. Innovations such as cross-chain interoperability and improved consensus mechanisms are being explored to address the scalability and security challenges that have plagued the industry. These technological strides are essential for building a more resilient infrastructure that can support the growing demand for stable digital currencies.

Furthermore, the lessons learned from the UST and LUNA saga have spurred a renewed focus on risk management and transparency within the stablecoin ecosystem. Issuers are now prioritizing robust risk assessment frameworks and transparent reporting practices to mitigate potential vulnerabilities. By fostering a culture of accountability and openness, stablecoin projects aim to rebuild trust and credibility among users and investors.

As the stablecoin landscape continues to evolve, collaboration between industry stakeholders, regulators, and technology developers will be crucial. By working together, these entities can create a stablecoin ecosystem that is not only innovative but also secure and resilient. The post-UST and LUNA era presents an opportunity to redefine the role of stablecoins in the global financial system, ensuring they fulfill their promise of providing stability and efficiency in an increasingly digital world. Through careful consideration of past failures and a commitment to innovation, the future of stablecoins holds the potential to revolutionize the way we perceive and utilize digital currencies.

Q&A

1. **What is UST?**

UST, or TerraUSD, was an algorithmic stablecoin designed to maintain a 1:1 peg with the US dollar, part of the Terra blockchain ecosystem.

2. **What is LUNA?**

LUNA was the native cryptocurrency of the Terra blockchain, used for governance, staking, and to help maintain the price stability of UST.

3. **How did UST maintain its peg?**

UST maintained its peg through an algorithmic mechanism involving LUNA, where users could swap 1 UST for $1 worth of LUNA and vice versa, theoretically stabilizing UST’s price.

4. **What led to the rise of UST and LUNA?**

The rise was driven by high demand for decentralized finance (DeFi) applications on the Terra blockchain, attractive yields on UST deposits, and strong community support.

5. **What triggered the fall of UST and LUNA?**

The fall was triggered by a loss of confidence in UST’s peg, leading to massive sell-offs and a death spiral where LUNA’s supply inflated dramatically as its price collapsed.

6. **What was the impact of the collapse?**

The collapse wiped out billions in market value, severely impacting investors, and led to broader scrutiny and regulatory interest in algorithmic stablecoins.

7. **What lessons were learned from the collapse?**

The collapse highlighted the risks of algorithmic stablecoins, the importance of robust collateralization, and the need for better risk management and transparency in crypto projects.

Conclusion

The rise and fall of UST and LUNA represent a significant chapter in the volatile world of cryptocurrency. Initially, the Terra ecosystem, with its algorithmic stablecoin UST and native token LUNA, gained rapid popularity due to its innovative approach to decentralized finance and attractive yield opportunities. However, the lack of robust collateralization and over-reliance on algorithmic mechanisms led to vulnerabilities. In May 2022, a series of market events triggered a de-pegging of UST from the US dollar, causing a catastrophic collapse in its value and a subsequent crash in LUNA’s price. This event wiped out billions in market value, eroded investor confidence, and highlighted the inherent risks in algorithmic stablecoins. The downfall of UST and LUNA serves as a cautionary tale about the importance of sustainable economic models, transparency, and risk management in the crypto industry.