“Market Momentum Pauses: Anticipation Builds as Earnings Week Looms”

Introduction

U.S. stocks have recently pulled back from their record highs as investors brace for a pivotal earnings week that could set the tone for the markets in the coming months. This retreat comes amid heightened anticipation and uncertainty, as major corporations across various sectors are set to report their quarterly earnings. Market participants are keenly watching these earnings reports for insights into corporate health, consumer demand, and the broader economic recovery. The recent dip in stock prices reflects a cautious sentiment among investors, who are weighing the potential impacts of inflationary pressures, supply chain disruptions, and monetary policy shifts on corporate profitability. As the earnings season unfolds, the financial markets are poised for increased volatility, with investors closely analyzing the results to gauge the resilience of the economic recovery and to adjust their investment strategies accordingly.

Factors Contributing to the Recent Decline in US Stock Markets

The recent retreat of US stocks from their record highs has captured the attention of investors and analysts alike, as they seek to understand the underlying factors contributing to this decline. As the market braces for a major earnings week, several elements have emerged as significant contributors to the current downturn. Among these, concerns over inflation, interest rate hikes, and geopolitical tensions have played pivotal roles in shaping investor sentiment.

To begin with, inflationary pressures have been a persistent concern for the market. The US economy has been experiencing rising inflation rates, driven by supply chain disruptions and increased consumer demand as the country recovers from the pandemic. This has led to apprehensions about the Federal Reserve’s monetary policy, as investors speculate on potential interest rate hikes to curb inflation. The anticipation of tighter monetary policy has, in turn, created volatility in the stock market, as higher interest rates could increase borrowing costs for companies and reduce consumer spending, ultimately impacting corporate profits.

Moreover, the prospect of interest rate hikes has also contributed to the recent decline in US stock markets. The Federal Reserve has signaled its intention to gradually taper its bond-buying program, a move that is often seen as a precursor to raising interest rates. This has led to a shift in investor sentiment, as market participants reassess the valuations of high-growth stocks, which are particularly sensitive to changes in interest rates. Consequently, sectors such as technology, which have been major drivers of the market’s previous gains, have experienced notable declines.

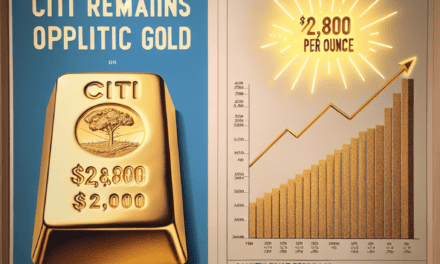

In addition to domestic economic factors, geopolitical tensions have also played a role in the recent market retreat. The ongoing conflict in Eastern Europe, coupled with strained US-China relations, has heightened uncertainty in global markets. Investors are wary of potential disruptions to international trade and supply chains, which could further exacerbate inflationary pressures and impact global economic growth. This geopolitical uncertainty has prompted a flight to safety, with investors seeking refuge in traditionally safer assets such as bonds and gold, thereby contributing to the decline in stock prices.

Furthermore, the upcoming earnings week has added another layer of complexity to the market dynamics. As major corporations prepare to release their quarterly results, investors are keenly focused on corporate earnings reports to gauge the health of the economy and the resilience of businesses in the face of current challenges. Any signs of weaker-than-expected earnings or cautious forward guidance could further dampen investor confidence and exacerbate the market’s downward trend.

In conclusion, the recent decline in US stock markets can be attributed to a confluence of factors, including inflationary pressures, the prospect of interest rate hikes, geopolitical tensions, and the anticipation of a major earnings week. As these elements continue to unfold, investors remain vigilant, closely monitoring economic indicators and corporate earnings reports to navigate the uncertain landscape. While the market’s retreat from record highs may be unsettling, it also serves as a reminder of the complex interplay of factors that influence stock market performance. As such, a comprehensive understanding of these dynamics is essential for investors seeking to make informed decisions in an ever-evolving financial environment.

Key Earnings Reports to Watch in the Upcoming Week

As the US stock market experiences a retreat from its recent record highs, investors are turning their attention to the upcoming week, which promises a series of key earnings reports that could significantly influence market sentiment. This period is particularly crucial as it follows a phase of robust market performance, driven by optimism surrounding economic recovery and strong corporate earnings. However, the current pullback suggests a degree of caution among investors, who are now keenly focused on the forthcoming earnings announcements to gauge the sustainability of the recent rally.

In the upcoming week, several major companies across diverse sectors are set to release their quarterly earnings reports. These reports are anticipated to provide valuable insights into the health of the economy and the resilience of corporate America in the face of ongoing challenges such as inflationary pressures, supply chain disruptions, and geopolitical tensions. Among the most closely watched will be the tech giants, whose performance has been pivotal in driving the market to its recent highs. Companies like Apple, Microsoft, and Alphabet are expected to reveal how they have navigated the complexities of the current economic landscape, particularly in terms of managing costs and maintaining growth momentum.

Moreover, the financial sector will also be under scrutiny, with major banks set to disclose their earnings. Investors will be eager to assess how these institutions have fared amid fluctuating interest rates and regulatory changes. The performance of banks is often seen as a barometer for the broader economy, given their role in facilitating business activities and consumer spending. Therefore, their earnings reports could offer critical clues about the economic outlook and potential shifts in monetary policy.

In addition to technology and finance, the consumer goods sector will also be in the spotlight. Companies in this space are expected to provide updates on consumer demand trends, which have been a focal point for analysts trying to understand the post-pandemic recovery trajectory. With inflation impacting consumer purchasing power, these earnings reports will be scrutinized for indications of how companies are managing pricing strategies and cost pressures.

Furthermore, the energy sector’s earnings will be of particular interest, especially in light of recent fluctuations in oil prices. As global energy markets remain volatile, the performance of energy companies could have broader implications for inflation and economic stability. Investors will be keen to see how these companies are adapting to the evolving energy landscape, including shifts towards renewable energy sources and sustainability initiatives.

As the earnings week unfolds, market participants will be closely monitoring not only the financial results but also the forward guidance provided by these companies. Forward guidance is often a critical component of earnings reports, as it offers insights into management’s expectations for future performance and strategic priorities. This information can significantly influence investor sentiment and market dynamics, particularly in a period marked by uncertainty and rapid change.

In conclusion, the upcoming week of earnings reports represents a pivotal moment for the US stock market, as investors seek clarity on the economic outlook and corporate health. The insights gleaned from these reports will likely shape market trends in the near term, as investors recalibrate their strategies based on the latest data and projections. As such, this earnings season is poised to be a defining period for market participants, offering both challenges and opportunities in equal measure.

How Market Volatility Affects Investor Sentiment

As US stocks retreat from record highs ahead of a major earnings week, the phenomenon of market volatility once again takes center stage, influencing investor sentiment in profound ways. Market volatility, characterized by rapid and significant price movements, often serves as a barometer for investor confidence and economic stability. When stock prices fluctuate unpredictably, it can lead to heightened anxiety among investors, prompting them to reassess their portfolios and investment strategies. This retreat from record highs is not merely a numerical decline but a reflection of the broader psychological landscape that governs market behavior.

To understand how market volatility affects investor sentiment, it is essential to consider the underlying factors that contribute to these fluctuations. Economic indicators, geopolitical events, and corporate earnings reports are among the myriad elements that can trigger volatility. For instance, the anticipation of a major earnings week can lead to speculative trading, as investors attempt to predict the financial performance of key companies. This speculation can result in increased trading volumes and price swings, further amplifying market volatility. Consequently, investors may experience a range of emotions, from optimism to fear, as they navigate these uncertain waters.

Moreover, the impact of market volatility on investor sentiment is often magnified by the media and financial analysts, who provide continuous updates and interpretations of market movements. This constant flow of information can create a feedback loop, where investor reactions to market news contribute to further volatility. In such an environment, even seasoned investors may find it challenging to maintain a long-term perspective, as short-term market movements dominate the narrative. As a result, investor sentiment can become increasingly reactive, driven by the latest headlines rather than fundamental analysis.

In addition to external factors, psychological biases also play a significant role in shaping investor sentiment during periods of market volatility. Behavioral finance studies have shown that investors are prone to cognitive biases, such as overconfidence and loss aversion, which can influence their decision-making processes. For example, during a market downturn, loss aversion may lead investors to sell off assets prematurely to avoid further losses, even if the long-term prospects of those assets remain strong. Conversely, overconfidence during a market upswing can result in excessive risk-taking, as investors underestimate the potential for future volatility.

Despite these challenges, market volatility can also present opportunities for investors who are able to maintain a disciplined approach. By focusing on long-term investment goals and adhering to a well-defined strategy, investors can potentially capitalize on price fluctuations to enhance their portfolios. Diversification, for instance, is a key strategy that can help mitigate the impact of volatility by spreading risk across different asset classes. Additionally, dollar-cost averaging, which involves investing a fixed amount at regular intervals, can reduce the emotional impact of market swings by smoothing out the effects of volatility over time.

In conclusion, while market volatility can significantly affect investor sentiment, it is important for investors to remain vigilant and informed. By understanding the factors that drive volatility and recognizing the influence of psychological biases, investors can better navigate the complexities of the market. As US stocks retreat from record highs, the upcoming earnings week will undoubtedly provide further insights into the interplay between market volatility and investor sentiment, offering valuable lessons for those willing to look beyond the immediate fluctuations and focus on long-term financial objectives.

Historical Analysis of Stock Market Trends During Earnings Season

The stock market has long been a barometer of economic health, with investors closely monitoring its fluctuations to gauge the financial landscape. As US stocks recently retreated from record highs, attention has turned to the upcoming earnings season, a period that historically brings heightened volatility and investor scrutiny. Understanding the historical trends of the stock market during earnings season can provide valuable insights into what investors might expect in the coming weeks.

Earnings season, which occurs quarterly, is a time when publicly traded companies release their financial results for the previous quarter. This period is crucial as it offers a glimpse into corporate performance and economic conditions. Historically, earnings season has been characterized by increased market activity, as investors react to earnings reports that either meet, exceed, or fall short of expectations. The anticipation and subsequent release of these reports often lead to significant market movements, as investors adjust their portfolios based on new information.

Looking back at historical data, it is evident that earnings season can be a double-edged sword for the stock market. On one hand, positive earnings surprises can propel stocks to new heights, as investor confidence is bolstered by strong corporate performance. For instance, during the tech boom of the late 1990s, many technology companies consistently reported robust earnings, driving the Nasdaq Composite to unprecedented levels. On the other hand, disappointing earnings can trigger sharp declines, as seen during the financial crisis of 2008 when widespread earnings misses led to a dramatic market downturn.

Moreover, the impact of earnings season on stock market trends is not uniform across all sectors. Certain industries, such as technology and consumer goods, tend to experience more pronounced reactions due to their high visibility and the significant role they play in the economy. For example, technology giants like Apple and Microsoft often set the tone for the market, with their earnings reports closely watched by investors worldwide. In contrast, sectors like utilities and real estate may see more muted responses, as their earnings are generally more stable and less susceptible to rapid changes.

In addition to sector-specific trends, macroeconomic factors also play a crucial role in shaping market behavior during earnings season. Interest rates, inflation, and geopolitical events can all influence investor sentiment and, consequently, stock prices. For instance, in periods of rising interest rates, companies with high levels of debt may face increased scrutiny, as higher borrowing costs can impact their profitability. Similarly, geopolitical tensions can create uncertainty, leading to cautious investor behavior and increased market volatility.

As we approach the upcoming earnings season, it is essential to consider these historical trends and factors. While past performance is not always indicative of future results, understanding the patterns that have emerged over time can help investors make more informed decisions. By analyzing how different sectors and macroeconomic conditions have historically influenced the market during earnings season, investors can better anticipate potential outcomes and adjust their strategies accordingly.

In conclusion, the retreat of US stocks from record highs ahead of a major earnings week underscores the importance of earnings season in shaping market trends. By examining historical data and considering sector-specific and macroeconomic factors, investors can gain valuable insights into the potential impact of upcoming earnings reports. As always, a cautious and informed approach is key to navigating the complexities of the stock market during this critical period.

Strategies for Investors During Market Pullbacks

As US stocks retreat from record highs ahead of a major earnings week, investors find themselves at a critical juncture, contemplating strategies to navigate the current market pullback. Understanding the dynamics of market fluctuations is essential for investors aiming to make informed decisions during such periods. While market pullbacks can be unsettling, they also present opportunities for strategic positioning and long-term growth.

To begin with, it is crucial for investors to maintain a clear perspective on market volatility. Market pullbacks, though often perceived negatively, are a natural part of the economic cycle. They provide a necessary correction to overvalued stocks and can lead to more sustainable growth in the long run. By recognizing this, investors can avoid making impulsive decisions driven by short-term market movements. Instead, they should focus on their long-term investment goals and remain committed to their financial plans.

Moreover, diversification remains a key strategy during market pullbacks. By spreading investments across various asset classes, sectors, and geographic regions, investors can mitigate risks associated with market volatility. Diversification helps in balancing the portfolio, ensuring that a downturn in one area does not disproportionately affect the overall investment. This approach not only provides a cushion during market declines but also positions investors to capitalize on potential rebounds in different sectors.

In addition to diversification, maintaining a disciplined approach to asset allocation is vital. Investors should regularly review and adjust their portfolios to align with their risk tolerance and investment objectives. During market pullbacks, it may be tempting to shift allocations drastically; however, such actions can lead to unintended consequences. A disciplined approach ensures that investors remain aligned with their long-term strategies, avoiding the pitfalls of emotional decision-making.

Furthermore, market pullbacks offer an opportune moment for investors to reassess the fundamentals of their investments. This involves evaluating the financial health, growth prospects, and competitive positioning of the companies within their portfolios. By focusing on quality investments with strong fundamentals, investors can identify stocks that are likely to weather market downturns and emerge stronger. This strategic evaluation can also uncover undervalued opportunities that may have been overlooked during periods of market exuberance.

Additionally, maintaining liquidity is an important consideration during market pullbacks. Having access to cash or cash-equivalent assets allows investors to take advantage of buying opportunities when prices are depressed. This liquidity can be used to strategically enter positions in high-quality stocks that have been temporarily undervalued due to market conditions. By being prepared with liquidity, investors can act decisively when attractive opportunities arise.

Finally, it is essential for investors to stay informed and updated on market developments. Keeping abreast of economic indicators, corporate earnings reports, and geopolitical events can provide valuable insights into market trends and potential risks. Informed investors are better equipped to make strategic decisions and adjust their portfolios in response to changing market conditions.

In conclusion, while market pullbacks can be challenging, they also present opportunities for strategic positioning and long-term growth. By maintaining a clear perspective, diversifying investments, adhering to disciplined asset allocation, reassessing investment fundamentals, ensuring liquidity, and staying informed, investors can navigate market pullbacks with confidence. These strategies not only help mitigate risks but also position investors to capitalize on potential opportunities as markets stabilize and recover.

The Role of Economic Indicators in Stock Market Movements

The stock market is a complex ecosystem influenced by a myriad of factors, among which economic indicators play a pivotal role. As US stocks retreat from record highs ahead of a major earnings week, it becomes increasingly important to understand how these indicators can impact market movements. Economic indicators, such as GDP growth rates, unemployment figures, and consumer confidence indices, provide valuable insights into the health of the economy, thereby influencing investor sentiment and stock prices.

To begin with, GDP growth rates are often seen as a barometer of economic vitality. When GDP figures exceed expectations, they typically signal robust economic activity, which can lead to increased corporate earnings and, consequently, higher stock prices. Conversely, when GDP growth falls short of projections, it may indicate economic sluggishness, prompting investors to reassess their portfolios and potentially triggering a sell-off in stocks. This dynamic is particularly relevant as investors brace for the upcoming earnings reports, which will shed light on how companies have navigated recent economic conditions.

In addition to GDP, unemployment figures are another critical economic indicator that can sway stock market movements. A declining unemployment rate generally suggests a strengthening labor market, which can boost consumer spending and drive corporate profits. This positive outlook often translates into bullish market behavior. However, if unemployment figures rise unexpectedly, it may raise concerns about economic stability, leading to increased market volatility. As the earnings week approaches, investors will be keenly watching employment data to gauge the potential impact on corporate performance.

Moreover, consumer confidence indices offer insights into the mindset of consumers, who are a driving force behind economic growth. High consumer confidence typically indicates that individuals are more willing to spend, which can bolster company revenues and support stock prices. On the other hand, a dip in consumer confidence may signal caution among consumers, potentially leading to reduced spending and lower corporate earnings. This sentiment can weigh heavily on stock markets, especially when investors are already on edge due to upcoming earnings announcements.

Furthermore, inflation rates are another economic indicator that can influence stock market trends. Moderate inflation is often seen as a sign of a healthy economy, as it suggests steady demand for goods and services. However, when inflation rises too quickly, it can erode purchasing power and squeeze profit margins, causing concern among investors. In anticipation of the earnings week, market participants will be closely monitoring inflation data to assess its potential impact on corporate profitability and stock valuations.

In addition to these traditional indicators, central bank policies also play a crucial role in shaping market movements. Interest rate decisions, in particular, can have a profound effect on investor behavior. Lower interest rates tend to encourage borrowing and investment, which can drive stock prices higher. Conversely, rising interest rates can increase borrowing costs and dampen economic activity, potentially leading to a decline in stock prices. As the earnings week looms, any signals from the Federal Reserve regarding future rate hikes will be scrutinized for their implications on the stock market.

In conclusion, economic indicators are integral to understanding stock market movements, especially as US stocks retreat from record highs ahead of a major earnings week. By analyzing GDP growth rates, unemployment figures, consumer confidence indices, inflation rates, and central bank policies, investors can gain valuable insights into the economic landscape and make informed decisions. As the earnings reports unfold, these indicators will continue to play a crucial role in shaping market sentiment and guiding investor actions.

Expert Predictions on the Future of US Stock Markets

As US stocks retreat from record highs, investors and analysts alike are keenly observing the market dynamics ahead of a major earnings week. This period is often characterized by heightened volatility and uncertainty, as companies across various sectors prepare to release their quarterly earnings reports. The anticipation surrounding these announcements is palpable, as they are expected to provide critical insights into the health of the economy and the future trajectory of the stock market. In this context, expert predictions on the future of US stock markets are particularly valuable, offering guidance and perspective to those navigating these turbulent waters.

To begin with, it is essential to understand the factors contributing to the recent pullback in US stocks. Several elements have converged to create a more cautious market environment. Rising inflationary pressures, driven by supply chain disruptions and increased consumer demand, have raised concerns about potential interest rate hikes by the Federal Reserve. Such monetary policy adjustments could dampen economic growth and, consequently, corporate earnings. Additionally, geopolitical tensions and ongoing uncertainties related to the global pandemic continue to weigh on investor sentiment, prompting a more conservative approach to stock market investments.

In light of these challenges, experts are offering a range of predictions regarding the future of US stock markets. Some analysts maintain a bullish outlook, arguing that the underlying fundamentals of the economy remain strong. They point to robust consumer spending, a resilient labor market, and continued innovation in key sectors such as technology and healthcare as indicators of sustained growth potential. These experts suggest that the recent market retreat may be a temporary correction, providing an opportunity for investors to buy stocks at more attractive valuations.

Conversely, other analysts adopt a more cautious stance, emphasizing the potential risks that could derail the current economic recovery. They highlight the possibility of prolonged inflation, which could erode corporate profit margins and reduce consumer purchasing power. Furthermore, the prospect of higher interest rates may lead to increased borrowing costs for businesses, potentially stifling investment and expansion efforts. These experts caution that the stock market may experience further volatility in the coming months, as investors grapple with these complex and evolving challenges.

Despite these differing perspectives, there is a consensus among experts that diversification remains a key strategy for navigating the uncertainties of the stock market. By spreading investments across a range of asset classes and sectors, investors can mitigate risk and enhance their potential for long-term returns. Additionally, maintaining a focus on high-quality companies with strong balance sheets and competitive advantages can provide a measure of stability in an otherwise unpredictable market environment.

As the major earnings week approaches, investors will be closely monitoring the performance of individual companies and sectors, seeking clues about the broader economic landscape. The insights gleaned from these earnings reports will likely influence market sentiment and shape the direction of US stock markets in the near term. In this context, expert predictions serve as a valuable resource, offering informed perspectives and strategic guidance to those navigating the complexities of the financial markets. Ultimately, while the path forward may be fraught with challenges, a disciplined and informed approach can help investors successfully navigate the evolving landscape of US stock markets.

Q&A

1. **What caused US stocks to retreat from record highs?**

Concerns over inflation, rising interest rates, and geopolitical tensions often contribute to market pullbacks.

2. **Which sectors were most affected by the retreat?**

Technology and consumer discretionary sectors typically see significant impacts during market retreats due to their sensitivity to economic changes.

3. **What major earnings reports are anticipated during the earnings week?**

Reports from major companies like Apple, Amazon, Microsoft, and Alphabet are often highly anticipated.

4. **How do earnings reports influence stock market performance?**

Positive earnings can boost investor confidence and drive stock prices up, while disappointing results can lead to declines.

5. **What role do interest rates play in stock market movements?**

Rising interest rates can increase borrowing costs and reduce consumer spending, negatively impacting stock prices.

6. **How might geopolitical tensions affect US stocks?**

Geopolitical tensions can create uncertainty, leading to market volatility and potential declines in stock prices.

7. **What strategies do investors use during market retreats?**

Investors might diversify portfolios, invest in defensive stocks, or hold cash to mitigate risks during market downturns.

Conclusion

US stocks have retreated from their record highs as investors exercise caution ahead of a major earnings week. This pullback reflects market participants’ anticipation of upcoming corporate earnings reports, which are expected to provide insights into the health of various sectors and the broader economy. The retreat may also indicate concerns over potential volatility and the impact of external factors such as inflation, interest rates, and geopolitical tensions. As companies prepare to release their financial results, investors are likely reassessing their positions, leading to a temporary decline in stock prices. The outcome of the earnings week will be crucial in determining the market’s direction in the near term.