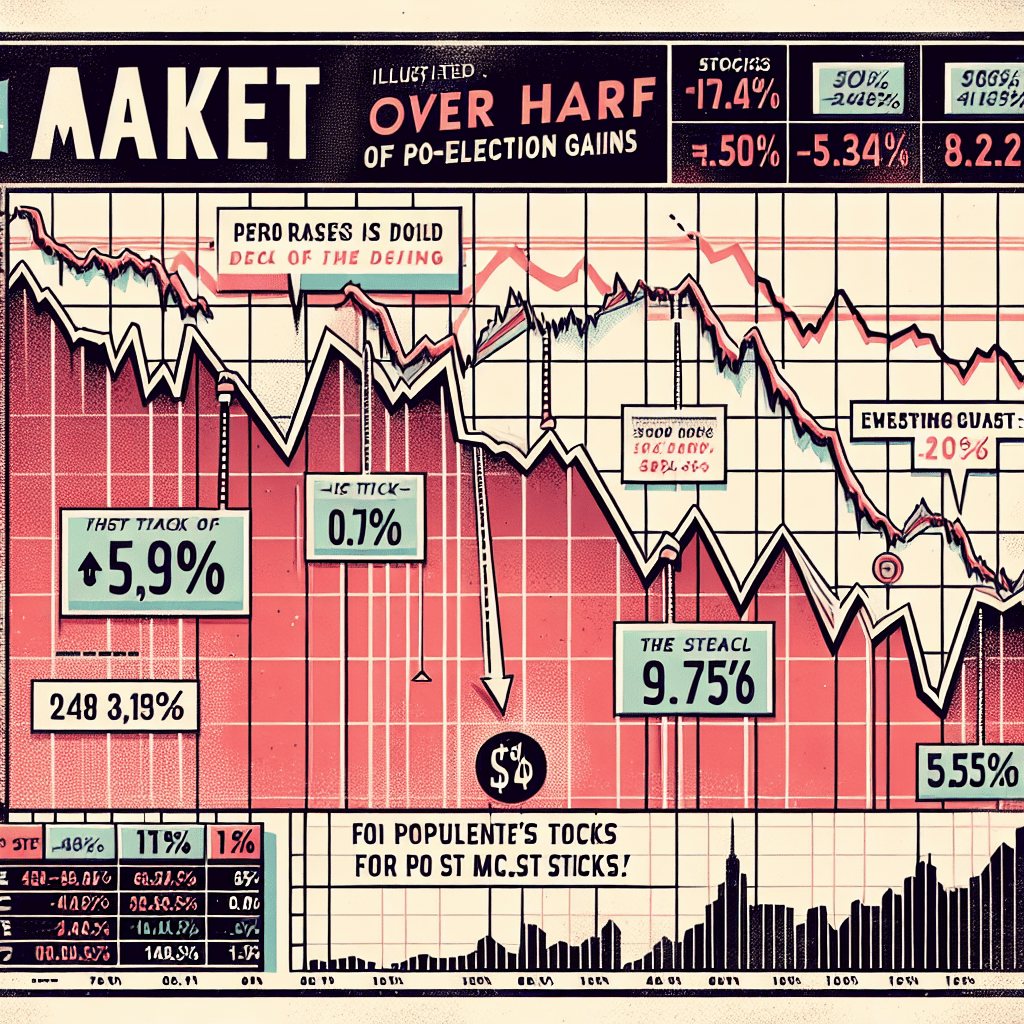

“US Stocks Tumble: Post-Election Gains Halved in Market Shakeup”

Introduction

Following a period of significant growth, U.S. stocks have recently experienced a notable downturn, erasing more than half of the gains accumulated since the last presidential election. This market shift reflects a complex interplay of economic factors, including rising inflation, interest rate adjustments by the Federal Reserve, and geopolitical tensions, which have collectively contributed to increased volatility and investor uncertainty. As analysts assess the implications of these developments, the focus remains on understanding the underlying causes and potential future trajectories of the market.

Impact Of Political Changes On US Stock Market

The US stock market, a barometer of economic sentiment and investor confidence, has recently experienced a significant downturn, losing over half of the gains it had accumulated since the last presidential election. This decline underscores the profound impact that political changes can have on financial markets. As investors navigate the complexities of a shifting political landscape, it becomes crucial to understand the underlying factors contributing to this market volatility.

To begin with, the initial post-election rally was largely driven by investor optimism surrounding anticipated policy changes. The new administration’s promises of tax reforms, deregulation, and infrastructure spending fueled expectations of accelerated economic growth. Consequently, sectors such as technology, finance, and industrials saw substantial gains as investors positioned themselves to benefit from these potential policy shifts. However, as the political environment evolved, so too did market sentiment.

One of the primary catalysts for the recent market downturn has been the growing uncertainty surrounding the implementation of key policy initiatives. Legislative gridlock and partisan divisions have stalled several major proposals, leading to investor skepticism about the administration’s ability to deliver on its promises. This uncertainty has been exacerbated by geopolitical tensions and trade disputes, which have further clouded the economic outlook. As a result, investors have become increasingly cautious, leading to a reevaluation of risk and a subsequent sell-off in equities.

Moreover, the Federal Reserve’s monetary policy has played a significant role in shaping market dynamics. In response to rising inflationary pressures, the Fed has signaled a shift towards a more hawkish stance, with plans to gradually increase interest rates. This has led to concerns about the potential impact on corporate profits and economic growth, prompting investors to reassess their portfolios. Higher interest rates tend to increase borrowing costs for companies, which can weigh on earnings and dampen investment. Consequently, sectors that are particularly sensitive to interest rate changes, such as real estate and utilities, have experienced heightened volatility.

In addition to domestic factors, global economic conditions have also influenced US stock market performance. The ongoing pandemic, supply chain disruptions, and varying recovery trajectories across different regions have contributed to a complex and uncertain global economic environment. These challenges have prompted investors to adopt a more cautious approach, seeking safe-haven assets and diversifying their portfolios to mitigate risk.

Despite these challenges, it is important to recognize that market fluctuations are a natural part of the investment landscape. While political changes can introduce volatility, they also present opportunities for astute investors. By staying informed and maintaining a long-term perspective, investors can navigate these turbulent times and potentially capitalize on market dislocations.

In conclusion, the recent decline in US stock market gains highlights the intricate relationship between political changes and financial markets. As the political landscape continues to evolve, investors must remain vigilant and adaptable, carefully considering the implications of policy developments and macroeconomic trends. By doing so, they can better position themselves to weather the uncertainties of the market and achieve their financial objectives.

Analyzing The Post-Election Stock Market Surge And Decline

In the aftermath of the recent U.S. elections, the stock market experienced a significant surge, driven by investor optimism and expectations of favorable economic policies. However, this initial exuberance has been tempered by a subsequent decline, with U.S. stocks losing over half of their post-election gains. This fluctuation in the market can be attributed to a confluence of factors that have influenced investor sentiment and market dynamics.

Initially, the post-election rally was fueled by the anticipation of policy changes that were expected to stimulate economic growth. Investors were particularly hopeful about potential tax reforms, infrastructure spending, and deregulation, which were seen as catalysts for corporate profitability and economic expansion. This optimism was reflected in the rapid appreciation of stock prices, as market participants positioned themselves to benefit from the anticipated policy shifts.

However, as the initial excitement began to wane, several factors emerged that contributed to the erosion of these gains. One of the primary concerns has been the uncertainty surrounding the implementation of the proposed policies. While the election results provided a clear mandate, the complexities of the legislative process have introduced delays and uncertainties, causing investors to reassess their expectations. This uncertainty has been compounded by geopolitical tensions and global economic challenges, which have further clouded the outlook for the U.S. economy.

Moreover, the market’s initial reaction may have been overly optimistic, as investors underestimated the potential obstacles to policy implementation. As these challenges became more apparent, market participants began to recalibrate their expectations, leading to a correction in stock prices. This recalibration was also influenced by economic indicators that suggested a more moderate pace of growth than initially anticipated. For instance, data on consumer spending, employment, and manufacturing output have pointed to a mixed economic picture, prompting investors to adopt a more cautious stance.

In addition to domestic factors, global economic conditions have also played a role in the market’s decline. Concerns about slowing growth in major economies, such as China and the Eurozone, have weighed on investor sentiment, as these regions are key trading partners for the United States. Furthermore, fluctuations in commodity prices and currency exchange rates have added to the market’s volatility, as investors grapple with the implications of these changes for corporate earnings and economic stability.

Despite these challenges, it is important to note that the market’s decline does not necessarily signal a long-term downturn. Rather, it reflects a period of adjustment as investors digest new information and reassess their strategies. In this context, the recent volatility can be seen as a natural part of the market cycle, where periods of exuberance are followed by corrections that bring valuations more in line with economic fundamentals.

Looking ahead, the trajectory of the stock market will likely depend on a range of factors, including the resolution of policy uncertainties, the performance of the global economy, and the ability of companies to adapt to changing conditions. While the path forward may be fraught with challenges, it also presents opportunities for investors who are able to navigate the complexities of the current environment. As such, a careful analysis of market trends and economic indicators will be crucial for those seeking to capitalize on potential opportunities in the evolving landscape.

Key Factors Behind The Recent US Stock Market Downturn

The recent downturn in the US stock market has captured the attention of investors and analysts alike, as stocks have lost over half of their post-election gains. This decline can be attributed to a confluence of factors that have collectively exerted downward pressure on the market. Understanding these key elements is crucial for investors seeking to navigate the current financial landscape.

To begin with, rising interest rates have played a significant role in the recent market downturn. The Federal Reserve’s decision to increase interest rates in response to inflationary pressures has led to higher borrowing costs for businesses and consumers. As a result, companies face increased expenses, which can negatively impact their profitability. Moreover, higher interest rates tend to make fixed-income investments more attractive compared to equities, prompting a shift in investor preferences away from stocks.

In addition to interest rate hikes, geopolitical tensions have also contributed to market volatility. Ongoing trade disputes and diplomatic conflicts have created an environment of uncertainty, causing investors to reassess their risk exposure. For instance, the trade tensions between the United States and China have led to concerns about potential disruptions in global supply chains, which could adversely affect corporate earnings. Furthermore, geopolitical instability in regions such as Eastern Europe and the Middle East has heightened fears of potential economic repercussions, further dampening investor sentiment.

Another factor influencing the recent stock market decline is the mixed economic data emerging from various sectors. While some areas of the economy have shown resilience, others have exhibited signs of slowing growth. For example, the manufacturing sector has experienced a deceleration, with supply chain bottlenecks and labor shortages hindering production. On the other hand, the service sector has demonstrated relative strength, driven by consumer demand. This divergence in economic performance has created uncertainty about the overall trajectory of the economy, leading to cautious investor behavior.

Moreover, corporate earnings reports have been a mixed bag, adding to the market’s unease. While some companies have reported robust earnings, others have fallen short of expectations, citing challenges such as rising input costs and supply chain disruptions. This inconsistency in earnings performance has made it difficult for investors to gauge the health of the corporate sector, contributing to increased market volatility.

In light of these factors, it is important to consider the role of investor sentiment in the recent market downturn. As uncertainty looms large, investor confidence has been shaken, leading to increased market volatility. The fear of potential economic slowdowns and geopolitical risks has prompted many investors to adopt a more cautious approach, resulting in reduced demand for equities.

In conclusion, the recent decline in US stock markets can be attributed to a combination of rising interest rates, geopolitical tensions, mixed economic data, and inconsistent corporate earnings. These factors have collectively created an environment of uncertainty, leading to a loss of investor confidence and a subsequent downturn in stock prices. As the market continues to navigate these challenges, investors must remain vigilant and adaptable, carefully assessing the evolving economic landscape to make informed investment decisions. By understanding the key factors behind the recent market downturn, investors can better position themselves to weather the current volatility and capitalize on potential opportunities that may arise in the future.

Investor Sentiment And Its Role In Market Volatility

Investor sentiment plays a crucial role in the volatility of financial markets, often acting as a barometer for the broader economic outlook. Recently, US stocks have experienced a significant downturn, losing over half of their post-election gains. This decline underscores the intricate relationship between investor sentiment and market performance. Understanding this dynamic is essential for investors seeking to navigate the complexities of the stock market.

Initially, the post-election period was marked by optimism, as investors anticipated favorable economic policies and regulatory reforms. This optimism was reflected in the stock market’s robust performance, with major indices reaching record highs. However, as time progressed, several factors began to erode this positive sentiment. Economic indicators, geopolitical tensions, and policy uncertainties contributed to a more cautious outlook among investors. Consequently, the initial euphoria gave way to a more tempered and, at times, pessimistic sentiment.

One of the primary drivers of this shift in sentiment has been the mixed economic data emerging from various sectors. While some industries have shown resilience, others have struggled to regain their footing in the post-pandemic landscape. For instance, the technology sector, which had been a significant contributor to market gains, faced headwinds due to regulatory scrutiny and supply chain disruptions. These challenges have led investors to reassess their positions, resulting in increased market volatility.

Moreover, geopolitical tensions have further exacerbated investor concerns. Trade disputes, diplomatic conflicts, and global economic uncertainties have created an environment of unpredictability. Investors, wary of potential disruptions to international trade and economic growth, have become more risk-averse. This cautious approach has contributed to the recent decline in stock prices, as market participants seek to mitigate potential losses.

In addition to these external factors, domestic policy uncertainties have also played a role in shaping investor sentiment. The ongoing debates over fiscal policy, taxation, and regulatory changes have left many investors uncertain about the future trajectory of the US economy. This uncertainty has been reflected in the stock market, as investors grapple with the potential implications of policy decisions on corporate profitability and economic growth.

Despite these challenges, it is important to recognize that market volatility is an inherent aspect of investing. While short-term fluctuations can be unsettling, they also present opportunities for astute investors. By maintaining a long-term perspective and focusing on fundamental analysis, investors can navigate periods of volatility with greater confidence. Diversification, risk management, and a disciplined investment approach are key strategies for weathering market turbulence.

In conclusion, the recent decline in US stocks highlights the significant impact of investor sentiment on market volatility. As economic indicators, geopolitical tensions, and policy uncertainties continue to shape the investment landscape, understanding the interplay between these factors and investor sentiment is crucial. While the current environment presents challenges, it also offers opportunities for those willing to adopt a strategic and informed approach. By staying attuned to market developments and maintaining a focus on long-term objectives, investors can better position themselves to navigate the complexities of the stock market.

Comparing Pre- And Post-Election Stock Market Performance

In the wake of the recent downturn in the U.S. stock market, investors and analysts alike are taking a closer look at the performance of stocks before and after the last presidential election. The market, which had experienced a significant rally following the election, has now seen more than half of those gains erased. This shift has prompted a reevaluation of the factors that initially drove the market upwards and those that are currently contributing to its decline.

Initially, the post-election period was characterized by a surge in investor optimism. The election results were perceived as favorable for business, with expectations of deregulation, tax cuts, and increased government spending fueling a bullish sentiment. This optimism was reflected in the stock market, as major indices such as the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite reached record highs. Investors were particularly enthusiastic about sectors like financials, energy, and industrials, which were expected to benefit from the new administration’s policies.

However, as time progressed, several factors began to weigh on the market, leading to a reversal of fortunes. One of the primary concerns has been the uncertainty surrounding the implementation of the promised economic policies. While initial announcements were met with enthusiasm, the actual legislative process has proven to be more complex and contentious than anticipated. This has led to delays and, in some cases, the scaling back of proposed measures, dampening investor confidence.

Moreover, geopolitical tensions have also played a significant role in the market’s recent performance. International conflicts and trade disputes have introduced a level of unpredictability that has made investors wary. The imposition of tariffs and retaliatory measures by trading partners has raised concerns about the potential impact on global economic growth, further contributing to market volatility.

In addition to these external factors, internal economic indicators have also influenced market sentiment. While the U.S. economy has shown signs of strength, with low unemployment rates and steady GDP growth, there are underlying concerns about inflation and interest rates. The Federal Reserve’s monetary policy, particularly its approach to interest rate hikes, has been closely scrutinized by investors. The prospect of rising rates has led to fears of increased borrowing costs, which could potentially slow down economic expansion and affect corporate profitability.

Furthermore, corporate earnings, which had been a strong driver of stock market gains, have shown signs of deceleration. While many companies continue to report robust earnings, the pace of growth has moderated, leading to questions about the sustainability of previous valuations. This has prompted a reassessment of stock prices, contributing to the recent market correction.

In conclusion, the U.S. stock market’s loss of over half of its post-election gains can be attributed to a combination of political, geopolitical, and economic factors. The initial optimism that drove the market to new heights has been tempered by the realities of policy implementation, global uncertainties, and evolving economic conditions. As investors navigate this complex landscape, they are increasingly focused on assessing the long-term implications of these developments on market performance. While the future remains uncertain, the current environment underscores the importance of a cautious and informed approach to investing.

Lessons From The US Stock Market’s Post-Election Fluctuations

The recent fluctuations in the US stock market have provided a wealth of lessons for investors and analysts alike, particularly in the wake of the post-election period. Following the election, the stock market experienced a significant surge, driven by optimism and expectations of favorable economic policies. However, this initial exuberance has been tempered by a series of events and factors that have led to the market losing over half of its post-election gains. Understanding these fluctuations requires a closer examination of the underlying causes and the broader implications for investors.

Initially, the post-election rally was fueled by investor confidence in anticipated policy changes, including tax reforms, deregulation, and infrastructure spending. These expectations created a bullish sentiment, propelling stock prices upward. However, as time progressed, the market began to grapple with the complexities and uncertainties inherent in the political and economic landscape. One of the primary lessons from this period is the importance of managing expectations. Investors must recognize that while political developments can influence market trends, the actual implementation of policies is often fraught with challenges and delays.

Moreover, the market’s recent downturn highlights the impact of external factors on stock performance. Geopolitical tensions, trade disputes, and global economic slowdowns have all contributed to increased volatility. For instance, ongoing trade negotiations have introduced a level of uncertainty that has weighed heavily on investor sentiment. This underscores the need for investors to remain vigilant and adaptable, as external events can swiftly alter market dynamics. Diversification and risk management strategies become crucial in navigating such turbulent times.

In addition to external factors, internal economic indicators have played a significant role in shaping market movements. Economic data, such as employment figures, inflation rates, and consumer confidence, have provided mixed signals, leading to fluctuating investor confidence. The Federal Reserve’s monetary policy decisions, particularly regarding interest rates, have also been pivotal. The central bank’s actions and communications have the power to either reassure or unsettle the market, emphasizing the importance of closely monitoring economic indicators and central bank policies.

Furthermore, the recent market fluctuations serve as a reminder of the psychological aspects of investing. Market sentiment can be influenced by a range of factors, including media coverage, investor behavior, and herd mentality. The rapid dissemination of information in today’s digital age can amplify market reactions, leading to heightened volatility. Investors must be aware of these psychological dynamics and strive to make informed decisions based on fundamental analysis rather than succumbing to emotional responses.

In conclusion, the lessons from the US stock market’s post-election fluctuations are multifaceted. Investors must manage expectations, remain adaptable to external influences, closely monitor economic indicators, and be mindful of psychological factors. While the market’s recent losses may be disheartening, they also present opportunities for learning and growth. By understanding the complexities of market dynamics and adopting a disciplined approach, investors can better navigate the challenges and uncertainties that lie ahead. As the market continues to evolve, these lessons will remain invaluable in guiding investment strategies and fostering resilience in the face of future fluctuations.

Strategies For Investors During Market Corrections

In the wake of recent market volatility, US stocks have surrendered more than half of their gains accumulated since the last presidential election. This downturn has left many investors questioning their strategies and seeking guidance on how to navigate such turbulent times. Understanding the dynamics of market corrections and implementing effective strategies can help investors mitigate risks and potentially capitalize on opportunities that arise during these periods.

To begin with, it is essential to recognize that market corrections, defined as a decline of 10% or more in stock prices from their recent highs, are a natural part of the economic cycle. They serve as a mechanism for recalibrating overvalued assets and can often present buying opportunities for astute investors. However, the emotional impact of seeing portfolio values decline can lead to hasty decisions, which underscores the importance of maintaining a disciplined approach.

One of the most effective strategies during market corrections is diversification. By spreading investments across various asset classes, sectors, and geographic regions, investors can reduce the impact of a downturn in any single area. This approach not only helps in managing risk but also positions the portfolio to benefit from potential recoveries in different segments of the market. For instance, while technology stocks may experience a significant decline, other sectors such as healthcare or consumer staples might remain relatively stable or even appreciate.

In addition to diversification, maintaining a long-term perspective is crucial. Market corrections, while unsettling, are typically short-lived compared to the overall upward trajectory of the stock market over time. Investors who remain focused on their long-term goals and resist the urge to make impulsive changes to their portfolios are often better positioned to weather the storm. Historical data suggests that markets tend to recover and even reach new highs following corrections, rewarding those who stay the course.

Moreover, during periods of market volatility, it is beneficial for investors to reassess their risk tolerance and investment objectives. A market correction can serve as a reminder to evaluate whether one’s portfolio aligns with their financial goals and risk appetite. Adjusting asset allocations to better reflect these factors can enhance an investor’s ability to endure future market fluctuations.

Another strategy to consider is dollar-cost averaging, which involves investing a fixed amount of money at regular intervals, regardless of market conditions. This approach can help investors avoid the pitfalls of trying to time the market, a notoriously difficult endeavor even for seasoned professionals. By consistently investing over time, investors can potentially lower their average cost per share and benefit from the market’s eventual recovery.

Furthermore, maintaining a cash reserve can provide flexibility and peace of mind during market corrections. Having liquid assets available allows investors to take advantage of buying opportunities when prices are depressed, without the need to sell existing investments at a loss. This strategy not only supports portfolio growth but also reinforces an investor’s confidence in their financial plan.

In conclusion, while market corrections can be challenging, they also offer valuable opportunities for investors who are prepared and informed. By employing strategies such as diversification, maintaining a long-term perspective, reassessing risk tolerance, utilizing dollar-cost averaging, and keeping a cash reserve, investors can navigate these periods with greater confidence and resilience. Ultimately, understanding and adapting to market dynamics is key to achieving long-term investment success.

Q&A

1. **What caused US stocks to lose over half of their post-election gains?**

Economic uncertainty and geopolitical tensions contributed to the decline.

2. **Which sectors were most affected by the stock market downturn?**

Technology and financial sectors were among the most affected.

3. **How did investor sentiment change during this period?**

Investor sentiment turned more cautious and risk-averse.

4. **What role did interest rates play in the stock market’s performance?**

Rising interest rates led to increased borrowing costs, impacting stock valuations.

5. **Were there any significant policy changes influencing the market?**

Concerns over potential regulatory changes and fiscal policies influenced market dynamics.

6. **How did international markets react to the US stock downturn?**

International markets experienced volatility, with some following the US market’s downward trend.

7. **What strategies did investors adopt in response to the market decline?**

Investors shifted towards safer assets, such as bonds and gold, to mitigate risk.

Conclusion

The recent downturn in U.S. stocks has erased more than half of the gains accumulated since the last presidential election, reflecting heightened market volatility and investor uncertainty. Contributing factors include concerns over economic growth, inflationary pressures, and geopolitical tensions, which have collectively undermined investor confidence. The sell-off has been broad-based, affecting major indices and sectors, and highlights the market’s sensitivity to both domestic and international developments. As investors reassess their risk exposure, the focus will likely shift to upcoming economic data releases and policy decisions that could influence market direction in the near term.