“UK Markets Brace for Impact as Global Bond Crisis Unfolds.”

Introduction

The UK markets are currently experiencing significant turbulence as a result of a global bond crisis that has sent shockwaves through financial systems worldwide. Rising interest rates, inflationary pressures, and geopolitical uncertainties have led to a sell-off in government bonds, causing yields to spike and investor confidence to wane. This turmoil has not only affected bond markets but has also reverberated through equities and other asset classes, prompting concerns about economic stability and growth prospects in the UK. As investors grapple with the implications of these developments, the outlook for the UK economy remains uncertain, with potential ramifications for businesses and consumers alike.

UK Market Reactions to Global Bond Crisis

The recent turmoil in global bond markets has sent ripples through the UK financial landscape, prompting a series of reactions from investors, policymakers, and analysts alike. As yields on government bonds surged, reflecting rising inflation expectations and tightening monetary policies across major economies, the UK market found itself grappling with the implications of these shifts. The immediate response was a noticeable increase in volatility, as market participants reassessed their strategies in light of the changing economic environment.

In the wake of the bond crisis, UK equities experienced a pronounced sell-off, particularly in sectors sensitive to interest rate fluctuations. Financial stocks, which typically benefit from higher rates, initially appeared resilient; however, the broader market sentiment quickly turned negative as fears of an economic slowdown took hold. This was compounded by concerns that rising borrowing costs could stifle consumer spending and business investment, leading to a potential slowdown in economic growth. Consequently, the FTSE 100 index, which had shown signs of recovery earlier in the year, faced downward pressure, reflecting the uncertainty that permeated the market.

Moreover, the bond crisis has also influenced the Bank of England’s monetary policy considerations. As central banks around the world, including the Federal Reserve and the European Central Bank, signaled a more aggressive stance on interest rates to combat inflation, the UK central bank found itself at a crossroads. The challenge lies in balancing the need to control inflation while ensuring that the economy does not tip into recession. This delicate balancing act has led to increased speculation regarding the timing and magnitude of future rate hikes, further complicating the investment landscape.

In addition to equities, the UK bond market has not been immune to the turbulence. Gilt yields have risen sharply, reflecting the broader trend in global bond markets. Investors have begun to demand higher returns for holding UK government debt, which has implications for the cost of borrowing for both the government and private sector. As yields rise, the attractiveness of fixed-income investments diminishes, prompting a shift in asset allocation strategies among institutional investors. This shift has led to a flight to quality, with many seeking refuge in safer assets, thereby exacerbating the volatility in riskier assets.

Furthermore, the impact of the global bond crisis extends beyond immediate market reactions; it also raises questions about the long-term structural changes in the UK economy. The potential for sustained higher interest rates could alter the landscape for businesses, particularly those reliant on cheap financing. As companies reassess their capital expenditure plans in light of increased borrowing costs, the implications for economic growth could be significant. This scenario underscores the interconnectedness of global financial markets and the importance of monitoring developments beyond national borders.

In conclusion, the UK market’s response to the global bond crisis illustrates the complexities of navigating an increasingly volatile economic environment. As investors grapple with rising yields and shifting monetary policies, the implications for equities, bonds, and overall economic growth remain uncertain. The interplay between domestic and international factors will continue to shape market dynamics, necessitating a vigilant approach from all stakeholders involved. As the situation evolves, the ability to adapt to these changes will be crucial for maintaining stability in the UK financial markets.

Impact of Rising Interest Rates on UK Investments

As the global financial landscape experiences significant upheaval, the impact of rising interest rates on UK investments has become a pressing concern for investors and policymakers alike. The recent surge in interest rates, driven by central banks’ efforts to combat inflation, has reverberated across various asset classes, prompting a reevaluation of investment strategies. In the UK, where the Bank of England has been compelled to raise rates in response to persistent inflationary pressures, the implications for both equity and fixed-income markets are profound.

To begin with, higher interest rates typically lead to increased borrowing costs, which can dampen consumer spending and business investment. This, in turn, affects corporate earnings, as companies may face higher expenses and reduced demand for their products and services. Consequently, equity markets may experience volatility as investors reassess the growth prospects of publicly traded companies. Sectors that are particularly sensitive to interest rate fluctuations, such as real estate and utilities, may see a more pronounced impact, as their valuations often rely on the stability of cash flows and the cost of capital.

Moreover, the bond market is experiencing its own set of challenges. As interest rates rise, existing bonds with lower yields become less attractive, leading to a decline in their market value. This phenomenon can create a ripple effect, as investors may shift their portfolios away from fixed-income securities in search of better returns elsewhere. In the UK, where government bonds, or gilts, have traditionally been viewed as a safe haven, the rising yields may prompt a reassessment of risk and return profiles. Investors may find themselves navigating a more complex landscape, where the traditional inverse relationship between bond prices and interest rates becomes increasingly pronounced.

In addition to these immediate effects, the rising interest rate environment also raises questions about the long-term sustainability of certain investment strategies. For instance, the popularity of growth stocks, which often rely on future earnings projections, may wane as the cost of capital increases. Investors may begin to favor value stocks, which tend to offer more stable earnings and dividends, thereby providing a buffer against economic uncertainty. This shift in investor sentiment could lead to a broader reallocation of capital within the UK markets, as participants seek to mitigate risk in an increasingly volatile environment.

Furthermore, the implications of rising interest rates extend beyond domestic markets, as global interconnectedness means that developments in one region can influence others. For instance, if the US Federal Reserve continues to raise rates aggressively, it could lead to capital outflows from emerging markets, thereby impacting the UK’s trade relationships and economic growth prospects. As investors grapple with these complexities, the need for a diversified investment approach becomes paramount. By spreading investments across various asset classes and geographies, investors can better position themselves to weather the storm of rising interest rates.

In conclusion, the impact of rising interest rates on UK investments is multifaceted, affecting everything from corporate earnings to asset valuations. As the financial landscape continues to evolve, investors must remain vigilant and adaptable, recognizing that the interplay between interest rates and market dynamics will shape their investment decisions for the foreseeable future. By understanding these trends and their implications, investors can navigate the challenges ahead and seek opportunities amidst the turbulence.

Strategies for Navigating UK Market Volatility

As the UK markets grapple with the repercussions of a global bond crisis, investors are increasingly seeking strategies to navigate the ensuing volatility. The interconnectedness of financial markets means that fluctuations in bond yields can have far-reaching implications for equities, currencies, and commodities. Consequently, understanding the dynamics at play is essential for making informed investment decisions during these turbulent times.

One effective strategy for managing risk in the face of market uncertainty is diversification. By spreading investments across various asset classes, sectors, and geographical regions, investors can mitigate the impact of adverse movements in any single market. For instance, while UK equities may be under pressure due to rising bond yields, sectors such as utilities or consumer staples may offer relative stability. Additionally, incorporating international assets can provide a buffer against domestic volatility, as different markets often respond differently to global economic shifts.

Moreover, investors should consider adopting a defensive investment approach. This involves focusing on high-quality stocks with strong balance sheets, consistent earnings, and a history of dividend payments. Such companies tend to be more resilient during periods of market stress, as they are better positioned to weather economic downturns. Furthermore, defensive sectors, including healthcare and consumer goods, often exhibit less sensitivity to interest rate fluctuations, making them attractive options in a rising rate environment.

In addition to diversification and defensive positioning, maintaining a long-term perspective is crucial. Market volatility can provoke emotional reactions, leading investors to make impulsive decisions that may not align with their overall financial goals. By adhering to a well-defined investment strategy and focusing on long-term objectives, investors can avoid the pitfalls of short-term market noise. This approach not only helps in preserving capital but also allows for the potential to capitalize on market recoveries when they occur.

Another strategy worth considering is the use of hedging techniques. Options and futures contracts can provide a means to protect portfolios against downside risk. For instance, purchasing put options on major indices can offer a safeguard against significant market declines. While hedging may involve additional costs, it can serve as a valuable tool for risk management, particularly in uncertain market conditions.

Furthermore, staying informed about macroeconomic indicators and central bank policies is essential for navigating market volatility. The Bank of England’s decisions regarding interest rates and quantitative easing can significantly influence market sentiment and asset prices. By keeping abreast of economic data releases, such as inflation rates and employment figures, investors can better anticipate potential market movements and adjust their strategies accordingly.

Lastly, engaging with financial advisors or investment professionals can provide valuable insights and guidance during turbulent times. These experts can help investors assess their risk tolerance, refine their investment strategies, and identify opportunities that may arise from market dislocations. Collaborative discussions can also foster a deeper understanding of market dynamics, enabling investors to make more informed decisions.

In conclusion, while the UK markets face significant challenges amid a global bond crisis, there are several strategies that investors can employ to navigate this volatility. By diversifying their portfolios, adopting a defensive stance, maintaining a long-term perspective, utilizing hedging techniques, staying informed about economic indicators, and seeking professional advice, investors can position themselves to weather the storm and potentially emerge stronger in the aftermath of market turbulence.

The Role of Central Banks in the Bond Crisis

The current turbulence in UK markets can be largely attributed to the ongoing global bond crisis, a situation that has drawn significant attention to the role of central banks. Central banks, as the primary monetary authorities in their respective countries, wield considerable influence over interest rates and, consequently, the bond markets. Their policies and decisions can either stabilize or exacerbate market conditions, and in the context of the current crisis, their actions are under intense scrutiny.

To understand the role of central banks in this crisis, it is essential to consider the broader economic landscape. In recent years, many central banks adopted aggressive monetary policies, including low interest rates and quantitative easing, to stimulate economic growth in the aftermath of the financial crisis. These measures led to a prolonged period of low yields on government bonds, encouraging investors to seek higher returns in riskier assets. However, as inflationary pressures began to mount, central banks faced a dilemma: continue supporting the economy or pivot towards tightening monetary policy to combat rising prices.

As central banks began signaling a shift towards tightening, the bond markets reacted swiftly. In the UK, the Bank of England’s decisions regarding interest rates have been particularly impactful. The anticipation of rate hikes has led to a sell-off in government bonds, resulting in rising yields. This shift not only affects the cost of borrowing for the government but also has broader implications for businesses and consumers. Higher yields can lead to increased mortgage rates and borrowing costs, which may dampen consumer spending and investment, further complicating the economic recovery.

Moreover, the interconnectedness of global financial markets means that the actions of one central bank can have ripple effects across the world. For instance, the Federal Reserve’s decisions in the United States have historically influenced the Bank of England’s policy choices. As the Fed embarked on its own tightening cycle, the pressure on the Bank of England to follow suit intensified. This synchronization of monetary policy among major economies has contributed to the volatility observed in bond markets, as investors reassess their strategies in light of changing interest rate expectations.

In addition to interest rate adjustments, central banks also play a crucial role in managing market expectations. Forward guidance, a tool used by central banks to communicate future policy intentions, can significantly influence investor behavior. However, in the current climate, the uncertainty surrounding inflation and economic growth has made it challenging for central banks to provide clear guidance. This ambiguity can lead to increased market volatility, as investors grapple with conflicting signals about the future trajectory of interest rates.

Furthermore, the bond crisis has raised questions about the effectiveness of central banks’ traditional tools. As yields rise and market conditions become more volatile, the ability of central banks to stabilize the economy through interest rate adjustments may be limited. This situation has prompted discussions about the need for new policy frameworks and tools to address the complexities of modern financial markets.

In conclusion, the role of central banks in the ongoing bond crisis is multifaceted and critical. Their decisions regarding interest rates and market communication have far-reaching implications for both domestic and global markets. As the UK navigates this turbulent landscape, the actions of central banks will remain a focal point for investors and policymakers alike, highlighting the delicate balance they must strike between fostering economic growth and maintaining financial stability.

Sector Analysis: Which UK Industries Are Most Affected?

As the global bond crisis unfolds, the repercussions are being felt across various sectors of the UK economy, prompting a closer examination of which industries are most vulnerable to these financial tremors. The bond market, often viewed as a barometer of economic stability, has experienced significant volatility, leading to rising yields and increased borrowing costs. This shift has created a ripple effect, influencing investor sentiment and altering the landscape for numerous sectors.

One of the most affected industries is real estate, particularly commercial property. As interest rates climb, the cost of financing new developments and acquisitions rises correspondingly. This situation has led to a slowdown in investment activity, as potential buyers reassess the viability of their projects in light of higher borrowing costs. Furthermore, the uncertainty surrounding the bond market has made investors more cautious, resulting in a decline in property valuations. Consequently, real estate firms are grappling with reduced demand and tighter margins, which could lead to a prolonged period of stagnation in the sector.

In addition to real estate, the construction industry is also feeling the strain. The rising costs of materials, exacerbated by inflationary pressures and supply chain disruptions, have already posed challenges for construction firms. With the added burden of increased financing costs due to the bond crisis, many companies are now facing difficult decisions regarding project timelines and budgets. As a result, some firms may be forced to delay or scale back their operations, which could have a cascading effect on employment and economic growth within the sector.

The financial services sector is another area experiencing turbulence. Banks and financial institutions are navigating a complex environment characterized by fluctuating interest rates and heightened market volatility. While higher interest rates can potentially enhance profit margins for lenders, the associated risks of increased defaults and reduced consumer spending cannot be overlooked. Moreover, investment firms are reassessing their portfolios in light of the bond crisis, leading to a potential reallocation of capital away from riskier assets. This shift could dampen market activity and impact the overall performance of the financial sector.

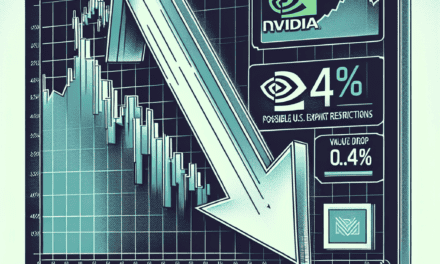

Moreover, the technology sector, which has been a significant driver of growth in recent years, is not immune to the effects of the bond crisis. Many tech companies rely on external financing to fuel their expansion and innovation efforts. As borrowing costs rise, these firms may find it increasingly challenging to secure the necessary capital for research and development initiatives. This situation could stifle innovation and slow down the pace of technological advancement, ultimately affecting the sector’s long-term growth prospects.

Conversely, some industries may exhibit resilience in the face of these challenges. For instance, essential consumer goods and utilities tend to be less sensitive to economic fluctuations, as demand for these products remains relatively stable regardless of market conditions. Companies in these sectors may benefit from a flight to safety, as investors seek more secure investments during periods of uncertainty.

In conclusion, the ongoing global bond crisis is casting a shadow over several key industries in the UK, with real estate, construction, financial services, and technology facing significant challenges. As the situation evolves, it will be crucial for stakeholders to remain vigilant and adaptable, navigating the complexities of a shifting economic landscape while seeking opportunities for growth amidst the turbulence.

Historical Comparisons: Past UK Market Turbulence

The current turbulence in UK markets, exacerbated by a global bond crisis, invites comparisons to historical instances of financial instability that have shaped the economic landscape. Understanding these past events provides valuable insights into the potential implications of the present situation. One notable period of market upheaval occurred in the late 1970s, characterized by rampant inflation and rising interest rates. During this time, the UK faced significant economic challenges, including a decline in consumer confidence and a surge in unemployment. The government’s response, which included austerity measures and attempts to control inflation, ultimately led to a prolonged period of economic stagnation known as the “Winter of Discontent.” This historical episode serves as a reminder of how external pressures, such as global economic shifts, can precipitate domestic market turmoil.

Transitioning to the early 1990s, the UK experienced another significant market crisis, primarily driven by the collapse of the Exchange Rate Mechanism (ERM). The decision to maintain a fixed exchange rate amid rising inflation and economic divergence from other European economies proved unsustainable. As the pound came under pressure, the Bank of England was forced to raise interest rates dramatically to defend the currency, leading to a recession that saw house prices plummet and unemployment rise sharply. This period highlighted the vulnerabilities inherent in fixed exchange rate systems and underscored the importance of flexible monetary policy in responding to market dynamics.

Fast forward to the 2008 financial crisis, which had profound implications for the UK economy and its markets. The collapse of major financial institutions, triggered by the subprime mortgage crisis in the United States, sent shockwaves through global markets. In the UK, the government intervened with substantial bailouts for banks, while the Bank of England slashed interest rates to historic lows in an effort to stimulate economic growth. The aftermath of this crisis saw a protracted period of recovery, marked by sluggish growth and persistent concerns over public debt. The lessons learned from this crisis continue to resonate today, particularly regarding the interconnectedness of global financial systems and the potential for rapid contagion across markets.

As we examine these historical precedents, it becomes evident that the current turbulence in UK markets is not an isolated phenomenon but rather part of a broader narrative of economic volatility. The global bond crisis, driven by rising interest rates and inflationary pressures, has created an environment of uncertainty that echoes past challenges. Investors are grappling with the implications of tightening monetary policy, which could lead to increased borrowing costs and reduced consumer spending. Furthermore, the potential for a slowdown in economic growth raises questions about corporate profitability and market stability.

In conclusion, the historical comparisons of past UK market turbulence provide a framework for understanding the current challenges faced by investors and policymakers alike. Each episode of financial instability has left an indelible mark on the economic landscape, shaping responses and strategies for future crises. As the UK navigates the complexities of the present global bond crisis, it is crucial to draw upon these lessons to foster resilience and adaptability in the face of uncertainty. The interplay between domestic and global factors will continue to influence market dynamics, underscoring the importance of vigilance and informed decision-making in these turbulent times.

Future Outlook: Predictions for the UK Economy Amidst Bond Crisis

As the UK markets grapple with the ramifications of a global bond crisis, the future outlook for the UK economy remains a topic of considerable debate among economists and financial analysts. The current turbulence in the bond markets, characterized by rising yields and increasing volatility, has raised concerns about the potential impact on economic growth, inflation, and monetary policy in the UK. In this context, it is essential to explore the various factors that could shape the trajectory of the UK economy in the coming months and years.

To begin with, the bond crisis has been largely driven by central banks’ efforts to combat inflation, which has surged in many economies following the pandemic. As central banks, including the Bank of England, signal intentions to tighten monetary policy, the resulting increase in interest rates could have profound implications for borrowing costs across the UK. Higher interest rates may dampen consumer spending and business investment, leading to a slowdown in economic growth. Consequently, analysts predict that the UK may experience a period of subdued economic activity as households and businesses adjust to the new financial landscape.

Moreover, the bond crisis has also raised concerns about the stability of financial markets. As investors reassess their portfolios in light of rising yields, there is a risk of increased market volatility, which could further exacerbate economic uncertainty. This volatility may lead to a tightening of credit conditions, making it more challenging for businesses to secure financing. In turn, this could hinder capital investment and innovation, both of which are crucial for long-term economic growth. Therefore, the outlook for the UK economy hinges on the ability of financial institutions to navigate these turbulent waters while maintaining stability.

In addition to these domestic challenges, the UK economy is also influenced by global economic conditions. The interconnectedness of financial markets means that developments in other major economies, particularly the United States and the Eurozone, can have significant repercussions for the UK. For instance, if the Federal Reserve continues to raise interest rates aggressively, it could lead to capital outflows from the UK, putting additional pressure on the pound and potentially exacerbating inflationary pressures. Consequently, the UK’s economic outlook is inextricably linked to global trends, making it essential for policymakers to remain vigilant and responsive to external developments.

Furthermore, the ongoing geopolitical tensions and supply chain disruptions stemming from various global events add another layer of complexity to the economic outlook. These factors could contribute to persistent inflationary pressures, complicating the Bank of England’s efforts to achieve its inflation targets. As a result, the central bank may face a challenging balancing act: tightening monetary policy to combat inflation while ensuring that economic growth does not stall. This delicate equilibrium will be crucial in determining the future trajectory of the UK economy.

In conclusion, the future outlook for the UK economy amidst the global bond crisis is fraught with uncertainty. While there are potential headwinds that could impede growth, there are also opportunities for resilience and adaptation. Policymakers will need to navigate these challenges with a keen understanding of both domestic and global dynamics. Ultimately, the ability of the UK economy to weather this storm will depend on a combination of sound monetary policy, robust financial institutions, and a proactive approach to addressing the underlying issues that have contributed to the current crisis. As the situation evolves, stakeholders will be closely monitoring developments to gauge the long-term implications for the UK economy.

Q&A

1. **What is causing the turbulence in UK markets?**

The turbulence is primarily due to a global bond crisis, characterized by rising interest rates and inflation concerns.

2. **How are UK government bonds (gilts) affected?**

UK government bonds are experiencing increased yields, leading to a decline in their prices as investors reassess risk.

3. **What impact does the bond crisis have on UK equities?**

The bond crisis is causing volatility in UK equities, as higher borrowing costs can negatively affect corporate profits and investor sentiment.

4. **Are there specific sectors in the UK market that are more affected?**

Yes, sectors such as real estate and utilities, which are sensitive to interest rate changes, are particularly impacted.

5. **What measures are being taken by the Bank of England?**

The Bank of England may consider adjusting interest rates or implementing quantitative easing to stabilize the markets.

6. **How are investors responding to the current market conditions?**

Investors are becoming more risk-averse, leading to a flight to safer assets and increased demand for cash and gold.

7. **What are the long-term implications for the UK economy?**

Prolonged turbulence in the markets could lead to slower economic growth, increased borrowing costs, and potential challenges for consumer spending.

Conclusion

The UK markets are experiencing significant turbulence as a result of the global bond crisis, characterized by rising yields and increased volatility. This situation has led to heightened uncertainty among investors, impacting stock prices and overall market stability. The interplay between domestic economic conditions and international financial trends will be crucial in determining the future trajectory of the UK markets. Immediate measures may be necessary to restore confidence and mitigate risks associated with the ongoing crisis.