“Trump’s Comeback Fuels Dollar Surge, Shaking Emerging Markets’ Stability.”

Introduction

In recent financial developments, the resurgence of Donald Trump in the political arena has triggered a notable rally in the U.S. dollar, exerting significant influence on emerging markets worldwide. As investors react to the potential implications of Trump’s political comeback, the dollar’s strength has surged, creating ripples across global financial markets. This rally has led to increased volatility and uncertainty in emerging economies, which are particularly sensitive to fluctuations in the U.S. currency. The strengthening dollar poses challenges for these markets, impacting trade balances, foreign investment flows, and debt servicing costs. As the situation unfolds, policymakers and investors in emerging markets are closely monitoring the developments, assessing the potential long-term effects on their economic stability and growth prospects.

Trump’s Comeback: Catalyzing a Dollar Surge in Global Markets

The recent resurgence of Donald Trump in the political arena has sparked a notable rally in the U.S. dollar, sending ripples across global financial markets, particularly impacting emerging economies. As Trump reasserts his influence, investors are recalibrating their strategies, leading to a strengthened dollar that is reshaping economic dynamics worldwide. This development is not only a testament to the interconnectedness of global markets but also highlights the intricate balance between political events and economic outcomes.

The dollar’s rally can be attributed to several factors, with Trump’s comeback playing a pivotal role. His re-emergence has rekindled investor confidence in the U.S. economy, prompting a shift towards dollar-denominated assets. This shift is driven by expectations of potential policy changes that could stimulate economic growth, such as tax reforms and deregulation, reminiscent of his previous administration. Consequently, the dollar has appreciated against a basket of major currencies, reflecting heightened demand and investor optimism.

However, the strengthening dollar poses challenges for emerging markets, which are particularly sensitive to fluctuations in the U.S. currency. Many of these economies rely heavily on dollar-denominated debt, making them vulnerable to exchange rate volatility. As the dollar appreciates, the cost of servicing this debt increases, straining national budgets and potentially leading to financial instability. Moreover, a stronger dollar often results in capital outflows from emerging markets as investors seek higher returns in the U.S., further exacerbating economic pressures.

In addition to debt servicing challenges, emerging markets face the risk of inflationary pressures due to the dollar’s rally. A stronger dollar typically leads to higher import costs for countries with weaker currencies, driving up prices for goods and services. This inflationary trend can erode purchasing power and dampen economic growth, creating a challenging environment for policymakers striving to maintain stability.

Furthermore, the dollar’s appreciation can impact trade dynamics, as it makes U.S. exports more expensive and imports cheaper. For emerging markets that rely on exporting goods to the U.S., this shift can lead to reduced competitiveness and lower export revenues. Conversely, cheaper imports may benefit consumers in these countries but could also undermine local industries, leading to potential job losses and economic dislocation.

Despite these challenges, some emerging markets may find opportunities amid the dollar’s rally. Countries with strong economic fundamentals and diversified export bases may attract investment as investors seek alternatives to the U.S. market. Additionally, those with significant foreign exchange reserves can mitigate the impact of a stronger dollar by intervening in currency markets to stabilize their own currencies.

In conclusion, Trump’s comeback has catalyzed a dollar surge that is reshaping global financial landscapes, with significant implications for emerging markets. While the strengthened dollar reflects investor confidence in the U.S. economy, it also presents challenges for countries with dollar-denominated debt and trade dependencies. As these economies navigate the complexities of a stronger dollar, they must balance the risks and opportunities presented by this dynamic environment. Ultimately, the interplay between political developments and economic outcomes underscores the need for strategic foresight and adaptability in an ever-evolving global market.

Emerging Markets React to Trump’s Influence on the Dollar

The recent resurgence of Donald Trump in the political arena has had a notable impact on global financial markets, particularly influencing the value of the U.S. dollar. This development has, in turn, created ripples across emerging markets, which are often sensitive to fluctuations in the dollar’s strength. As Trump reasserts his presence, the dollar has experienced a rally, driven by investor speculation about potential shifts in U.S. economic policy and geopolitical dynamics. This rally has significant implications for emerging markets, which are now navigating the challenges posed by a stronger dollar.

To understand the impact of Trump’s comeback on the dollar, it is essential to consider the factors contributing to the currency’s appreciation. Investors often view the dollar as a safe haven during times of uncertainty, and Trump’s re-emergence has introduced a degree of unpredictability into the global economic landscape. As a result, there has been an increased demand for the dollar, pushing its value higher. This appreciation is further fueled by expectations of potential policy changes that could affect trade, taxation, and international relations, all of which are closely monitored by market participants.

The strengthening of the dollar poses several challenges for emerging markets. Many of these economies rely heavily on dollar-denominated debt, and a stronger dollar increases the cost of servicing this debt. Consequently, countries with significant external debt burdens may face heightened financial pressures, potentially leading to fiscal instability. Additionally, a robust dollar can lead to capital outflows from emerging markets, as investors seek higher returns in U.S. assets. This shift in capital can exacerbate currency depreciation in emerging economies, further complicating their economic outlook.

Moreover, the impact of a stronger dollar extends to trade dynamics. Emerging markets often depend on exports to drive economic growth, and a more expensive dollar can make their goods less competitive in international markets. This situation can lead to a decline in export revenues, putting additional strain on these economies. Furthermore, the increased cost of imports, particularly for essential goods and commodities priced in dollars, can contribute to inflationary pressures, eroding purchasing power and affecting consumer confidence.

Despite these challenges, some emerging markets may find opportunities amid the dollar rally. For instance, countries with substantial foreign exchange reserves or those that have implemented sound macroeconomic policies may be better positioned to weather the storm. Additionally, a stronger dollar can benefit exporters of commodities such as oil and metals, as these goods are typically priced in dollars. As a result, commodity-exporting nations may experience a boost in revenues, partially offsetting the adverse effects of a stronger dollar.

In conclusion, Trump’s comeback and the subsequent dollar rally have created a complex landscape for emerging markets. While the stronger dollar presents significant challenges, it also offers opportunities for those economies that can adapt to the changing environment. As these markets navigate the implications of a resurgent Trump and a robust dollar, policymakers must carefully balance short-term pressures with long-term strategies to ensure economic stability and growth. By doing so, emerging markets can better position themselves to thrive in an increasingly interconnected and dynamic global economy.

The Dollar Rally: How Trump’s Return Shapes Emerging Economies

The recent resurgence of Donald Trump in the political arena has sparked a notable rally in the U.S. dollar, a development that is sending ripples across global financial markets, particularly impacting emerging economies. As Trump reasserts his influence, investors are recalibrating their expectations, leading to a strengthening of the dollar. This shift is not merely a reflection of domestic political dynamics but also a response to anticipated changes in U.S. economic policy, which could have far-reaching implications for global trade and investment flows.

The dollar’s rally can be attributed to several factors associated with Trump’s potential return to the political forefront. Investors are speculating that his policies might prioritize domestic economic growth, potentially leading to higher interest rates. This expectation of a more robust U.S. economy is enticing investors to seek dollar-denominated assets, thereby increasing demand for the currency. As a result, the dollar’s appreciation is exerting pressure on emerging markets, which often rely on dollar-denominated debt and trade.

Emerging economies are particularly vulnerable to fluctuations in the dollar’s value. A stronger dollar makes it more expensive for these countries to service their debt, as they need more of their local currency to meet dollar-denominated obligations. This situation can strain national budgets and lead to fiscal challenges, especially for countries with significant external debt. Moreover, a robust dollar can lead to capital outflows from emerging markets, as investors seek higher returns in the U.S., further exacerbating financial instability in these regions.

In addition to debt servicing challenges, the dollar’s rally can impact trade dynamics. Emerging markets often depend on exports to drive economic growth, and a stronger dollar can make their goods more expensive and less competitive in international markets. This shift can lead to a decrease in export revenues, putting additional pressure on these economies. Furthermore, the cost of importing essential goods, such as food and energy, can rise, leading to inflationary pressures that affect the purchasing power of consumers in these countries.

While the immediate effects of the dollar’s rally are evident, the long-term implications for emerging markets depend on how these economies adapt to the changing landscape. Some countries may seek to diversify their trade partners and reduce reliance on dollar-denominated debt, while others might implement policy measures to stabilize their currencies and mitigate inflationary pressures. Additionally, international financial institutions may play a crucial role in providing support to vulnerable economies, helping them navigate the challenges posed by a stronger dollar.

In conclusion, Trump’s comeback and the subsequent dollar rally underscore the interconnectedness of global financial markets and the significant impact that U.S. political developments can have on emerging economies. As these countries grapple with the challenges posed by a stronger dollar, their ability to adapt and implement effective policy measures will be crucial in maintaining economic stability. The evolving situation serves as a reminder of the importance of resilience and adaptability in an increasingly complex and interdependent global economy. As the world watches the unfolding political and economic landscape, the responses of emerging markets will be pivotal in shaping their future trajectories amidst the shifting tides of global finance.

Trump’s Political Resurgence and Its Ripple Effect on Emerging Markets

Donald Trump’s political resurgence has once again captured the attention of global markets, with the U.S. dollar experiencing a notable rally as a result. This development has significant implications for emerging markets, which are often sensitive to fluctuations in the value of the dollar. As Trump reasserts his influence on the political stage, investors are closely monitoring the potential economic consequences, particularly in regions where the strength of the dollar can have profound effects.

The dollar’s rally can be attributed to several factors linked to Trump’s comeback. Firstly, his return to the political arena has reignited discussions around his economic policies, which historically emphasized tax cuts, deregulation, and a strong dollar. These policies, if reintroduced or even anticipated, could bolster investor confidence in the U.S. economy, thereby increasing demand for the dollar. Additionally, Trump’s potential influence on future fiscal policies may lead to expectations of higher interest rates, further strengthening the currency.

As the dollar appreciates, emerging markets face a dual challenge. On one hand, a stronger dollar makes it more expensive for these countries to service their dollar-denominated debt. Many emerging economies rely on borrowing in dollars to finance growth and development projects. Consequently, a rising dollar can lead to increased debt servicing costs, straining national budgets and potentially leading to fiscal instability. On the other hand, a robust dollar can also make exports from emerging markets less competitive. As their goods become more expensive for foreign buyers, these countries may experience a decline in export revenues, which are crucial for economic growth.

Moreover, the dollar’s rally can trigger capital outflows from emerging markets. Investors, seeking higher returns and stability, may redirect their investments towards the U.S., where the strengthening dollar promises better yields. This shift can lead to a depreciation of local currencies, further exacerbating the financial challenges faced by emerging economies. In turn, central banks in these regions may be compelled to raise interest rates to defend their currencies, potentially stifling economic growth and increasing the cost of borrowing domestically.

While the immediate impact of Trump’s political resurgence is evident in the currency markets, the long-term effects on emerging markets remain uncertain. Policymakers in these regions must navigate a complex landscape, balancing the need to maintain economic stability with the pressures of a strong dollar. Some countries may seek to diversify their foreign exchange reserves, reducing their reliance on the dollar and mitigating the risks associated with its fluctuations. Others might explore regional trade agreements or partnerships that lessen their exposure to dollar volatility.

In conclusion, Trump’s comeback has set off a chain reaction in the global financial system, with the dollar’s rally posing significant challenges for emerging markets. As these countries grapple with the implications of a stronger dollar, they must adopt strategic measures to safeguard their economies. The interplay between U.S. political developments and global economic dynamics underscores the interconnectedness of today’s financial landscape, where shifts in one region can have far-reaching consequences across the globe. As the situation evolves, both investors and policymakers will need to remain vigilant, adapting to the changing tides of the global economy.

Analyzing the Dollar’s Strength Amid Trump’s Political Comeback

The recent resurgence of Donald Trump in the political arena has sparked a notable rally in the U.S. dollar, a development that is reverberating across global financial markets, particularly impacting emerging economies. As Trump reasserts his influence, investors are recalibrating their expectations, leading to a strengthening of the dollar. This phenomenon is not merely a reflection of domestic political dynamics but also a testament to the intricate interplay between politics and economics on the global stage.

To understand the implications of this dollar rally, it is essential to consider the factors driving the currency’s appreciation. Trump’s comeback has reignited discussions around potential shifts in U.S. economic policy, including tax reforms and deregulation, which are perceived by investors as conducive to economic growth. Consequently, there is an increased demand for dollar-denominated assets, as investors anticipate higher returns. This demand, in turn, has bolstered the dollar’s value against a basket of other currencies.

The strengthening of the dollar, while beneficial for U.S. exporters and those holding dollar-denominated assets, poses significant challenges for emerging markets. These economies often rely on foreign capital to finance growth and development, and a stronger dollar can lead to capital outflows as investors seek safer, more lucrative opportunities in the U.S. Moreover, many emerging markets have substantial dollar-denominated debt, which becomes more expensive to service as the dollar appreciates. This situation can strain national budgets and exacerbate existing economic vulnerabilities.

Furthermore, the dollar’s rally can lead to inflationary pressures in emerging markets. As local currencies depreciate against the dollar, the cost of imports rises, contributing to higher consumer prices. Central banks in these regions may be compelled to raise interest rates to combat inflation, which can stifle economic growth by increasing borrowing costs for businesses and consumers alike. Thus, the ripple effects of the dollar’s strength are multifaceted, influencing everything from trade balances to monetary policy decisions.

In addition to these economic considerations, the geopolitical landscape also plays a crucial role in shaping the impact of the dollar’s rally. Emerging markets are often more susceptible to geopolitical risks, and the uncertainty surrounding Trump’s political comeback adds another layer of complexity. Investors may become more risk-averse, further exacerbating capital flight from these regions. This dynamic underscores the interconnectedness of global markets and the importance of political stability in fostering economic resilience.

While the immediate effects of the dollar’s rally are evident, the long-term implications remain uncertain. Emerging markets may need to adapt by diversifying their economies and reducing reliance on external financing. Additionally, policymakers in these regions might explore strategies to enhance financial stability, such as building foreign exchange reserves or implementing structural reforms to attract sustainable investment.

In conclusion, Trump’s political resurgence has catalyzed a rally in the U.S. dollar, with significant repercussions for emerging markets. The interplay between political developments and economic outcomes highlights the complexity of global financial systems. As the situation evolves, stakeholders must navigate these challenges with foresight and adaptability, ensuring that the benefits of a strong dollar are maximized while mitigating its adverse effects on vulnerable economies. Through strategic planning and international cooperation, it is possible to foster a more balanced and resilient global economic environment.

Emerging Markets Under Pressure: The Trump-Induced Dollar Rally

The recent resurgence of Donald Trump in the political arena has sparked a notable rally in the U.S. dollar, creating ripples across global financial markets. This development has placed emerging markets under significant pressure, as the strengthening dollar poses challenges to their economic stability. The dollar’s appreciation is largely attributed to investor anticipation of potential policy shifts that could arise from Trump’s political comeback, which has reignited discussions around trade, fiscal policies, and international relations.

As the dollar gains strength, emerging markets face a dual challenge. Firstly, a stronger dollar often leads to capital outflows from these markets as investors seek the relative safety and higher returns of U.S. assets. This capital flight can result in depreciating local currencies, making it more expensive for these countries to service their dollar-denominated debts. Consequently, nations with substantial foreign debt burdens may find themselves grappling with increased financial strain, potentially leading to fiscal instability.

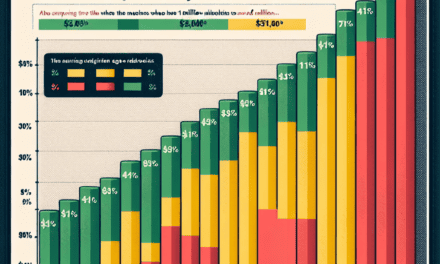

Moreover, the appreciation of the dollar tends to exert downward pressure on commodity prices, as these are typically priced in dollars. For many emerging markets that rely heavily on commodity exports, this scenario can lead to reduced export revenues, further exacerbating their economic challenges. Countries such as Brazil, South Africa, and Indonesia, which are significant commodity exporters, may find their trade balances adversely affected, thereby impacting their overall economic growth prospects.

In addition to these economic pressures, the Trump-induced dollar rally has also heightened geopolitical uncertainties. Trump’s previous tenure was marked by a series of trade tensions and protectionist policies, which had significant implications for global trade dynamics. The prospect of a return to such policies has led to increased volatility in emerging markets, as investors weigh the potential impact on global supply chains and trade agreements. This uncertainty can deter foreign investment, which is crucial for the development and growth of emerging economies.

Furthermore, the strengthening dollar can lead to tighter financial conditions globally. As the Federal Reserve may respond to a stronger dollar with interest rate adjustments, emerging markets could face higher borrowing costs. This scenario is particularly concerning for countries with fragile economies or those already experiencing inflationary pressures. Higher interest rates can stifle economic growth by increasing the cost of borrowing for businesses and consumers, thereby slowing down investment and consumption.

Despite these challenges, some emerging markets may find opportunities amidst the dollar rally. Countries with strong economic fundamentals and diversified export bases may attract investors seeking higher returns in a low-yield global environment. Additionally, nations that have implemented sound fiscal and monetary policies may be better positioned to weather the storm, maintaining investor confidence and economic stability.

In conclusion, the Trump-induced dollar rally presents a complex set of challenges for emerging markets. While the strengthening dollar can lead to capital outflows, increased debt burdens, and reduced export revenues, it also underscores the importance of sound economic policies and diversification. As these markets navigate the uncertainties of a shifting global landscape, their ability to adapt and respond to these pressures will be crucial in determining their economic resilience and future growth trajectories. The interplay between political developments in the United States and economic conditions in emerging markets highlights the interconnectedness of the global economy, emphasizing the need for careful monitoring and strategic planning by policymakers worldwide.

Trump’s Comeback: A Boon or Bane for Emerging Market Economies?

The recent resurgence of Donald Trump in the political arena has sparked a notable rally in the U.S. dollar, a development that is sending ripples across global financial markets, particularly impacting emerging market economies. As Trump reasserts his influence, investors are recalibrating their expectations, leading to a strengthening of the dollar. This shift is largely driven by the anticipation of potential policy changes that could affect trade, taxation, and international relations, reminiscent of the economic strategies during his previous tenure. Consequently, the dollar’s appreciation is creating a complex landscape for emerging markets, which are often sensitive to fluctuations in the U.S. currency.

Emerging markets, characterized by their rapid growth and volatility, are particularly vulnerable to changes in the dollar’s value. A stronger dollar can lead to increased borrowing costs for these economies, as many have significant amounts of debt denominated in U.S. currency. When the dollar appreciates, the cost of servicing this debt rises, putting additional strain on national budgets and potentially leading to fiscal imbalances. Moreover, a robust dollar can also result in capital outflows from emerging markets, as investors seek safer, dollar-denominated assets, thereby exacerbating financial instability in these regions.

In addition to the financial implications, the dollar rally can have profound effects on trade dynamics. Emerging markets often rely heavily on exports, and a stronger dollar can make their goods more expensive and less competitive in the global market. This shift can lead to a decrease in export revenues, further straining economies that are already grappling with the challenges of post-pandemic recovery. Furthermore, the potential for protectionist policies under a Trump comeback could exacerbate these issues, as emerging markets may face increased tariffs and trade barriers, hindering their access to key markets.

However, it is essential to consider that the impact of a stronger dollar is not uniformly negative for all emerging markets. Some countries may benefit from lower import costs, particularly those that rely on importing commodities priced in dollars. Additionally, nations with robust foreign exchange reserves and diversified economies may be better positioned to weather the challenges posed by a stronger dollar. These countries can leverage their reserves to stabilize their currencies and mitigate the adverse effects on their economies.

As the global economic landscape continues to evolve, emerging markets must navigate the complexities of a stronger dollar while also addressing domestic challenges. Policymakers in these regions may need to implement measures to enhance economic resilience, such as diversifying export markets, strengthening fiscal policies, and fostering domestic investment. Moreover, international cooperation and dialogue will be crucial in addressing the broader implications of a potential Trump comeback and its impact on global trade and financial stability.

In conclusion, while Trump’s political resurgence and the subsequent dollar rally present significant challenges for emerging market economies, they also offer an opportunity for these nations to reassess and strengthen their economic strategies. By adopting proactive measures and fostering international collaboration, emerging markets can mitigate the adverse effects of a stronger dollar and position themselves for sustainable growth in an increasingly interconnected world. As the situation unfolds, the global community will be closely watching how these economies adapt and respond to the shifting tides of international finance and politics.

Q&A

1. **What triggered the dollar rally?**

The dollar rally was triggered by news of Trump’s political comeback, which increased investor confidence in the U.S. economy.

2. **How did Trump’s comeback affect investor sentiment?**

Trump’s comeback led to increased optimism among investors about potential economic policies that could strengthen the U.S. economy.

3. **What was the immediate impact on emerging markets?**

Emerging markets experienced capital outflows as investors moved their funds to the U.S., seeking safer and potentially higher returns.

4. **Which emerging market currencies were most affected?**

Currencies such as the Turkish lira, South African rand, and Brazilian real were among those most affected by the dollar’s strength.

5. **How did the stock markets in emerging economies react?**

Stock markets in emerging economies generally saw declines due to the outflow of capital and increased risk aversion among investors.

6. **What are the potential long-term effects on emerging markets?**

Long-term effects could include increased borrowing costs, inflationary pressures, and slower economic growth due to reduced foreign investment.

7. **What measures can emerging markets take to mitigate the impact?**

Emerging markets can implement monetary policies to stabilize their currencies, seek alternative investment sources, and strengthen economic fundamentals to attract investors.

Conclusion

The resurgence of Donald Trump in the political arena has led to a rally in the U.S. dollar, which in turn has significant implications for emerging markets. A stronger dollar typically results in capital outflows from these markets as investors seek the relative safety and higher returns of U.S. assets. This can lead to depreciating local currencies, increased inflationary pressures, and higher costs for servicing dollar-denominated debt in emerging economies. Consequently, these markets may face economic instability and reduced growth prospects. The dollar rally, driven by Trump’s comeback, underscores the interconnectedness of global financial systems and highlights the vulnerabilities of emerging markets to external political and economic shifts.