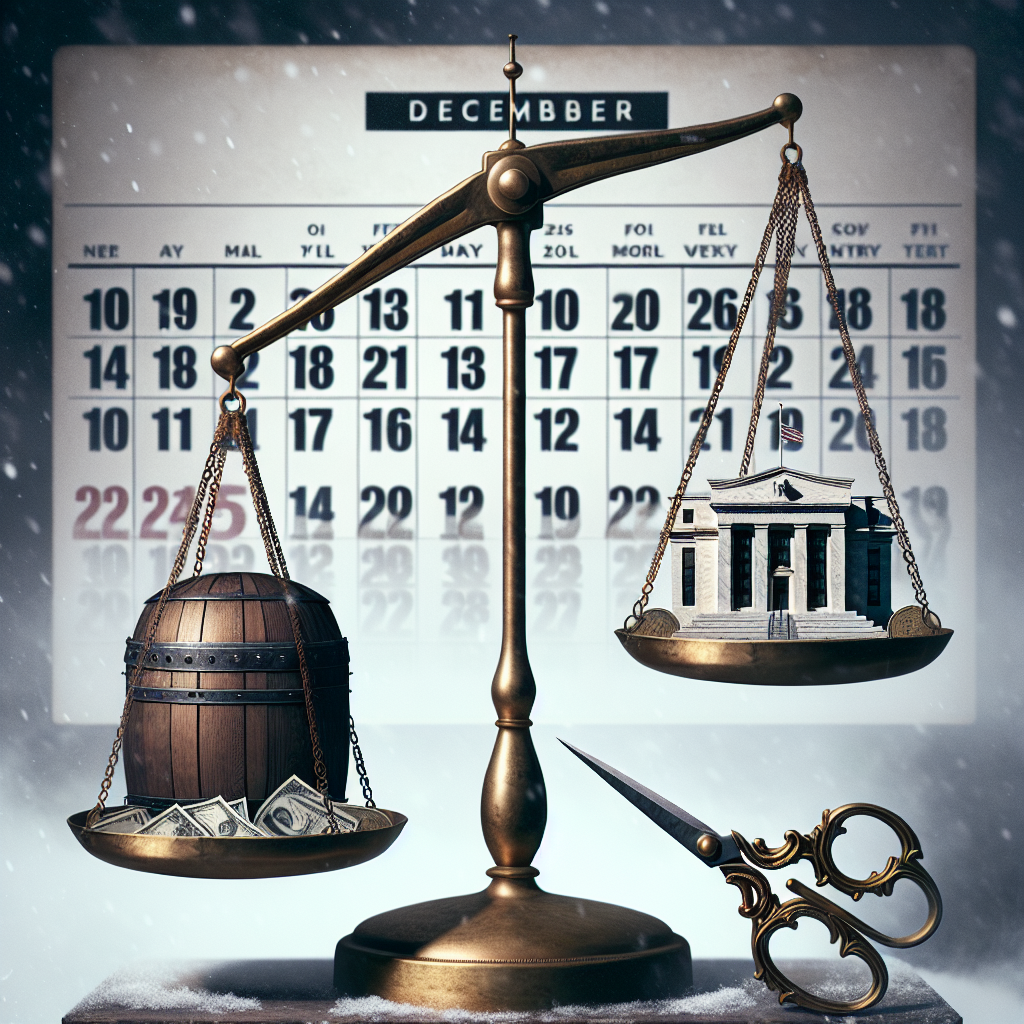

“2024 Treasury Gains in Limbo: December Fed Cut Holds the Key”

Introduction

In 2024, the outlook for Treasury gains faces uncertainty as the anticipated Federal Reserve interest rate cut in December remains in question. Investors and market analysts have been closely monitoring the Fed’s monetary policy decisions, which significantly influence bond yields and, consequently, Treasury gains. The potential delay or absence of a rate cut could impact the bond market, affecting investor strategies and economic forecasts. As the year progresses, the interplay between economic indicators, inflation rates, and Federal Reserve actions will be pivotal in shaping the trajectory of Treasury gains, leaving stakeholders to navigate an environment marked by unpredictability and cautious optimism.

Impact Of Uncertain Fed Cuts On Treasury Gains In 2024

As the financial world looks ahead to 2024, the potential for treasury gains is increasingly under scrutiny, largely due to the uncertainty surrounding the Federal Reserve’s decision on interest rate cuts in December. The Federal Reserve’s monetary policy decisions have long been a critical factor influencing the bond market, and any ambiguity in their actions can lead to significant volatility. This uncertainty is particularly pertinent as investors and analysts attempt to forecast the trajectory of treasury yields and the broader economic landscape in the coming year.

The Federal Reserve’s interest rate policy is a key determinant of treasury yields. When the Fed cuts rates, it typically leads to lower yields on treasuries, as investors seek higher returns elsewhere. Conversely, if the Fed decides to maintain or increase rates, treasury yields may rise, reflecting the higher cost of borrowing. The current uncertainty regarding a potential rate cut in December has left market participants in a state of speculation, as they attempt to gauge the Fed’s next move amidst a backdrop of mixed economic signals.

Economic indicators have been sending conflicting messages, further complicating the Fed’s decision-making process. On one hand, inflationary pressures have shown signs of easing, which could justify a rate cut to stimulate economic growth. On the other hand, the labor market remains robust, with unemployment rates at historically low levels, suggesting that the economy may not require additional monetary stimulus. This dichotomy presents a challenge for the Federal Reserve, as it seeks to balance its dual mandate of promoting maximum employment and ensuring price stability.

The uncertainty surrounding the Fed’s decision has already begun to impact the bond market. Investors, wary of potential volatility, have adopted a cautious approach, leading to fluctuations in treasury prices. This cautious sentiment is likely to persist until there is greater clarity on the Fed’s policy direction. In the meantime, the potential for treasury gains in 2024 remains in question, as market participants weigh the risks and rewards of investing in government securities amidst an uncertain interest rate environment.

Moreover, the global economic landscape adds another layer of complexity to the situation. Geopolitical tensions, trade dynamics, and economic performance in major economies such as China and the European Union all have the potential to influence the Federal Reserve’s decision-making process. Any significant developments on these fronts could sway the Fed’s stance on interest rates, further impacting treasury yields and investor sentiment.

In light of these uncertainties, financial analysts and investors are closely monitoring upcoming economic data releases and Federal Reserve communications for any hints regarding future policy actions. The minutes from the Federal Open Market Committee meetings, speeches by Fed officials, and key economic indicators such as inflation and employment reports will be scrutinized for insights into the Fed’s thinking.

In conclusion, the potential for treasury gains in 2024 is intricately linked to the Federal Reserve’s interest rate decisions. The uncertainty surrounding a possible rate cut in December has created a challenging environment for investors, as they navigate a complex web of economic indicators and geopolitical factors. As the year progresses, greater clarity on the Fed’s policy direction will be crucial in determining the trajectory of treasury yields and the broader financial landscape. Until then, market participants will remain vigilant, adapting their strategies to manage risk and capitalize on opportunities in an uncertain economic environment.

Strategies For Navigating Treasury Investments Amid Fed Uncertainty

As investors look toward 2024, the landscape for Treasury investments is fraught with uncertainty, primarily due to the ambiguous signals emanating from the Federal Reserve regarding potential interest rate cuts in December. This uncertainty poses a significant challenge for those seeking to navigate the Treasury market effectively. Understanding the implications of the Federal Reserve’s decisions and developing strategies to mitigate associated risks is crucial for investors aiming to optimize their portfolios in the coming year.

The Federal Reserve’s monetary policy plays a pivotal role in shaping the Treasury market. Interest rate adjustments directly influence bond yields, which in turn affect the attractiveness of Treasury securities. When the Fed cuts rates, bond prices typically rise, leading to lower yields. Conversely, if the Fed decides to maintain or increase rates, bond prices may fall, resulting in higher yields. This dynamic underscores the importance of closely monitoring the Fed’s policy signals, as even subtle hints can lead to significant market shifts.

Currently, the market is rife with speculation about whether the Federal Reserve will implement a rate cut in December. While some analysts predict a reduction to stimulate economic growth, others argue that the Fed may hold steady to combat inflationary pressures. This divergence in expectations creates a challenging environment for investors, who must weigh the potential outcomes and adjust their strategies accordingly.

One approach to navigating this uncertainty is to adopt a diversified investment strategy. By spreading investments across various maturities and types of Treasury securities, investors can mitigate the risks associated with interest rate fluctuations. Short-term Treasuries, for instance, are less sensitive to rate changes and can provide stability in a volatile market. On the other hand, long-term Treasuries may offer higher yields but come with increased risk if rates rise unexpectedly.

Another strategy involves closely monitoring economic indicators that could influence the Fed’s decision-making process. Key metrics such as inflation rates, employment figures, and GDP growth can provide valuable insights into the central bank’s potential actions. By staying informed about these indicators, investors can make more informed decisions and adjust their portfolios in anticipation of market movements.

Additionally, investors may consider utilizing Treasury Inflation-Protected Securities (TIPS) as a hedge against inflation. TIPS are designed to protect against inflationary pressures by adjusting their principal value in line with changes in the Consumer Price Index. This feature makes them an attractive option for those concerned about the potential impact of inflation on their investments.

Moreover, maintaining a flexible investment approach is essential in times of uncertainty. Investors should be prepared to adjust their strategies as new information becomes available and market conditions evolve. This may involve rebalancing portfolios, reallocating assets, or even temporarily reducing exposure to Treasuries if the risk of rate hikes becomes more pronounced.

In conclusion, the uncertainty surrounding the Federal Reserve’s potential rate cut in December presents both challenges and opportunities for Treasury investors. By adopting a diversified strategy, staying informed about economic indicators, considering inflation-protected securities, and maintaining flexibility, investors can better navigate the complexities of the Treasury market in 2024. As the year unfolds, remaining vigilant and responsive to changing conditions will be key to achieving favorable outcomes in an unpredictable financial landscape.

Analyzing The December Fed Decision And Its Implications For Treasury Markets

As the financial world turns its attention to the Federal Reserve’s upcoming December meeting, the uncertainty surrounding a potential interest rate cut looms large over the Treasury markets. Investors and analysts alike are keenly observing the Fed’s signals, as any decision to alter the current interest rate could have significant implications for Treasury gains in 2024. The anticipation of a rate cut has been fueled by a combination of economic indicators and market expectations, yet the Fed’s ultimate decision remains shrouded in ambiguity.

To understand the potential impact of the Fed’s decision, it is essential to consider the current economic landscape. Inflation, a key determinant of monetary policy, has shown signs of moderation in recent months. However, it remains above the Fed’s target, prompting a cautious approach from policymakers. Additionally, the labor market continues to exhibit strength, with low unemployment rates and steady job growth. These factors contribute to a complex economic environment, making the Fed’s decision-making process particularly challenging.

In light of these conditions, the possibility of a December rate cut has been a topic of intense debate. On one hand, a reduction in interest rates could provide a much-needed boost to economic growth, particularly as global uncertainties persist. Lower rates would reduce borrowing costs, potentially stimulating investment and consumer spending. This, in turn, could support Treasury markets by increasing demand for government securities, as investors seek safe-haven assets in a low-rate environment.

Conversely, maintaining the current interest rate could signal the Fed’s confidence in the economy’s resilience, thereby stabilizing market expectations. However, this approach carries its own set of risks. Should inflationary pressures resurface or economic growth falter, the Fed may find itself in a reactive position, necessitating more aggressive rate cuts in the future. Such a scenario could lead to increased volatility in Treasury markets, as investors reassess their strategies in response to shifting monetary policy.

Moreover, the global economic context cannot be overlooked. International developments, such as trade tensions and geopolitical uncertainties, continue to influence the Fed’s decision-making process. A cautious approach may be warranted to mitigate potential external shocks, yet this could also limit the Fed’s flexibility in addressing domestic economic challenges. As a result, the interplay between global and domestic factors adds another layer of complexity to the Fed’s deliberations.

In anticipation of the December meeting, market participants are closely monitoring the Fed’s communications for any hints of its future policy direction. The central bank’s statements and economic projections will be scrutinized for insights into its assessment of inflation, growth, and other key indicators. This information will be crucial for investors as they navigate the uncertain landscape and adjust their portfolios accordingly.

Ultimately, the Fed’s decision in December will have far-reaching implications for Treasury markets in 2024. Whether the central bank opts for a rate cut or maintains the status quo, its actions will shape investor sentiment and influence market dynamics. As such, stakeholders must remain vigilant and adaptable, ready to respond to the evolving economic environment and the Fed’s policy maneuvers. In this context, the December meeting represents not just a pivotal moment for monetary policy, but also a critical juncture for the future trajectory of Treasury gains.

How Potential Fed Rate Cuts Could Influence Treasury Yields In 2024

As we approach the end of 2023, the financial markets are abuzz with speculation regarding the Federal Reserve’s next moves, particularly concerning potential rate cuts. The anticipation of these cuts has significant implications for Treasury yields in 2024, a topic that has garnered considerable attention from investors and analysts alike. Understanding the relationship between Federal Reserve policies and Treasury yields is crucial for those looking to navigate the complexities of the financial landscape in the coming year.

Historically, Federal Reserve rate cuts have been associated with a decrease in Treasury yields. This is because lower interest rates generally lead to increased demand for Treasuries, as investors seek safer, more stable returns in a low-rate environment. Consequently, as demand for Treasuries rises, their yields typically fall. However, the current economic climate presents a unique set of challenges that could disrupt this traditional dynamic.

One of the primary factors contributing to the uncertainty surrounding Treasury yields is the ambiguity of the Federal Reserve’s intentions. While there has been widespread speculation about a potential rate cut in December, the Fed has remained non-committal, leaving market participants to grapple with a range of possible scenarios. This uncertainty is compounded by mixed economic signals, such as fluctuating inflation rates and uneven employment figures, which make it difficult to predict the Fed’s course of action with any degree of certainty.

Moreover, the global economic environment adds another layer of complexity to the situation. Geopolitical tensions, trade disputes, and varying economic performances across different regions all have the potential to influence the Fed’s decision-making process. For instance, if global economic conditions deteriorate, the Fed might be more inclined to cut rates to support domestic growth. Conversely, if international markets stabilize or improve, the Fed may opt to maintain current rates to prevent overheating the economy.

In addition to these external factors, internal dynamics within the United States also play a crucial role in shaping Treasury yields. The fiscal policies enacted by the government, including spending initiatives and tax reforms, can have a direct impact on the economy’s overall health and, by extension, influence the Fed’s monetary policy decisions. As such, any significant changes in fiscal policy could alter the trajectory of Treasury yields in 2024.

Given these complexities, investors are advised to adopt a cautious approach when considering their Treasury investments for the upcoming year. Diversification remains a key strategy, as it allows investors to mitigate risks associated with potential rate fluctuations. Additionally, staying informed about economic indicators and Fed communications can provide valuable insights into future market trends.

In conclusion, while the prospect of a December rate cut by the Federal Reserve has the potential to influence Treasury yields in 2024, the outcome is far from certain. A myriad of factors, both domestic and international, contribute to the current climate of uncertainty. As such, investors must remain vigilant and adaptable, ready to respond to changes in the economic landscape. By doing so, they can better position themselves to navigate the challenges and opportunities that lie ahead in the coming year.

Preparing For Volatility: Treasury Gains And Fed Policy Uncertainty

As the financial markets brace for the upcoming year, the potential for treasury gains in 2024 is increasingly under scrutiny, primarily due to the uncertainty surrounding the Federal Reserve’s policy decisions. Investors and analysts alike are closely monitoring the Federal Reserve’s actions, particularly the anticipated interest rate cut in December, which remains uncertain. This uncertainty is casting a shadow over the prospects for treasury gains, as market participants attempt to navigate the complexities of monetary policy and its implications for the bond market.

The Federal Reserve’s interest rate decisions are pivotal in shaping the economic landscape, influencing borrowing costs, consumer spending, and investment strategies. In recent months, the Fed has signaled a cautious approach, balancing the need to curb inflation with the desire to support economic growth. However, the lack of clarity regarding a potential rate cut in December has left investors in a state of anticipation, as they weigh the possible outcomes and their impact on treasury yields.

Treasury securities, often considered a safe haven for investors, are particularly sensitive to changes in interest rates. When the Federal Reserve cuts rates, it typically leads to lower yields on treasuries, as the cost of borrowing decreases. This, in turn, can drive up the prices of existing bonds, resulting in gains for investors holding these securities. Conversely, if the Fed decides to maintain or increase rates, treasury yields may rise, potentially diminishing the value of existing bonds and curbing potential gains.

The current economic environment adds another layer of complexity to this scenario. Inflationary pressures, geopolitical tensions, and global economic uncertainties are all factors that the Federal Reserve must consider as it deliberates its next move. These elements contribute to the unpredictability of the Fed’s decision-making process, making it challenging for investors to formulate strategies with confidence.

Moreover, the interplay between fiscal policy and monetary policy further complicates the outlook for treasury gains. Government spending initiatives and tax policies can influence economic growth and inflation, thereby affecting the Fed’s policy choices. As policymakers navigate these dynamics, the potential for volatility in the bond market remains high, underscoring the need for investors to remain vigilant and adaptable.

In light of these uncertainties, market participants are advised to adopt a cautious approach, diversifying their portfolios to mitigate potential risks. While treasuries may still offer a degree of safety, the unpredictable nature of Fed policy decisions necessitates a broader investment strategy that considers alternative asset classes and hedging techniques. By doing so, investors can better position themselves to weather potential market fluctuations and capitalize on opportunities as they arise.

In conclusion, the prospects for treasury gains in 2024 are intricately linked to the Federal Reserve’s policy decisions, particularly the anticipated rate cut in December. As uncertainty looms over the bond market, investors must remain attuned to the evolving economic landscape and the myriad factors influencing the Fed’s actions. By preparing for potential volatility and adopting a diversified investment approach, market participants can navigate the challenges ahead and enhance their chances of achieving favorable outcomes in the coming year.

The Role Of Economic Indicators In Predicting Treasury Market Trends

The role of economic indicators in predicting treasury market trends is a subject of perennial interest to investors and policymakers alike. As we approach 2024, the treasury market finds itself at a crossroads, with potential gains threatened by the uncertainty surrounding a possible Federal Reserve rate cut in December. Understanding how economic indicators influence these trends is crucial for anticipating market movements and making informed investment decisions.

Economic indicators serve as vital tools for predicting the direction of the treasury market. Among these, inflation rates, employment figures, and GDP growth are particularly influential. Inflation, for instance, directly impacts the yield on treasury securities. When inflation is high, the purchasing power of future interest payments is eroded, leading investors to demand higher yields. Conversely, low inflation typically results in lower yields. Currently, inflation remains a focal point for the Federal Reserve, as it balances the dual mandate of price stability and maximum employment. The uncertainty surrounding the Fed’s decision to cut rates in December hinges significantly on inflation trends, which in turn affects treasury yields.

Employment figures also play a critical role in shaping treasury market trends. A robust labor market often signals economic strength, prompting the Federal Reserve to consider tightening monetary policy. This can lead to higher interest rates, which generally result in lower bond prices and higher yields. However, if employment data suggests a weakening job market, the Fed might opt for a rate cut to stimulate economic activity, potentially boosting treasury prices. As of now, employment indicators present a mixed picture, adding to the uncertainty about the Fed’s next move.

GDP growth is another key economic indicator that influences treasury market trends. Strong GDP growth typically leads to higher interest rates as the economy expands, while sluggish growth might prompt the Fed to lower rates to encourage spending and investment. The current economic landscape is marked by moderate growth, with concerns about a potential slowdown. This has led to speculation about whether the Fed will implement a rate cut in December, a decision that could significantly impact treasury gains for 2024.

In addition to these primary indicators, other factors such as geopolitical events, fiscal policy, and global economic conditions also affect treasury market trends. Geopolitical tensions can lead to increased demand for safe-haven assets like U.S. treasuries, driving prices up and yields down. Similarly, changes in fiscal policy, such as government spending and tax reforms, can influence economic growth and, consequently, treasury yields. Moreover, global economic conditions, including the performance of major economies like China and the European Union, can have ripple effects on the U.S. treasury market.

As we look ahead to 2024, the interplay of these economic indicators will be crucial in determining the trajectory of the treasury market. The uncertainty surrounding a potential December rate cut by the Federal Reserve adds an additional layer of complexity. Investors and analysts will need to closely monitor these indicators to gauge the likelihood of a rate cut and its potential impact on treasury gains. By understanding the intricate relationships between economic indicators and market trends, stakeholders can better navigate the uncertainties and make strategic decisions in the ever-evolving financial landscape.

Investor Sentiment And Treasury Gains: The Fed’s Influence In 2024

Investor sentiment is a crucial factor influencing the trajectory of treasury gains, particularly as we approach 2024. The Federal Reserve’s monetary policy decisions play a pivotal role in shaping this sentiment, and the uncertainty surrounding a potential rate cut in December has introduced a layer of complexity to the financial landscape. As investors navigate these uncertain waters, the interplay between Federal Reserve actions and treasury yields becomes increasingly significant.

The Federal Reserve’s decisions on interest rates are closely watched by investors, as they have direct implications for treasury yields. A rate cut typically leads to lower yields, which can diminish the attractiveness of treasuries as an investment. Conversely, maintaining or increasing rates can bolster yields, making treasuries more appealing. As of now, the possibility of a December rate cut remains uncertain, leaving investors in a state of anticipation. This uncertainty can lead to volatility in the treasury market, as investors adjust their portfolios in response to potential shifts in monetary policy.

Moreover, the broader economic context cannot be ignored. Inflationary pressures, labor market dynamics, and global economic conditions all contribute to the Federal Reserve’s decision-making process. Inflation, in particular, has been a persistent concern, with rates remaining above the Fed’s target for an extended period. Should inflation continue to rise, the Fed may be compelled to maintain or even increase interest rates to curb inflationary pressures, thereby impacting treasury yields. On the other hand, if inflation shows signs of stabilizing, a rate cut could be on the table, further complicating the outlook for treasury gains.

In addition to domestic factors, global economic conditions also play a role in shaping investor sentiment and treasury yields. Geopolitical tensions, trade dynamics, and economic performance in major economies such as China and the European Union can influence the demand for U.S. treasuries. In times of global uncertainty, treasuries are often seen as a safe haven, leading to increased demand and potentially lower yields. However, if global economic conditions improve, the demand for treasuries may wane, affecting their performance.

As investors assess these various factors, the importance of diversification becomes apparent. While treasuries have traditionally been viewed as a low-risk investment, the current environment underscores the need for a balanced portfolio that can withstand potential fluctuations in the treasury market. By diversifying across asset classes, investors can mitigate the risks associated with uncertainty in Federal Reserve policy and global economic conditions.

In conclusion, the potential for treasury gains in 2024 is intricately linked to the Federal Reserve’s monetary policy decisions and the broader economic landscape. The uncertainty surrounding a December rate cut adds a layer of complexity to investor sentiment, influencing the demand for treasuries and their subsequent yields. As investors navigate this environment, a keen understanding of the interplay between domestic and global factors will be essential in making informed investment decisions. By staying attuned to these dynamics and maintaining a diversified portfolio, investors can better position themselves to capitalize on opportunities while mitigating risks in the ever-evolving financial landscape.

Q&A

1. **What are Treasury gains?**

Treasury gains refer to the increase in value of U.S. government bonds, which can occur when interest rates fall, leading to higher bond prices.

2. **Why are Treasury gains important for 2024?**

Treasury gains are important for 2024 as they can impact investment portfolios, influence borrowing costs, and affect economic growth projections.

3. **What is the significance of a December Fed cut?**

A December Fed cut would mean a reduction in interest rates by the Federal Reserve, which typically boosts bond prices and leads to Treasury gains.

4. **Why is the December Fed cut uncertain?**

The uncertainty around the December Fed cut may stem from mixed economic indicators, inflation concerns, or differing opinions within the Federal Reserve about the appropriate monetary policy.

5. **How does uncertainty about the Fed cut affect Treasury gains?**

Uncertainty about the Fed cut can lead to volatility in bond markets, making it difficult for investors to predict Treasury gains and adjust their strategies accordingly.

6. **What factors could influence the Fed’s decision in December?**

Factors influencing the Fed’s decision could include inflation rates, employment data, economic growth forecasts, and global economic conditions.

7. **What are potential outcomes if the Fed does not cut rates in December?**

If the Fed does not cut rates, Treasury gains might be limited, bond prices could stabilize or decline, and investors may seek alternative assets for returns.

Conclusion

In 2024, the potential for treasury gains is under threat due to the uncertainty surrounding a possible Federal Reserve interest rate cut in December. Market participants had anticipated a rate cut, which typically boosts bond prices and leads to gains in treasuries. However, mixed economic signals and the Fed’s cautious stance have cast doubt on this outcome. If the Fed decides against a rate cut, treasury yields may remain elevated, suppressing bond prices and limiting gains. This uncertainty requires investors to remain vigilant and adaptable to changing monetary policy signals as they navigate the bond market landscape in the coming year.