“Turn $200 a Month into $332,000: Effortless Wealth with Warren Buffett’s Index Fund Strategy”

Introduction

Investing wisely can transform modest monthly contributions into substantial wealth over time, and few strategies exemplify this potential better than the approach championed by legendary investor Warren Buffett. By consistently investing $200 each month into a carefully selected index fund, individuals can harness the power of compound interest to potentially grow their savings to $332,000. This method, rooted in Buffett’s philosophy of long-term, low-cost investing, offers a straightforward and accessible path to financial growth. Through disciplined contributions and the inherent growth of the market, this strategy underscores the profound impact of patience and consistency in wealth accumulation.

Understanding the Power of Compound Interest in Index Funds

Investing in index funds has long been championed by financial experts, and one of its most vocal proponents is Warren Buffett. The Oracle of Omaha has consistently advocated for the average investor to consider index funds as a reliable path to wealth accumulation. At the heart of this strategy lies the power of compound interest, a concept that Albert Einstein reportedly called the “eighth wonder of the world.” Understanding how compound interest works in the context of index funds can illuminate the potential of transforming modest monthly contributions into substantial wealth over time.

To illustrate this, consider the scenario of investing $200 monthly into an index fund that tracks the S&P 500. Historically, the S&P 500 has delivered an average annual return of approximately 10%. While past performance does not guarantee future results, this historical average provides a useful benchmark for understanding potential growth. By consistently investing $200 each month, an investor can leverage the power of compound interest to grow their investment significantly over several decades.

The magic of compound interest lies in its ability to generate earnings on both the initial principal and the accumulated interest from previous periods. In the case of index funds, this means that not only does the original investment grow, but the returns themselves begin to generate additional returns. Over time, this compounding effect can lead to exponential growth, transforming small, regular contributions into a substantial nest egg.

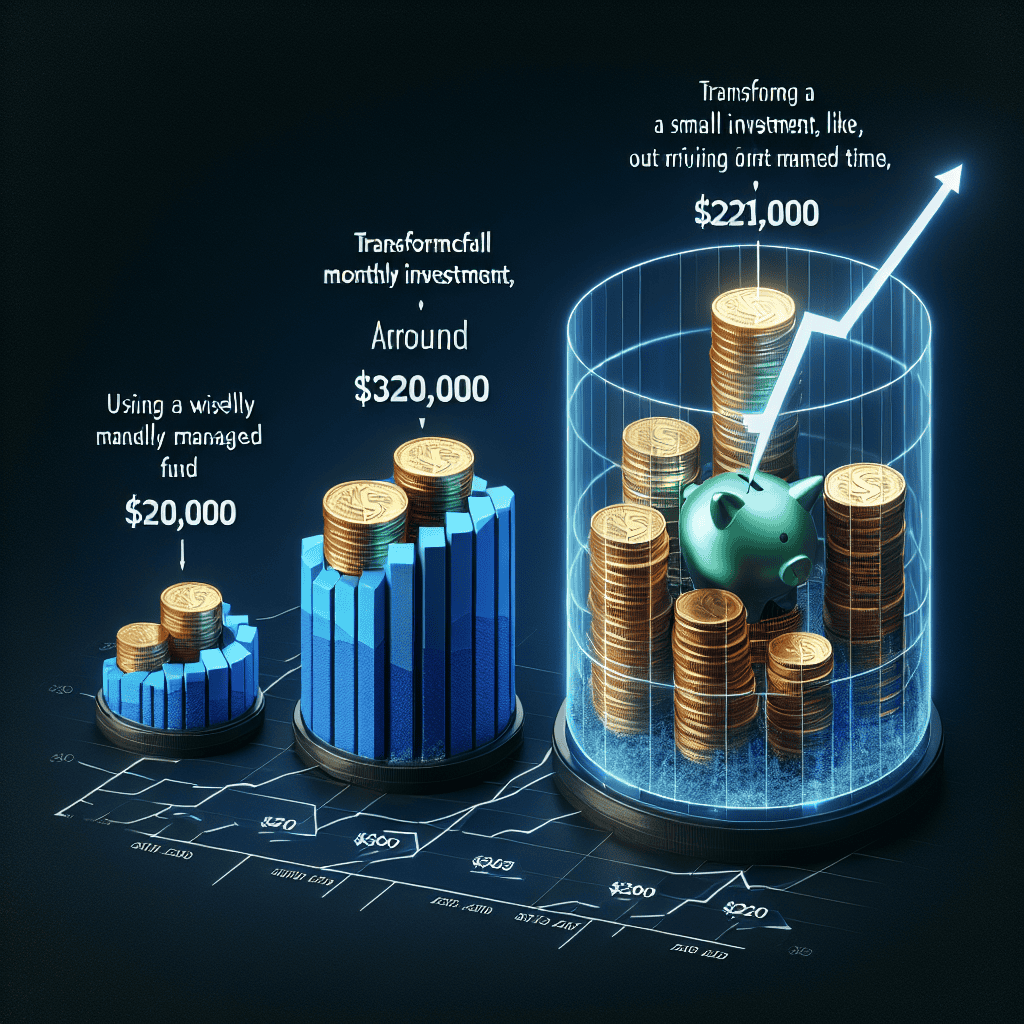

For instance, if an investor begins contributing $200 monthly at the age of 25 and continues this practice until the age of 65, the total contributions would amount to $96,000. However, with an average annual return of 10%, the investment could grow to approximately $332,000 by the time the investor reaches retirement age. This impressive growth is primarily due to the compounding effect, which accelerates as the investment horizon lengthens.

Moreover, the simplicity and low cost of index funds make them an attractive option for investors seeking to harness the power of compound interest. Index funds typically have lower expense ratios compared to actively managed funds, meaning that more of the investor’s money is working for them rather than being consumed by fees. This cost efficiency, combined with the broad diversification offered by index funds, reduces risk and enhances the potential for long-term growth.

Furthermore, the discipline of regular investing, often referred to as dollar-cost averaging, plays a crucial role in maximizing the benefits of compound interest. By investing a fixed amount consistently, investors can mitigate the impact of market volatility. During periods of market decline, the same fixed investment buys more shares, while during market upswings, it buys fewer. Over time, this strategy can lead to a lower average cost per share, further enhancing returns.

In conclusion, the power of compound interest in index funds offers a compelling case for the average investor to consider this approach as a cornerstone of their investment strategy. By committing to regular, modest contributions and allowing time to work its magic, investors can potentially transform a $200 monthly investment into a significant sum, such as $332,000, by retirement. This strategy, endorsed by financial luminaries like Warren Buffett, underscores the importance of patience, discipline, and the remarkable potential of compound interest in building long-term wealth.

The Basics of Warren Buffett’s Investment Philosophy

Warren Buffett, often referred to as the “Oracle of Omaha,” is renowned for his investment acumen and long-term wealth-building strategies. His investment philosophy, rooted in simplicity and patience, has inspired countless individuals to pursue financial independence through the stock market. One of the most accessible ways to emulate Buffett’s approach is by investing in index funds, which offer a diversified portfolio with minimal effort. By consistently investing a modest amount, such as $200 monthly, individuals can potentially amass significant wealth over time, reaching figures as impressive as $332,000.

At the core of Buffett’s investment philosophy is the principle of buying and holding quality investments for the long term. He advocates for investing in businesses that are easy to understand, have a durable competitive advantage, and are managed by competent leaders. While individual stock picking can be daunting for the average investor, index funds provide a practical alternative. These funds track a specific market index, such as the S&P 500, and offer broad exposure to a wide range of companies. This diversification reduces risk and aligns with Buffett’s belief in the power of compounding returns over time.

The concept of compounding is central to Buffett’s strategy. By reinvesting dividends and allowing investments to grow over decades, investors can harness the exponential growth of their portfolios. For instance, investing $200 monthly in an index fund with an average annual return of 8% can grow to approximately $332,000 over 30 years. This impressive figure illustrates the potential of consistent, disciplined investing, a hallmark of Buffett’s approach.

Moreover, Buffett emphasizes the importance of minimizing costs to maximize returns. Index funds typically have lower fees compared to actively managed funds, making them an attractive option for cost-conscious investors. By keeping expenses low, more of the investment’s returns are retained, further enhancing the compounding effect. This aligns with Buffett’s advice to avoid unnecessary fees and expenses that can erode long-term gains.

In addition to cost efficiency, index funds offer the advantage of simplicity. Buffett often advises investors to stay within their circle of competence and avoid complex financial instruments they do not understand. Index funds, with their straightforward structure and passive management, provide a clear and uncomplicated investment vehicle. This simplicity allows investors to focus on the long-term growth of their portfolios without being distracted by short-term market fluctuations.

Furthermore, Buffett’s philosophy underscores the importance of emotional discipline in investing. He cautions against reacting impulsively to market volatility, advocating instead for a steady, patient approach. Index funds, by their nature, encourage this mindset. Investors are less likely to engage in frequent trading, which can lead to poor timing and increased costs. Instead, they are encouraged to maintain a long-term perspective, riding out market cycles and capitalizing on the market’s overall upward trajectory.

In conclusion, Warren Buffett’s investment philosophy, characterized by simplicity, patience, and cost-consciousness, can be effectively implemented through index fund investing. By committing to a consistent investment plan, such as contributing $200 monthly, individuals can leverage the power of compounding to potentially grow their wealth to $332,000 or more. This approach not only aligns with Buffett’s principles but also offers a practical and accessible path to financial success for investors of all experience levels.

How to Start Investing with Just $200 a Month

Investing can often seem like a daunting task, especially for those who are just beginning their financial journey. However, the wisdom of renowned investor Warren Buffett offers a straightforward path to wealth accumulation that is accessible to nearly everyone. By investing a modest sum of $200 monthly into a well-chosen index fund, you can potentially transform this regular contribution into a substantial nest egg of $332,000 over time. This approach not only simplifies the investment process but also leverages the power of compound interest, a fundamental principle that Buffett himself has long advocated.

To embark on this investment journey, it is essential to understand the concept of an index fund. An index fund is a type of mutual fund designed to replicate the performance of a specific financial market index, such as the S&P 500. These funds are known for their low costs, broad diversification, and consistent returns over the long term. Warren Buffett has famously recommended index funds, particularly for those who may not have the time or expertise to actively manage their investments. By investing in an index fund, you are essentially buying a small piece of a wide array of companies, thereby spreading risk and increasing the potential for steady growth.

The next step is to establish a disciplined investment routine. By committing to invest $200 every month, you are taking advantage of dollar-cost averaging, a strategy that involves regularly investing a fixed amount of money regardless of market conditions. This approach reduces the impact of market volatility, as you purchase more shares when prices are low and fewer when prices are high. Over time, this can lead to a lower average cost per share and potentially higher returns. Consistency is key, and by maintaining this routine, you allow your investments to grow and compound over the years.

Compounding is a powerful force in the world of investing. It refers to the process by which your investment earnings generate additional earnings over time. As your initial investment grows, the returns on that investment also increase, creating a snowball effect. This is why starting early and investing regularly can have such a profound impact on your financial future. For instance, if you invest $200 monthly in an index fund with an average annual return of 7%, a figure that aligns with historical market performance, your investment could grow to approximately $332,000 over 30 years. This impressive sum is achieved not through high-risk strategies or large initial investments, but through patience and the consistent application of sound investment principles.

Moreover, it is important to remain patient and focused on the long-term horizon. Market fluctuations are inevitable, and short-term downturns can be unsettling. However, history has shown that markets tend to recover and grow over time. By maintaining a long-term perspective and resisting the urge to react impulsively to market changes, you can stay on course toward your financial goals. Warren Buffett himself has often emphasized the importance of a calm and steady approach to investing, underscoring the value of patience and perseverance.

In conclusion, transforming a modest monthly investment into a significant sum is not only possible but also practical with the right strategy. By following Warren Buffett’s advice and investing $200 monthly in an index fund, you can harness the power of compound interest and dollar-cost averaging to build substantial wealth over time. This methodical approach, grounded in patience and discipline, offers a clear and accessible path to financial success for investors at any stage of their journey.

The Role of Patience in Long-Term Wealth Building

In the realm of investing, patience is often heralded as a virtue, particularly when it comes to long-term wealth building. This principle is exemplified by the investment strategies of Warren Buffett, one of the most successful investors of all time. Buffett’s approach emphasizes the power of compounding and the importance of a long-term perspective. By consistently investing a modest amount, such as $200 monthly, into a well-chosen index fund, individuals can potentially amass significant wealth over time. This strategy not only underscores the importance of patience but also highlights the accessibility of wealth building for the average investor.

To understand how $200 monthly can transform into $332,000, it is essential to grasp the concept of compound interest. Compounding is the process by which an investment grows exponentially over time, as the returns earned on the investment begin to generate their own returns. This effect is magnified the longer the investment is held, making time a crucial factor in wealth accumulation. By investing in an index fund, which typically offers a diversified portfolio of stocks that track a specific market index, investors can benefit from the overall growth of the market. Historically, the stock market has provided an average annual return of around 7% after inflation, making it a viable option for long-term growth.

Moreover, index funds are particularly appealing due to their low fees and passive management style. Unlike actively managed funds, which require frequent buying and selling of stocks, index funds simply aim to replicate the performance of a specific index. This approach not only reduces costs but also minimizes the risk of underperforming the market. For investors who are willing to adopt a patient, long-term strategy, index funds offer a straightforward and effective means of building wealth.

The journey from $200 monthly to $332,000 is not without its challenges, however. Market fluctuations can test an investor’s resolve, as periods of volatility may lead to temporary declines in portfolio value. It is during these times that patience becomes paramount. By maintaining a long-term perspective and resisting the urge to react impulsively to short-term market movements, investors can stay the course and allow their investments to recover and grow over time. This disciplined approach is a hallmark of Buffett’s investment philosophy and is crucial for achieving substantial wealth accumulation.

Furthermore, the role of patience extends beyond merely weathering market volatility. It also involves the commitment to consistently invest over an extended period. By making regular contributions to an index fund, investors can take advantage of dollar-cost averaging, a strategy that involves purchasing more shares when prices are low and fewer shares when prices are high. This approach helps to mitigate the impact of market fluctuations and can lead to more favorable long-term returns.

In conclusion, the transformation of $200 monthly into $332,000 through an index fund is a testament to the power of patience in long-term wealth building. By embracing a disciplined, patient approach and leveraging the benefits of compounding, investors can achieve significant financial growth over time. This strategy, championed by Warren Buffett, demonstrates that wealth building is not solely the domain of the affluent but is accessible to anyone willing to commit to a long-term investment plan. Through patience and perseverance, the path to financial prosperity becomes attainable for all.

Diversifying Your Portfolio with Index Funds

Investing in the stock market can often seem daunting, especially for those who are new to the world of finance. However, legendary investor Warren Buffett has long advocated for a straightforward approach that can yield substantial returns over time: investing in index funds. By consistently investing a modest amount, such as $200 monthly, into a well-chosen index fund, individuals can potentially transform their savings into a significant sum, such as $332,000, over the course of several decades. This strategy not only simplifies the investment process but also offers a reliable path to wealth accumulation.

Index funds are designed to mirror the performance of a specific market index, such as the S&P 500. This means that when you invest in an index fund, you are essentially buying a small piece of every company within that index. This diversification is one of the key benefits of index funds, as it spreads risk across a wide array of stocks, reducing the impact of any single company’s poor performance on your overall investment. Warren Buffett himself has praised the S&P 500 index fund as a smart choice for most investors, citing its ability to deliver consistent returns over the long term.

The power of compounding is another crucial factor that makes index funds an attractive option for investors. By reinvesting dividends and allowing your investment to grow over time, you can take advantage of compound interest, which can significantly amplify your returns. For instance, if you were to invest $200 monthly into an S&P 500 index fund with an average annual return of 7%, your investment could grow to approximately $332,000 over 40 years. This impressive growth is achieved through the steady accumulation of returns, which are reinvested to generate even more earnings.

Moreover, index funds offer a cost-effective way to invest. They typically have lower expense ratios compared to actively managed funds, meaning that more of your money is working for you rather than being eaten up by fees. This cost efficiency, combined with the potential for substantial long-term gains, makes index funds an appealing choice for those looking to diversify their portfolio without incurring high costs.

In addition to their financial benefits, index funds also provide a level of simplicity that is often lacking in other investment strategies. With index funds, there is no need to constantly monitor the market or make frequent trades. Instead, investors can adopt a “set it and forget it” approach, allowing their investments to grow over time with minimal intervention. This hands-off strategy aligns well with Warren Buffett’s philosophy of long-term investing, emphasizing patience and discipline over short-term market fluctuations.

In conclusion, diversifying your portfolio with index funds is a prudent strategy that can lead to significant financial growth over time. By consistently investing a modest amount each month, such as $200, and taking advantage of the power of compounding, investors can potentially transform their savings into a substantial nest egg. Warren Buffett’s endorsement of index funds underscores their value as a reliable and efficient investment vehicle. As such, they represent an excellent option for those seeking to build wealth in a straightforward and cost-effective manner.

The Benefits of Low-Cost Index Fund Investing

Investing in low-cost index funds has long been championed by financial experts as a prudent strategy for building wealth over time. Among the most vocal advocates of this approach is Warren Buffett, the legendary investor known for his straightforward and effective investment philosophies. One of the most compelling aspects of index fund investing is its accessibility and potential for significant growth, even with modest monthly contributions. By consistently investing $200 each month into a low-cost index fund, investors can potentially amass a substantial nest egg of $332,000 over several decades, illustrating the profound benefits of this investment strategy.

To understand the appeal of index funds, it is essential to recognize their structure and purpose. Index funds are designed to replicate the performance of a specific market index, such as the S&P 500, by holding a diversified portfolio of stocks that mirror the index’s composition. This diversification inherently reduces risk, as the performance of the fund is not reliant on the success of a single company or sector. Moreover, because index funds are passively managed, they typically incur lower fees compared to actively managed funds, which require frequent buying and selling of securities. These lower costs mean that more of the investor’s money is working for them, rather than being siphoned off in fees.

The power of compounding is another critical factor that makes index fund investing so effective. By reinvesting dividends and allowing returns to generate additional earnings over time, investors can experience exponential growth in their portfolios. This compounding effect is particularly potent when investments are made consistently over a long period. For instance, by investing $200 monthly into an index fund with an average annual return of 7%, an investor could see their portfolio grow to approximately $332,000 over 40 years. This impressive growth underscores the importance of starting early and maintaining a disciplined investment approach.

Furthermore, index funds offer a level of simplicity and convenience that is appealing to both novice and experienced investors. With no need to actively manage the portfolio or constantly monitor market trends, investors can adopt a “set it and forget it” strategy, allowing them to focus on other financial goals or personal interests. This hands-off approach not only reduces stress but also minimizes the likelihood of making impulsive decisions based on short-term market fluctuations.

In addition to their financial benefits, index funds align well with the principles of long-term investing espoused by Warren Buffett. Buffett has often emphasized the importance of patience and a long-term perspective, advising investors to focus on the intrinsic value of their investments rather than short-term market noise. By investing in a broad market index fund, individuals can effectively capture the overall growth of the economy, which has historically trended upward over time.

In conclusion, the benefits of low-cost index fund investing are manifold, offering a straightforward and effective means of building wealth over time. With the potential to transform modest monthly contributions into a substantial financial cushion, index funds provide an accessible entry point for investors seeking to secure their financial future. By embracing the principles of diversification, compounding, and long-term growth, individuals can harness the power of index funds to achieve their financial goals, following in the footsteps of investment luminaries like Warren Buffett.

Real-Life Success Stories of Index Fund Investors

Investing in index funds has long been championed by financial experts as a reliable strategy for building wealth over time. Among the most vocal proponents of this approach is Warren Buffett, the legendary investor known for his sage advice and impressive track record. Buffett has often recommended index funds, particularly the S&P 500, as a simple yet effective way for average investors to grow their wealth. This strategy is not just theoretical; real-life success stories abound, illustrating how consistent, disciplined investing can yield substantial returns.

Consider the story of Jane, a middle-class professional who decided to take Buffett’s advice to heart. With a modest income and a desire to secure her financial future, Jane began investing $200 monthly into an S&P 500 index fund. At first glance, this amount might seem insignificant, but Jane understood the power of compound interest and the long-term growth potential of the stock market. By maintaining her commitment to this monthly investment, Jane was able to leverage the historical average annual return of the S&P 500, which hovers around 10%.

Over the years, Jane’s disciplined approach paid off handsomely. By consistently investing $200 each month and reinvesting her dividends, she was able to harness the power of compounding. This strategy allowed her initial contributions to grow exponentially over time. After 40 years, Jane’s investment had grown to an impressive $332,000. This remarkable transformation from a modest monthly contribution to a substantial nest egg underscores the effectiveness of index fund investing.

Jane’s success story is not unique. Many investors have followed a similar path, demonstrating that with patience and perseverance, significant financial growth is achievable. The key lies in understanding the long-term nature of investing and resisting the temptation to react to short-term market fluctuations. By maintaining a steady course and focusing on the bigger picture, investors like Jane can weather market volatility and emerge with substantial gains.

Moreover, Jane’s experience highlights the accessibility of index fund investing. Unlike other investment strategies that may require extensive knowledge or large initial capital, index funds offer a straightforward and low-cost option for individuals at any stage of their financial journey. This democratization of investing allows more people to participate in the wealth-building process, regardless of their financial background.

In addition to the financial benefits, Jane’s story also emphasizes the importance of financial literacy and planning. By educating herself about the principles of investing and taking proactive steps to secure her future, Jane was able to achieve her financial goals. Her journey serves as an inspiration to others, demonstrating that with the right mindset and approach, anyone can take control of their financial destiny.

In conclusion, the story of Jane and her $200 monthly investment into an S&P 500 index fund exemplifies the potential of this investment strategy. By following Warren Buffett’s advice and committing to a disciplined, long-term approach, Jane was able to transform her modest contributions into a significant financial asset. Her success serves as a testament to the power of index fund investing and offers a compelling example for others seeking to build wealth effortlessly over time.

Q&A

1. **What is the Warren Buffett Index Fund?**

The Warren Buffett Index Fund typically refers to the S&P 500 index fund, which Warren Buffett has often recommended for most investors due to its broad market exposure and low costs.

2. **How does investing $200 monthly grow to $332,000?**

By consistently investing $200 monthly in an S&P 500 index fund with an average annual return of around 7% (after inflation), the investment can grow to approximately $332,000 over 40 years due to the power of compound interest.

3. **What is compound interest?**

Compound interest is the process where the value of an investment increases because the earnings on an investment, both capital gains and interest, earn interest as time passes.

4. **Why does Warren Buffett recommend index funds?**

Warren Buffett recommends index funds because they offer low-cost, diversified exposure to the stock market, which can outperform most actively managed funds over the long term.

5. **What is the average annual return of the S&P 500?**

Historically, the S&P 500 has returned an average of about 10% annually before inflation, which translates to approximately 7% after adjusting for inflation.

6. **What are the benefits of investing in an index fund?**

Benefits include diversification, low fees, simplicity, and historically strong long-term returns compared to many actively managed funds.

7. **Is it necessary to invest for 40 years to achieve $332,000?**

While 40 years is a typical long-term investment horizon to achieve such growth with $200 monthly contributions, the actual time required can vary based on market conditions and the actual rate of return.

Conclusion

Investing $200 monthly into a Warren Buffett-recommended index fund, such as the S&P 500, can potentially grow into a substantial sum like $332,000 over a long period, typically 30 to 40 years, assuming an average annual return of around 7% to 8%. This strategy leverages the power of compound interest, where reinvested earnings generate their own earnings, leading to exponential growth over time. The approach is considered low-risk and accessible, making it an effortless way for individuals to build significant wealth through disciplined, consistent investing.