“Luxury Unraveled: Scandal Spurs $38M Singapore Mansion Sale”

Introduction

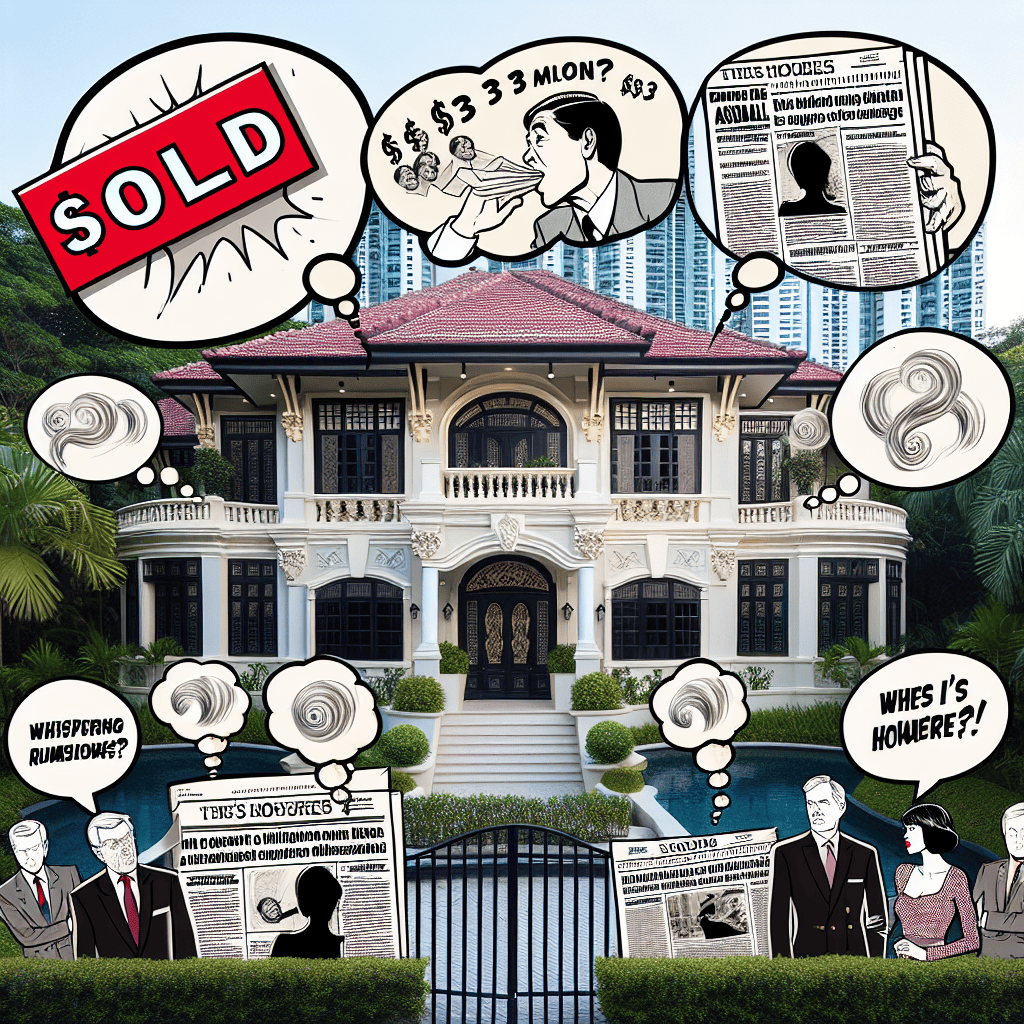

In the midst of a swirling financial scandal, the wife of a co-founder of the now-defunct cryptocurrency hedge fund Three Arrows Capital has reportedly sold a luxurious mansion in Singapore for a staggering $38 million. This high-profile transaction comes as the firm faces intense scrutiny and legal challenges following its dramatic collapse, which sent shockwaves through the crypto industry. The sale of the opulent property, located in one of Singapore’s most prestigious neighborhoods, has drawn significant attention, highlighting the personal and financial ramifications of the ongoing controversy surrounding Three Arrows Capital. As investigations continue, this development adds another layer to the unfolding saga of one of the most talked-about financial debacles in recent times.

Impact Of Scandals On Real Estate Decisions

The recent sale of a $38 million mansion in Singapore by the wife of a co-founder of Three Arrows Capital has drawn significant attention, not only due to the property’s impressive valuation but also because of the circumstances surrounding the transaction. This event highlights the intricate relationship between personal scandals and real estate decisions, illustrating how external pressures can influence property markets and individual choices. As scandals unfold, they often bring about a cascade of consequences that extend beyond the immediate parties involved, affecting financial decisions and real estate transactions in unexpected ways.

In the case of Three Arrows Capital, a hedge fund that has been embroiled in controversy, the sale of the mansion can be seen as a strategic move to mitigate financial and reputational damage. When individuals or entities face public scrutiny, their assets often become focal points for both legal and public interest. Consequently, selling high-value properties can serve as a means to liquidate assets quickly, providing liquidity that may be necessary to address legal fees, settle debts, or simply distance oneself from the negative publicity associated with the scandal.

Moreover, the decision to sell such a high-profile property in Singapore, a city known for its robust real estate market, underscores the impact of scandals on property values and market dynamics. In times of controversy, properties linked to scandalized individuals may experience fluctuations in perceived value. Potential buyers might be wary of associating with properties that have garnered negative attention, leading to a more challenging sales process. However, in a market as resilient as Singapore’s, where demand for luxury real estate remains strong, such properties can still attract interest, albeit with a more cautious approach from prospective buyers.

Furthermore, the sale of the mansion also reflects broader trends in how scandals influence real estate decisions on a global scale. In an interconnected world, news travels fast, and the reputational risks associated with owning or purchasing properties linked to scandals can have far-reaching implications. Buyers and investors are increasingly mindful of the potential for reputational damage, which can affect not only their personal standing but also the future resale value of the property. As a result, properties associated with scandals may require additional due diligence and strategic marketing to reassure potential buyers of their value and desirability.

Additionally, the sale of such a high-value property amid scandal can also be interpreted as a move towards financial prudence. In uncertain times, liquidating assets can provide a sense of security and flexibility, allowing individuals to navigate the complexities of legal and financial challenges more effectively. This decision-making process is often influenced by advisors who weigh the potential benefits of holding onto a property against the immediate advantages of a sale, particularly when the property in question is tied to ongoing controversies.

In conclusion, the sale of the $38 million Singapore mansion by the wife of a Three Arrows Capital co-founder serves as a compelling example of how scandals can impact real estate decisions. It highlights the multifaceted considerations that come into play when individuals face public scrutiny, from the need for liquidity and financial prudence to the challenges of managing reputational risks. As scandals continue to shape the landscape of real estate transactions, both buyers and sellers must navigate these complexities with careful consideration and strategic foresight.

High-Profile Property Sales In Singapore

In the realm of high-profile property sales in Singapore, the recent transaction involving the wife of a co-founder of the now-defunct cryptocurrency hedge fund, Three Arrows Capital, has captured significant attention. The sale of a luxurious mansion for a staggering $38 million has not only made headlines due to its sheer value but also because of the scandal surrounding the hedge fund’s collapse. This event underscores the intricate interplay between personal fortunes and public controversies, particularly in the world of high finance and real estate.

The mansion, located in one of Singapore’s most prestigious neighborhoods, epitomizes opulence and exclusivity. With its sprawling grounds, state-of-the-art amenities, and architectural grandeur, the property is a testament to the wealth and status of its former owners. However, the sale of this mansion is not merely a transaction of bricks and mortar; it is emblematic of the broader fallout from the financial debacle that engulfed Three Arrows Capital. As the hedge fund faced insolvency, its founders came under intense scrutiny, with creditors and regulators alike seeking accountability and restitution.

In this context, the decision by the co-founder’s wife to sell the mansion can be seen as a strategic move, possibly aimed at liquidating assets amidst mounting legal and financial pressures. The sale may also reflect a desire to distance oneself from the scandal, both physically and symbolically. Moreover, it highlights the often-overlooked personal ramifications of corporate failures, where family members find themselves entangled in the consequences of business decisions.

The transaction itself is noteworthy not only for its financial magnitude but also for its implications within the Singaporean real estate market. Singapore, known for its robust property sector, has long been a magnet for affluent individuals seeking stable investments. The sale of such a high-value property could potentially influence market dynamics, setting a benchmark for future transactions in the luxury segment. Furthermore, it raises questions about the impact of external factors, such as financial scandals, on property valuations and buyer sentiment.

While the sale of the mansion is a significant event in its own right, it also serves as a lens through which to examine broader trends in high-profile property sales. In recent years, Singapore has witnessed a surge in demand for luxury real estate, driven by both domestic and international buyers. This trend is fueled by the city-state’s reputation as a safe haven for wealth, offering political stability, economic resilience, and a favorable regulatory environment. However, the intersection of real estate and financial controversies, as exemplified by this sale, adds a layer of complexity to the market.

In conclusion, the sale of the $38 million mansion by the wife of a Three Arrows Capital co-founder is a multifaceted event that resonates beyond the confines of the property itself. It encapsulates the challenges faced by individuals caught in the crossfire of corporate scandals, while also shedding light on the dynamics of Singapore’s luxury real estate market. As the story unfolds, it will be interesting to observe how this high-profile sale influences perceptions and decisions within the realm of elite property transactions. Ultimately, it serves as a reminder of the intricate connections between personal fortunes, public controversies, and the ever-evolving landscape of high-value real estate.

Financial Implications Of Luxury Property Sales

The recent sale of a $38 million mansion in Singapore by the wife of a co-founder of the now-defunct cryptocurrency hedge fund, Three Arrows Capital, has sparked significant interest and discussion within financial circles. This transaction not only highlights the intricate relationship between personal financial decisions and broader economic implications but also underscores the potential impact of high-profile scandals on luxury property markets. As the dust settles from the collapse of Three Arrows Capital, the sale of this opulent property offers a lens through which to examine the financial ramifications of such high-stakes transactions.

To begin with, the sale of luxury properties, particularly those associated with individuals embroiled in financial controversies, often serves as a barometer for market sentiment. In this instance, the decision to sell the mansion could be interpreted as a strategic move to liquidate assets amidst ongoing legal and financial scrutiny. The sale price of $38 million, while substantial, may reflect a need to quickly convert real estate holdings into liquid capital, possibly to address legal fees or other financial obligations arising from the scandal. This urgency can sometimes lead to properties being sold at a discount, thereby influencing the perceived value of similar high-end properties in the area.

Moreover, the sale of such a high-value property can have ripple effects on the local real estate market. In Singapore, a city-state known for its robust luxury property sector, the transaction could signal a shift in market dynamics. Potential buyers and investors may perceive this sale as indicative of a cooling market, prompting them to reassess their investment strategies. Conversely, it could also attract opportunistic buyers looking to capitalize on perceived market weaknesses. Thus, the sale of this mansion not only affects the immediate parties involved but also has broader implications for market trends and investor behavior.

Furthermore, the intersection of personal financial decisions and public perception cannot be overlooked. The sale of the mansion, given its association with a high-profile scandal, may influence public opinion regarding the financial stability and integrity of those involved. This, in turn, can affect the reputation and future business prospects of individuals associated with the transaction. In the world of high finance, where reputation is often as valuable as financial assets, such sales can have long-lasting implications beyond the immediate financial gain or loss.

Additionally, the sale highlights the role of luxury properties as both status symbols and financial instruments. For many high-net-worth individuals, real estate serves as a tangible asset that can be leveraged in times of financial uncertainty. The decision to sell a luxury property, therefore, is not merely a personal choice but a strategic financial maneuver. This underscores the dual nature of luxury real estate as both a personal sanctuary and a critical component of one’s financial portfolio.

In conclusion, the sale of the $38 million Singapore mansion by the wife of a Three Arrows Capital co-founder amid scandal offers a multifaceted view of the financial implications of luxury property sales. It illustrates how such transactions can influence market dynamics, investor perceptions, and personal reputations. As the luxury real estate market continues to evolve, particularly in the context of high-profile financial controversies, understanding these implications becomes increasingly important for investors, market analysts, and the public alike.

The Role Of Family In Financial Scandals

In the intricate web of financial scandals, the role of family often emerges as a significant yet understated element. The recent sale of a $38 million Singapore mansion by the wife of a co-founder of Three Arrows Capital, a now-defunct cryptocurrency hedge fund, underscores the complex interplay between personal relationships and financial controversies. This event not only highlights the financial implications for those directly involved but also raises questions about the broader impact on family members who find themselves entangled in such scandals.

Financial scandals, by their very nature, tend to cast a wide net, ensnaring not only the primary actors but also their families. In the case of Three Arrows Capital, the collapse of the hedge fund amid allegations of mismanagement and financial impropriety has had far-reaching consequences. The decision by the co-founder’s wife to sell their opulent Singapore mansion can be seen as a strategic move to mitigate financial fallout and preserve family assets. This action reflects a common response among families caught in the crossfire of financial scandals, where safeguarding personal wealth becomes a priority.

Moreover, the sale of such a high-value asset often serves as a public signal of the family’s attempt to distance themselves from the scandal. It is a tangible step towards rebuilding their lives and reputations, which may have been tarnished by association. This distancing is crucial, as family members frequently face scrutiny and judgment from the public and media, despite not being directly involved in the alleged wrongdoing. The sale of the mansion, therefore, can be interpreted as an effort to draw a line between personal and professional spheres, emphasizing the family’s desire to move forward.

In addition to financial considerations, the emotional toll on families involved in financial scandals cannot be overlooked. The stress and uncertainty that accompany such situations can strain relationships and test familial bonds. For the spouse of a scandal-embroiled individual, the decision to sell a family home may also be driven by a need for emotional closure and a fresh start. The mansion, once a symbol of success and stability, may become a constant reminder of the scandal, prompting the desire for change.

Furthermore, the involvement of family members in financial scandals often leads to a reevaluation of trust and responsibility within the family unit. Questions may arise about the extent of knowledge or complicity, even if unfounded. This can lead to difficult conversations and a reassessment of roles and responsibilities, as families navigate the aftermath of public exposure. In some cases, family members may choose to take on more active roles in managing finances, seeking to prevent future crises and ensure greater transparency.

Ultimately, the sale of the Singapore mansion by the wife of a Three Arrows Capital co-founder illustrates the multifaceted role of family in financial scandals. It highlights the intersection of financial strategy, emotional resilience, and the quest for personal redemption. As families grapple with the repercussions of such scandals, their actions often reflect a delicate balance between protecting their interests and seeking a path forward. In doing so, they provide a poignant reminder of the human dimension that underlies even the most complex financial controversies.

Market Reactions To High-Value Property Listings

The recent sale of a $38 million mansion in Singapore, owned by the wife of a co-founder of the now-defunct cryptocurrency hedge fund Three Arrows Capital, has sent ripples through the high-value property market. This transaction, occurring amid a backdrop of financial scandal and legal scrutiny, has captured the attention of investors and market analysts alike. As the real estate sector grapples with the implications of such high-profile sales, it is essential to understand the broader market reactions and the potential impact on luxury property listings.

To begin with, the sale of this opulent mansion, located in one of Singapore’s most prestigious neighborhoods, underscores the resilience of the luxury property market even in times of financial turbulence. Despite the controversies surrounding Three Arrows Capital, the property attracted significant interest from affluent buyers, highlighting the enduring appeal of prime real estate in global financial hubs. This phenomenon is not uncommon, as high-net-worth individuals often view luxury properties as stable investments, particularly in regions with robust economic fundamentals.

Moreover, the transaction has sparked discussions about the motivations behind such sales, especially when linked to individuals embroiled in financial scandals. In this case, the sale could be interpreted as a strategic move to liquidate assets amid ongoing legal proceedings and potential financial liabilities. This perspective is not without precedent, as history has shown that individuals facing financial scrutiny often resort to selling high-value assets to mitigate risks and secure liquidity. Consequently, this sale may prompt other high-profile individuals in similar situations to consider divesting their luxury properties, potentially leading to an increase in high-value listings in the market.

Furthermore, the sale has implications for the perception of luxury real estate as a safe haven for wealth preservation. While the property market has traditionally been viewed as a stable investment, the association with financial scandals can introduce an element of reputational risk. Buyers and investors may become more cautious, scrutinizing the backgrounds of sellers and the provenance of properties more closely. This heightened due diligence could lead to longer transaction times and more stringent vetting processes, ultimately affecting the dynamics of the luxury property market.

In addition to these considerations, the sale of the Singapore mansion also highlights the role of global economic conditions in shaping market reactions. With interest rates fluctuating and economic uncertainties looming, investors are increasingly seeking tangible assets that offer both security and potential for appreciation. Luxury properties, particularly in economically stable regions like Singapore, continue to attract interest from international buyers looking to diversify their portfolios. This trend is likely to persist, as geopolitical tensions and market volatility drive investors to seek refuge in real estate.

In conclusion, the sale of the $38 million Singapore mansion amid the Three Arrows Capital scandal serves as a microcosm of the broader market reactions to high-value property listings. It underscores the resilience of the luxury real estate market, while also highlighting the complexities introduced by financial scandals and global economic conditions. As the market continues to evolve, stakeholders must remain vigilant, adapting to changing dynamics and ensuring that luxury properties remain attractive investments for discerning buyers worldwide. Through careful analysis and strategic decision-making, the luxury property market can continue to thrive, even in the face of challenges and uncertainties.

Privacy Concerns In High-Profile Real Estate Transactions

In the realm of high-profile real estate transactions, privacy concerns often take center stage, especially when the individuals involved are linked to financial scandals. The recent sale of a $38 million mansion in Singapore by the wife of a co-founder of the now-defunct cryptocurrency hedge fund, Three Arrows Capital, underscores the intricate balance between public interest and personal privacy. This transaction, while significant in its financial magnitude, also highlights the broader implications of privacy in the world of luxury real estate.

The sale of such a high-value property inevitably attracts public attention, particularly when the seller is connected to a financial scandal that has captured global headlines. Three Arrows Capital, once a prominent player in the cryptocurrency market, collapsed amid allegations of mismanagement and financial impropriety. As a result, the personal lives of its founders and their families have come under intense scrutiny. In this context, the sale of the Singapore mansion raises questions about the extent to which personal privacy can be maintained in high-profile real estate dealings.

Privacy concerns in these transactions are multifaceted. On one hand, there is the legitimate interest of the public and regulatory bodies in understanding the financial dealings of individuals involved in scandals. This interest is often driven by the need for transparency and accountability, particularly when significant sums of money are involved. On the other hand, there is the right to privacy for individuals who, despite their connections to public figures, may not themselves be public figures. This tension between transparency and privacy is a recurring theme in high-profile real estate transactions.

Moreover, the sale of luxury properties often involves complex legal and financial arrangements that can further complicate privacy issues. In many cases, properties are held through trusts or corporate entities, which can obscure the identities of the true owners. While these structures are legal and often used for legitimate reasons such as estate planning or tax efficiency, they can also be perceived as tools for evading scrutiny. This perception can fuel public suspicion and lead to calls for greater transparency in real estate transactions.

In response to these concerns, some jurisdictions have implemented measures to increase transparency in property ownership. For instance, beneficial ownership registries have been established in several countries to reveal the individuals who ultimately control corporate entities that own real estate. These registries aim to strike a balance between privacy and transparency by providing a mechanism for authorities to access ownership information while protecting it from public disclosure. However, the effectiveness of these measures in addressing privacy concerns remains a topic of debate.

The sale of the Singapore mansion also highlights the role of the media in shaping public perceptions of privacy in high-profile real estate transactions. Media coverage can amplify privacy concerns by drawing attention to the personal lives of individuals involved in these transactions. While such coverage can serve the public interest by promoting transparency, it can also intrude on personal privacy, particularly when it delves into aspects of individuals’ lives that are unrelated to the transaction itself.

In conclusion, the sale of the $38 million Singapore mansion by the wife of a Three Arrows Capital co-founder illustrates the complex interplay between privacy and transparency in high-profile real estate transactions. As public interest in these transactions continues to grow, finding a balance that respects individual privacy while ensuring accountability remains a challenging yet essential task.

The Intersection Of Personal And Professional Lives In Scandals

The recent sale of a $38 million mansion in Singapore by the wife of a co-founder of the now-defunct cryptocurrency hedge fund, Three Arrows Capital, has drawn significant attention, highlighting the intricate interplay between personal and professional lives during times of scandal. This event underscores how personal assets and decisions can become entangled with professional controversies, often leading to public scrutiny and speculation.

The mansion, a symbol of opulence and success, became a focal point as the hedge fund faced legal and financial turmoil. The sale of such a high-value property inevitably raises questions about the motivations behind the decision, whether it was a strategic move to liquidate assets amidst financial distress or a personal choice to distance oneself from the unfolding scandal. This intersection of personal and professional spheres is not uncommon in high-profile cases, where the actions of individuals closely associated with a company can have far-reaching implications.

In the case of Three Arrows Capital, the hedge fund’s collapse was marked by significant financial losses and legal challenges, which inevitably cast a shadow over the personal lives of its founders. The sale of the mansion, therefore, cannot be viewed in isolation but rather as part of a broader narrative where personal decisions are influenced by professional circumstances. This intertwining of personal and professional realms is further complicated by the public’s interest in the lives of those involved, often leading to intense media scrutiny.

Moreover, the sale of such a property during a scandal can also be seen as a strategic maneuver to manage public perception. By divesting from a high-profile asset, individuals may seek to convey a message of responsibility or a desire to move forward from the controversy. However, this can also backfire, as it may be perceived as an attempt to shield assets from potential legal claims or financial liabilities. Thus, the motivations behind such decisions are often subject to interpretation, adding another layer of complexity to the situation.

The intersection of personal and professional lives in scandals is further exemplified by the legal implications that often arise. In many cases, personal assets become entangled in legal proceedings, especially when there are allegations of financial misconduct or mismanagement. This can lead to a protracted legal battle where personal and professional boundaries are blurred, and individuals must navigate the challenges of protecting their personal interests while addressing professional obligations.

Furthermore, the impact of such scandals on personal relationships cannot be overlooked. The stress and pressure of dealing with public scrutiny and legal challenges can strain personal relationships, leading to difficult decisions about asset management and personal priorities. In this context, the sale of a significant asset like a mansion may also reflect broader personal considerations, such as the desire to simplify one’s life or to focus on rebuilding in the aftermath of a scandal.

In conclusion, the sale of the $38 million Singapore mansion by the wife of a Three Arrows Capital co-founder serves as a poignant example of how personal and professional lives intersect during times of scandal. It highlights the complex motivations and implications of personal decisions made in the shadow of professional controversies. As such, it underscores the need for a nuanced understanding of the interplay between personal and professional spheres, particularly in high-profile cases where public interest and legal considerations are at play.

Q&A

1. **Who is the co-founder of Three Arrows Capital?**

Zhu Su and Kyle Davies.

2. **Who is the wife of the co-founder involved in the sale?**

Zhu Su’s wife, Tao Yaqiong Zhu.

3. **What is the value of the mansion sold in Singapore?**

$38 million.

4. **Why was the sale of the mansion significant?**

It occurred amid the financial scandal and collapse of Three Arrows Capital.

5. **What was the scandal involving Three Arrows Capital?**

The hedge fund faced liquidation due to its inability to meet margin calls and repay creditors.

6. **Where is the mansion located?**

In Singapore.

7. **What was the impact of the scandal on Three Arrows Capital?**

The firm went into liquidation, and its founders faced legal and financial scrutiny.

Conclusion

The sale of the $38 million Singapore mansion by the wife of a Three Arrows Capital co-founder amid scandal highlights the financial and reputational fallout from the firm’s collapse. This move likely reflects an attempt to manage personal and financial repercussions as legal and financial scrutiny intensifies. The sale underscores the broader impact of the firm’s failure on those connected to its leadership, illustrating the personal consequences of corporate mismanagement and the ripple effects of financial scandals.