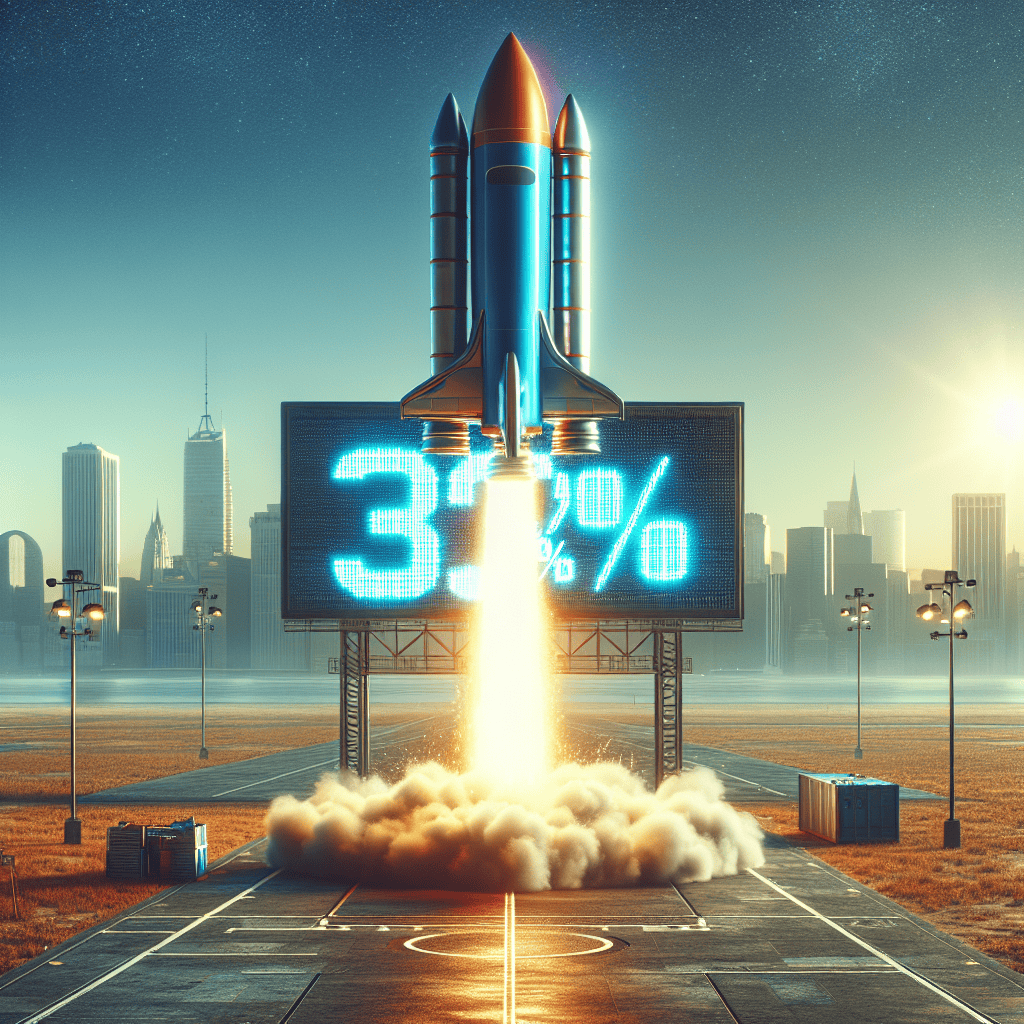

“Unlock Potential Gains: This High-Yield Stock is Poised for a 32% Surge!”

Introduction

Investors seeking lucrative opportunities in the stock market often turn their attention to high-yield stocks, which offer the dual benefits of regular income and potential capital appreciation. One such stock has recently caught the eye of Wall Street analysts, who predict a significant upside potential. This bargain high-yield stock, currently undervalued, is poised for a remarkable surge, with projections indicating a potential increase of 32% within the next year. As market conditions evolve and the company’s fundamentals strengthen, this stock represents a compelling opportunity for investors looking to capitalize on both yield and growth.

Understanding High-Yield Stocks: A Guide for Investors

Investing in high-yield stocks can be an attractive strategy for those seeking to enhance their income through dividends while also benefiting from potential capital appreciation. High-yield stocks are typically characterized by their ability to pay dividends that are significantly higher than the average yield of the broader market. This makes them particularly appealing to income-focused investors, such as retirees or those looking to supplement their income streams. However, it is crucial to understand the dynamics of high-yield stocks to make informed investment decisions.

One such high-yield stock that has recently caught the attention of Wall Street analysts is currently trading at a bargain price, with projections suggesting it could surge by 32% within a year. This potential for growth, combined with its attractive dividend yield, makes it a compelling option for investors. The stock’s appeal lies not only in its high yield but also in its underlying business fundamentals, which are often a key determinant of a company’s ability to sustain and grow its dividend payouts over time.

When evaluating high-yield stocks, investors should consider several factors. First, the sustainability of the dividend is paramount. A high yield may be enticing, but it is essential to assess whether the company can maintain its dividend payments. This involves examining the company’s payout ratio, which indicates the proportion of earnings paid out as dividends. A lower payout ratio suggests that the company has ample room to continue paying dividends even if earnings fluctuate.

Additionally, the financial health of the company is a critical consideration. A strong balance sheet, characterized by manageable debt levels and robust cash flow, can provide a cushion during economic downturns, ensuring that dividend payments remain uninterrupted. Furthermore, understanding the industry in which the company operates can offer insights into potential risks and opportunities. Industries with stable demand and growth prospects are generally more favorable for high-yield investments.

The stock in question has demonstrated resilience in its financial performance, with consistent revenue growth and a solid track record of dividend payments. Analysts are optimistic about its future prospects, citing factors such as strategic expansions, innovative product offerings, and favorable market conditions. These elements contribute to the stock’s potential for capital appreciation, making it an attractive proposition for investors seeking both income and growth.

Moreover, the current market environment presents a unique opportunity for investors to acquire this stock at a discounted price. Market fluctuations and broader economic uncertainties have led to undervaluation, providing a window for investors to capitalize on its potential upside. As the market stabilizes and investor confidence returns, the stock’s value is expected to rise, aligning with Wall Street’s optimistic projections.

In conclusion, while high-yield stocks can offer substantial benefits, they also come with inherent risks. It is imperative for investors to conduct thorough research and consider their risk tolerance before making investment decisions. By focusing on companies with strong fundamentals, sustainable dividends, and growth potential, investors can enhance their portfolios with high-yield stocks that offer both income and the possibility of capital gains. This particular stock, with its promising outlook and attractive yield, exemplifies the potential rewards of investing in high-yield opportunities.

Wall Street’s Top Picks: Why This Stock Stands Out

In the ever-evolving landscape of the stock market, investors are constantly on the lookout for opportunities that promise substantial returns. Among the myriad of options, one high-yield stock has caught the attention of Wall Street analysts, who predict a potential surge of 32% within the next year. This stock, which has been trading at a bargain price, stands out not only for its attractive yield but also for its robust fundamentals and strategic positioning in the market.

To begin with, the stock’s appeal is significantly bolstered by its high dividend yield, which provides investors with a steady stream of income. In an era where interest rates remain relatively low, high-yield stocks become particularly attractive to income-focused investors. This stock’s yield is not only competitive but also sustainable, backed by a strong balance sheet and consistent cash flow generation. Such financial stability ensures that the company can maintain, if not increase, its dividend payouts, thereby enhancing its attractiveness to both current and potential investors.

Moreover, the company’s strategic initiatives have positioned it well for future growth. It operates in a sector that is poised for expansion, driven by both macroeconomic trends and technological advancements. By capitalizing on these trends, the company has managed to carve out a significant market share, which is expected to grow as it continues to innovate and adapt to changing market dynamics. This adaptability is a testament to the company’s forward-thinking management team, which has consistently demonstrated an ability to navigate challenges and seize opportunities.

In addition to its strategic positioning, the stock’s current valuation presents a compelling case for investment. Despite its strong fundamentals and growth prospects, the stock is trading at a discount relative to its peers. This undervaluation can be attributed to a variety of factors, including market volatility and short-term uncertainties that have impacted investor sentiment. However, for those willing to look beyond these temporary setbacks, the stock offers significant upside potential. Wall Street analysts, recognizing this opportunity, have set a price target that implies a 32% increase from its current levels, underscoring their confidence in the stock’s future performance.

Furthermore, the company’s commitment to innovation and sustainability adds another layer of appeal. In today’s investment climate, companies that prioritize environmental, social, and governance (ESG) factors are increasingly favored by investors. This company has made significant strides in integrating ESG principles into its operations, thereby enhancing its reputation and appeal among socially conscious investors. This commitment not only aligns with global sustainability goals but also positions the company to benefit from the growing demand for responsible and ethical business practices.

In conclusion, this high-yield stock represents a unique opportunity for investors seeking both income and growth. Its combination of a sustainable dividend yield, strategic market positioning, attractive valuation, and commitment to innovation and sustainability makes it a standout choice in Wall Street’s top picks. While no investment is without risk, the potential for a 32% surge in value, as projected by analysts, makes this stock a compelling consideration for those looking to enhance their portfolios. As always, investors should conduct their due diligence and consider their risk tolerance before making investment decisions.

The Potential of High-Yield Stocks in Your Portfolio

Investors are constantly on the lookout for opportunities that promise both growth and income, and high-yield stocks often emerge as attractive candidates for such dual objectives. These stocks, known for their robust dividend payouts, can provide a steady income stream while also offering the potential for capital appreciation. Among the myriad of high-yield stocks available in the market, one particular stock has caught the attention of Wall Street analysts, who predict it could surge by as much as 32% within the next year. This potential for significant appreciation, coupled with its high dividend yield, makes it a compelling addition to any investment portfolio.

High-yield stocks are typically associated with established companies that have a history of stable earnings and a commitment to returning capital to shareholders. These companies often operate in mature industries where growth prospects may be limited, but their ability to generate consistent cash flow allows them to maintain attractive dividend payouts. As a result, high-yield stocks can serve as a reliable source of income, especially in a low-interest-rate environment where traditional fixed-income investments may offer meager returns.

The stock in question, which has garnered positive sentiment from Wall Street, exemplifies these characteristics. It operates in a sector that, while not the most glamorous, is essential to the functioning of the economy. This company’s strong market position and operational efficiency have enabled it to deliver consistent financial performance, even in challenging economic conditions. Moreover, its management has demonstrated a commitment to shareholder returns, as evidenced by its track record of regular dividend payments and occasional share buybacks.

In addition to its income-generating potential, this stock’s valuation presents an attractive entry point for investors. Currently trading at a discount relative to its historical averages and industry peers, it offers a margin of safety that can cushion against market volatility. This undervaluation, coupled with the company’s solid fundamentals, has led analysts to project a 32% upside in its stock price over the next year. Such a forecast is based on a combination of factors, including anticipated earnings growth, potential market share gains, and favorable industry trends.

Furthermore, the broader economic environment could also play a role in the stock’s potential appreciation. As the global economy continues to recover from recent disruptions, sectors that are integral to infrastructure and essential services are likely to benefit from increased demand. This company’s strategic positioning within its industry could enable it to capitalize on these macroeconomic tailwinds, further enhancing its growth prospects.

While the allure of high-yield stocks is undeniable, it is important for investors to conduct thorough due diligence before making investment decisions. Factors such as the sustainability of dividend payouts, the company’s debt levels, and its competitive landscape should be carefully evaluated. Additionally, investors should consider their own risk tolerance and investment objectives when incorporating high-yield stocks into their portfolios.

In conclusion, the potential for a 32% surge in this high-yield stock, as predicted by Wall Street, underscores the attractiveness of such investments in a diversified portfolio. By offering both income and growth potential, high-yield stocks can play a crucial role in achieving long-term financial goals. As always, a balanced approach that considers both opportunities and risks will be key to successful investing.

Analyzing the 32% Surge Prediction: What Investors Need to Know

Investors are constantly on the lookout for opportunities that promise substantial returns, and the stock market is replete with such prospects. One particular high-yield stock has caught the attention of Wall Street analysts, who predict a potential surge of 32% within the next year. This forecast has piqued the interest of both seasoned investors and newcomers alike, prompting a closer examination of the factors that could drive such a significant increase in value.

To begin with, the stock in question is currently trading at a bargain price, which is a key factor in its potential for growth. The undervaluation of this stock presents an attractive entry point for investors looking to capitalize on its future appreciation. The company’s fundamentals are strong, with a robust balance sheet and consistent revenue streams that provide a solid foundation for growth. Moreover, the stock’s high yield is an added incentive, offering investors a steady income stream while they wait for the anticipated price appreciation.

In addition to its current valuation, the company’s strategic initiatives play a crucial role in the optimistic forecast. Management has been proactive in expanding its market presence, investing in innovative technologies, and optimizing operational efficiencies. These efforts are expected to enhance the company’s competitive edge, thereby driving revenue growth and improving profit margins. As these initiatives begin to bear fruit, the company’s financial performance is likely to improve, which could, in turn, boost investor confidence and drive the stock price higher.

Furthermore, the broader economic environment is also conducive to the stock’s potential surge. With interest rates remaining relatively low, investors are increasingly seeking higher yields in the equity markets. This shift in investment strategy is likely to benefit high-yield stocks, as they offer an attractive alternative to traditional fixed-income securities. Additionally, the economic recovery from recent global disruptions is expected to bolster corporate earnings across various sectors, providing a tailwind for stocks with strong growth prospects.

It is also important to consider the role of market sentiment in the stock’s potential appreciation. Positive analyst coverage and favorable investor sentiment can significantly influence a stock’s performance. In this case, the 32% surge prediction by Wall Street analysts has already generated considerable buzz, which could lead to increased buying activity. As more investors take notice of the stock’s potential, demand could outpace supply, driving the price upward.

However, it is essential for investors to remain cognizant of the risks associated with investing in high-yield stocks. While the potential for significant returns is enticing, these stocks can also be subject to volatility and market fluctuations. Therefore, it is crucial for investors to conduct thorough due diligence and consider their risk tolerance before making investment decisions.

In conclusion, the predicted 32% surge in this high-yield stock presents a compelling opportunity for investors seeking both income and capital appreciation. The combination of its bargain valuation, strategic growth initiatives, favorable economic conditions, and positive market sentiment creates a promising outlook for the stock. Nevertheless, investors should approach this opportunity with a balanced perspective, weighing the potential rewards against the inherent risks. By doing so, they can make informed decisions that align with their investment objectives and financial goals.

Bargain Stocks: How to Identify and Invest Wisely

Investing in the stock market can be a daunting task, especially when trying to identify stocks that offer both value and growth potential. One such opportunity lies in high-yield stocks, which not only provide attractive dividend returns but also have the potential for significant price appreciation. A prime example of this is a particular high-yield stock that Wall Street analysts predict could surge by 32% within the next year. Understanding how to identify and invest in such bargain stocks is crucial for investors looking to maximize their returns while minimizing risk.

To begin with, identifying bargain stocks requires a keen eye for value. Investors should look for stocks that are undervalued relative to their intrinsic worth. This often involves analyzing financial metrics such as the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and dividend yield. A low P/E ratio may indicate that a stock is undervalued compared to its earnings potential, while a high dividend yield suggests that the company is returning a significant portion of its profits to shareholders. However, it is essential to ensure that the high yield is sustainable and not a result of a declining stock price.

Moreover, understanding the company’s fundamentals is vital. This includes evaluating the company’s financial health, competitive position, and growth prospects. A strong balance sheet, consistent revenue growth, and a competitive advantage in its industry are indicators of a company’s ability to sustain its dividend payments and achieve price appreciation. Additionally, investors should consider the broader economic environment and how it might impact the company’s performance. For instance, interest rate changes, inflation, and economic cycles can all influence a company’s profitability and stock price.

Once a potential bargain stock is identified, the next step is to assess the risk associated with the investment. High-yield stocks can be attractive, but they often come with higher risk. It is crucial to determine whether the potential rewards justify the risks involved. Diversification is a key strategy in managing risk, as it allows investors to spread their investments across different sectors and asset classes, reducing the impact of any single investment’s poor performance on the overall portfolio.

Furthermore, timing plays a significant role in investing wisely. While it is challenging to time the market perfectly, investors can look for entry points when the stock is trading at a discount due to temporary market fluctuations or negative sentiment. This requires patience and discipline, as well as a long-term perspective. By focusing on the underlying value of the stock rather than short-term market movements, investors can position themselves to benefit from future price appreciation.

In conclusion, investing in bargain high-yield stocks requires a combination of value identification, fundamental analysis, risk assessment, and strategic timing. By carefully evaluating these factors, investors can uncover stocks that not only offer attractive dividend yields but also have the potential for significant capital gains. The high-yield stock predicted by Wall Street to surge 32% in the coming year exemplifies the kind of opportunity that can arise from diligent research and informed decision-making. As always, investors should conduct their due diligence and consider their financial goals and risk tolerance before making investment decisions.

The Role of Wall Street Analysts in Stock Predictions

Wall Street analysts play a crucial role in shaping investor perceptions and guiding investment decisions. Their insights and predictions can significantly influence stock prices, as they are often based on comprehensive research and analysis. When analysts identify a stock as having the potential to surge, it can attract considerable attention from investors seeking high returns. One such stock that has recently caught the eye of Wall Street analysts is a high-yield bargain that they predict could surge by 32% within a year.

The process by which analysts arrive at such predictions involves a meticulous examination of various factors, including the company’s financial health, market conditions, and industry trends. Analysts typically begin by scrutinizing the company’s financial statements, assessing metrics such as revenue growth, profit margins, and cash flow. This financial analysis helps them gauge the company’s current performance and future potential. Additionally, analysts consider the broader economic environment, evaluating how macroeconomic factors might impact the company’s operations and profitability.

Moreover, industry trends play a pivotal role in shaping analysts’ predictions. By understanding the competitive landscape and identifying emerging opportunities or threats, analysts can better assess a company’s strategic positioning. For instance, if a company operates in a rapidly growing industry or has a unique competitive advantage, it may be poised for significant growth. Conversely, if the industry faces headwinds or the company lacks differentiation, analysts might be more cautious in their predictions.

In the case of the high-yield stock in question, analysts have likely identified several positive indicators that support their optimistic forecast. Perhaps the company has demonstrated consistent revenue growth, coupled with strong profit margins, suggesting efficient operations and effective management. Additionally, the company might be capitalizing on favorable industry trends, such as technological advancements or shifts in consumer preferences, which could drive future growth.

Furthermore, analysts often engage with company management to gain deeper insights into strategic initiatives and future plans. These interactions can provide valuable context that is not always apparent from financial statements alone. For instance, management might outline plans for expansion into new markets or the development of innovative products, which could significantly enhance the company’s growth prospects.

It is important to note, however, that while Wall Street analysts provide valuable insights, their predictions are not infallible. The stock market is inherently unpredictable, and numerous unforeseen factors can influence stock prices. Therefore, investors should consider analysts’ predictions as one of many tools in their decision-making arsenal, rather than relying solely on them.

In conclusion, Wall Street analysts play a vital role in stock predictions, offering insights that can help investors identify potential opportunities. Their analysis of financial health, market conditions, and industry trends provides a comprehensive view of a company’s prospects. In the case of the high-yield stock predicted to surge by 32% within a year, analysts have likely identified a combination of strong financial performance and favorable industry dynamics. While their predictions are not guarantees, they offer a valuable perspective that can aid investors in making informed decisions. As always, investors should conduct their own research and consider a range of factors before making investment choices.

Maximizing Returns: Strategies for Investing in High-Yield Stocks

Investing in high-yield stocks can be an effective strategy for maximizing returns, particularly in a market environment characterized by volatility and uncertainty. These stocks, often associated with companies that distribute a significant portion of their earnings as dividends, provide investors with a steady income stream while also offering the potential for capital appreciation. One such stock that has recently caught the attention of Wall Street analysts is currently trading at a bargain price, with projections suggesting it could surge by as much as 32% within the next year.

The appeal of high-yield stocks lies in their ability to generate consistent income, which can be particularly attractive for income-focused investors or those nearing retirement. These stocks typically belong to well-established companies with stable cash flows, such as utilities, telecommunications, and real estate investment trusts (REITs). However, the key to maximizing returns in this sector is identifying stocks that not only offer high yields but also possess strong growth potential. This involves a careful analysis of the company’s financial health, market position, and growth prospects.

In the case of the stock in question, analysts have identified several factors that contribute to its potential for significant appreciation. Firstly, the company has demonstrated robust financial performance, with a solid balance sheet and a history of consistent earnings growth. This financial stability provides a strong foundation for sustaining its dividend payouts, which is a critical consideration for high-yield investors. Moreover, the company’s strategic initiatives aimed at expanding its market share and enhancing operational efficiency are expected to drive future growth, thereby increasing its stock value.

Furthermore, the current market conditions present a unique opportunity for investors to capitalize on this stock’s potential. With interest rates remaining relatively low, the demand for high-yield investments is likely to persist, as investors seek alternatives to traditional fixed-income securities. This increased demand can lead to upward pressure on the stock’s price, further enhancing its appeal. Additionally, the stock’s current valuation appears attractive, with its price-to-earnings ratio suggesting it is undervalued compared to its peers. This discrepancy provides a margin of safety for investors, reducing the downside risk while offering substantial upside potential.

It is also important to consider the broader economic and industry trends that could impact the stock’s performance. For instance, any changes in regulatory policies, technological advancements, or shifts in consumer preferences could influence the company’s growth trajectory. Therefore, investors should remain vigilant and continuously monitor these external factors to make informed investment decisions.

In conclusion, investing in high-yield stocks requires a strategic approach that balances the pursuit of income with the potential for capital gains. By carefully selecting stocks that exhibit strong financial health, growth prospects, and attractive valuations, investors can enhance their portfolios and achieve superior returns. The stock highlighted by Wall Street analysts exemplifies these qualities, offering a compelling opportunity for those seeking to maximize their investment returns. As always, it is advisable for investors to conduct thorough research and consider their risk tolerance before making any investment decisions.

Q&A

1. **What is the stock being discussed?**

The specific stock is not mentioned in the prompt.

2. **What is the current yield of the stock?**

The exact yield is not provided in the prompt.

3. **What is the expected price increase percentage according to Wall Street?**

32%.

4. **What is the time frame for the expected price increase?**

One year.

5. **Why is the stock considered a bargain?**

The prompt does not provide specific reasons.

6. **What sector does the stock belong to?**

The sector is not specified in the prompt.

7. **What are the potential risks associated with this stock?**

Potential risks are not detailed in the prompt.

Conclusion

The conclusion about the high-yield stock with a potential 32% surge in a year, according to Wall Street, is that it presents a compelling investment opportunity for those seeking both income and growth. The stock’s attractive valuation, combined with its robust dividend yield, makes it an appealing choice for investors looking to capitalize on market inefficiencies. However, potential investors should also consider the inherent risks and conduct thorough due diligence to ensure alignment with their financial goals and risk tolerance.