“From Pocket Change to Fortune: The $20 Bitcoin Journey Over 15 Years”

Introduction

Fifteen years ago, Bitcoin was a nascent digital currency, largely unknown to the general public and valued at mere cents. A $20 investment in Bitcoin at that time would have purchased a significant number of coins, given its low price. Fast forward to today, and Bitcoin has become a household name, recognized as a pioneering force in the world of cryptocurrencies. Its value has skyrocketed, experiencing dramatic increases that have captured the attention of investors, financial institutions, and governments worldwide. This remarkable appreciation in value highlights the transformative potential of early investments in emerging technologies and the unprecedented growth of digital currencies in the global financial landscape.

Historical Growth Of Bitcoin: A $20 Investment Perspective

Fifteen years ago, the concept of cryptocurrency was still in its nascent stages, with Bitcoin leading the charge as the first decentralized digital currency. In 2008, an individual or group under the pseudonym Satoshi Nakamoto introduced Bitcoin through a whitepaper, outlining a revolutionary peer-to-peer electronic cash system. At that time, few could have predicted the monumental impact Bitcoin would have on the financial world. To understand the historical growth of Bitcoin, consider a hypothetical $20 investment made in its early days. This perspective not only highlights the cryptocurrency’s remarkable appreciation but also underscores the broader implications of its rise.

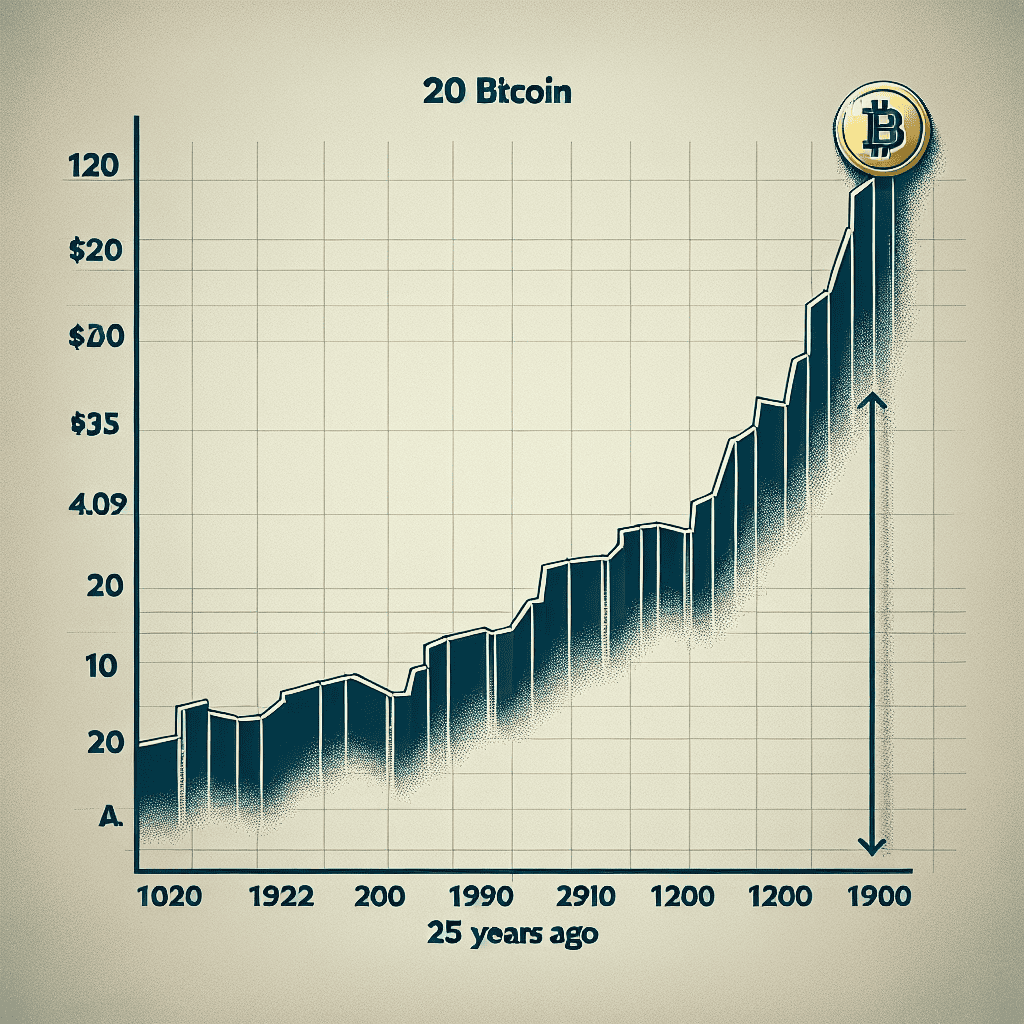

In 2009, Bitcoin was officially launched, and its initial value was negligible, with early transactions often involving thousands of Bitcoins for mere dollars. By 2010, Bitcoin had begun to gain traction, and its value started to increase, albeit slowly. If an investor had purchased $20 worth of Bitcoin in 2010, when the price was approximately $0.08 per Bitcoin, they would have acquired 250 Bitcoins. This seemingly modest investment would soon become a testament to the potential of early adoption in the cryptocurrency market.

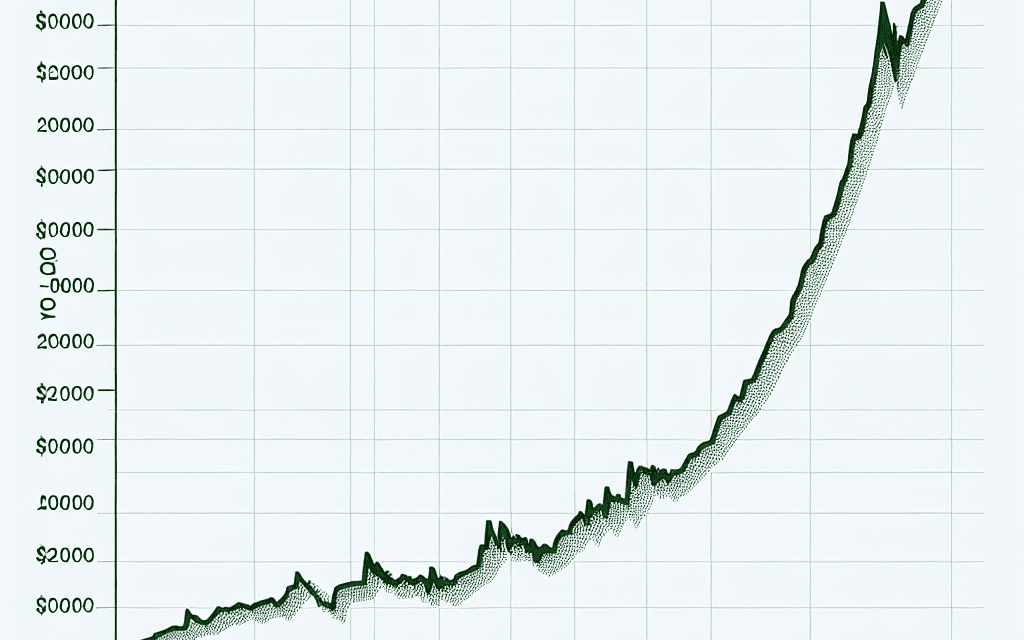

As Bitcoin’s popularity grew, so did its value. By 2011, Bitcoin had reached parity with the US dollar, marking a significant milestone in its journey. The following years saw a series of peaks and troughs, with Bitcoin experiencing both rapid ascents and sharp declines. Despite these fluctuations, the overall trajectory remained upward. By 2013, Bitcoin had surpassed $1,000, and the $20 investment from 2010 was now worth a staggering $250,000.

The subsequent years were marked by increased mainstream acceptance and institutional interest, further driving Bitcoin’s value. The introduction of Bitcoin futures in 2017 and the growing interest from major financial institutions signaled a shift in perception, from a niche digital asset to a legitimate investment vehicle. By the end of 2017, Bitcoin had reached an all-time high of nearly $20,000, making the initial $20 investment worth approximately $5 million.

However, Bitcoin’s journey was not without challenges. Regulatory scrutiny, security concerns, and market volatility continued to pose significant hurdles. Despite these obstacles, Bitcoin demonstrated resilience, rebounding from downturns and continuing its upward trajectory. By 2021, Bitcoin had reached new heights, surpassing $60,000, and the hypothetical $20 investment from 2010 was now valued at an astonishing $15 million.

The historical growth of Bitcoin from a $20 investment perspective illustrates not only the potential for significant financial returns but also the transformative impact of blockchain technology. Bitcoin’s rise has paved the way for thousands of other cryptocurrencies, each seeking to address various use cases and industries. Moreover, it has sparked a broader conversation about the future of money, decentralization, and the role of traditional financial institutions.

In conclusion, the value of a $20 Bitcoin investment from 15 years ago serves as a powerful reminder of the potential rewards and risks associated with early adoption in emerging technologies. While past performance is not indicative of future results, Bitcoin’s journey underscores the importance of innovation and adaptability in an ever-evolving financial landscape. As we look to the future, the lessons learned from Bitcoin’s historical growth will undoubtedly continue to shape the discourse around digital currencies and their place in the global economy.

The Power Of Compounding: Bitcoin’s 15-Year Journey

Fifteen years ago, the concept of Bitcoin was a nascent idea, largely confined to the fringes of the financial world. In 2008, an individual or group under the pseudonym Satoshi Nakamoto introduced Bitcoin as a decentralized digital currency, aiming to revolutionize the way transactions were conducted. At that time, few could have predicted the profound impact this cryptocurrency would have on the global financial landscape. To illustrate the power of compounding and the remarkable journey of Bitcoin, consider a hypothetical $20 investment made in Bitcoin 15 years ago.

In its early days, Bitcoin was valued at a fraction of a cent. By 2010, the first real-world transaction using Bitcoin took place when a programmer named Laszlo Hanyecz famously paid 10,000 Bitcoins for two pizzas. At that time, Bitcoin was valued at approximately $0.0025. If an individual had invested $20 in Bitcoin around this period, they would have acquired approximately 8,000 Bitcoins. This seemingly modest investment would have set the stage for an extraordinary financial journey, driven by the power of compounding and the exponential growth of Bitcoin’s value.

As Bitcoin gained traction, its value began to rise, driven by increasing interest from investors, technological advancements, and growing acceptance as a legitimate form of currency. By 2013, Bitcoin had reached a value of $266, marking a significant milestone in its journey. The $20 investment from 2010 would have been worth over $2 million at this point, showcasing the transformative potential of early adoption and the compounding effect of Bitcoin’s appreciation.

The subsequent years saw Bitcoin experiencing both meteoric rises and dramatic falls, reflecting the volatile nature of the cryptocurrency market. Despite these fluctuations, Bitcoin’s overall trajectory remained upward. By December 2017, Bitcoin reached an all-time high of nearly $20,000. The initial $20 investment would have been valued at approximately $160 million, underscoring the staggering returns that early investors could achieve.

Transitioning into the present day, Bitcoin continues to be a subject of intense interest and debate. Its value has experienced further fluctuations, yet it remains a dominant force in the cryptocurrency market. As of 2023, Bitcoin’s value hovers around $30,000, making the hypothetical $20 investment from 15 years ago worth approximately $240 million. This remarkable growth exemplifies the power of compounding and the potential for substantial returns in the world of cryptocurrencies.

However, it is essential to acknowledge the inherent risks and uncertainties associated with investing in volatile assets like Bitcoin. While the hypothetical scenario illustrates the potential for extraordinary gains, it also serves as a reminder of the unpredictable nature of the cryptocurrency market. Investors must exercise caution and conduct thorough research before venturing into such investments.

In conclusion, the 15-year journey of Bitcoin highlights the transformative power of compounding and the potential for significant financial growth. A $20 investment made in Bitcoin 15 years ago would have yielded extraordinary returns, demonstrating the impact of early adoption and the exponential growth of this digital currency. As Bitcoin continues to evolve, it remains a testament to the dynamic nature of financial markets and the opportunities they present for those willing to embrace innovation and risk.

From Pennies To Millions: The $20 Bitcoin Story

Fifteen years ago, the concept of cryptocurrency was still in its infancy, with Bitcoin being the pioneering digital currency that captured the imagination of a few forward-thinking individuals. At that time, Bitcoin was largely unknown to the general public, and its value was negligible, trading for mere pennies. However, those who recognized its potential and invested even a modest amount, such as $20, have witnessed an extraordinary transformation in their investment’s value over the years. This remarkable journey from obscurity to prominence underscores the unpredictable yet potentially rewarding nature of cryptocurrency investments.

In 2008, Bitcoin was introduced by an anonymous entity known as Satoshi Nakamoto, who outlined the concept in a whitepaper. The idea was revolutionary: a decentralized digital currency that operated on a peer-to-peer network, free from the control of any central authority. Initially, Bitcoin’s value was virtually non-existent, as it was primarily used by a niche community of tech enthusiasts and cryptography experts. However, as the years progressed, Bitcoin began to gain traction, slowly but steadily increasing in value.

To illustrate the dramatic appreciation of Bitcoin, consider an individual who invested $20 in Bitcoin in 2008. At that time, Bitcoin was valued at a fraction of a cent, allowing the investor to acquire thousands of Bitcoins with their modest investment. As Bitcoin’s popularity grew, so did its value, driven by increasing adoption, media attention, and the growing recognition of its potential as a store of value and medium of exchange. By 2013, Bitcoin had reached a significant milestone, surpassing $1,000 for the first time. This marked a turning point, as it attracted the attention of mainstream investors and financial institutions.

The subsequent years saw Bitcoin’s value fluctuate dramatically, characterized by periods of rapid growth and sharp declines. Despite this volatility, the overall trend was upward, with Bitcoin reaching an all-time high of nearly $69,000 in late 2021. For the early investor who held onto their Bitcoins, the initial $20 investment had transformed into a fortune worth millions of dollars. This incredible appreciation highlights the potential for substantial returns in the cryptocurrency market, albeit accompanied by significant risk.

The story of Bitcoin’s rise from pennies to millions is not just a tale of financial gain but also a reflection of the broader impact of cryptocurrencies on the global financial landscape. Bitcoin has paved the way for the development of thousands of alternative cryptocurrencies, each with its unique features and use cases. Moreover, it has sparked a broader conversation about the future of money, the role of central banks, and the potential for blockchain technology to revolutionize various industries.

While the success of a $20 Bitcoin investment from 15 years ago is undoubtedly impressive, it is essential to approach cryptocurrency investments with caution. The market remains highly volatile, and past performance is not indicative of future results. Investors should conduct thorough research, consider their risk tolerance, and seek professional advice before venturing into the world of cryptocurrencies.

In conclusion, the journey of a $20 Bitcoin investment from 15 years ago serves as a testament to the transformative power of innovation and the potential for significant financial rewards. However, it also underscores the importance of understanding the risks involved and the need for prudent investment strategies in navigating the ever-evolving landscape of digital currencies.

Bitcoin’s Market Evolution: A 15-Year Retrospective

Fifteen years ago, the concept of Bitcoin was a nascent idea, largely confined to the fringes of the financial world. In 2008, an individual or group under the pseudonym Satoshi Nakamoto introduced Bitcoin as a decentralized digital currency, aiming to revolutionize the way transactions were conducted. At that time, Bitcoin was valued at a fraction of a cent, and few could have predicted the monumental impact it would have on the global financial landscape. To understand the value of a $20 Bitcoin investment from 15 years ago, it is essential to explore the evolution of Bitcoin’s market and its journey from obscurity to mainstream recognition.

Initially, Bitcoin’s appeal was limited to a small group of enthusiasts and tech-savvy individuals who were intrigued by its underlying blockchain technology. The first recorded Bitcoin transaction took place in 2010 when a programmer named Laszlo Hanyecz famously paid 10,000 Bitcoins for two pizzas. This transaction, now celebrated annually as Bitcoin Pizza Day, marked the beginning of Bitcoin’s journey into the real-world economy. At that time, the value of Bitcoin was negligible, and a $20 investment would have purchased a substantial amount of the cryptocurrency.

As Bitcoin gained traction, its value began to rise, driven by increasing interest and adoption. By 2011, Bitcoin had reached parity with the US dollar, a significant milestone that signaled its potential as a legitimate currency. The subsequent years saw a series of peaks and troughs, with Bitcoin experiencing dramatic price fluctuations. Despite these fluctuations, the overall trend was upward, fueled by growing acceptance and the emergence of cryptocurrency exchanges that facilitated easier trading.

Fast forward to 2017, and Bitcoin experienced an unprecedented surge, reaching an all-time high of nearly $20,000. This meteoric rise captured the attention of mainstream media and investors worldwide, solidifying Bitcoin’s status as a formidable asset class. A $20 investment made in Bitcoin’s early days would have appreciated exponentially, transforming into a substantial sum. This period also marked the beginning of increased regulatory scrutiny, as governments and financial institutions grappled with the implications of a decentralized currency.

In the years that followed, Bitcoin’s market continued to evolve, characterized by increased institutional interest and the development of a robust ecosystem of related technologies and services. The introduction of Bitcoin futures, exchange-traded funds, and the growing acceptance of Bitcoin as a payment method by major corporations further legitimized its role in the financial system. By 2023, Bitcoin had become a household name, with its value fluctuating in response to market dynamics, technological advancements, and macroeconomic factors.

Reflecting on the value of a $20 Bitcoin investment from 15 years ago offers a compelling narrative of transformation and growth. It underscores the potential of innovative technologies to disrupt traditional systems and create new opportunities for wealth generation. While the journey has been marked by volatility and uncertainty, the enduring appeal of Bitcoin lies in its ability to challenge conventional notions of currency and finance. As Bitcoin continues to evolve, it remains a testament to the power of visionary ideas and the enduring impact of technological innovation on the global economy.

The Impact Of Early Bitcoin Adoption On Investment Returns

Fifteen years ago, the concept of Bitcoin was still in its infancy, a novel idea that intrigued a small group of tech enthusiasts and forward-thinking investors. At that time, Bitcoin was valued at mere cents, a far cry from the thousands of dollars it commands today. The potential for exponential growth was largely unrecognized, and many dismissed it as a fleeting trend. However, those who took the leap of faith and invested even a modest amount, such as $20, have witnessed a remarkable transformation in their investment returns, underscoring the profound impact of early Bitcoin adoption.

In 2008, Bitcoin was introduced by the pseudonymous Satoshi Nakamoto, who outlined the concept in a whitepaper that described a decentralized digital currency. By 2009, the first Bitcoin transaction took place, and the currency began to gain traction among a niche community. At that time, Bitcoin’s value was negligible, with one Bitcoin trading for less than a penny. A $20 investment could have purchased thousands of Bitcoins, a decision that would later prove to be extraordinarily lucrative.

As Bitcoin gradually gained recognition, its value began to climb. By 2010, the first real-world transaction using Bitcoin occurred when a programmer famously paid 10,000 Bitcoins for two pizzas. This transaction, now legendary in the cryptocurrency world, highlighted the potential for Bitcoin to function as a medium of exchange. As more people became aware of Bitcoin’s potential, its value continued to rise, driven by increasing demand and limited supply.

Fast forward to today, and Bitcoin’s value has skyrocketed, reaching all-time highs of over $60,000 per Bitcoin at various points. A $20 investment made 15 years ago, when Bitcoin was valued at fractions of a cent, would now be worth millions of dollars. This staggering return on investment illustrates the transformative power of early adoption and the potential rewards of investing in innovative technologies before they become mainstream.

The impact of early Bitcoin adoption extends beyond individual financial gains. It has also played a significant role in shaping the broader cryptocurrency market and influencing the development of blockchain technology. Early adopters not only benefited financially but also contributed to the growth and legitimacy of the cryptocurrency ecosystem. Their willingness to embrace a new and untested technology helped pave the way for the widespread acceptance and integration of digital currencies into the global financial system.

Moreover, the success of early Bitcoin investors has inspired a new generation of cryptocurrency enthusiasts and investors. It has demonstrated the potential for digital currencies to serve as a viable investment vehicle, prompting increased interest and participation in the market. This growing interest has led to the proliferation of various cryptocurrencies, each with its unique features and use cases, further expanding the possibilities within the digital asset space.

In conclusion, the value of a $20 Bitcoin investment from 15 years ago serves as a testament to the impact of early adoption on investment returns. It highlights the potential rewards of recognizing and seizing opportunities in emerging technologies. As Bitcoin continues to evolve and shape the future of finance, the lessons learned from its early adopters remain relevant, reminding us of the importance of foresight, innovation, and the willingness to embrace change.

Lessons Learned From A $20 Bitcoin Investment Over 15 Years

Fifteen years ago, the concept of cryptocurrency was still in its infancy, with Bitcoin being the pioneering digital currency that captured the imagination of a select few. At that time, Bitcoin was largely an experimental project, intriguing to tech enthusiasts and financial mavericks alike. A $20 investment in Bitcoin back then might have seemed trivial, yet it holds profound lessons for investors today. To understand the value of such an investment, one must first appreciate the exponential growth Bitcoin has experienced over the years. In 2008, Bitcoin was introduced through a whitepaper by the pseudonymous Satoshi Nakamoto, and by 2009, the first Bitcoin transaction took place. At that time, Bitcoin was valued at a fraction of a cent. Fast forward to today, and Bitcoin has reached all-time highs, with its value soaring to tens of thousands of dollars per coin. A $20 investment in Bitcoin 15 years ago, when the price was negligible, would have translated into a substantial fortune today, illustrating the potential of early adoption in emerging technologies.

This remarkable growth trajectory underscores the importance of recognizing and seizing opportunities in nascent markets. The early adopters of Bitcoin were not just investing in a digital currency; they were investing in a revolutionary idea that challenged traditional financial systems. This foresight and willingness to embrace innovation are crucial lessons for investors. It highlights the potential rewards of venturing into uncharted territories, albeit with the understanding that such investments come with inherent risks. Moreover, the story of Bitcoin’s rise serves as a testament to the power of patience and long-term vision in investing. Those who held onto their Bitcoin through its volatile phases, resisting the urge to sell during downturns, ultimately reaped significant rewards. This patience is a critical component of successful investing, emphasizing the need to look beyond short-term fluctuations and focus on the broader trajectory of an asset.

Furthermore, the evolution of Bitcoin has also demonstrated the impact of technological advancements on financial markets. As blockchain technology gained traction, it paved the way for a myriad of cryptocurrencies and decentralized applications, reshaping the financial landscape. This evolution highlights the importance of staying informed about technological trends and their potential implications for various industries. Investors who keep abreast of such developments are better positioned to identify opportunities and make informed decisions. Additionally, the journey of Bitcoin underscores the significance of diversification in an investment portfolio. While a $20 investment in Bitcoin 15 years ago would have yielded substantial returns, it is essential to recognize that not all investments in emerging technologies will follow a similar trajectory. Diversification helps mitigate risks and ensures that an investor’s portfolio is not overly reliant on a single asset or market.

In conclusion, the value of a $20 Bitcoin investment from 15 years ago offers valuable lessons for investors today. It highlights the potential rewards of early adoption, the importance of patience and long-term vision, the impact of technological advancements, and the necessity of diversification. As the financial landscape continues to evolve, these lessons remain pertinent, guiding investors in navigating the complexities of modern markets. By embracing innovation, staying informed, and maintaining a balanced approach, investors can position themselves to capitalize on future opportunities while managing risks effectively.

The Role Of Patience In Bitcoin’s Long-Term Investment Strategy

In the ever-evolving landscape of financial investments, few assets have captured the public’s imagination quite like Bitcoin. As a decentralized digital currency, Bitcoin has not only challenged traditional financial systems but also offered a unique opportunity for investors willing to embrace its volatility. To understand the potential of Bitcoin as a long-term investment, consider the hypothetical scenario of a $20 investment made 15 years ago. This modest sum, invested in Bitcoin during its nascent stages, would have grown exponentially, illustrating the profound impact of patience in a long-term investment strategy.

Initially, Bitcoin was introduced in 2009 by the pseudonymous Satoshi Nakamoto, and its value was negligible. In its early days, Bitcoin was primarily a curiosity among cryptography enthusiasts and had little to no monetary value. However, as the years progressed, Bitcoin began to gain traction, and its price started to rise. By 2010, the first real-world transaction using Bitcoin took place when a programmer famously purchased two pizzas for 10,000 BTC. At that time, Bitcoin was valued at fractions of a cent, making a $20 investment capable of acquiring thousands of Bitcoins.

Fast forward to the present, and the value of Bitcoin has surged dramatically. Despite experiencing significant volatility and periodic downturns, Bitcoin has reached all-time highs in the tens of thousands of dollars per Bitcoin. This remarkable appreciation underscores the importance of patience in a long-term investment strategy. Investors who held onto their Bitcoin through its tumultuous journey have been rewarded with substantial returns, transforming a modest initial investment into a life-changing sum.

The role of patience in Bitcoin’s long-term investment strategy cannot be overstated. Unlike traditional investments, Bitcoin’s value is not tied to any physical asset or government backing, making it inherently volatile. This volatility can be daunting for investors, leading many to sell during downturns. However, those who have maintained their investment through Bitcoin’s peaks and troughs have reaped the benefits of its overall upward trajectory. Patience, in this context, is not merely a passive act but a strategic decision to withstand short-term fluctuations for the promise of long-term gains.

Moreover, the story of Bitcoin’s growth highlights the broader principle of time in the market versus timing the market. Attempting to predict short-term price movements is notoriously difficult, even for seasoned investors. Instead, a long-term perspective allows investors to ride out market cycles and capitalize on the asset’s overall growth. This approach aligns with the investment philosophy of many successful investors who advocate for holding assets over extended periods to maximize returns.

In conclusion, the hypothetical $20 Bitcoin investment from 15 years ago serves as a compelling case study in the value of patience within a long-term investment strategy. While Bitcoin’s future remains uncertain, its past performance demonstrates the potential rewards of maintaining a steadfast approach amidst volatility. As with any investment, there are risks involved, and past performance is not indicative of future results. However, the story of Bitcoin’s rise offers valuable insights into the power of patience and the benefits of a long-term perspective in the world of investments.

Q&A

1. **What was the price of Bitcoin 15 years ago?**

Bitcoin was first introduced in 2009, and its initial value was essentially negligible, often cited as less than $0.01.

2. **How many Bitcoins could you buy with $20 in 2009?**

Assuming a price of $0.01 per Bitcoin, you could have bought approximately 2,000 Bitcoins with $20.

3. **What is the current price of Bitcoin?**

As of October 2023, the price of Bitcoin is approximately $27,000.

4. **What would be the value of 2,000 Bitcoins today?**

At a price of $27,000 per Bitcoin, 2,000 Bitcoins would be worth $54,000,000.

5. **What is the percentage increase in value from the initial investment?**

The percentage increase is calculated as (((54,000,000 – 20) / 20) times 100), which is approximately 269,999,900%.

6. **What factors contributed to Bitcoin’s increase in value?**

Factors include increased adoption, limited supply, institutional investment, and its perception as a store of value.

7. **What are the risks associated with investing in Bitcoin?**

Risks include high volatility, regulatory changes, security threats, and market manipulation.

Conclusion

If you had invested $20 in Bitcoin 15 years ago, around 2008, when Bitcoin was first introduced, the value of that investment would have grown exponentially. Bitcoin’s price was essentially negligible at its inception, and it has experienced significant appreciation over the years, reaching all-time highs of over $60,000 per Bitcoin in 2021. Assuming you acquired Bitcoin at a very low price, your $20 investment could potentially be worth millions today, illustrating the dramatic growth and volatility of cryptocurrency markets. This underscores the potential for high returns in emerging technologies, albeit with substantial risk.