“Tesla Stock Outlook: Navigating Post-Earnings Waves with Options Market Insights”

Introduction

Tesla’s stock performance is a focal point for investors, especially following its earnings announcements, which often lead to significant market reactions. The options market provides a unique lens through which to gauge investor sentiment and expectations regarding Tesla’s future stock movements. Post-earnings, options trading activity can reveal insights into how traders are positioning themselves in anticipation of potential volatility or price shifts. By analyzing metrics such as implied volatility, open interest, and the put-call ratio, investors can gain a deeper understanding of the market’s outlook on Tesla’s stock. This analysis can help in making informed decisions about potential investment strategies, whether they involve hedging existing positions or speculating on future price movements.

Analyzing Tesla’s Post-Earnings Volatility Through Options Markets

Tesla’s recent earnings report has once again captured the attention of investors and analysts alike, prompting a closer examination of the company’s stock performance and future prospects. In the wake of the earnings announcement, the options markets have become a focal point for gauging investor sentiment and predicting potential volatility in Tesla’s stock. By analyzing the activity and pricing in these markets, one can glean valuable insights into how investors are positioning themselves in response to the latest financial disclosures.

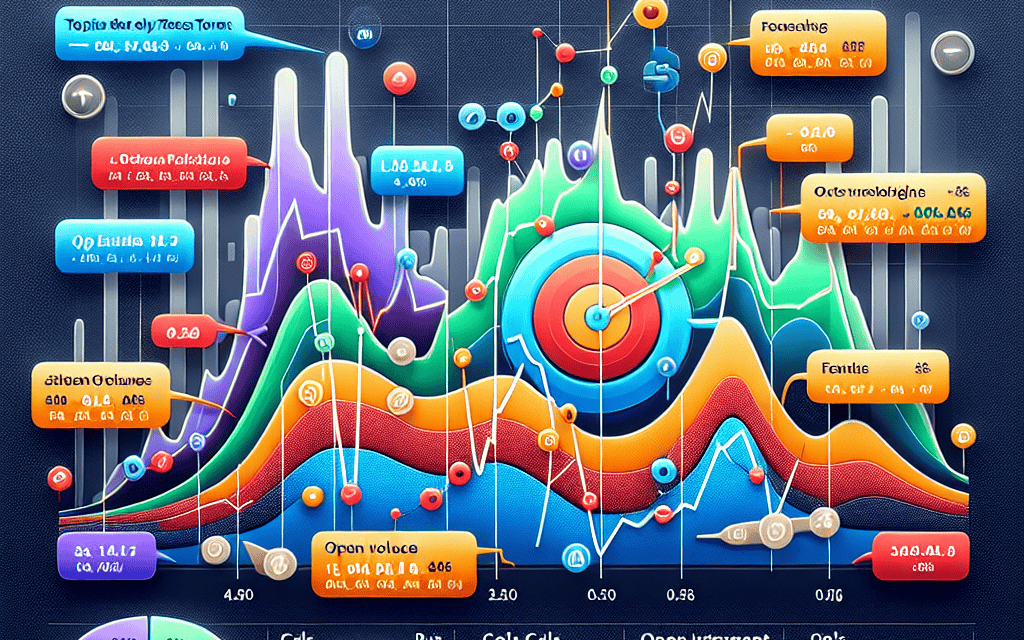

To begin with, options markets are often viewed as a barometer for investor expectations, particularly in the context of anticipated volatility. Following Tesla’s earnings release, there was a noticeable uptick in options trading volume, indicating heightened interest and activity among market participants. This surge in trading can be attributed to investors seeking to hedge their positions or capitalize on potential price movements. The implied volatility, a key metric derived from options prices, provides a quantifiable measure of the market’s expectations for future stock price fluctuations. In Tesla’s case, the implied volatility spiked post-earnings, suggesting that investors are bracing for significant price swings in the near term.

Moreover, the options market offers insights into investor sentiment through the analysis of put and call options. A put option gives the holder the right to sell a stock at a predetermined price, while a call option provides the right to buy. The put-call ratio, which compares the volume of put options to call options, serves as an indicator of market sentiment. A higher ratio typically signals bearish sentiment, as more investors are betting on a decline in the stock price. Conversely, a lower ratio suggests bullish sentiment. In the aftermath of Tesla’s earnings report, the put-call ratio exhibited a slight increase, reflecting a cautious stance among investors who may be hedging against potential downside risks.

Furthermore, the options market can reveal investor expectations regarding specific price levels for Tesla’s stock. By examining the open interest, or the number of outstanding options contracts, at various strike prices, one can identify key levels that investors are focusing on. These strike prices often act as psychological barriers or support levels, influencing the stock’s price movement. In Tesla’s case, there was significant open interest concentrated around certain strike prices, indicating that investors are closely monitoring these levels as potential inflection points.

In addition to these quantitative measures, the options market also provides qualitative insights into investor behavior. The presence of large block trades or unusual options activity can signal the actions of institutional investors or hedge funds, who may possess more sophisticated strategies or access to proprietary information. Such activity can serve as a leading indicator of future stock movements, offering retail investors a glimpse into the potential direction of Tesla’s stock.

In conclusion, the options markets offer a wealth of information for analyzing Tesla’s post-earnings volatility and investor sentiment. By examining metrics such as implied volatility, the put-call ratio, open interest, and unusual trading activity, investors can gain a deeper understanding of how the market is positioning itself in response to Tesla’s latest financial performance. While the options market is not infallible, it provides a valuable lens through which to assess the potential risks and opportunities associated with Tesla’s stock in the aftermath of its earnings report. As always, investors should consider these insights in conjunction with other fundamental and technical analyses to make informed decisions.

Key Options Market Indicators for Tesla’s Stock Outlook

Tesla’s stock has long been a focal point for investors, with its volatile nature and innovative business model capturing the attention of both retail and institutional investors. Following the company’s recent earnings report, the options market has provided valuable insights into the stock’s future trajectory. By examining key options market indicators, investors can gain a deeper understanding of the potential movements in Tesla’s stock price.

One of the primary indicators to consider is the implied volatility, which reflects the market’s expectations of future price fluctuations. Post-earnings, Tesla’s implied volatility often experiences significant shifts as investors reassess their positions based on the company’s financial performance and forward guidance. A rise in implied volatility typically suggests that the market anticipates larger price swings, which could be due to uncertainty surrounding Tesla’s future earnings potential or broader market conditions. Conversely, a decline in implied volatility might indicate a more stable outlook, with investors expecting less dramatic price movements.

In addition to implied volatility, the options market’s open interest can provide insights into investor sentiment. Open interest represents the total number of outstanding options contracts and can signal the level of investor engagement with the stock. A surge in open interest following Tesla’s earnings report may suggest heightened investor interest and a potential increase in trading activity. This could be driven by a variety of factors, such as new information from the earnings call or changes in market conditions that prompt investors to adjust their positions.

Furthermore, examining the put-call ratio can offer clues about market sentiment towards Tesla’s stock. This ratio compares the number of put options, which are typically used to hedge against or speculate on a decline in stock price, to the number of call options, which are generally used to bet on a price increase. A high put-call ratio may indicate bearish sentiment, as more investors are seeking protection against a potential drop in Tesla’s stock price. Conversely, a low put-call ratio could suggest bullish sentiment, with investors anticipating upward momentum.

Another important aspect to consider is the options market’s reaction to Tesla’s earnings report in terms of changes in the skew. The skew refers to the difference in implied volatility between out-of-the-money puts and calls. A steep skew might indicate that investors are particularly concerned about downside risk, leading them to pay a premium for protective puts. On the other hand, a flatter skew could suggest a more balanced outlook, with less emphasis on downside protection.

Moreover, the options market can also provide insights into potential price targets for Tesla’s stock. By analyzing the distribution of open interest across different strike prices, investors can identify key levels where significant options activity is concentrated. These levels often act as psychological barriers, influencing the stock’s price movement as it approaches them. For instance, a large concentration of open interest at a particular strike price might suggest that investors expect Tesla’s stock to gravitate towards that level in the near term.

In conclusion, the options market offers a wealth of information that can help investors gauge the outlook for Tesla’s stock following its earnings report. By closely monitoring indicators such as implied volatility, open interest, the put-call ratio, skew, and strike price distribution, investors can develop a more nuanced understanding of market sentiment and potential price movements. As Tesla continues to navigate the challenges and opportunities in the rapidly evolving electric vehicle industry, these options market insights will remain crucial for investors seeking to make informed decisions.

Understanding Implied Volatility in Tesla’s Post-Earnings Scenario

In the wake of Tesla’s recent earnings announcement, investors and analysts alike are keenly observing the options markets to glean insights into the stock’s future trajectory. A critical component in this analysis is understanding implied volatility, which serves as a barometer for market expectations regarding future price fluctuations. Implied volatility, derived from the prices of options, reflects the market’s forecast of a stock’s potential movement. In the context of Tesla, a company known for its dynamic stock performance and innovative strides, this metric becomes particularly significant.

Following the earnings report, Tesla’s implied volatility often experiences a notable shift. This change is indicative of the market’s reassessment of risk and potential price swings based on the new financial data. Typically, earnings announcements can lead to heightened volatility as investors digest the implications of the company’s performance and future guidance. For Tesla, whose earnings reports are closely scrutinized for insights into production numbers, delivery forecasts, and technological advancements, the stakes are even higher. Consequently, the options market becomes a focal point for understanding how these factors might influence stock price movements in the near term.

Moreover, the relationship between implied volatility and options pricing is crucial for investors looking to capitalize on post-earnings opportunities. Higher implied volatility generally leads to more expensive options, as the potential for significant price movement increases the value of these contracts. Conversely, a decrease in implied volatility post-earnings might suggest a stabilization in market sentiment, potentially leading to lower options premiums. For Tesla, whose stock is often subject to rapid and unpredictable changes, these fluctuations in implied volatility can offer strategic insights for both options traders and long-term investors.

In addition to providing a snapshot of market sentiment, implied volatility can also serve as a predictive tool. By analyzing changes in this metric, investors can infer the level of uncertainty or confidence surrounding Tesla’s future performance. For instance, a spike in implied volatility might suggest that the market anticipates significant news or developments that could impact the stock. On the other hand, a decline could indicate a consensus that the earnings report has adequately addressed existing uncertainties, leading to a more stable outlook.

Furthermore, understanding the nuances of implied volatility in Tesla’s post-earnings scenario requires a comprehensive approach. Investors must consider not only the absolute levels of volatility but also how these levels compare to historical norms and the broader market context. This comparative analysis can reveal whether the current market sentiment is an overreaction or a justified response to the earnings data. For Tesla, whose stock is often influenced by broader industry trends and macroeconomic factors, this contextual understanding is essential.

In conclusion, the options market, through the lens of implied volatility, offers valuable insights into Tesla’s post-earnings outlook. By examining how this metric evolves in response to the company’s financial disclosures, investors can better gauge market sentiment and potential price movements. As Tesla continues to navigate its path of innovation and growth, understanding the implications of implied volatility will remain a critical component of informed investment decision-making. This approach not only enhances the ability to anticipate future stock performance but also provides a strategic advantage in navigating the complexities of the options market.

Options Market Sentiment: Bullish or Bearish on Tesla?

In the wake of Tesla’s recent earnings report, investors and analysts alike are keenly observing the options market to gauge sentiment regarding the company’s stock. The options market, known for its ability to reflect investor expectations and sentiment, provides a nuanced perspective on whether the outlook for Tesla is bullish or bearish. By examining the activity and trends within this market, one can glean insights into how traders are positioning themselves in response to Tesla’s financial performance and future prospects.

To begin with, the options market is characterized by the trading of contracts that give investors the right, but not the obligation, to buy or sell Tesla stock at a predetermined price within a specified timeframe. This market is often seen as a barometer of investor sentiment, as it allows traders to express their views on the stock’s future direction. Following Tesla’s earnings announcement, there has been a noticeable uptick in options trading volume, indicating heightened interest and activity among investors.

One of the key indicators of sentiment in the options market is the put-call ratio, which compares the number of put options to call options. A higher ratio suggests a bearish sentiment, as more investors are betting on a decline in the stock price, while a lower ratio indicates bullish sentiment. In Tesla’s case, the put-call ratio has shown a slight decline post-earnings, suggesting a tilt towards bullishness among traders. This shift may be attributed to Tesla’s robust earnings performance, which exceeded market expectations and reinforced confidence in the company’s growth trajectory.

Moreover, the implied volatility of Tesla options, which reflects the market’s expectations of future stock price fluctuations, has also seen changes. Implied volatility tends to rise ahead of earnings announcements due to uncertainty, but it often decreases once the results are out and the uncertainty is resolved. In Tesla’s scenario, the implied volatility has moderated post-earnings, indicating that the market perceives less risk and uncertainty in the stock’s near-term future. This reduction in implied volatility can be interpreted as a sign of stability and confidence among investors.

Additionally, examining the open interest in Tesla options provides further insights into market sentiment. Open interest refers to the total number of outstanding options contracts and can indicate the level of investor engagement. A rise in open interest, particularly in call options, suggests that investors are increasingly optimistic about Tesla’s prospects. In the aftermath of the earnings report, there has been a noticeable increase in open interest for Tesla call options, reinforcing the notion of a bullish sentiment prevailing in the market.

Furthermore, the options market’s reaction to Tesla’s earnings can also be contextualized within broader market trends and economic conditions. The electric vehicle industry, in which Tesla is a dominant player, continues to experience significant growth and innovation. This industry momentum, coupled with Tesla’s strategic initiatives and technological advancements, contributes to the positive sentiment observed in the options market.

In conclusion, the options market sentiment towards Tesla post-earnings appears to lean towards bullishness, as evidenced by the declining put-call ratio, moderated implied volatility, and increased open interest in call options. These indicators suggest that investors are optimistic about Tesla’s future performance and are positioning themselves accordingly. While the options market is just one piece of the puzzle, it provides valuable insights into investor sentiment and expectations, offering a glimpse into the potential trajectory of Tesla’s stock in the coming months.

How Options Trading Volume Reflects Tesla’s Future Stock Movements

In the wake of Tesla’s recent earnings report, investors and analysts alike are keenly observing the options markets to glean insights into the company’s future stock movements. Options trading volume, a critical indicator of market sentiment, provides a nuanced perspective on how traders are positioning themselves in anticipation of Tesla’s stock trajectory. By examining the patterns and trends within this market, one can gain a deeper understanding of the potential directions Tesla’s stock may take in the coming months.

To begin with, options trading volume reflects the level of interest and activity among investors regarding a particular stock. In the case of Tesla, the volume of options trading has surged significantly following the earnings announcement. This uptick in activity suggests that market participants are actively reassessing their positions and strategies based on the new financial data. The heightened volume is indicative of a market that is both reactive and anticipatory, as traders seek to capitalize on potential price movements.

Moreover, the balance between call and put options provides further insight into market sentiment. A predominance of call options, which give the holder the right to buy the stock at a predetermined price, typically signals bullish sentiment. Conversely, a higher volume of put options, which allow the holder to sell the stock, often indicates bearish expectations. In Tesla’s case, the post-earnings options market has shown a notable increase in call options, suggesting that many investors remain optimistic about the company’s future performance despite any short-term volatility.

Additionally, the implied volatility of Tesla’s options is another crucial factor to consider. Implied volatility reflects the market’s expectations of future price fluctuations and is often used as a gauge of investor uncertainty. Following the earnings report, Tesla’s implied volatility has experienced a noticeable shift, indicating that traders are anticipating more significant price swings in the near term. This heightened volatility can be attributed to several factors, including the company’s ambitious growth plans, competitive pressures, and broader market conditions.

Furthermore, the options market can also provide insights into potential support and resistance levels for Tesla’s stock. By analyzing the strike prices with the highest open interest, investors can identify key price points where significant buying or selling pressure may emerge. These levels often serve as psychological barriers that can influence the stock’s movement. In the current landscape, certain strike prices have emerged as focal points, suggesting areas where traders expect the stock to encounter resistance or support.

In conclusion, the options market offers a wealth of information that can help investors better understand Tesla’s future stock movements. By examining trading volume, the balance between call and put options, implied volatility, and key strike prices, one can gain valuable insights into market sentiment and potential price trajectories. While the options market is inherently complex and influenced by a myriad of factors, it remains an essential tool for those seeking to navigate the ever-evolving landscape of Tesla’s stock. As the company continues to innovate and expand, the options market will undoubtedly remain a critical barometer of investor expectations and sentiment.

The Role of Put/Call Ratios in Predicting Tesla’s Stock Direction

In the ever-evolving landscape of financial markets, the analysis of options data has become an indispensable tool for investors seeking to predict stock movements. Tesla, Inc., a company that consistently captures the attention of both retail and institutional investors, provides a compelling case study in this regard. Following its recent earnings report, the focus has shifted to the options market, particularly the put/call ratios, as a means of gauging the future direction of Tesla’s stock.

The put/call ratio is a widely used metric that compares the volume of put options to call options. A put option gives the holder the right to sell a stock at a predetermined price, while a call option provides the right to buy. Generally, a high put/call ratio is interpreted as a bearish signal, indicating that more investors are betting on the stock’s decline. Conversely, a low ratio suggests bullish sentiment, with more investors expecting the stock to rise.

In the context of Tesla, the recent earnings report has sparked a flurry of activity in the options market. Investors are keenly analyzing the put/call ratios to discern market sentiment and potential stock movements. Notably, the ratio has shown fluctuations in response to the earnings announcement, reflecting the market’s mixed reactions. Initially, the ratio spiked, suggesting a surge in bearish sentiment as investors digested the earnings figures. However, as the market absorbed the details, the ratio began to stabilize, indicating a more balanced outlook.

The interpretation of put/call ratios is not always straightforward, as it requires consideration of various factors. For instance, the overall market environment, macroeconomic indicators, and sector-specific trends can all influence investor sentiment and, consequently, the put/call ratio. In Tesla’s case, the company’s unique position in the electric vehicle market, coupled with its ambitious growth plans, adds layers of complexity to the analysis.

Moreover, it is essential to recognize that the put/call ratio is just one piece of the puzzle. While it provides valuable insights into investor sentiment, it should be used in conjunction with other analytical tools and indicators. Technical analysis, fundamental analysis, and broader market trends all play crucial roles in forming a comprehensive view of Tesla’s stock outlook.

Furthermore, the options market is influenced by a myriad of factors, including volatility, time decay, and interest rates, which can affect the pricing and attractiveness of options contracts. As such, investors must exercise caution and consider these elements when interpreting put/call ratios.

In conclusion, the put/call ratio serves as a useful barometer of market sentiment, offering insights into the potential direction of Tesla’s stock post-earnings. However, it is imperative for investors to adopt a holistic approach, integrating multiple analytical perspectives to make informed decisions. As Tesla continues to navigate the dynamic landscape of the electric vehicle industry, the options market will remain a critical arena for gauging investor sentiment and anticipating stock movements. By understanding the nuances of put/call ratios and their implications, investors can better position themselves to capitalize on opportunities and mitigate risks in the ever-volatile world of Tesla’s stock.

Insights from Options Skew on Tesla’s Post-Earnings Performance

Tesla’s recent earnings report has once again captured the attention of investors and analysts alike, prompting a closer examination of the company’s stock performance and future prospects. One of the more nuanced ways to gauge market sentiment and potential future movements of Tesla’s stock is through the lens of options markets, particularly by analyzing the options skew. This approach provides insights that go beyond traditional stock analysis, offering a glimpse into how traders are positioning themselves in anticipation of future volatility and price direction.

Options skew refers to the difference in implied volatility between out-of-the-money put and call options. A pronounced skew can indicate that investors are hedging against potential downside risks or, conversely, betting on significant upside potential. In the case of Tesla, the options skew post-earnings has shown some intriguing patterns that merit attention. Following the earnings announcement, there was a noticeable increase in the implied volatility of out-of-the-money put options compared to call options. This suggests that, despite the company’s robust earnings performance, there remains a degree of caution among investors regarding potential downside risks.

Several factors could be contributing to this cautious stance. Firstly, Tesla operates in a highly competitive and rapidly evolving industry. The electric vehicle market is witnessing an influx of new entrants, each vying for a share of the market that Tesla has long dominated. This increased competition could potentially impact Tesla’s market share and profitability, leading investors to hedge against possible adverse outcomes. Additionally, macroeconomic factors such as interest rate hikes and supply chain disruptions continue to pose challenges, further fueling the demand for protective puts.

Moreover, the options skew can also reflect broader market sentiment and investor psychology. The heightened demand for put options may not necessarily indicate a bearish outlook on Tesla specifically but could be symptomatic of a more cautious approach to equities in general. With global economic uncertainties and geopolitical tensions persisting, investors might be seeking to protect their portfolios against broader market downturns, using Tesla’s options as a proxy for such hedging strategies.

On the other hand, the relatively lower implied volatility of call options suggests that while there is caution, there is also a recognition of Tesla’s potential for continued growth. The company’s ongoing innovations, expansion into new markets, and leadership in battery technology and autonomous driving systems provide a solid foundation for future success. Investors who are optimistic about these prospects might be less inclined to pay a premium for call options, reflecting a belief that Tesla’s stock could appreciate steadily without the need for aggressive upside bets.

In conclusion, the insights gleaned from Tesla’s options skew post-earnings reveal a complex interplay of optimism and caution among investors. While there is an evident desire to hedge against potential risks, there is also an underlying confidence in Tesla’s ability to navigate challenges and capitalize on opportunities. As the company continues to innovate and expand, the options market will remain a valuable tool for assessing investor sentiment and anticipating future stock movements. By understanding these dynamics, investors can make more informed decisions, balancing the potential rewards of investing in Tesla with the inherent risks of a rapidly changing market landscape.

Q&A

1. **What is the current sentiment in the options market for Tesla stock post-earnings?**

– The options market sentiment for Tesla stock post-earnings is generally cautious, with a mix of bullish and bearish positions reflecting uncertainty about the stock’s near-term direction.

2. **How have Tesla’s recent earnings impacted its stock volatility?**

– Tesla’s recent earnings have led to increased implied volatility in the options market, indicating that traders expect larger price swings in the near future.

3. **What are the key support and resistance levels for Tesla stock according to options data?**

– Key support levels are often identified around significant open interest in put options, while resistance levels are marked by high open interest in call options. Specific levels can vary based on current market conditions.

4. **Are there any notable trends in call vs. put options for Tesla?**

– There is a notable trend of higher open interest in call options compared to put options, suggesting a slight bullish bias among traders, though this can change rapidly with market conditions.

5. **What strategies are options traders using for Tesla stock post-earnings?**

– Options traders are employing strategies such as straddles and strangles to capitalize on expected volatility, as well as covered calls and protective puts to hedge against potential downside.

6. **How do options traders view Tesla’s long-term growth prospects?**

– Long-term options, such as LEAPS, show a mix of optimism and caution, with some traders betting on Tesla’s continued growth and innovation, while others hedge against potential market or company-specific risks.

7. **What external factors are influencing Tesla’s options market outlook?**

– External factors include macroeconomic conditions, interest rates, regulatory changes, and developments in the electric vehicle industry, all of which can impact trader sentiment and options pricing for Tesla stock.

Conclusion

Tesla’s stock outlook post-earnings, as interpreted from options markets, suggests a mixed sentiment among investors. The options market often reflects investor expectations and potential volatility. Following earnings announcements, Tesla’s options may show increased implied volatility, indicating uncertainty or anticipated price swings. Bullish investors might be buying call options, betting on future price increases, while bearish investors might be purchasing puts, anticipating declines. The skew in options pricing can also reveal market sentiment, with a higher demand for puts suggesting caution. Overall, the options market provides a nuanced view of investor expectations, highlighting both optimism and caution regarding Tesla’s future stock performance.