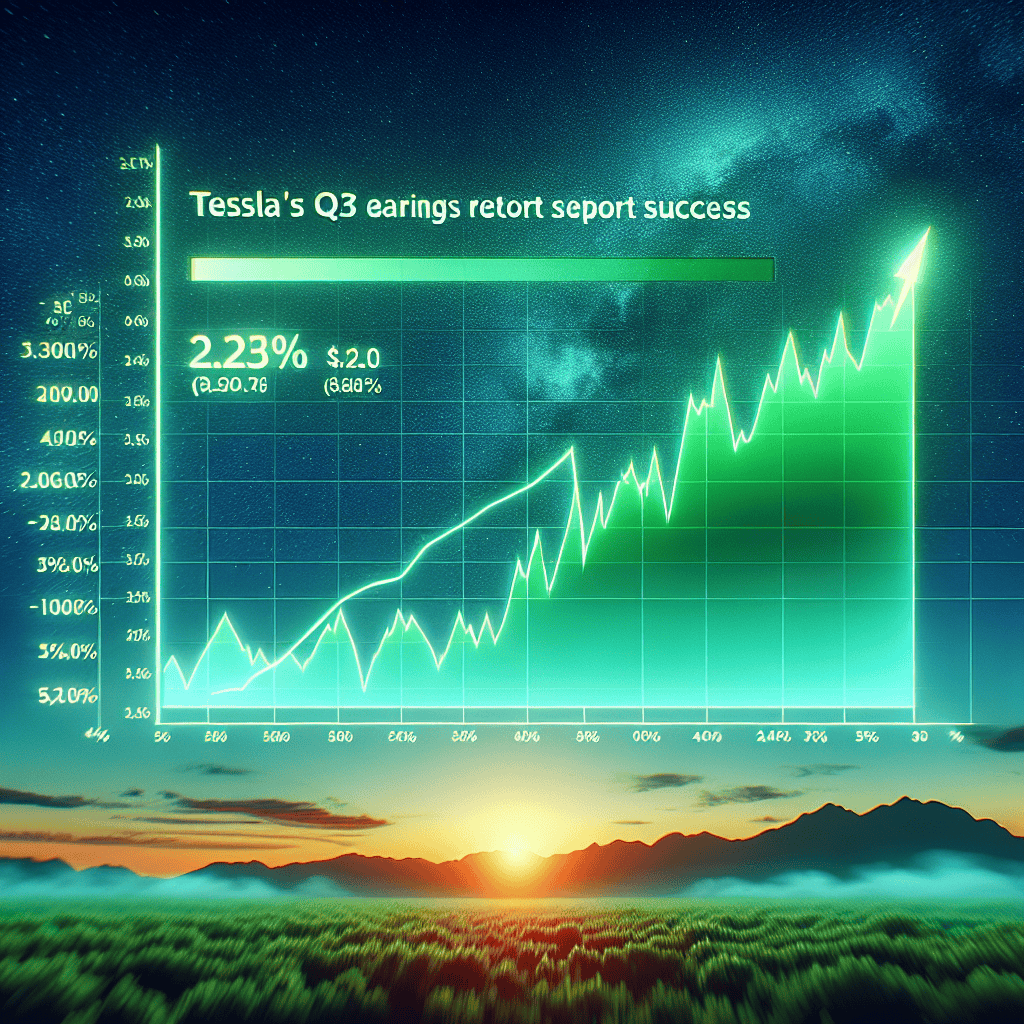

“Tesla’s Q3 Triumph: Driving Investor Confidence to New Heights!”

Introduction

Tesla shares experienced a significant surge following the release of its Q3 earnings report, which exceeded market expectations and garnered widespread approval from investors. The electric vehicle giant reported robust financial performance, highlighting increased revenue and improved profit margins, driven by strong vehicle deliveries and operational efficiencies. This positive financial outcome has reinforced investor confidence in Tesla’s growth trajectory and its ability to maintain a competitive edge in the rapidly evolving automotive industry. The market’s enthusiastic response underscores the company’s strategic advancements and its potential for sustained success in the future.

Tesla’s Q3 Earnings: Key Highlights Driving Share Surge

Tesla’s recent Q3 earnings report has sparked a significant surge in its share prices, capturing the attention of investors and analysts alike. The electric vehicle giant’s performance in the third quarter has exceeded market expectations, leading to a wave of optimism about its future prospects. This surge in Tesla’s shares can be attributed to several key highlights from the earnings report, which collectively paint a picture of robust growth and strategic advancements.

To begin with, Tesla reported a substantial increase in revenue, which reached $21.5 billion for the quarter, marking a 30% year-over-year growth. This impressive revenue growth was primarily driven by a record number of vehicle deliveries, which totaled 435,000 units. The company’s ability to ramp up production and meet the growing demand for electric vehicles has been a critical factor in its financial success. Moreover, Tesla’s expansion into new markets, particularly in Asia and Europe, has further bolstered its sales figures, contributing to the overall revenue increase.

In addition to revenue growth, Tesla’s profitability has also seen a notable improvement. The company reported a net income of $3.2 billion, representing a 40% increase compared to the same period last year. This rise in profitability can be attributed to several factors, including operational efficiencies and cost management strategies. Tesla’s focus on streamlining its production processes and reducing manufacturing costs has played a pivotal role in enhancing its profit margins. Furthermore, the company’s decision to diversify its revenue streams by investing in energy storage solutions and solar products has also contributed to its bottom line.

Another significant highlight from the Q3 earnings report is Tesla’s advancements in technology and innovation. The company has continued to invest heavily in research and development, with a particular emphasis on autonomous driving technology. Tesla’s Full Self-Driving (FSD) software has made considerable progress, with the latest updates receiving positive feedback from users. This technological edge not only sets Tesla apart from its competitors but also positions it as a leader in the future of transportation.

Moreover, Tesla’s commitment to sustainability and environmental responsibility has resonated well with investors. The company’s efforts to reduce its carbon footprint and promote renewable energy solutions align with the growing global emphasis on sustainability. Tesla’s Gigafactories, which are designed to produce batteries and electric vehicles with minimal environmental impact, exemplify this commitment. As a result, Tesla has garnered support from environmentally conscious investors who view the company as a catalyst for positive change in the automotive industry.

In light of these key highlights, it is no surprise that Tesla’s shares have experienced a surge following the Q3 earnings report. The company’s strong financial performance, coupled with its strategic focus on innovation and sustainability, has instilled confidence in investors about its long-term growth potential. As Tesla continues to expand its global footprint and push the boundaries of technology, it remains well-positioned to capitalize on the increasing demand for electric vehicles and renewable energy solutions.

In conclusion, Tesla’s Q3 earnings report has provided a comprehensive overview of the company’s achievements and future prospects. The surge in share prices reflects the market’s positive reception of these developments, underscoring the confidence investors have in Tesla’s ability to maintain its growth trajectory. As the company navigates the evolving landscape of the automotive industry, its commitment to innovation, sustainability, and operational excellence will undoubtedly play a crucial role in shaping its success.

Investor Reactions to Tesla’s Impressive Q3 Performance

Tesla’s recent Q3 earnings report has sparked a wave of enthusiasm among investors, leading to a significant surge in the company’s share price. The electric vehicle giant’s performance exceeded market expectations, showcasing robust growth and operational efficiency that have reassured stakeholders about its long-term prospects. As investors digest the details of the report, the positive sentiment is palpable, reflecting confidence in Tesla’s strategic direction and its ability to navigate the challenges of a competitive automotive landscape.

The earnings report revealed that Tesla achieved record revenues, driven by increased vehicle deliveries and a strong performance in its energy and services divisions. This impressive financial outcome was bolstered by the company’s ability to manage supply chain disruptions that have plagued the automotive industry globally. By securing critical components and optimizing production processes, Tesla has demonstrated resilience and adaptability, qualities that investors find particularly appealing in the current economic climate.

Moreover, Tesla’s focus on expanding its manufacturing capabilities has been a key factor in its success. The ramp-up of production at the Gigafactories in Berlin and Texas has not only increased output but also reduced costs, contributing to improved profit margins. This strategic expansion aligns with Tesla’s long-term vision of scaling operations to meet growing demand for electric vehicles worldwide. Investors are encouraged by these developments, viewing them as a testament to Tesla’s commitment to maintaining its leadership position in the EV market.

In addition to its manufacturing prowess, Tesla’s advancements in technology continue to capture investor interest. The company’s ongoing efforts in autonomous driving and battery innovation are seen as pivotal to its future growth. The Q3 report highlighted progress in these areas, with updates on the Full Self-Driving (FSD) software and the development of next-generation battery technologies. These innovations not only enhance Tesla’s product offerings but also position the company at the forefront of technological evolution in the automotive sector.

Furthermore, Tesla’s financial health remains robust, with a strong balance sheet and healthy cash flow. This financial stability provides the company with the flexibility to invest in research and development, pursue strategic acquisitions, and expand its global footprint. Investors are particularly reassured by Tesla’s prudent financial management, which mitigates risks and supports sustainable growth.

The market’s reaction to Tesla’s Q3 performance is also influenced by broader trends in the automotive industry. As the world increasingly shifts towards sustainable energy solutions, Tesla’s role as a pioneer in electric vehicles becomes more pronounced. The company’s commitment to environmental sustainability resonates with investors who prioritize ESG (Environmental, Social, and Governance) criteria in their investment decisions. This alignment with global sustainability goals further enhances Tesla’s appeal as a forward-thinking and responsible corporate entity.

In conclusion, Tesla’s Q3 earnings report has reinforced investor confidence, driving a surge in its share price. The company’s strong financial performance, strategic expansion, technological advancements, and commitment to sustainability have collectively contributed to this positive market sentiment. As Tesla continues to innovate and expand, investors remain optimistic about its ability to deliver long-term value and maintain its leadership in the rapidly evolving electric vehicle industry. The enthusiasm surrounding Tesla’s recent achievements underscores the market’s belief in its potential to shape the future of transportation and energy.

Analyzing Tesla’s Financial Growth in Q3 2023

Tesla’s financial performance in the third quarter of 2023 has captured the attention of investors and analysts alike, as the company’s shares experienced a significant surge following the release of its earnings report. This upward trajectory in Tesla’s stock price can be attributed to a combination of robust financial results, strategic initiatives, and market dynamics that have collectively bolstered investor confidence. As we delve into the details of Tesla’s Q3 earnings, it becomes evident that the company’s growth trajectory is underpinned by several key factors.

To begin with, Tesla reported a substantial increase in revenue for the third quarter, surpassing market expectations and demonstrating the company’s ability to scale its operations effectively. This revenue growth was primarily driven by a surge in vehicle deliveries, as Tesla continued to expand its production capabilities and meet the growing demand for electric vehicles. The company’s Gigafactories, strategically located across the globe, have played a pivotal role in enhancing production efficiency and reducing costs, thereby contributing to improved profit margins.

Moreover, Tesla’s focus on innovation and technological advancements has further solidified its position as a leader in the electric vehicle industry. The introduction of new models and enhancements to existing ones have not only attracted a broader customer base but have also reinforced Tesla’s brand as synonymous with cutting-edge technology and sustainability. This commitment to innovation is reflected in the company’s research and development investments, which have yielded significant advancements in battery technology and autonomous driving capabilities.

In addition to its core automotive business, Tesla’s energy division has also made noteworthy contributions to the company’s financial performance. The growing adoption of solar energy solutions and energy storage products has opened new revenue streams, diversifying Tesla’s portfolio and reducing its reliance on vehicle sales alone. This strategic diversification has positioned Tesla to capitalize on the increasing global emphasis on renewable energy and sustainability.

Furthermore, Tesla’s financial health is underscored by its strong balance sheet and prudent financial management. The company has successfully navigated supply chain challenges and inflationary pressures, maintaining a healthy cash flow and liquidity position. This financial resilience has enabled Tesla to invest in future growth opportunities, such as expanding its manufacturing footprint and exploring new markets.

The positive market reaction to Tesla’s Q3 earnings report is also indicative of broader investor sentiment towards the electric vehicle sector. As governments worldwide implement policies to combat climate change and promote sustainable transportation, the demand for electric vehicles is expected to continue its upward trajectory. Tesla, with its established brand and technological prowess, is well-positioned to benefit from this shift in consumer preferences and regulatory landscapes.

In conclusion, Tesla’s impressive financial performance in the third quarter of 2023 has reinforced its status as a formidable player in the automotive and energy sectors. The company’s ability to deliver strong revenue growth, driven by increased vehicle deliveries and strategic diversification, has instilled confidence among investors. As Tesla continues to innovate and expand its global presence, it remains poised to capitalize on the evolving dynamics of the electric vehicle market. Consequently, the surge in Tesla’s shares following the Q3 earnings report reflects not only the company’s current achievements but also its potential for sustained growth in the future.

Market Impact: Tesla’s Q3 Earnings and Share Price Surge

Tesla’s recent third-quarter earnings report has sent ripples through the financial markets, as the electric vehicle giant’s shares experienced a significant surge. This upward trajectory in Tesla’s stock price can be attributed to a combination of robust financial performance, strategic advancements, and investor optimism. As the company continues to solidify its position as a leader in the electric vehicle industry, the latest earnings report has provided a fresh impetus for investors to rally behind Tesla.

To begin with, Tesla’s Q3 earnings exceeded market expectations, showcasing a remarkable increase in both revenue and net income. The company reported a substantial rise in vehicle deliveries, which played a pivotal role in driving revenue growth. This achievement is particularly noteworthy given the ongoing challenges in the global supply chain, which have affected many automakers. Tesla’s ability to navigate these obstacles and deliver a strong performance underscores its operational resilience and strategic foresight.

Moreover, the earnings report highlighted Tesla’s progress in expanding its production capacity. The company’s Gigafactories in Berlin and Texas are ramping up operations, promising to enhance production efficiency and meet the growing demand for electric vehicles. This expansion is crucial for Tesla’s long-term growth strategy, as it aims to increase its market share in both established and emerging markets. Investors have responded positively to these developments, viewing them as indicators of Tesla’s commitment to scaling its operations and maintaining its competitive edge.

In addition to production advancements, Tesla’s focus on innovation continues to captivate investors. The company’s ongoing efforts in developing autonomous driving technology and energy solutions have positioned it at the forefront of technological advancements in the automotive industry. The Q3 earnings report provided updates on Tesla’s progress in these areas, further fueling investor confidence. As the world increasingly shifts towards sustainable energy solutions, Tesla’s innovations are seen as pivotal in shaping the future of transportation and energy consumption.

Furthermore, Tesla’s financial health remains robust, with a strong balance sheet and healthy cash flow. The company’s ability to generate substantial cash from operations provides it with the flexibility to invest in research and development, expand its infrastructure, and explore new business opportunities. This financial stability is a key factor that reassures investors about Tesla’s capacity to weather economic uncertainties and continue its growth trajectory.

The market’s reaction to Tesla’s Q3 earnings report is also reflective of broader investor sentiment towards the electric vehicle sector. As governments worldwide implement stricter emissions regulations and promote green energy initiatives, the demand for electric vehicles is expected to rise significantly. Tesla, with its established brand and innovative offerings, is well-positioned to capitalize on this trend. Consequently, investors are increasingly viewing Tesla as a long-term investment opportunity, further driving up its share price.

In conclusion, Tesla’s Q3 earnings report has had a profound impact on its share price, as investors applaud the company’s strong financial performance, strategic advancements, and innovative pursuits. The surge in Tesla’s stock is not only a testament to its current achievements but also a reflection of the market’s confidence in its future potential. As Tesla continues to navigate the evolving landscape of the automotive industry, its ability to deliver on its promises will be crucial in sustaining investor enthusiasm and maintaining its upward momentum in the stock market.

Tesla’s Strategic Moves Behind Q3 Success

Tesla’s recent Q3 earnings report has sent ripples through the financial markets, as the company’s shares surged in response to the impressive figures. This upward trajectory in Tesla’s stock price can be attributed to a series of strategic moves that have not only bolstered its financial performance but also reinforced investor confidence in the company’s long-term vision. As we delve into the factors contributing to Tesla’s Q3 success, it becomes evident that a combination of innovative product development, strategic market expansion, and operational efficiency has played a pivotal role.

To begin with, Tesla’s commitment to innovation remains at the core of its success. The company has consistently pushed the boundaries of electric vehicle technology, and this quarter was no exception. The introduction of new models and enhancements to existing ones has kept consumer interest piqued. For instance, the rollout of the updated Model S and Model X, featuring improved range and performance, has been met with enthusiasm from both consumers and critics alike. This continuous innovation not only attracts new customers but also strengthens brand loyalty among existing ones, thereby driving sales and revenue growth.

In addition to product innovation, Tesla’s strategic market expansion has been instrumental in its Q3 achievements. The company has made significant inroads into international markets, particularly in regions where the demand for electric vehicles is on the rise. By establishing manufacturing facilities in key locations such as China and Germany, Tesla has been able to reduce production costs and mitigate supply chain disruptions. This localized production approach not only enhances operational efficiency but also allows Tesla to cater to regional preferences and regulatory requirements more effectively. Consequently, the company’s global footprint has expanded, contributing to a robust increase in sales volume.

Moreover, Tesla’s focus on operational efficiency has yielded substantial benefits. The company has implemented cost-cutting measures and optimized its production processes, resulting in improved profit margins. By leveraging economies of scale and streamlining its supply chain, Tesla has been able to reduce production costs while maintaining high-quality standards. This operational prowess has not only enhanced profitability but also provided the company with a competitive edge in the increasingly crowded electric vehicle market.

Furthermore, Tesla’s strategic investments in energy solutions have also contributed to its Q3 success. The company’s energy division, which includes solar products and energy storage solutions, has shown promising growth. As the world shifts towards renewable energy sources, Tesla’s diversified portfolio positions it well to capitalize on this trend. The integration of energy solutions with its automotive offerings creates a comprehensive ecosystem that appeals to environmentally conscious consumers and businesses alike.

In conclusion, Tesla’s Q3 earnings report reflects the successful execution of a multifaceted strategy that encompasses innovation, market expansion, operational efficiency, and diversification. These strategic moves have not only driven financial performance but also reinforced investor confidence in Tesla’s ability to navigate the challenges of the evolving automotive landscape. As the company continues to innovate and expand its global presence, it remains well-positioned to sustain its growth trajectory and maintain its leadership in the electric vehicle industry. The surge in Tesla’s shares following the Q3 earnings announcement is a testament to the market’s recognition of these strategic achievements and the promising future that lies ahead for the company.

Future Outlook: Tesla’s Growth Trajectory Post-Q3 Earnings

Tesla’s recent Q3 earnings report has sparked a significant surge in its share prices, capturing the attention of investors and analysts alike. The electric vehicle giant’s performance in the third quarter exceeded market expectations, showcasing robust growth and operational efficiency. This positive financial outcome has not only bolstered investor confidence but also set the stage for Tesla’s future growth trajectory. As the company continues to expand its global footprint, the implications of this earnings report extend beyond immediate financial gains, offering insights into Tesla’s strategic direction and long-term potential.

The Q3 earnings report revealed a substantial increase in revenue, driven by a combination of higher vehicle deliveries and improved production capabilities. Tesla’s ability to scale its operations efficiently has been a critical factor in achieving these results. The company’s focus on optimizing its supply chain and manufacturing processes has enabled it to meet the growing demand for electric vehicles, even amidst global supply chain disruptions. This operational resilience underscores Tesla’s commitment to maintaining its competitive edge in the rapidly evolving automotive industry.

Moreover, Tesla’s advancements in battery technology and energy solutions have played a pivotal role in its recent success. The company’s investment in research and development has yielded significant innovations, enhancing the performance and range of its vehicles. These technological breakthroughs not only strengthen Tesla’s product offerings but also position the company as a leader in the transition to sustainable energy. As the world increasingly shifts towards renewable energy sources, Tesla’s strategic investments in this area are likely to yield substantial returns in the coming years.

In addition to its core automotive business, Tesla’s expansion into new markets and product lines further augments its growth prospects. The company’s foray into energy storage solutions and solar products has opened up new revenue streams, diversifying its business model. This diversification strategy not only mitigates risks associated with the automotive sector but also aligns with global trends towards energy sustainability. As governments worldwide implement policies to combat climate change, Tesla’s comprehensive approach to clean energy solutions positions it favorably to capitalize on these regulatory shifts.

Furthermore, Tesla’s global expansion efforts have been instrumental in driving its recent success. The establishment of Gigafactories in strategic locations around the world has enabled the company to increase production capacity and reduce logistical costs. These facilities not only support Tesla’s ambitious production targets but also facilitate its entry into emerging markets. By localizing production, Tesla can better serve regional markets, tailoring its offerings to meet specific consumer preferences and regulatory requirements.

Looking ahead, Tesla’s growth trajectory appears promising, supported by a combination of strategic initiatives and favorable market conditions. The company’s commitment to innovation, coupled with its expanding global presence, positions it well to capture a significant share of the growing electric vehicle market. However, challenges remain, including intensifying competition and potential regulatory hurdles. To sustain its momentum, Tesla must continue to innovate and adapt to the dynamic landscape of the automotive industry.

In conclusion, Tesla’s impressive Q3 earnings report has not only driven a surge in its share prices but also highlighted the company’s potential for sustained growth. As Tesla navigates the complexities of the global market, its strategic focus on innovation, diversification, and expansion will be crucial in shaping its future trajectory. Investors and stakeholders will undoubtedly be watching closely as Tesla continues to redefine the boundaries of the automotive and energy sectors.

Comparing Tesla’s Q3 Results with Industry Peers

Tesla’s recent Q3 earnings report has sent ripples through the financial markets, with its shares experiencing a significant surge. This positive momentum is largely attributed to the company’s impressive performance, which has outpaced many of its industry peers. As investors and analysts delve into the details of Tesla’s financial results, it becomes evident that the electric vehicle (EV) giant continues to set benchmarks in an increasingly competitive market.

To begin with, Tesla’s revenue growth in the third quarter has been nothing short of remarkable. The company reported a substantial increase in revenue, driven by robust sales of its Model 3 and Model Y vehicles. This growth is particularly noteworthy when compared to traditional automakers, many of whom are grappling with supply chain disruptions and fluctuating demand. While companies like Ford and General Motors have reported mixed results, Tesla’s ability to navigate these challenges and maintain a steady production output has been a key differentiator.

Moreover, Tesla’s profitability has also been a focal point for investors. The company has consistently improved its margins, thanks in part to its focus on cost efficiencies and economies of scale. In contrast, several of its competitors are still struggling to achieve similar levels of profitability, as they invest heavily in transitioning from internal combustion engines to electric powertrains. This strategic advantage has allowed Tesla to reinvest in research and development, further solidifying its position as a leader in innovation within the EV sector.

In addition to financial metrics, Tesla’s advancements in technology and infrastructure have also set it apart from its peers. The company’s investment in its Supercharger network and battery technology continues to pay dividends, providing Tesla with a competitive edge in terms of range and charging convenience. While other automakers are making strides in these areas, Tesla’s head start and ongoing commitment to enhancing its technology infrastructure remain significant advantages.

Furthermore, Tesla’s global expansion strategy has been a critical component of its success. The company’s Gigafactories in Shanghai and Berlin have played pivotal roles in meeting international demand and reducing production costs. This global footprint not only supports Tesla’s growth ambitions but also positions it favorably against competitors who are still in the early stages of establishing a similar presence. As a result, Tesla’s ability to scale its operations efficiently has been a key factor in its outperformance relative to industry peers.

However, it is important to acknowledge that the EV market is becoming increasingly crowded, with both established automakers and new entrants vying for market share. Companies like Rivian and Lucid Motors are making headlines with their innovative offerings, while traditional manufacturers are ramping up their EV portfolios. Despite this intensifying competition, Tesla’s strong brand recognition and loyal customer base provide it with a formidable advantage.

In conclusion, Tesla’s Q3 earnings report has reinforced its status as a leader in the electric vehicle industry. By consistently outperforming its peers in terms of revenue growth, profitability, technological advancements, and global expansion, Tesla has demonstrated its ability to thrive in a rapidly evolving market. As the company continues to innovate and expand its reach, it remains well-positioned to capitalize on the growing demand for sustainable transportation solutions. Investors, therefore, have ample reason to applaud Tesla’s achievements, as the company continues to set the pace for the future of mobility.

Q&A

1. **What caused Tesla shares to surge recently?**

Tesla shares surged due to a positive reaction from investors following the release of the company’s Q3 earnings report.

2. **How did Tesla perform financially in Q3?**

Tesla reported strong financial performance in Q3, exceeding market expectations in terms of revenue and profit.

3. **What were the key highlights of Tesla’s Q3 earnings report?**

Key highlights included record vehicle deliveries, increased revenue, and improved profit margins.

4. **How did Tesla’s vehicle deliveries impact investor sentiment?**

Record vehicle deliveries demonstrated strong demand and operational efficiency, boosting investor confidence.

5. **What role did Tesla’s profit margins play in the share surge?**

Improved profit margins indicated better cost management and operational efficiency, positively influencing investor sentiment.

6. **Did Tesla provide any future guidance in the Q3 report?**

Yes, Tesla provided optimistic future guidance, projecting continued growth and expansion in production capacity.

7. **How did analysts react to Tesla’s Q3 earnings report?**

Analysts generally reacted positively, with many raising their price targets and maintaining or upgrading their ratings on Tesla stock.

Conclusion

Tesla’s shares experienced a significant surge following the release of its Q3 earnings report, which exceeded market expectations and demonstrated robust financial performance. The company’s strong revenue growth, driven by increased vehicle deliveries and improved operational efficiencies, reassured investors about its long-term growth trajectory. Additionally, Tesla’s advancements in battery technology and expansion into new markets further bolstered investor confidence. As a result, the positive market reaction underscores the company’s solid position in the electric vehicle industry and its potential for continued success.