“Tesla Shares Tumble: Anticipation Builds Ahead of Earnings Reveal”

Introduction

Tesla shares experienced a notable decline ahead of the company’s upcoming earnings report, reflecting investor caution and market volatility. This downturn comes as analysts and stakeholders eagerly anticipate Tesla’s financial performance and strategic outlook, particularly in light of recent economic challenges and competitive pressures in the electric vehicle sector. The dip in share price underscores the heightened scrutiny on Tesla’s ability to sustain its growth trajectory, manage production costs, and navigate supply chain disruptions. As the earnings report looms, market participants remain focused on key metrics such as delivery numbers, profit margins, and future guidance, which will provide critical insights into Tesla’s operational resilience and long-term prospects.

Impact Of Market Speculation On Tesla’s Share Price

Tesla shares have recently experienced a decline, a development that has captured the attention of investors and market analysts alike. This downturn in share price comes at a critical juncture, as the company is poised to release its earnings report. The anticipation surrounding this report has fueled market speculation, which in turn has had a tangible impact on Tesla’s stock performance. Understanding the dynamics at play requires a closer examination of how market speculation can influence investor behavior and, consequently, share prices.

Market speculation is a powerful force in the financial world, often driven by investor sentiment, media reports, and analyst predictions. In the case of Tesla, a company that has consistently been in the spotlight due to its innovative approach to the automotive industry and its charismatic CEO, Elon Musk, speculation can be particularly intense. As the earnings report looms, investors are keenly focused on potential indicators of the company’s financial health, such as production numbers, profit margins, and future guidance. This heightened scrutiny can lead to increased volatility in the stock market, as investors react to both confirmed information and rumors.

The decline in Tesla’s share price ahead of the earnings report can be attributed to several factors. Firstly, there is the inherent uncertainty that accompanies any earnings announcement. Investors are often wary of potential surprises, whether positive or negative, that could significantly alter the company’s valuation. In Tesla’s case, the stakes are particularly high given its ambitious growth targets and the competitive pressures it faces in the electric vehicle market. As a result, even minor deviations from expected performance metrics can trigger substantial market reactions.

Moreover, external factors also play a role in shaping market speculation. For instance, macroeconomic conditions, such as interest rate fluctuations and geopolitical tensions, can influence investor confidence and risk appetite. In recent months, concerns about inflation and global supply chain disruptions have added an additional layer of complexity to the investment landscape. These broader economic trends can exacerbate the impact of speculation on Tesla’s share price, as investors weigh the potential implications for the company’s operations and profitability.

In addition to these external influences, internal company developments can also contribute to market speculation. Tesla’s strategic decisions, such as its expansion into new markets or its investments in emerging technologies, are closely monitored by investors. Any announcements or leaks related to these initiatives can lead to rapid shifts in market sentiment. For example, news of a delay in the production of a new vehicle model or a change in leadership could prompt investors to reassess their expectations for the company’s future performance.

As the earnings report approaches, it is crucial for investors to maintain a balanced perspective. While market speculation can provide valuable insights into potential risks and opportunities, it is important to distinguish between substantiated information and mere conjecture. By focusing on the underlying fundamentals of the company and its long-term strategic vision, investors can make more informed decisions that are less susceptible to the whims of market speculation.

In conclusion, the decline in Tesla’s share price ahead of its earnings report underscores the significant impact that market speculation can have on investor behavior. As various factors converge to shape market sentiment, it is essential for investors to navigate this complex landscape with a discerning eye. By doing so, they can better position themselves to capitalize on the opportunities that arise in the ever-evolving world of financial markets.

Analyzing Tesla’s Financial Performance Trends

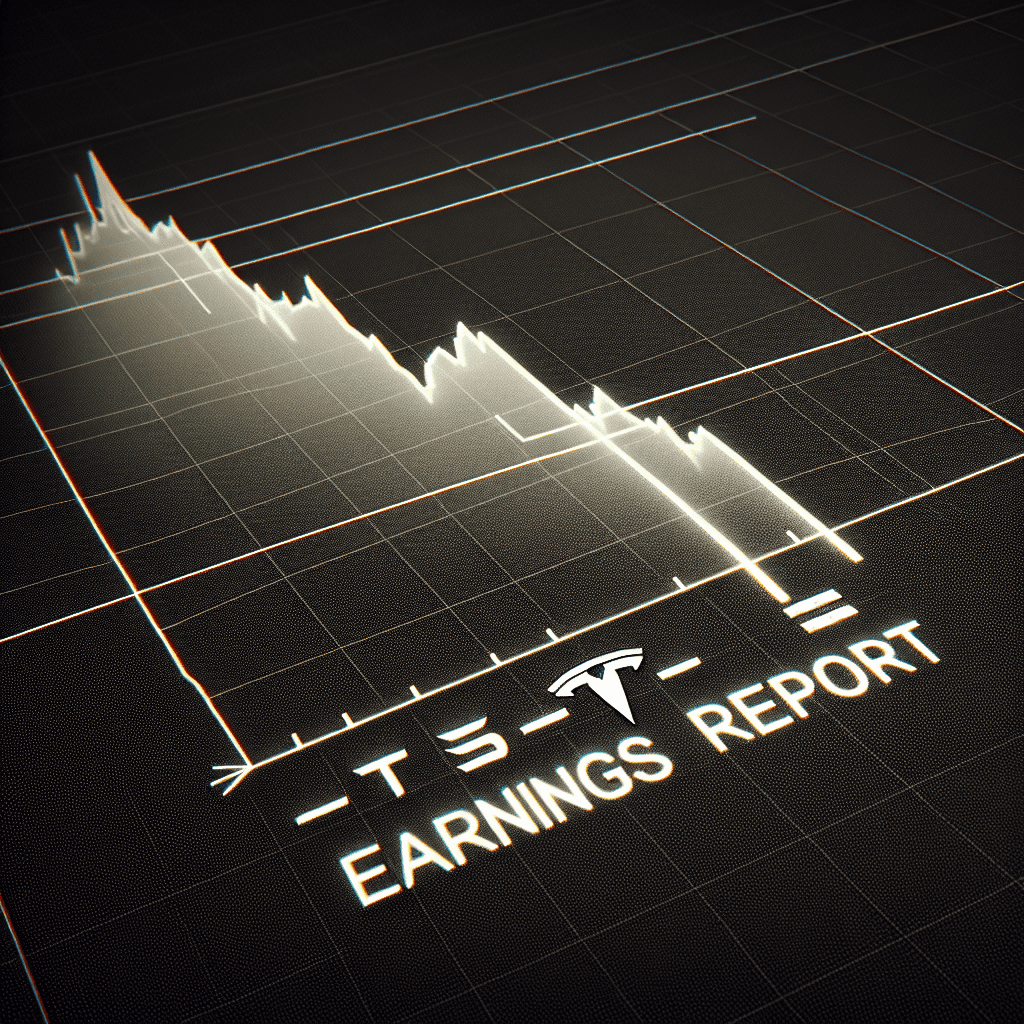

Tesla shares have recently experienced a decline, capturing the attention of investors and analysts alike as the company approaches its upcoming earnings report. This development has sparked discussions about the potential implications for Tesla’s financial performance and the broader electric vehicle market. To understand the current situation, it is essential to examine the trends that have characterized Tesla’s financial performance in recent years, as well as the factors that may be influencing investor sentiment.

Over the past decade, Tesla has emerged as a dominant force in the electric vehicle industry, consistently pushing the boundaries of innovation and sustainability. The company’s growth trajectory has been marked by impressive milestones, including the expansion of its production capabilities and the introduction of new models. However, despite these achievements, Tesla’s financial performance has not been without its challenges. Fluctuations in production costs, supply chain disruptions, and regulatory hurdles have all played a role in shaping the company’s financial landscape.

In recent quarters, Tesla has reported mixed financial results, with some metrics showing strength while others have raised concerns. For instance, the company has consistently demonstrated robust revenue growth, driven by increased vehicle deliveries and the expansion of its energy and services segments. Nevertheless, profitability has remained a point of contention, as Tesla continues to invest heavily in research and development, infrastructure, and global expansion. These investments, while crucial for long-term growth, have occasionally weighed on the company’s bottom line.

As Tesla prepares to release its latest earnings report, several factors are contributing to the current decline in its share price. One significant concern is the broader economic environment, which has been characterized by rising interest rates and inflationary pressures. These macroeconomic factors have led to increased scrutiny of high-growth companies like Tesla, as investors reassess their risk tolerance and seek more stable investment opportunities. Additionally, the competitive landscape in the electric vehicle market is evolving rapidly, with traditional automakers and new entrants alike vying for market share. This intensifying competition has raised questions about Tesla’s ability to maintain its leadership position and sustain its growth momentum.

Moreover, recent developments in Tesla’s operational strategy have also influenced investor sentiment. The company’s decision to cut prices on certain models, while aimed at boosting demand, has sparked concerns about potential margin compression. Furthermore, Tesla’s ongoing efforts to ramp up production at its new facilities in Texas and Germany have been met with both optimism and skepticism, as the success of these ventures will be critical to meeting future demand and achieving economies of scale.

In light of these factors, the upcoming earnings report will be closely scrutinized for insights into Tesla’s financial health and strategic direction. Investors will be particularly interested in key performance indicators such as vehicle delivery numbers, gross margins, and guidance for future quarters. Additionally, any commentary from Tesla’s leadership regarding supply chain challenges, competitive dynamics, and regulatory developments will be of great interest.

In conclusion, the recent decline in Tesla shares ahead of its earnings report underscores the complex interplay of factors influencing the company’s financial performance. While Tesla’s long-term growth prospects remain compelling, the current environment presents both challenges and opportunities. As the company navigates these dynamics, its ability to adapt and innovate will be crucial in maintaining investor confidence and sustaining its position as a leader in the electric vehicle industry.

Investor Sentiment And Its Effect On Tesla Stock

Tesla shares have recently experienced a decline, a development that has captured the attention of investors and market analysts alike. This downturn in stock value comes at a critical juncture, as the company is poised to release its latest earnings report. The anticipation surrounding this report has undoubtedly contributed to the current investor sentiment, which appears to be characterized by a mix of caution and uncertainty. Understanding the factors influencing this sentiment is crucial for comprehending the broader implications for Tesla’s stock performance.

To begin with, investor sentiment is often shaped by a combination of market expectations and external economic conditions. In the case of Tesla, the company’s stock has historically been subject to significant volatility, driven by its innovative business model and ambitious growth targets. As a leader in the electric vehicle industry, Tesla’s performance is closely watched, and any deviation from expected outcomes can lead to swift market reactions. The upcoming earnings report is expected to provide insights into the company’s financial health, production capabilities, and future outlook, all of which are key determinants of investor confidence.

Moreover, the broader economic environment plays a pivotal role in shaping investor sentiment. Recent fluctuations in global markets, driven by factors such as inflationary pressures and geopolitical tensions, have contributed to a more cautious approach among investors. These macroeconomic conditions can exacerbate concerns about Tesla’s ability to maintain its growth trajectory, particularly in light of potential supply chain disruptions and increased competition in the electric vehicle sector. As a result, investors may be adopting a more conservative stance, leading to the observed decline in Tesla’s share price.

In addition to these external factors, internal company dynamics also influence investor sentiment. Tesla’s leadership, spearheaded by CEO Elon Musk, has been a significant driver of the company’s success. However, Musk’s unconventional management style and frequent public statements can sometimes lead to uncertainty among investors. Any perceived missteps or controversial decisions can have a pronounced impact on the stock’s performance. As the earnings report approaches, investors are likely scrutinizing Tesla’s strategic decisions, such as its expansion plans and technological advancements, to assess their potential impact on future profitability.

Furthermore, the anticipation of the earnings report itself can create a self-reinforcing cycle of investor sentiment. As market participants speculate on the potential outcomes, their actions can influence stock prices, which in turn affect sentiment. This phenomenon, often referred to as “buy the rumor, sell the news,” can lead to increased volatility in the lead-up to the report’s release. Investors may choose to adjust their positions based on their expectations, contributing to the observed fluctuations in Tesla’s share price.

In conclusion, the decline in Tesla shares ahead of the earnings report is a multifaceted issue, driven by a combination of market expectations, economic conditions, and company-specific factors. Investor sentiment, shaped by these elements, plays a crucial role in determining the stock’s performance. As the earnings report is unveiled, it will provide valuable insights into Tesla’s current standing and future prospects, potentially influencing investor sentiment and, consequently, the company’s stock price. Understanding these dynamics is essential for investors seeking to navigate the complexities of the market and make informed decisions regarding their investments in Tesla.

Comparing Tesla’s Valuation With Industry Peers

Tesla’s shares have recently experienced a decline, prompting investors and analysts to scrutinize the company’s valuation in comparison to its industry peers. As the electric vehicle (EV) market continues to evolve, understanding Tesla’s position relative to other automakers is crucial for stakeholders. This analysis not only provides insight into Tesla’s current market standing but also sheds light on broader industry trends.

To begin with, Tesla’s valuation has long been a topic of debate among investors. The company’s market capitalization has often surpassed that of traditional automotive giants, despite producing a fraction of the vehicles. This discrepancy is largely attributed to Tesla’s perceived potential for growth and innovation in the EV sector. However, as the company prepares to release its earnings report, the recent decline in share price suggests that investors are reassessing these expectations.

In comparison to its industry peers, Tesla’s valuation metrics, such as price-to-earnings (P/E) ratio, have historically been significantly higher. This is indicative of the market’s optimism about Tesla’s future earnings potential. However, as other automakers, such as General Motors, Ford, and Volkswagen, ramp up their EV production and introduce competitive models, the landscape is becoming increasingly crowded. These traditional manufacturers bring decades of experience in mass production and supply chain management, which could pose a challenge to Tesla’s market dominance.

Moreover, the competitive pressure is not limited to established automakers. New entrants, such as Rivian and Lucid Motors, are also vying for a share of the EV market. These companies, backed by substantial investments, are focusing on niche segments and innovative technologies, further intensifying the competition. As a result, Tesla’s ability to maintain its valuation premium is being tested.

In addition to competitive dynamics, regulatory factors are also influencing Tesla’s valuation. Governments worldwide are implementing stricter emissions standards and offering incentives for EV adoption. While this is generally favorable for Tesla, it also benefits its competitors, who are accelerating their transition to electric vehicles. Consequently, Tesla must continue to innovate and expand its product offerings to stay ahead.

Furthermore, Tesla’s valuation is closely tied to its technological advancements, particularly in battery technology and autonomous driving. The company’s progress in these areas has been a key driver of investor confidence. However, as other companies make strides in similar technologies, Tesla’s lead may narrow. For instance, partnerships between automakers and tech firms are becoming more common, potentially accelerating the development of autonomous vehicles.

Despite these challenges, Tesla’s brand strength and loyal customer base remain significant assets. The company’s ability to capture consumer interest and maintain high demand for its vehicles is a testament to its market appeal. Nevertheless, as the EV market matures, sustaining this level of enthusiasm will require continuous innovation and strategic positioning.

In conclusion, while Tesla’s shares have declined ahead of its earnings report, the company’s valuation relative to its industry peers remains a focal point for investors. The evolving competitive landscape, regulatory environment, and technological advancements all play a role in shaping Tesla’s market position. As the company navigates these challenges, its ability to adapt and innovate will be crucial in determining its future valuation and market leadership.

The Role Of Macroeconomic Factors In Tesla’s Stock Movement

Tesla, a leading name in the electric vehicle industry, has often been at the forefront of discussions regarding stock market performance. Recently, Tesla shares have experienced a decline ahead of its anticipated earnings report, prompting investors and analysts to examine the macroeconomic factors influencing this movement. Understanding these factors is crucial for comprehending the broader context of Tesla’s stock fluctuations.

To begin with, the global economic environment plays a significant role in shaping investor sentiment and, consequently, stock prices. Inflation rates, for instance, have been a persistent concern for economies worldwide. Rising inflation can lead to increased production costs for companies like Tesla, which rely heavily on raw materials such as lithium and cobalt for battery production. As these costs rise, profit margins may be squeezed, leading to apprehension among investors about future earnings potential.

Moreover, interest rates are another critical macroeconomic factor affecting Tesla’s stock movement. Central banks, in response to inflationary pressures, may raise interest rates to curb spending and borrowing. Higher interest rates can increase the cost of financing for both consumers and businesses. For Tesla, this could mean higher costs for expanding production facilities or developing new technologies. Additionally, consumers may find it more expensive to finance vehicle purchases, potentially dampening demand for Tesla’s products.

In addition to inflation and interest rates, currency fluctuations can also impact Tesla’s stock performance. As a global company, Tesla operates in multiple markets, and its revenues are subject to exchange rate variations. A stronger U.S. dollar, for example, can make Tesla’s vehicles more expensive in foreign markets, potentially reducing sales and affecting the company’s bottom line. Consequently, investors may react to these currency movements by adjusting their expectations for Tesla’s future earnings.

Furthermore, geopolitical tensions and trade policies can have far-reaching effects on Tesla’s operations and stock price. Trade disputes or tariffs can disrupt supply chains and increase costs for imported components. For a company like Tesla, which sources parts from various countries, such disruptions can lead to production delays and increased expenses. Investors, wary of these potential challenges, may become more cautious, contributing to stock price volatility.

Transitioning to the energy sector, fluctuations in oil prices can also influence Tesla’s stock movement. While higher oil prices generally make electric vehicles more attractive to consumers, they can also lead to increased costs for manufacturing and transportation. Conversely, lower oil prices might reduce the immediate economic incentive for consumers to switch to electric vehicles, potentially impacting Tesla’s sales growth.

Lastly, the broader stock market trends and investor behavior cannot be overlooked. During periods of market uncertainty or volatility, investors may adopt a risk-averse approach, leading to sell-offs in high-growth stocks like Tesla. This behavior can be exacerbated by algorithmic trading and market speculation, which can amplify stock price movements.

In conclusion, the decline in Tesla shares ahead of its earnings report can be attributed to a complex interplay of macroeconomic factors. Inflation, interest rates, currency fluctuations, geopolitical tensions, oil prices, and overall market sentiment all contribute to shaping investor perceptions and decisions. As these factors continue to evolve, they will undoubtedly play a pivotal role in determining Tesla’s stock trajectory in the future. Understanding these dynamics is essential for investors seeking to navigate the complexities of the stock market and make informed decisions regarding their investments in Tesla.

How Tesla’s Earnings Report Could Influence Future Stock Prices

Tesla’s shares have recently experienced a decline, a development that has captured the attention of investors and market analysts alike. This downturn comes at a critical juncture, as the company is poised to release its latest earnings report. The anticipation surrounding this report is palpable, given Tesla’s influential position in the automotive and technology sectors. Understanding how this earnings report could influence future stock prices requires a comprehensive analysis of several key factors.

To begin with, Tesla’s earnings report will provide crucial insights into the company’s financial health, including revenue growth, profit margins, and cash flow. These metrics are vital for investors who are keen to assess the company’s operational efficiency and its ability to generate sustainable profits. A strong earnings report, characterized by robust revenue growth and healthy profit margins, could potentially reverse the recent decline in Tesla’s share price. Conversely, if the report reveals weaker-than-expected financial performance, it could exacerbate the downward trend, leading to further declines in stock prices.

Moreover, Tesla’s earnings report will likely shed light on the company’s production capabilities and delivery numbers. Given the global supply chain disruptions and semiconductor shortages that have plagued the automotive industry, investors are particularly interested in how Tesla has navigated these challenges. A positive report on production and delivery could bolster investor confidence, suggesting that Tesla is well-positioned to meet demand and expand its market share. On the other hand, any indication of production bottlenecks or delivery shortfalls could raise concerns about Tesla’s ability to maintain its competitive edge, potentially impacting its stock valuation.

In addition to financial and operational metrics, Tesla’s earnings report will also be scrutinized for updates on its strategic initiatives and future growth prospects. The company’s ventures into energy storage, solar products, and autonomous driving technology are areas of significant interest. Investors will be eager to learn about any advancements or setbacks in these domains, as they represent potential revenue streams that could drive Tesla’s long-term growth. Positive developments in these areas could enhance investor sentiment and lead to an upward revision of Tesla’s stock price targets. Conversely, any delays or challenges could dampen enthusiasm and contribute to a more cautious outlook.

Furthermore, the broader economic environment and market conditions will play a crucial role in shaping the impact of Tesla’s earnings report on its stock prices. Factors such as interest rates, inflation, and consumer spending patterns can influence investor behavior and market dynamics. For instance, a favorable economic backdrop with low interest rates and strong consumer demand could amplify the positive effects of a strong earnings report. Conversely, a challenging economic environment could mitigate the impact of positive earnings, as investors may remain cautious about the broader market outlook.

In conclusion, Tesla’s upcoming earnings report is poised to be a significant event with the potential to influence the company’s future stock prices. By providing insights into financial performance, production capabilities, strategic initiatives, and market conditions, the report will offer valuable information for investors seeking to make informed decisions. As such, the anticipation surrounding this report underscores its importance in shaping the trajectory of Tesla’s stock in the coming months. Investors and analysts will be closely monitoring the outcomes, as they seek to navigate the complexities of the ever-evolving automotive and technology landscapes.

Strategies For Investors During Tesla’s Earnings Season

As Tesla’s earnings season approaches, investors are keenly observing the fluctuations in the company’s stock price, which has recently experienced a decline. This period of anticipation and uncertainty presents both challenges and opportunities for investors looking to navigate the volatile landscape of Tesla shares. Understanding the dynamics at play and employing strategic approaches can help investors make informed decisions during this critical time.

To begin with, it is essential to recognize the factors contributing to the recent decline in Tesla’s share price. Market sentiment often plays a significant role in stock price movements, and in the case of Tesla, investor expectations surrounding the upcoming earnings report are a primary driver. Speculation about the company’s performance, potential supply chain disruptions, and broader economic conditions can all influence investor behavior. Consequently, it is crucial for investors to remain informed about these variables and consider how they might impact Tesla’s financial results.

In light of these considerations, one effective strategy for investors is to adopt a long-term perspective. While short-term fluctuations in stock prices can be unsettling, focusing on Tesla’s overall growth trajectory and future potential can provide a more stable foundation for investment decisions. Tesla’s commitment to innovation, expansion into new markets, and advancements in electric vehicle technology are factors that could contribute to sustained growth over time. By maintaining a long-term outlook, investors can better weather the temporary volatility that often accompanies earnings seasons.

Moreover, diversification remains a key strategy for mitigating risk during periods of uncertainty. By spreading investments across a range of assets, investors can reduce their exposure to the specific risks associated with Tesla’s earnings report. This approach not only helps to balance potential losses but also allows investors to capitalize on opportunities in other sectors that may be performing well. Diversification, therefore, serves as a prudent measure to safeguard one’s portfolio against the inherent unpredictability of the stock market.

In addition to diversification, staying informed about Tesla’s strategic initiatives and market developments is crucial. Investors should pay close attention to any announcements or updates from the company that could influence its stock price. For instance, news regarding production targets, new product launches, or partnerships can provide valuable insights into Tesla’s future prospects. By keeping abreast of such information, investors can make more informed decisions and adjust their strategies accordingly.

Furthermore, it is important for investors to manage their expectations realistically. While Tesla has demonstrated remarkable growth in recent years, it is essential to acknowledge that no company is immune to challenges. Economic fluctuations, regulatory changes, and competitive pressures are all factors that can impact Tesla’s performance. By setting realistic expectations and being prepared for potential setbacks, investors can avoid making impulsive decisions based on short-term market movements.

In conclusion, as Tesla’s earnings season approaches and its share price experiences fluctuations, investors must adopt strategic approaches to navigate this period of uncertainty. By maintaining a long-term perspective, diversifying their portfolios, staying informed about market developments, and managing expectations, investors can position themselves to make informed decisions. While the path may be fraught with challenges, these strategies can help investors capitalize on opportunities and mitigate risks, ultimately contributing to a more resilient investment approach during Tesla’s earnings season.

Q&A

1. **Question:** What caused Tesla shares to decline ahead of the earnings report?

**Answer:** Concerns about potential lower-than-expected earnings and revenue, as well as broader market volatility, contributed to the decline in Tesla shares.

2. **Question:** How did analysts react to the anticipated earnings report for Tesla?

**Answer:** Analysts expressed caution, with some adjusting their price targets and earnings estimates due to uncertainties about Tesla’s production and delivery numbers.

3. **Question:** What specific financial metrics were investors concerned about regarding Tesla’s earnings report?

**Answer:** Investors were particularly concerned about Tesla’s profit margins, revenue growth, and vehicle delivery numbers.

4. **Question:** Did any external factors influence the decline in Tesla shares?

**Answer:** Yes, external factors such as rising interest rates, supply chain disruptions, and geopolitical tensions also played a role in the decline.

5. **Question:** How did Tesla’s stock performance compare to the broader market during this period?

**Answer:** Tesla’s stock underperformed compared to the broader market indices, which were also experiencing volatility but to a lesser extent.

6. **Question:** Were there any significant changes in Tesla’s production or delivery forecasts that impacted investor sentiment?

**Answer:** Yes, there were concerns about potential production slowdowns and delivery challenges, which negatively impacted investor sentiment.

7. **Question:** What are investors hoping to learn from Tesla’s upcoming earnings report?

**Answer:** Investors are looking for clarity on Tesla’s future growth prospects, updates on new product developments, and insights into how the company plans to navigate current economic challenges.

Conclusion

Tesla shares experienced a decline ahead of its earnings report, reflecting investor caution and market volatility. This downturn may be attributed to concerns over potential earnings misses, increased competition in the electric vehicle market, or broader economic factors affecting tech stocks. The anticipation surrounding the earnings report highlights the market’s sensitivity to Tesla’s financial performance and strategic outlook. Investors are likely scrutinizing key metrics such as delivery numbers, profit margins, and future guidance to assess the company’s growth trajectory and operational efficiency. The outcome of the earnings report will be crucial in determining whether Tesla can reassure investors and stabilize its stock performance.