“Anticipating Growth: T. Rowe Sees 10-Year Treasury Yields Climbing to 5% by Spring.”

Introduction

T. Rowe Price, a prominent global investment management firm, has recently projected that the yield on the 10-year U.S. Treasury note could rise to 5% within the next six months. This forecast comes amid a backdrop of evolving economic conditions, including persistent inflationary pressures and the Federal Reserve’s ongoing monetary policy adjustments. The anticipated increase in yields reflects expectations of tighter financial conditions as the central bank continues its efforts to curb inflation and stabilize the economy. Such a rise in Treasury yields could have significant implications for various sectors, influencing borrowing costs, investment strategies, and overall market dynamics. As investors and analysts closely monitor these developments, T. Rowe Price’s prediction underscores the complex interplay between economic indicators and financial markets in the current environment.

Impact Of Rising Treasury Yields On Investment Portfolios

The recent prediction by T. Rowe that 10-year Treasury yields could reach 5% within the next six months has sparked considerable discussion among investors and financial analysts. This anticipated rise in yields is poised to have significant implications for investment portfolios, necessitating a strategic reassessment of asset allocations and risk management practices. As Treasury yields are a critical benchmark for various financial instruments, their increase can ripple through the broader financial markets, affecting both fixed-income and equity investments.

To begin with, rising Treasury yields typically lead to a decline in bond prices. This inverse relationship means that as yields climb, the market value of existing bonds with lower interest rates decreases. Consequently, investors holding long-duration bonds may experience capital losses, prompting a reevaluation of their fixed-income strategies. In this environment, portfolio managers might consider shifting towards shorter-duration bonds or diversifying into other fixed-income securities that are less sensitive to interest rate changes. Additionally, the prospect of higher yields could attract investors seeking safer, more predictable returns, potentially leading to a reallocation of funds from riskier assets to government securities.

Moreover, the impact of rising Treasury yields extends beyond the bond market, influencing equity valuations as well. Higher yields often result in increased borrowing costs for companies, which can compress profit margins and dampen earnings growth. This scenario may lead to a reassessment of stock valuations, particularly for growth-oriented companies that rely heavily on future earnings potential. As a result, investors might gravitate towards value stocks or sectors that are less sensitive to interest rate fluctuations, such as consumer staples or utilities, which tend to offer more stable cash flows and dividends.

In addition to affecting individual asset classes, the anticipated rise in Treasury yields could also alter the dynamics of portfolio diversification. Traditionally, bonds have served as a hedge against equity market volatility, providing a counterbalance during periods of economic uncertainty. However, with the potential for bond prices to decline as yields rise, the effectiveness of this diversification strategy may be called into question. Investors may need to explore alternative hedging strategies, such as incorporating commodities or real estate investments, to maintain a balanced risk profile.

Furthermore, the broader economic implications of rising Treasury yields cannot be overlooked. Higher yields often signal expectations of stronger economic growth and inflationary pressures, which can influence central bank policies and interest rate decisions. As monetary authorities respond to these developments, the cost of capital for businesses and consumers may increase, potentially impacting spending and investment decisions. Investors must remain vigilant in monitoring these macroeconomic trends and adjust their portfolios accordingly to navigate the evolving landscape.

In conclusion, the prediction by T. Rowe that 10-year Treasury yields could reach 5% in the near term underscores the need for investors to reassess their portfolio strategies in light of changing market conditions. By understanding the potential impact on both fixed-income and equity investments, as well as the broader economic environment, investors can make informed decisions to optimize their asset allocations and manage risk effectively. As the financial landscape continues to evolve, maintaining a proactive and flexible approach will be essential for navigating the challenges and opportunities presented by rising Treasury yields.

Strategies For Investors In A High-Yield Environment

In the ever-evolving landscape of financial markets, investors are constantly seeking strategies to navigate the complexities of changing economic conditions. Recently, T. Rowe Price, a renowned investment management firm, has projected that the yield on the 10-year U.S. Treasury note could reach 5% within the next six months. This prediction, if realized, would mark a significant shift in the fixed-income market, prompting investors to reassess their strategies in a high-yield environment. As yields rise, the implications for various asset classes and investment strategies become increasingly pertinent.

To begin with, rising Treasury yields often signal a shift in the broader economic landscape, reflecting expectations of higher inflation and economic growth. For investors, this environment presents both challenges and opportunities. On one hand, higher yields can lead to a decline in the prices of existing bonds, as newer issues offer more attractive returns. Consequently, bondholders may experience capital losses if they need to sell their holdings before maturity. On the other hand, for those looking to invest in fixed-income securities, higher yields provide an opportunity to lock in more attractive returns over the long term.

In light of T. Rowe Price’s forecast, investors may consider adjusting their portfolios to mitigate potential risks while capitalizing on new opportunities. One strategy is to shorten the duration of bond holdings. By investing in shorter-term bonds, investors can reduce their exposure to interest rate risk, as these securities are less sensitive to changes in interest rates compared to their longer-term counterparts. Additionally, as bonds mature, investors can reinvest the proceeds at higher yields, thereby enhancing their overall returns.

Moreover, diversification remains a key principle in managing investment portfolios, particularly in a high-yield environment. Investors might explore diversifying across different asset classes, such as equities, real estate, and commodities, to balance the risks associated with rising interest rates. Equities, for instance, can offer growth potential that may outpace inflation, while real estate investments can provide a hedge against inflationary pressures through rental income and property appreciation.

Furthermore, within the equity market, certain sectors may benefit from rising interest rates. Financial institutions, such as banks and insurance companies, often experience improved profit margins in a high-yield environment, as they can charge higher interest rates on loans. Consequently, investors might consider increasing their exposure to these sectors to capitalize on potential gains.

In addition to sector-specific strategies, investors should also remain vigilant about the broader economic indicators that influence interest rates. Monitoring inflation trends, central bank policies, and economic growth forecasts can provide valuable insights into the trajectory of interest rates and help investors make informed decisions.

In conclusion, T. Rowe Price’s prediction of 10-year Treasury yields reaching 5% within six months underscores the importance of strategic planning in a high-yield environment. By considering adjustments to bond durations, diversifying across asset classes, and focusing on sectors poised to benefit from rising rates, investors can position themselves to navigate the challenges and seize the opportunities presented by this evolving landscape. As always, maintaining a well-balanced and informed approach will be crucial in achieving long-term financial goals amidst changing market conditions.

Historical Analysis Of Treasury Yield Trends

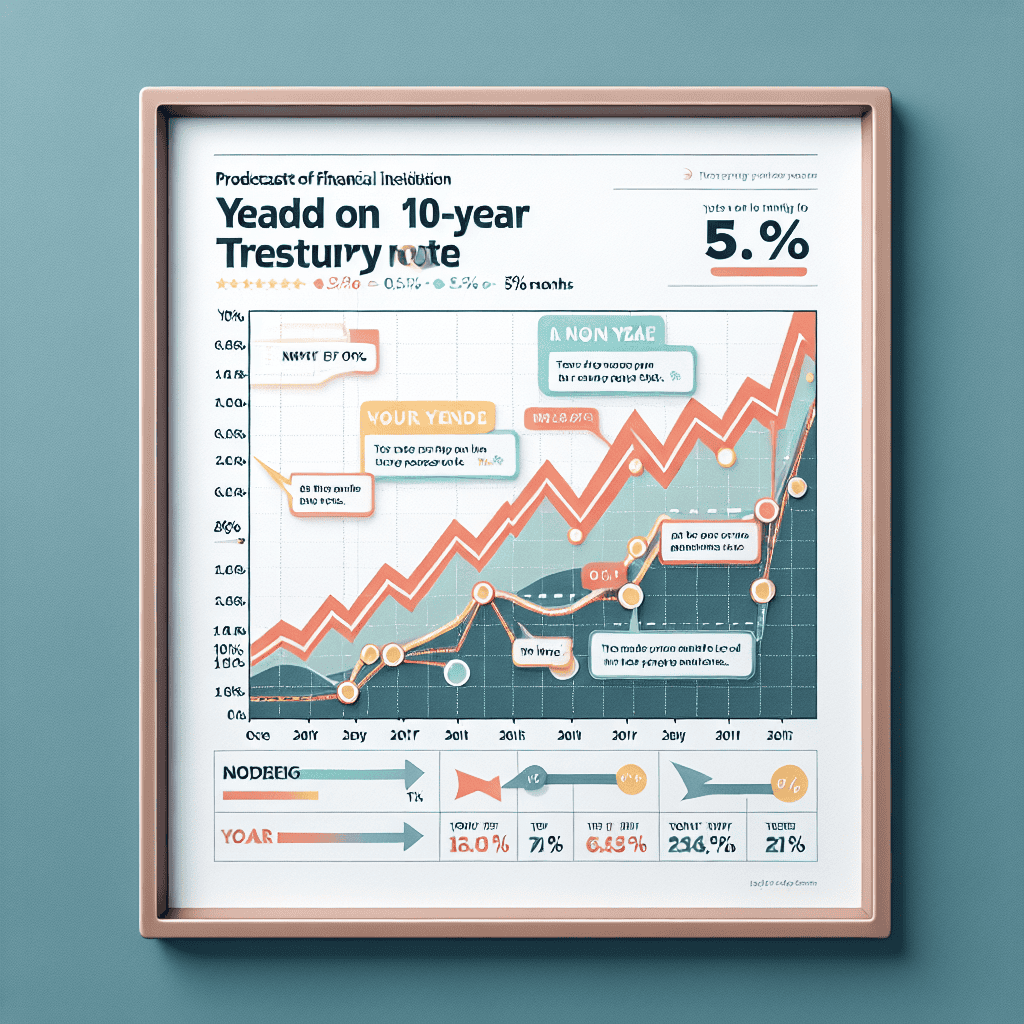

In examining the historical trends of Treasury yields, it is essential to consider the broader economic context that influences these fluctuations. Treasury yields, particularly the 10-year Treasury yield, serve as a critical benchmark for various financial instruments and are closely watched by investors, policymakers, and economists alike. The recent prediction by T. Rowe that 10-year Treasury yields will reach 5% within the next six months invites a deeper exploration of past trends and the factors that have historically driven such movements.

Historically, Treasury yields have been influenced by a combination of monetary policy, inflation expectations, and economic growth prospects. During periods of robust economic expansion, yields tend to rise as investors anticipate higher inflation and interest rates. Conversely, in times of economic uncertainty or recession, yields often decline as investors seek the safety of government bonds, driving prices up and yields down. This cyclical nature of Treasury yields underscores the complex interplay between economic indicators and market sentiment.

In the late 20th century, particularly during the 1980s, the United States experienced a period of high inflation and interest rates, with 10-year Treasury yields peaking at over 15%. This era was marked by aggressive monetary tightening by the Federal Reserve to combat inflation, which significantly impacted yield trends. As inflation was brought under control in the subsequent decades, yields gradually declined, reflecting a more stable economic environment and lower inflation expectations.

The early 21st century saw further shifts in Treasury yield trends, particularly in response to global economic events. The financial crisis of 2008, for instance, led to a dramatic drop in yields as the Federal Reserve implemented unprecedented monetary easing measures to stabilize the economy. This period of low yields persisted for several years, influenced by continued economic uncertainty and accommodative monetary policies.

More recently, the COVID-19 pandemic has introduced new dynamics into the Treasury yield landscape. Initially, yields plummeted as investors flocked to the safety of government bonds amid global economic disruptions. However, as economies began to recover and inflationary pressures emerged, yields started to rise, reflecting changing expectations about future interest rates and economic growth.

T. Rowe’s prediction of 10-year Treasury yields reaching 5% within six months suggests a significant shift in market conditions. This forecast likely considers several factors, including anticipated changes in monetary policy, inflation trends, and economic growth projections. The Federal Reserve’s stance on interest rates, for instance, plays a crucial role in shaping yield expectations. If the Fed signals a more aggressive approach to curbing inflation, it could lead to higher yields as investors adjust their portfolios accordingly.

Moreover, inflation expectations are a key driver of yield movements. If inflation is perceived to be persistent rather than transitory, investors may demand higher yields to compensate for the eroding purchasing power of fixed-income returns. Additionally, economic growth prospects can influence yield trends, as stronger growth may lead to higher interest rates and, consequently, higher yields.

In conclusion, the prediction of 10-year Treasury yields reaching 5% within six months reflects a complex interplay of historical trends and current economic conditions. Understanding these dynamics requires a nuanced analysis of past yield movements and the factors that have historically influenced them. As the economic landscape continues to evolve, monitoring these trends will be crucial for investors and policymakers alike in navigating the challenges and opportunities that lie ahead.

Implications For The Bond Market With 5% Yields

T. Rowe Price, a renowned investment management firm, has recently projected that the yield on the 10-year U.S. Treasury note will rise to 5% within the next six months. This forecast, if realized, could have significant implications for the bond market, influencing both investors and issuers alike. As yields rise, bond prices typically fall, which could lead to a revaluation of existing bond portfolios. This potential shift in the bond market landscape necessitates a closer examination of the factors driving this prediction and the subsequent effects on various market participants.

To begin with, the anticipated increase in yields can be attributed to several macroeconomic factors. Inflationary pressures, driven by robust economic growth and supply chain disruptions, have been a primary concern for policymakers. The Federal Reserve’s monetary policy stance, which has been gradually shifting towards tightening, is also a critical factor. As the central bank raises interest rates to combat inflation, yields on government securities are likely to follow suit. Furthermore, increased government borrowing to finance fiscal stimulus measures could lead to higher yields as the supply of Treasury securities rises.

For investors, a rise in 10-year Treasury yields to 5% presents both challenges and opportunities. On one hand, higher yields could result in capital losses for existing bondholders, as the market value of their holdings declines. This scenario is particularly concerning for those with long-duration bonds, which are more sensitive to interest rate changes. On the other hand, new investors may find the higher yields attractive, as they offer better returns compared to the historically low rates seen in recent years. Consequently, portfolio managers may need to reassess their strategies, potentially shifting towards shorter-duration bonds or diversifying into other asset classes to mitigate interest rate risk.

Issuers of bonds, including corporations and municipalities, may also feel the impact of rising yields. As borrowing costs increase, these entities might face higher expenses when issuing new debt or refinancing existing obligations. This could lead to a slowdown in bond issuance, particularly for those with lower credit ratings, as investors demand higher yields to compensate for perceived risks. In turn, this could affect capital expenditure plans and overall economic growth, as companies may become more cautious in their investment decisions.

Moreover, the broader financial markets could experience ripple effects from the anticipated rise in Treasury yields. Equities, for instance, might face increased volatility as investors reassess the relative attractiveness of stocks versus bonds. Higher yields could also strengthen the U.S. dollar, as foreign investors seek the safety and returns of U.S. government securities, potentially impacting global trade dynamics.

In conclusion, T. Rowe Price’s prediction of 10-year Treasury yields reaching 5% within six months underscores the importance of understanding the interconnectedness of economic factors and market dynamics. Investors and issuers alike must remain vigilant, adapting their strategies to navigate the evolving landscape. While challenges are inevitable, opportunities will also arise for those who can effectively manage risk and capitalize on changing market conditions. As the bond market braces for potential shifts, the coming months will be crucial in determining the trajectory of yields and their far-reaching implications.

Economic Indicators Influencing Treasury Yield Predictions

T. Rowe Price, a renowned investment management firm, has recently projected that the yield on the 10-year U.S. Treasury note will rise to 5% within the next six months. This prediction has garnered significant attention from investors and economists alike, as it suggests a notable shift in the economic landscape. Understanding the factors influencing this forecast requires a closer examination of the economic indicators that play a crucial role in shaping Treasury yield movements.

To begin with, inflation expectations are a primary driver of Treasury yields. When investors anticipate higher inflation in the future, they demand higher yields to compensate for the eroding purchasing power of their returns. Recent data indicates that inflationary pressures have been mounting, driven by a combination of supply chain disruptions, increased consumer demand, and rising commodity prices. As these factors persist, they contribute to the upward pressure on yields, aligning with T. Rowe’s prediction.

Moreover, the Federal Reserve’s monetary policy stance is another critical factor influencing Treasury yields. The central bank’s decisions regarding interest rates and asset purchases directly impact the bond market. In recent months, the Federal Reserve has signaled a potential shift towards tightening monetary policy to combat inflation. This includes the possibility of raising interest rates and tapering its bond-buying program. Such actions would likely lead to higher yields, as investors adjust their expectations in response to a less accommodative monetary environment.

In addition to domestic factors, global economic conditions also play a significant role in shaping U.S. Treasury yields. The interconnectedness of global financial markets means that developments in other major economies can influence investor sentiment and demand for U.S. Treasuries. For instance, if economic growth in Europe or Asia accelerates, it could lead to increased competition for capital, driving up yields in the U.S. market. Conversely, geopolitical tensions or economic slowdowns abroad could result in a flight to safety, temporarily suppressing yields.

Furthermore, fiscal policy decisions by the U.S. government can impact Treasury yields. Large-scale government spending, particularly if financed through borrowing, can lead to an increase in the supply of Treasury securities. This, in turn, may necessitate higher yields to attract investors. Recent legislative initiatives, such as infrastructure spending and social programs, have raised concerns about the potential for increased government borrowing, which could contribute to the upward trajectory of yields.

It is also important to consider the role of investor sentiment and market dynamics in shaping yield movements. As investors assess the economic outlook, their risk appetite and portfolio allocation decisions can influence demand for Treasuries. A shift towards riskier assets, driven by optimism about economic growth, could lead to a decrease in demand for safe-haven assets like Treasuries, thereby pushing yields higher.

In conclusion, T. Rowe Price’s prediction of 10-year Treasury yields reaching 5% within six months is grounded in a complex interplay of economic indicators. Inflation expectations, Federal Reserve policy, global economic conditions, fiscal policy, and investor sentiment all contribute to the evolving landscape of Treasury yields. As these factors continue to unfold, market participants will closely monitor developments to gauge the accuracy of this forecast and its implications for the broader economy.

Comparing T. Rowe’s Forecast With Other Financial Institutions

T. Rowe Price, a prominent global investment management firm, has recently made headlines with its bold prediction that the yield on the 10-year U.S. Treasury note will reach 5% within the next six months. This forecast has sparked considerable interest and debate within the financial community, as it contrasts with the projections of several other major financial institutions. To understand the implications of T. Rowe’s forecast, it is essential to compare it with the expectations of other key players in the financial sector.

Firstly, it is important to consider the current economic environment and the factors influencing Treasury yields. The U.S. economy has been navigating a complex landscape characterized by inflationary pressures, fluctuating interest rates, and geopolitical uncertainties. In this context, T. Rowe’s prediction of a 5% yield on the 10-year Treasury note suggests a significant shift in market dynamics. The firm likely anticipates that persistent inflation and robust economic growth will compel the Federal Reserve to maintain or even increase interest rates, thereby driving up Treasury yields.

In contrast, other financial institutions have offered more conservative forecasts. For instance, Goldman Sachs has projected that the 10-year Treasury yield will rise to around 4% over the same period. This more cautious outlook reflects a belief that while inflationary pressures may persist, they will not be severe enough to necessitate aggressive monetary tightening by the Federal Reserve. Similarly, JPMorgan Chase has suggested that yields will stabilize at approximately 4.25%, indicating a moderate increase but not reaching the levels anticipated by T. Rowe.

Moreover, the divergence in these forecasts can be attributed to differing assessments of the Federal Reserve’s policy trajectory. T. Rowe’s prediction implies a more hawkish stance from the central bank, with a focus on curbing inflation even at the risk of slowing economic growth. On the other hand, institutions like Goldman Sachs and JPMorgan Chase may be factoring in a more balanced approach, where the Federal Reserve aims to support economic expansion while gradually addressing inflationary concerns.

Additionally, it is worth noting that market sentiment and investor behavior play crucial roles in shaping Treasury yields. T. Rowe’s forecast may also reflect an expectation of increased demand for riskier assets, leading investors to seek higher yields from Treasuries as a compensatory measure. Conversely, other institutions might anticipate a more cautious investor sentiment, resulting in a slower rise in yields.

Furthermore, the global economic landscape cannot be overlooked when comparing these forecasts. International factors, such as economic growth in major economies like China and the European Union, as well as geopolitical tensions, can influence U.S. Treasury yields. T. Rowe’s prediction may incorporate a scenario where global economic conditions contribute to upward pressure on yields, while other institutions might foresee a more stable international environment.

In conclusion, T. Rowe Price’s forecast of a 5% yield on the 10-year Treasury note within six months presents a more aggressive outlook compared to other financial institutions. This divergence highlights the complexities and uncertainties inherent in predicting market movements. As investors and policymakers navigate this challenging landscape, the varying forecasts underscore the importance of closely monitoring economic indicators, Federal Reserve actions, and global developments to make informed decisions. Ultimately, the coming months will reveal which of these projections aligns more closely with the evolving economic reality.

Potential Effects On Mortgage Rates And Consumer Loans

T. Rowe Price, a renowned investment management firm, has recently projected that the yield on the 10-year U.S. Treasury note could reach 5% within the next six months. This forecast has significant implications for various sectors of the economy, particularly in the realm of mortgage rates and consumer loans. As the 10-year Treasury yield is a critical benchmark for determining interest rates across the financial spectrum, its anticipated rise could lead to notable shifts in borrowing costs for consumers.

To begin with, the 10-year Treasury yield serves as a foundational reference point for setting mortgage rates. When Treasury yields increase, mortgage rates typically follow suit. This is because lenders often peg their interest rates to the yields on government securities, which are considered low-risk investments. Consequently, if T. Rowe’s prediction materializes, prospective homebuyers may face higher mortgage rates, potentially dampening their purchasing power. Higher mortgage rates could lead to increased monthly payments, making homeownership less affordable for many individuals. This scenario might also deter some potential buyers from entering the housing market altogether, thereby affecting overall demand.

Moreover, the anticipated rise in Treasury yields could have a ripple effect on consumer loans, including personal loans, auto loans, and credit card interest rates. Financial institutions often adjust their lending rates in response to changes in Treasury yields to maintain their profit margins. As a result, consumers may encounter higher borrowing costs across various loan products. This increase in interest rates could lead to a reduction in consumer spending, as individuals may become more cautious about taking on additional debt. In turn, this could have broader implications for economic growth, given that consumer spending is a significant driver of the U.S. economy.

Furthermore, the potential increase in borrowing costs may also impact existing homeowners with adjustable-rate mortgages (ARMs). These loans have interest rates that fluctuate based on market conditions, often tied to Treasury yields. As yields rise, homeowners with ARMs could see their monthly payments increase, potentially straining household budgets. This situation might prompt some homeowners to refinance their mortgages to lock in fixed rates, although the higher interest rate environment could make refinancing less attractive.

In addition to affecting individual borrowers, the projected rise in Treasury yields could influence the broader financial markets. Higher yields may attract more investors to government bonds, as they offer more attractive returns compared to other fixed-income investments. This shift in investor preference could lead to a reallocation of capital away from riskier assets, such as stocks, potentially resulting in increased market volatility.

In conclusion, T. Rowe Price’s prediction of a 5% yield on the 10-year Treasury note within six months carries significant implications for mortgage rates and consumer loans. As Treasury yields rise, borrowing costs are likely to increase, affecting homebuyers, existing homeowners, and consumers seeking loans. These changes could lead to reduced consumer spending and potentially impact economic growth. Additionally, the financial markets may experience shifts in investor behavior as they respond to the evolving interest rate landscape. As such, individuals and businesses alike should remain vigilant and consider the potential effects of these developments on their financial strategies and decisions.

Q&A

1. **What is T. Rowe’s prediction regarding the 10-year Treasury yields?**

T. Rowe predicts that the 10-year Treasury yields will reach 5% in six months.

2. **What is the current yield of the 10-year Treasury?**

The current yield of the 10-year Treasury is not specified in the question, but it is implied to be lower than 5%.

3. **What factors might influence the 10-year Treasury yields to reach 5%?**

Factors could include inflation expectations, Federal Reserve interest rate policies, economic growth projections, and changes in investor demand for Treasuries.

4. **How might a 5% yield on the 10-year Treasury impact the bond market?**

A 5% yield could lead to a decrease in bond prices, as yields and prices move inversely. It might also attract more investors seeking higher returns.

5. **What could be the implications for the stock market if 10-year Treasury yields reach 5%?**

Higher yields could make bonds more attractive compared to stocks, potentially leading to a shift in investment from equities to bonds. It might also increase borrowing costs for companies.

6. **How might this prediction affect mortgage rates?**

Mortgage rates could rise, as they are often influenced by the yields on long-term Treasuries like the 10-year note.

7. **What are potential risks if the 10-year Treasury yields reach 5%?**

Potential risks include increased borrowing costs for consumers and businesses, potential slowdowns in economic growth, and increased volatility in financial markets.

Conclusion

T. Rowe’s prediction that 10-year Treasury yields will reach 5% in six months suggests a significant shift in the bond market, likely driven by expectations of rising inflation, increased government borrowing, or changes in Federal Reserve policy. If realized, this increase could impact borrowing costs, investment strategies, and economic growth, potentially signaling tighter financial conditions and influencing both domestic and global financial markets. Investors and policymakers will need to closely monitor economic indicators and adjust their strategies accordingly to navigate the potential implications of such a yield increase.