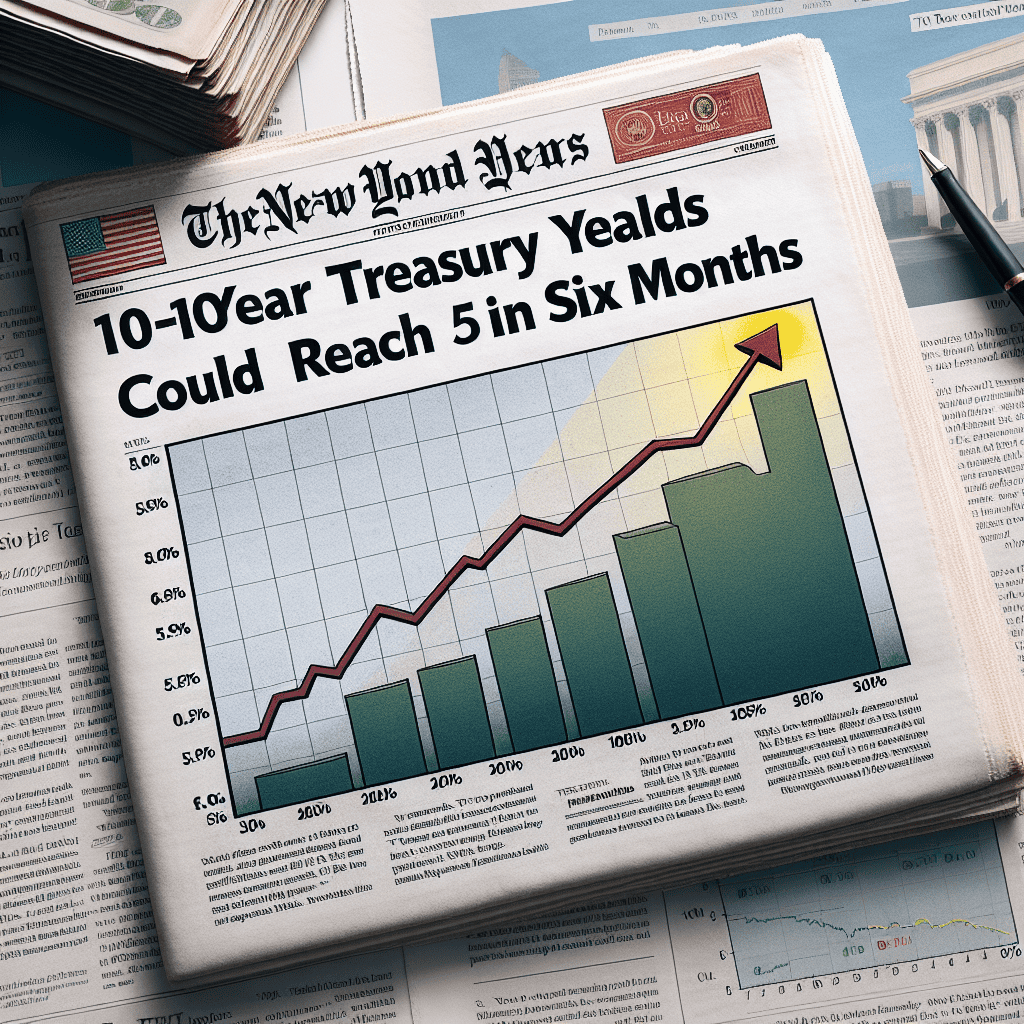

“Anticipating Growth: T. Rowe’s Bold 5% Treasury Yield Forecast”

Introduction

T. Rowe Price, a prominent global investment management firm, has recently projected that the yield on the 10-year U.S. Treasury note could climb to 5% within the next six months. This forecast comes amid a backdrop of evolving economic conditions, including persistent inflationary pressures and the Federal Reserve’s ongoing monetary policy adjustments. The anticipated rise in yields reflects expectations of continued economic growth and potential shifts in investor sentiment as markets adapt to changing fiscal landscapes. T. Rowe Price’s prediction underscores the dynamic nature of the bond market and highlights the importance of strategic investment planning in response to anticipated interest rate movements.

Impact Of Rising Treasury Yields On Investment Portfolios

The recent prediction by T. Rowe Price that 10-year Treasury yields could reach 5% within the next six months has sparked considerable discussion among investors and financial analysts. This potential rise in yields is significant, as it could have far-reaching implications for investment portfolios across various asset classes. Understanding the impact of such a shift requires a comprehensive analysis of how rising Treasury yields influence different investment strategies and asset allocations.

To begin with, Treasury yields are a critical benchmark for interest rates across the financial system. When yields rise, borrowing costs for corporations and consumers typically increase, which can lead to a slowdown in economic activity. For fixed-income investors, higher yields on Treasuries can be both a blessing and a curse. On one hand, new investments in Treasuries become more attractive due to the higher returns. On the other hand, existing bond holdings may suffer as their prices decline in response to rising yields. This inverse relationship between bond prices and yields means that portfolios heavily weighted in long-duration bonds could experience significant losses.

Moreover, the impact of rising Treasury yields extends beyond the bond market. Equities, particularly those in sectors sensitive to interest rates such as utilities and real estate, may also be affected. Higher yields can lead to increased discount rates used in valuing future cash flows, potentially resulting in lower stock valuations. Additionally, as Treasuries become more attractive, investors might reallocate funds from equities to bonds, exerting downward pressure on stock prices. However, it is important to note that not all sectors are equally impacted. Financial stocks, for instance, might benefit from rising rates as they can improve profit margins for banks and other financial institutions.

In the context of diversified investment portfolios, the anticipated rise in Treasury yields necessitates a reevaluation of asset allocation strategies. Investors may need to consider reducing exposure to long-duration bonds and interest-rate-sensitive equities while exploring opportunities in sectors that could benefit from a higher interest rate environment. Furthermore, alternative investments such as commodities or real estate investment trusts (REITs) might offer diversification benefits and potential hedges against inflation, which often accompanies rising interest rates.

Transitioning to the broader economic implications, rising Treasury yields can also influence monetary policy decisions. Central banks, including the Federal Reserve, closely monitor yield movements as they assess the appropriate stance for interest rates. A significant increase in yields could prompt central banks to adjust their policy rates to maintain economic stability. This interplay between market-driven yields and policy rates adds another layer of complexity for investors seeking to navigate the evolving landscape.

In conclusion, the prediction by T. Rowe Price that 10-year Treasury yields could reach 5% in the near term underscores the importance of proactive portfolio management. Investors must remain vigilant and adaptable, considering both the risks and opportunities presented by a rising yield environment. By carefully assessing the potential impacts on various asset classes and adjusting strategies accordingly, investors can better position themselves to achieve their financial objectives amidst changing market conditions. As always, consulting with financial advisors and staying informed about economic developments will be crucial in making informed investment decisions.

Strategies For Investors In A High-Yield Environment

In the ever-evolving landscape of financial markets, investors are constantly seeking strategies to navigate the complexities of changing economic conditions. Recently, T. Rowe Price, a renowned investment management firm, has projected that 10-year Treasury yields could reach 5% within the next six months. This prediction, if realized, would mark a significant shift in the fixed-income market, presenting both challenges and opportunities for investors. As yields rise, the implications for investment strategies become increasingly pertinent, necessitating a careful reassessment of portfolio allocations and risk management approaches.

To begin with, it is essential to understand the factors driving this potential increase in Treasury yields. Rising yields often reflect expectations of higher inflation and economic growth, prompting central banks to adjust monetary policies accordingly. In this context, investors should consider the broader economic indicators and policy decisions that could influence yield movements. For instance, if inflationary pressures persist, central banks may adopt a more hawkish stance, leading to higher interest rates and, consequently, increased yields on government bonds.

In light of these developments, investors may need to recalibrate their strategies to optimize returns in a high-yield environment. One approach is to diversify fixed-income portfolios by incorporating a mix of short-duration and inflation-protected securities. Short-duration bonds are less sensitive to interest rate fluctuations, thereby mitigating potential losses as yields rise. Meanwhile, Treasury Inflation-Protected Securities (TIPS) offer a hedge against inflation, preserving purchasing power and providing a buffer against rising prices.

Moreover, investors might explore opportunities in sectors that traditionally perform well in rising yield environments. For example, financial institutions such as banks and insurance companies often benefit from higher interest rates, as they can improve their net interest margins. Consequently, allocating a portion of the portfolio to financial sector equities could enhance returns. Additionally, sectors like energy and materials, which are closely tied to economic growth, may also present attractive investment prospects as yields climb.

Furthermore, it is crucial for investors to maintain a balanced perspective, recognizing that rising yields can also impact equity markets. Higher yields may lead to increased borrowing costs for companies, potentially affecting profit margins and valuations. Therefore, a comprehensive risk assessment is vital to ensure that equity exposures align with the investor’s risk tolerance and long-term objectives. Diversification across asset classes and geographies can help mitigate these risks, providing a more resilient portfolio structure.

In addition to these strategies, investors should remain vigilant and adaptable, continuously monitoring market conditions and adjusting their approaches as necessary. Engaging with financial advisors and leveraging their expertise can provide valuable insights and guidance in navigating this complex environment. By staying informed and proactive, investors can position themselves to capitalize on opportunities while managing potential risks associated with rising Treasury yields.

In conclusion, T. Rowe Price’s projection of 10-year Treasury yields reaching 5% within six months underscores the importance of strategic planning in a high-yield environment. By diversifying fixed-income portfolios, exploring sector-specific opportunities, and maintaining a balanced perspective on equity markets, investors can effectively navigate the challenges and opportunities presented by rising yields. Ultimately, a well-considered approach, grounded in thorough analysis and adaptability, will be key to achieving long-term financial goals in this dynamic landscape.

Historical Analysis Of Treasury Yield Trends

In examining the historical trends of Treasury yields, it is essential to consider the broader economic context that influences these fluctuations. Treasury yields, particularly the 10-year Treasury yield, serve as a critical benchmark for various financial instruments and are closely watched by investors, policymakers, and economists alike. The recent prediction by T. Rowe that 10-year Treasury yields could reach 5% within the next six months invites a deeper exploration of past trends and the factors that have historically driven such movements.

Historically, Treasury yields have been influenced by a combination of monetary policy, inflation expectations, and economic growth prospects. During periods of robust economic expansion, yields tend to rise as investors anticipate higher inflation and interest rates. Conversely, in times of economic uncertainty or recession, yields often decline as investors seek the safety of government bonds, driving prices up and yields down. This cyclical nature of Treasury yields underscores the complex interplay between economic indicators and market sentiment.

In the late 20th century, particularly during the 1980s, the United States experienced a period of high inflation, prompting the Federal Reserve to implement aggressive interest rate hikes. This led to a significant increase in Treasury yields, with the 10-year yield peaking at over 15% in 1981. As inflation was brought under control in the subsequent decades, yields gradually declined, reflecting a more stable economic environment and the Fed’s shift towards a more accommodative monetary policy.

The early 21st century saw further fluctuations in Treasury yields, influenced by events such as the dot-com bubble burst, the 2008 financial crisis, and the subsequent Great Recession. During these times, the Federal Reserve employed various measures, including lowering interest rates and implementing quantitative easing, to stimulate the economy. These actions contributed to a prolonged period of low yields, with the 10-year yield reaching historic lows in the years following the financial crisis.

In recent years, the global economic landscape has been shaped by factors such as geopolitical tensions, trade disputes, and the COVID-19 pandemic. These events have introduced new uncertainties, impacting investor behavior and Treasury yield trends. The pandemic, in particular, led to unprecedented fiscal and monetary responses worldwide, further influencing yield movements. As economies began to recover, discussions around inflation and potential interest rate hikes have resurfaced, contributing to the current environment where a rise in yields is anticipated.

T. Rowe’s prediction of a potential increase in 10-year Treasury yields to 5% within six months reflects a confluence of factors, including expectations of continued economic recovery, potential inflationary pressures, and the Federal Reserve’s monetary policy stance. If realized, such an increase would mark a significant shift from the low-yield environment that has persisted for much of the past decade. It would also have far-reaching implications for various sectors, including housing, corporate borrowing, and government financing.

In conclusion, the historical analysis of Treasury yield trends reveals a dynamic interplay of economic forces that shape these movements over time. While past trends provide valuable insights, the future trajectory of yields remains contingent on a myriad of factors, both domestic and global. As such, investors and policymakers must remain vigilant, continuously assessing the evolving economic landscape to navigate the complexities of the financial markets effectively.

Implications For The Bond Market With 5% Yields

T. Rowe Price, a renowned investment management firm, has recently projected that the yield on the 10-year U.S. Treasury note could reach 5% within the next six months. This forecast, if realized, would have significant implications for the bond market, influencing both investors and issuers alike. As the yield on the 10-year Treasury is often considered a benchmark for other interest rates, a rise to 5% would signal a substantial shift in the financial landscape.

To begin with, higher yields on the 10-year Treasury would likely lead to a repricing of risk across the bond market. Investors, seeking better returns, might shift their portfolios away from lower-yielding bonds, such as those issued by corporations or municipalities, towards Treasuries. This could result in a sell-off in these other bond categories, driving their prices down and yields up. Consequently, companies and municipalities might face higher borrowing costs, as they would need to offer more attractive yields to entice investors. This could potentially slow down capital investment and infrastructure projects, impacting economic growth.

Moreover, the anticipated rise in Treasury yields could also affect the mortgage market. Mortgage rates are closely tied to the yields on long-term government bonds, and an increase in the 10-year Treasury yield would likely lead to higher mortgage rates. This could dampen the housing market, as potential homebuyers might find it more expensive to finance their purchases. Existing homeowners with adjustable-rate mortgages could also see their monthly payments increase, potentially straining household budgets.

In addition to these direct effects, the broader economic implications of higher Treasury yields should not be overlooked. For instance, the Federal Reserve might interpret rising yields as a sign of increasing inflation expectations or stronger economic growth. This could influence the central bank’s monetary policy decisions, potentially leading to further interest rate hikes. Such a scenario would reinforce the upward pressure on bond yields, creating a feedback loop that could further reshape the bond market.

On the other hand, higher yields could attract foreign investors seeking better returns compared to their domestic markets. This influx of capital could help stabilize the bond market, mitigating some of the negative impacts of rising yields. However, it could also lead to an appreciation of the U.S. dollar, which might have mixed effects on the economy. While a stronger dollar could make imports cheaper, benefiting consumers, it could also make U.S. exports less competitive, potentially widening the trade deficit.

Furthermore, the potential for 5% yields on the 10-year Treasury could have implications for equity markets. As bonds become more attractive, some investors might reallocate their portfolios away from stocks, particularly those with high valuations or low dividend yields. This could lead to increased volatility in equity markets, as investors reassess their risk-reward profiles.

In conclusion, T. Rowe Price’s prediction of 5% yields on the 10-year Treasury within six months presents a complex set of challenges and opportunities for the bond market. While higher yields could offer better returns for investors, they also carry the potential to disrupt various sectors of the economy. As such, market participants will need to carefully consider their strategies in light of these potential developments, balancing the pursuit of higher returns with the management of increased risks.

Economic Factors Driving Treasury Yield Increases

T. Rowe Price, a renowned investment management firm, has recently projected that the yield on the 10-year U.S. Treasury note could reach 5% within the next six months. This prediction has garnered significant attention from investors and economists alike, as it suggests a notable shift in the economic landscape. Understanding the factors driving this potential increase in Treasury yields is crucial for comprehending the broader implications for the financial markets and the economy.

One of the primary factors contributing to the anticipated rise in Treasury yields is the Federal Reserve’s monetary policy stance. Over the past year, the Fed has been gradually tightening its monetary policy in response to persistent inflationary pressures. By raising interest rates, the central bank aims to curb inflation and stabilize the economy. As a result, higher interest rates tend to lead to increased yields on government bonds, including the 10-year Treasury note. This relationship is rooted in the fact that investors demand higher returns to compensate for the opportunity cost of holding bonds in a rising interest rate environment.

In addition to the Federal Reserve’s actions, inflation expectations play a pivotal role in influencing Treasury yields. Inflation erodes the purchasing power of fixed-income investments, prompting investors to seek higher yields as compensation. Recent data has shown that inflation remains elevated, driven by factors such as supply chain disruptions, labor market constraints, and geopolitical tensions. Consequently, if inflation expectations continue to rise, investors may demand higher yields on Treasuries to offset the anticipated loss in purchasing power.

Moreover, the state of the global economy can significantly impact U.S. Treasury yields. As the world’s largest economy, the United States is deeply interconnected with global markets. Economic developments in other major economies, such as Europe and China, can influence investor sentiment and capital flows. For instance, if economic growth in these regions slows down, investors may flock to the relative safety of U.S. Treasuries, driving yields lower. Conversely, robust global economic growth could lead to increased demand for riskier assets, pushing Treasury yields higher as investors seek better returns elsewhere.

Another factor to consider is the U.S. government’s fiscal policy. The federal budget deficit and the level of government debt can affect Treasury yields. When the government runs large deficits, it often needs to issue more debt to finance its spending. This increased supply of Treasuries can put upward pressure on yields, as the market requires higher returns to absorb the additional debt. Furthermore, if investors perceive that the government’s fiscal position is unsustainable, they may demand higher yields as compensation for the perceived risk.

Finally, market sentiment and investor behavior can also influence Treasury yields. In times of uncertainty or market volatility, investors often seek the safety of government bonds, which can drive yields lower. Conversely, during periods of optimism and risk appetite, investors may shift their portfolios towards equities and other riskier assets, leading to higher Treasury yields. Therefore, understanding the interplay between these factors is essential for anticipating changes in Treasury yields.

In conclusion, T. Rowe Price’s prediction that 10-year Treasury yields could reach 5% within six months is grounded in a complex interplay of economic factors. The Federal Reserve’s monetary policy, inflation expectations, global economic conditions, U.S. fiscal policy, and market sentiment all contribute to the dynamics of Treasury yields. As these factors evolve, they will continue to shape the trajectory of yields, with significant implications for investors and the broader economy.

Comparing T. Rowe’s Predictions With Other Analysts

T. Rowe Price, a prominent investment management firm, has recently made headlines with its bold prediction that 10-year Treasury yields could reach 5% within the next six months. This forecast has sparked considerable interest and debate among financial analysts and investors, as it suggests a significant shift in the bond market landscape. To better understand the implications of T. Rowe’s prediction, it is essential to compare it with the perspectives of other analysts in the field.

To begin with, T. Rowe’s forecast is notably more aggressive than the consensus among many financial analysts. Currently, the 10-year Treasury yield hovers around 4%, and while some analysts anticipate a gradual increase, few predict such a rapid ascent to 5% within the specified timeframe. T. Rowe’s projection is based on several factors, including expectations of continued economic growth, persistent inflationary pressures, and the Federal Reserve’s monetary policy stance. The firm believes that these elements will drive yields higher as investors demand greater compensation for the risks associated with long-term bonds.

In contrast, other analysts offer a more tempered outlook. For instance, some experts argue that while inflation remains a concern, it may not be as persistent as T. Rowe suggests. They point to recent data indicating a potential stabilization in price levels, which could alleviate some upward pressure on yields. Additionally, these analysts highlight the possibility of a more cautious approach by the Federal Reserve, which might opt for a slower pace of interest rate hikes to avoid stifling economic growth. This perspective suggests that yields may rise, but perhaps not as swiftly or dramatically as T. Rowe anticipates.

Moreover, some analysts emphasize the role of global economic conditions in shaping U.S. Treasury yields. They argue that factors such as geopolitical tensions, trade dynamics, and economic performance in other major economies could influence investor sentiment and demand for U.S. Treasuries. For example, heightened geopolitical risks might drive investors toward the relative safety of U.S. government bonds, thereby exerting downward pressure on yields. This global context adds another layer of complexity to the yield outlook, potentially counterbalancing some of the domestic factors highlighted by T. Rowe.

Furthermore, it is important to consider the potential impact of fiscal policy on Treasury yields. Some analysts suggest that increased government spending or changes in tax policy could affect the supply and demand dynamics in the bond market. For instance, if the government were to implement significant fiscal stimulus measures, it could lead to higher borrowing needs and, consequently, upward pressure on yields. However, the timing and magnitude of such policy changes remain uncertain, adding another variable to the equation.

In conclusion, while T. Rowe Price’s prediction of 10-year Treasury yields reaching 5% in six months is certainly attention-grabbing, it is essential to weigh this forecast against the broader spectrum of analyst opinions. The divergence in views underscores the complexity and uncertainty inherent in financial markets, where multiple factors interact to shape outcomes. As investors navigate this landscape, they must consider a range of scenarios and remain vigilant to shifts in economic conditions, monetary policy, and global developments. Ultimately, the path of Treasury yields will depend on a confluence of factors, making it a topic of ongoing interest and analysis in the financial community.

How Rising Yields Affect Mortgage And Loan Rates

T. Rowe Price, a renowned investment management firm, has recently projected that the yield on the 10-year U.S. Treasury note could climb to 5% within the next six months. This forecast has significant implications for various financial sectors, particularly the mortgage and loan markets. As Treasury yields rise, they often lead to an increase in interest rates across the board, affecting everything from home loans to personal and business borrowing costs. Understanding the relationship between Treasury yields and these rates is crucial for both consumers and investors as they navigate the evolving economic landscape.

To begin with, the 10-year Treasury yield serves as a benchmark for a wide array of interest rates, including those for mortgages. When Treasury yields increase, lenders typically raise mortgage rates to maintain their profit margins. This is because higher yields on government bonds make them more attractive to investors, prompting lenders to offer higher rates to compete for investment dollars. Consequently, prospective homebuyers may face higher borrowing costs, which can impact their purchasing power and overall housing affordability. For those with existing adjustable-rate mortgages, rising yields could lead to increased monthly payments when their loans reset, potentially straining household budgets.

Moreover, the ripple effect of rising Treasury yields extends beyond the housing market. Personal loans, auto loans, and credit card interest rates are also influenced by changes in Treasury yields. As these rates climb, consumers may find it more expensive to finance major purchases or carry balances on their credit cards. This can lead to a reduction in consumer spending, which is a critical driver of economic growth. Businesses, too, are not immune to the effects of rising yields. Companies that rely on borrowing to fund expansion or operations may face higher interest expenses, which can impact their profitability and investment decisions.

In addition to affecting consumer and business borrowing costs, rising Treasury yields can influence the broader financial markets. Higher yields often lead to a reallocation of investment portfolios, as investors seek to capitalize on the more attractive returns offered by government bonds. This shift can result in decreased demand for equities, potentially leading to stock market volatility. Furthermore, as yields rise, the cost of capital for companies increases, which can affect their valuations and stock prices. Investors must therefore carefully consider the implications of rising yields on their investment strategies and asset allocations.

While the prospect of higher Treasury yields presents challenges, it is important to recognize that it also reflects a strengthening economy. Rising yields often signal expectations of robust economic growth and inflationary pressures, which can be positive indicators for the overall economic outlook. However, the transition to higher rates must be managed carefully to avoid unintended consequences, such as stifling economic growth or triggering financial instability.

In conclusion, T. Rowe Price’s prediction of a potential rise in 10-year Treasury yields to 5% within six months underscores the interconnectedness of financial markets and the broader economy. As yields rise, mortgage and loan rates are likely to follow suit, impacting consumers, businesses, and investors alike. By understanding these dynamics, stakeholders can better prepare for the potential challenges and opportunities that lie ahead in an environment of rising interest rates. As always, staying informed and proactive in financial planning will be key to navigating this evolving landscape.

Q&A

1. **What is T. Rowe’s prediction regarding 10-year Treasury yields?**

T. Rowe predicts that 10-year Treasury yields could reach 5% in six months.

2. **What is the current context for this prediction?**

The prediction is made in the context of ongoing economic conditions, including inflationary pressures and monetary policy adjustments.

3. **What factors might contribute to the rise in Treasury yields?**

Factors include potential Federal Reserve interest rate hikes, inflation expectations, and economic growth prospects.

4. **How might rising Treasury yields impact the bond market?**

Rising yields typically lead to falling bond prices, affecting bond market valuations and investor returns.

5. **What could be the implications for stock markets?**

Higher yields might lead to increased borrowing costs for companies, potentially impacting stock valuations and investor sentiment.

6. **How might this prediction affect individual investors?**

Individual investors might see changes in their bond portfolio values and could consider adjusting their investment strategies in response to yield changes.

7. **What are potential risks associated with this prediction?**

Risks include the possibility of economic slowdown, unexpected changes in monetary policy, or geopolitical events that could alter yield trajectories.

Conclusion

T. Rowe Price’s prediction that 10-year Treasury yields could reach 5% within six months suggests a significant shift in the bond market, likely driven by expectations of persistent inflationary pressures and potential monetary policy adjustments by the Federal Reserve. If realized, this increase in yields could have broad implications for financial markets, including higher borrowing costs, potential impacts on equity valuations, and shifts in investor asset allocation strategies. Such a rise would reflect a more aggressive stance on interest rates to combat inflation, signaling a period of tighter financial conditions. Investors and policymakers will need to closely monitor economic indicators and central bank communications to navigate the potential challenges and opportunities presented by this forecasted change in the interest rate environment.