“From Algorithms to Oracle: Steve Cohen Bets Big on Buffett’s Wisdom”

Introduction

Steve Cohen, the renowned hedge fund manager and founder of Point72 Asset Management, has made a significant shift in his investment strategy by reducing his holdings in AI-related stocks by 67.5%. This strategic move comes as Cohen reallocates capital towards a top investment pick of legendary investor Warren Buffett. The decision underscores Cohen’s adaptive approach to market dynamics and his confidence in aligning with Buffett’s investment philosophy. By pivoting away from the highly volatile AI sector, Cohen is positioning his portfolio to potentially benefit from the stability and long-term growth prospects associated with Buffett’s favored investments. This reallocation highlights the ongoing influence of Buffett’s investment strategies on prominent market players and reflects broader trends in the investment landscape.

Impact Of Steve Cohen’s Investment Shift On The AI Sector

Steve Cohen, the renowned hedge fund manager and founder of Point72 Asset Management, has recently made a significant shift in his investment strategy by reducing his holdings in artificial intelligence (AI) stocks by 67.5%. This move has captured the attention of investors and analysts alike, as Cohen redirects his focus towards Warren Buffett’s top investment pick. The implications of this strategic pivot are multifaceted, affecting not only the AI sector but also the broader investment landscape.

To understand the impact of Cohen’s decision, it is essential to consider the context in which it occurs. The AI sector has been experiencing rapid growth, driven by advancements in machine learning, data analytics, and automation technologies. These innovations have attracted substantial investments, with many investors viewing AI as a cornerstone of future technological development. However, the sector’s rapid expansion has also led to heightened volatility and inflated valuations, prompting some investors to reassess their positions.

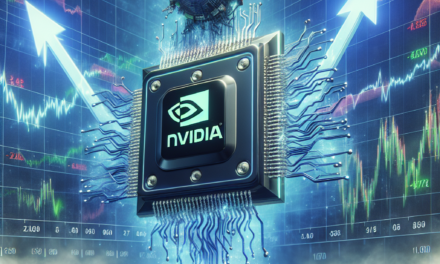

Cohen’s decision to reduce his AI stock holdings can be seen as a response to these market dynamics. By reallocating his investments, he is signaling a cautious approach towards the AI sector’s current valuation levels. This move may prompt other investors to reevaluate their own positions, potentially leading to a cooling effect on the sector’s growth trajectory. As a result, companies within the AI space might experience increased pressure to demonstrate sustainable business models and tangible returns on investment.

Moreover, Cohen’s shift towards Warren Buffett’s top pick underscores a broader trend among investors seeking stability and value in uncertain times. Buffett, known for his value investing philosophy, has long advocated for investments in companies with strong fundamentals and long-term growth potential. By aligning with Buffett’s strategy, Cohen is likely aiming to balance his portfolio with assets that offer more predictable returns, thereby mitigating the risks associated with the high volatility of the AI sector.

This strategic realignment also highlights the influence of prominent investors on market sentiment. As a highly respected figure in the financial world, Cohen’s investment decisions are closely watched by both institutional and retail investors. His move away from AI stocks could lead to a ripple effect, prompting others to follow suit and potentially impacting the flow of capital into the sector. Consequently, AI companies may face increased scrutiny from investors, who will be keen to assess their ability to deliver on growth promises amidst changing market conditions.

In addition to affecting investor sentiment, Cohen’s investment shift may also have implications for innovation within the AI sector. With reduced capital inflows, some companies might encounter challenges in securing funding for research and development initiatives. This could slow down the pace of technological advancements and impact the sector’s ability to maintain its current growth momentum. However, it may also encourage a more disciplined approach to innovation, with companies focusing on projects that offer clear value propositions and competitive advantages.

In conclusion, Steve Cohen’s decision to reduce his AI stock holdings by 67.5% in favor of investing in Warren Buffett’s top pick is a significant development with far-reaching implications. It reflects a cautious stance towards the AI sector’s current valuation levels and highlights a broader trend of seeking stability in uncertain times. As investors and companies navigate this evolving landscape, the focus will likely shift towards sustainable growth and value creation, shaping the future trajectory of the AI sector and the broader investment environment.

Analyzing Warren Buffett’s Top Pick: Why It Attracted Steve Cohen

In the ever-evolving landscape of investment strategies, the decisions of prominent investors often serve as a beacon for market participants seeking to understand emerging trends and opportunities. Recently, the financial world was abuzz with the news that Steve Cohen, the billionaire hedge fund manager and founder of Point72 Asset Management, significantly reduced his holdings in artificial intelligence (AI) stocks by 67.5%. This strategic shift was not merely a reallocation of resources but a calculated move to invest in what is currently Warren Buffett’s top pick. This decision has sparked considerable interest and speculation, prompting a closer examination of the factors that might have influenced Cohen’s investment strategy.

Warren Buffett, the legendary investor known for his value-oriented approach, has long been a proponent of investing in companies with strong fundamentals and sustainable competitive advantages. His top pick, which has now attracted Cohen’s attention, exemplifies these principles. While the specific company remains undisclosed, it is likely characterized by robust financial health, a proven track record of profitability, and a clear path for future growth. These attributes align with Buffett’s investment philosophy, which prioritizes long-term value over short-term gains.

The decision by Steve Cohen to pivot away from AI stocks, despite their recent popularity and potential for innovation, underscores a critical aspect of investment strategy: the importance of diversification and risk management. AI stocks, while promising, are often subject to volatility due to rapid technological advancements and regulatory uncertainties. By reducing his exposure to this sector, Cohen is likely seeking to mitigate potential risks associated with market fluctuations and technological disruptions. This move also reflects a broader trend among investors who are increasingly cautious about overexposure to high-growth sectors that may not yet have fully matured.

Furthermore, Cohen’s decision to align with Buffett’s top pick suggests a strategic alignment with value investing principles. This approach emphasizes investing in companies that are undervalued by the market but possess intrinsic worth that is expected to be realized over time. By shifting his focus to a company endorsed by Buffett, Cohen is likely betting on the stability and resilience of a business that has demonstrated its ability to weather economic cycles and deliver consistent returns.

In addition to the financial metrics, the qualitative aspects of Buffett’s top pick may have also played a role in Cohen’s decision. Companies that attract Buffett’s attention often exhibit strong leadership, a clear vision, and a commitment to ethical business practices. These factors contribute to a company’s long-term success and can enhance investor confidence. By investing in such a company, Cohen is not only aligning with a proven investment strategy but also endorsing a business model that prioritizes sustainable growth and shareholder value.

In conclusion, Steve Cohen’s decision to reduce his AI stock holdings in favor of investing in Warren Buffett’s top pick is a testament to the enduring appeal of value investing. This strategic shift highlights the importance of balancing innovation with stability and underscores the value of aligning with investment philosophies that prioritize long-term growth and resilience. As market dynamics continue to evolve, the actions of influential investors like Cohen and Buffett will undoubtedly continue to shape investment strategies and influence market trends.

The Strategic Implications Of Reducing AI Stock Holdings

In recent financial maneuvers that have captured the attention of investors and analysts alike, Steve Cohen, the renowned hedge fund manager and founder of Point72 Asset Management, has made a significant shift in his investment strategy. By reducing his holdings in artificial intelligence (AI) stocks by a substantial 67.5%, Cohen has redirected his focus towards a top pick of legendary investor Warren Buffett. This strategic reallocation of assets not only highlights the dynamic nature of investment strategies but also underscores the importance of adaptability in the ever-evolving financial landscape.

The decision to reduce AI stock holdings comes at a time when the sector has experienced both remarkable growth and heightened volatility. AI technologies have been at the forefront of innovation, driving advancements across various industries. However, the rapid pace of development and the speculative nature of some AI investments have led to fluctuating valuations. By trimming his exposure to AI stocks, Cohen appears to be mitigating potential risks associated with the sector’s volatility, thereby safeguarding his portfolio against unforeseen downturns.

Transitioning from AI to Warren Buffett’s top pick signifies a strategic pivot towards stability and long-term value. Buffett, known for his value investing philosophy, has consistently advocated for investments in companies with strong fundamentals and sustainable competitive advantages. By aligning with Buffett’s investment choice, Cohen is likely seeking to capitalize on the enduring strength and reliability of such companies. This move reflects a broader trend among investors who are increasingly prioritizing stability and resilience in their portfolios amidst uncertain economic conditions.

Moreover, this shift in investment strategy may also be indicative of Cohen’s confidence in the underlying fundamentals of Buffett’s favored company. While the specific company remains undisclosed, it is reasonable to infer that it possesses attributes that align with Buffett’s investment criteria, such as a robust business model, a strong market position, and a history of consistent performance. By reallocating resources towards this company, Cohen is not only diversifying his portfolio but also potentially positioning himself to benefit from its long-term growth prospects.

In addition to the strategic implications for Cohen’s portfolio, this move also serves as a reminder of the importance of adaptability in investment strategies. The financial markets are inherently dynamic, influenced by a myriad of factors ranging from technological advancements to geopolitical developments. Successful investors, like Cohen, recognize the need to remain agile and responsive to changing market conditions. By adjusting his holdings in response to evolving trends, Cohen exemplifies the proactive approach required to navigate the complexities of modern investing.

Furthermore, this decision underscores the significance of aligning investment strategies with broader economic trends. As the global economy continues to grapple with challenges such as inflationary pressures and supply chain disruptions, investors are increasingly seeking refuge in companies with resilient business models and strong fundamentals. By reducing exposure to the more speculative AI sector and embracing Buffett’s top pick, Cohen is aligning his strategy with these prevailing economic realities.

In conclusion, Steve Cohen’s decision to reduce AI stock holdings by 67.5% in favor of investing in Warren Buffett’s top pick is a strategic move that reflects both a response to market volatility and a commitment to long-term value. This shift not only highlights the importance of adaptability in investment strategies but also underscores the enduring appeal of companies with strong fundamentals. As the financial landscape continues to evolve, Cohen’s actions serve as a testament to the necessity of aligning investment decisions with broader economic trends and the timeless principles of value investing.

Comparing Investment Philosophies: Steve Cohen Vs. Warren Buffett

In the ever-evolving landscape of investment strategies, the recent decision by Steve Cohen to significantly reduce his holdings in AI stocks by 67.5% in favor of investing in Warren Buffett’s top pick has sparked considerable interest among financial analysts and investors alike. This strategic shift not only highlights the contrasting investment philosophies of two of the most influential figures in the financial world but also underscores the dynamic nature of market opportunities and risks.

Steve Cohen, renowned for his aggressive and often short-term trading strategies, has built a reputation for capitalizing on market inefficiencies and leveraging advanced technologies, including artificial intelligence, to gain a competitive edge. His decision to scale back on AI stocks, which have been a cornerstone of his portfolio, suggests a reevaluation of the risk-reward balance in this rapidly growing sector. While AI continues to promise transformative potential across various industries, the volatility and speculative nature of many AI stocks may have prompted Cohen to seek more stable and predictable returns.

In contrast, Warren Buffett, the legendary investor known for his value-oriented approach, has consistently advocated for investing in companies with strong fundamentals, competitive advantages, and long-term growth prospects. Buffett’s top pick, which has now attracted Cohen’s attention, likely embodies these characteristics, offering a more conservative yet potentially rewarding investment opportunity. This alignment with Buffett’s philosophy indicates a strategic pivot for Cohen, who may be seeking to diversify his portfolio and mitigate risks associated with the high-stakes world of AI investments.

The juxtaposition of Cohen’s and Buffett’s investment philosophies provides a fascinating lens through which to examine the broader trends in the financial markets. Cohen’s data-driven, technology-focused approach often leads to rapid shifts in portfolio composition, reflecting his responsiveness to market signals and emerging trends. On the other hand, Buffett’s emphasis on intrinsic value and long-term growth fosters a more patient and disciplined investment strategy, often resulting in a more stable portfolio over time.

This divergence in strategies also highlights the importance of adaptability in the face of changing market conditions. As technological advancements continue to reshape industries, investors like Cohen must balance the allure of innovation with the inherent risks of volatility and uncertainty. Meanwhile, Buffett’s steadfast commitment to value investing serves as a reminder of the enduring principles that can guide investors through market fluctuations.

Moreover, Cohen’s recent move underscores the significance of diversification in investment portfolios. By reallocating resources from AI stocks to Buffett’s top pick, Cohen is not only hedging against potential downturns in the tech sector but also positioning himself to capitalize on opportunities in other areas of the market. This strategic diversification aligns with a broader trend among investors seeking to balance growth potential with risk management.

In conclusion, Steve Cohen’s decision to reduce his AI stock holdings in favor of investing in Warren Buffett’s top pick offers a compelling case study in contrasting investment philosophies. While Cohen’s shift may signal a temporary retreat from the high-risk, high-reward world of AI, it also reflects a strategic alignment with Buffett’s value-driven approach. As the financial landscape continues to evolve, the interplay between these two investment titans will undoubtedly provide valuable insights for investors navigating the complexities of modern markets.

Market Reactions To Steve Cohen’s Portfolio Changes

In recent developments within the financial markets, Steve Cohen, the renowned hedge fund manager and owner of the New York Mets, has made a significant shift in his investment strategy. Cohen’s decision to reduce his holdings in artificial intelligence (AI) stocks by a substantial 67.5% has captured the attention of investors and analysts alike. This strategic move comes as Cohen reallocates his capital towards a more traditional investment, aligning with Warren Buffett’s top pick. The market’s reaction to this portfolio adjustment has been both swift and varied, reflecting the broader sentiment towards AI stocks and the enduring influence of Buffett’s investment philosophy.

Cohen’s decision to scale back his AI stock holdings is particularly noteworthy given the recent surge in interest and investment in the AI sector. Over the past few years, AI has been heralded as a transformative force across various industries, promising to revolutionize everything from healthcare to finance. However, despite the potential for growth, the sector has also been characterized by volatility and speculative valuations. By reducing his exposure to AI, Cohen appears to be signaling a more cautious approach, perhaps in response to concerns about overvaluation or the inherent risks associated with emerging technologies.

Simultaneously, Cohen’s pivot towards Warren Buffett’s top pick underscores a return to more traditional investment principles. Buffett, known for his value investing strategy, has long advocated for investments in companies with strong fundamentals, competitive advantages, and consistent earnings. By aligning with Buffett’s choice, Cohen may be seeking stability and long-term growth potential, qualities that are often associated with Buffett’s investment style. This move could also be interpreted as a vote of confidence in the enduring relevance of value investing, even in an era dominated by technological innovation.

The market’s reaction to Cohen’s portfolio changes has been multifaceted. On one hand, the reduction in AI stock holdings has prompted some investors to reevaluate their own positions in the sector. The move has sparked discussions about the sustainability of current valuations and the potential for a market correction. On the other hand, Cohen’s investment in Buffett’s top pick has been met with interest and curiosity, as market participants seek to identify the specific company or companies that have captured Cohen’s attention. This shift has also reignited debates about the merits of value investing versus growth investing, with proponents of each strategy closely monitoring the performance of Cohen’s revised portfolio.

Moreover, Cohen’s actions have highlighted the broader trend of diversification among institutional investors. As market conditions evolve and new opportunities emerge, investors are increasingly seeking to balance their portfolios by incorporating a mix of growth-oriented and value-oriented assets. This approach not only mitigates risk but also positions investors to capitalize on a range of market scenarios. In this context, Cohen’s decision can be seen as part of a larger strategy to navigate the complexities of the current investment landscape.

In conclusion, Steve Cohen’s reduction of AI stock holdings and subsequent investment in Warren Buffett’s top pick has generated significant interest and discussion within the financial community. As investors assess the implications of these moves, the broader themes of valuation, risk management, and investment strategy continue to shape market dynamics. Ultimately, Cohen’s actions serve as a reminder of the ever-evolving nature of investing and the importance of adaptability in achieving long-term success.

Future Trends In AI Investments Post-Cohen’s Decision

Steve Cohen, the renowned hedge fund manager and founder of Point72 Asset Management, recently made headlines by significantly reducing his holdings in AI stocks by 67.5%. This strategic move has sparked widespread discussion among investors and analysts, as Cohen redirected his focus towards investing in Warren Buffett’s top pick. This decision not only highlights the dynamic nature of investment strategies but also raises questions about the future trends in AI investments.

To understand the implications of Cohen’s decision, it is essential to consider the broader context of the AI industry. Artificial intelligence has been a focal point for investors over the past decade, with its potential to revolutionize various sectors, from healthcare to finance. The rapid advancements in machine learning, natural language processing, and robotics have fueled a surge in AI-related investments. However, as with any burgeoning industry, the AI sector is not without its challenges. Issues such as ethical concerns, regulatory hurdles, and the need for substantial capital investment have led some investors to reassess their positions.

Cohen’s decision to reduce his AI stock holdings may reflect a growing sentiment among investors to adopt a more cautious approach. While AI continues to offer promising opportunities, the market has become increasingly competitive, with numerous companies vying for dominance. This saturation can lead to volatility, prompting investors to seek more stable alternatives. By shifting his focus to Warren Buffett’s top pick, Cohen may be signaling a preference for investments with a proven track record and a more predictable growth trajectory.

Warren Buffett, known for his value investing philosophy, has long been an advocate for investing in companies with strong fundamentals and sustainable competitive advantages. His top pick, which Cohen has now embraced, likely embodies these principles. This move suggests a potential trend where investors might prioritize established companies with robust business models over speculative ventures in emerging technologies. Such a shift could lead to a reevaluation of investment strategies within the AI sector, as stakeholders seek to balance innovation with stability.

Moreover, Cohen’s decision could influence other institutional investors to reconsider their AI portfolios. As a prominent figure in the financial world, his actions often serve as a barometer for market sentiment. If other investors follow suit, we may witness a recalibration of capital flows within the AI industry. This could result in a more selective investment landscape, where only the most promising AI companies with clear paths to profitability attract significant funding.

In addition to impacting investment strategies, Cohen’s move may also prompt AI companies to reassess their business models. To attract and retain investor interest, these companies might need to demonstrate not only technological innovation but also financial viability and resilience. This could lead to a greater emphasis on developing sustainable revenue streams and achieving operational efficiency.

In conclusion, Steve Cohen’s decision to reduce his AI stock holdings and invest in Warren Buffett’s top pick underscores the evolving nature of investment strategies in the face of emerging technologies. While AI remains a field with immense potential, investors may increasingly seek a balance between innovation and stability. As the industry continues to mature, companies that can navigate these dynamics successfully are likely to emerge as leaders in the next phase of AI investment.

Lessons For Investors From Steve Cohen’s Recent Moves

Steve Cohen, the renowned hedge fund manager and founder of Point72 Asset Management, has recently made a significant shift in his investment strategy, reducing his holdings in artificial intelligence (AI) stocks by 67.5%. This move has captured the attention of investors and market analysts alike, as Cohen redirects his focus towards a top pick of legendary investor Warren Buffett. This strategic pivot offers valuable lessons for investors seeking to navigate the complexities of the stock market.

To begin with, Cohen’s decision to reduce his AI stock holdings underscores the importance of adaptability in investment strategies. The AI sector, while promising and innovative, is also characterized by volatility and rapid technological advancements. By scaling back his investments in this area, Cohen demonstrates a willingness to reassess and realign his portfolio in response to changing market conditions. This flexibility is crucial for investors who aim to optimize their returns while managing risk effectively.

Moreover, Cohen’s move highlights the significance of diversification in investment portfolios. By reallocating funds from AI stocks to Warren Buffett’s top pick, Cohen is not only reducing his exposure to a single sector but also embracing a more balanced approach. Diversification is a fundamental principle in investing, as it helps mitigate risks associated with market fluctuations and sector-specific downturns. Investors can learn from Cohen’s example by ensuring their portfolios are well-diversified across various industries and asset classes.

In addition to diversification, Cohen’s investment shift emphasizes the value of aligning with proven investment philosophies. Warren Buffett, known for his value investing approach, has consistently advocated for investing in companies with strong fundamentals, competitive advantages, and long-term growth potential. By choosing to invest in Buffett’s top pick, Cohen is aligning himself with these principles, which have stood the test of time. This alignment suggests that investors can benefit from studying and adopting successful investment strategies that have been validated by industry veterans.

Furthermore, Cohen’s recent moves serve as a reminder of the importance of thorough research and due diligence. The decision to reduce AI stock holdings and invest in a Buffett-endorsed company likely involved extensive analysis and evaluation of market trends, company performance, and future prospects. Investors should take note of the diligence required to make informed investment decisions. Conducting comprehensive research and staying informed about market developments are essential practices for anyone looking to achieve long-term success in the stock market.

Finally, Cohen’s actions illustrate the potential benefits of patience and a long-term perspective. While the allure of AI stocks may be strong due to their potential for rapid growth, Cohen’s shift towards a more stable investment reflects a commitment to sustainable, long-term gains. This approach aligns with Buffett’s philosophy of holding investments for the long haul, allowing time for the intrinsic value of companies to be realized. Investors can learn from this by resisting the temptation of short-term market trends and focusing on building a portfolio that can withstand the test of time.

In conclusion, Steve Cohen’s recent reduction in AI stock holdings and subsequent investment in Warren Buffett’s top pick offer several valuable lessons for investors. By emphasizing adaptability, diversification, alignment with proven strategies, thorough research, and a long-term perspective, Cohen provides a blueprint for navigating the ever-evolving landscape of the stock market. As investors seek to emulate his success, these principles can serve as guiding lights on their own investment journeys.

Q&A

1. **Who is Steve Cohen?**

Steve Cohen is a billionaire hedge fund manager and the founder of Point72 Asset Management.

2. **What action did Steve Cohen take regarding AI stocks?**

Steve Cohen reduced his holdings in AI stocks by 67.5%.

3. **Why did Steve Cohen reduce his AI stock holdings?**

The specific reasons for the reduction are not detailed, but it may be part of a strategic reallocation of his investment portfolio.

4. **What did Steve Cohen invest in after reducing AI stock holdings?**

He invested in Warren Buffett’s top pick, though the specific stock is not mentioned.

5. **Who is Warren Buffett?**

Warren Buffett is a renowned investor and the chairman and CEO of Berkshire Hathaway.

6. **What is Warren Buffett’s top pick that Steve Cohen invested in?**

The specific stock is not mentioned, but it is implied to be a significant and strategic investment choice.

7. **What is the significance of Steve Cohen’s investment shift?**

The shift indicates a strategic move to align with Warren Buffett’s investment choices, possibly reflecting confidence in Buffett’s investment strategy.

Conclusion

Steve Cohen’s decision to reduce his AI stock holdings by 67.5% in favor of investing in Warren Buffett’s top pick suggests a strategic shift in his investment approach. This move indicates a potential reevaluation of the growth prospects or risk associated with AI stocks, while showing confidence in the stability or potential returns of Buffett’s favored investment. By aligning with Buffett’s choice, Cohen may be seeking to capitalize on a more established or undervalued opportunity, reflecting a preference for a potentially safer or more promising investment avenue amidst market uncertainties.