“Brewing Concerns: Starbucks Faces Slump with Weak Q4 Sales in Key Markets”

Introduction

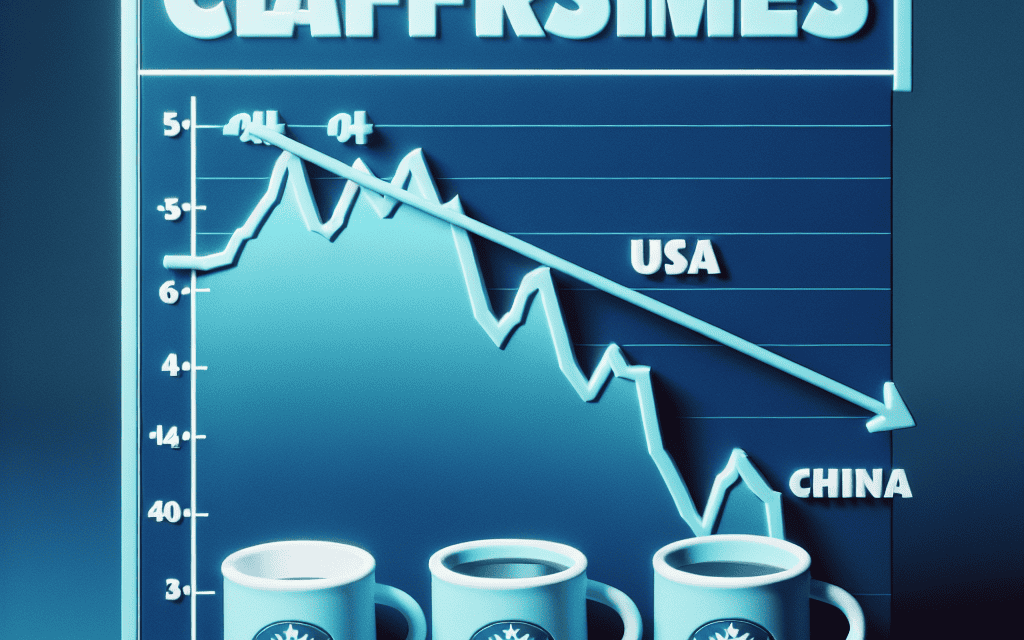

Starbucks Corporation experienced a notable decline in its stock value following the release of its fourth-quarter financial results, which revealed weaker-than-expected sales in both the United States and China. The coffee giant, known for its global presence and robust brand, faced challenges in its two largest markets, leading to investor concerns and a subsequent drop in share prices. In the U.S., the company struggled with slower customer traffic and increased competition, while in China, economic uncertainties and changing consumer behaviors impacted sales growth. These factors combined to create a challenging environment for Starbucks, prompting a reevaluation of its strategies to regain momentum in these critical regions.

Impact Of Weak Q4 Sales On Starbucks Stock Performance

Starbucks Corporation, a global leader in the coffeehouse industry, recently experienced a notable decline in its stock performance, primarily attributed to weaker-than-expected fourth-quarter sales in its two largest markets, the United States and China. This downturn has raised concerns among investors and analysts, prompting a closer examination of the factors contributing to this financial setback and its potential implications for the company’s future.

To begin with, the United States, which represents Starbucks’ largest market, has shown signs of slowing growth. Despite the company’s efforts to innovate and expand its product offerings, including the introduction of new seasonal beverages and an enhanced food menu, consumer spending has not met expectations. Several factors may have contributed to this trend, including increased competition from other coffee chains and local cafes, as well as changing consumer preferences towards more health-conscious and sustainable options. Additionally, inflationary pressures have led to higher operational costs, which, in turn, have affected pricing strategies and consumer purchasing power.

Meanwhile, in China, Starbucks’ second-largest market, the situation is equally challenging. The Chinese economy has been grappling with a series of headwinds, including a slowdown in economic growth and ongoing trade tensions with the United States. These macroeconomic factors have dampened consumer confidence and spending, directly impacting Starbucks’ sales in the region. Furthermore, the resurgence of COVID-19 cases in certain areas has led to intermittent lockdowns and restrictions, further disrupting business operations and consumer foot traffic in Starbucks stores.

In light of these challenges, Starbucks’ management has acknowledged the need for strategic adjustments to navigate the current landscape. The company is focusing on enhancing its digital capabilities, recognizing the growing importance of mobile ordering and delivery services in driving sales. By investing in technology and improving the customer experience through its mobile app, Starbucks aims to capture a larger share of the digital market and cater to the evolving preferences of its customer base.

Moreover, Starbucks is committed to expanding its presence in international markets beyond the United States and China. By diversifying its geographic footprint, the company seeks to mitigate risks associated with over-reliance on a few key markets. This strategy involves opening new stores in emerging markets, where there is significant potential for growth, and tailoring its offerings to meet local tastes and preferences.

Despite these proactive measures, the immediate impact of weak fourth-quarter sales on Starbucks’ stock performance cannot be overlooked. The decline in stock value reflects investor apprehension about the company’s ability to sustain its growth trajectory in the face of mounting challenges. Consequently, Starbucks must demonstrate resilience and adaptability to regain investor confidence and stabilize its stock performance.

In conclusion, the recent decline in Starbucks’ stock performance underscores the complex interplay of factors affecting its sales in the United States and China. While the company faces significant challenges, its strategic initiatives aimed at enhancing digital capabilities and expanding into new markets offer a pathway to recovery. As Starbucks navigates this period of uncertainty, its ability to adapt to changing market dynamics and consumer preferences will be crucial in determining its long-term success and stock performance. Investors and stakeholders will be closely monitoring the company’s progress in addressing these challenges and capitalizing on new opportunities for growth.

Analyzing Starbucks’ Q4 Sales Decline In The US And China

Starbucks, the global coffeehouse chain, recently experienced a notable decline in its stock value following the release of its fourth-quarter sales report, which revealed weaker-than-expected performance in both the United States and China. This downturn has raised concerns among investors and analysts, prompting a closer examination of the factors contributing to the company’s disappointing results in these key markets. As the United States and China represent Starbucks’ largest and most significant markets, understanding the dynamics at play is crucial for assessing the company’s future prospects.

In the United States, Starbucks has long been a staple of the coffee culture, with a vast network of stores catering to a diverse customer base. However, the fourth-quarter sales figures indicate a slowdown in growth, which can be attributed to several factors. Firstly, the competitive landscape in the U.S. coffee market has intensified, with numerous local and national chains vying for consumer attention. This increased competition has pressured Starbucks to innovate and differentiate its offerings continually. Additionally, changing consumer preferences, particularly among younger demographics, have led to a shift towards more artisanal and specialty coffee experiences, which some perceive as lacking in the traditional Starbucks model.

Moreover, the economic environment in the United States has also played a role in the company’s sales performance. Inflationary pressures have led to higher costs for both consumers and businesses, impacting discretionary spending. As a result, some consumers may be opting for more affordable coffee options or reducing their frequency of visits to premium coffeehouses like Starbucks. Furthermore, labor shortages and supply chain disruptions have posed operational challenges, affecting store efficiency and customer satisfaction.

Turning to China, Starbucks has faced a different set of challenges that have contributed to its weak sales performance. The Chinese market, which has been a significant growth driver for the company in recent years, has been affected by a combination of economic and regulatory factors. The Chinese economy has experienced a slowdown, partly due to ongoing trade tensions and domestic policy shifts. This economic uncertainty has dampened consumer confidence and spending, impacting Starbucks’ sales in the region.

Additionally, the Chinese government has implemented stricter regulations on foreign businesses, which have created operational hurdles for Starbucks. These regulations have necessitated adjustments in the company’s business strategies, including store expansion plans and supply chain management. Furthermore, the rise of local coffee brands and the increasing popularity of tea culture in China have intensified competition, challenging Starbucks’ market dominance.

Despite these challenges, Starbucks remains committed to its long-term growth strategy in both the United States and China. The company has announced plans to invest in digital innovation, enhance its loyalty program, and expand its product offerings to cater to evolving consumer preferences. In China, Starbucks aims to strengthen its presence by opening new stores in emerging cities and leveraging partnerships with local companies to enhance its market position.

In conclusion, the recent decline in Starbucks’ stock value following weak fourth-quarter sales in the United States and China underscores the complex and evolving nature of the global coffee market. While the company faces significant challenges in these key regions, its strategic initiatives and commitment to innovation provide a foundation for potential recovery and growth. As Starbucks navigates these turbulent times, its ability to adapt to changing market dynamics and consumer preferences will be crucial in determining its future success.

Investor Reactions To Starbucks’ Q4 Financial Results

Starbucks Corporation recently released its fourth-quarter financial results, revealing weaker-than-expected sales in both the United States and China, two of its most significant markets. This announcement has led to a noticeable decline in the company’s stock price, prompting a range of reactions from investors. The coffee giant, known for its robust global presence and strong brand loyalty, has faced several challenges that have contributed to its underwhelming performance in these key regions.

In the United States, Starbucks has been grappling with shifting consumer preferences and increased competition from both established coffee chains and emerging local cafes. The rise of remote work has also altered consumer habits, reducing the frequency of morning coffee runs that once drove significant foot traffic to its stores. Despite efforts to adapt by expanding its digital offerings and enhancing its loyalty program, the company has struggled to fully recapture its pre-pandemic momentum. Consequently, the U.S. market, which traditionally serves as a cornerstone of Starbucks’ revenue, has not met the growth expectations set by analysts.

Meanwhile, in China, Starbucks has encountered a different set of challenges. The Chinese market, which the company has long viewed as a critical growth engine, has been affected by ongoing economic uncertainties and fluctuating consumer confidence. Additionally, the resurgence of COVID-19 cases in certain regions has led to intermittent lockdowns and restrictions, further dampening consumer spending and foot traffic in Starbucks stores. The competitive landscape in China has also intensified, with local coffee brands gaining traction and offering formidable competition to the Seattle-based coffee chain.

As a result of these factors, Starbucks’ overall sales growth has been slower than anticipated, leading to a decline in its stock price. Investors, who had been optimistic about the company’s ability to navigate these challenges, have expressed concern over its future growth prospects. The stock’s decline reflects a broader apprehension about the company’s ability to sustain its market position amid evolving consumer behaviors and heightened competition.

In response to the disappointing financial results, Starbucks’ management has outlined several strategic initiatives aimed at revitalizing growth. These include plans to accelerate store openings in high-potential markets, enhance digital engagement through its mobile app, and introduce new product offerings tailored to local tastes. Additionally, the company is focusing on sustainability initiatives, which it believes will resonate with environmentally conscious consumers and strengthen its brand image.

Despite these efforts, investor sentiment remains cautious. Analysts have pointed out that while Starbucks’ strategic initiatives are promising, their successful implementation will be crucial in determining the company’s ability to regain its growth trajectory. The challenges in both the U.S. and China are complex and multifaceted, requiring a nuanced approach that balances short-term recovery with long-term sustainability.

In conclusion, Starbucks’ recent financial results have sparked a wave of investor reactions, reflecting concerns over the company’s ability to navigate the current market dynamics. While the stock’s decline underscores these apprehensions, it also highlights the importance of strategic adaptability in an ever-changing global landscape. As Starbucks moves forward, its ability to effectively address these challenges will be pivotal in restoring investor confidence and achieving sustained growth.

Strategies Starbucks Could Implement To Recover From Q4 Losses

Starbucks, a global leader in the coffee industry, recently faced a significant setback as its stock fell following weaker-than-expected fourth-quarter sales in both the United States and China. This decline has prompted investors and analysts to scrutinize the company’s strategies and explore potential avenues for recovery. To regain its footing, Starbucks could consider implementing a series of strategic initiatives aimed at revitalizing its growth trajectory and restoring investor confidence.

Firstly, Starbucks might benefit from enhancing its digital engagement strategies. In an era where digital transformation is pivotal, the company could further leverage its mobile app and loyalty program to drive customer engagement and increase sales. By offering personalized promotions and rewards, Starbucks can foster a deeper connection with its customers, encouraging repeat visits and higher spending. Additionally, expanding its delivery services through partnerships with third-party platforms could tap into the growing demand for convenience, particularly in urban areas where time is a premium commodity.

Moreover, Starbucks could focus on diversifying its product offerings to cater to evolving consumer preferences. With an increasing number of consumers seeking healthier and more sustainable options, the company could expand its menu to include a wider range of plant-based and low-calorie beverages. This approach not only aligns with current market trends but also positions Starbucks as a brand that is responsive to the needs of health-conscious consumers. Furthermore, introducing limited-time seasonal offerings can create a sense of urgency and excitement, driving foot traffic and boosting sales during key periods.

In addition to product diversification, Starbucks could enhance its in-store experience to attract and retain customers. By investing in store redesigns and incorporating elements that reflect local culture and aesthetics, the company can create a more inviting and personalized atmosphere. This strategy not only differentiates Starbucks from its competitors but also fosters a sense of community and belonging among its patrons. Furthermore, training staff to deliver exceptional customer service can enhance the overall experience, encouraging customers to choose Starbucks as their preferred coffee destination.

Expanding its presence in emerging markets could also serve as a catalyst for Starbucks’ recovery. While the company has a strong foothold in developed markets, there is significant untapped potential in regions such as Southeast Asia and Latin America. By tailoring its offerings to suit local tastes and preferences, Starbucks can capture a larger share of these growing markets. Strategic partnerships with local businesses and suppliers can facilitate this expansion, ensuring that the brand resonates with local consumers while maintaining its global appeal.

Lastly, Starbucks could strengthen its commitment to sustainability and corporate social responsibility. As consumers become increasingly conscious of environmental and social issues, demonstrating a genuine commitment to sustainability can enhance brand loyalty and attract a broader customer base. Initiatives such as reducing single-use plastics, sourcing ethically produced coffee, and supporting community development projects can position Starbucks as a leader in responsible business practices.

In conclusion, while the recent decline in Starbucks’ stock is a cause for concern, it also presents an opportunity for the company to reassess and refine its strategies. By focusing on digital engagement, product diversification, in-store experience enhancement, market expansion, and sustainability, Starbucks can navigate the challenges it faces and emerge stronger. These strategic initiatives, if executed effectively, have the potential to not only recover from the Q4 losses but also set the stage for sustained growth and success in the future.

Comparing Starbucks’ Q4 Sales With Competitors In The Coffee Industry

In the latest financial quarter, Starbucks has faced a notable decline in its stock value, primarily driven by weaker-than-expected sales in both the United States and China. This downturn has sparked considerable interest among investors and industry analysts, particularly when comparing Starbucks’ performance to its competitors in the coffee industry. As the global coffee market continues to evolve, understanding the dynamics at play is crucial for stakeholders seeking to navigate this complex landscape.

To begin with, Starbucks has long been a dominant force in the coffee industry, renowned for its expansive global presence and strong brand loyalty. However, the recent Q4 sales figures have highlighted vulnerabilities in its business model, especially in key markets like the US and China. In the United States, where Starbucks has traditionally enjoyed robust sales, the company has faced increased competition from both established and emerging players. Competitors such as Dunkin’ and McDonald’s have intensified their efforts to capture a larger share of the coffee market, offering competitive pricing and innovative menu options that appeal to a broad consumer base. This heightened competition has undoubtedly impacted Starbucks’ ability to maintain its growth trajectory.

Moreover, the situation in China presents its own set of challenges. As one of Starbucks’ most significant growth markets, China has been a focal point for the company’s expansion strategy. However, the recent economic slowdown and changing consumer preferences have posed obstacles to Starbucks’ growth ambitions. Local competitors, such as Luckin Coffee, have capitalized on these shifts by leveraging technology and aggressive pricing strategies to attract cost-conscious consumers. Consequently, Starbucks has found it increasingly difficult to sustain its market share in this rapidly evolving environment.

In contrast, some of Starbucks’ competitors have managed to navigate these challenges more effectively. For instance, Dunkin’ has successfully capitalized on its value-oriented positioning, appealing to consumers seeking affordable yet high-quality coffee options. By focusing on convenience and speed, Dunkin’ has managed to maintain steady sales growth, even as Starbucks grapples with its current challenges. Similarly, McDonald’s has leveraged its extensive global footprint and diversified menu offerings to attract a wide range of customers, thereby mitigating the impact of market fluctuations.

Furthermore, the rise of specialty coffee chains and independent cafes has added another layer of complexity to the competitive landscape. These smaller players have carved out a niche by emphasizing unique, artisanal coffee experiences that resonate with discerning consumers. As a result, Starbucks faces pressure not only from large-scale competitors but also from these nimble, innovative entities that continue to gain traction in the market.

In light of these developments, Starbucks is actively exploring strategies to regain its competitive edge. The company is investing in digital initiatives, such as mobile ordering and loyalty programs, to enhance customer engagement and drive sales. Additionally, Starbucks is focusing on expanding its product offerings, including plant-based and premium beverage options, to cater to evolving consumer preferences. While these efforts are promising, it remains to be seen whether they will be sufficient to counteract the challenges posed by its competitors.

In conclusion, the recent decline in Starbucks’ stock amid weak Q4 sales in the US and China underscores the intensifying competition within the coffee industry. As Starbucks navigates this challenging landscape, its ability to adapt and innovate will be critical in determining its future success. By closely monitoring the strategies of its competitors and responding to changing market dynamics, Starbucks can position itself to regain its footing and continue to thrive in the global coffee market.

Long-term Implications Of Q4 Sales Decline For Starbucks’ Global Strategy

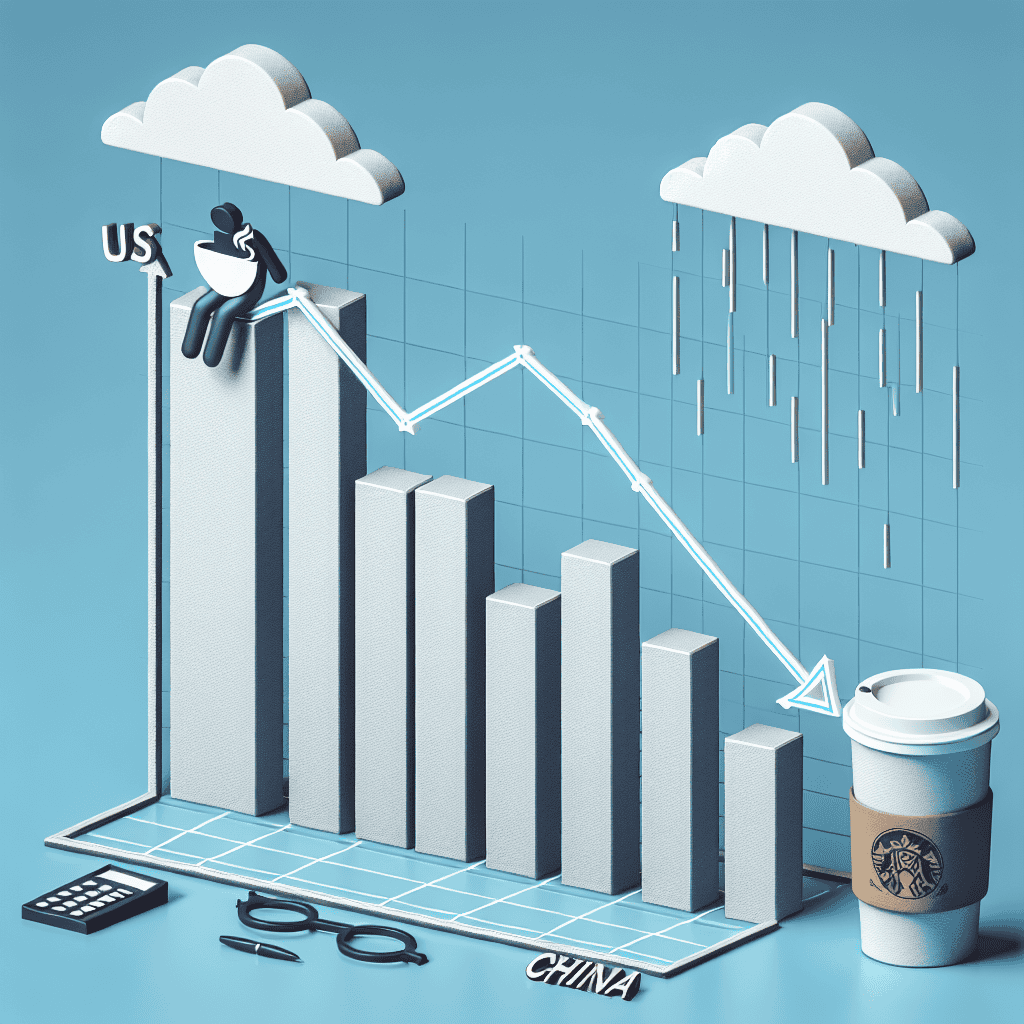

Starbucks, a global leader in the coffee industry, recently faced a significant setback as its stock fell following the announcement of weaker-than-expected fourth-quarter sales in both the United States and China. This development has raised concerns about the long-term implications for the company’s global strategy. As Starbucks navigates these challenges, it is crucial to examine the factors contributing to the sales decline and how the company might adapt its strategy to sustain growth in an increasingly competitive market.

To begin with, the decline in sales in the United States, Starbucks’ largest market, can be attributed to several factors. The ongoing economic uncertainty has led to reduced consumer spending, particularly in discretionary categories such as premium coffee. Additionally, the rise of remote work has altered consumer habits, with fewer people commuting and thus less frequent visits to Starbucks locations. This shift in consumer behavior necessitates a reevaluation of Starbucks’ traditional business model, which has heavily relied on high foot traffic in urban centers.

Meanwhile, in China, Starbucks faces a different set of challenges. The Chinese market, which has been a significant growth driver for the company, is experiencing a slowdown due to a combination of economic headwinds and increased competition from local coffee chains. Moreover, the lingering effects of the COVID-19 pandemic have disrupted supply chains and consumer confidence, further complicating Starbucks’ efforts to maintain its growth trajectory in the region. As a result, the company must consider innovative strategies to strengthen its foothold in China, such as expanding its digital presence and enhancing its delivery services to cater to changing consumer preferences.

In light of these challenges, Starbucks’ global strategy must evolve to address both immediate concerns and long-term growth opportunities. One potential avenue for growth is the expansion of its digital ecosystem. By leveraging technology, Starbucks can enhance customer engagement through personalized marketing and loyalty programs, thereby driving sales both in-store and online. Furthermore, the company can explore partnerships with delivery platforms to reach a broader customer base, particularly in markets where physical store expansion may be constrained.

Another critical aspect of Starbucks’ global strategy is sustainability. As consumers become increasingly conscious of environmental issues, Starbucks has the opportunity to differentiate itself by committing to sustainable practices. This includes reducing its carbon footprint, sourcing ethically produced coffee, and minimizing waste through innovative packaging solutions. By aligning its business practices with consumer values, Starbucks can strengthen its brand reputation and foster long-term customer loyalty.

Moreover, Starbucks must continue to innovate its product offerings to stay ahead of competitors. This involves not only introducing new beverages and food items but also adapting its menu to cater to local tastes and preferences. By doing so, Starbucks can maintain its relevance in diverse markets and attract a wider range of customers.

In conclusion, the recent decline in fourth-quarter sales in the United States and China presents significant challenges for Starbucks. However, by adapting its global strategy to address these issues, the company can position itself for sustained growth. Through digital innovation, a commitment to sustainability, and a focus on product diversification, Starbucks can navigate the complexities of the current market environment and continue to thrive as a leader in the global coffee industry. As the company moves forward, it will be essential to remain agile and responsive to changing consumer dynamics, ensuring that it remains a beloved brand worldwide.

Market Analysts’ Predictions For Starbucks Stock Post-Q4 Results

Starbucks Corporation, a global leader in the coffeehouse industry, recently experienced a notable decline in its stock value following the release of its fourth-quarter sales results. The company’s performance in two of its most significant markets, the United States and China, fell short of expectations, prompting market analysts to reassess their predictions for Starbucks’ stock in the coming months. As investors digest the implications of these results, it is crucial to understand the factors contributing to the sales slump and the potential strategies Starbucks might employ to regain its footing.

To begin with, the U.S. market, which accounts for a substantial portion of Starbucks’ revenue, has shown signs of saturation. Despite the company’s efforts to innovate its menu and enhance customer experience, the competitive landscape in the U.S. has intensified. Rivals, both large and small, have been aggressively expanding their presence, offering consumers a wider array of choices. This increased competition has made it challenging for Starbucks to maintain its growth trajectory. Furthermore, inflationary pressures have led to higher operational costs, which, coupled with cautious consumer spending, have impacted the company’s bottom line.

Meanwhile, in China, Starbucks faces a different set of challenges. The Chinese market, once seen as a significant growth driver for the company, has been affected by a slower-than-expected economic recovery. The lingering effects of the COVID-19 pandemic, coupled with regulatory changes and shifting consumer preferences, have dampened sales growth. Additionally, local competitors have been gaining ground, offering products that resonate more closely with Chinese consumers’ tastes and preferences. This competitive pressure has necessitated a reevaluation of Starbucks’ strategy in the region.

In light of these challenges, market analysts are closely monitoring Starbucks’ strategic responses. One potential area of focus is digital innovation. Starbucks has been investing in its digital ecosystem, including mobile ordering and loyalty programs, to enhance customer engagement and streamline operations. Analysts believe that further advancements in this area could help Starbucks differentiate itself from competitors and drive sales growth. Moreover, expanding delivery services and leveraging data analytics to personalize customer experiences could also prove beneficial.

Another critical aspect is Starbucks’ commitment to sustainability and social responsibility. As consumers become increasingly conscious of environmental and social issues, companies that prioritize these values are likely to gain favor. Starbucks has made strides in this area, with initiatives aimed at reducing waste, supporting ethical sourcing, and promoting diversity and inclusion. Analysts suggest that strengthening these efforts could enhance the company’s brand image and attract a broader customer base.

Looking ahead, market analysts remain cautiously optimistic about Starbucks’ long-term prospects. While the current challenges are significant, the company’s strong brand equity, global presence, and history of innovation provide a solid foundation for recovery. Analysts predict that if Starbucks can effectively address the issues in its key markets and capitalize on emerging opportunities, its stock could rebound in the future. However, they also caution that the path to recovery may be gradual, requiring strategic agility and a keen understanding of evolving consumer dynamics.

In conclusion, the recent dip in Starbucks’ stock following weak Q4 sales in the U.S. and China has prompted a reevaluation of its market position. While challenges persist, particularly in terms of competition and economic conditions, strategic initiatives focused on digital innovation and sustainability could pave the way for renewed growth. As Starbucks navigates this complex landscape, market analysts will continue to assess its performance and adjust their predictions accordingly, keeping a close eye on the company’s ability to adapt and thrive in an ever-changing market environment.

Q&A

1. **What caused Starbucks stock to fall?**

Weak Q4 sales in both the US and China led to the decline in Starbucks stock.

2. **How did Starbucks perform in the US market during Q4?**

Starbucks experienced weaker-than-expected sales growth in the US market during Q4.

3. **What was the impact of the Chinese market on Starbucks’ Q4 performance?**

The Chinese market also showed disappointing sales figures, contributing to the overall weak performance in Q4.

4. **Did Starbucks meet its sales expectations for Q4?**

No, Starbucks did not meet its sales expectations for Q4 due to underperformance in key markets.

5. **How did investors react to Starbucks’ Q4 sales report?**

Investors reacted negatively, leading to a decline in Starbucks stock value.

6. **What are the potential reasons for the weak sales in China?**

Potential reasons could include economic challenges, increased competition, or changing consumer preferences in China.

7. **What might Starbucks do to improve future sales?**

Starbucks might focus on strategic initiatives such as menu innovation, digital engagement, and expanding its presence in emerging markets to improve future sales.

Conclusion

Starbucks experienced a decline in its stock value following the announcement of weaker-than-expected fourth-quarter sales in both the U.S. and China. The disappointing performance in these key markets raised concerns among investors about the company’s growth prospects and its ability to navigate ongoing economic challenges. The sales shortfall in the U.S. may reflect changing consumer behaviors or increased competition, while the underperformance in China could be attributed to lingering impacts of the pandemic and economic uncertainties. This situation underscores the need for Starbucks to reassess its strategies in these critical regions to regain investor confidence and drive future growth.