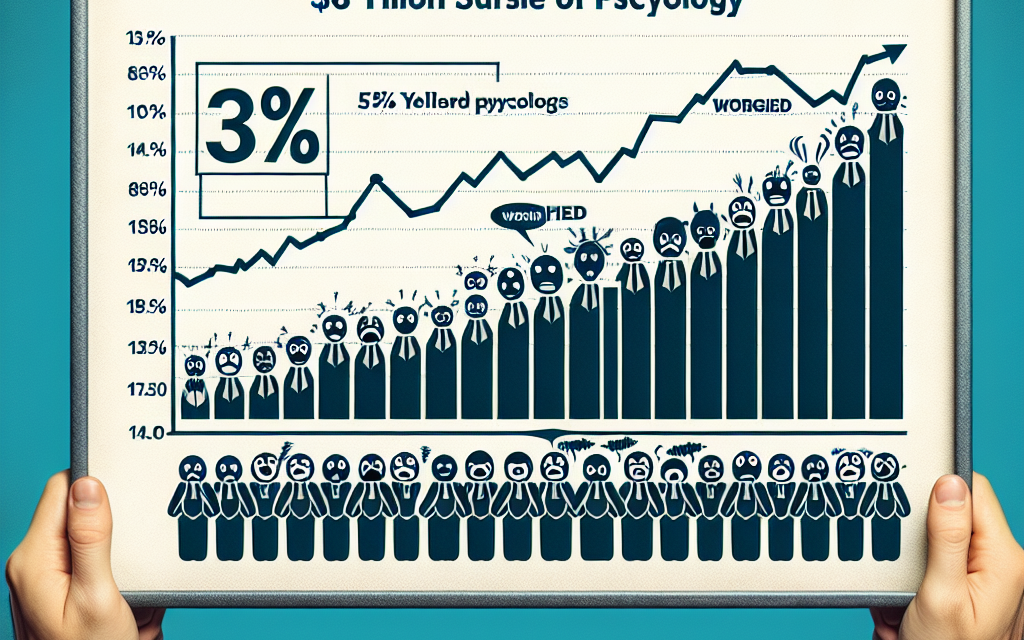

“Navigating the $18 Trillion Surge: S&P Faces Headwinds from 5% Yield Psychology.”

Introduction

The S&P 500, a key benchmark for U.S. equities, has experienced a remarkable surge, surpassing the $18 trillion mark in market capitalization. However, this impressive growth is now facing potential headwinds as rising interest rates push yields to 5%. The psychological impact of higher yields can lead investors to reassess their risk appetite, shifting capital away from equities and into fixed-income securities that offer more attractive returns. This shift in sentiment could pose significant challenges for the continued expansion of the stock market, as investors weigh the benefits of equity investments against the allure of safer, yield-generating assets.

S&P’s $18 Trillion Surge: An Overview

The S&P 500 index has experienced a remarkable surge, accumulating an impressive $18 trillion in market capitalization over recent years. This growth can be attributed to a combination of factors, including robust corporate earnings, low interest rates, and a favorable economic environment. Investors have flocked to equities, drawn by the potential for higher returns compared to traditional fixed-income investments. However, as the landscape shifts, particularly with the rise of interest rates, the psychology surrounding yields is beginning to change, posing a potential risk to this substantial market gain.

Historically, low interest rates have encouraged investors to seek out equities as a means of achieving better returns. With the Federal Reserve maintaining a policy of low rates for an extended period, the stock market flourished, leading to unprecedented levels of investment in the S&P 500. This influx of capital not only bolstered stock prices but also fostered a sense of confidence among investors, who were increasingly willing to take on risk in pursuit of higher yields. Consequently, the index reached new heights, reflecting the optimism that characterized the market during this period.

However, the recent shift towards higher interest rates, particularly with yields approaching the 5% mark, has begun to alter this dynamic. As bond yields rise, the attractiveness of fixed-income investments increases, drawing capital away from equities. Investors who once viewed stocks as the primary avenue for growth may now reconsider their strategies, weighing the benefits of a more stable, albeit lower, return from bonds against the potential volatility of the stock market. This psychological shift could lead to a significant reallocation of assets, which may, in turn, impact the S&P 500’s performance.

Moreover, the implications of rising yields extend beyond mere investor sentiment. Higher interest rates can lead to increased borrowing costs for corporations, which may subsequently affect their profitability. As companies face steeper expenses, the growth in earnings that has fueled the S&P’s ascent could be jeopardized. This potential slowdown in corporate performance may further exacerbate investor concerns, leading to a more cautious approach to equity investments. Consequently, the interplay between rising yields and corporate earnings becomes a critical factor in determining the future trajectory of the S&P 500.

In addition to these economic considerations, the broader market environment is also evolving. Geopolitical tensions, inflationary pressures, and supply chain disruptions are all contributing to an atmosphere of uncertainty. As investors grapple with these challenges, the allure of equities may diminish, particularly if they perceive that the risks associated with stock investments are no longer justified by the potential rewards. This shift in perception could lead to increased volatility in the S&P 500, as market participants reassess their positions in light of changing economic conditions.

In conclusion, while the S&P 500 has enjoyed an extraordinary surge, accumulating $18 trillion in market capitalization, the rise of interest rates and the accompanying psychological shift towards higher yields present significant risks. As investors reevaluate their strategies in response to these changes, the future performance of the index may be influenced by a complex interplay of factors, including corporate earnings, borrowing costs, and broader market dynamics. Ultimately, the sustainability of the S&P’s remarkable growth will depend on how effectively investors navigate this evolving landscape and adapt to the new realities of the financial environment.

The Impact of 5% Yields on Investor Sentiment

The recent surge in the S&P 500, which has seen an impressive increase of $18 trillion, is now facing potential headwinds due to the psychological impact of rising yields, particularly as they approach the 5% mark. This threshold is significant not only in terms of numerical value but also in how it shapes investor sentiment and market dynamics. As yields rise, particularly on government bonds, they create a competing investment landscape that can alter the risk-reward calculus for investors.

When yields on safe-haven assets like U.S. Treasuries reach 5%, they offer a compelling alternative to equities, which inherently carry more risk. This shift in attractiveness can lead to a reallocation of capital, as investors may choose to lock in the guaranteed returns offered by bonds rather than expose themselves to the volatility of the stock market. Consequently, this psychological shift can trigger a broader market reaction, as fear of missing out on safer returns may prompt a sell-off in equities, thereby undermining the substantial gains that have characterized the S&P 500’s recent performance.

Moreover, the psychological barrier of 5% yields can evoke a sense of caution among investors. Historically, such levels have been associated with tightening monetary policy and potential economic slowdowns. As a result, the perception that rising yields signal a shift in the economic landscape can lead to increased volatility in the stock market. Investors may begin to question the sustainability of corporate earnings growth, which has been a key driver of the S&P 500’s ascent. This uncertainty can create a feedback loop where declining investor confidence leads to further market corrections, exacerbating the initial concerns.

In addition to the direct impact on investment choices, the rise in yields can also influence corporate behavior. Companies may face higher borrowing costs as interest rates climb, which can dampen capital expenditures and expansion plans. This, in turn, can affect future earnings projections, leading analysts to revise their forecasts downward. As earnings expectations shift, so too does investor sentiment, creating a cycle where fear of declining profits feeds into broader market pessimism.

Furthermore, the psychological effects of rising yields are not limited to institutional investors; retail investors are also susceptible to these shifts in sentiment. As news of rising yields permeates the media, individual investors may react by pulling back from the market, fearing that they are entering a period of increased risk. This collective behavior can amplify market movements, as a wave of selling pressure can lead to sharp declines in stock prices, further reinforcing the narrative that equities are becoming less attractive.

In conclusion, the psychological impact of 5% yields on investor sentiment is profound and multifaceted. As yields rise, they not only present a tangible alternative to equities but also evoke broader concerns about economic stability and corporate profitability. This shift in sentiment can lead to significant market corrections, as both institutional and retail investors reassess their strategies in light of changing conditions. Ultimately, the interplay between rising yields and investor psychology will be crucial in determining the future trajectory of the S&P 500 and the broader market landscape. As such, market participants must remain vigilant, recognizing that the psychological barriers posed by rising yields could pose substantial risks to the impressive gains achieved in recent years.

Historical Context: Yield Psychology and Market Trends

The relationship between interest rates and market performance has long been a focal point for investors and analysts alike. Historically, the psychology surrounding yields has played a pivotal role in shaping market trends, particularly in the context of the S&P 500, which has seen an extraordinary surge of approximately $18 trillion in value over recent years. This surge, however, is now at risk as the prevailing yield environment shifts, particularly with the prospect of sustained 5% yields becoming a psychological barrier for investors.

To understand the implications of this yield psychology, it is essential to consider the historical context of interest rates and their influence on equity markets. In periods of low interest rates, such as those experienced in the aftermath of the 2008 financial crisis, investors were incentivized to seek higher returns in equities, as the opportunity cost of holding cash or low-yielding bonds diminished. This environment fostered a bullish sentiment, leading to significant capital inflows into the stock market. Consequently, the S&P 500 experienced a remarkable ascent, driven by both fundamental growth and speculative enthusiasm.

However, as interest rates began to rise in response to inflationary pressures and tightening monetary policy, the dynamics shifted. The psychological impact of higher yields cannot be understated; when yields approach or exceed 5%, the attractiveness of fixed-income investments increases, prompting a reevaluation of risk and return among investors. This shift in sentiment can lead to a reallocation of capital away from equities, as investors seek the relative safety and guaranteed returns offered by bonds. As a result, the S&P 500 may face downward pressure, as the influx of capital that previously fueled its growth begins to wane.

Moreover, the historical tendency for market corrections in response to rising yields further complicates the current landscape. Investors often exhibit a heightened sense of caution when yields rise, leading to increased volatility and potential sell-offs in equity markets. This behavior is rooted in the fear of diminished corporate earnings, as higher borrowing costs can squeeze profit margins and slow economic growth. Consequently, the psychological threshold of 5% yields may act as a tipping point, where the balance between risk and reward shifts unfavorably for equities.

In addition to these psychological factors, the broader economic context also plays a crucial role in shaping market trends. For instance, if rising yields coincide with slowing economic growth or deteriorating corporate fundamentals, the potential for a market downturn becomes more pronounced. Investors are likely to reassess their positions, leading to a more cautious approach to equity investments. This interplay between yield psychology and economic indicators underscores the complexity of the current market environment.

As we navigate this evolving landscape, it is essential for investors to remain vigilant and adaptable. The historical context of yield psychology serves as a reminder of the delicate balance between interest rates and market performance. While the S&P 500 has enjoyed unprecedented growth, the looming threat of sustained 5% yields may challenge this trajectory. Ultimately, understanding the psychological underpinnings of yield movements will be crucial for investors seeking to navigate the potential risks and opportunities that lie ahead. In this context, the interplay between yields and market sentiment will continue to shape the future of the S&P 500 and the broader financial landscape.

Analyzing the Risks of High-Yield Environments

The recent surge in the S&P 500, which has seen an impressive increase of $18 trillion, is now facing potential risks due to the psychological impact of high-yield environments. As interest rates rise, particularly with yields reaching around 5%, investors are beginning to reassess their strategies and the attractiveness of equities compared to fixed-income securities. This shift in sentiment can significantly influence market dynamics, as the allure of higher yields in bonds may divert capital away from stocks, thereby affecting the overall performance of the equity market.

In a high-yield environment, the opportunity cost of holding equities becomes more pronounced. Investors often weigh the potential returns from stocks against the guaranteed returns from bonds. When bond yields rise, the relative attractiveness of stocks diminishes, leading to a potential reallocation of investment portfolios. This psychological shift can create a ripple effect, as institutional investors, who manage substantial assets, may feel compelled to adjust their positions in response to changing market conditions. Consequently, this could lead to increased volatility in the stock market as investors react to the evolving landscape.

Moreover, the psychological impact of high yields extends beyond mere portfolio adjustments. It can also influence consumer behavior and corporate investment decisions. For instance, higher yields may signal a tightening monetary policy, which can dampen consumer spending and business expansion plans. As borrowing costs rise, companies may become more cautious in their capital expenditures, potentially stifling growth and innovation. This cautious approach can further exacerbate the challenges faced by the equity market, as lower corporate earnings may lead to downward revisions in stock valuations.

Additionally, the interplay between inflation and interest rates cannot be overlooked. In a high-yield environment, inflationary pressures often accompany rising rates, creating a complex scenario for investors. If inflation remains elevated, the real returns on fixed-income investments may not be as attractive as they initially appear. However, the psychological impact of perceived risk can still lead investors to favor bonds over stocks, particularly in uncertain economic climates. This behavior can create a feedback loop, where the demand for bonds increases, further driving down yields and potentially leading to a more pronounced shift away from equities.

Furthermore, the historical context of high-yield environments provides valuable insights into potential market reactions. Past instances of rising interest rates have often resulted in corrections within the equity market, as investors grapple with the implications of changing economic conditions. The current environment, characterized by a significant surge in the S&P 500, raises questions about sustainability. If investor sentiment shifts dramatically due to the psychological effects of high yields, the market could experience a sharp correction, undermining the substantial gains achieved over recent years.

In conclusion, the risks associated with high-yield environments are multifaceted and deeply intertwined with investor psychology. As yields approach 5%, the potential for a significant reallocation of capital from equities to fixed-income securities looms large. This shift could not only impact stock valuations but also influence broader economic dynamics, including consumer behavior and corporate investment strategies. Therefore, as the S&P 500 navigates this precarious landscape, it is essential for investors to remain vigilant and consider the psychological factors at play in shaping market trends. The interplay between yields, investor sentiment, and economic conditions will ultimately determine the trajectory of the equity market in the face of rising interest rates.

Strategies for Investors Amidst Rising Yields

As the financial landscape evolves, investors are increasingly confronted with the implications of rising yields, particularly in the context of the S&P 500’s remarkable $18 trillion surge. This surge, which has been a hallmark of the post-pandemic recovery, is now at risk as the Federal Reserve signals a potential shift in monetary policy. With yields on government bonds approaching 5%, the psychological impact on investors cannot be understated. In this environment, it becomes crucial for investors to adopt strategies that not only safeguard their portfolios but also capitalize on emerging opportunities.

One of the first strategies to consider is diversification. As yields rise, the attractiveness of fixed-income investments increases, which can lead to a reallocation of capital away from equities. To mitigate this risk, investors should ensure their portfolios are well-diversified across various asset classes. This includes not only traditional stocks and bonds but also alternative investments such as real estate, commodities, and even cryptocurrencies. By spreading investments across different sectors and asset classes, investors can reduce their exposure to any single market downturn, thereby enhancing their overall risk-adjusted returns.

In addition to diversification, investors should also focus on quality. In a rising yield environment, companies with strong balance sheets, robust cash flows, and sustainable competitive advantages are likely to outperform their peers. These high-quality stocks tend to be more resilient during periods of economic uncertainty, making them a safer bet as interest rates climb. Investors should conduct thorough fundamental analyses to identify companies that exhibit these characteristics, ensuring that their portfolios are anchored by solid investments that can weather the storm of rising yields.

Moreover, it is essential for investors to remain vigilant and adaptable. The financial markets are inherently dynamic, and the ability to pivot in response to changing conditions is vital. This may involve reassessing investment theses and being open to reallocating capital as new information becomes available. For instance, sectors that have historically performed well in low-yield environments, such as technology and growth stocks, may face headwinds as yields rise. Conversely, sectors like financials and utilities may become more attractive as they benefit from higher interest rates. By staying informed and flexible, investors can position themselves to take advantage of these shifts.

Another important consideration is the role of fixed-income investments in a rising yield environment. While higher yields can make bonds more appealing, they also pose a risk to existing bondholders, as rising rates typically lead to falling bond prices. Therefore, investors should evaluate their fixed-income allocations carefully. Shorter-duration bonds may be preferable in this context, as they are less sensitive to interest rate changes. Additionally, exploring floating-rate bonds or inflation-protected securities can provide a hedge against rising yields, allowing investors to maintain exposure to fixed income while mitigating potential losses.

Finally, maintaining a long-term perspective is crucial. While the psychological impact of rising yields can create short-term volatility, history has shown that markets tend to recover over time. Investors should resist the urge to make impulsive decisions based on market fluctuations and instead focus on their long-term financial goals. By adhering to a disciplined investment strategy and remaining committed to their objectives, investors can navigate the complexities of a changing yield environment with confidence.

In conclusion, as the S&P 500 faces the potential threat of rising yields, investors must adopt proactive strategies to safeguard their portfolios. By diversifying investments, focusing on quality, remaining adaptable, reassessing fixed-income allocations, and maintaining a long-term perspective, investors can effectively navigate the challenges posed by a shifting financial landscape.

The Role of Central Banks in Yield Management

The role of central banks in yield management is pivotal in shaping the economic landscape, particularly in the context of the recent surge in the S&P 500, which has reached an astonishing $18 trillion. Central banks, through their monetary policy tools, influence interest rates and, consequently, the yields on various financial instruments. This influence is crucial, especially as the market grapples with the psychological implications of a 5% yield threshold. As investors become increasingly sensitive to yield levels, the actions and communications of central banks take on heightened significance.

Central banks, such as the Federal Reserve in the United States, utilize a range of strategies to manage yields, including setting benchmark interest rates and engaging in open market operations. By adjusting these rates, central banks can either encourage or discourage borrowing and spending, which in turn affects economic growth and inflation. When yields are low, as they have been for an extended period, investors often seek higher returns in equities, driving up stock prices. This dynamic has contributed to the remarkable growth of the S&P 500, as investors have been willing to accept lower yields in exchange for potential capital appreciation.

However, as yields approach the 5% mark, a psychological shift may occur among investors. The perception of a 5% yield as a benchmark can lead to a reassessment of risk and return. Investors may begin to view equities as less attractive compared to fixed-income securities that offer more competitive yields. This shift in sentiment can create volatility in the stock market, as capital flows may reverse, leading to a potential decline in stock prices. Consequently, central banks must navigate this delicate balance, as their policies can either mitigate or exacerbate these psychological effects.

Moreover, the communication strategies employed by central banks are critical in managing market expectations. Forward guidance, which involves signaling future policy intentions, can help shape investor behavior. If a central bank indicates a commitment to maintaining low interest rates, it may bolster confidence in equities, sustaining the momentum of the S&P 500. Conversely, if a central bank hints at tightening monetary policy in response to rising yields, it could trigger a sell-off in stocks as investors reassess their portfolios. Thus, the interplay between central bank communications and market psychology is a vital consideration for investors.

In addition to interest rate policies, central banks also engage in quantitative easing, which involves purchasing government securities to inject liquidity into the economy. This strategy has been instrumental in keeping yields low and supporting asset prices. However, as the economy recovers and inflationary pressures mount, central banks may be compelled to taper these asset purchases. Such actions could lead to a rise in yields, further complicating the investment landscape. The potential for a rapid increase in yields poses a significant risk to the S&P 500’s valuation, as investors may quickly pivot towards safer assets.

In conclusion, the role of central banks in yield management is a critical factor influencing the current economic environment and the performance of the S&P 500. As yields approach the psychologically significant 5% level, the potential for market volatility increases. Central banks must carefully consider their policy decisions and communication strategies to navigate this complex landscape. Ultimately, the interplay between central bank actions and investor psychology will play a decisive role in determining the future trajectory of both yields and equity markets.

Future Projections: S&P Performance in a High-Yield Landscape

As the financial landscape evolves, the implications of rising interest rates and their psychological impact on investors cannot be overstated. The S&P 500, which has seen an impressive surge of approximately $18 trillion in market capitalization over recent years, now faces a critical juncture as yields approach the 5% mark. This shift in the yield environment raises important questions about the future performance of the index and the broader implications for equity markets.

Historically, low interest rates have fueled a bull market in equities, encouraging investors to seek higher returns in stocks rather than in fixed-income securities. However, as yields rise, particularly in the context of a 5% threshold, the dynamics of investor behavior may shift significantly. The psychological impact of such a yield level can lead to a reassessment of risk and return, prompting investors to reconsider their asset allocations. This transition is not merely a numerical adjustment; it reflects a fundamental change in the investment landscape that could alter the trajectory of the S&P 500.

Moreover, the relationship between interest rates and stock valuations is complex. Higher yields typically lead to increased discount rates applied to future cash flows, which can depress equity valuations. As investors begin to perceive bonds as more attractive alternatives, the demand for stocks may wane, resulting in downward pressure on prices. This scenario is particularly concerning for the S&P 500, which has thrived in an environment characterized by low borrowing costs and abundant liquidity. The potential for a shift in investor sentiment could create volatility, as market participants grapple with the implications of a high-yield environment.

In addition to the psychological factors at play, macroeconomic conditions will also influence the S&P’s performance. If rising yields are accompanied by robust economic growth, the impact on equities may be mitigated, as companies could benefit from increased consumer spending and higher corporate earnings. Conversely, if higher yields signal tightening monetary policy or economic slowdown, the S&P 500 could face significant headwinds. The interplay between interest rates, economic growth, and corporate profitability will be crucial in determining the index’s future trajectory.

Furthermore, sector performance within the S&P 500 may diverge in a high-yield environment. Traditionally, sectors such as utilities and real estate, which are sensitive to interest rate changes, may underperform as yields rise. In contrast, financials could benefit from higher rates, as banks typically see improved margins on loans. This sector rotation could lead to a more nuanced performance within the index, complicating the overall outlook for investors.

As we look ahead, it is essential to recognize that the S&P 500’s future performance will be shaped by a confluence of factors, including investor psychology, macroeconomic conditions, and sector dynamics. The potential for a shift in sentiment as yields approach 5% cannot be ignored, as it may prompt a reevaluation of risk and return across the equity landscape. Consequently, investors must remain vigilant and adaptable, ready to navigate the complexities of a high-yield environment. In this context, understanding the interplay between interest rates and equity valuations will be paramount for making informed investment decisions in the months and years to come. The S&P 500’s remarkable ascent may be at risk, but with careful analysis and strategic foresight, opportunities may still abound amidst the challenges presented by rising yields.

Q&A

1. **What is the S&P’s $18 trillion surge?**

– The S&P’s $18 trillion surge refers to the significant increase in the market capitalization of the S&P 500 index, reflecting a rise in stock prices over a period of time.

2. **What does a 5% yield refer to?**

– A 5% yield typically refers to the return on investment from bonds or other fixed-income securities, indicating that investors can earn a 5% return annually.

3. **How does a 5% yield impact stock market psychology?**

– A 5% yield can shift investor preference from stocks to bonds, as the fixed income becomes more attractive, potentially leading to reduced demand for equities and a decline in stock prices.

4. **What risks does the S&P face due to rising yields?**

– Rising yields can lead to increased borrowing costs for companies, reduced consumer spending, and a shift in investment strategies, all of which can negatively impact stock valuations.

5. **What is the significance of investor psychology in this context?**

– Investor psychology plays a crucial role in market dynamics; if investors perceive higher yields as a signal to move away from stocks, it can create a self-fulfilling prophecy that drives stock prices down.

6. **What could trigger a shift in investor sentiment regarding yields?**

– Economic indicators, changes in monetary policy, inflation rates, or geopolitical events can all influence investor sentiment and lead to a reassessment of the attractiveness of stocks versus bonds.

7. **What are potential outcomes if the S&P’s surge is at risk?**

– If the S&P’s surge is at risk, potential outcomes include market corrections, increased volatility, and a reevaluation of investment strategies, which could lead to lower overall market confidence.

Conclusion

The S&P 500’s $18 trillion surge is at risk due to the psychological impact of rising yields, particularly as the 5% threshold may lead investors to reassess risk and return dynamics. Higher yields can make fixed-income investments more attractive compared to equities, potentially prompting a shift in capital allocation. This shift could dampen stock market momentum, as investors weigh the opportunity cost of holding equities against safer, higher-yielding assets. Consequently, sustained high yields may challenge the valuation levels of the S&P 500, leading to increased volatility and a potential correction in the market.