“Verizon Stock: Dial into Potential Growth or Hang Up?”

Introduction

Investing in Verizon stock today requires a careful evaluation of various factors that influence its potential for growth and stability. As one of the largest telecommunications companies in the United States, Verizon Communications Inc. has a significant presence in the wireless and broadband sectors, offering a range of services that cater to both individual consumers and businesses. The company’s performance is often influenced by its ability to innovate, expand its 5G network, and maintain competitive pricing strategies. Additionally, investors should consider Verizon’s financial health, dividend yield, and market position relative to its competitors. Economic conditions, regulatory changes, and technological advancements also play crucial roles in shaping the investment landscape for Verizon. By analyzing these elements, potential investors can make informed decisions about whether Verizon stock aligns with their financial goals and risk tolerance.

Current Market Performance Of Verizon Stock

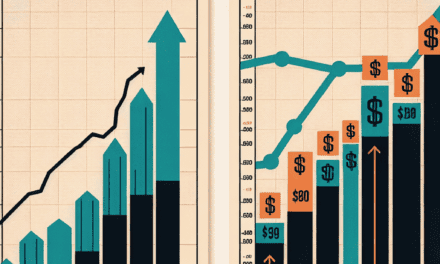

Verizon Communications Inc., a prominent player in the telecommunications industry, has long been a staple in many investment portfolios. As investors consider the current market performance of Verizon stock, it is essential to evaluate various factors that influence its valuation and potential for future growth. In recent months, Verizon’s stock performance has been subject to the broader market trends and specific industry dynamics. Understanding these elements can provide a clearer picture of whether investing in Verizon stock today is a prudent decision.

To begin with, Verizon’s stock has experienced fluctuations in line with the overall market volatility. The telecommunications sector, while traditionally seen as a stable investment due to its essential services, has not been immune to the economic uncertainties that have characterized the market in recent times. Factors such as inflationary pressures, interest rate hikes, and global supply chain disruptions have all played a role in shaping investor sentiment. Consequently, Verizon’s stock performance has mirrored these broader economic challenges, reflecting both the resilience and vulnerabilities inherent in the sector.

Moreover, Verizon’s financial health and strategic initiatives are crucial components in assessing its current market performance. The company has consistently demonstrated strong revenue streams, driven by its expansive network infrastructure and a loyal customer base. Verizon’s commitment to expanding its 5G network is particularly noteworthy, as it positions the company to capitalize on the growing demand for faster and more reliable connectivity. This strategic focus on 5G technology not only enhances Verizon’s competitive edge but also promises potential revenue growth in the long term.

In addition to its technological advancements, Verizon’s financial metrics provide further insight into its market performance. The company’s dividend yield remains attractive to income-focused investors, offering a steady return in an otherwise uncertain market environment. Furthermore, Verizon’s efforts to manage its debt levels and optimize operational efficiencies underscore its commitment to maintaining a robust financial position. These factors collectively contribute to a sense of stability, which is often appealing to investors seeking a balance between risk and reward.

However, it is important to consider the competitive landscape in which Verizon operates. The telecommunications industry is characterized by intense competition, with major players like AT&T and T-Mobile vying for market share. This competitive pressure necessitates continuous innovation and investment in infrastructure, which can impact profit margins and overall financial performance. As such, potential investors must weigh Verizon’s ability to navigate this competitive environment while sustaining growth and profitability.

Furthermore, regulatory considerations and technological advancements also play a significant role in shaping Verizon’s market performance. The evolving regulatory landscape, particularly concerning data privacy and net neutrality, can introduce uncertainties that may affect the company’s operations and strategic direction. Additionally, the rapid pace of technological change requires Verizon to remain agile and adaptive, ensuring that it can leverage new opportunities while mitigating potential risks.

In conclusion, the current market performance of Verizon stock is influenced by a myriad of factors, ranging from macroeconomic conditions to industry-specific dynamics. While Verizon’s strong financial position, strategic focus on 5G, and attractive dividend yield present compelling reasons for investment, potential investors must also consider the competitive pressures and regulatory challenges that could impact future performance. By carefully evaluating these elements, investors can make informed decisions about whether Verizon stock aligns with their investment objectives and risk tolerance.

Verizon’s Dividend Yield And Its Impact On Investors

When considering an investment in Verizon stock, one of the most compelling aspects for potential investors is its dividend yield. Verizon Communications Inc., a prominent player in the telecommunications industry, has long been recognized for its commitment to returning value to shareholders through dividends. This focus on dividends is particularly appealing to income-focused investors who prioritize steady cash flow over capital appreciation. As of the latest data, Verizon’s dividend yield stands at an attractive level compared to many other stocks in the market, making it a noteworthy option for those seeking regular income.

The dividend yield is a critical metric for evaluating the attractiveness of a stock for income investors. It is calculated by dividing the annual dividend payment by the stock’s current price. A higher yield often indicates that a company is distributing a significant portion of its earnings back to shareholders. In Verizon’s case, the company has consistently maintained a robust dividend policy, which has been a cornerstone of its appeal. This commitment to dividends is underpinned by Verizon’s stable cash flow, which is largely driven by its extensive network infrastructure and substantial customer base.

Moreover, Verizon’s dividend yield is not only a reflection of its current financial health but also an indicator of its long-term strategic priorities. The company has demonstrated a strong track record of sustaining and even increasing its dividend payouts over time. This reliability can be particularly reassuring for investors who are wary of market volatility and seek a more predictable return on their investment. Furthermore, in an era of low interest rates, the yield offered by Verizon can be especially attractive when compared to traditional fixed-income securities, such as bonds, which may offer lower returns.

However, while the dividend yield is an important factor, it should not be the sole consideration for investors. It is crucial to assess the sustainability of these dividends. Verizon’s ability to continue paying dividends at the current rate depends on its capacity to generate sufficient earnings and cash flow. This, in turn, is influenced by various factors, including market competition, regulatory changes, and technological advancements. Investors should be mindful of these dynamics and consider how they might impact Verizon’s future performance and its ability to maintain its dividend policy.

In addition to evaluating the sustainability of dividends, potential investors should also consider the broader context of Verizon’s financial health and strategic direction. The company’s investments in 5G technology and its efforts to expand its digital services are pivotal to its growth prospects. These initiatives could enhance Verizon’s competitive position and potentially lead to increased revenue streams, which would support its dividend payments. However, they also require substantial capital expenditure, which could impact the company’s financial flexibility.

In conclusion, while Verizon’s dividend yield is undoubtedly an attractive feature for income-focused investors, it is essential to conduct a comprehensive analysis of the company’s overall financial health and strategic initiatives. By doing so, investors can make a more informed decision about whether Verizon stock aligns with their investment goals and risk tolerance. As with any investment, a balanced approach that considers both the potential rewards and risks is crucial for achieving long-term financial success.

Analyzing Verizon’s Financial Health And Stability

When considering an investment in Verizon stock, it is crucial to analyze the company’s financial health and stability. Verizon Communications Inc., a leading telecommunications company, has long been a staple in the portfolios of many investors seeking stable returns and reliable dividends. To determine whether Verizon stock is a wise investment today, one must delve into various financial metrics and market conditions that influence its performance.

First and foremost, Verizon’s revenue streams provide a solid foundation for its financial health. The company generates substantial income from its wireless services, which account for a significant portion of its total revenue. This segment has shown resilience even in challenging economic climates, as consumers and businesses alike continue to rely on mobile connectivity. Furthermore, Verizon’s strategic investments in 5G technology position it well for future growth, as the demand for faster and more reliable wireless services is expected to increase.

In addition to its revenue-generating capabilities, Verizon’s balance sheet reflects a stable financial position. The company maintains a manageable level of debt, which is crucial for sustaining operations and funding future investments. While Verizon’s debt levels are higher than some of its peers, the company has consistently demonstrated its ability to service this debt through strong cash flow generation. This financial discipline is further evidenced by Verizon’s commitment to returning value to shareholders through dividends. The company has a long history of paying dividends, and its current yield is attractive to income-focused investors.

Moreover, Verizon’s financial stability is supported by its operational efficiency. The company has implemented cost-cutting measures and streamlined operations to enhance profitability. These efforts have resulted in a healthy operating margin, which is a key indicator of a company’s ability to convert revenue into profit. By maintaining a focus on efficiency, Verizon can better weather economic downturns and remain competitive in the telecommunications industry.

However, it is important to consider the challenges that Verizon faces in the current market environment. The telecommunications industry is highly competitive, with major players like AT&T and T-Mobile vying for market share. This competition can lead to pricing pressures, which may impact Verizon’s profitability. Additionally, the rapid pace of technological advancements requires continuous investment in infrastructure and innovation, which can strain financial resources.

Despite these challenges, Verizon’s strategic initiatives provide a pathway for sustained growth. The company’s focus on expanding its 5G network and exploring new revenue streams, such as Internet of Things (IoT) solutions and digital media, positions it to capitalize on emerging opportunities. These initiatives not only enhance Verizon’s growth prospects but also diversify its revenue base, reducing reliance on traditional wireless services.

In conclusion, while Verizon faces certain challenges in the competitive telecommunications landscape, its strong financial health and stability make it a compelling investment option. The company’s robust revenue streams, manageable debt levels, and commitment to operational efficiency provide a solid foundation for future growth. Furthermore, Verizon’s strategic investments in 5G technology and new business ventures position it well to navigate industry challenges and capitalize on emerging opportunities. Therefore, for investors seeking a stable and potentially rewarding addition to their portfolio, Verizon stock presents a viable option worth considering.

Competitive Landscape: Verizon Vs. Other Telecom Giants

In the ever-evolving telecommunications industry, Verizon Communications Inc. stands as a formidable player, consistently vying for dominance alongside other telecom giants. As potential investors consider whether to invest in Verizon stock today, it is crucial to examine the competitive landscape in which Verizon operates. This analysis not only provides insight into Verizon’s current market position but also highlights the challenges and opportunities that may influence its future performance.

Verizon’s primary competitors include AT&T, T-Mobile, and to a lesser extent, smaller regional carriers and emerging tech companies. Each of these entities brings unique strengths and strategies to the table, shaping the competitive dynamics of the industry. AT&T, for instance, has long been a direct rival to Verizon, with both companies offering similar services such as wireless communication, broadband, and digital entertainment. However, AT&T’s recent strategic focus on divesting non-core assets and reducing debt has allowed it to streamline operations and potentially enhance its competitive edge. This shift could pose a challenge to Verizon, which must continue to innovate and expand its offerings to maintain its market share.

Meanwhile, T-Mobile has emerged as a formidable competitor, particularly after its merger with Sprint. This consolidation has bolstered T-Mobile’s network capabilities and customer base, enabling it to aggressively pursue market share through competitive pricing and innovative service offerings. T-Mobile’s emphasis on 5G technology and its commitment to expanding coverage in rural areas have further intensified the competition. Consequently, Verizon must remain vigilant and proactive in its 5G deployment and customer acquisition strategies to counter T-Mobile’s growing influence.

In addition to these traditional competitors, Verizon faces challenges from tech giants like Google and Amazon, which are increasingly encroaching on the telecom space. These companies leverage their technological prowess and vast resources to offer alternative communication solutions, such as cloud-based services and internet of things (IoT) connectivity. As these tech behemoths continue to innovate, Verizon must adapt by investing in cutting-edge technologies and forming strategic partnerships to stay relevant in a rapidly changing landscape.

Despite these competitive pressures, Verizon possesses several strengths that could bolster its position. The company’s robust network infrastructure, renowned for its reliability and coverage, remains a significant asset. Verizon’s early and aggressive investment in 5G technology has positioned it as a leader in the next generation of wireless communication, offering faster speeds and lower latency. This technological advantage could attract more customers and drive revenue growth, particularly as 5G adoption becomes more widespread.

Moreover, Verizon’s strategic focus on diversifying its revenue streams through ventures into digital media and advertising, such as its acquisition of Yahoo and AOL, demonstrates its commitment to evolving beyond traditional telecom services. While these ventures have faced challenges, they represent potential growth areas that could enhance Verizon’s competitive standing.

In conclusion, the decision to invest in Verizon stock today requires a careful consideration of the competitive landscape. While Verizon faces formidable challenges from both traditional telecom rivals and emerging tech companies, its strong network infrastructure, leadership in 5G technology, and strategic diversification efforts provide a solid foundation for future growth. Investors must weigh these factors against the broader industry dynamics and Verizon’s ability to adapt to an ever-changing market. Ultimately, Verizon’s success will depend on its capacity to innovate and maintain its competitive edge in a highly competitive environment.

Technological Advancements And Verizon’s Growth Potential

In the rapidly evolving landscape of telecommunications, Verizon Communications Inc. stands as a formidable player, consistently adapting to technological advancements to maintain its competitive edge. As investors contemplate the potential of Verizon stock, it is crucial to consider the company’s strategic positioning in the context of technological growth. The advent of 5G technology represents a significant milestone in the telecommunications industry, promising faster speeds, lower latency, and the capacity to connect a multitude of devices seamlessly. Verizon has been at the forefront of this transition, investing heavily in the development and deployment of 5G infrastructure. This commitment not only underscores Verizon’s dedication to innovation but also positions the company to capitalize on the myriad opportunities that 5G technology presents.

Moreover, Verizon’s strategic investments extend beyond 5G. The company has been actively exploring the potential of edge computing, which brings computation and data storage closer to the location where it is needed, thereby improving response times and saving bandwidth. By integrating edge computing with its 5G network, Verizon aims to enhance its service offerings, particularly in sectors such as autonomous vehicles, smart cities, and the Internet of Things (IoT). This integration is expected to unlock new revenue streams and drive growth, making Verizon an attractive prospect for investors seeking exposure to cutting-edge technological advancements.

In addition to its technological initiatives, Verizon’s financial health is a critical factor for investors to consider. The company has demonstrated a robust financial performance, characterized by steady revenue growth and strong cash flow generation. This financial stability enables Verizon to continue investing in its network infrastructure and technological innovations without compromising its ability to return value to shareholders. Furthermore, Verizon’s commitment to maintaining a healthy balance sheet and prudent capital allocation strategies provides a level of assurance to investors regarding the sustainability of its growth trajectory.

However, it is essential to acknowledge the competitive pressures that Verizon faces in the telecommunications sector. Rivals such as AT&T and T-Mobile are also aggressively pursuing 5G and other technological advancements, which could potentially impact Verizon’s market share and profitability. Additionally, the capital-intensive nature of the telecommunications industry necessitates continuous investment in infrastructure, which could strain financial resources if not managed judiciously. Despite these challenges, Verizon’s strategic focus on innovation and its track record of operational excellence suggest that it is well-equipped to navigate the competitive landscape.

Furthermore, regulatory considerations play a significant role in shaping the telecommunications industry. Changes in government policies and regulations can have profound implications for companies like Verizon, affecting everything from spectrum allocation to data privacy standards. While regulatory risks are inherent in the industry, Verizon’s proactive engagement with policymakers and its commitment to compliance mitigate some of these concerns.

In conclusion, the decision to invest in Verizon stock hinges on a careful evaluation of the company’s growth potential in light of technological advancements. Verizon’s leadership in 5G deployment, coupled with its exploration of emerging technologies like edge computing, positions it favorably for future growth. While competitive and regulatory challenges persist, Verizon’s strong financial foundation and strategic focus on innovation provide a compelling case for investors considering an investment in the telecommunications sector. As with any investment decision, potential investors should conduct thorough research and consider their risk tolerance before making a commitment.

Risks And Challenges Facing Verizon In Today’s Market

Investing in Verizon stock today requires a careful examination of the risks and challenges the company faces in the current market environment. As one of the largest telecommunications companies in the United States, Verizon has long been a staple in many investment portfolios, known for its robust network infrastructure and consistent dividend payouts. However, the rapidly evolving landscape of the telecommunications industry presents several hurdles that could impact Verizon’s future performance.

To begin with, the competitive nature of the telecommunications sector poses a significant challenge for Verizon. The company is in constant competition with other major players such as AT&T and T-Mobile, all vying for market share in a saturated market. This intense competition often leads to price wars, which can erode profit margins and put pressure on revenue growth. Moreover, the emergence of smaller, more agile companies offering innovative services at competitive prices further complicates Verizon’s ability to maintain its market position.

In addition to competitive pressures, Verizon must navigate the complexities of technological advancements. The rollout of 5G technology is a double-edged sword for the company. On one hand, it presents an opportunity for growth and increased revenue through new services and applications. On the other hand, the substantial capital expenditure required to build and maintain a 5G network is a significant financial burden. This investment is necessary to stay competitive, but it also increases the company’s debt levels and financial risk.

Furthermore, regulatory challenges add another layer of complexity to Verizon’s operating environment. The telecommunications industry is heavily regulated, and changes in government policies can have profound impacts on business operations. For instance, net neutrality regulations and spectrum allocation policies can influence how Verizon delivers its services and how much it can charge customers. Navigating these regulatory waters requires strategic foresight and adaptability, as any misstep could lead to costly penalties or lost opportunities.

Another risk factor to consider is the potential for economic downturns, which can affect consumer spending and, consequently, Verizon’s revenue. During periods of economic uncertainty, consumers may cut back on discretionary spending, including telecommunications services. While Verizon’s services are often considered essential, prolonged economic challenges could lead to increased customer churn or a shift towards lower-cost alternatives, impacting the company’s bottom line.

Moreover, Verizon faces operational risks related to cybersecurity threats. As a provider of critical communication infrastructure, the company is a prime target for cyberattacks. A successful breach could not only disrupt services but also lead to significant financial and reputational damage. Verizon must continually invest in cybersecurity measures to protect its network and customer data, which adds to its operational costs.

In conclusion, while Verizon remains a prominent player in the telecommunications industry, potential investors must weigh the risks and challenges it faces in today’s market. The competitive landscape, technological demands, regulatory environment, economic conditions, and cybersecurity threats all present significant hurdles that could impact Verizon’s future performance. Therefore, investors should conduct thorough due diligence and consider these factors carefully before deciding to invest in Verizon stock. By understanding these risks, investors can make more informed decisions about whether Verizon aligns with their investment goals and risk tolerance.

Expert Opinions And Forecasts On Verizon’s Stock Future

When considering whether to invest in Verizon stock today, it is essential to examine expert opinions and forecasts regarding its future performance. Verizon Communications Inc., a leading telecommunications company, has long been a staple in many investment portfolios due to its robust infrastructure and consistent dividend payouts. However, the rapidly evolving landscape of the telecommunications industry, coupled with economic uncertainties, necessitates a closer look at what experts are predicting for Verizon’s stock.

To begin with, analysts often highlight Verizon’s strong market position as a key factor in its favor. As one of the largest wireless carriers in the United States, Verizon benefits from a substantial customer base and a well-established network. This provides the company with a steady revenue stream, which is particularly appealing to investors seeking stability. Furthermore, Verizon’s commitment to expanding its 5G network is seen as a strategic move to maintain its competitive edge. The rollout of 5G technology is expected to drive growth by enabling new services and applications, thus potentially increasing Verizon’s market share.

Nevertheless, it is important to consider the challenges that Verizon faces. The telecommunications industry is highly competitive, with major players like AT&T and T-Mobile constantly vying for market dominance. This competition can lead to pricing pressures, which may impact Verizon’s profit margins. Additionally, the substantial capital expenditure required for 5G infrastructure development poses a financial burden. While these investments are crucial for future growth, they can strain the company’s resources in the short term.

In light of these factors, expert forecasts for Verizon’s stock are mixed. Some analysts remain optimistic, citing the company’s strong fundamentals and strategic initiatives as reasons for potential stock appreciation. They argue that Verizon’s focus on 5G and its ability to leverage its existing customer base will drive long-term growth. Moreover, Verizon’s history of paying reliable dividends makes it an attractive option for income-focused investors.

Conversely, other experts express caution, pointing to the broader economic environment as a potential headwind. Rising interest rates and inflationary pressures could affect consumer spending, which in turn might impact Verizon’s revenue. Additionally, regulatory changes and technological disruptions pose risks that could alter the competitive landscape. These analysts suggest that while Verizon’s stock may offer stability, its growth prospects could be limited in the face of these challenges.

Transitioning to a broader perspective, it is also worth considering the overall market sentiment towards telecommunications stocks. The sector has traditionally been viewed as defensive, providing a safe haven during economic downturns. However, with the increasing convergence of technology and telecommunications, investors are now more focused on growth potential. This shift in sentiment could influence Verizon’s stock performance, as investors weigh the company’s ability to innovate and adapt.

In conclusion, the decision to invest in Verizon stock today hinges on a careful evaluation of both its strengths and the challenges it faces. While the company’s solid market position and strategic focus on 5G offer promising prospects, potential investors must also consider the competitive pressures and economic uncertainties that could impact its future performance. By weighing these expert opinions and forecasts, investors can make a more informed decision about whether Verizon stock aligns with their investment goals and risk tolerance.

Q&A

1. **Question:** What is Verizon’s current financial performance?

**Answer:** Verizon’s financial performance can be assessed by reviewing its latest earnings reports, revenue growth, profit margins, and cash flow statements.

2. **Question:** How does Verizon’s dividend yield compare to industry peers?

**Answer:** Verizon typically offers a high dividend yield compared to industry peers, making it attractive for income-focused investors.

3. **Question:** What are the growth prospects for Verizon in the 5G market?

**Answer:** Verizon is heavily investing in 5G infrastructure, which could drive future growth as demand for faster mobile networks increases.

4. **Question:** What are the risks associated with investing in Verizon stock?

**Answer:** Risks include high competition in the telecom sector, regulatory challenges, and the substantial capital expenditure required for 5G deployment.

5. **Question:** How does Verizon’s valuation compare to its historical averages?

**Answer:** Verizon’s valuation can be compared using metrics like P/E ratio, P/B ratio, and EV/EBITDA against its historical averages and industry benchmarks.

6. **Question:** What is the analyst consensus on Verizon stock?

**Answer:** Analyst consensus can vary, but it typically includes a mix of buy, hold, and sell ratings based on current market conditions and company performance.

7. **Question:** How does Verizon’s debt level impact its investment appeal?

**Answer:** Verizon’s high debt level may be a concern for some investors, as it could affect financial flexibility and increase risk, especially in a rising interest rate environment.

Conclusion

Investing in Verizon stock today requires careful consideration of several factors. Verizon is a well-established telecommunications company with a strong market presence and a history of paying dividends, which may appeal to income-focused investors. However, the company faces challenges such as intense competition, significant capital expenditure requirements for network upgrades, and potential regulatory changes. Additionally, the broader economic environment, including interest rates and consumer spending trends, can impact its performance. Prospective investors should weigh these factors against their investment goals and risk tolerance. Conducting thorough research and possibly consulting with a financial advisor is advisable before making any investment decision.