“Strategize Your Retirement: Convert Smartly, Save Wisely.”

Introduction

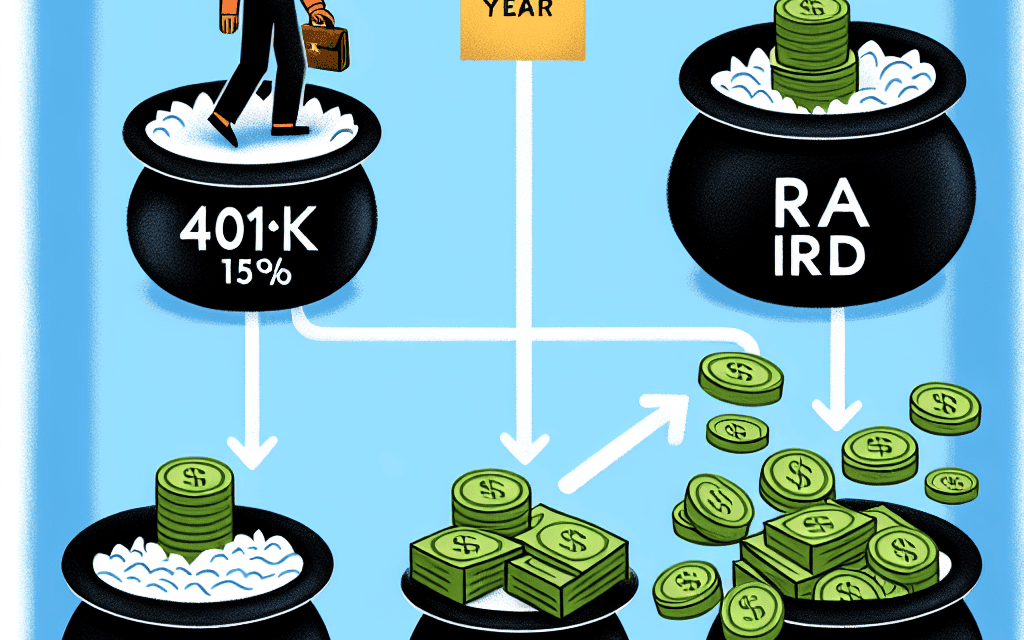

Converting a portion of your 401(k) to a Roth IRA each year can be a strategic financial decision, particularly when aiming to minimize taxes and required minimum distributions (RMDs) in retirement. This approach involves transferring funds from a traditional 401(k), where contributions are typically made pre-tax, to a Roth IRA, where contributions are made post-tax but qualified withdrawals are tax-free. By annually converting 15% of your 401(k) to a Roth IRA, you may effectively manage your taxable income, potentially keeping it within a lower tax bracket, and reduce the impact of RMDs, which are mandatory withdrawals from traditional retirement accounts starting at age 73. This strategy can offer long-term tax benefits and greater flexibility in retirement planning, but it requires careful consideration of current and future tax rates, your overall financial situation, and potential penalties or fees associated with conversions.

Understanding the Benefits of Converting 401(k) to Roth IRA

Converting a portion of your 401(k) to a Roth IRA annually can be a strategic move to minimize taxes and required minimum distributions (RMDs) in retirement. This approach involves transferring funds from a traditional 401(k), where contributions are made pre-tax, to a Roth IRA, where contributions are made post-tax. The primary advantage of this conversion is the potential for tax-free growth and withdrawals in retirement, which can be particularly beneficial if you anticipate being in a higher tax bracket in the future.

One of the key benefits of converting to a Roth IRA is the elimination of RMDs. Traditional 401(k) accounts require you to start taking distributions at age 72, which can increase your taxable income and potentially push you into a higher tax bracket. By converting to a Roth IRA, you are not subject to RMDs, allowing your investments to continue growing tax-free for as long as you wish. This flexibility can be especially advantageous if you do not need the funds immediately and prefer to leave a larger inheritance to your beneficiaries.

Moreover, converting to a Roth IRA can provide tax diversification in retirement. Having both pre-tax and post-tax accounts allows you to strategically manage your withdrawals to minimize your overall tax liability. For instance, in years when your taxable income is lower, you can withdraw from your traditional 401(k) to take advantage of lower tax rates. Conversely, in years when your income is higher, you can withdraw from your Roth IRA tax-free, thereby avoiding a spike in your tax bracket.

However, it is important to consider the tax implications of the conversion itself. When you convert funds from a 401(k) to a Roth IRA, you must pay taxes on the converted amount as it is considered taxable income for that year. Therefore, it is crucial to assess your current tax situation and determine whether you can afford the additional tax burden. Converting too large an amount in a single year could push you into a higher tax bracket, negating some of the benefits of the conversion.

To mitigate this risk, many financial advisors recommend a gradual conversion strategy, such as converting 15% of your 401(k) annually. This approach allows you to spread the tax liability over several years, making it more manageable and reducing the likelihood of a significant increase in your tax bracket. Additionally, by converting smaller amounts each year, you can take advantage of any fluctuations in your income or tax rates, optimizing the timing of your conversions.

It is also essential to consider the impact of state taxes, as some states do not tax Roth IRA conversions, while others do. Understanding your state’s tax laws can help you make a more informed decision about the timing and amount of your conversions. Furthermore, consulting with a financial advisor or tax professional can provide personalized guidance based on your unique financial situation and goals.

In conclusion, annually converting a portion of your 401(k) to a Roth IRA can be an effective strategy to minimize taxes and RMDs in retirement. By carefully planning your conversions and considering the tax implications, you can enhance your financial flexibility and potentially increase your retirement savings. As with any financial decision, it is important to weigh the benefits and drawbacks and seek professional advice to ensure that your strategy aligns with your long-term objectives.

Tax Implications of Annual 401(k) to Roth IRA Conversions

When considering the financial strategy of converting a portion of your 401(k) to a Roth IRA annually, it is crucial to understand the tax implications and potential benefits associated with this decision. The primary motivation for such conversions often revolves around minimizing future tax liabilities and required minimum distributions (RMDs). By converting 15% of your 401(k) to a Roth IRA each year, you may effectively manage your tax burden and enhance your retirement planning.

To begin with, it is important to recognize that traditional 401(k) contributions are made with pre-tax dollars, meaning that taxes are deferred until withdrawals are made during retirement. In contrast, Roth IRA contributions are made with after-tax dollars, allowing for tax-free withdrawals in retirement, provided certain conditions are met. This fundamental difference in tax treatment is a key factor in the decision to convert funds from a 401(k) to a Roth IRA.

One of the primary advantages of converting to a Roth IRA is the potential for tax diversification. By having both pre-tax and post-tax retirement accounts, you can strategically manage your taxable income in retirement. This flexibility can be particularly beneficial if you anticipate being in a higher tax bracket in the future. Moreover, Roth IRAs are not subject to RMDs during the account holder’s lifetime, unlike traditional 401(k)s. This feature allows for greater control over your retirement funds and can be advantageous for estate planning purposes.

However, it is essential to consider the immediate tax implications of such conversions. When you convert funds from a 401(k) to a Roth IRA, the amount converted is treated as taxable income for that year. This increase in taxable income could potentially push you into a higher tax bracket, resulting in a larger tax bill. Therefore, it is crucial to carefully evaluate your current tax situation and future income projections before proceeding with a conversion strategy.

To mitigate the risk of a significant tax impact, some individuals opt to convert only a portion of their 401(k) each year, such as 15%. This gradual approach can help spread the tax liability over several years, making it more manageable. Additionally, by converting smaller amounts annually, you may be able to stay within your current tax bracket, thereby minimizing the immediate tax consequences.

Furthermore, it is advisable to consider the timing of these conversions. Converting during years when your income is lower, such as early retirement or a sabbatical, can be particularly advantageous. This strategy allows you to take advantage of lower tax rates, thereby reducing the overall tax burden of the conversion.

In conclusion, while annually converting 15% of your 401(k) to a Roth IRA can offer significant long-term benefits, it is imperative to thoroughly assess the tax implications and align the strategy with your overall financial goals. Consulting with a financial advisor or tax professional can provide valuable insights tailored to your specific circumstances. By carefully planning and executing this conversion strategy, you can potentially minimize taxes and RMDs, ultimately enhancing your financial security in retirement.

How Roth IRA Conversions Affect Required Minimum Distributions

When considering the strategic conversion of a portion of your 401(k) to a Roth IRA, it is essential to understand how this decision can impact your required minimum distributions (RMDs) and overall tax liability. The primary motivation behind such conversions is often to minimize future taxes and manage RMDs more effectively. To begin with, it is important to recognize that traditional 401(k) accounts are funded with pre-tax dollars, meaning that taxes are deferred until withdrawals are made during retirement. Consequently, RMDs from these accounts are subject to ordinary income tax, which can significantly affect your taxable income in retirement.

In contrast, Roth IRAs are funded with after-tax dollars, allowing for tax-free growth and tax-free withdrawals in retirement, provided certain conditions are met. Notably, Roth IRAs are not subject to RMDs during the original account holder’s lifetime, which can be a significant advantage for those looking to reduce their taxable income in retirement. By converting a portion of your 401(k) to a Roth IRA annually, you can gradually decrease the balance of your traditional 401(k), thereby reducing the amount subject to RMDs and potentially lowering your future tax burden.

However, it is crucial to consider the tax implications of such conversions. When you convert funds from a 401(k) to a Roth IRA, the amount converted is treated as taxable income for that year. This can push you into a higher tax bracket, especially if the conversion amount is substantial. Therefore, it is advisable to carefully plan the conversion amount each year, taking into account your current tax bracket and any other sources of income. By converting only a manageable portion, such as 15% annually, you can spread the tax liability over several years, potentially avoiding a significant spike in your taxable income.

Moreover, it is important to consider the timing of these conversions. Converting during years when your income is lower, such as early retirement or a sabbatical, can be particularly advantageous. Additionally, if you anticipate being in a higher tax bracket in the future, converting now at a lower tax rate can be beneficial. It is also worth noting that tax laws and rates are subject to change, so staying informed about potential legislative changes is crucial for making informed decisions.

Another factor to consider is the impact on your overall retirement strategy. While reducing RMDs and future tax liabilities is beneficial, it is essential to ensure that you maintain sufficient liquidity and diversification in your retirement portfolio. Converting too much of your 401(k) to a Roth IRA could limit your access to funds in the short term, as Roth IRAs have specific rules regarding withdrawals before age 59½. Therefore, balancing the conversion strategy with your broader financial goals and needs is vital.

In conclusion, annually converting a portion of your 401(k) to a Roth IRA can be an effective strategy for minimizing taxes and managing RMDs. However, it requires careful planning and consideration of various factors, including current and future tax brackets, timing, and overall retirement strategy. Consulting with a financial advisor or tax professional can provide valuable insights tailored to your specific situation, ensuring that your approach aligns with your long-term financial objectives. By thoughtfully navigating these complexities, you can optimize your retirement savings and achieve greater financial security.

Strategies for Minimizing Taxes Through Roth IRA Conversions

When considering strategies for minimizing taxes in retirement, converting a portion of your 401(k) to a Roth IRA annually can be an effective approach. This strategy involves transferring funds from a traditional 401(k), which is funded with pre-tax dollars, to a Roth IRA, where contributions are made with after-tax dollars. The primary advantage of this conversion is the potential for tax-free growth and withdrawals in retirement, which can be particularly beneficial if you anticipate being in a higher tax bracket in the future. Moreover, Roth IRAs are not subject to required minimum distributions (RMDs), unlike traditional 401(k)s, which can provide greater flexibility in managing your retirement income.

To begin with, converting 15% of your 401(k) to a Roth IRA each year can help spread out the tax liability over time. This gradual approach can prevent a significant spike in your taxable income in any given year, which might otherwise push you into a higher tax bracket. By carefully planning these conversions, you can manage your tax burden more effectively and potentially reduce the overall taxes paid during retirement. Additionally, this strategy allows you to take advantage of the current tax rates, which may be lower than those in the future due to potential legislative changes.

Furthermore, the absence of RMDs for Roth IRAs offers a distinct advantage in retirement planning. Traditional 401(k) accounts require you to start taking distributions at age 73, which can lead to increased taxable income and potentially higher taxes. By converting a portion of your 401(k) to a Roth IRA, you can retain more control over your withdrawals, allowing you to tailor your income to your needs and tax situation. This flexibility can be particularly advantageous if you have other sources of income or if you wish to leave a larger inheritance to your beneficiaries, as Roth IRAs can be passed on tax-free.

However, it is essential to consider the potential drawbacks of this strategy. The most immediate concern is the tax liability incurred at the time of conversion. Since the funds transferred from a 401(k) to a Roth IRA are subject to income tax, it is crucial to ensure that you have sufficient funds outside of your retirement accounts to cover this expense. Paying the taxes from the converted amount could diminish the benefits of the conversion, as it would reduce the amount available for tax-free growth.

Moreover, it is important to evaluate your current and projected future tax brackets. If you expect to be in a lower tax bracket during retirement, the immediate tax cost of conversion may outweigh the long-term benefits. Therefore, a thorough analysis of your financial situation, including your income sources, tax rates, and retirement goals, is necessary to determine if this strategy aligns with your objectives.

In conclusion, annually converting 15% of your 401(k) to a Roth IRA can be a viable strategy for minimizing taxes and managing RMDs in retirement. By spreading out the tax liability and taking advantage of the benefits offered by Roth IRAs, you can enhance your financial flexibility and potentially reduce your overall tax burden. Nevertheless, it is imperative to carefully assess your individual circumstances and consult with a financial advisor to ensure that this approach is suitable for your specific needs and goals.

Evaluating the Long-term Financial Impact of Roth IRA Conversions

When considering the long-term financial impact of converting a portion of your 401(k) to a Roth IRA, it is essential to weigh the potential benefits against the possible drawbacks. Converting 15% of your 401(k) annually to a Roth IRA can be a strategic move to minimize taxes and required minimum distributions (RMDs) in retirement. However, this decision should be made with careful consideration of your current financial situation, future income projections, and tax implications.

One of the primary advantages of converting to a Roth IRA is the tax-free growth and withdrawals it offers. Unlike traditional 401(k) accounts, which are funded with pre-tax dollars and taxed upon withdrawal, Roth IRAs are funded with after-tax dollars. This means that once you pay taxes on the converted amount, any future growth and qualified withdrawals are tax-free. This can be particularly beneficial if you anticipate being in a higher tax bracket during retirement or if you expect tax rates to rise in the future. By paying taxes now, you can potentially save a significant amount in taxes later.

Moreover, Roth IRAs do not have RMDs during the account holder’s lifetime, unlike traditional 401(k)s and IRAs, which require withdrawals starting at age 73. This feature allows for greater flexibility in managing your retirement income and can help preserve your savings for a longer period. By reducing the balance in your 401(k) through annual conversions, you can also decrease the amount subject to RMDs, thereby lowering your taxable income in retirement.

However, it is crucial to consider the immediate tax implications of converting a portion of your 401(k) to a Roth IRA. The converted amount is treated as taxable income in the year of conversion, which could push you into a higher tax bracket and increase your overall tax liability. Therefore, it is important to evaluate whether you have the financial means to cover the additional tax burden without dipping into your retirement savings. Additionally, spreading the conversions over several years, as suggested by the 15% annual conversion strategy, can help mitigate the impact on your tax bracket and provide a more manageable approach.

Another factor to consider is your time horizon until retirement. The longer you have until you begin withdrawing from your Roth IRA, the more time your investments have to grow tax-free, enhancing the benefits of the conversion. Conversely, if you are close to retirement, the immediate tax hit may outweigh the potential long-term benefits, making the conversion less advantageous.

Furthermore, it is essential to assess your overall retirement strategy and how a Roth conversion fits into it. Consider consulting with a financial advisor to analyze your specific situation, including your current and projected income, tax rates, and retirement goals. They can help you determine the optimal conversion amount and timing to align with your financial objectives.

In conclusion, while annually converting 15% of your 401(k) to a Roth IRA can offer significant tax advantages and flexibility in retirement, it is not a one-size-fits-all solution. Careful consideration of your current financial situation, future income expectations, and tax implications is necessary to make an informed decision. By evaluating these factors and seeking professional guidance, you can determine whether this strategy aligns with your long-term financial goals and retirement plans.

Key Considerations Before Converting 401(k) to Roth IRA Annually

When contemplating the annual conversion of 15% of a 401(k) to a Roth IRA, several key considerations must be taken into account to ensure that this strategy aligns with one’s financial goals and tax situation. The primary motivation for such a conversion often revolves around minimizing future taxes and required minimum distributions (RMDs). However, the decision is not straightforward and requires a thorough understanding of the implications involved.

Firstly, it is essential to consider the current tax bracket and how the conversion might impact it. Converting a portion of a 401(k) to a Roth IRA involves paying taxes on the converted amount at the current income tax rate. Therefore, if an individual is in a lower tax bracket now than they anticipate being in retirement, it might be advantageous to convert. This strategy allows for the payment of taxes at a lower rate, potentially resulting in tax savings over the long term. Conversely, if the conversion pushes the individual into a higher tax bracket, it may negate the benefits of the conversion.

Moreover, the timing of the conversion plays a crucial role. Converting during a year with lower income, such as after retirement but before RMDs begin, can be particularly beneficial. This period often presents a window of opportunity to convert funds at a lower tax rate. Additionally, spreading the conversion over several years, rather than converting a large sum in a single year, can help manage tax liabilities and avoid bracket creep.

Another consideration is the impact on Medicare premiums. Since Medicare premiums are based on modified adjusted gross income (MAGI), a significant conversion could increase MAGI and, consequently, Medicare premiums. This potential increase should be factored into the decision-making process, as it could offset some of the tax benefits gained from the conversion.

Furthermore, it is important to evaluate the long-term benefits of a Roth IRA. Unlike traditional 401(k)s, Roth IRAs do not have RMDs, allowing the account to grow tax-free for a longer period. This feature can be particularly advantageous for those who do not need to draw on their retirement savings immediately, as it provides greater flexibility in managing retirement income. Additionally, Roth IRAs offer tax-free withdrawals in retirement, which can be a significant benefit if tax rates rise in the future.

However, the decision to convert should also consider the availability of funds to pay the taxes due upon conversion. Ideally, taxes should be paid from sources outside the retirement account to maximize the growth potential of the Roth IRA. Using funds from the 401(k) to pay taxes reduces the amount available for growth and diminishes the benefits of the conversion.

In conclusion, while annually converting 15% of a 401(k) to a Roth IRA can be a strategic move to minimize taxes and RMDs, it requires careful consideration of various factors. These include current and future tax brackets, the timing of the conversion, potential impacts on Medicare premiums, and the availability of funds to cover taxes. By thoroughly evaluating these aspects, individuals can make informed decisions that align with their long-term financial objectives and retirement plans.

Comparing Traditional 401(k) and Roth IRA for Retirement Planning

When planning for retirement, understanding the nuances between a traditional 401(k) and a Roth IRA is crucial for optimizing tax efficiency and managing required minimum distributions (RMDs). The decision to annually convert a portion of your 401(k) to a Roth IRA can significantly impact your financial strategy, particularly in terms of minimizing taxes and RMDs. To begin with, it is essential to comprehend the fundamental differences between these two retirement accounts. A traditional 401(k) allows individuals to contribute pre-tax income, which reduces taxable income in the contribution year. However, withdrawals during retirement are taxed as ordinary income. In contrast, a Roth IRA is funded with after-tax dollars, meaning contributions do not reduce taxable income in the year they are made, but qualified withdrawals are tax-free.

The potential tax benefits of converting a portion of a 401(k) to a Roth IRA are compelling. By paying taxes on the converted amount now, you can potentially avoid higher tax rates in the future, especially if you anticipate being in a higher tax bracket during retirement. This strategy can be particularly advantageous if you expect tax rates to rise or if your income is currently lower than it will be in the future. Moreover, Roth IRAs do not have RMDs during the account holder’s lifetime, unlike traditional 401(k)s, which require withdrawals starting at age 73. This feature of Roth IRAs provides greater flexibility in managing retirement income and can help preserve wealth for heirs.

However, the decision to convert should not be taken lightly, as it involves several considerations. One must evaluate their current and projected future tax brackets, as well as the potential impact on their overall financial situation. Converting a large sum at once could push you into a higher tax bracket, negating some of the benefits. Therefore, a gradual conversion strategy, such as converting 15% annually, might be more beneficial. This approach allows for spreading the tax liability over several years, potentially keeping you in a lower tax bracket and minimizing the immediate tax impact.

Additionally, it is important to consider the time horizon until retirement. The longer the time until withdrawals are needed, the more advantageous a Roth conversion might be, as it allows more time for the converted funds to grow tax-free. Conversely, if retirement is imminent, the benefits of conversion may be less pronounced. Furthermore, individuals should assess their ability to pay the taxes due on the conversion without dipping into retirement savings, as using retirement funds to pay taxes can diminish the growth potential of those savings.

In conclusion, while converting a portion of a 401(k) to a Roth IRA annually can offer significant tax advantages and reduce RMDs, it requires careful consideration of various factors, including current and future tax rates, time until retirement, and the ability to pay conversion taxes. Consulting with a financial advisor can provide personalized insights and help determine the most effective strategy for your unique financial situation. By thoughtfully evaluating these elements, you can make informed decisions that align with your long-term retirement goals and financial well-being.

Q&A

1. **What is the main benefit of converting a 401(k) to a Roth IRA?**

Converting a 401(k) to a Roth IRA allows for tax-free growth and withdrawals in retirement, as Roth IRAs are funded with after-tax dollars.

2. **How does converting to a Roth IRA affect Required Minimum Distributions (RMDs)?**

Roth IRAs do not have RMDs during the account holder’s lifetime, unlike traditional 401(k)s, which can help minimize taxable income in retirement.

3. **What are the tax implications of converting a 401(k) to a Roth IRA?**

The amount converted is considered taxable income in the year of conversion, potentially increasing your tax liability for that year.

4. **How can converting 15% annually help with tax management?**

Converting a portion annually can spread out the tax impact over several years, potentially keeping you in a lower tax bracket each year.

5. **What factors should be considered before converting?**

Consider your current and expected future tax rates, your ability to pay the taxes due on conversion, and your retirement timeline.

6. **Are there any penalties for converting a 401(k) to a Roth IRA?**

There are no penalties for converting, but taxes must be paid on the converted amount. Ensure you have funds available to cover this tax liability.

7. **Is there an income limit for converting a 401(k) to a Roth IRA?**

There are no income limits for conversions, unlike contributions to a Roth IRA, making it accessible for high-income earners.

Conclusion

Converting 15% of your 401(k) to a Roth IRA annually can be a strategic move to minimize taxes and required minimum distributions (RMDs) in retirement. By paying taxes on the converted amount now, you potentially reduce your taxable income in the future, as Roth IRAs do not have RMDs and qualified withdrawals are tax-free. This strategy is particularly beneficial if you expect to be in a higher tax bracket during retirement or if you want to leave a tax-free inheritance. However, it’s crucial to consider your current tax situation, potential changes in tax laws, and your long-term financial goals. Consulting with a financial advisor can provide personalized guidance tailored to your circumstances.