“Timeless Wisdom: Shaq’s Game-Changing Investment Insight from an 80-Year-Old Mentor”

Introduction

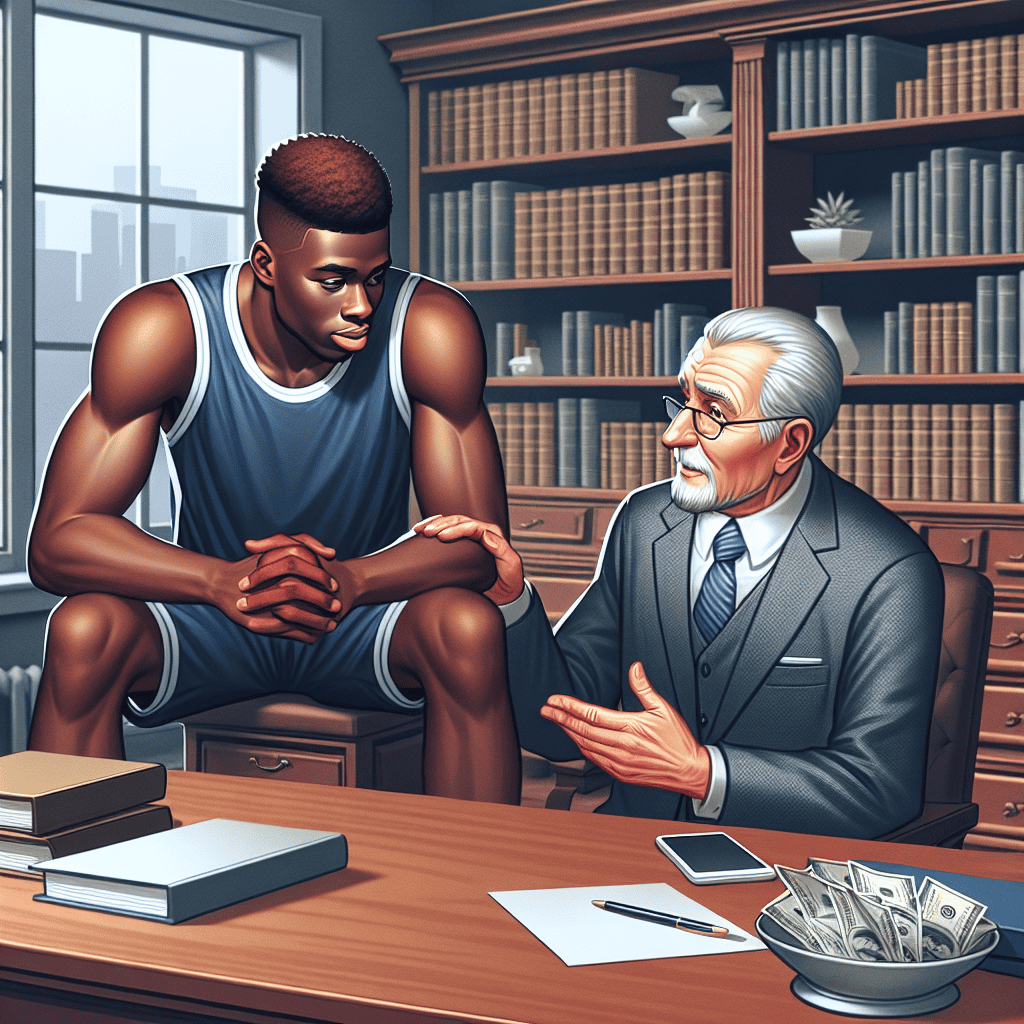

Shaquille O’Neal, the legendary basketball player turned successful entrepreneur, has often credited his off-court achievements to the wisdom imparted by his mentors. Among the most impactful advice he received came from an 80-year-old mentor who profoundly influenced his approach to investing. This guidance not only shaped O’Neal’s financial strategies but also underscored the importance of patience, diversification, and long-term vision in building sustainable wealth. As O’Neal shares this invaluable advice, it offers a glimpse into the principles that have guided his transition from sports icon to savvy businessman, providing inspiration and insight for aspiring investors.

The Impact of Mentorship: How Shaquille O’Neal’s 80-Year-Old Mentor Shaped His Investment Strategy

Shaquille O’Neal, a name synonymous with basketball excellence, has also carved out a significant presence in the world of business and investment. While many know him for his towering presence on the court, fewer are aware of the strategic acumen he has developed off the court, particularly in the realm of investments. This transformation from athlete to astute businessman did not occur in isolation; rather, it was significantly influenced by the guidance of an 80-year-old mentor whose wisdom has left an indelible mark on O’Neal’s approach to investing.

The journey of mentorship began when O’Neal, despite his success in basketball, recognized the importance of financial literacy and the need to secure his future beyond sports. It was during this period of introspection that he encountered his mentor, a seasoned investor with decades of experience. This mentor imparted a piece of advice that would become the cornerstone of O’Neal’s investment philosophy: “It’s not about how much money you make, but how much money you keep.” This simple yet profound statement shifted O’Neal’s perspective, emphasizing the importance of sustainable wealth management over mere accumulation.

Under the guidance of his mentor, O’Neal learned to prioritize investments that offered long-term value and stability. This approach was a departure from the high-risk, high-reward mentality that often tempts new investors. Instead, O’Neal was encouraged to focus on opportunities that aligned with his personal values and interests, ensuring that his investments were not only financially sound but also personally fulfilling. This strategy has led him to invest in a diverse portfolio that includes real estate, technology startups, and even a stake in a fast-food franchise.

Moreover, the mentorship emphasized the importance of due diligence and informed decision-making. O’Neal was taught to thoroughly research potential investments, understanding the market dynamics and the competitive landscape before committing his resources. This meticulous approach has enabled him to identify promising ventures while avoiding pitfalls that could jeopardize his financial stability. The mentor’s insistence on education and preparation has been instrumental in shaping O’Neal’s reputation as a savvy investor.

In addition to financial guidance, the mentor also instilled in O’Neal the value of giving back to the community. This principle has been a driving force behind many of O’Neal’s philanthropic endeavors, where he leverages his financial success to make a positive impact on society. By integrating social responsibility into his investment strategy, O’Neal has not only enhanced his personal brand but also contributed to causes that resonate with his values.

The impact of this mentorship extends beyond financial success, as it has also influenced O’Neal’s personal growth and development. The mentor’s wisdom has taught him the importance of humility, patience, and perseverance, qualities that have served him well in both his professional and personal life. As O’Neal continues to expand his business ventures, the lessons imparted by his mentor remain a guiding force, ensuring that his investments are not only profitable but also meaningful.

In conclusion, the mentorship of an 80-year-old investor has profoundly shaped Shaquille O’Neal’s approach to investing, providing him with the tools and insights necessary to navigate the complex world of finance. Through a focus on sustainable wealth management, informed decision-making, and social responsibility, O’Neal has successfully transitioned from a basketball legend to a respected businessman. This transformation underscores the invaluable role that mentorship can play in shaping one’s career and life, offering lessons that extend far beyond financial success.

Timeless Wisdom: Investment Lessons from Shaquille O’Neal’s Elderly Mentor

Shaquille O’Neal, the legendary basketball player known for his towering presence on the court, has also made a significant impact off the court as a successful businessman and investor. Over the years, O’Neal has diversified his portfolio, investing in various industries ranging from technology to food and beverage. However, his journey into the world of investments was not one he navigated alone. In a recent interview, O’Neal shared the invaluable investment advice he received from an 80-year-old mentor, which has profoundly influenced his approach to building wealth.

The advice, simple yet profound, was to invest in what you know and understand. This principle, often echoed by seasoned investors, emphasizes the importance of familiarity and comprehension in making sound investment decisions. O’Neal’s mentor advised him to focus on industries and products he was passionate about and had a deep understanding of, rather than chasing trends or succumbing to the allure of quick profits. This approach not only minimizes risk but also allows investors to make informed decisions based on their knowledge and experience.

O’Neal took this advice to heart, applying it to his investment strategy with remarkable success. For instance, his investments in the food and beverage industry, including a stake in a popular fast-food chain, were driven by his personal interest and understanding of the market. By investing in sectors he was familiar with, O’Neal was able to leverage his insights and connections, ultimately leading to more informed and strategic decisions.

Moreover, the advice to invest in what you know aligns with the broader investment philosophy of conducting thorough research and due diligence. O’Neal’s mentor emphasized the importance of understanding the intricacies of a business before committing capital. This involves analyzing financial statements, understanding market trends, and assessing the competitive landscape. By doing so, investors can identify potential risks and opportunities, enabling them to make more calculated and confident investment choices.

In addition to investing in familiar industries, O’Neal’s mentor also stressed the significance of patience and long-term thinking. The mentor advised that wealth is not built overnight but rather through consistent and disciplined investing over time. This perspective encourages investors to adopt a long-term mindset, focusing on sustainable growth rather than short-term gains. O’Neal has embraced this philosophy, often emphasizing the importance of patience and perseverance in his investment endeavors.

Furthermore, the mentor’s advice underscores the value of diversification. While investing in familiar industries is crucial, it is equally important to diversify one’s portfolio to mitigate risk. O’Neal has successfully diversified his investments across various sectors, including technology, real estate, and entertainment. This diversification not only spreads risk but also provides opportunities for growth in different market conditions.

In conclusion, the investment advice Shaquille O’Neal received from his 80-year-old mentor serves as a timeless reminder of the fundamental principles of successful investing. By focusing on what you know, conducting thorough research, adopting a long-term perspective, and diversifying your portfolio, investors can navigate the complexities of the financial world with greater confidence and success. O’Neal’s journey from basketball legend to savvy investor exemplifies the power of these principles, offering valuable lessons for both novice and experienced investors alike.

Shaquille O’Neal’s Financial Success: Insights from His 80-Year-Old Mentor

Shaquille O’Neal, a name synonymous with basketball greatness, has also carved out a significant niche in the world of business and investments. While many know him for his towering presence on the court, fewer are aware of his astute financial acumen off it. O’Neal’s journey into the realm of successful investing is not just a tale of personal triumph but also a testament to the wisdom imparted by his 80-year-old mentor. This mentor, whose identity remains a closely guarded secret, provided O’Neal with invaluable advice that has shaped his financial strategies and contributed to his success.

The cornerstone of the advice given to O’Neal was the importance of understanding the value of money and the power of making informed decisions. His mentor emphasized that wealth is not merely about accumulating money but about making it work for you. This perspective encouraged O’Neal to view investments not as mere transactions but as opportunities to grow and sustain wealth over time. By adopting this mindset, O’Neal was able to transition from a successful athlete to a savvy investor, diversifying his portfolio across various industries.

Moreover, O’Neal’s mentor instilled in him the significance of patience and long-term planning. In a world where quick returns are often glorified, the advice to focus on sustainable growth rather than immediate gratification was pivotal. This approach allowed O’Neal to invest in ventures that aligned with his values and interests, ensuring that his financial endeavors were not only profitable but also personally fulfilling. By prioritizing long-term stability over short-term gains, O’Neal has been able to build a robust financial foundation that continues to thrive.

In addition to patience, the mentor highlighted the importance of due diligence and research. O’Neal was taught to thoroughly investigate potential investments, understanding the intricacies of each opportunity before committing his resources. This meticulous approach has enabled him to make informed decisions, minimizing risks and maximizing returns. By being diligent and well-informed, O’Neal has successfully navigated the complexities of the investment world, avoiding many of the pitfalls that often ensnare less cautious investors.

Furthermore, O’Neal’s mentor encouraged him to surround himself with knowledgeable and trustworthy advisors. Recognizing that no one can be an expert in every field, O’Neal sought the counsel of professionals who could provide insights and guidance in areas beyond his expertise. This collaborative approach has been instrumental in his financial success, allowing him to leverage the knowledge and experience of others to make sound investment choices.

Lastly, the mentor’s advice underscored the importance of giving back to the community. O’Neal has consistently used his financial success to support charitable causes, understanding that true wealth is measured not only by personal gain but by the positive impact one can have on others. This philanthropic mindset has not only enriched O’Neal’s life but has also reinforced the values imparted by his mentor.

In conclusion, the investment advice Shaquille O’Neal received from his 80-year-old mentor has been a guiding force in his financial journey. By emphasizing the value of money, the importance of patience, due diligence, collaboration, and philanthropy, this mentor has helped shape O’Neal into a successful investor and a responsible steward of his wealth. Through these insights, O’Neal continues to inspire others, demonstrating that with the right guidance and mindset, financial success is within reach.

Age-Old Advice: The Best Investment Tips Shaquille O’Neal Learned from His Mentor

Shaquille O’Neal, the legendary basketball player known for his towering presence on the court, has also made a significant impact off the court as a successful businessman and investor. Over the years, O’Neal has diversified his portfolio, investing in various industries ranging from technology to food and beverage. However, his journey into the world of investments was not one he navigated alone. O’Neal attributes much of his financial acumen to the invaluable advice he received from an 80-year-old mentor, whose wisdom has guided him through the complexities of the investment landscape.

The essence of the advice imparted to O’Neal by his mentor revolves around the principle of patience and the importance of understanding the value of long-term investments. In a world where instant gratification often takes precedence, this age-old wisdom emphasizes the significance of thinking beyond immediate returns. O’Neal’s mentor advised him to focus on investments that would yield benefits over time, rather than those promising quick profits. This perspective has allowed O’Neal to build a robust investment portfolio that continues to grow steadily.

Moreover, O’Neal’s mentor stressed the importance of due diligence and thorough research before committing to any investment. This advice underscores the necessity of understanding the intricacies of the market and the specific industry in which one is investing. By taking the time to analyze potential investments, O’Neal has been able to make informed decisions that align with his financial goals and risk tolerance. This methodical approach has been instrumental in minimizing risks and maximizing returns, a testament to the soundness of his mentor’s guidance.

In addition to patience and research, O’Neal’s mentor highlighted the value of diversification. By spreading investments across various sectors, O’Neal has been able to mitigate risks associated with market volatility. This strategy not only protects his assets but also provides opportunities for growth in different economic conditions. Diversification, as advised by his mentor, has been a cornerstone of O’Neal’s investment strategy, allowing him to capitalize on emerging trends while safeguarding his financial future.

Furthermore, O’Neal’s mentor instilled in him the importance of staying true to one’s values and investing in companies that align with personal beliefs. This ethical approach to investing ensures that O’Neal’s financial endeavors reflect his principles, fostering a sense of integrity and purpose in his business ventures. By supporting companies that resonate with his values, O’Neal not only contributes to their success but also reinforces his commitment to responsible investing.

In conclusion, the investment advice Shaquille O’Neal received from his 80-year-old mentor has been instrumental in shaping his approach to financial management. The principles of patience, thorough research, diversification, and ethical investing have guided O’Neal in building a successful and sustainable investment portfolio. As he continues to navigate the ever-evolving world of finance, O’Neal remains grateful for the timeless wisdom imparted by his mentor, which has proven to be as relevant today as it was when first shared. Through this guidance, O’Neal exemplifies how age-old advice can serve as a foundation for modern financial success, bridging the gap between experience and innovation.

From Basketball to Business: Shaquille O’Neal’s Mentor-Driven Investment Journey

Shaquille O’Neal, a name synonymous with basketball excellence, has seamlessly transitioned from the hardwood courts to the boardrooms of business. His journey from a celebrated athlete to a successful entrepreneur is not just a tale of personal ambition but also one of mentorship and learning. At the heart of this transformation lies the invaluable advice he received from an 80-year-old mentor, which has profoundly influenced his investment strategies and business acumen.

O’Neal’s foray into the world of business was not an impulsive leap but a carefully considered decision, guided by the wisdom of those who had walked the path before him. Among these guiding figures was an elderly mentor whose insights into investment were both simple and profound. The mentor’s advice was rooted in the principle of understanding and passion. He emphasized that one should only invest in businesses and ventures that they genuinely understand and are passionate about. This advice resonated deeply with O’Neal, who realized that his success on the basketball court was largely due to his passion for the game and his deep understanding of its nuances.

Transitioning this philosophy into the business realm, O’Neal began to scrutinize potential investments through the lens of personal interest and comprehension. This approach not only minimized risks but also ensured that he remained engaged and motivated in his business endeavors. For instance, his investments in the food and beverage industry, including franchises like Krispy Kreme and Papa John’s, were driven by his personal affinity for these brands and a thorough understanding of their market dynamics. This strategy of aligning investments with personal interests has been a cornerstone of his business success.

Moreover, the mentor’s advice extended beyond the realm of financial investments to encompass the broader concept of investing in people. O’Neal learned the importance of surrounding himself with knowledgeable and trustworthy individuals who could offer diverse perspectives and expertise. This approach has allowed him to build a robust network of advisors and partners, each contributing to his ventures’ success in unique ways. By investing in relationships and fostering a collaborative environment, O’Neal has been able to leverage collective wisdom, which has been instrumental in navigating the complexities of the business world.

In addition to these principles, O’Neal’s mentor also instilled in him the value of patience and long-term vision. The mentor often reminded him that successful investments are not about quick returns but about sustainable growth and enduring value. This perspective has shaped O’Neal’s investment philosophy, encouraging him to focus on ventures that promise long-term benefits rather than short-lived gains. His strategic patience has been evident in his real estate investments, where he has consistently prioritized properties with potential for appreciation over time.

In conclusion, Shaquille O’Neal’s transition from basketball to business is a testament to the power of mentorship and the enduring value of sound investment advice. The guidance he received from his 80-year-old mentor has not only shaped his investment strategies but also reinforced the importance of passion, understanding, and patience in achieving success. As O’Neal continues to expand his business empire, these principles remain at the core of his endeavors, guiding him toward new opportunities and challenges with confidence and clarity.

The Mentor’s Influence: How Shaquille O’Neal Applies His Mentor’s Investment Advice

Shaquille O’Neal, a name synonymous with basketball excellence, has also carved out a significant presence in the world of business and investment. While many know him for his dominance on the court, fewer are aware of the strategic acumen he applies to his financial ventures. Central to his success in this arena is the invaluable advice he received from an 80-year-old mentor, whose wisdom has profoundly influenced O’Neal’s approach to investing. This guidance has not only shaped his financial decisions but also provided a framework for sustainable wealth management.

The mentor, whose identity O’Neal has chosen to keep private, imparted a simple yet powerful piece of advice: “Invest in things that change people’s lives.” This principle has become a cornerstone of O’Neal’s investment strategy, guiding him to focus on opportunities that offer both financial returns and societal impact. By prioritizing investments that have the potential to make a difference, O’Neal has been able to align his financial goals with his personal values, creating a portfolio that reflects his commitment to positive change.

Transitioning from the basketball court to the boardroom, O’Neal has applied this advice in various sectors, including technology, food, and entertainment. For instance, his investment in Google during its early days exemplifies his ability to identify transformative opportunities. Recognizing the potential of a company that would revolutionize the way people access information, O’Neal’s decision to invest in Google was not only financially astute but also aligned with his mentor’s philosophy of supporting life-changing innovations.

Moreover, O’Neal’s involvement with companies like Ring, the smart doorbell company, further illustrates his adherence to this investment principle. By investing in a product that enhances home security and peace of mind for countless individuals, O’Neal has demonstrated his commitment to backing ventures that improve everyday life. This approach not only yields financial benefits but also contributes to a legacy of meaningful impact.

In addition to technology, O’Neal has ventured into the food industry, investing in brands that promote healthier lifestyles. His partnership with Papa John’s, for example, goes beyond financial interest; it reflects his desire to influence the company’s direction towards more inclusive and community-focused practices. By leveraging his platform and resources, O’Neal aims to drive positive change within the industry, embodying the mentor’s advice to invest in transformative initiatives.

Furthermore, O’Neal’s investment strategy is characterized by a long-term perspective, another lesson imparted by his mentor. Rather than seeking quick profits, he emphasizes the importance of patience and resilience, understanding that meaningful change and substantial returns often require time. This mindset has enabled him to weather market fluctuations and remain committed to his investment principles, ensuring sustained growth and impact.

In conclusion, the investment advice Shaquille O’Neal received from his 80-year-old mentor has been instrumental in shaping his approach to business and finance. By focusing on opportunities that change people’s lives, O’Neal has built a diverse and impactful portfolio that reflects his values and vision. Through strategic investments in technology, food, and entertainment, he continues to apply this wisdom, demonstrating that the most successful ventures are those that balance financial success with societal benefit. As O’Neal’s journey illustrates, the guidance of a wise mentor can leave an indelible mark, influencing decisions and shaping legacies for years to come.

Learning from Experience: Shaquille O’Neal’s Investment Philosophy Inspired by His Mentor

Shaquille O’Neal, the legendary basketball player known for his towering presence on the court, has also made a significant impact off the court as a successful businessman and investor. His journey into the world of investments, however, was not one he embarked upon alone. O’Neal attributes much of his financial acumen to the invaluable advice he received from an 80-year-old mentor, whose wisdom has profoundly shaped his investment philosophy. This mentor, whose identity O’Neal has chosen to keep private, imparted lessons that have guided him through the complexities of financial decision-making.

One of the most pivotal pieces of advice O’Neal received was the importance of understanding the value of money and the necessity of making it work for him. This principle, though seemingly straightforward, is often overlooked by many who come into sudden wealth. O’Neal’s mentor emphasized the significance of investing in assets that generate passive income, thereby ensuring financial stability and growth over time. This approach resonated with O’Neal, who recognized the need to secure his financial future beyond his basketball career.

Moreover, O’Neal’s mentor instilled in him the importance of due diligence and thorough research before making any investment. This advice has been instrumental in O’Neal’s approach to business ventures, as he meticulously evaluates potential opportunities, considering both the risks and rewards. By doing so, he has been able to make informed decisions that align with his long-term financial goals. This methodical approach has not only minimized potential losses but also maximized returns, allowing O’Neal to build a diverse and robust investment portfolio.

In addition to financial prudence, O’Neal’s mentor also highlighted the value of investing in industries and products that resonate personally with him. This advice has led O’Neal to invest in businesses that align with his interests and values, such as technology, real estate, and consumer products. By focusing on areas he is passionate about, O’Neal has been able to leverage his personal brand and expertise, further enhancing the success of his investments. This strategy underscores the importance of aligning one’s investments with personal interests, as it not only fosters a deeper understanding of the industry but also enhances the potential for success.

Furthermore, O’Neal’s mentor taught him the significance of giving back to the community and using his wealth to make a positive impact. This lesson has been a guiding principle in O’Neal’s life, as he actively engages in philanthropic endeavors and invests in initiatives that promote social good. By doing so, he has been able to create a legacy that extends beyond financial success, embodying the values of responsibility and compassion.

In conclusion, the investment philosophy that Shaquille O’Neal has developed, inspired by the sage advice of his 80-year-old mentor, is a testament to the power of learning from experience. By emphasizing the importance of financial literacy, due diligence, personal alignment, and social responsibility, O’Neal has crafted a successful investment strategy that continues to yield dividends. His journey serves as an inspiring example for aspiring investors, illustrating the profound impact that mentorship and thoughtful guidance can have on one’s financial trajectory.

Q&A

1. **Question:** Who is Shaquille O’Neal’s 80-year-old mentor?

– **Answer:** Shaquille O’Neal’s 80-year-old mentor is not specifically named in the context of the investment advice he received.

2. **Question:** What is the best investment advice Shaquille O’Neal received from his mentor?

– **Answer:** The best investment advice Shaquille O’Neal received was to invest in things that change people’s lives.

3. **Question:** How has Shaquille O’Neal applied this investment advice in his career?

– **Answer:** Shaquille O’Neal has applied this advice by investing in companies and products that have a significant impact on people’s lives, such as technology and consumer goods.

4. **Question:** What is one example of a successful investment Shaquille O’Neal made following this advice?

– **Answer:** One example of a successful investment is his early investment in Google, which has had a transformative impact on technology and information access.

5. **Question:** Why does Shaquille O’Neal value this investment advice?

– **Answer:** Shaquille O’Neal values this advice because it aligns with his desire to make a positive impact and ensure his investments are meaningful and beneficial to society.

6. **Question:** How does Shaquille O’Neal’s investment strategy reflect his personal values?

– **Answer:** His investment strategy reflects his personal values by focusing on opportunities that promote innovation, improve quality of life, and contribute to societal progress.

7. **Question:** What is a key takeaway from Shaquille O’Neal’s investment philosophy?

– **Answer:** A key takeaway is the importance of investing in ventures that not only offer financial returns but also have the potential to make a significant positive difference in the world.

Conclusion

Shaquille O’Neal shared that the best investment advice he received from his 80-year-old mentor was to focus on investing in things that align with his passions and interests, rather than just chasing profits. This approach not only ensures a deeper personal connection to his investments but also increases the likelihood of long-term success and fulfillment. By prioritizing investments that resonate with his values and experiences, O’Neal has been able to build a diverse and successful portfolio that reflects his unique perspective and strengths.