“Sam Altman’s Startup Soars: Powering the Future with a 130% Surge in Nuclear Innovation!”

Introduction

Sam Altman’s startup has experienced a remarkable surge, with its valuation skyrocketing by 130% amid a growing interest in nuclear stocks. This surge reflects a broader trend in the investment community, where nuclear energy is increasingly seen as a viable and sustainable solution to global energy challenges. Altman, known for his visionary leadership and innovative approach, has positioned his company at the forefront of this burgeoning sector. As investors seek out opportunities in clean and efficient energy sources, Altman’s startup stands out, attracting significant attention and capital. This growth underscores the potential of nuclear technology to play a pivotal role in the future energy landscape, driven by advancements and strategic investments in the field.

The Rise of Sam Altman: A Deep Dive into His Startup’s 130% Surge

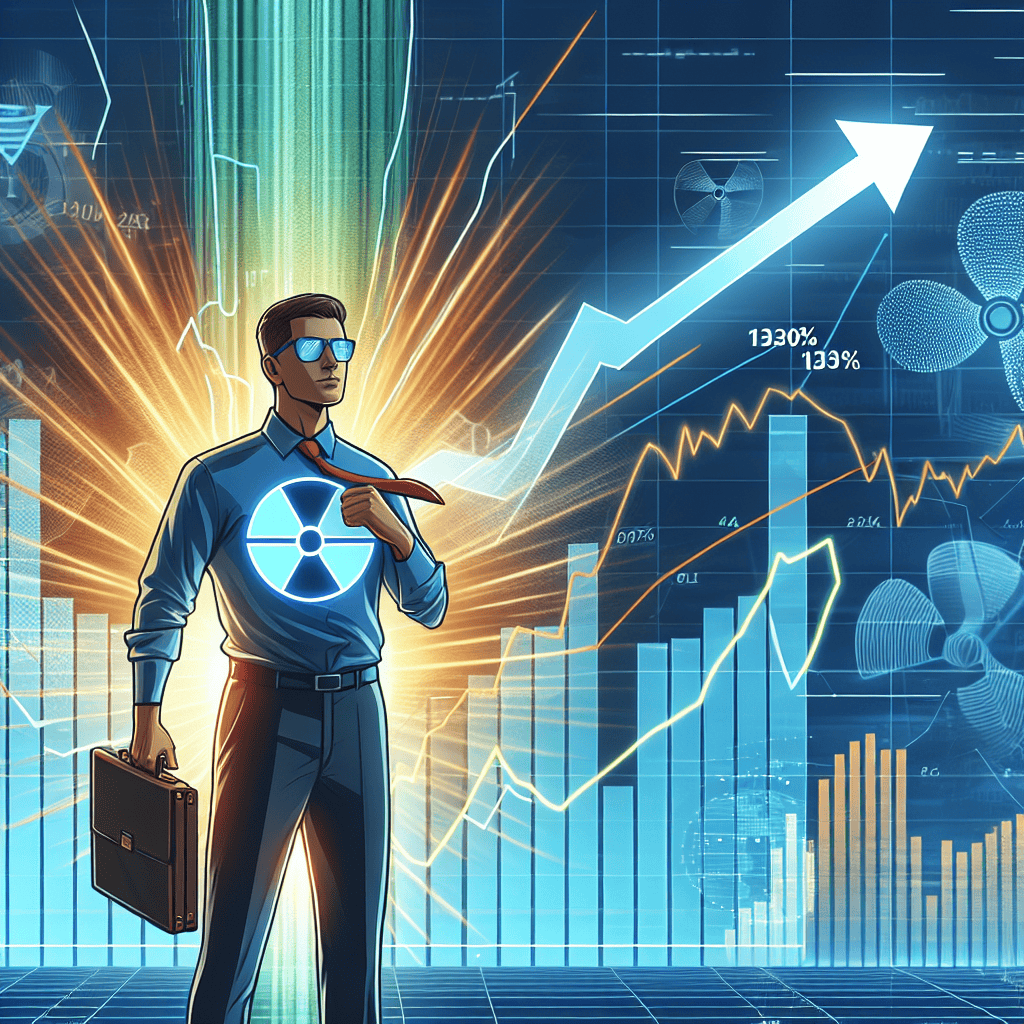

Sam Altman, a prominent figure in the tech industry, has recently made headlines with his startup’s remarkable 130% surge in valuation, capturing the attention of investors and analysts alike. This surge is not only a testament to Altman’s visionary leadership but also indicative of a broader trend in the market: the rising interest in nuclear stocks. As the world grapples with the urgent need for sustainable energy solutions, nuclear power is increasingly being viewed as a viable alternative to fossil fuels, and Altman’s startup is strategically positioned to capitalize on this shift.

The startup, which focuses on innovative nuclear technologies, has been at the forefront of developing safer and more efficient nuclear reactors. These advancements are crucial in addressing the longstanding concerns associated with nuclear energy, such as safety risks and waste management. By leveraging cutting-edge technology, Altman’s company aims to revolutionize the nuclear industry, making it more palatable to both regulators and the public. This strategic focus has undoubtedly contributed to the company’s impressive growth, as investors are eager to support ventures that promise both profitability and sustainability.

Moreover, the global energy landscape is undergoing a significant transformation, driven by the increasing demand for clean energy sources. Governments worldwide are setting ambitious targets to reduce carbon emissions, and nuclear energy is being reconsidered as a key component of the clean energy mix. This renewed interest in nuclear power has led to a surge in nuclear stocks, with investors recognizing the potential for substantial returns. Altman’s startup, with its innovative approach and strong leadership, is well-positioned to benefit from this trend, attracting significant investment and driving its valuation upward.

In addition to the favorable market conditions, Altman’s reputation as a successful entrepreneur and investor has played a crucial role in the startup’s rapid ascent. Known for his tenure as the president of Y Combinator, Altman has a proven track record of identifying and nurturing high-potential startups. His involvement in the nuclear sector has lent credibility to the venture, instilling confidence in investors and stakeholders. Furthermore, Altman’s ability to assemble a team of experts in nuclear technology and business development has been instrumental in executing the company’s strategic vision, ensuring that it remains at the cutting edge of innovation.

The startup’s success also highlights the growing intersection of technology and energy, as advancements in artificial intelligence, materials science, and data analytics are increasingly being applied to the energy sector. By harnessing these technologies, Altman’s company is not only improving the efficiency and safety of nuclear reactors but also reducing costs, making nuclear energy more competitive with other renewable sources. This technological integration is a key factor in the startup’s appeal to investors, who are keen to support companies that are driving the future of energy.

In conclusion, Sam Altman’s startup’s 130% surge is a reflection of both the company’s strategic positioning in the burgeoning nuclear sector and the broader market dynamics favoring clean energy solutions. As the world continues to seek sustainable alternatives to traditional energy sources, nuclear power is poised to play a pivotal role, and Altman’s venture is at the forefront of this transformation. With a strong leadership team, innovative technology, and a favorable market environment, the startup is well-equipped to continue its upward trajectory, offering promising prospects for investors and contributing to the global transition towards a more sustainable energy future.

Understanding the Market: Why Nuclear Stocks Are Gaining Popularity

In recent months, the financial markets have witnessed a remarkable surge in the valuation of nuclear energy stocks, with Sam Altman’s startup leading the charge with an impressive 130% increase. This surge is not an isolated phenomenon but rather a reflection of a broader trend that has seen nuclear stocks gaining popularity among investors. Understanding the factors driving this interest requires a closer examination of the current energy landscape, technological advancements, and shifting investor sentiments.

To begin with, the global energy market is undergoing a significant transformation as countries strive to meet ambitious climate goals. The urgency to reduce carbon emissions has intensified the search for sustainable and reliable energy sources. In this context, nuclear energy is increasingly being recognized as a viable solution due to its ability to generate large amounts of electricity with minimal greenhouse gas emissions. Unlike fossil fuels, nuclear power plants produce energy through fission, a process that does not emit carbon dioxide during operation. This characteristic positions nuclear energy as a critical component in the transition to a low-carbon future.

Moreover, technological advancements have played a pivotal role in enhancing the appeal of nuclear energy. Innovations in reactor design, such as small modular reactors (SMRs), promise to address some of the traditional concerns associated with nuclear power, including safety and waste management. SMRs are designed to be more flexible, cost-effective, and safer than conventional reactors, making them an attractive option for both developed and developing nations. As these technologies continue to mature, they are likely to bolster investor confidence in the nuclear sector.

In addition to technological progress, geopolitical factors are also contributing to the rising interest in nuclear stocks. The ongoing volatility in global oil and gas markets, exacerbated by geopolitical tensions, has underscored the need for energy diversification. Countries are increasingly looking to reduce their dependence on imported fossil fuels and enhance their energy security. Nuclear energy, with its potential for domestic production and stable supply, offers a strategic advantage in this regard. Consequently, governments are revisiting their nuclear policies and investing in the development of nuclear infrastructure, further fueling investor optimism.

Furthermore, the financial community’s growing emphasis on environmental, social, and governance (ESG) criteria is reshaping investment strategies. Investors are increasingly seeking opportunities that align with sustainable and ethical practices. Nuclear energy, despite its historical controversies, is gaining recognition as a clean energy source that can contribute to ESG goals. This shift in perception is attracting institutional investors and funds that prioritize sustainability, thereby driving up the demand for nuclear stocks.

Sam Altman’s startup, which has seen its valuation surge by 130%, exemplifies the confluence of these factors. The company’s innovative approach to nuclear technology, coupled with its alignment with global sustainability objectives, has captured the attention of investors eager to capitalize on the burgeoning nuclear market. As more startups and established companies enter the nuclear space, the sector is poised for further growth.

In conclusion, the rising popularity of nuclear stocks is a multifaceted phenomenon driven by the urgent need for clean energy, technological advancements, geopolitical considerations, and evolving investment paradigms. As the world continues to grapple with the challenges of climate change and energy security, nuclear energy is emerging as a key player in the global energy transition. Investors, recognizing the potential of this sector, are increasingly turning their attention to nuclear stocks, propelling companies like Sam Altman’s startup to new heights.

Sam Altman’s Vision: How Innovation Drives Success in the Nuclear Sector

Sam Altman, a prominent figure in the tech industry, has recently made headlines with his startup’s remarkable 130% surge in valuation, reflecting a growing interest in nuclear stocks. This surge is not merely a result of market speculation but is deeply rooted in Altman’s visionary approach to innovation within the nuclear sector. As the world grapples with the dual challenges of climate change and energy security, nuclear energy is increasingly being viewed as a viable solution. Altman’s startup, leveraging cutting-edge technology and strategic foresight, is well-positioned to capitalize on this trend.

The renewed interest in nuclear energy is driven by its potential to provide a stable and low-carbon energy source. Unlike fossil fuels, nuclear power generates electricity without emitting greenhouse gases during operation, making it an attractive option for countries aiming to meet their climate goals. Furthermore, advancements in nuclear technology, such as small modular reactors (SMRs) and fusion energy, promise to address some of the traditional concerns associated with nuclear power, including safety and waste management. Altman’s startup is at the forefront of these advancements, focusing on developing innovative solutions that enhance the safety, efficiency, and sustainability of nuclear energy.

One of the key factors contributing to the success of Altman’s startup is its emphasis on research and development. By investing heavily in R&D, the company is able to push the boundaries of what is possible in nuclear technology. This commitment to innovation is evident in its collaborations with leading research institutions and its recruitment of top talent from around the world. These efforts have resulted in several breakthroughs, positioning the startup as a leader in the nuclear sector.

Moreover, Altman’s strategic vision extends beyond technological innovation. Recognizing the importance of public perception and regulatory support, the startup actively engages with policymakers, industry stakeholders, and the public to build trust and foster a positive narrative around nuclear energy. This proactive approach has helped to mitigate some of the skepticism and resistance that often accompany nuclear projects, paving the way for smoother implementation and adoption of their technologies.

In addition to its technological and strategic initiatives, Altman’s startup benefits from a favorable market environment. The increasing urgency to transition to clean energy sources, coupled with geopolitical tensions affecting global energy supplies, has heightened interest in nuclear stocks. Investors are keen to support companies that offer sustainable and reliable energy solutions, and Altman’s startup fits this profile perfectly. The company’s impressive growth trajectory is a testament to its ability to attract investment and capitalize on market opportunities.

Furthermore, Altman’s leadership style plays a crucial role in the startup’s success. Known for his forward-thinking approach and ability to inspire teams, Altman fosters a culture of innovation and collaboration within the company. This culture not only drives the development of groundbreaking technologies but also ensures that the startup remains agile and responsive to changing market dynamics.

In conclusion, Sam Altman’s startup’s 130% surge amid rising interest in nuclear stocks is a reflection of its strategic vision, commitment to innovation, and ability to navigate the complexities of the nuclear sector. As the world continues to seek sustainable energy solutions, Altman’s startup is poised to play a significant role in shaping the future of nuclear energy. Through its technological advancements, strategic engagement, and strong leadership, the company exemplifies how innovation can drive success in the nuclear sector, offering a promising path forward in the quest for clean and reliable energy.

Investment Trends: The Growing Interest in Nuclear Energy Stocks

In recent months, the investment landscape has witnessed a remarkable shift, with nuclear energy stocks capturing the attention of investors worldwide. This burgeoning interest is largely driven by the growing recognition of nuclear power as a viable solution to the global energy crisis and the urgent need to transition to cleaner energy sources. Among the companies benefiting from this trend is Sam Altman’s startup, which has experienced a staggering 130% surge in its stock value. This impressive growth underscores the increasing confidence in nuclear energy as a cornerstone of future energy strategies.

The surge in Altman’s startup is emblematic of a broader trend in the energy sector, where nuclear power is being reevaluated as a sustainable and efficient energy source. As the world grapples with the dual challenges of reducing carbon emissions and meeting rising energy demands, nuclear energy offers a compelling solution. Unlike fossil fuels, nuclear power generates electricity with minimal greenhouse gas emissions, making it an attractive option for countries striving to meet their climate goals. Furthermore, advancements in nuclear technology, such as small modular reactors (SMRs), promise to enhance the safety and efficiency of nuclear power plants, further bolstering investor confidence.

Transitioning to the financial implications, the surge in nuclear stocks is not merely a reflection of technological advancements but also a response to geopolitical dynamics. The ongoing energy crisis, exacerbated by geopolitical tensions and supply chain disruptions, has highlighted the vulnerabilities of relying heavily on fossil fuels. Consequently, governments and investors are increasingly looking towards nuclear energy as a stable and reliable alternative. This shift in focus is evident in the growing number of policy initiatives and investments aimed at revitalizing the nuclear sector, thereby creating a favorable environment for companies like Altman’s startup to thrive.

Moreover, the rising interest in nuclear stocks is also fueled by the increasing awareness of the limitations of renewable energy sources. While solar and wind power are integral components of a sustainable energy future, their intermittent nature poses significant challenges to grid stability. Nuclear energy, with its ability to provide a constant and reliable power supply, complements these renewable sources, ensuring a balanced and resilient energy mix. This realization is prompting investors to diversify their portfolios by including nuclear stocks, thereby driving up their value.

In addition to these factors, the role of influential figures like Sam Altman cannot be overlooked. As a prominent entrepreneur and investor, Altman’s involvement in the nuclear sector lends credibility and visibility to the industry. His startup’s success serves as a testament to the potential of nuclear energy and inspires confidence among investors. Altman’s strategic vision and commitment to innovation are instrumental in positioning his company at the forefront of the nuclear renaissance, attracting significant investment and driving stock performance.

In conclusion, the 130% surge in Sam Altman’s startup is a reflection of the growing interest in nuclear energy stocks, driven by technological advancements, geopolitical dynamics, and the need for a sustainable energy future. As the world continues to navigate the complexities of the energy transition, nuclear power is poised to play a pivotal role, offering a reliable and low-carbon solution. For investors, this presents a unique opportunity to capitalize on the evolving energy landscape, with nuclear stocks emerging as a promising avenue for growth and diversification. As such, the momentum behind nuclear energy is likely to persist, shaping the future of investment trends in the energy sector.

The Future of Energy: Sam Altman’s Role in the Nuclear Revolution

Sam Altman, a prominent figure in the tech industry, has recently made headlines with his startup’s remarkable 130% surge in valuation, reflecting a growing interest in nuclear energy stocks. This surge is not merely a financial milestone but a testament to the shifting dynamics in the global energy landscape. As the world grapples with the pressing need to transition to cleaner energy sources, nuclear power is increasingly being recognized as a viable solution to meet the dual challenges of reducing carbon emissions and ensuring a stable energy supply.

Altman, known for his visionary leadership and innovative approach, has positioned his startup at the forefront of this nuclear revolution. His company focuses on developing advanced nuclear technologies that promise to be safer, more efficient, and more sustainable than traditional nuclear power plants. By leveraging cutting-edge research and development, Altman’s startup aims to address the longstanding concerns associated with nuclear energy, such as safety risks and radioactive waste management.

The renewed interest in nuclear energy is driven by several factors. Firstly, the urgency to combat climate change has intensified the search for low-carbon energy sources. Unlike fossil fuels, nuclear power generates electricity without emitting greenhouse gases, making it an attractive option for countries striving to meet their climate goals. Furthermore, advancements in nuclear technology have led to the development of small modular reactors (SMRs), which offer greater flexibility and scalability compared to conventional reactors. These innovations have the potential to revolutionize the nuclear industry by reducing costs and construction times, thereby making nuclear energy more accessible and economically viable.

In addition to technological advancements, geopolitical considerations are also playing a role in the resurgence of nuclear energy. As nations seek to enhance their energy security and reduce dependence on imported fossil fuels, nuclear power presents a reliable and domestically sourced alternative. This strategic advantage is particularly appealing in the context of global energy market volatility and supply chain disruptions.

Altman’s involvement in the nuclear sector is emblematic of a broader trend where tech entrepreneurs are increasingly venturing into the energy industry. Their entry brings fresh perspectives and a willingness to challenge conventional norms, which can accelerate innovation and drive transformative change. By applying principles of entrepreneurship and technological innovation, these leaders are poised to reshape the future of energy.

However, the path forward is not without challenges. Public perception of nuclear energy remains mixed, with concerns about safety and environmental impact persisting. To address these issues, Altman and other industry leaders must engage in transparent communication and foster public trust through education and outreach initiatives. Moreover, regulatory frameworks need to evolve to accommodate the rapid pace of technological advancements while ensuring rigorous safety standards.

In conclusion, Sam Altman’s startup’s impressive growth underscores the rising interest in nuclear energy as a key component of the future energy mix. As the world seeks sustainable solutions to its energy needs, nuclear power, with its potential for low-carbon and reliable electricity generation, is gaining renewed attention. Altman’s role in this nuclear revolution highlights the intersection of technology and energy, where innovation can drive significant progress. As the industry continues to evolve, the collaboration between tech visionaries and energy experts will be crucial in shaping a sustainable and secure energy future.

Analyzing the Surge: Factors Behind the 130% Increase in Altman’s Startup

Sam Altman’s startup has recently experienced a remarkable surge, with its stock price increasing by 130%. This significant rise has captured the attention of investors and analysts alike, prompting a closer examination of the factors contributing to this impressive growth. As the world increasingly turns its focus towards sustainable and clean energy solutions, nuclear energy has emerged as a pivotal player in the global energy landscape. Consequently, Altman’s venture, which is deeply rooted in the nuclear sector, has benefited from this heightened interest.

One of the primary factors driving the surge in Altman’s startup is the growing recognition of nuclear energy as a viable solution to the pressing issue of climate change. As countries worldwide strive to reduce their carbon emissions and transition to cleaner energy sources, nuclear power offers a reliable and low-carbon alternative to fossil fuels. This shift in perception has led to increased investment in nuclear technology, with Altman’s startup positioned at the forefront of innovation in this field. By developing advanced nuclear reactors that promise enhanced safety and efficiency, the company has attracted significant attention from both private and institutional investors.

Moreover, the geopolitical landscape has also played a crucial role in the rising interest in nuclear stocks. With energy security becoming a top priority for many nations, the need for a stable and independent energy supply has never been more critical. Nuclear energy, with its ability to provide a consistent and large-scale power output, is increasingly seen as a strategic asset. Altman’s startup, with its cutting-edge technology and potential to revolutionize the nuclear industry, has become an attractive investment opportunity for those looking to capitalize on this trend.

In addition to these broader industry dynamics, Altman’s reputation as a visionary entrepreneur has further fueled investor confidence in his startup. Known for his successful track record in the tech industry, Altman brings a wealth of experience and a forward-thinking approach to the nuclear sector. His leadership and strategic vision have been instrumental in positioning the company as a leader in the development of next-generation nuclear technologies. This has not only bolstered investor trust but also attracted top talent and partnerships, further strengthening the company’s position in the market.

Furthermore, the startup’s recent technological breakthroughs have played a significant role in its stock price surge. By achieving key milestones in reactor design and safety features, the company has demonstrated its capability to deliver on its promises. These advancements have not only validated the company’s technological approach but have also set it apart from competitors, making it a standout player in the nuclear industry.

Finally, the broader economic environment has also contributed to the increased interest in nuclear stocks. With inflationary pressures and volatile energy prices affecting global markets, investors are seeking stable and long-term investment opportunities. Nuclear energy, with its potential for consistent returns and growth, offers an attractive proposition. Altman’s startup, with its innovative solutions and strategic positioning, has emerged as a prime candidate for those looking to invest in the future of energy.

In conclusion, the 130% surge in Sam Altman’s startup can be attributed to a confluence of factors, including the growing recognition of nuclear energy’s role in combating climate change, geopolitical considerations, Altman’s leadership, technological advancements, and the broader economic environment. As the world continues to navigate the complexities of energy transition, Altman’s venture stands poised to play a significant role in shaping the future of sustainable energy.

The Impact of Nuclear Energy on Global Markets: Insights from Sam Altman’s Success

In recent years, the global energy landscape has been undergoing a significant transformation, with nuclear energy emerging as a pivotal player in the quest for sustainable and reliable power sources. This shift has been underscored by the remarkable success of Sam Altman’s startup, which has seen its stock surge by an impressive 130%. This surge is not merely a reflection of the company’s innovative approach but also indicative of the broader rising interest in nuclear stocks. As the world grapples with the dual challenges of climate change and energy security, nuclear energy is increasingly being recognized for its potential to provide a stable and low-carbon energy supply.

Sam Altman, a visionary entrepreneur known for his forward-thinking ventures, has positioned his startup at the forefront of this nuclear renaissance. The company’s success can be attributed to its strategic focus on developing advanced nuclear technologies that promise to address some of the longstanding concerns associated with traditional nuclear power. By investing in next-generation reactors that are safer, more efficient, and less waste-intensive, Altman’s startup is not only capturing the attention of investors but also contributing to the broader narrative of nuclear energy as a viable solution to global energy challenges.

The surge in Altman’s startup stock is emblematic of a growing investor confidence in the nuclear sector. This confidence is fueled by several factors, including technological advancements, supportive government policies, and an increasing recognition of nuclear energy’s role in achieving net-zero emissions targets. As countries around the world set ambitious climate goals, the demand for clean and reliable energy sources is intensifying. Nuclear power, with its ability to provide a consistent energy output without the carbon emissions associated with fossil fuels, is uniquely positioned to meet this demand.

Moreover, the geopolitical landscape is also playing a crucial role in shaping the future of nuclear energy. With energy security becoming a top priority for many nations, the diversification of energy sources is seen as essential to reducing dependence on volatile fossil fuel markets. Nuclear energy, with its potential for domestic production and long-term stability, offers an attractive alternative. This has led to increased government support and investment in nuclear technologies, further bolstering the sector’s growth prospects.

However, the path forward is not without challenges. Public perception of nuclear energy remains mixed, with concerns about safety, waste management, and high initial costs persisting. To address these issues, companies like Altman’s are focusing on innovation and transparency, aiming to build public trust and demonstrate the tangible benefits of modern nuclear technologies. By prioritizing safety and sustainability, these companies are working to reshape the narrative around nuclear energy and highlight its potential as a cornerstone of a clean energy future.

In conclusion, the remarkable rise of Sam Altman’s startup is a testament to the growing momentum behind nuclear energy in global markets. As technological advancements continue to address historical concerns, and as governments and investors increasingly recognize the strategic importance of nuclear power, the sector is poised for significant growth. Altman’s success serves as both an inspiration and a blueprint for other innovators seeking to capitalize on the opportunities presented by this evolving energy landscape. As the world moves towards a more sustainable future, nuclear energy is set to play a crucial role in powering the transition.

Q&A

1. **What is the name of Sam Altman’s startup that surged 130%?**

– Oklo.

2. **What sector is Oklo involved in?**

– Nuclear energy.

3. **What caused the surge in Oklo’s stock?**

– Rising interest in nuclear stocks.

4. **What is Oklo’s primary focus within the nuclear sector?**

– Developing advanced nuclear reactors.

5. **How much did Oklo’s stock increase by?**

– 130%.

6. **What is driving the renewed interest in nuclear energy stocks?**

– Growing demand for clean and sustainable energy solutions.

7. **Who is Sam Altman?**

– A prominent entrepreneur and investor, known for his involvement in technology and energy sectors.

Conclusion

Sam Altman’s startup has experienced a significant surge of 130% in its valuation, reflecting a growing investor interest in nuclear stocks. This increase is likely driven by a combination of factors, including heightened awareness of nuclear energy’s potential as a sustainable and reliable power source, advancements in nuclear technology, and a global shift towards cleaner energy solutions. The surge underscores the market’s confidence in the startup’s strategic positioning and potential to capitalize on the evolving energy landscape. As nuclear energy gains traction as a viable alternative to fossil fuels, companies in this sector, like Altman’s, are poised to benefit from increased investment and interest.