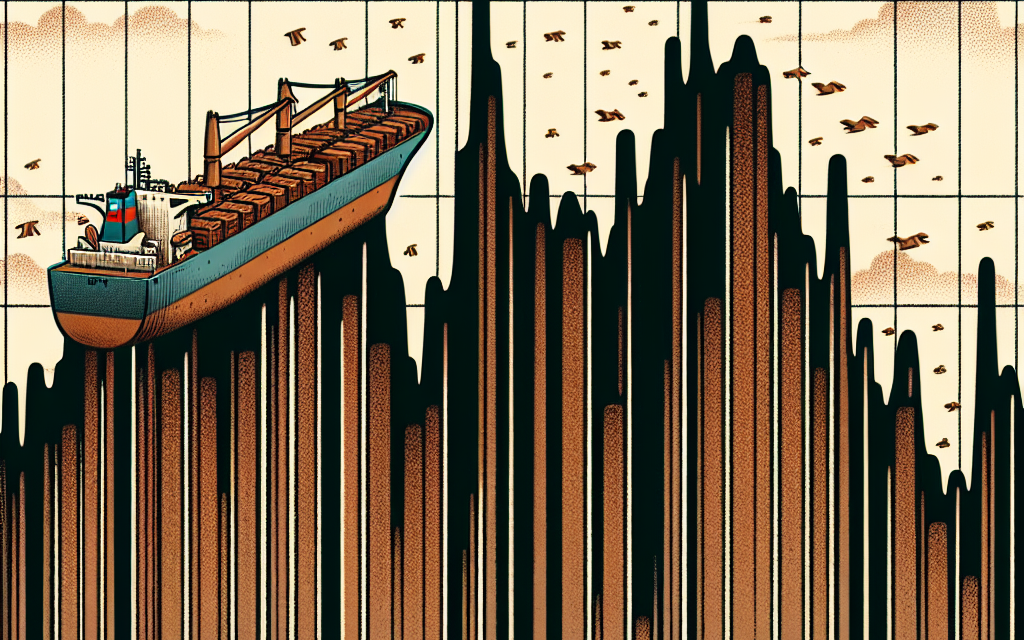

“Russia’s Crude Exports Plummet to 16-Month Low Amid Global Market Shifts.”

Introduction

Russia’s crude oil exports have recently plummeted to a 16-month low, reflecting the impact of international sanctions, production cuts, and shifting global demand dynamics. This decline underscores the challenges faced by the Russian energy sector amid geopolitical tensions and efforts by Western nations to reduce reliance on Russian oil. The decrease in exports not only affects Russia’s economy but also has broader implications for global oil markets, pricing, and energy security.

Russia’s Crude Export Trends: Analyzing the 16-Month Low

In recent months, Russia’s crude oil exports have experienced a significant decline, reaching a 16-month low that has raised concerns among analysts and industry stakeholders. This downturn can be attributed to a combination of geopolitical tensions, sanctions, and shifts in global demand, all of which have played a crucial role in shaping the current landscape of Russian oil exports. As the world grapples with the implications of these developments, it is essential to analyze the factors contributing to this decline and the potential consequences for both Russia and the global oil market.

One of the primary drivers behind the reduction in crude exports is the ongoing impact of international sanctions imposed on Russia in response to its actions in Ukraine. These sanctions have not only restricted Russia’s ability to access certain markets but have also complicated its relationships with traditional buyers. Consequently, countries that once relied heavily on Russian oil have sought alternative sources, leading to a decrease in demand for Russian crude. This shift has been particularly pronounced in Europe, where nations are increasingly prioritizing energy security and diversification away from Russian supplies.

Moreover, the geopolitical landscape has further complicated Russia’s export capabilities. The ongoing conflict has prompted many countries to reassess their energy partnerships, resulting in a reconfiguration of global supply chains. As a result, Russia has found itself in a precarious position, struggling to maintain its market share while facing the dual challenges of reduced demand and increased competition from other oil-producing nations. This situation has been exacerbated by the fact that many of Russia’s traditional customers are now actively seeking to reduce their dependence on Russian energy, thereby intensifying the pressure on the country’s crude export levels.

In addition to geopolitical factors, fluctuations in global oil prices have also played a significant role in shaping Russia’s export trends. The volatility of oil prices, driven by a myriad of factors including OPEC+ production decisions and shifts in global economic conditions, has created an uncertain environment for Russian crude exports. As prices fluctuate, so too does the incentive for buyers to engage with Russian suppliers. When prices are high, buyers may be more willing to overlook geopolitical concerns, but when prices drop, the allure of alternative sources becomes more pronounced, further diminishing Russia’s export prospects.

Furthermore, the internal dynamics of the Russian oil industry cannot be overlooked. The country’s oil production has faced challenges related to aging infrastructure and a lack of investment in new technologies. These issues have hindered Russia’s ability to maintain consistent production levels, which in turn affects its export capacity. As the country grapples with these internal challenges, the combination of reduced output and declining demand has created a perfect storm, leading to the current 16-month low in crude exports.

Looking ahead, the implications of this decline are significant. For Russia, the reduction in crude exports not only threatens its economic stability but also raises questions about its long-term energy strategy. As the global energy landscape continues to evolve, Russia must navigate these challenges while seeking to reestablish its position in the market. For the global oil market, the decline in Russian exports could lead to increased volatility as countries adjust to the shifting dynamics of supply and demand. Ultimately, the interplay of these factors will shape the future of Russia’s crude exports and the broader energy landscape in the months and years to come.

Impact of Sanctions on Russia’s Oil Industry

In recent months, the impact of sanctions on Russia’s oil industry has become increasingly evident, culminating in a significant decline in crude exports that have reached a 16-month low. The sanctions, imposed by Western nations in response to geopolitical tensions and military actions, have targeted various sectors of the Russian economy, with the oil industry being one of the most affected. As a major player in the global oil market, Russia’s ability to export crude oil is crucial not only for its economy but also for the stability of global oil prices.

The sanctions have disrupted Russia’s traditional trading relationships, making it more challenging for the country to find buyers for its crude oil. Many Western companies and nations have distanced themselves from Russian oil, either due to legal restrictions or ethical considerations. This shift has forced Russia to seek alternative markets, primarily in Asia, where demand for oil remains robust. However, the transition has not been seamless. The logistical challenges of rerouting oil supplies, coupled with the need to negotiate new contracts, have contributed to a decline in export volumes.

Moreover, the sanctions have also targeted the financial mechanisms that facilitate oil trade. Restrictions on banking transactions and insurance coverage have made it increasingly difficult for Russian oil companies to operate on the international stage. As a result, many companies have faced heightened operational risks, leading to a decrease in production levels. This decline in production is not merely a short-term consequence; it reflects a broader trend of diminishing investment in the oil sector, as foreign investors remain wary of engaging with Russian enterprises.

In addition to the immediate effects of sanctions, the long-term implications for Russia’s oil industry are profound. The country has historically relied on oil exports as a primary source of revenue, and the current situation threatens to undermine this economic foundation. With reduced access to international markets and capital, Russia may struggle to maintain its production capacity. This decline could lead to a vicious cycle, where decreased investment results in lower output, further exacerbating the economic challenges faced by the nation.

Furthermore, the sanctions have prompted Russia to accelerate its efforts to develop domestic alternatives and enhance self-sufficiency. While this strategy may provide some short-term relief, it is unlikely to fully compensate for the loss of international partnerships and expertise. The oil industry is inherently global, and the absence of foreign technology and investment could hinder Russia’s ability to innovate and improve efficiency in its operations.

As the situation evolves, the global oil market is also feeling the repercussions of Russia’s declining exports. With a significant portion of the world’s oil supply at stake, fluctuations in Russian production can lead to increased volatility in oil prices. This uncertainty affects not only oil-importing nations but also global economic stability, as rising energy costs can have cascading effects on inflation and economic growth.

In conclusion, the impact of sanctions on Russia’s oil industry is multifaceted, leading to a notable decline in crude exports and raising questions about the future viability of the sector. As Russia navigates these challenges, the interplay between geopolitical dynamics and global energy markets will continue to shape the landscape of oil production and trade. The long-term consequences of these sanctions may redefine Russia’s role in the global oil market, with implications that extend far beyond its borders.

Global Oil Market Reactions to Russia’s Export Decline

In recent months, the global oil market has experienced significant fluctuations, largely influenced by Russia’s crude oil export decline, which has reached a 16-month low. This development has sent ripples through the international energy landscape, prompting various reactions from both producers and consumers. As one of the world’s leading oil exporters, Russia’s reduced output has raised concerns about supply shortages, leading to a reevaluation of market dynamics.

The immediate response from oil markets has been a surge in prices, as traders react to the tightening supply. With Russia’s crude exports diminishing, countries that rely heavily on Russian oil have been forced to seek alternative sources. This shift has not only affected the pricing of crude oil but has also led to increased competition among oil-producing nations. For instance, countries in the Middle East, particularly those within the Organization of the Petroleum Exporting Countries (OPEC), have been quick to capitalize on the situation. They have ramped up production to fill the void left by Russia, thereby exerting their influence on the global oil market.

Moreover, the decline in Russian exports has prompted a reassessment of energy strategies among major economies. Nations such as China and India, which have historically been significant importers of Russian crude, are now exploring new partnerships and diversifying their energy sources. This shift is not merely a reaction to the current supply constraints but also a strategic move to enhance energy security in an increasingly volatile geopolitical landscape. As these countries seek to reduce their dependence on Russian oil, they are likely to forge stronger ties with other oil-producing nations, further altering the balance of power in the global energy market.

In addition to the immediate price reactions and shifts in trade patterns, the decline in Russian crude exports has also sparked discussions about the long-term implications for global energy consumption. Analysts are closely monitoring how this situation may accelerate the transition towards renewable energy sources. As countries grapple with the realities of fluctuating oil supplies, there is a growing recognition of the need to invest in sustainable energy alternatives. This transition could be further catalyzed by government policies aimed at reducing carbon emissions and promoting green technologies, which may ultimately reshape the energy landscape.

Furthermore, the geopolitical ramifications of Russia’s export decline cannot be overlooked. The ongoing tensions between Russia and Western nations have already led to sanctions that have impacted the oil sector. As these geopolitical dynamics evolve, they will likely continue to influence global oil prices and trade flows. The uncertainty surrounding Russia’s future role in the global oil market adds another layer of complexity, as countries navigate their energy needs amid shifting alliances and potential supply disruptions.

In conclusion, Russia’s crude exports hitting a 16-month low has triggered a multifaceted response from the global oil market. The immediate effects are evident in rising prices and shifts in trade patterns, as countries seek to adapt to the changing landscape. Additionally, this situation may accelerate the transition towards renewable energy and prompt a reevaluation of geopolitical alliances. As the world continues to grapple with these developments, the long-term implications for energy consumption and international relations remain to be seen, underscoring the interconnectedness of global markets and the importance of strategic energy planning.

The Future of Russia’s Crude Production Amidst Export Challenges

As Russia’s crude exports have recently plummeted to a 16-month low, the implications for the future of the country’s crude production are becoming increasingly significant. This decline can be attributed to a combination of international sanctions, shifting market dynamics, and the ongoing geopolitical tensions that have reshaped the global energy landscape. Consequently, the challenges facing Russia’s crude production are multifaceted, requiring a nuanced understanding of both domestic and international factors.

To begin with, the sanctions imposed by Western nations in response to Russia’s actions in Ukraine have severely restricted the country’s ability to access key markets. These sanctions have not only targeted financial transactions but have also included restrictions on technology transfers and equipment necessary for oil extraction and production. As a result, Russian oil companies are grappling with the dual challenge of maintaining production levels while navigating a landscape that has become increasingly hostile to their operations. This situation raises questions about the sustainability of Russia’s crude production in the long term, particularly as the country seeks to adapt to a new reality where traditional markets are no longer as accessible.

Moreover, the shift in global energy demand is another critical factor influencing the future of Russia’s crude production. As countries around the world increasingly prioritize renewable energy sources and commit to reducing carbon emissions, the demand for fossil fuels, including crude oil, is expected to decline. This transition poses a significant challenge for Russia, which has historically relied on oil exports as a primary source of revenue. The need for diversification in the energy sector is becoming more pressing, and the Russian government may need to invest in alternative energy sources to mitigate the risks associated with a potential long-term decline in crude oil demand.

In addition to these external pressures, internal factors also play a crucial role in shaping the future of Russia’s crude production. The aging infrastructure of oil fields, coupled with a lack of investment in new technologies, has led to declining production rates in some regions. Furthermore, the Russian government’s focus on maintaining state control over the energy sector can stifle innovation and limit the ability of companies to respond effectively to market changes. As a result, the future of crude production in Russia may hinge on the government’s willingness to embrace reforms that encourage investment and modernization within the industry.

Transitioning to the potential for new markets, it is essential to consider Russia’s pivot towards Asia, particularly China and India, as alternative destinations for its crude exports. While these markets present opportunities for growth, they also come with their own set of challenges. For instance, the logistics of transporting crude oil to these regions can be complex and costly, and the geopolitical relationships between Russia and these countries can influence trade dynamics. Additionally, the competition from other oil-producing nations seeking to establish or expand their presence in Asian markets may further complicate Russia’s efforts to secure a foothold.

In conclusion, the future of Russia’s crude production is fraught with challenges stemming from both external and internal factors. The decline in exports, driven by sanctions and shifting global energy demands, necessitates a reevaluation of strategies within the industry. As Russia navigates this complex landscape, the ability to adapt to changing market conditions, invest in new technologies, and explore alternative markets will be crucial in determining the sustainability of its crude production in the years to come. Ultimately, the path forward will require a delicate balance between maintaining traditional practices and embracing innovation to ensure resilience in an ever-evolving energy landscape.

Geopolitical Implications of Russia’s Falling Oil Exports

The recent decline in Russia’s crude oil exports, which have reached a 16-month low, carries significant geopolitical implications that extend beyond the immediate economic ramifications. As one of the world’s leading oil producers, Russia’s ability to influence global energy markets has been a cornerstone of its foreign policy and economic strategy. The reduction in oil exports not only reflects internal challenges but also highlights the shifting dynamics of international relations, particularly in the context of ongoing sanctions and geopolitical tensions.

To begin with, the decrease in crude oil exports can be attributed to a combination of factors, including Western sanctions imposed in response to Russia’s actions in Ukraine and the broader global shift towards renewable energy sources. These sanctions have targeted key sectors of the Russian economy, particularly energy, which is vital for the country’s revenue. As a result, Russia has faced difficulties in maintaining its production levels and securing new markets for its oil. This situation has led to a decrease in revenue, which in turn affects the Kremlin’s ability to fund various domestic and foreign initiatives.

Moreover, the falling oil exports have implications for Russia’s relationships with its traditional allies and partners. Countries that have historically relied on Russian oil, such as those in Europe, are increasingly seeking alternative sources to reduce their dependence on Russian energy. This shift not only undermines Russia’s economic leverage but also alters the geopolitical landscape, as nations reassess their energy security strategies. For instance, European nations are investing in renewable energy and diversifying their energy imports, which diminishes Russia’s influence over the continent.

In addition to the European market, Russia’s pivot towards Asia, particularly China and India, has become increasingly important. However, this shift is not without its challenges. While these countries have expressed interest in purchasing Russian oil, they are also cautious about the potential repercussions of engaging with a nation facing international isolation. Consequently, Russia may find itself in a precarious position, reliant on a limited number of buyers who may not be willing to pay premium prices, thereby further straining its economy.

Furthermore, the decline in oil exports could lead to increased domestic unrest within Russia. The economy is heavily dependent on energy revenues, and as these revenues dwindle, public discontent may rise. This situation could prompt the Kremlin to adopt more aggressive foreign policies as a means of rallying domestic support and diverting attention from economic woes. Such actions could exacerbate existing tensions with the West and lead to further isolation, creating a vicious cycle that undermines Russia’s long-term stability.

In light of these developments, the geopolitical implications of Russia’s falling oil exports are profound. The shift in energy dynamics not only affects Russia’s economic standing but also reshapes alliances and power structures on a global scale. As countries seek to reduce their reliance on Russian energy, the potential for new partnerships and rivalries emerges, leading to a reconfiguration of international relations. Ultimately, the decline in crude oil exports serves as a critical indicator of Russia’s changing role in the world, highlighting the interconnectedness of energy, economics, and geopolitics in an increasingly complex global landscape. As the situation evolves, it will be essential for policymakers and analysts to closely monitor these trends and their far-reaching consequences.

Economic Consequences for Russia Due to Reduced Crude Sales

The recent decline in Russia’s crude oil exports, which have reached a 16-month low, has significant economic implications for the nation. As one of the world’s leading oil producers, Russia’s economy is heavily reliant on the revenue generated from crude oil sales. Consequently, a reduction in exports not only affects the immediate financial inflow but also has broader ramifications for the country’s economic stability and growth prospects.

To begin with, the decrease in crude oil exports directly impacts the federal budget, which is largely funded by oil and gas revenues. In recent years, these revenues have accounted for a substantial portion of the government’s income, enabling it to finance various public services and infrastructure projects. With the current downturn in exports, the government faces the challenge of adjusting its budgetary plans. This situation may lead to cuts in public spending, which could adversely affect social programs and economic development initiatives. As a result, the overall quality of life for many citizens may decline, leading to increased public discontent.

Moreover, the reduced crude sales have implications for the Russian currency, the ruble. A significant portion of the country’s foreign exchange earnings comes from oil exports, and a decline in these earnings can lead to depreciation of the ruble. A weaker currency can exacerbate inflationary pressures, as the cost of imported goods rises. This inflation can further strain household budgets, reducing consumer spending and dampening economic growth. Consequently, the combination of a declining currency and rising prices can create a challenging economic environment for both consumers and businesses.

In addition to these immediate financial concerns, the long-term economic consequences of reduced crude exports cannot be overlooked. The global energy market is undergoing a transformation, with a growing emphasis on renewable energy sources and a shift away from fossil fuels. As countries around the world commit to reducing their carbon emissions, the demand for crude oil may continue to decline. This shift poses a significant risk to Russia’s economy, which is heavily dependent on oil exports. If the country fails to diversify its economy and reduce its reliance on crude oil, it may find itself increasingly vulnerable to fluctuations in global oil prices and demand.

Furthermore, the geopolitical landscape plays a crucial role in shaping Russia’s economic future. Sanctions imposed by Western nations in response to various geopolitical conflicts have already strained Russia’s access to international markets and investment. The current decline in crude exports may exacerbate these challenges, limiting the country’s ability to attract foreign investment and technology necessary for modernizing its energy sector. Without these critical resources, Russia may struggle to maintain its position as a leading oil producer, further jeopardizing its economic stability.

In conclusion, the recent drop in Russia’s crude oil exports to a 16-month low presents a multifaceted economic challenge for the nation. The immediate effects on government revenues and the ruble, coupled with the long-term risks associated with a shifting global energy landscape and geopolitical tensions, underscore the need for Russia to adapt its economic strategies. As the country navigates these turbulent waters, the importance of diversifying its economy and investing in sustainable energy alternatives becomes increasingly apparent. Failure to do so may result in prolonged economic difficulties and diminished global influence.

Alternatives for Russia: Diversifying Oil Export Markets

As Russia’s crude exports have recently plummeted to a 16-month low, the nation faces significant challenges in maintaining its position as a leading oil supplier on the global stage. This decline can be attributed to a combination of factors, including international sanctions, geopolitical tensions, and a shift in global energy dynamics. In light of these developments, it has become increasingly imperative for Russia to explore alternatives and diversify its oil export markets to mitigate the impact of reduced demand from traditional partners.

Historically, Europe has been one of Russia’s largest markets for crude oil. However, the ongoing conflict in Ukraine and the subsequent sanctions imposed by Western nations have led to a substantial decrease in Russian oil imports by European countries. As a result, Russia must seek new avenues for its crude exports to sustain its economy and maintain its influence in the global energy market. One potential alternative lies in strengthening ties with Asian countries, particularly China and India, which have shown a growing appetite for energy resources.

China, as the world’s largest importer of crude oil, presents a significant opportunity for Russia. The two nations have already established a robust energy partnership, with Russia supplying a considerable portion of China’s oil needs. By enhancing this relationship, Russia can not only secure a reliable market for its crude but also potentially negotiate favorable terms that could offset the losses incurred from reduced European demand. Furthermore, the Belt and Road Initiative, which aims to enhance connectivity and trade between Asia and Europe, could facilitate increased energy cooperation between the two countries.

In addition to China, India has emerged as another key player in the global oil market. With its rapidly growing economy and increasing energy consumption, India is actively seeking to diversify its sources of crude oil. Russia has the opportunity to capitalize on this demand by offering competitive pricing and favorable trade agreements. By positioning itself as a reliable supplier to India, Russia can further reduce its dependence on European markets and create a more balanced export portfolio.

Moreover, Russia can explore opportunities in other emerging markets across Southeast Asia, Africa, and Latin America. Countries such as Vietnam, Indonesia, and Brazil are experiencing economic growth and rising energy needs, making them potential markets for Russian crude. By engaging in diplomatic efforts and establishing trade agreements with these nations, Russia can expand its reach and create new channels for oil exports.

In addition to diversifying its export markets, Russia may also consider investing in refining capacity and petrochemical production within its borders. By enhancing its domestic processing capabilities, Russia can add value to its crude oil and create a more resilient economy that is less vulnerable to fluctuations in global oil prices. This strategy not only allows for greater control over the supply chain but also positions Russia as a more competitive player in the global energy market.

In conclusion, as Russia’s crude exports face unprecedented challenges, the need for diversification has never been more critical. By forging stronger ties with Asian countries, exploring emerging markets, and investing in domestic refining capabilities, Russia can navigate the complexities of the current geopolitical landscape. Ultimately, these strategies will be essential for Russia to maintain its status as a key player in the global oil market while adapting to the evolving energy demands of the world.

Q&A

1. **What recent trend has been observed in Russia’s crude oil exports?**

– Russia’s crude oil exports have hit a 16-month low.

2. **What factors contributed to the decline in Russia’s crude oil exports?**

– Factors include Western sanctions, reduced demand, and production cuts.

3. **How have sanctions impacted Russia’s oil export capabilities?**

– Sanctions have restricted access to markets and technology, limiting export volumes.

4. **What is the significance of the 16-month low in crude exports for Russia’s economy?**

– The decline may lead to reduced revenue, impacting the overall economy and budget.

5. **Which countries have been the primary importers of Russian crude oil?**

– Key importers include China and India, although their purchases have also fluctuated.

6. **What measures is Russia taking to address the decline in crude exports?**

– Russia is seeking to redirect exports to non-Western markets and increase domestic consumption.

7. **What are the potential long-term implications of this decline in crude exports for global oil markets?**

– A sustained decline could lead to tighter global oil supply and increased prices, affecting energy markets worldwide.

Conclusion

Russia’s crude exports have reached a 16-month low, primarily due to ongoing sanctions, reduced demand from key markets, and production cuts implemented by the government. This decline reflects the broader impact of geopolitical tensions and economic pressures on Russia’s oil industry, potentially leading to significant revenue losses and further challenges for the country’s economy.