“Golden Heights: Precious Metals Soar, Leaving Stocks in the Dust!”

Introduction

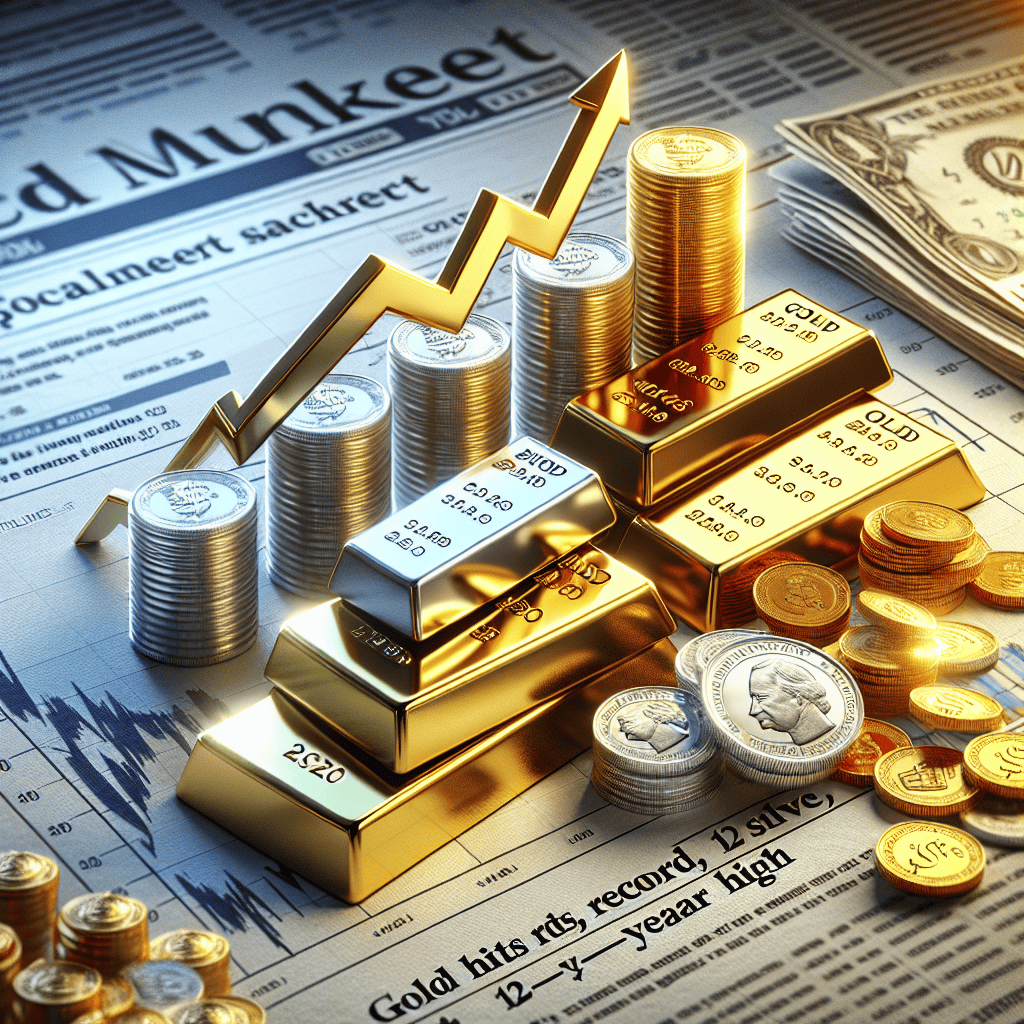

In recent market developments, precious metals have captured significant attention as gold and silver experience remarkable surges. Gold has reached an unprecedented record high, while silver has climbed to its highest level in 12 years, both outpacing traditional stock market performance. This surge in precious metals is driven by a confluence of factors, including economic uncertainty, inflationary pressures, and geopolitical tensions, prompting investors to seek refuge in these time-honored safe-haven assets. As a result, gold and silver are not only shining in their intrinsic value but also in their appeal as strategic investments amidst fluctuating global markets.

Gold’s Record-Breaking Surge: What It Means for Investors

In recent months, the financial markets have witnessed a remarkable surge in the value of precious metals, with gold reaching an all-time high and silver climbing to a 12-year peak. This unprecedented rise has captured the attention of investors worldwide, prompting a reevaluation of investment strategies and asset allocations. As traditional stock markets experience volatility and uncertainty, the allure of precious metals as a safe haven has become increasingly pronounced. This trend underscores the shifting dynamics in global finance and highlights the enduring appeal of gold and silver as reliable stores of value.

Gold’s record-breaking ascent can be attributed to a confluence of factors that have collectively bolstered its appeal. Chief among these is the prevailing economic uncertainty, exacerbated by geopolitical tensions, inflationary pressures, and fluctuating interest rates. In times of economic instability, investors often gravitate towards gold, viewing it as a hedge against inflation and currency devaluation. Moreover, central banks around the world have been increasing their gold reserves, further driving up demand and contributing to the metal’s price surge. This strategic move by central banks reflects a growing recognition of gold’s intrinsic value and its role in diversifying national reserves.

Simultaneously, silver has experienced a significant upswing, reaching levels not seen in over a decade. While often overshadowed by gold, silver possesses unique attributes that make it an attractive investment option. Its dual role as both a precious metal and an industrial commodity positions it favorably in the current economic landscape. The ongoing transition towards renewable energy sources and the proliferation of electronic devices have spurred demand for silver, given its critical applications in solar panels and electronic components. Consequently, silver’s price trajectory has mirrored that of gold, reinforcing its status as a valuable asset in an investor’s portfolio.

The surge in precious metals has prompted investors to reassess their portfolios, particularly in light of the underperformance of traditional stock markets. As equities face headwinds from economic slowdowns and geopolitical uncertainties, the relative stability of gold and silver becomes increasingly attractive. This shift in investor sentiment is further amplified by the growing interest in sustainable and ethical investing. Precious metals, often perceived as more environmentally friendly compared to other extractive industries, align with the values of socially conscious investors seeking to minimize their carbon footprint.

Furthermore, the rise of digital platforms and exchange-traded funds (ETFs) has democratized access to precious metals, enabling a broader range of investors to participate in this burgeoning market. These platforms offer a convenient and cost-effective means of acquiring gold and silver, eliminating the logistical challenges associated with physical ownership. As a result, the barriers to entry have been significantly lowered, allowing individual investors to capitalize on the upward momentum of precious metals.

In conclusion, the recent surge in gold and silver prices underscores the enduring appeal of these precious metals as safe-haven assets. Amidst economic uncertainty and stock market volatility, investors are increasingly turning to gold and silver to safeguard their wealth and diversify their portfolios. The unique attributes of these metals, coupled with their accessibility through digital platforms, have solidified their position as indispensable components of a well-rounded investment strategy. As the global financial landscape continues to evolve, the allure of precious metals is likely to persist, offering investors a reliable refuge in times of uncertainty.

Silver’s 12-Year High: A New Era for Precious Metals

In recent months, the financial markets have witnessed a remarkable surge in the value of precious metals, with gold reaching unprecedented heights and silver achieving a 12-year high. This phenomenon has captured the attention of investors and analysts alike, as these metals have outperformed traditional stock markets, signaling a potential shift in investment strategies. The rise in silver prices, in particular, marks a significant development in the precious metals sector, suggesting a new era of appreciation and demand.

The ascent of silver to a 12-year high can be attributed to several interrelated factors. Firstly, the ongoing economic uncertainty has driven investors to seek safe-haven assets, with silver emerging as a preferred choice alongside gold. The global economic landscape, characterized by inflationary pressures and geopolitical tensions, has heightened the appeal of tangible assets that can preserve value over time. As a result, silver has experienced increased demand, pushing its price to levels not seen in over a decade.

Moreover, the industrial applications of silver have further bolstered its value. Silver’s unique properties make it indispensable in various industries, including electronics, solar energy, and medical devices. The growing emphasis on renewable energy sources, particularly solar power, has led to a surge in demand for silver, which is a critical component in photovoltaic cells. This industrial demand, coupled with its status as a precious metal, has created a dual appeal for silver, enhancing its attractiveness to investors.

In addition to these factors, the relative affordability of silver compared to gold has played a crucial role in its recent price surge. While gold has traditionally been the go-to asset for wealth preservation, its high price point can be prohibitive for some investors. Silver, on the other hand, offers a more accessible entry point, allowing a broader range of investors to participate in the precious metals market. This accessibility has contributed to increased investment in silver, driving up its price.

The performance of silver, outshining stocks in recent times, underscores a broader trend in the financial markets. As equities face volatility and uncertainty, investors are increasingly turning to alternative assets to diversify their portfolios and mitigate risk. Precious metals, with their intrinsic value and historical resilience, have emerged as a compelling option. This shift in investment focus highlights the evolving dynamics of the market, where traditional asset classes are being reevaluated in light of changing economic conditions.

Furthermore, the surge in silver prices reflects a growing recognition of its potential as a strategic asset. Investors are beginning to appreciate the unique characteristics of silver, which combines the stability of a precious metal with the growth potential of an industrial commodity. This dual nature positions silver as a versatile asset that can offer both security and opportunity in an uncertain economic environment.

In conclusion, the recent rise of silver to a 12-year high signifies a new era for precious metals, characterized by increased demand and appreciation. As economic uncertainties persist and industrial applications expand, silver is poised to maintain its upward trajectory, offering investors a valuable alternative to traditional stock markets. This development not only highlights the enduring appeal of precious metals but also underscores the importance of adapting investment strategies to navigate the complexities of the modern financial landscape.

Comparing Precious Metals and Stocks: Where to Invest Now

In recent months, the financial markets have witnessed a remarkable surge in the value of precious metals, with gold reaching an all-time high and silver climbing to a 12-year peak. This unprecedented rise has sparked a renewed interest among investors, prompting a reevaluation of traditional investment strategies. As the allure of precious metals intensifies, it becomes imperative to compare these assets with stocks to determine the most prudent investment path in the current economic climate.

To begin with, the appeal of precious metals, particularly gold and silver, lies in their historical role as safe-haven assets. During times of economic uncertainty, investors often flock to these metals to preserve wealth and hedge against inflation. The recent surge can be attributed to a confluence of factors, including geopolitical tensions, fluctuating interest rates, and concerns over global economic stability. These elements have collectively fueled a demand for tangible assets, driving prices to unprecedented levels.

In contrast, the stock market, while offering the potential for substantial returns, is inherently more volatile. Stocks are subject to market fluctuations, influenced by corporate performance, economic indicators, and investor sentiment. While equities have historically outperformed other asset classes over the long term, they are not immune to downturns, as evidenced by recent market corrections. Consequently, investors seeking stability may find solace in the relative predictability of precious metals.

Moreover, the current economic landscape presents unique challenges and opportunities for both asset classes. On one hand, the ongoing recovery from the global pandemic has led to increased fiscal stimulus and accommodative monetary policies, which have buoyed stock markets. However, these measures have also raised concerns about inflationary pressures, further enhancing the appeal of gold and silver as inflation hedges. On the other hand, the potential for rising interest rates poses a risk to both stocks and precious metals, as higher rates could dampen economic growth and increase the opportunity cost of holding non-yielding assets like gold.

Transitioning to the practical considerations of investing, diversification remains a key principle. A balanced portfolio that includes both stocks and precious metals can mitigate risks and enhance returns. While stocks offer growth potential and income through dividends, precious metals provide a counterbalance during market volatility. This complementary relationship underscores the importance of a diversified investment strategy, particularly in uncertain times.

Furthermore, technological advancements and the rise of digital platforms have democratized access to both asset classes. Investors can now easily trade stocks and precious metals through online brokerages, exchange-traded funds (ETFs), and other financial instruments. This accessibility has broadened the investor base, allowing individuals to tailor their portfolios according to their risk tolerance and financial goals.

In conclusion, the recent surge in precious metals highlights their enduring value as a component of a diversified investment strategy. While stocks continue to offer growth potential, the stability and historical significance of gold and silver cannot be overlooked. As investors navigate the complexities of the current economic environment, a thoughtful comparison of these asset classes is essential. By considering factors such as market conditions, inflationary pressures, and individual risk preferences, investors can make informed decisions that align with their long-term objectives. Ultimately, the choice between precious metals and stocks is not mutually exclusive but rather a matter of balance and strategic allocation.

Factors Driving the Precious Metals Boom in 2023

In 2023, the financial markets have witnessed a remarkable surge in precious metals, with gold reaching an all-time high and silver climbing to its highest level in 12 years. This unprecedented rise has captured the attention of investors worldwide, as these metals have outperformed traditional stock markets. Several factors have contributed to this boom, each playing a crucial role in driving the demand for these valuable commodities.

To begin with, economic uncertainty has been a significant catalyst for the increased interest in precious metals. In recent years, global economies have faced numerous challenges, including geopolitical tensions, trade disputes, and the lingering effects of the COVID-19 pandemic. These factors have led to heightened volatility in stock markets, prompting investors to seek safer havens for their capital. Gold and silver, known for their stability and intrinsic value, have historically been regarded as reliable stores of wealth during turbulent times. Consequently, as uncertainty persists, investors have flocked to these metals, driving up their prices.

Moreover, inflationary pressures have further fueled the demand for precious metals. Central banks around the world have implemented expansive monetary policies to stimulate economic growth, resulting in increased money supply and, subsequently, inflation. As the purchasing power of fiat currencies erodes, investors have turned to gold and silver as hedges against inflation. These metals have a long-standing reputation for preserving value, making them attractive options for those seeking to protect their wealth from the devaluation of paper money.

In addition to economic factors, technological advancements have also played a role in the rising demand for silver. The metal is a critical component in various industries, including electronics, solar energy, and electric vehicles. As the world transitions towards cleaner energy sources and more advanced technologies, the demand for silver has surged. This increased industrial demand, coupled with its appeal as a safe-haven asset, has contributed to the metal’s impressive price performance in 2023.

Furthermore, central banks have been actively increasing their gold reserves, adding another layer of support to the precious metals market. Countries such as China and Russia have been diversifying their foreign exchange reserves by purchasing gold, aiming to reduce their reliance on the US dollar. This strategic move has not only bolstered gold prices but also signaled to investors the enduring value of the metal as a global reserve asset.

Additionally, the weakening of the US dollar has provided further impetus for the rise in precious metals. As the dollar depreciates, commodities priced in the currency, such as gold and silver, become more affordable for foreign investors. This increased accessibility has led to a surge in demand, pushing prices even higher.

In conclusion, the precious metals boom in 2023 can be attributed to a confluence of factors, including economic uncertainty, inflationary pressures, technological advancements, central bank policies, and currency fluctuations. As these dynamics continue to unfold, gold and silver are likely to remain attractive investment options for those seeking stability and protection in an ever-changing financial landscape. The record highs achieved by these metals underscore their enduring appeal and highlight their critical role in the global economy.

The Role of Global Economic Uncertainty in Precious Metals’ Rise

In recent months, the financial markets have witnessed a remarkable surge in the value of precious metals, with gold reaching an all-time high and silver climbing to a 12-year peak. This unprecedented rise has captured the attention of investors worldwide, as these metals have outperformed traditional stock markets. The driving force behind this phenomenon can be largely attributed to global economic uncertainty, which has prompted investors to seek refuge in these time-tested safe havens. As we delve into the factors contributing to this trend, it becomes evident that the interplay of various economic elements has played a crucial role in the ascent of gold and silver.

To begin with, the ongoing geopolitical tensions have significantly contributed to the heightened demand for precious metals. In an era marked by trade disputes, political instability, and regional conflicts, investors have become increasingly wary of the potential risks associated with equities and other volatile assets. Consequently, gold and silver have emerged as attractive alternatives, offering a sense of security amidst the turbulence. Moreover, the persistent threat of inflation has further fueled the appeal of these metals. As central banks around the world continue to implement expansive monetary policies to stimulate their economies, concerns about currency devaluation have intensified. In this context, gold and silver are perceived as effective hedges against inflation, preserving wealth in times of economic instability.

Furthermore, the global economic slowdown has played a pivotal role in the rising allure of precious metals. With major economies grappling with sluggish growth rates and mounting debt levels, the prospects for robust economic recovery appear uncertain. This has led investors to reassess their portfolios, opting for assets that can withstand economic downturns. Gold, in particular, has a long-standing reputation as a store of value during periods of economic distress, making it a preferred choice for risk-averse investors. Similarly, silver, often regarded as “poor man’s gold,” has benefited from this shift in investment sentiment, as it offers a more affordable entry point into the precious metals market.

In addition to these macroeconomic factors, the recent surge in demand for precious metals can also be attributed to technological advancements and industrial applications. Silver, for instance, plays a crucial role in the production of solar panels and electronic devices, sectors that have experienced significant growth in recent years. This increased industrial demand has further bolstered silver’s value, complementing its status as a safe-haven asset. Meanwhile, gold’s use in various high-tech applications, such as electronics and medical devices, has also contributed to its rising demand.

As we consider the broader implications of this trend, it is essential to recognize the potential impact on global financial markets. The shift towards precious metals as a preferred investment vehicle may lead to a reallocation of capital, with investors diversifying their portfolios to include a greater proportion of these assets. This could result in increased volatility in stock markets, as traditional equities face heightened competition from gold and silver. Additionally, the sustained demand for precious metals may prompt mining companies to ramp up production, potentially influencing supply dynamics and pricing in the long term.

In conclusion, the surge in gold and silver prices can be largely attributed to the prevailing global economic uncertainty. As investors navigate an increasingly complex financial landscape, the enduring appeal of these precious metals as safe-haven assets remains evident. While the future trajectory of gold and silver prices is subject to various factors, their current ascent underscores the critical role they play in providing stability and security in times of economic turmoil.

How Gold and Silver Outperformed Traditional Stock Markets

In recent months, the financial markets have witnessed a remarkable shift as precious metals, particularly gold and silver, have surged to unprecedented levels, outshining traditional stock markets. This phenomenon has captured the attention of investors worldwide, prompting a reevaluation of investment strategies and asset allocations. The allure of gold and silver, often seen as safe-haven assets, has been magnified by a confluence of economic factors, geopolitical tensions, and market dynamics, leading to their impressive performance.

To begin with, gold has reached a record high, driven by a combination of factors that have heightened its appeal as a store of value. The ongoing uncertainty in global markets, exacerbated by geopolitical tensions and economic instability, has led investors to seek refuge in gold. Historically, gold has been perceived as a hedge against inflation and currency devaluation, and in the current economic climate, these concerns have become increasingly pronounced. Central banks around the world have adopted accommodative monetary policies, including low interest rates and quantitative easing measures, which have further fueled inflationary pressures. Consequently, investors have turned to gold as a means of preserving their wealth, pushing its price to new heights.

In parallel, silver has also experienced a significant surge, reaching a 12-year high. While often overshadowed by gold, silver possesses unique attributes that have contributed to its recent outperformance. Silver is not only a precious metal but also an industrial commodity, with applications in various sectors such as electronics, solar energy, and automotive industries. The growing demand for green technologies and renewable energy solutions has bolstered the industrial demand for silver, adding to its appeal as an investment. Moreover, the silver market is relatively smaller and more volatile than gold, which can lead to more pronounced price movements. As a result, silver has captured the attention of investors seeking both a safe-haven asset and exposure to industrial growth.

In contrast, traditional stock markets have faced a series of challenges that have hindered their performance. The global economic recovery from the pandemic has been uneven, with supply chain disruptions, labor shortages, and rising commodity prices creating headwinds for many industries. Additionally, concerns over potential interest rate hikes by central banks to combat inflation have added to market volatility. These factors have contributed to a more cautious approach among investors, who are increasingly diversifying their portfolios to include alternative assets such as precious metals.

Furthermore, the correlation between precious metals and stock markets has historically been low, making gold and silver attractive options for portfolio diversification. In times of market turbulence, the negative correlation between these asset classes can help mitigate risk and enhance overall portfolio stability. This diversification benefit has become particularly appealing in the current environment, where uncertainty looms large.

In conclusion, the recent surge in gold and silver prices underscores the shifting dynamics in global financial markets. As investors navigate an increasingly complex landscape, the appeal of precious metals as both safe-haven assets and vehicles for diversification has been reinforced. While traditional stock markets continue to grapple with economic challenges, gold and silver have emerged as standout performers, offering a compelling alternative for those seeking stability and growth. As the world continues to evolve, the role of precious metals in investment portfolios is likely to remain significant, reflecting their enduring value and resilience in the face of uncertainty.

Future Predictions: Will Precious Metals Continue to Shine?

The recent surge in precious metals, particularly gold and silver, has captured the attention of investors worldwide. Gold has reached an unprecedented record high, while silver has climbed to a 12-year peak, outperforming traditional stock markets. This remarkable performance has prompted analysts and investors alike to ponder whether this trend will persist in the future. To understand the potential trajectory of precious metals, it is essential to consider the factors driving their current ascent and the broader economic context.

One of the primary catalysts for the rise in gold and silver prices is the prevailing economic uncertainty. In times of financial instability, investors often seek refuge in assets perceived as safe havens. Gold, in particular, has long been regarded as a store of value, providing a hedge against inflation and currency devaluation. As central banks around the world continue to implement expansive monetary policies, including low interest rates and quantitative easing, concerns about inflationary pressures have intensified. Consequently, investors are increasingly turning to gold as a means of preserving their wealth.

Moreover, geopolitical tensions and global trade disputes have further fueled the demand for precious metals. In an interconnected world, political instability in one region can have far-reaching implications for global markets. As a result, investors are diversifying their portfolios by allocating a portion of their assets to gold and silver, which are less susceptible to geopolitical risks compared to equities.

In addition to these macroeconomic factors, the supply and demand dynamics of precious metals also play a crucial role in their price movements. Gold and silver mining operations have faced numerous challenges, including environmental regulations, labor disputes, and declining ore grades. These factors have constrained the supply of precious metals, contributing to upward pressure on prices. On the demand side, technological advancements and the growing popularity of renewable energy sources have increased the industrial use of silver, further boosting its value.

While the current environment appears favorable for precious metals, it is important to consider potential headwinds that could impact their future performance. A significant factor to watch is the trajectory of interest rates. Should central banks decide to tighten monetary policy in response to rising inflation, higher interest rates could diminish the appeal of non-yielding assets like gold and silver. Additionally, a resolution of geopolitical tensions or a stabilization of global trade relations could reduce the demand for safe-haven assets.

Furthermore, the performance of precious metals is closely linked to investor sentiment and market psychology. As with any asset class, shifts in sentiment can lead to volatility and abrupt price corrections. Therefore, investors should remain vigilant and consider a diversified approach to managing their portfolios.

In conclusion, the recent surge in gold and silver prices reflects a confluence of economic, geopolitical, and supply-demand factors. While the outlook for precious metals remains positive in the near term, driven by ongoing economic uncertainties and supply constraints, potential challenges such as rising interest rates and changing investor sentiment could influence their future trajectory. As such, investors should carefully assess the evolving landscape and consider a balanced strategy that accounts for both the opportunities and risks associated with precious metals.

Q&A

1. **What caused the recent surge in precious metals like gold and silver?**

Economic uncertainty, inflation concerns, and geopolitical tensions have driven investors towards safe-haven assets like gold and silver.

2. **What record did gold recently achieve?**

Gold hit an all-time high, surpassing previous records due to increased demand and market conditions.

3. **How did silver perform in comparison to its historical prices?**

Silver reached a 12-year high, marking a significant increase in value compared to its performance over the past decade.

4. **Why are precious metals currently outshining stocks?**

Investors are seeking stability amidst volatile stock markets, leading to a preference for tangible assets like gold and silver.

5. **What impact does a strong dollar have on precious metals?**

Typically, a strong dollar can suppress precious metal prices, but current demand has outweighed this effect.

6. **How are central bank policies influencing precious metal prices?**

Low interest rates and quantitative easing by central banks have increased the appeal of non-yielding assets like gold and silver.

7. **What are the future prospects for gold and silver prices?**

Continued economic uncertainty and inflation fears suggest that gold and silver prices may remain elevated or continue to rise.

Conclusion

The recent surge in precious metals, with gold reaching a record high and silver hitting a 12-year peak, underscores a significant shift in investor sentiment towards safe-haven assets. This trend highlights growing concerns over economic uncertainty, inflationary pressures, and geopolitical tensions, which have collectively diminished confidence in traditional equities. As investors seek stability, the outperformance of gold and silver compared to stocks suggests a strategic pivot towards assets perceived as more resilient in volatile markets. This movement not only reflects immediate market conditions but also signals a potential long-term recalibration of investment strategies favoring precious metals.