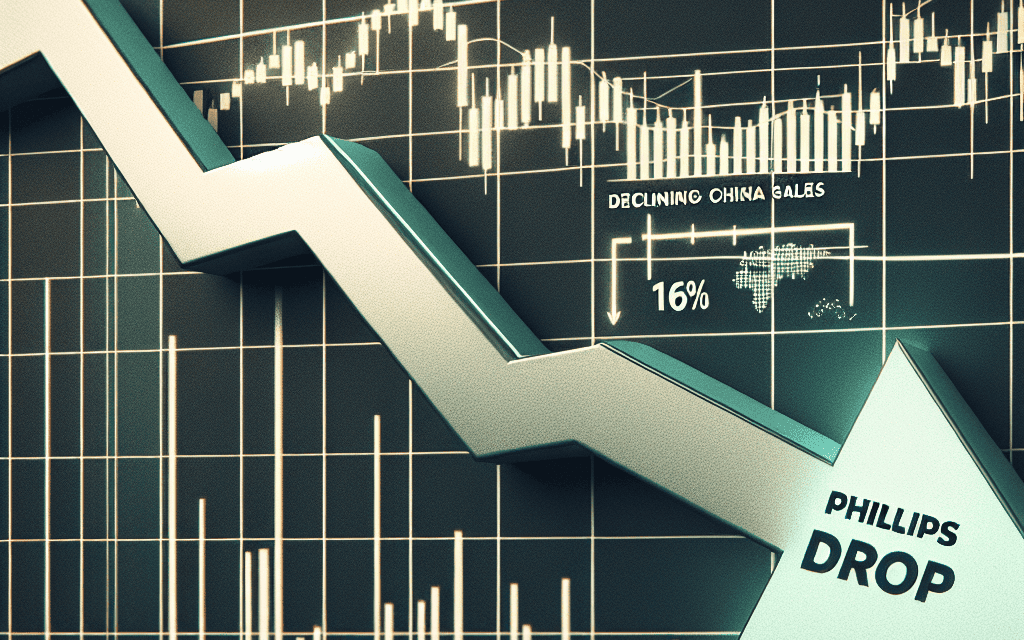

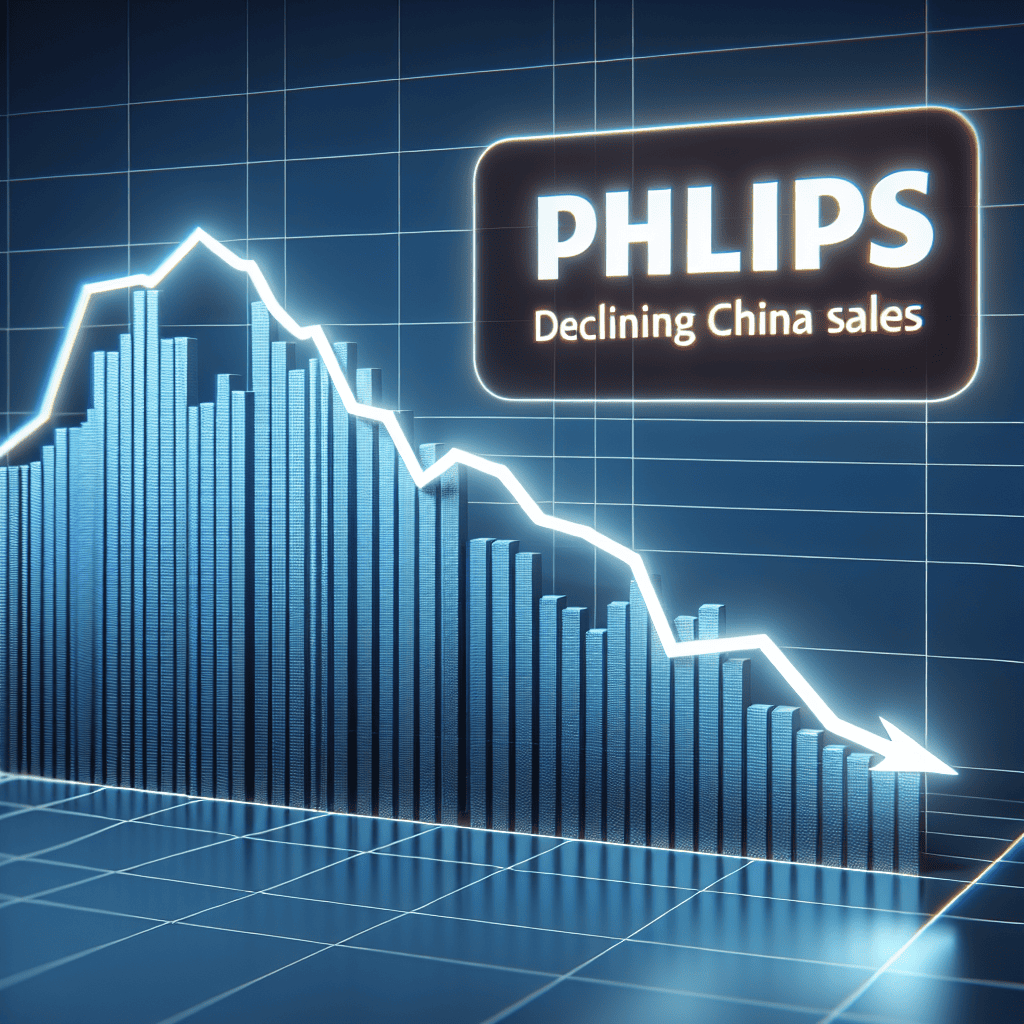

“Philips Faces a 16% Dive: China’s Market Woes Cast a Shadow”

Introduction

Philips, the Dutch multinational conglomerate, experienced a significant financial setback as its shares plummeted by 16%, driven by a notable decline in sales within the Chinese market. This downturn highlights the challenges faced by the company in one of its key international markets, where economic fluctuations and shifting consumer behaviors have impacted its performance. The sharp drop in share value underscores investor concerns about Philips’ ability to navigate these market dynamics and sustain its growth trajectory. As the company grapples with these headwinds, it must strategize effectively to stabilize its operations and reassure stakeholders of its long-term viability.

Impact Of Declining China Sales On Philips’ Global Market Strategy

Philips, a global leader in health technology and consumer electronics, recently experienced a significant downturn in its stock value, with shares plummeting by 16%. This sharp decline is primarily attributed to a notable decrease in sales within the Chinese market, a region that has long been a cornerstone of Philips’ global market strategy. As the company grapples with this setback, it is imperative to examine the broader implications of declining China sales on Philips’ global market strategy and the potential adjustments the company may need to consider.

China has been a pivotal market for Philips, contributing significantly to its revenue and growth over the years. The country’s burgeoning middle class and increasing demand for advanced healthcare solutions have made it an attractive destination for Philips’ wide array of products, ranging from medical imaging systems to consumer health devices. However, recent geopolitical tensions, coupled with a slowdown in China’s economic growth, have posed challenges for multinational companies operating in the region, including Philips. The decline in sales can be attributed to several factors, including increased competition from local manufacturers, regulatory hurdles, and shifting consumer preferences.

In light of these challenges, Philips must reassess its global market strategy to mitigate the impact of declining sales in China. One potential approach is to diversify its market presence by strengthening its foothold in other emerging markets. Regions such as Southeast Asia, Latin America, and Africa present significant growth opportunities due to their expanding healthcare infrastructure and rising demand for medical technology. By leveraging its expertise and innovative product offerings, Philips can tap into these markets to offset the losses incurred in China.

Moreover, Philips may need to enhance its focus on digital transformation and innovation to remain competitive in the global market. The healthcare industry is rapidly evolving, with digital health solutions gaining traction worldwide. By investing in cutting-edge technologies such as artificial intelligence, telemedicine, and connected care solutions, Philips can position itself as a leader in the digital health space. This strategic shift not only aligns with global healthcare trends but also caters to the growing demand for personalized and efficient healthcare services.

Additionally, Philips could benefit from strengthening its partnerships and collaborations with local entities in various regions. By forging alliances with local healthcare providers, governments, and technology firms, Philips can gain valuable insights into regional market dynamics and tailor its offerings to meet specific needs. Such collaborations can also facilitate smoother navigation of regulatory landscapes and enhance Philips’ brand presence in diverse markets.

Furthermore, Philips must continue to prioritize sustainability and corporate social responsibility as integral components of its global strategy. As consumers and stakeholders increasingly demand environmentally conscious and socially responsible business practices, Philips’ commitment to sustainability can serve as a differentiating factor in the competitive landscape. By integrating sustainable practices into its operations and product development, Philips can enhance its brand reputation and appeal to a broader audience.

In conclusion, the decline in China sales presents a formidable challenge for Philips, necessitating a reevaluation of its global market strategy. By diversifying its market presence, embracing digital innovation, fostering strategic partnerships, and prioritizing sustainability, Philips can navigate the complexities of the global market and continue to drive growth. As the company adapts to these changing dynamics, it remains poised to maintain its position as a leader in health technology and consumer electronics on the world stage.

Analyzing The 16% Plunge In Philips Shares: Causes And Consequences

Philips, a global leader in health technology, recently experienced a significant 16% drop in its share value, a development that has sent ripples through the financial markets and raised concerns among investors. This decline is primarily attributed to a sharp decrease in sales within the Chinese market, a region that has historically been a substantial contributor to the company’s revenue. As we delve into the causes and consequences of this downturn, it is essential to understand the broader context in which Philips operates and the specific challenges it faces.

To begin with, the Chinese market has been a cornerstone of Philips’ growth strategy, given its vast population and increasing demand for advanced healthcare solutions. However, recent geopolitical tensions and economic uncertainties have created a challenging environment for multinational companies operating in China. For Philips, these factors have translated into reduced consumer spending and a slowdown in the adoption of new technologies, directly impacting its sales figures. Moreover, the Chinese government’s emphasis on self-reliance in technology has led to increased competition from domestic firms, further eroding Philips’ market share.

In addition to these external pressures, Philips has been grappling with internal challenges that have exacerbated the situation. The company has been undergoing a strategic transformation, shifting its focus from consumer electronics to healthcare technology. While this transition holds long-term promise, it has also led to short-term disruptions and increased operational costs. The restructuring efforts, coupled with supply chain disruptions caused by the global pandemic, have strained Philips’ resources and affected its ability to meet market demands efficiently.

Furthermore, the recall of certain sleep and respiratory care products due to safety concerns has added another layer of complexity to Philips’ predicament. This recall not only resulted in financial losses but also damaged the company’s reputation, leading to a loss of consumer trust. The combination of these factors has created a perfect storm, culminating in the steep decline in share value.

The consequences of this plunge are multifaceted. For investors, the immediate impact is a decrease in the value of their holdings, prompting a reevaluation of their investment strategies. Some may choose to divest, while others might see this as an opportunity to buy shares at a lower price, banking on Philips’ potential recovery. For the company itself, the drop in share value serves as a wake-up call, highlighting the need for a reassessment of its strategies and operations.

In response to these challenges, Philips is likely to intensify its efforts to regain market confidence. This could involve accelerating its innovation pipeline, enhancing its product offerings, and strengthening its presence in emerging markets beyond China. Additionally, rebuilding consumer trust through transparent communication and effective resolution of product safety issues will be crucial.

In conclusion, the 16% plunge in Philips shares underscores the complex interplay of external and internal factors that can influence a company’s financial performance. While the immediate outlook may appear daunting, Philips’ commitment to innovation and its strategic focus on healthcare technology position it well for a potential rebound. As the company navigates these turbulent times, its ability to adapt and respond to changing market dynamics will be key to restoring investor confidence and achieving sustainable growth in the future.

How Philips Plans To Recover From The Recent Stock Market Setback

Philips, the Dutch multinational conglomerate, recently faced a significant setback as its shares plunged by 16%, primarily due to declining sales in China. This downturn has raised concerns among investors and stakeholders, prompting the company to devise a strategic plan to recover from this stock market setback. Understanding the underlying causes of this decline is crucial for Philips as it navigates the challenges posed by the current economic climate.

The decline in sales in China, a key market for Philips, can be attributed to several factors. The ongoing geopolitical tensions and trade uncertainties have created an unpredictable business environment, affecting consumer confidence and spending. Additionally, the resurgence of COVID-19 in certain regions has led to renewed restrictions, further dampening economic activity. These external pressures have compounded the challenges faced by Philips, necessitating a comprehensive approach to recovery.

In response to these challenges, Philips is focusing on several strategic initiatives aimed at revitalizing its growth trajectory. Firstly, the company is intensifying its efforts to innovate and diversify its product portfolio. By investing in research and development, Philips aims to introduce cutting-edge technologies that cater to evolving consumer needs. This focus on innovation is expected to enhance the company’s competitive edge and attract a broader customer base, thereby offsetting the decline in sales in specific markets.

Moreover, Philips is strengthening its presence in emerging markets, which hold significant growth potential. By expanding its operations in regions such as Southeast Asia and Latin America, the company seeks to tap into new revenue streams and reduce its reliance on the Chinese market. This geographical diversification strategy is designed to mitigate risks associated with market-specific downturns and ensure a more balanced global footprint.

In addition to geographical diversification, Philips is also prioritizing digital transformation as a key pillar of its recovery strategy. The company is leveraging digital technologies to enhance operational efficiency and improve customer engagement. By adopting data-driven approaches, Philips aims to optimize its supply chain, streamline production processes, and deliver personalized experiences to consumers. This digital shift is expected to not only drive cost savings but also foster stronger customer loyalty, contributing to long-term growth.

Furthermore, Philips is committed to sustainability and corporate social responsibility, recognizing their importance in today’s business landscape. The company is actively working towards reducing its carbon footprint and promoting sustainable practices across its operations. By aligning its business objectives with environmental goals, Philips aims to enhance its brand reputation and appeal to environmentally conscious consumers. This commitment to sustainability is anticipated to create new opportunities for growth and differentiation in the market.

To support these strategic initiatives, Philips is also focusing on strengthening its financial position. The company is implementing cost-saving measures and optimizing its capital allocation to ensure financial stability. By maintaining a robust balance sheet, Philips aims to weather short-term challenges and invest in long-term growth opportunities.

In conclusion, while the recent decline in shares poses a significant challenge for Philips, the company is proactively addressing the situation through a multifaceted recovery strategy. By focusing on innovation, geographical diversification, digital transformation, sustainability, and financial resilience, Philips is positioning itself for a sustainable recovery. As the company navigates this period of uncertainty, its ability to adapt and execute these strategic initiatives will be crucial in restoring investor confidence and driving future growth.

The Role Of China In Philips’ Overall Business Performance

Philips, a global leader in health technology and consumer electronics, recently experienced a significant downturn in its stock value, with shares plummeting by 16%. This decline is largely attributed to a notable decrease in sales within the Chinese market, a region that has historically played a crucial role in the company’s overall business performance. Understanding the impact of China on Philips’ operations requires an examination of both the strategic importance of this market and the broader economic factors influencing consumer behavior in the region.

China has long been a pivotal market for Philips, contributing substantially to its revenue and growth. The country’s vast population and rapidly expanding middle class have made it an attractive destination for multinational corporations seeking to capitalize on increasing consumer demand for advanced healthcare solutions and high-quality electronic products. Philips, with its diverse portfolio ranging from medical imaging systems to personal health devices, has positioned itself to meet these demands, thereby securing a significant share of the market.

However, recent economic challenges in China have posed considerable obstacles for Philips. The country’s economic growth has been slowing, influenced by a combination of domestic policy shifts and global economic uncertainties. This slowdown has led to reduced consumer spending, particularly in sectors that are non-essential or luxury in nature. Consequently, Philips has faced declining sales in its consumer electronics division, which includes products such as electric toothbrushes and home appliances. These items, while popular, are often considered discretionary purchases, making them vulnerable to shifts in consumer confidence and spending power.

Moreover, the healthcare sector, another critical component of Philips’ business in China, has also encountered hurdles. The Chinese government’s ongoing healthcare reforms, aimed at improving access and affordability, have resulted in pricing pressures and increased competition from local manufacturers. These factors have challenged Philips’ ability to maintain its market share and profitability in the region. Additionally, the global supply chain disruptions caused by the COVID-19 pandemic have further exacerbated these issues, leading to delays and increased costs that have impacted the company’s bottom line.

In response to these challenges, Philips has been exploring various strategies to mitigate the impact of declining sales in China. The company is focusing on innovation and digital transformation to enhance its product offerings and improve operational efficiency. By investing in research and development, Philips aims to introduce cutting-edge technologies that cater to the evolving needs of Chinese consumers and healthcare providers. Furthermore, the company is strengthening its partnerships with local entities to better navigate the regulatory landscape and expand its reach within the market.

Despite these efforts, the recent plunge in Philips’ share price underscores the significant influence that the Chinese market holds over the company’s overall business performance. As China continues to navigate its economic transition, Philips must remain agile and adaptive to sustain its growth and maintain its competitive edge. The company’s ability to successfully address the challenges in China will not only determine its future prospects in the region but also have broader implications for its global operations.

In conclusion, the decline in Philips’ shares highlights the critical role that China plays in the company’s business strategy. While the current economic environment presents challenges, it also offers opportunities for Philips to innovate and strengthen its position in the market. By leveraging its expertise and focusing on strategic initiatives, Philips can navigate the complexities of the Chinese market and continue to drive its overall business performance.

Investor Reactions To Philips’ Declining Sales In China

Philips, the Dutch multinational conglomerate known for its innovative healthcare solutions and consumer electronics, recently experienced a significant drop in its share value, plummeting by 16%. This sharp decline has been primarily attributed to the company’s underwhelming sales performance in China, a market that has long been considered a cornerstone of its growth strategy. Investors, analysts, and stakeholders are now closely examining the implications of this downturn, seeking to understand the broader impact on Philips’ financial health and future prospects.

The Chinese market, with its vast population and rapidly growing middle class, has been a focal point for many global companies, including Philips. The company’s strategic investments in China were aimed at capitalizing on the increasing demand for advanced healthcare technologies and consumer products. However, recent geopolitical tensions, coupled with a slowdown in the Chinese economy, have posed significant challenges. These factors have led to a decrease in consumer spending and a more cautious approach to purchasing high-end products, directly affecting Philips’ sales figures.

In response to the declining sales, Philips has acknowledged the need to reassess its strategies in China. The company is exploring various avenues to regain its foothold, including potential partnerships with local firms and a renewed focus on tailoring products to meet the specific needs of Chinese consumers. Despite these efforts, the immediate impact on investor sentiment has been palpable. The 16% drop in share value reflects a broader concern about Philips’ ability to navigate the complexities of the Chinese market and maintain its competitive edge.

Moreover, the decline in sales has raised questions about Philips’ overall growth trajectory. Investors are particularly concerned about the company’s reliance on the Chinese market as a key driver of revenue. With China accounting for a significant portion of Philips’ global sales, any sustained downturn could have far-reaching consequences. This has prompted some investors to reevaluate their positions, leading to increased volatility in Philips’ stock.

In addition to the challenges in China, Philips is also grappling with other external pressures. The global supply chain disruptions, exacerbated by the COVID-19 pandemic, have affected the company’s ability to deliver products efficiently. Furthermore, rising inflation and increased competition in the healthcare sector have added to the complexities Philips faces. These factors, combined with the recent sales decline in China, have created a perfect storm, testing the resilience of Philips’ business model.

Despite these challenges, Philips remains committed to its long-term vision of improving people’s health and well-being through meaningful innovation. The company is investing in research and development to drive future growth and is optimistic about the potential of emerging markets beyond China. Additionally, Philips is focusing on expanding its digital health solutions, which have shown promising growth prospects.

In conclusion, the recent plunge in Philips’ share value underscores the significant impact of declining sales in China on investor confidence. While the company is actively seeking solutions to address these challenges, the road ahead is fraught with uncertainties. Investors will be closely monitoring Philips’ strategic moves and market developments, as the company navigates this critical juncture. Ultimately, Philips’ ability to adapt and innovate will be key to restoring investor trust and achieving sustainable growth in the years to come.

Comparing Philips’ Market Performance With Competitors Amidst China Sales Drop

Philips, the Dutch multinational conglomerate, recently experienced a significant downturn in its market performance, with shares plummeting by 16%. This decline is primarily attributed to a substantial drop in sales within the Chinese market, a region that has historically been a stronghold for the company. As Philips grapples with these challenges, it is essential to compare its market performance with that of its competitors to gain a comprehensive understanding of the broader industry dynamics.

To begin with, Philips has long been a prominent player in the healthcare technology sector, offering a wide range of products from imaging systems to consumer health devices. However, the recent decline in sales in China has raised concerns about its ability to maintain its competitive edge. The Chinese market, known for its rapid growth and vast consumer base, has become increasingly vital for global companies seeking expansion. Consequently, Philips’ struggles in this region have had a pronounced impact on its overall financial health.

In contrast, some of Philips’ competitors have managed to navigate the challenges in China more effectively. For instance, Siemens Healthineers, a major competitor in the healthcare technology space, has reported steady growth in its Chinese operations. This success can be attributed to its strategic partnerships with local firms and a robust understanding of the regulatory landscape. By aligning its offerings with the specific needs of the Chinese market, Siemens Healthineers has been able to sustain its growth trajectory despite the broader economic uncertainties.

Similarly, General Electric’s healthcare division has also demonstrated resilience in the face of declining sales in China. Through a combination of innovation and strategic localization, GE Healthcare has managed to maintain a stable market presence. By investing in research and development tailored to the Chinese market, GE has introduced products that cater to local preferences and regulatory requirements, thereby mitigating the impact of the sales downturn.

Moreover, it is worth noting that the challenges faced by Philips are not solely confined to the healthcare sector. The consumer electronics division, which includes products such as personal health devices and domestic appliances, has also been affected by the declining sales in China. In this regard, companies like Samsung and LG have shown a more adaptable approach. By leveraging their extensive distribution networks and focusing on digital marketing strategies, these companies have been able to offset some of the negative impacts of the Chinese market slowdown.

Furthermore, the broader economic context cannot be ignored when analyzing Philips’ market performance. The ongoing trade tensions between China and other major economies, coupled with the lingering effects of the COVID-19 pandemic, have created an environment of uncertainty. This has led to fluctuations in consumer spending and disruptions in supply chains, factors that have undoubtedly contributed to Philips’ current predicament.

In conclusion, while Philips faces significant challenges due to declining sales in China, a comparison with its competitors reveals that strategic adaptability and localization are key to navigating these turbulent times. Companies that have successfully aligned their offerings with the unique demands of the Chinese market have managed to sustain their growth, despite the broader economic headwinds. As Philips seeks to regain its footing, it may benefit from adopting similar strategies to enhance its market performance and restore investor confidence.

Future Outlook For Philips: Strategies To Mitigate Risks In The Chinese Market

Philips, a global leader in health technology, recently experienced a significant 16% drop in its share value, primarily attributed to declining sales in the Chinese market. This downturn has raised concerns among investors and stakeholders about the company’s future prospects in one of its key markets. As Philips navigates these challenges, it is imperative to explore strategies that could mitigate risks and stabilize its position in China.

To begin with, understanding the root causes of the declining sales in China is crucial. The Chinese market, known for its rapid economic growth and vast consumer base, has become increasingly competitive. Local companies have been gaining ground, offering innovative products at competitive prices. Additionally, geopolitical tensions and trade uncertainties have further complicated the landscape for foreign companies operating in China. In response to these challenges, Philips must adopt a multifaceted approach to regain its foothold.

One potential strategy is to enhance localization efforts. By tailoring products and services to meet the specific needs and preferences of Chinese consumers, Philips can differentiate itself from competitors. This could involve investing in local research and development centers to foster innovation that resonates with the local market. Moreover, forming strategic partnerships with Chinese companies could provide Philips with valuable insights and access to established distribution networks, thereby enhancing its market penetration.

Furthermore, Philips should consider strengthening its digital presence in China. The country is at the forefront of digital transformation, with a significant portion of consumer interactions occurring online. By leveraging digital marketing strategies and e-commerce platforms, Philips can reach a broader audience and engage with consumers more effectively. This approach not only aligns with current consumer behavior trends but also offers a cost-effective way to boost brand visibility and drive sales.

In addition to these strategies, Philips must remain vigilant about regulatory changes and compliance requirements in China. The regulatory environment in China is dynamic, with frequent updates that can impact foreign businesses. By maintaining a proactive approach to compliance, Philips can avoid potential legal pitfalls and build trust with both consumers and regulatory bodies. This could involve investing in a dedicated team to monitor regulatory developments and ensure that all operations align with local laws and standards.

Moreover, sustainability and corporate social responsibility (CSR) initiatives could play a pivotal role in Philips’ strategy to mitigate risks in China. As Chinese consumers become more environmentally conscious, demonstrating a commitment to sustainable practices can enhance Philips’ brand image and appeal. By integrating sustainability into its core business operations and communicating these efforts transparently, Philips can strengthen its reputation and foster long-term loyalty among Chinese consumers.

Finally, it is essential for Philips to maintain open lines of communication with its stakeholders, including investors, employees, and customers. By providing regular updates on its strategies and progress in the Chinese market, Philips can manage expectations and build confidence in its ability to navigate the challenges ahead. This transparency will be crucial in maintaining stakeholder support as the company implements its risk mitigation strategies.

In conclusion, while the recent decline in Philips’ share value due to falling sales in China presents significant challenges, it also offers an opportunity for the company to reassess and refine its approach in this critical market. By focusing on localization, digital engagement, regulatory compliance, sustainability, and stakeholder communication, Philips can position itself for a more resilient and prosperous future in China.

Q&A

1. **What caused Philips shares to plunge by 16%?**

Philips shares plunged by 16% due to declining sales in China.

2. **How significant was the decline in China sales for Philips?**

The decline in China sales was significant enough to impact the company’s overall financial performance, leading to a sharp drop in share prices.

3. **What specific factors contributed to the decline in China sales for Philips?**

Specific factors may include reduced consumer demand, economic slowdown, or increased competition in the Chinese market.

4. **How did the market react to the news of declining China sales for Philips?**

The market reacted negatively, resulting in a 16% drop in Philips’ share price.

5. **What other regions, if any, were affected by the sales decline?**

The primary focus was on China, but any ripple effects on other regions were not specified.

6. **What measures is Philips considering to address the decline in sales?**

Philips may consider strategic adjustments, such as enhancing marketing efforts or restructuring operations, though specific measures were not detailed.

7. **How does the decline in China sales impact Philips’ future outlook?**

The decline poses challenges for Philips’ growth prospects and may necessitate a reassessment of their strategy in the Chinese market.

Conclusion

Philips shares experienced a significant 16% decline, primarily driven by a notable decrease in sales within the Chinese market. This downturn reflects broader challenges the company faces in maintaining its market position amid shifting economic conditions and competitive pressures in China. The decline in sales could be attributed to various factors, including changing consumer preferences, increased competition from local and international brands, and potential regulatory hurdles. This situation underscores the importance for Philips to reassess its strategies in China, focusing on innovation, local partnerships, and market-specific solutions to regain its footing and stabilize its financial performance. The sharp drop in share value also highlights investor concerns about the company’s ability to navigate these challenges effectively and sustain growth in one of its key markets.