“Philippe Laffont: From Nvidia’s Heights to AI’s Hidden Gems.”

Introduction

Philippe Laffont, the renowned hedge fund manager and founder of Coatue Management, is making headlines with a strategic pivot in his investment portfolio. Known for his astute tech investments, Laffont has recently shifted his focus from Nvidia, a leading player in the semiconductor and AI industry, to a lesser-known but promising AI stock that he perceives as undervalued. This move underscores Laffont’s reputation for identifying high-potential opportunities in the ever-evolving tech landscape. As Nvidia continues to dominate the AI sector, Laffont’s decision to reallocate resources suggests a calculated bet on emerging technologies and companies that could offer substantial returns. This strategic shift not only highlights Laffont’s investment acumen but also signals potential trends and opportunities within the AI market that investors and industry watchers are keenly observing.

Philippe Laffont’s Strategic Shift: From Nvidia to Emerging AI Opportunities

Philippe Laffont, the founder of Coatue Management, is renowned for his astute investment strategies, particularly in the technology sector. His recent decision to pivot from Nvidia, a titan in the AI and semiconductor industry, to a lesser-known AI stock has captured the attention of investors and analysts alike. This strategic shift underscores Laffont’s ability to identify emerging opportunities in a rapidly evolving market landscape.

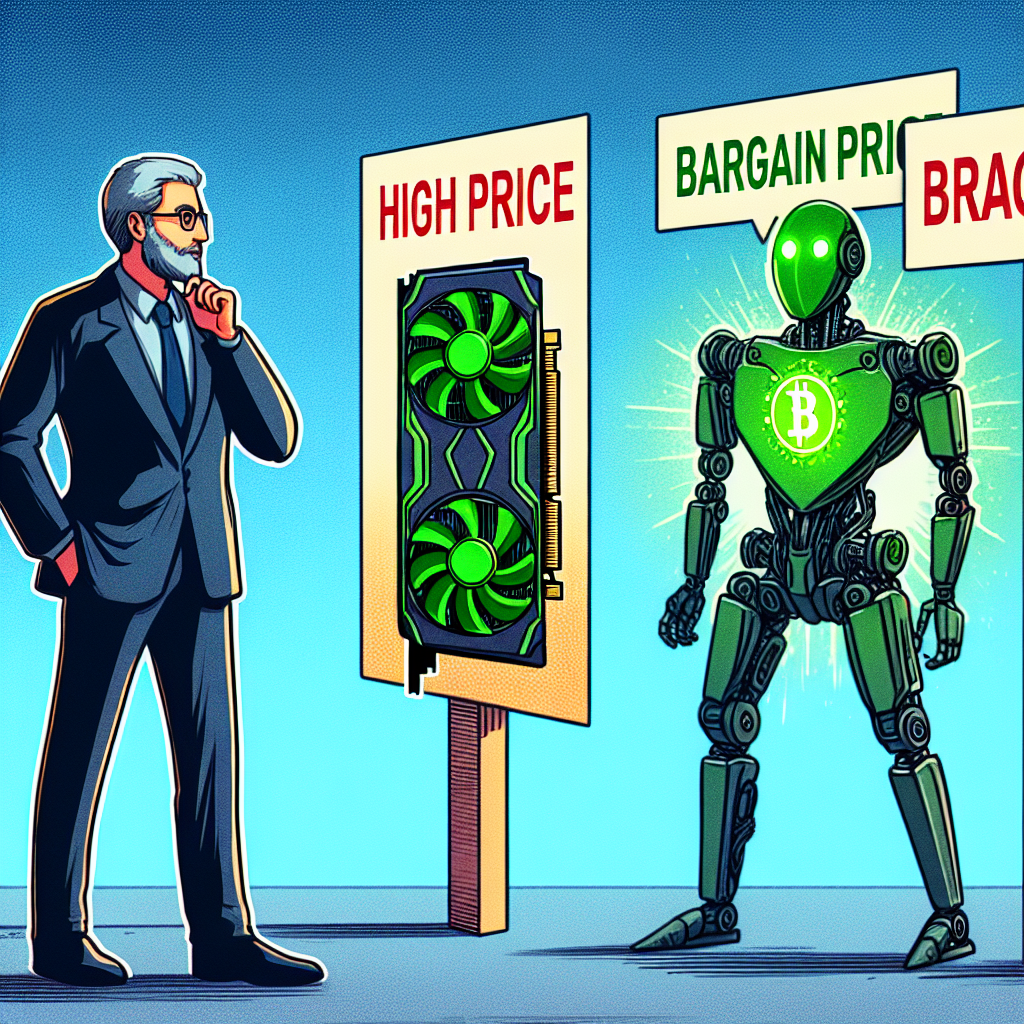

Nvidia has long been a favorite among investors, thanks to its dominance in the graphics processing unit (GPU) market and its pivotal role in the advancement of artificial intelligence technologies. The company’s GPUs are integral to AI applications, from data centers to autonomous vehicles, making it a cornerstone of the AI revolution. However, as Nvidia’s stock price soared, driven by its strong performance and market position, Laffont began to reassess the potential for future returns. The high valuation of Nvidia, while reflective of its success, also suggested limited upside potential, prompting Laffont to explore alternative investments that could offer greater growth prospects.

In this context, Laffont’s decision to shift focus to a bargain AI stock is both strategic and forward-thinking. By identifying a company with strong fundamentals and significant growth potential, Laffont aims to capitalize on the next wave of AI innovation. This move is indicative of his broader investment philosophy, which emphasizes the importance of staying ahead of market trends and recognizing undervalued opportunities before they become mainstream.

The AI landscape is vast and continually evolving, with numerous companies vying for a share of the market. While Nvidia remains a dominant player, the emergence of new technologies and applications has created opportunities for smaller, more agile companies to make their mark. Laffont’s choice to invest in a lesser-known AI stock suggests that he sees untapped potential in areas that may not yet be fully appreciated by the broader market. This approach aligns with his history of investing in disruptive technologies and companies that have the potential to redefine industries.

Moreover, Laffont’s strategic shift highlights the importance of diversification in investment portfolios. By reallocating resources from a well-established company like Nvidia to a promising newcomer, Laffont is not only seeking higher returns but also mitigating risk. This balance between stability and growth is a hallmark of successful investment strategies, particularly in sectors characterized by rapid technological advancements and market fluctuations.

In addition to financial considerations, Laffont’s decision may also be influenced by the broader societal impact of AI technologies. As AI continues to transform industries and reshape the global economy, investors are increasingly considering the ethical and social implications of their investments. By supporting a company that aligns with his values and vision for the future, Laffont is positioning himself as a leader in responsible investing within the AI sector.

In conclusion, Philippe Laffont’s shift from Nvidia to a bargain AI stock reflects his keen ability to navigate the complexities of the technology market. By identifying emerging opportunities and balancing risk with potential reward, Laffont continues to demonstrate his prowess as a forward-thinking investor. As the AI landscape continues to evolve, his strategic decisions will likely serve as a bellwether for other investors seeking to capitalize on the next wave of technological innovation.

Analyzing Philippe Laffont’s Investment Moves: Bargain AI Stocks in Focus

Philippe Laffont, the founder of Coatue Management, is renowned for his astute investment strategies, particularly in the technology sector. His recent shift in focus from Nvidia, a titan in the AI industry, to a lesser-known bargain AI stock has captured the attention of investors and analysts alike. This strategic pivot underscores Laffont’s ability to identify emerging opportunities in a rapidly evolving market landscape. As Nvidia continues to dominate headlines with its groundbreaking advancements in artificial intelligence, Laffont’s decision to explore alternative investments suggests a nuanced understanding of the sector’s dynamics.

Nvidia’s prominence in the AI space is undisputed, with its GPUs serving as the backbone for numerous AI applications. However, Laffont’s move away from Nvidia indicates a search for undervalued opportunities that may offer substantial growth potential. This shift is not merely a reaction to Nvidia’s current market valuation but rather a proactive approach to diversifying Coatue Management’s portfolio. By identifying a bargain AI stock, Laffont aims to capitalize on the potential upside of a company that may not yet be fully appreciated by the broader market.

The AI industry is characterized by rapid innovation and intense competition, with new players constantly emerging. In this context, Laffont’s investment strategy reflects a keen awareness of the sector’s volatility and the importance of staying ahead of market trends. By focusing on a bargain AI stock, Laffont is positioning Coatue Management to benefit from the growth of a company that could become a significant player in the industry. This approach aligns with Laffont’s history of investing in companies with strong fundamentals and innovative technologies.

Moreover, Laffont’s decision to shift focus highlights the importance of adaptability in investment strategies. As the AI landscape continues to evolve, investors must be willing to reassess their positions and explore new opportunities. Laffont’s move serves as a reminder that even established companies like Nvidia, despite their current success, may not always represent the best investment option. Instead, identifying emerging companies with the potential to disrupt the market can yield significant returns.

In addition to showcasing Laffont’s investment acumen, this strategic shift also emphasizes the broader trend of investors seeking value in an increasingly competitive market. As AI technology becomes more integrated into various industries, the demand for innovative solutions is expected to grow. Consequently, investors are looking beyond established giants to find companies that offer unique value propositions and the potential for long-term growth.

Furthermore, Laffont’s focus on a bargain AI stock underscores the importance of thorough research and analysis in investment decision-making. By delving into the fundamentals of lesser-known companies, investors can uncover opportunities that may not be immediately apparent. This approach requires a deep understanding of the industry and a willingness to take calculated risks.

In conclusion, Philippe Laffont’s shift from Nvidia to a bargain AI stock reflects a strategic move to capitalize on emerging opportunities within the AI sector. This decision highlights the importance of adaptability, thorough research, and a forward-looking perspective in investment strategies. As the AI industry continues to evolve, Laffont’s approach serves as a valuable example for investors seeking to navigate the complexities of this dynamic market. By focusing on undervalued companies with strong growth potential, Laffont is positioning Coatue Management to thrive in an increasingly competitive landscape.

The Rationale Behind Philippe Laffont’s Transition from Nvidia to AI Bargains

Philippe Laffont, the renowned hedge fund manager and founder of Coatue Management, has recently made headlines with his strategic pivot from Nvidia, a titan in the semiconductor industry, to a lesser-known but promising AI stock. This transition has sparked considerable interest and speculation within the investment community, as Laffont is known for his astute market insights and ability to identify lucrative opportunities ahead of the curve. To understand the rationale behind this shift, it is essential to delve into the factors influencing Laffont’s decision-making process and the broader context of the AI industry.

Nvidia has long been a dominant player in the semiconductor market, particularly with its cutting-edge graphics processing units (GPUs) that have become integral to AI and machine learning applications. The company’s stock has seen substantial growth, driven by the increasing demand for AI technologies across various sectors. However, as Nvidia’s valuation soared, concerns about its sustainability and potential overvaluation began to surface. In this context, Laffont’s decision to reduce his stake in Nvidia can be seen as a strategic move to capitalize on the gains while seeking new opportunities that offer greater growth potential at a more attractive valuation.

Transitioning from a well-established company like Nvidia to a lesser-known AI stock may seem counterintuitive at first glance. However, Laffont’s investment philosophy often emphasizes the importance of identifying emerging trends and companies that are poised to benefit from them. By shifting focus to a bargain AI stock, Laffont is likely aiming to leverage the rapid advancements in AI technology and the increasing adoption of AI solutions across industries. This approach aligns with his track record of investing in disruptive technologies and companies that have the potential to redefine their respective markets.

Moreover, the AI industry is currently experiencing a transformative phase, with numerous startups and smaller companies making significant strides in developing innovative AI solutions. These companies often operate under the radar, offering investors the opportunity to enter at a lower cost before their potential is fully recognized by the broader market. Laffont’s move suggests a keen awareness of this dynamic landscape and a willingness to explore opportunities beyond the established giants.

In addition to the potential for higher returns, investing in a bargain AI stock also allows for diversification within the AI sector. By spreading investments across multiple companies, Laffont can mitigate risks associated with any single entity while still capitalizing on the overall growth trajectory of the industry. This strategy not only reflects a prudent approach to risk management but also underscores Laffont’s confidence in the long-term prospects of AI technology.

Furthermore, Laffont’s transition may also be influenced by macroeconomic factors and market conditions. With increasing regulatory scrutiny and geopolitical tensions affecting the tech industry, diversifying investments can serve as a hedge against potential disruptions. By identifying undervalued AI stocks, Laffont positions himself to navigate these challenges while maintaining exposure to the sector’s growth potential.

In conclusion, Philippe Laffont’s shift from Nvidia to a bargain AI stock is a calculated move that reflects his deep understanding of market dynamics and his commitment to identifying emerging opportunities. By focusing on undervalued AI companies, Laffont not only seeks to maximize returns but also demonstrates a forward-thinking approach that aligns with the evolving landscape of the AI industry. As the sector continues to evolve, Laffont’s strategic pivot serves as a reminder of the importance of adaptability and foresight in the ever-changing world of investment.

How Philippe Laffont Identifies Value in AI Stocks Beyond Nvidia

Philippe Laffont, the founder of Coatue Management, has long been recognized for his astute investment strategies, particularly in the technology sector. His recent shift in focus from Nvidia, a titan in the AI industry, to a lesser-known but promising AI stock has captured the attention of investors and analysts alike. This strategic pivot underscores Laffont’s ability to identify value in emerging opportunities, even as the broader market remains enamored with established giants like Nvidia.

Nvidia’s dominance in the AI space is undeniable, with its cutting-edge graphics processing units (GPUs) serving as the backbone for numerous AI applications. However, Laffont’s decision to explore beyond Nvidia suggests a keen awareness of the evolving landscape of AI technology. As the AI sector continues to expand, driven by advancements in machine learning, natural language processing, and data analytics, new players are emerging with innovative solutions that challenge the status quo. Laffont’s investment philosophy, which emphasizes long-term growth potential and technological innovation, aligns well with the exploration of these burgeoning opportunities.

In identifying value beyond Nvidia, Laffont employs a comprehensive approach that involves rigorous analysis of market trends, technological advancements, and competitive positioning. He recognizes that while Nvidia’s GPUs are integral to AI development, the industry is not monolithic. There are numerous facets of AI technology, including software development, data management, and specialized hardware, each offering unique investment prospects. By diversifying his focus, Laffont aims to capitalize on the multifaceted nature of AI, seeking out companies that are poised to benefit from niche areas within the sector.

One such company that has caught Laffont’s attention is a lesser-known AI firm that specializes in developing software solutions for data analytics and machine learning. This company, while not as prominent as Nvidia, has demonstrated significant potential through its innovative approach to AI technology. Its software platforms are designed to enhance data processing capabilities, enabling businesses to derive actionable insights from vast datasets. This focus on data-driven decision-making is increasingly critical in today’s digital economy, where organizations are inundated with information and require sophisticated tools to navigate it effectively.

Laffont’s interest in this company is further bolstered by its strong management team and strategic partnerships, which provide a solid foundation for future growth. The firm’s leadership has a proven track record of executing ambitious projects and fostering a culture of innovation. Moreover, its collaborations with industry leaders and academic institutions position it well to stay at the forefront of AI research and development. These factors, combined with a robust product pipeline, suggest that the company is well-equipped to capture a significant share of the AI market in the coming years.

In conclusion, Philippe Laffont’s shift from Nvidia to a bargain AI stock exemplifies his forward-thinking investment strategy and his ability to identify value in emerging opportunities. By looking beyond established players and focusing on companies with strong growth potential and innovative solutions, Laffont continues to demonstrate his prowess in navigating the dynamic technology landscape. As the AI sector evolves, his approach serves as a reminder of the importance of adaptability and foresight in investment decision-making, offering valuable insights for those seeking to capitalize on the next wave of technological advancements.

The Impact of Philippe Laffont’s Investment Strategy on AI Stock Markets

Philippe Laffont, a prominent figure in the investment world and the founder of Coatue Management, has long been recognized for his astute investment strategies, particularly in the technology sector. His recent shift in focus from Nvidia, a titan in the AI industry, to a lesser-known but promising AI stock has sparked considerable interest and speculation among investors and market analysts alike. This strategic pivot underscores the dynamic nature of the AI stock market and highlights Laffont’s ability to identify potential opportunities where others may not.

Nvidia has been a dominant force in the AI sector, largely due to its cutting-edge graphics processing units (GPUs) that are integral to AI computations. The company’s stock has seen substantial growth, driven by the increasing demand for AI technologies across various industries. However, Laffont’s decision to reduce his stake in Nvidia suggests a nuanced understanding of market dynamics and a willingness to explore undervalued opportunities. This move is not merely a reaction to Nvidia’s current market position but rather a calculated decision to diversify and potentially capitalize on emerging trends within the AI landscape.

The AI stock market is characterized by rapid innovation and intense competition, with numerous companies vying for leadership in developing next-generation technologies. In this context, Laffont’s shift towards a bargain AI stock indicates a strategic foresight that goes beyond immediate market trends. By investing in a company that may not yet have achieved Nvidia’s level of recognition or market share, Laffont is positioning himself to benefit from future growth potential. This approach reflects a broader investment philosophy that values long-term gains over short-term fluctuations.

Moreover, Laffont’s investment strategy is likely to have a ripple effect on the AI stock markets. As a respected investor, his decisions often influence other market participants, leading to increased interest and investment in the companies he chooses to back. This can result in a revaluation of the targeted stock, as well as heightened scrutiny of its business model, technological capabilities, and growth prospects. Consequently, Laffont’s focus on a bargain AI stock could catalyze a shift in market sentiment, encouraging other investors to explore similar opportunities.

In addition to impacting individual stock valuations, Laffont’s strategy may also contribute to broader trends within the AI sector. By highlighting the potential of lesser-known companies, he draws attention to the diverse range of innovations occurring outside the spotlight of industry giants. This can foster a more competitive and dynamic market environment, where emerging players have the opportunity to challenge established leaders and drive technological advancements.

Furthermore, Laffont’s investment decisions underscore the importance of adaptability and foresight in navigating the complexities of the AI stock market. As technological advancements continue to reshape industries and create new opportunities, investors must remain vigilant and open to exploring unconventional paths. Laffont’s shift from Nvidia to a bargain AI stock exemplifies this mindset, demonstrating the value of strategic flexibility in an ever-evolving market landscape.

In conclusion, Philippe Laffont’s recent investment shift from Nvidia to a lesser-known AI stock highlights his strategic acumen and ability to anticipate market trends. This move not only influences individual stock valuations but also contributes to broader dynamics within the AI sector. As the market continues to evolve, Laffont’s approach serves as a reminder of the importance of adaptability and long-term vision in successful investment strategies.

Philippe Laffont’s Vision: Uncovering Hidden Gems in the AI Sector

Philippe Laffont, the renowned hedge fund manager and founder of Coatue Management, has long been recognized for his astute investment strategies, particularly in the technology sector. His recent decision to shift focus from Nvidia, a titan in the AI industry, to a lesser-known but promising AI stock has captured the attention of investors and analysts alike. This strategic move underscores Laffont’s ability to identify hidden gems within the rapidly evolving AI landscape, a skill that has consistently set him apart from his peers.

Nvidia has been a dominant force in the AI sector, primarily due to its cutting-edge graphics processing units (GPUs) that power a wide range of AI applications. The company’s strong market position and robust financial performance have made it a favorite among investors. However, Laffont’s decision to pivot away from Nvidia suggests a deeper analysis of the AI market’s future potential. By redirecting his focus, Laffont is signaling that there are other opportunities within the sector that may offer substantial growth prospects at a more attractive valuation.

The AI industry is characterized by rapid innovation and a constant influx of new players, each vying to carve out a niche in this competitive field. Laffont’s investment philosophy has always been rooted in identifying companies that not only possess groundbreaking technology but also demonstrate the potential for long-term growth. This approach has led him to explore beyond the well-trodden paths of established giants like Nvidia, seeking out companies that may not yet be on the radar of mainstream investors.

In this context, Laffont’s interest in a bargain AI stock reflects his commitment to uncovering undervalued opportunities. While the identity of this particular stock remains undisclosed, it is likely that Laffont has identified a company with innovative technology, a strong management team, and a clear path to profitability. Such attributes are crucial for any company looking to make a significant impact in the AI sector, where competition is fierce and the pace of technological advancement is relentless.

Moreover, Laffont’s shift in focus highlights the importance of adaptability in investment strategies. As the AI industry continues to evolve, staying ahead of trends and recognizing emerging opportunities is essential for sustained success. By moving away from Nvidia, Laffont is demonstrating his willingness to adapt and recalibrate his investment approach in response to changing market dynamics. This flexibility is a hallmark of successful investors who understand that the ability to pivot is often as important as the initial investment decision itself.

Furthermore, Laffont’s decision may also be influenced by the broader economic environment. With increasing concerns about market volatility and potential economic downturns, investors are becoming more cautious about overvalued stocks. In this context, identifying a bargain AI stock could provide a more secure investment avenue, offering both growth potential and a buffer against market fluctuations.

In conclusion, Philippe Laffont’s strategic shift from Nvidia to a lesser-known AI stock underscores his visionary approach to investing in the technology sector. By focusing on uncovering hidden gems, Laffont continues to demonstrate his prowess in navigating the complexities of the AI industry. His ability to identify undervalued opportunities, coupled with his willingness to adapt to changing market conditions, reaffirms his status as a leading figure in the world of hedge fund management. As the AI sector continues to expand, Laffont’s investment decisions will undoubtedly be closely watched by those seeking to emulate his success.

Lessons from Philippe Laffont: Navigating the AI Investment Landscape

Philippe Laffont, a prominent figure in the investment world and the founder of Coatue Management, has long been recognized for his astute ability to identify and capitalize on emerging technological trends. His recent shift in focus from Nvidia, a titan in the AI industry, to a lesser-known but promising AI stock, offers valuable insights into navigating the complex landscape of AI investments. This strategic pivot underscores the importance of adaptability and foresight in the ever-evolving world of technology.

Nvidia has been a dominant force in the AI sector, renowned for its cutting-edge graphics processing units (GPUs) that power a wide array of AI applications. Its stock has been a favorite among investors, driven by the company’s consistent innovation and robust market position. However, Laffont’s decision to reduce his stake in Nvidia and redirect his attention to a more undervalued AI stock highlights a critical lesson for investors: the necessity of looking beyond established giants to uncover hidden opportunities.

The AI industry is characterized by rapid advancements and a dynamic competitive landscape. While established companies like Nvidia offer stability and proven track records, they may not always present the most lucrative opportunities for growth. Laffont’s move suggests that even in a sector dominated by a few key players, there are emerging companies with the potential to disrupt the market and deliver substantial returns. This approach requires a keen understanding of industry trends and the ability to identify companies that possess unique technological advantages or innovative business models.

Moreover, Laffont’s strategy emphasizes the importance of valuation in investment decisions. As Nvidia’s stock price soared, driven by high demand and investor enthusiasm, its valuation became increasingly stretched. In contrast, the AI stock that Laffont has turned his attention to is perceived as a bargain, offering a more attractive risk-reward profile. This shift underscores the significance of assessing a company’s intrinsic value and growth potential, rather than being swayed solely by market sentiment.

In addition to valuation, Laffont’s investment philosophy highlights the importance of diversification. By reallocating resources from a well-established company to a lesser-known entity, he demonstrates a willingness to balance risk and reward. This approach not only mitigates the potential downside of overexposure to a single stock but also positions investors to capitalize on the growth of emerging players in the AI space. Diversification, therefore, emerges as a crucial strategy for navigating the uncertainties inherent in the technology sector.

Furthermore, Laffont’s actions serve as a reminder of the importance of continuous learning and adaptation in investment strategies. The AI landscape is constantly evolving, with new technologies and applications emerging at a rapid pace. Investors must remain vigilant, continuously updating their knowledge and reassessing their portfolios to ensure alignment with the latest industry developments. Laffont’s ability to pivot his focus exemplifies the need for flexibility and a forward-thinking mindset in the face of technological change.

In conclusion, Philippe Laffont’s shift from Nvidia to a bargain AI stock offers several valuable lessons for investors seeking to navigate the AI investment landscape. By emphasizing the importance of looking beyond established giants, focusing on valuation, diversifying portfolios, and maintaining a commitment to continuous learning, Laffont provides a blueprint for success in this dynamic and rapidly evolving sector. As the AI industry continues to grow and transform, these principles will remain essential for investors aiming to capitalize on the opportunities it presents.

Q&A

1. **Who is Philippe Laffont?**

Philippe Laffont is the founder of Coatue Management, a prominent technology-focused hedge fund.

2. **What was Laffont’s previous focus in AI investments?**

Laffont previously focused on investing in Nvidia, a leading company in AI hardware and software.

3. **Why is Laffont shifting focus from Nvidia?**

Laffont is shifting focus due to Nvidia’s high valuation, seeking more affordable opportunities in the AI sector.

4. **What is the new AI stock Laffont is focusing on?**

The specific AI stock Laffont is shifting focus to has not been disclosed in the provided information.

5. **What criteria is Laffont using to select the new AI stock?**

Laffont is looking for a “bargain” AI stock, indicating a focus on undervalued or reasonably priced companies with growth potential.

6. **How does Laffont’s investment strategy impact the market?**

As a significant player in the tech investment space, Laffont’s shifts can influence market trends and investor sentiment towards specific stocks.

7. **What is the potential benefit of investing in a bargain AI stock?**

Investing in a bargain AI stock can offer substantial returns if the company grows and the market recognizes its value, especially in a rapidly expanding sector like AI.

Conclusion

Philippe Laffont, known for his strategic investment acumen, has shifted his focus from Nvidia, a leading player in the AI and semiconductor industry, to a more undervalued AI stock. This move suggests a strategic pivot towards identifying and capitalizing on emerging opportunities within the AI sector that may offer greater growth potential or value. By investing in a bargain AI stock, Laffont is likely aiming to leverage his expertise in identifying companies with strong fundamentals and innovative capabilities that are currently underappreciated by the market. This decision underscores the dynamic nature of investment strategies in the rapidly evolving AI landscape, where identifying the next wave of technological advancement and market leaders can yield significant returns.