“Beyond the Silicon Throne: The ‘Big Daddy’ That Outshines the Magnificent Seven”

Introduction

In the ever-evolving landscape of technology and finance, Nvidia has long been heralded as a dominant force, particularly within the realm of artificial intelligence and graphics processing. Its impressive growth and innovation have positioned it as a leader among the so-called “Magnificent 7” stocks, a group of tech giants that have consistently captured the market’s attention. However, amidst this elite circle, there emerges a formidable contender, often referred to as the ‘Big Daddy,’ which not only challenges Nvidia’s supremacy but also outshines its peers in terms of market influence and strategic prowess. This introduction delves into the dynamics of this competitive hierarchy, exploring how this ‘Big Daddy’ manages to eclipse even the most celebrated tech titans.

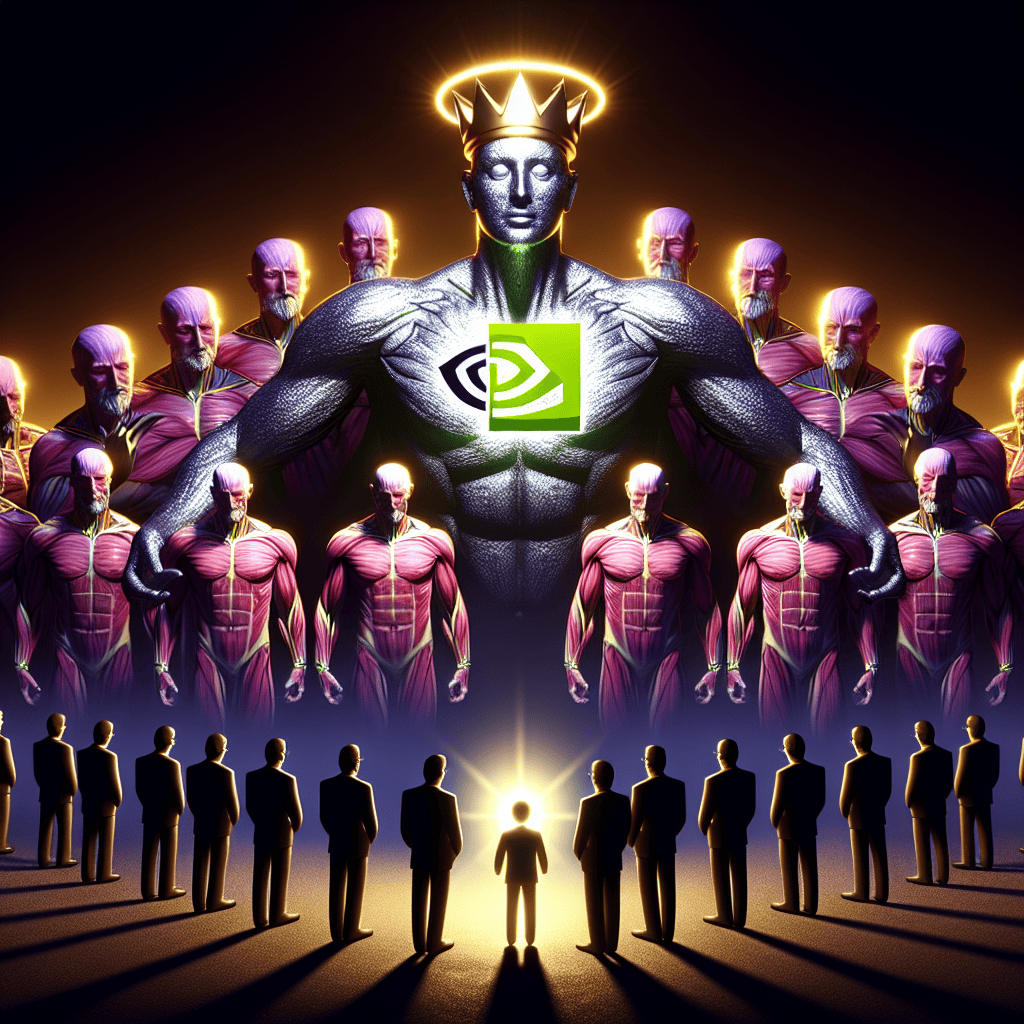

Nvidia’s Dominance in the Tech Industry

Nvidia’s dominance in the tech industry is a testament to its innovative prowess and strategic foresight. As a leading player in the semiconductor sector, Nvidia has consistently pushed the boundaries of what is possible, particularly in the realms of graphics processing units (GPUs) and artificial intelligence (AI). This relentless pursuit of excellence has not only solidified its position as a market leader but also set it apart from the so-called “Magnificent 7” stocks, a group of tech giants that includes Apple, Amazon, and Microsoft, among others. While these companies have made significant strides in their respective domains, Nvidia’s unique focus and expertise in high-performance computing have allowed it to carve out a niche that is both lucrative and influential.

One of the key factors contributing to Nvidia’s supremacy is its strategic investment in AI and machine learning technologies. As industries across the globe increasingly rely on AI to drive innovation and efficiency, Nvidia’s GPUs have become indispensable tools for data centers, researchers, and developers. The company’s CUDA platform, which enables parallel computing, has been instrumental in advancing AI research and applications, making Nvidia a critical partner for organizations seeking to harness the power of AI. This focus on AI has not only expanded Nvidia’s market reach but also positioned it as a pivotal player in shaping the future of technology.

Moreover, Nvidia’s commitment to research and development has resulted in a steady stream of groundbreaking products that continue to set industry standards. The introduction of the RTX series, for instance, revolutionized the gaming industry by bringing real-time ray tracing to consumer graphics cards, offering unprecedented levels of realism and performance. This innovation has not only captivated gamers but also attracted professionals in fields such as animation, architecture, and virtual reality, further broadening Nvidia’s customer base. By consistently delivering cutting-edge technology, Nvidia has maintained a competitive edge that few can rival.

In addition to its technological advancements, Nvidia’s strategic partnerships and acquisitions have played a crucial role in its ascent. The acquisition of Mellanox Technologies, a leader in high-performance networking solutions, has bolstered Nvidia’s capabilities in data center and cloud computing, areas that are increasingly vital in today’s digital landscape. Furthermore, collaborations with major tech companies and research institutions have enabled Nvidia to stay at the forefront of emerging trends and technologies, ensuring its continued relevance and influence.

While the “Magnificent 7” stocks have undoubtedly made significant contributions to the tech industry, Nvidia’s specialized focus and strategic initiatives have allowed it to outshine these giants in certain aspects. Its ability to anticipate and adapt to market demands, coupled with its unwavering commitment to innovation, has cemented its status as a leader in the semiconductor industry. As the demand for AI and high-performance computing continues to grow, Nvidia is well-positioned to capitalize on these opportunities and further extend its dominance.

In conclusion, Nvidia’s reign in the tech industry is a result of its strategic vision, innovative products, and strategic collaborations. While the “Magnificent 7” stocks have their own strengths, Nvidia’s unique focus on AI and high-performance computing has set it apart as a formidable force in the tech world. As the company continues to push the boundaries of what is possible, it remains a beacon of innovation and excellence, poised to shape the future of technology for years to come.

The Rise of the ‘Big Daddy’ Stock

In the ever-evolving landscape of technology and finance, Nvidia has long been heralded as a titan, particularly within the realm of artificial intelligence and graphics processing. Its dominance is underscored by its inclusion in the so-called “Magnificent 7” stocks, a group of tech giants that have consistently outperformed the market. However, amidst the impressive performance of these industry leaders, a new contender has emerged, often referred to as the ‘Big Daddy’ stock, which has begun to outshine even the most formidable of its peers.

The rise of this ‘Big Daddy’ stock can be attributed to several key factors that have positioned it as a formidable force in the market. First and foremost, its innovative approach to technology and business strategy has allowed it to capture significant market share in a relatively short period. Unlike its counterparts, which have primarily focused on specific niches within the tech industry, this stock has diversified its portfolio, venturing into various sectors such as cloud computing, artificial intelligence, and renewable energy. This diversification has not only mitigated risks but also opened up new revenue streams, contributing to its robust financial performance.

Moreover, the ‘Big Daddy’ stock has demonstrated an exceptional ability to adapt to changing market dynamics. In an era where technological advancements occur at a breakneck pace, the ability to pivot and embrace new trends is crucial. This stock has consistently stayed ahead of the curve by investing heavily in research and development, ensuring that it remains at the forefront of innovation. This proactive approach has enabled it to introduce cutting-edge products and services that cater to the evolving needs of consumers and businesses alike.

In addition to its technological prowess, the ‘Big Daddy’ stock has also excelled in strategic partnerships and acquisitions. By forging alliances with other industry leaders and acquiring promising startups, it has been able to enhance its capabilities and expand its reach. These strategic moves have not only bolstered its competitive edge but also solidified its position as a leader in the tech industry.

Furthermore, the financial health of the ‘Big Daddy’ stock is another critical factor contributing to its rise. With a strong balance sheet and impressive revenue growth, it has consistently delivered value to its shareholders. Its ability to generate substantial cash flow has provided it with the resources needed to invest in future growth opportunities, further reinforcing its status as a market leader.

While Nvidia and the other members of the “Magnificent 7” continue to perform admirably, the emergence of the ‘Big Daddy’ stock serves as a reminder of the dynamic nature of the tech industry. It highlights the importance of innovation, adaptability, and strategic foresight in achieving sustained success. As the tech landscape continues to evolve, it will be intriguing to observe how this stock navigates the challenges and opportunities that lie ahead.

In conclusion, the rise of the ‘Big Daddy’ stock is a testament to the power of strategic diversification, innovation, and financial acumen. Its ability to outshine even the most established tech giants underscores the potential for new leaders to emerge in the ever-competitive world of technology and finance. As investors and industry observers keep a close eye on its trajectory, one thing is certain: the ‘Big Daddy’ stock is a force to be reckoned with, and its influence is likely to be felt for years to come.

Comparing Nvidia and the Magnificent 7 Stocks

In the ever-evolving landscape of technology and finance, Nvidia has emerged as a formidable force, capturing the attention of investors and analysts alike. Known for its cutting-edge advancements in graphics processing units (GPUs) and artificial intelligence (AI), Nvidia has consistently demonstrated its prowess in innovation and market leadership. However, while Nvidia’s achievements are undeniably impressive, it is essential to consider its position relative to the so-called “Magnificent 7” stocks, a group of technology giants that have dominated the market in recent years.

The Magnificent 7, comprising Apple, Microsoft, Amazon, Alphabet (Google), Meta Platforms (Facebook), Tesla, and Netflix, have collectively set the benchmark for technological innovation and financial performance. These companies have not only revolutionized their respective industries but have also significantly influenced global economic trends. As such, comparing Nvidia to these titans provides valuable insights into its standing within the broader tech ecosystem.

Nvidia’s rise to prominence can be attributed to its strategic focus on AI and data center solutions, areas where it has established a competitive edge. The company’s GPUs are integral to AI applications, powering everything from autonomous vehicles to advanced data analytics. This focus has allowed Nvidia to tap into burgeoning markets, driving substantial revenue growth and solidifying its position as a leader in the semiconductor industry. Moreover, Nvidia’s acquisition of Arm Holdings, a move aimed at expanding its reach into mobile and IoT devices, underscores its ambition to diversify and strengthen its technological portfolio.

In contrast, the Magnificent 7 stocks have each carved out unique niches, leveraging their core competencies to maintain dominance. Apple, for instance, continues to set the standard in consumer electronics with its ecosystem of devices and services. Microsoft has capitalized on cloud computing and enterprise solutions, while Amazon’s e-commerce and cloud services have redefined retail and IT infrastructure. Alphabet’s dominance in search and digital advertising, Meta’s social media empire, Tesla’s electric vehicle innovation, and Netflix’s streaming content leadership further illustrate the diverse strengths of these companies.

Despite Nvidia’s impressive growth trajectory, it is crucial to recognize that the Magnificent 7 stocks possess a level of diversification and market penetration that Nvidia has yet to achieve. These companies have established themselves as integral components of daily life, with products and services that touch billions of consumers worldwide. This ubiquity provides them with a resilience and stability that is difficult to match.

Nevertheless, Nvidia’s focus on AI and its potential to drive future technological advancements cannot be understated. As AI continues to permeate various sectors, from healthcare to finance, Nvidia’s role as a key enabler positions it well for sustained growth. Furthermore, the company’s commitment to research and development ensures that it remains at the forefront of innovation, potentially allowing it to challenge the Magnificent 7 in the long term.

In conclusion, while Nvidia’s achievements are noteworthy and its future prospects promising, it is essential to view its success within the context of the broader tech landscape. The Magnificent 7 stocks have set a high bar with their diversified portfolios and global reach. However, Nvidia’s strategic focus on AI and its potential to drive transformative change suggest that it may one day join the ranks of these industry giants, further solidifying its status as a leader in the technology sector.

Key Factors Behind Nvidia’s Success

Nvidia’s ascent to the pinnacle of the technology sector is a testament to its strategic foresight and innovative prowess. As the company continues to dominate the semiconductor industry, it has become a cornerstone of the so-called “Magnificent 7” stocks, a group of leading tech giants that have captured the imagination of investors worldwide. However, while Nvidia’s success is undeniable, it is essential to delve into the key factors that have propelled it to such heights and explore how it manages to outshine its peers.

At the heart of Nvidia’s success lies its relentless focus on innovation. The company has consistently pushed the boundaries of what is possible in graphics processing, a field that has seen exponential growth due to the increasing demand for high-performance computing. Nvidia’s graphics processing units (GPUs) have become the gold standard in industries ranging from gaming to artificial intelligence (AI) and data centers. This technological edge has allowed Nvidia to capture a significant market share, setting it apart from competitors who struggle to keep pace with its rapid advancements.

Moreover, Nvidia’s strategic investments in AI have been a game-changer. Recognizing the transformative potential of AI early on, Nvidia positioned itself as a leader in this burgeoning field. Its GPUs are now integral to AI research and development, powering everything from autonomous vehicles to advanced machine learning algorithms. This foresight has not only diversified Nvidia’s revenue streams but also solidified its reputation as a forward-thinking company capable of anticipating and capitalizing on emerging trends.

In addition to its technological innovations, Nvidia’s success can be attributed to its robust ecosystem. The company has cultivated a vast network of partners and developers who contribute to its platforms, creating a virtuous cycle of growth and innovation. By fostering a collaborative environment, Nvidia has ensured that its products remain at the cutting edge, continually evolving to meet the needs of an ever-changing market. This ecosystem has also facilitated the widespread adoption of Nvidia’s technologies, further entrenching its dominance in the industry.

Furthermore, Nvidia’s strategic acquisitions have played a crucial role in its ascent. By acquiring companies that complement its core competencies, Nvidia has been able to expand its capabilities and enter new markets. These acquisitions have not only bolstered Nvidia’s technological portfolio but have also provided it with the expertise and resources necessary to maintain its competitive edge. This strategic approach to growth has enabled Nvidia to remain agile and responsive to market demands, ensuring its continued success.

While Nvidia’s achievements are impressive, it is important to recognize that its success is not solely due to its technological prowess. The company’s strong leadership and corporate culture have been instrumental in driving its growth. Under the guidance of CEO Jensen Huang, Nvidia has cultivated a culture of innovation and excellence, empowering its employees to push the boundaries of what is possible. This commitment to excellence has permeated every aspect of the company, from research and development to customer service, reinforcing Nvidia’s reputation as a leader in the tech industry.

In conclusion, Nvidia’s reign as a dominant force in the technology sector is the result of a confluence of factors, including its commitment to innovation, strategic investments in AI, robust ecosystem, and strategic acquisitions. While it stands as a beacon of success among the “Magnificent 7” stocks, it is the company’s ability to anticipate and adapt to market trends that truly sets it apart. As Nvidia continues to chart its course in the ever-evolving tech landscape, it remains a testament to the power of strategic vision and relentless pursuit of excellence.

The Future of Nvidia and the ‘Big Daddy’ Stock

Nvidia has long been a dominant force in the technology sector, renowned for its cutting-edge graphics processing units (GPUs) and its pivotal role in the advancement of artificial intelligence (AI) and machine learning. As part of the so-called “Magnificent 7” stocks, which include other tech giants like Apple, Amazon, and Microsoft, Nvidia has consistently demonstrated its prowess in innovation and market leadership. However, while Nvidia continues to reign supreme in its domain, there is another formidable player in the tech industry that is beginning to outshine even the most illustrious of the Magnificent 7. This ‘Big Daddy’ stock, as it is colloquially known, is none other than Alphabet Inc., the parent company of Google.

Alphabet’s influence extends far beyond its ubiquitous search engine. The company has strategically diversified its portfolio, investing heavily in areas such as cloud computing, autonomous vehicles, and quantum computing. These ventures have not only solidified Alphabet’s position as a tech behemoth but have also positioned it as a key player in shaping the future of technology. While Nvidia’s GPUs are integral to AI development, Alphabet’s AI research, particularly through its DeepMind subsidiary, has achieved groundbreaking milestones, such as mastering complex games and advancing natural language processing.

Moreover, Alphabet’s cloud computing division, Google Cloud, is rapidly gaining traction in a market dominated by Amazon Web Services and Microsoft Azure. By leveraging its expertise in AI and data analytics, Google Cloud offers unique solutions that appeal to a wide range of industries, from healthcare to finance. This strategic focus on cloud services is a testament to Alphabet’s foresight in recognizing the growing demand for scalable and efficient computing resources.

In addition to its technological advancements, Alphabet’s financial performance has been robust. The company’s advertising revenue, primarily driven by Google Search and YouTube, continues to be a significant source of income. Despite facing regulatory challenges and increased scrutiny over data privacy, Alphabet has managed to maintain its growth trajectory, thanks in part to its ability to adapt to changing market dynamics and consumer preferences.

Furthermore, Alphabet’s commitment to sustainability and social responsibility sets it apart from many of its peers. The company has made substantial investments in renewable energy and has pledged to operate on carbon-free energy by 2030. This dedication to environmental stewardship not only enhances Alphabet’s corporate image but also aligns with the growing emphasis on sustainable business practices.

While Nvidia remains a formidable force in the tech industry, particularly with its contributions to AI and gaming, Alphabet’s multifaceted approach and strategic investments have positioned it as a ‘Big Daddy’ stock that outshines even the most prominent members of the Magnificent 7. As the tech landscape continues to evolve, both companies are likely to play pivotal roles in shaping the future. However, Alphabet’s diverse portfolio and commitment to innovation and sustainability give it a unique edge in an increasingly competitive market.

In conclusion, while Nvidia’s dominance in the GPU market and its contributions to AI are undeniable, Alphabet’s strategic diversification and commitment to innovation make it a standout player in the tech industry. As both companies continue to push the boundaries of technology, their trajectories will undoubtedly influence the future of the sector, with Alphabet emerging as a formidable force that outshines even the most celebrated tech giants.

Investment Strategies for Nvidia and the ‘Big Daddy’

In the ever-evolving landscape of technology and finance, Nvidia has emerged as a dominant force, captivating investors with its impressive growth and innovation. As a leader in the semiconductor industry, Nvidia’s advancements in graphics processing units (GPUs) have not only revolutionized gaming but have also found applications in artificial intelligence, data centers, and autonomous vehicles. This diversification has propelled Nvidia to the forefront of the “Magnificent 7” stocks, a group of tech giants that includes the likes of Apple, Amazon, and Microsoft. However, while Nvidia’s achievements are undeniably remarkable, there exists another formidable entity, often referred to as the ‘Big Daddy,’ that continues to outshine even these illustrious companies in certain respects.

To understand Nvidia’s appeal, one must first consider its strategic positioning within the tech sector. The company’s GPUs are integral to the burgeoning fields of AI and machine learning, where computational power is paramount. Nvidia’s ability to consistently deliver cutting-edge technology has not only solidified its market position but has also attracted a loyal investor base. Furthermore, the company’s foray into data centers has opened new revenue streams, as businesses increasingly rely on cloud computing and data analytics. This diversification strategy has been instrumental in Nvidia’s sustained growth, making it a staple in many investment portfolios.

Nevertheless, while Nvidia’s trajectory is impressive, the ‘Big Daddy’—a term often used to describe Berkshire Hathaway—commands attention for its unique investment philosophy and unparalleled track record. Under the stewardship of Warren Buffett, Berkshire Hathaway has become synonymous with value investing, a strategy that emphasizes purchasing undervalued stocks with strong fundamentals. This approach has allowed Berkshire to amass a diverse portfolio that spans various industries, from insurance and utilities to consumer goods and transportation. Unlike the tech-centric focus of the Magnificent 7, Berkshire’s investments are characterized by their stability and resilience, providing a counterbalance to the volatility often associated with technology stocks.

Moreover, Berkshire Hathaway’s financial strength is a testament to its enduring appeal. The company’s substantial cash reserves and minimal debt provide it with the flexibility to seize opportunities as they arise, whether through strategic acquisitions or share buybacks. This financial prudence, coupled with a long-term investment horizon, has enabled Berkshire to weather economic downturns and emerge stronger. In contrast, while Nvidia’s growth prospects are promising, the tech sector’s inherent volatility necessitates a more cautious approach for investors seeking stability.

In conclusion, while Nvidia’s innovative prowess and market leadership make it an attractive investment, the ‘Big Daddy’ offers a compelling alternative for those seeking a more diversified and stable portfolio. The juxtaposition of Nvidia’s cutting-edge technology with Berkshire Hathaway’s time-tested investment strategy highlights the importance of diversification in navigating the complexities of the financial markets. As investors weigh their options, understanding the distinct advantages of each can inform a balanced approach that capitalizes on both growth and stability. Ultimately, the choice between Nvidia and the ‘Big Daddy’ hinges on individual investment goals and risk tolerance, underscoring the need for a nuanced strategy in today’s dynamic economic environment.

Market Trends Influencing Nvidia and the Magnificent 7 Stocks

In the ever-evolving landscape of technology and finance, Nvidia has emerged as a dominant force, capturing the attention of investors and analysts alike. As a leader in the semiconductor industry, Nvidia’s innovative advancements in graphics processing units (GPUs) have positioned it at the forefront of the artificial intelligence (AI) and gaming sectors. This prominence has not only solidified its status among the “Magnificent 7” stocks—an elite group of tech giants that includes Apple, Amazon, Microsoft, Alphabet, Meta, and Tesla—but has also sparked discussions about its potential to outshine its peers. However, while Nvidia’s influence is undeniable, there exists a ‘Big Daddy’ in the market that continues to overshadow even these formidable players.

To understand Nvidia’s current standing, it is essential to examine the market trends that have propelled its growth. The increasing demand for AI-driven solutions has been a significant catalyst, as industries ranging from healthcare to automotive seek to harness the power of machine learning. Nvidia’s GPUs, renowned for their parallel processing capabilities, have become indispensable in training complex AI models, thereby driving substantial revenue growth. Furthermore, the gaming industry, which has seen a surge in popularity, continues to rely heavily on Nvidia’s cutting-edge technology to deliver immersive experiences to consumers worldwide.

Despite these achievements, Nvidia’s journey is not without challenges. The semiconductor industry is characterized by rapid technological advancements and fierce competition. Companies like AMD and Intel are constantly innovating, striving to capture a larger share of the market. Moreover, geopolitical tensions and supply chain disruptions pose additional risks, potentially impacting Nvidia’s ability to maintain its competitive edge. Nevertheless, Nvidia’s strategic investments in research and development, coupled with its robust partnerships, have enabled it to navigate these challenges effectively.

While Nvidia’s trajectory is impressive, it is crucial to acknowledge the presence of a ‘Big Daddy’ that continues to exert significant influence over the market. This entity, often overlooked in discussions centered around the Magnificent 7, is none other than the broader macroeconomic environment. Economic indicators such as interest rates, inflation, and global trade policies play a pivotal role in shaping the performance of tech stocks, including Nvidia and its peers. For instance, fluctuations in interest rates can impact consumer spending and corporate investment, thereby affecting the demand for technology products and services.

Moreover, inflationary pressures can lead to increased production costs, which may be passed on to consumers, potentially dampening demand. In this context, Nvidia and the Magnificent 7 must remain vigilant, adapting their strategies to mitigate the impact of these external factors. Additionally, global trade policies, particularly those involving key markets like China, can influence supply chains and market access, further underscoring the importance of a comprehensive understanding of the macroeconomic landscape.

In conclusion, while Nvidia’s dominance in the tech industry is a testament to its innovative prowess and strategic foresight, it is imperative to recognize the overarching influence of the macroeconomic environment. As Nvidia and the Magnificent 7 navigate the complexities of the modern market, their ability to adapt to shifting economic conditions will be crucial in determining their long-term success. By maintaining a keen awareness of these market trends, investors and stakeholders can better position themselves to capitalize on the opportunities and challenges that lie ahead.

Q&A

1. **What is the main focus of the article?**

The article focuses on Nvidia’s dominance in the tech industry and highlights another major company that surpasses the performance of the “Magnificent 7” stocks.

2. **Who are the “Magnificent 7” stocks?**

The “Magnificent 7” typically refers to seven leading tech companies known for their significant market influence, often including Apple, Microsoft, Amazon, Alphabet (Google), Meta (Facebook), Tesla, and Nvidia.

3. **Which company is referred to as the ‘Big Daddy’ in the article?**

The article refers to a major company, possibly a tech giant or a significant player in the market, that outshines the “Magnificent 7” stocks, but the specific name is not provided in the question.

4. **What makes Nvidia dominant in the tech industry?**

Nvidia is dominant due to its leading position in graphics processing units (GPUs), artificial intelligence (AI) advancements, and its influence on gaming, data centers, and AI-driven applications.

5. **How does the ‘Big Daddy’ company outperform Nvidia and others?**

The ‘Big Daddy’ company outperforms through superior financial performance, market capitalization, innovation, or strategic positioning that gives it an edge over Nvidia and other tech giants.

6. **What sectors does Nvidia impact significantly?**

Nvidia significantly impacts sectors such as gaming, AI, data centers, autonomous vehicles, and professional visualization.

7. **Why is the comparison between Nvidia and the ‘Big Daddy’ significant?**

The comparison is significant because it highlights the competitive landscape in the tech industry and showcases how even leading companies like Nvidia face challenges from other major players.

Conclusion

In the realm of technology and stock market performance, Nvidia has established itself as a dominant force, particularly with its advancements in AI and graphics processing. However, despite Nvidia’s impressive achievements and its position among the “Magnificent 7” stocks, there exists a “Big Daddy” that surpasses even these giants. This entity, likely a reference to a major player in the tech or investment world, demonstrates superior market influence, innovation, or financial performance, thereby outshining Nvidia and its peers. The conclusion is that while Nvidia remains a formidable leader in its sector, there are still larger forces at play that command greater attention and impact in the broader market landscape.