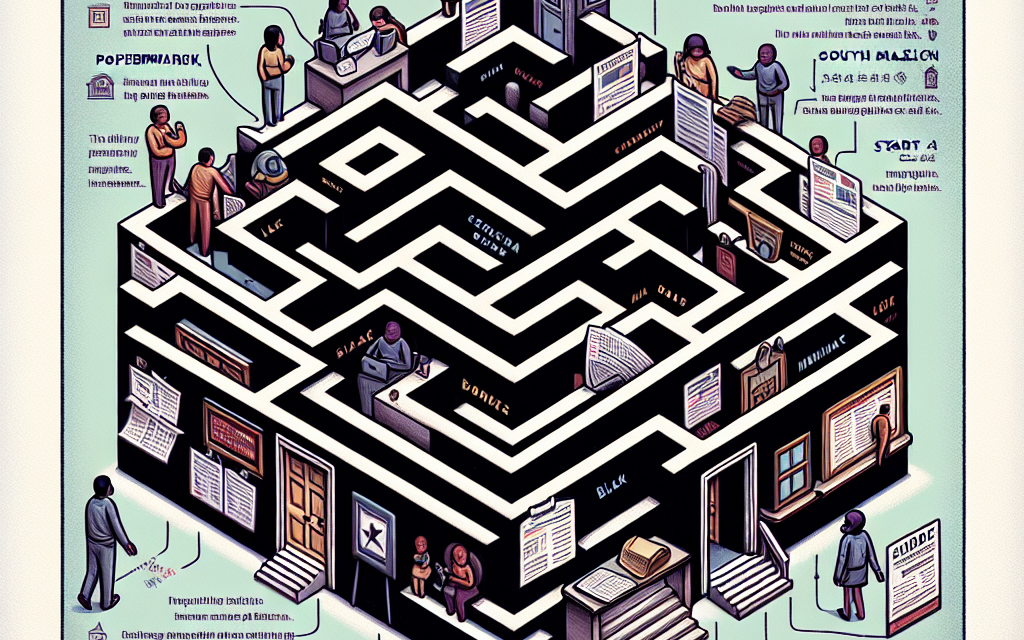

“Unlocking Homeownership: Your Guide to Navigating Home Loans for Undocumented Immigrants in the U.S.”

Introduction

Navigating home loans in the U.S. can be particularly challenging for undocumented immigrants, who often face unique barriers in the housing market. Despite the complexities of their legal status, many undocumented individuals seek to achieve the American dream of homeownership. Understanding the available options, such as alternative lending practices, community resources, and specific state regulations, is crucial for these individuals. This introduction aims to shed light on the pathways and challenges undocumented immigrants encounter when pursuing home loans, highlighting the importance of financial literacy and access to supportive networks in overcoming obstacles to homeownership.

Understanding Home Loan Options for Undocumented Immigrants

Navigating the complex landscape of home loans in the United States can be particularly challenging for undocumented immigrants. Despite the barriers they face, there are options available that can facilitate homeownership. Understanding these options is crucial for undocumented immigrants who aspire to secure a stable living environment for themselves and their families.

First and foremost, it is essential to recognize that traditional lenders often require a Social Security number, which many undocumented immigrants do not possess. However, some financial institutions have begun to adapt their policies to accommodate this demographic. For instance, certain lenders accept Individual Taxpayer Identification Numbers (ITINs) as a valid form of identification. An ITIN allows undocumented immigrants to file taxes and can serve as a means to establish a credit history, which is a critical component in the home loan application process. By utilizing an ITIN, undocumented immigrants can access mortgage products specifically designed for them, thereby broadening their options.

Moreover, it is important to consider the types of loans available. While conventional loans may be out of reach for many undocumented immigrants, alternative financing options exist. For example, some credit unions and community banks offer specialized loan programs that cater to individuals without traditional documentation. These institutions often have a more flexible approach to underwriting, allowing them to assess an applicant’s financial situation holistically rather than relying solely on conventional credit scores. This flexibility can be particularly beneficial for undocumented immigrants who may have a stable income but lack a traditional credit history.

In addition to exploring alternative lenders, undocumented immigrants should also be aware of the importance of building a strong financial profile. This can be achieved by maintaining a consistent income, saving for a down payment, and managing expenses wisely. By demonstrating financial responsibility, undocumented immigrants can improve their chances of securing a home loan. Furthermore, establishing a relationship with a lender who understands the unique challenges faced by undocumented immigrants can provide valuable guidance throughout the loan application process.

Another critical aspect to consider is the role of co-signers. In some cases, undocumented immigrants may have family members or friends who are U.S. citizens or legal residents willing to co-sign the loan. A co-signer can enhance the application by providing additional financial security to the lender, thereby increasing the likelihood of loan approval. However, it is essential for both parties to understand the implications of co-signing, as the co-signer assumes responsibility for the loan if the primary borrower defaults.

Additionally, seeking assistance from non-profit organizations and housing counseling services can be invaluable. These organizations often provide resources and support tailored to the needs of undocumented immigrants, including financial education, homebuyer workshops, and access to legal advice. By leveraging these resources, individuals can gain a better understanding of their rights and responsibilities as potential homeowners.

In conclusion, while navigating home loans in the U.S. presents unique challenges for undocumented immigrants, various options and resources are available to facilitate the process. By utilizing ITINs, exploring alternative lenders, building a strong financial profile, considering co-signers, and seeking assistance from non-profit organizations, undocumented immigrants can take significant steps toward achieving their dream of homeownership. With determination and the right support, the path to securing a home can become a reality, fostering stability and community for those who have long sought a place to call their own.

The Role of Credit History in Securing a Home Loan

Navigating the complexities of securing a home loan can be particularly challenging for undocumented immigrants in the United States, especially when it comes to the role of credit history. Credit history serves as a critical factor in determining an individual’s eligibility for a mortgage, influencing both the approval process and the terms of the loan. For many undocumented immigrants, the absence of a traditional credit history can pose significant barriers, yet understanding how to navigate this landscape can open doors to homeownership.

To begin with, it is essential to recognize that lenders typically rely on credit scores to assess the risk associated with lending money. A strong credit score indicates a history of responsible borrowing and repayment, which can lead to more favorable loan terms, such as lower interest rates and reduced down payment requirements. Conversely, a lack of credit history or a low credit score can result in higher interest rates or even denial of the loan application. This situation is particularly pertinent for undocumented immigrants, many of whom may not have established a credit history due to their immigration status.

However, there are alternative pathways for undocumented immigrants to build or demonstrate creditworthiness. One effective strategy is to utilize non-traditional credit sources. These can include payment histories for rent, utilities, and other recurring bills. By compiling evidence of timely payments, undocumented immigrants can present a more comprehensive picture of their financial responsibility to potential lenders. Some lenders are beginning to recognize these alternative credit histories, which can help bridge the gap for those who lack traditional credit scores.

Moreover, it is important to note that some financial institutions have begun to offer specialized loan programs tailored to the needs of undocumented immigrants. These programs often take into account non-traditional credit histories and may not require a Social Security number, making them more accessible to individuals without formal documentation. As a result, undocumented immigrants can explore these options to find lenders who are willing to consider their unique circumstances.

In addition to seeking out lenders who are open to non-traditional credit assessments, undocumented immigrants can also take proactive steps to improve their credit profiles. For instance, obtaining a secured credit card can be an effective way to establish a credit history. By making small purchases and paying off the balance in full each month, individuals can gradually build their credit scores. This process not only enhances their creditworthiness but also demonstrates financial responsibility, which is crucial when applying for a home loan.

Furthermore, it is advisable for undocumented immigrants to educate themselves about their rights and the lending process. Understanding the legal landscape surrounding home loans can empower individuals to make informed decisions and advocate for themselves effectively. Engaging with community organizations that specialize in housing and financial education can provide valuable resources and support throughout the home-buying journey.

In conclusion, while the role of credit history in securing a home loan presents unique challenges for undocumented immigrants, it is not an insurmountable obstacle. By leveraging non-traditional credit sources, exploring specialized loan programs, and taking proactive steps to build credit, individuals can enhance their chances of obtaining a mortgage. Ultimately, with determination and the right resources, undocumented immigrants can navigate the complexities of the home loan process and move closer to achieving their dream of homeownership.

Alternative Lenders for Undocumented Borrowers

Navigating the complex landscape of home loans in the United States can be particularly challenging for undocumented immigrants. Traditional lenders often impose stringent requirements that can exclude this demographic from accessing mortgage financing. However, alternative lenders have emerged as a viable option for undocumented borrowers seeking to secure a home loan. These lenders typically adopt more flexible criteria, allowing individuals without legal status to explore homeownership opportunities.

One of the primary advantages of alternative lenders is their willingness to consider non-traditional documentation. While conventional banks may require a Social Security number and a lengthy credit history, alternative lenders often accept an Individual Taxpayer Identification Number (ITIN) as a valid form of identification. This approach not only opens doors for undocumented immigrants but also acknowledges their contributions to the economy through tax payments. By utilizing an ITIN, borrowers can demonstrate their financial responsibility and commitment to fulfilling their obligations, which can enhance their chances of securing a loan.

Moreover, alternative lenders frequently assess a borrower’s overall financial profile rather than relying solely on credit scores. This holistic approach allows them to consider factors such as income stability, employment history, and savings patterns. For many undocumented immigrants, these aspects may present a more accurate picture of their ability to repay a loan. Consequently, individuals who may have been overlooked by traditional lenders can find a more welcoming environment with alternative financing options.

In addition to flexible documentation and assessment criteria, alternative lenders often provide a range of loan products tailored to meet the unique needs of undocumented borrowers. These products may include adjustable-rate mortgages, fixed-rate loans, and even specialized programs designed for first-time homebuyers. By offering diverse options, alternative lenders empower borrowers to choose a loan that aligns with their financial situation and long-term goals. This flexibility is particularly crucial for undocumented immigrants, who may face varying financial circumstances and housing needs.

Furthermore, many alternative lenders prioritize community engagement and support. They often work closely with local organizations that advocate for immigrant rights and provide resources for homeownership education. This collaboration not only fosters trust but also equips borrowers with the knowledge necessary to navigate the home-buying process. By participating in workshops and informational sessions, undocumented immigrants can gain insights into budgeting, mortgage terms, and the responsibilities of homeownership, ultimately leading to more informed decisions.

It is also important to note that while alternative lenders can provide access to financing, borrowers should exercise caution and conduct thorough research. Not all alternative lenders operate with the same level of transparency or ethical standards. Therefore, it is advisable for potential borrowers to seek recommendations, read reviews, and compare terms before committing to a loan. By doing so, undocumented immigrants can safeguard their interests and ensure they are making sound financial choices.

In conclusion, alternative lenders represent a promising avenue for undocumented immigrants seeking home loans in the United States. By embracing flexible documentation requirements, offering diverse loan products, and fostering community support, these lenders create opportunities for individuals who may otherwise be excluded from the housing market. As the landscape of home financing continues to evolve, it is essential for undocumented borrowers to remain informed and proactive in their pursuit of homeownership, ultimately contributing to the rich tapestry of American society.

The Importance of ITINs in Home Financing

Navigating the complexities of home loans in the United States can be particularly challenging for undocumented immigrants, primarily due to the stringent requirements imposed by financial institutions. One crucial element that can significantly ease this process is the Individual Taxpayer Identification Number (ITIN). While many may not be familiar with its importance, understanding the role of ITINs in home financing is essential for undocumented immigrants seeking to secure a mortgage.

An ITIN is a tax processing number issued by the Internal Revenue Service (IRS) to individuals who are not eligible for a Social Security number but need to file taxes. This number serves as a vital tool for undocumented immigrants, allowing them to fulfill their tax obligations and, importantly, establish a financial identity within the U.S. banking system. By obtaining an ITIN, individuals can demonstrate their commitment to contributing to the economy, which can enhance their credibility in the eyes of lenders.

Moreover, having an ITIN opens the door to various financial services, including the possibility of obtaining a mortgage. While traditional lenders may have stringent requirements that often exclude undocumented immigrants, some financial institutions and credit unions have begun to recognize the potential of ITIN holders. These lenders may offer mortgage products specifically designed for individuals with ITINs, thereby providing an avenue for undocumented immigrants to achieve homeownership. This shift in lending practices reflects a growing understanding of the diverse financial needs within the community and the importance of inclusivity in the housing market.

In addition to facilitating access to loans, ITINs can also help undocumented immigrants build a credit history. Establishing a credit profile is crucial for securing favorable loan terms and interest rates. By using their ITIN to open bank accounts, apply for credit cards, and make timely payments, individuals can gradually build a positive credit history. This process not only enhances their chances of obtaining a mortgage but also positions them for better financial opportunities in the future.

Furthermore, it is essential to recognize that the use of ITINs in home financing is not without its challenges. While some lenders are becoming more accommodating, many still adhere to traditional lending practices that may not recognize ITINs as a valid form of identification. Consequently, undocumented immigrants may face obstacles in finding lenders willing to work with them. However, by conducting thorough research and seeking out institutions that specialize in ITIN loans, individuals can identify potential options that align with their financial needs.

In conclusion, the importance of ITINs in home financing for undocumented immigrants cannot be overstated. By providing a means to fulfill tax obligations, establish a financial identity, and build credit, ITINs serve as a critical tool in the pursuit of homeownership. As the landscape of lending continues to evolve, it is imperative for undocumented immigrants to remain informed about their options and advocate for their rights within the housing market. By leveraging the benefits of an ITIN and seeking out supportive financial institutions, individuals can navigate the complexities of home loans and take significant steps toward achieving their dream of owning a home in the United States.

Overcoming Common Challenges in the Home Loan Process

Navigating the home loan process can be particularly challenging for undocumented immigrants in the United States. Despite the barriers they face, many individuals are finding ways to overcome these obstacles and secure financing for their homes. One of the primary challenges is the lack of a Social Security number, which is often a requirement for traditional mortgage applications. However, some lenders are beginning to recognize the potential of undocumented immigrants as viable borrowers and are offering alternative solutions. For instance, certain financial institutions accept Individual Taxpayer Identification Numbers (ITINs) as a substitute for Social Security numbers, allowing undocumented immigrants to apply for loans.

In addition to the issue of identification, undocumented immigrants often encounter difficulties in proving their income. Traditional documentation, such as pay stubs and W-2 forms, may not be readily available. Nevertheless, many lenders are becoming more flexible in their requirements. They may accept bank statements, letters from employers, or other forms of documentation that demonstrate a consistent income stream. This shift in perspective is crucial, as it opens the door for many individuals who have been contributing to the economy but lack conventional proof of income.

Moreover, credit history poses another significant hurdle. Many undocumented immigrants may not have established credit scores, which are typically essential for securing a loan. However, some lenders are willing to consider alternative credit assessments. This can include evaluating payment histories for rent, utilities, and other recurring expenses. By taking a more holistic approach to creditworthiness, lenders can better assess the financial reliability of undocumented borrowers, thereby increasing their chances of obtaining a mortgage.

Furthermore, the fear of deportation can deter many undocumented immigrants from pursuing homeownership. The stigma surrounding their status often leads to a reluctance to engage with financial institutions. To combat this fear, community organizations and advocacy groups are stepping in to provide education and resources. These organizations offer workshops that inform undocumented immigrants about their rights and the home loan process, empowering them to take informed steps toward homeownership. By fostering a supportive environment, these initiatives help to alleviate fears and encourage individuals to explore their options.

In addition to these challenges, the overall economic landscape can impact the ability of undocumented immigrants to secure home loans. Economic downturns or fluctuations in the housing market can make lenders more cautious, leading to stricter lending criteria. However, it is essential to recognize that the demand for housing remains strong, and many lenders are still willing to work with undocumented borrowers. As the market evolves, it is crucial for these individuals to stay informed about changing lending practices and to seek out lenders who are open to working with them.

Ultimately, while the path to homeownership for undocumented immigrants is fraught with challenges, it is not insurmountable. By leveraging alternative identification methods, demonstrating income through various means, and utilizing community resources, many individuals are successfully navigating the home loan process. As awareness grows and more lenders adopt inclusive practices, the landscape for undocumented immigrants seeking home loans is gradually improving. This progress not only benefits individuals and families but also contributes to the broader economy by fostering stability and investment in communities across the nation.

Resources and Support for Undocumented Homebuyers

Navigating the complex landscape of home loans in the United States can be particularly challenging for undocumented immigrants. However, various resources and support systems are available to assist these individuals in their pursuit of homeownership. Understanding these resources is crucial for undocumented homebuyers who wish to secure a stable living environment and invest in their future.

One of the primary resources available to undocumented immigrants is community organizations that specialize in housing assistance. These organizations often provide educational workshops and one-on-one counseling to help potential homebuyers understand the home-buying process. They can offer insights into the specific challenges faced by undocumented individuals, such as the lack of access to traditional mortgage products. By attending these workshops, undocumented immigrants can gain valuable knowledge about alternative financing options, budgeting, and the importance of credit scores, even if they do not have a Social Security number.

In addition to community organizations, some credit unions and banks have begun to recognize the unique needs of undocumented immigrants. These financial institutions may offer loans specifically designed for individuals without traditional documentation. For instance, some lenders accept Individual Taxpayer Identification Numbers (ITINs) as a valid form of identification, allowing undocumented immigrants to apply for mortgages. This shift in lending practices is a significant step toward inclusivity, as it opens doors for many who have been historically marginalized in the housing market.

Moreover, legal assistance is another critical resource for undocumented homebuyers. Various nonprofit organizations provide legal support to help individuals navigate the complexities of immigration and housing laws. These organizations can assist with understanding rights as tenants and homeowners, as well as provide guidance on how to avoid potential pitfalls in the home-buying process. By seeking legal advice, undocumented immigrants can better protect themselves from exploitation and ensure that they are making informed decisions.

Furthermore, networking within immigrant communities can also serve as a valuable resource. Many undocumented individuals find support through local immigrant advocacy groups, which often share information about housing opportunities and financing options. These networks can provide firsthand accounts of successful home-buying experiences, offering practical tips and emotional support. By connecting with others who have faced similar challenges, undocumented homebuyers can build a sense of community and empowerment.

Additionally, it is essential for undocumented immigrants to stay informed about local and state policies that may affect their ability to purchase a home. Some states have enacted laws that provide additional protections and resources for undocumented residents, including access to certain housing programs. By keeping abreast of these developments, potential homebuyers can take advantage of opportunities that may arise, further facilitating their journey toward homeownership.

In conclusion, while the path to homeownership for undocumented immigrants in the U.S. may be fraught with challenges, numerous resources and support systems exist to help navigate this journey. Community organizations, inclusive financial institutions, legal assistance, and strong networks within immigrant communities all play vital roles in empowering undocumented individuals to achieve their homeownership dreams. By leveraging these resources, undocumented homebuyers can overcome barriers and work toward securing a stable and prosperous future for themselves and their families.

Legal Considerations When Applying for a Home Loan

Navigating the complexities of home loans in the United States can be particularly challenging for undocumented immigrants, especially when it comes to understanding the legal considerations involved in the application process. While the landscape of home financing is often perceived as exclusive to citizens and legal residents, there are pathways available for undocumented individuals seeking to secure a mortgage. However, it is crucial to be aware of the legal implications and requirements that accompany this endeavor.

First and foremost, it is essential to recognize that undocumented immigrants do not possess a Social Security number, which is a common requirement for most traditional mortgage applications. Nevertheless, many lenders are beginning to accept Individual Taxpayer Identification Numbers (ITINs) as an alternative. This shift reflects a growing recognition of the contributions that undocumented immigrants make to the economy and the housing market. By utilizing an ITIN, applicants can demonstrate their tax compliance and financial responsibility, which can enhance their eligibility for a home loan.

Moreover, it is important to understand that the legal status of an applicant can influence the type of loan products available. For instance, some lenders may offer specific programs tailored for undocumented immigrants, which may include more flexible underwriting criteria. These programs often require a larger down payment and may come with higher interest rates, but they provide a viable option for those who may not qualify for conventional loans. Therefore, it is advisable for potential borrowers to conduct thorough research and seek out lenders who are known for their willingness to work with undocumented applicants.

In addition to understanding the lending landscape, it is also vital to be aware of the legal documentation required during the application process. While traditional loans typically necessitate a range of financial documents, undocumented immigrants may need to provide alternative forms of verification. This could include proof of income through pay stubs or bank statements, as well as documentation of residency and employment history. By compiling a comprehensive financial profile, applicants can present themselves as responsible borrowers, thereby increasing their chances of loan approval.

Furthermore, it is crucial to consider the implications of homeownership for undocumented immigrants. Owning a home can provide stability and a sense of belonging, but it also comes with responsibilities, such as property taxes and maintenance costs. Therefore, prospective homeowners should carefully evaluate their financial situation and ensure that they are prepared for the long-term commitment that homeownership entails. Consulting with a financial advisor or a housing counselor can provide valuable insights into budgeting and financial planning.

Additionally, it is important to remain informed about the evolving legal landscape surrounding immigration and housing. Policies and regulations can change, impacting the availability of loans for undocumented immigrants. Staying abreast of these developments can help applicants make informed decisions and adapt their strategies accordingly. Engaging with community organizations that advocate for immigrant rights can also provide support and resources throughout the home-buying process.

In conclusion, while navigating home loans in the U.S. as an undocumented immigrant presents unique challenges, understanding the legal considerations involved can empower individuals to pursue their homeownership dreams. By leveraging ITINs, exploring specialized loan programs, and preparing the necessary documentation, undocumented immigrants can enhance their chances of securing a mortgage. Ultimately, with careful planning and informed decision-making, the dream of homeownership can become a reality, fostering stability and community integration.

Q&A

1. **Can undocumented immigrants obtain a home loan in the U.S.?**

Yes, undocumented immigrants can obtain a home loan, but options may be limited and often require alternative documentation.

2. **What types of loans are available to undocumented immigrants?**

Some lenders offer non-QM (Qualified Mortgage) loans, which may not require traditional documentation, and some may accept ITINs (Individual Taxpayer Identification Numbers) instead of Social Security numbers.

3. **Do undocumented immigrants need a down payment?**

Yes, most lenders require a down payment, which can range from 3% to 20% of the home’s purchase price, depending on the loan type.

4. **What documentation is typically required for undocumented immigrants applying for a loan?**

Common documentation includes proof of income (pay stubs, tax returns), ITIN, bank statements, and sometimes a letter from an employer.

5. **Are there specific lenders that cater to undocumented immigrants?**

Yes, some credit unions and community banks are more flexible and may have programs specifically designed for undocumented immigrants.

6. **Can undocumented immigrants qualify for government-backed loans?**

No, government-backed loans like FHA, VA, or USDA typically require a valid Social Security number, which undocumented immigrants do not possess.

7. **What are the risks of obtaining a home loan as an undocumented immigrant?**

Risks include potential legal issues, higher interest rates, and the possibility of limited loan options, which may lead to financial strain if unable to meet repayment terms.

Conclusion

Navigating home loans in the U.S. for undocumented immigrants presents significant challenges due to legal and financial barriers. However, options such as alternative lending institutions, community banks, and credit unions that offer loans without requiring a Social Security number can provide pathways to homeownership. Additionally, building a strong credit history and demonstrating financial stability are crucial steps. Ultimately, while the process is complex, with the right resources and support, undocumented immigrants can find opportunities to secure home loans and achieve their homeownership goals.