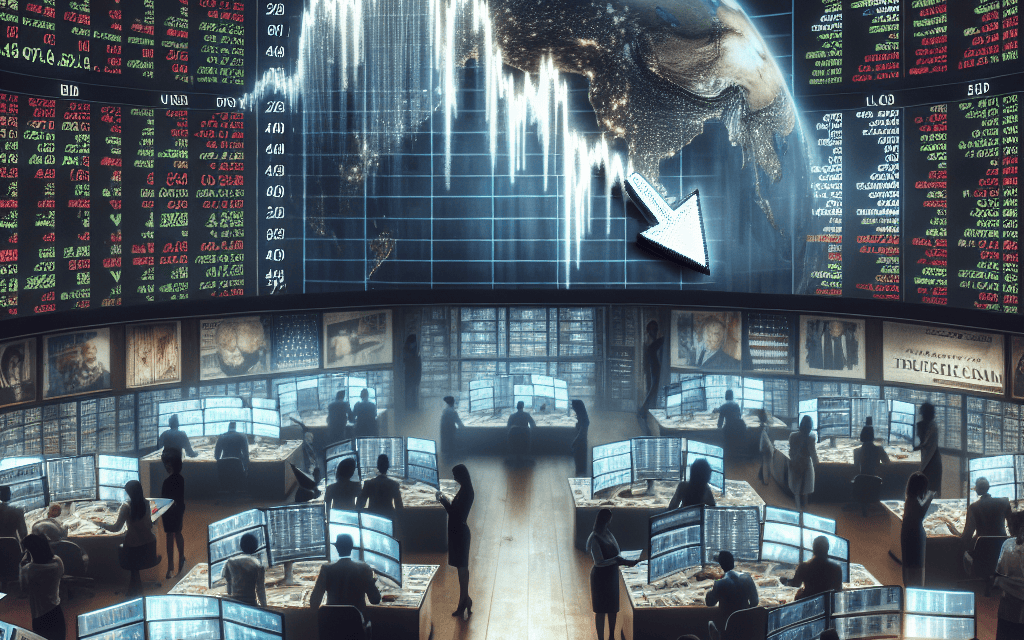

“Anticipation Turns to Tension: Nasdaq Futures Dip Ahead of Earnings Season”

Introduction

Nasdaq futures experienced a decline as investors prepared for the upcoming wave of corporate earnings reports, which are expected to provide crucial insights into the health of various sectors amid ongoing economic uncertainties. This downturn in futures trading reflects market participants’ cautious stance, as they anticipate potential volatility driven by earnings announcements from major technology and growth-oriented companies. The performance of these companies is particularly significant, given their substantial influence on the Nasdaq index. As earnings season unfolds, investors are keenly focused on revenue forecasts, profit margins, and any forward-looking guidance that could impact market sentiment and investment strategies in the near term.

Impact Of Earnings Reports On Nasdaq Futures

Nasdaq futures experienced a noticeable decline as investors and market participants braced themselves for the upcoming wave of earnings reports. This movement in the futures market is a reflection of the broader sentiment and anticipation surrounding the financial performance of major companies listed on the Nasdaq stock exchange. Earnings reports are pivotal in shaping investor expectations and can significantly influence market trends. As these reports are released, they provide insights into a company’s profitability, revenue growth, and overall financial health, which in turn affect stock prices and market indices.

The anticipation of earnings reports often leads to heightened volatility in the futures market. Investors attempt to predict the outcomes of these reports and adjust their positions accordingly. This pre-emptive behavior can result in fluctuations in futures prices, as seen with the recent drop in Nasdaq futures. The decline suggests a cautious approach by investors, possibly due to concerns over potential underperformance by key technology and growth-oriented companies that dominate the Nasdaq index. These companies, often characterized by high valuations, are particularly sensitive to earnings surprises, whether positive or negative.

Moreover, the broader economic environment plays a crucial role in shaping expectations for earnings reports. Factors such as interest rates, inflation, and global economic conditions can impact corporate earnings. For instance, rising interest rates may increase borrowing costs for companies, potentially squeezing profit margins. Similarly, inflationary pressures can affect consumer spending and input costs, thereby influencing revenue and profitability. As such, investors closely monitor these macroeconomic indicators alongside company-specific factors when assessing the potential impact of earnings reports on Nasdaq futures.

In addition to economic conditions, sector-specific trends also contribute to the market’s anticipation of earnings reports. The technology sector, which constitutes a significant portion of the Nasdaq index, is particularly susceptible to rapid changes in consumer preferences and technological advancements. Companies within this sector are often at the forefront of innovation, but they also face intense competition and regulatory scrutiny. Consequently, their earnings reports are scrutinized for indications of market share growth, product development, and strategic initiatives. Any deviation from expected performance in these areas can lead to significant movements in their stock prices and, by extension, the Nasdaq futures.

Furthermore, the guidance provided by companies during their earnings announcements is another critical factor influencing market sentiment. Forward-looking statements regarding future revenue, profit margins, and strategic priorities offer valuable insights into a company’s outlook. Investors use this information to gauge the potential for future growth and adjust their investment strategies accordingly. Positive guidance can bolster investor confidence and lead to upward momentum in futures prices, while cautious or negative guidance may exacerbate declines.

In conclusion, the drop in Nasdaq futures ahead of earnings reports underscores the intricate relationship between corporate performance, economic conditions, and investor sentiment. As companies prepare to disclose their financial results, market participants remain vigilant, analyzing a myriad of factors that could influence the trajectory of the Nasdaq index. The interplay between these elements highlights the complexity of financial markets and the importance of earnings reports in shaping market dynamics. As such, investors and analysts alike will be closely monitoring the upcoming earnings season, seeking to navigate the challenges and opportunities it presents.

Key Factors Influencing Nasdaq Futures Movements

Nasdaq futures have recently experienced a decline, reflecting the market’s cautious stance as investors brace for the upcoming earnings reports. This movement in futures is not an isolated event but rather a culmination of various factors that are currently influencing market sentiment. Understanding these key factors is essential for investors and analysts who are trying to navigate the complexities of the financial markets.

One of the primary factors affecting Nasdaq futures is the anticipation of corporate earnings reports. As companies prepare to release their quarterly results, investors are keenly focused on the performance of major technology firms, which are heavily weighted in the Nasdaq index. The technology sector has been a significant driver of market growth in recent years, and any indication of slowing growth or missed earnings expectations could lead to increased volatility in the futures market. Consequently, investors are closely monitoring earnings forecasts and analyst predictions to gauge the potential impact on stock prices.

In addition to earnings reports, macroeconomic indicators are playing a crucial role in shaping market expectations. Recent data on inflation, employment, and consumer spending have provided mixed signals about the health of the economy. Inflationary pressures, in particular, have raised concerns about potential interest rate hikes by the Federal Reserve. Higher interest rates could increase borrowing costs for companies, potentially dampening corporate profits and, in turn, affecting stock valuations. As a result, investors are paying close attention to any statements or policy changes from the Federal Reserve that could influence future interest rate decisions.

Geopolitical tensions also contribute to the uncertainty surrounding Nasdaq futures. Ongoing trade negotiations, international conflicts, and political developments can have far-reaching effects on global markets. For instance, any escalation in trade disputes could disrupt supply chains and impact the earnings of multinational corporations. Similarly, political instability in key regions could lead to fluctuations in currency exchange rates, further complicating the investment landscape. Investors are therefore keeping a watchful eye on geopolitical events that could potentially sway market dynamics.

Moreover, technological advancements and innovations continue to be a double-edged sword for the Nasdaq. On one hand, breakthroughs in areas such as artificial intelligence, cloud computing, and biotechnology offer significant growth opportunities for companies within the index. On the other hand, rapid technological changes can lead to increased competition and market saturation, posing challenges for established firms. Investors must weigh these opportunities and risks when assessing the future prospects of technology stocks.

Lastly, investor sentiment and market psychology play an integral role in influencing Nasdaq futures. Market participants often react to news and events based on their perceptions and expectations, which can lead to short-term fluctuations in futures prices. For example, positive news about a company’s product launch or strategic partnership might boost investor confidence, while negative news about regulatory challenges or legal issues could trigger a sell-off. Understanding the behavioral aspects of market movements is crucial for investors seeking to make informed decisions.

In conclusion, the recent drop in Nasdaq futures is a reflection of the complex interplay of factors that influence market movements. As investors await the upcoming earnings reports, they must consider a range of elements, including corporate performance, macroeconomic indicators, geopolitical developments, technological trends, and investor sentiment. By staying informed and analyzing these factors, investors can better navigate the uncertainties of the financial markets and make strategic investment choices.

Historical Trends: Nasdaq Futures During Earnings Season

As the financial world turns its attention to the upcoming earnings season, Nasdaq futures have experienced a noticeable decline, reflecting the market’s anticipation and apprehension. Historically, the period leading up to earnings reports has been characterized by heightened volatility, as investors adjust their positions based on expectations and forecasts. This trend is not new; rather, it is a recurring pattern that underscores the intricate relationship between corporate performance and market sentiment.

To understand the current movement in Nasdaq futures, it is essential to examine the historical trends that have shaped investor behavior during earnings seasons. Traditionally, the weeks preceding the release of quarterly earnings reports are marked by increased speculation. Investors and analysts alike engage in rigorous assessments of potential earnings outcomes, often leading to significant fluctuations in futures markets. This speculative activity is driven by a myriad of factors, including macroeconomic indicators, industry-specific developments, and individual company performance.

Moreover, the Nasdaq, being heavily weighted towards technology and growth-oriented companies, is particularly sensitive to earnings announcements. The tech sector, known for its rapid innovation and dynamic growth prospects, often experiences pronounced market reactions during earnings season. Positive earnings surprises can lead to sharp upward movements in stock prices, while disappointing results may trigger swift declines. Consequently, Nasdaq futures serve as a barometer for investor sentiment, reflecting the collective expectations of market participants.

In addition to the inherent volatility of earnings season, external factors also play a crucial role in shaping market dynamics. For instance, geopolitical events, changes in monetary policy, and shifts in consumer behavior can all influence investor sentiment and, by extension, Nasdaq futures. During periods of economic uncertainty, such as those caused by global trade tensions or unexpected policy shifts, futures markets may exhibit even greater volatility as investors seek to navigate the complex landscape.

Furthermore, the advent of algorithmic trading and high-frequency trading has amplified the speed and magnitude of market reactions. These technological advancements have enabled traders to execute large volumes of trades in milliseconds, often exacerbating price swings during earnings season. As a result, Nasdaq futures can experience rapid and significant changes in value, reflecting the swift adjustments made by market participants in response to new information.

Despite the inherent challenges of predicting market movements during earnings season, historical trends provide valuable insights for investors. By analyzing past patterns, investors can better understand the potential impact of earnings reports on Nasdaq futures and make more informed decisions. For instance, companies with a track record of consistent earnings growth may be perceived as safer bets, while those with volatile earnings histories may be viewed with caution.

In conclusion, the decline in Nasdaq futures ahead of earnings reports is a familiar phenomenon that highlights the complex interplay between corporate performance and market sentiment. Historical trends reveal that this period is often marked by increased volatility, driven by a combination of speculative activity, external factors, and technological advancements. As investors brace for the upcoming earnings season, understanding these trends can provide valuable context for navigating the uncertainties of the market. By recognizing the patterns that have shaped past earnings seasons, investors can better position themselves to capitalize on opportunities and mitigate risks in the ever-evolving financial landscape.

Strategies For Investors Amid Nasdaq Futures Volatility

As Nasdaq futures experience a downturn, investors are increasingly focused on developing strategies to navigate the volatility that often accompanies earnings report season. This period is marked by heightened uncertainty, as companies disclose their financial performance, which can significantly influence market sentiment. Consequently, investors must adopt a proactive approach to manage potential risks and capitalize on opportunities that may arise.

To begin with, diversification remains a cornerstone strategy for mitigating risk during volatile times. By spreading investments across various sectors and asset classes, investors can reduce their exposure to any single company’s earnings report. This approach not only helps in cushioning the impact of negative earnings surprises but also positions investors to benefit from positive performances in other areas. For instance, while technology stocks may be under pressure, sectors such as healthcare or consumer staples might offer stability and growth potential.

In addition to diversification, maintaining a long-term perspective is crucial. Short-term market fluctuations, often driven by earnings reports, can lead to impulsive decision-making. However, investors who focus on the long-term fundamentals of their investments are better equipped to weather temporary volatility. By concentrating on the underlying value and growth prospects of their holdings, investors can avoid the pitfalls of reacting to short-term market noise.

Moreover, staying informed is essential for making sound investment decisions. Investors should closely monitor not only the earnings reports themselves but also the broader economic indicators and market trends that can influence stock performance. This includes keeping an eye on interest rates, inflation data, and geopolitical developments, all of which can have a significant impact on market dynamics. By staying informed, investors can better anticipate potential market movements and adjust their strategies accordingly.

Another effective strategy is to employ options as a tool for hedging against volatility. Options can provide a way to protect portfolios from downside risk while still allowing for participation in potential upside gains. For example, purchasing put options can serve as insurance against a decline in stock prices, while call options can offer the opportunity to benefit from upward movements. However, it is important for investors to fully understand the complexities and risks associated with options trading before incorporating them into their strategies.

Furthermore, maintaining liquidity is a prudent approach during periods of market uncertainty. Having a portion of the portfolio in cash or cash-equivalent assets provides investors with the flexibility to take advantage of buying opportunities that may arise during market dips. This liquidity can also serve as a buffer against unforeseen expenses or financial needs, reducing the pressure to sell investments at inopportune times.

Lastly, consulting with financial advisors or investment professionals can provide valuable insights and guidance tailored to individual circumstances. These experts can help investors assess their risk tolerance, set realistic goals, and develop a comprehensive strategy that aligns with their financial objectives. By leveraging professional expertise, investors can enhance their ability to navigate the complexities of the market during earnings season.

In conclusion, as Nasdaq futures face downward pressure amid the anticipation of earnings reports, investors must employ a range of strategies to manage volatility effectively. Through diversification, maintaining a long-term perspective, staying informed, utilizing options, ensuring liquidity, and seeking professional advice, investors can position themselves to navigate the challenges and opportunities that lie ahead. By doing so, they can not only protect their portfolios but also potentially enhance their returns in the ever-evolving financial landscape.

Expert Predictions: Nasdaq Futures And Earnings Reports

As the financial world turns its attention to the upcoming earnings season, Nasdaq futures have experienced a noticeable decline, reflecting the market’s cautious stance. Investors and analysts alike are bracing for a series of earnings reports that are expected to provide crucial insights into the health of various sectors and the broader economy. This period is particularly significant as it follows a year marked by economic uncertainty, fluctuating interest rates, and geopolitical tensions, all of which have contributed to a volatile market environment.

The decline in Nasdaq futures can be attributed to several factors, chief among them being the anticipation of mixed earnings results. Many companies are grappling with the lingering effects of supply chain disruptions and inflationary pressures, which have impacted their bottom lines. As a result, market participants are approaching this earnings season with a degree of caution, aware that the outcomes could significantly influence market sentiment and future investment strategies.

Moreover, the technology sector, which constitutes a substantial portion of the Nasdaq index, is under particular scrutiny. Tech companies have been at the forefront of market growth in recent years, but they now face challenges such as regulatory pressures and changing consumer behaviors. These factors have led to a reassessment of valuations, with investors keenly observing how these companies navigate the current landscape. Consequently, the performance of major tech firms in their earnings reports will likely set the tone for the broader market.

In addition to sector-specific concerns, macroeconomic indicators are also playing a pivotal role in shaping market expectations. The Federal Reserve’s monetary policy decisions, especially regarding interest rates, continue to be a focal point for investors. Any hints of policy shifts in response to inflation data or economic growth figures could have a profound impact on market dynamics. Therefore, the interplay between corporate earnings and macroeconomic trends is being closely monitored, as it will provide a clearer picture of the economic trajectory.

Furthermore, geopolitical developments remain a wildcard in the equation. Ongoing tensions in various regions, coupled with trade negotiations and international policy decisions, add another layer of complexity to market predictions. Investors are acutely aware that any significant geopolitical event could swiftly alter market conditions, making it imperative to stay informed and adaptable.

As experts weigh in on the potential outcomes of this earnings season, there is a consensus that volatility is likely to persist. While some companies may exceed expectations, others could fall short, leading to fluctuations in stock prices and market indices. This environment underscores the importance of a diversified investment approach, as it can help mitigate risks associated with individual stock performance.

In conclusion, as Nasdaq futures drop in anticipation of earnings reports, the market is poised for a period of heightened activity and analysis. The convergence of corporate performance, macroeconomic indicators, and geopolitical factors creates a complex backdrop for investors. Navigating this landscape requires a keen understanding of both micro and macroeconomic elements, as well as the ability to adapt to rapidly changing conditions. As the earnings season unfolds, it will undoubtedly provide valuable insights into the resilience and adaptability of companies and the broader market, shaping investment strategies in the months to come.

Sector Analysis: Which Industries Affect Nasdaq Futures?

Nasdaq futures have recently experienced a decline, a movement that has captured the attention of investors and analysts alike. This drop is largely attributed to the anticipation surrounding upcoming earnings reports, which are expected to provide crucial insights into the financial health of various industries. Understanding which sectors have the most significant impact on Nasdaq futures is essential for investors aiming to navigate these turbulent times.

The technology sector, a dominant force within the Nasdaq index, plays a pivotal role in influencing futures. Companies such as Apple, Microsoft, and Alphabet are not only leaders in innovation but also major contributors to the index’s overall performance. As these tech giants prepare to release their earnings reports, investors are keenly observing their revenue growth, profit margins, and forward guidance. Any unexpected results, whether positive or negative, can lead to substantial fluctuations in Nasdaq futures, given the sector’s substantial weight in the index.

In addition to technology, the healthcare sector also exerts considerable influence on Nasdaq futures. This industry encompasses a wide range of companies, from pharmaceutical giants to biotechnology firms, all of which are integral to the index. The performance of healthcare stocks is often driven by factors such as drug approvals, clinical trial results, and regulatory changes. As earnings season approaches, investors are particularly interested in how these companies have navigated recent challenges, including supply chain disruptions and evolving healthcare policies. Positive earnings surprises in this sector can bolster investor confidence, while disappointing results may contribute to further declines in futures.

Moreover, the consumer discretionary sector is another critical component affecting Nasdaq futures. This sector includes companies that produce non-essential goods and services, such as retail, entertainment, and travel. The performance of consumer discretionary stocks is closely tied to consumer spending patterns, which are influenced by economic conditions, employment rates, and consumer confidence. As earnings reports are released, investors will be scrutinizing how these companies have adapted to changing consumer behaviors and economic uncertainties. Strong earnings in this sector could provide a boost to Nasdaq futures, while weaker-than-expected results might exacerbate the current downward trend.

Furthermore, the financial sector, though not as heavily weighted in the Nasdaq as in other indices, still plays a role in shaping futures movements. Financial institutions, including banks and investment firms, are sensitive to interest rate changes and economic outlooks. As these companies report their earnings, investors will be evaluating their performance in light of recent monetary policy decisions and market volatility. Positive earnings in the financial sector could help stabilize Nasdaq futures, while negative outcomes might contribute to further declines.

In conclusion, as markets brace for the upcoming earnings reports, it is evident that several key industries significantly impact Nasdaq futures. The technology, healthcare, consumer discretionary, and financial sectors each play a unique role in shaping investor sentiment and market movements. By closely monitoring the performance of these industries, investors can gain valuable insights into potential future trends. As earnings season unfolds, the interplay between these sectors will likely continue to drive fluctuations in Nasdaq futures, underscoring the importance of a comprehensive sector analysis for informed investment decisions.

How Global Events Shape Nasdaq Futures Performance

Nasdaq futures have recently experienced a downturn, reflecting the market’s anticipation of upcoming earnings reports. This fluctuation is not merely a reaction to domestic economic indicators but is also significantly influenced by global events. Understanding how these international occurrences shape Nasdaq futures performance requires a comprehensive analysis of the interconnectedness of global markets and the factors that drive investor sentiment.

To begin with, geopolitical tensions often play a crucial role in shaping market dynamics. For instance, escalating conflicts or diplomatic standoffs can lead to uncertainty, prompting investors to adopt a risk-averse stance. This cautious approach can result in a sell-off in futures markets, including Nasdaq, as investors seek safer assets. Moreover, trade relations between major economies, such as the United States and China, have a profound impact on market sentiment. Any indication of trade disputes or tariffs can lead to concerns about global economic growth, thereby affecting Nasdaq futures.

In addition to geopolitical factors, economic data from major economies also significantly influence Nasdaq futures. For example, economic indicators such as GDP growth rates, employment figures, and inflation data from the United States, the European Union, and China can sway investor confidence. Positive data can bolster market sentiment, leading to an uptick in futures, while disappointing figures can have the opposite effect. Furthermore, central bank policies, particularly those of the Federal Reserve, the European Central Bank, and the People’s Bank of China, are closely monitored by investors. Decisions regarding interest rates and monetary policy can lead to shifts in market expectations, thereby impacting Nasdaq futures.

Another critical factor is the performance of global technology companies, many of which are listed on the Nasdaq. As these companies often have a significant international presence, their performance is closely tied to global economic conditions. For instance, supply chain disruptions, which have been a persistent issue in recent years, can affect production and profitability, thereby influencing investor sentiment towards these companies. Additionally, regulatory changes in key markets, such as data privacy laws in the European Union or antitrust actions in China, can have far-reaching implications for technology firms, further affecting Nasdaq futures.

Moreover, global health events, such as the COVID-19 pandemic, have demonstrated the profound impact that such occurrences can have on financial markets. The pandemic led to unprecedented volatility in Nasdaq futures as investors grappled with the uncertainty surrounding economic shutdowns and recovery prospects. Although the immediate impact of the pandemic has subsided, the lessons learned underscore the importance of monitoring global health developments and their potential economic ramifications.

In conclusion, the performance of Nasdaq futures is intricately linked to a myriad of global events. Geopolitical tensions, economic data, central bank policies, the performance of international technology companies, and global health events all play a pivotal role in shaping investor sentiment and market dynamics. As markets brace for earnings reports, it is essential for investors to remain vigilant and consider these global factors when making informed decisions. By understanding the interconnected nature of global markets, investors can better navigate the complexities of Nasdaq futures and position themselves strategically in an ever-evolving financial landscape.

Q&A

1. **What are Nasdaq Futures?**

Nasdaq Futures are financial contracts that speculate on the future value of the Nasdaq 100 Index, allowing investors to hedge or speculate on market movements.

2. **Why do Nasdaq Futures drop?**

Nasdaq Futures may drop due to various factors, including negative economic data, geopolitical tensions, changes in interest rates, or investor sentiment ahead of significant events like earnings reports.

3. **What are earnings reports?**

Earnings reports are quarterly financial statements released by publicly traded companies, detailing their revenue, expenses, and profits, which can significantly impact stock prices.

4. **How do earnings reports affect Nasdaq Futures?**

Earnings reports can influence Nasdaq Futures by affecting investor expectations and sentiment. Positive reports may boost futures, while disappointing results can lead to declines.

5. **What sectors are most affected by Nasdaq Futures movements?**

Technology and growth sectors, which are heavily represented in the Nasdaq 100, are most affected by movements in Nasdaq Futures.

6. **How can investors prepare for earnings reports?**

Investors can prepare by analyzing company fundamentals, understanding market expectations, diversifying portfolios, and using hedging strategies to manage risk.

7. **What role does investor sentiment play in Nasdaq Futures?**

Investor sentiment plays a crucial role as it can drive market trends based on perceptions of economic conditions, company performance, and broader market outlooks.

Conclusion

Nasdaq futures experienced a decline as investors prepared for the release of upcoming earnings reports. This drop reflects market apprehension regarding the financial performance of major technology companies, which are heavily weighted in the Nasdaq index. The anticipation of earnings results has heightened market volatility, as investors seek to gauge the impact of economic conditions, interest rates, and consumer demand on corporate profitability. The outcome of these earnings reports will likely influence market sentiment and could set the tone for future trading sessions. Overall, the decline in Nasdaq futures underscores the cautious stance of investors amid uncertainty surrounding corporate earnings and broader economic indicators.