“Market Tensions Rise: Nasdaq Slips, 10-Year Yield Peaks Ahead of Earnings Season”

Introduction

As the earnings season approaches, the Nasdaq has exerted downward pressure on the stock market, reflecting investor caution and market volatility. This decline comes amid rising concerns over corporate earnings and economic outlooks, with the 10-year Treasury yield reaching its highest level since July. The increase in bond yields signals potential shifts in investor sentiment, as higher yields often lead to a reevaluation of equity valuations. This dynamic environment underscores the market’s sensitivity to upcoming earnings reports and broader economic indicators, setting the stage for a potentially turbulent period for investors.

Impact Of Rising 10-Year Yields On Tech Stocks

As the financial markets brace for the upcoming earnings season, the Nasdaq Composite Index has recently experienced a notable downturn, primarily influenced by the rising yields on 10-year U.S. Treasury bonds. This development has sparked concerns among investors, particularly those with significant stakes in technology stocks, which are known for their sensitivity to interest rate fluctuations. The 10-year yield, a critical benchmark for long-term interest rates, has reached its highest level since July, exerting downward pressure on the valuations of tech companies. This dynamic is crucial to understanding the current market environment and its implications for the technology sector.

To comprehend the impact of rising 10-year yields on tech stocks, it is essential to consider the relationship between interest rates and equity valuations. Higher yields often lead to increased borrowing costs, which can dampen corporate profits and, consequently, stock prices. For technology companies, which frequently rely on borrowing to finance innovation and expansion, this can be particularly detrimental. Moreover, tech stocks are often valued based on future earnings potential, and higher interest rates can reduce the present value of these anticipated earnings, making them less attractive to investors.

In addition to the direct financial implications, rising yields can also influence investor sentiment. As yields climb, fixed-income investments become more appealing, prompting a shift away from riskier assets like equities. This reallocation of capital can lead to a sell-off in the stock market, with tech stocks bearing the brunt due to their historically high valuations. The recent performance of the Nasdaq reflects this trend, as investors reassess their portfolios in light of changing economic conditions.

Furthermore, the anticipation of the earnings season adds another layer of complexity to the situation. Investors are keenly awaiting corporate earnings reports to gauge the health of the technology sector and the broader economy. Any indication of slowing growth or shrinking profit margins could exacerbate the current downward trend in tech stocks. Companies that fail to meet market expectations may face significant declines in their stock prices, further contributing to the volatility observed in the Nasdaq.

Despite these challenges, it is important to recognize that not all tech stocks are equally affected by rising yields. Companies with strong balance sheets, robust cash flows, and a proven track record of profitability may be better positioned to weather the storm. These firms can continue to invest in growth opportunities without relying heavily on external financing, making them more resilient in a high-interest-rate environment. Consequently, investors may seek refuge in such companies, potentially mitigating some of the broader market declines.

In conclusion, the interplay between rising 10-year yields and the performance of tech stocks is a critical factor shaping the current financial landscape. As the earnings season approaches, market participants will closely monitor corporate results and guidance to assess the resilience of the technology sector. While challenges persist, particularly for companies with high leverage and speculative valuations, opportunities remain for those with strong fundamentals. As always, a nuanced understanding of these dynamics is essential for investors navigating the complexities of the stock market.

Earnings Season: What Investors Should Watch For

As the earnings season approaches, investors are keenly observing the financial landscape, particularly the performance of the Nasdaq, which has recently exerted a downward pull on stocks. This decline comes at a time when the 10-year Treasury yield has reached its highest point since July, adding another layer of complexity to the investment environment. Understanding the interplay between these factors is crucial for investors aiming to navigate the upcoming earnings season effectively.

The Nasdaq, known for its heavy concentration of technology stocks, often serves as a barometer for investor sentiment in the tech sector. Recently, it has experienced a downturn, which can be attributed to a combination of factors including rising interest rates and concerns over tech valuations. As the 10-year Treasury yield climbs, borrowing costs increase, which can dampen the growth prospects of tech companies that rely heavily on debt financing. This scenario has led to a reevaluation of tech stock valuations, causing some investors to pull back.

Moreover, the rise in the 10-year yield is not an isolated event but rather a reflection of broader economic conditions. It signals investor expectations of future inflation and economic growth, which can influence corporate earnings. As yields rise, the cost of capital for companies increases, potentially squeezing profit margins. This is particularly pertinent for sectors that are capital-intensive or have significant debt loads. Consequently, investors are advised to pay close attention to how companies address these challenges in their earnings reports.

As earnings season unfolds, several key themes are likely to emerge. First, the impact of inflation on corporate profitability will be a focal point. Companies across various sectors have been grappling with rising input costs, and their ability to pass these costs onto consumers without sacrificing demand will be scrutinized. Investors should watch for commentary on pricing strategies and any indications of margin compression.

Additionally, the strength of consumer demand will be under the microscope. With the economy in a state of flux, consumer spending patterns may shift, affecting revenue streams for many companies. Earnings reports will provide insights into how businesses are adapting to these changes and whether they are successfully capturing consumer interest.

Furthermore, the global supply chain remains a critical issue. Disruptions have persisted, affecting production timelines and inventory levels. Companies that have managed to mitigate these challenges through strategic planning or diversification of suppliers may be better positioned to report positive earnings surprises. Investors should be attentive to any updates on supply chain resilience and future expectations.

Finally, guidance for the coming quarters will be of paramount importance. In an environment characterized by uncertainty, forward-looking statements from company executives can offer valuable clues about future performance. Investors should assess whether companies are optimistic or cautious in their outlooks and consider how these perspectives align with broader economic indicators.

In conclusion, as the earnings season looms, investors face a complex landscape shaped by the interplay of Nasdaq’s performance and rising 10-year yields. By focusing on key themes such as inflation, consumer demand, supply chain issues, and corporate guidance, investors can gain a clearer understanding of the challenges and opportunities that lie ahead. This informed approach will be essential for making strategic investment decisions in the weeks to come.

Historical Analysis: Nasdaq Performance During Earnings Season

As the financial markets brace for the upcoming earnings season, the Nasdaq Composite Index has recently experienced a downturn, raising concerns among investors and analysts alike. Historically, the performance of the Nasdaq during earnings season has been a subject of keen interest, as it often sets the tone for broader market trends. Understanding the historical patterns of the Nasdaq during these periods can provide valuable insights into potential future movements, especially as the 10-year Treasury yield reaches its highest level since July, adding another layer of complexity to the market dynamics.

Historically, the Nasdaq has exhibited a mixed performance during earnings seasons, with outcomes largely dependent on the economic backdrop and the performance of key sectors, particularly technology. In periods of economic expansion, the index has often rallied, buoyed by strong earnings reports from major tech companies that dominate its composition. Conversely, during times of economic uncertainty or contraction, the Nasdaq has sometimes struggled, reflecting broader market apprehensions. This duality underscores the importance of earnings reports as a barometer for investor sentiment and market direction.

Transitioning to the present scenario, the current market environment is characterized by heightened volatility, partly due to the rising 10-year Treasury yield. The yield’s ascent to its highest point since July signals investor concerns about inflation and potential interest rate hikes, which could impact the cost of borrowing and, consequently, corporate profits. This development adds a layer of complexity to the earnings season, as companies may face increased scrutiny over their financial health and future guidance. Investors will be closely watching how companies navigate these challenges, particularly those in the technology sector, which is highly sensitive to interest rate changes.

Moreover, the interplay between the Nasdaq’s performance and the broader economic indicators cannot be overlooked. The index’s trajectory during earnings season often mirrors the prevailing economic sentiment, with positive earnings surprises typically leading to upward momentum, while disappointing results can exacerbate market declines. This relationship highlights the critical role of earnings reports in shaping investor expectations and market trends. As such, the upcoming earnings season will be pivotal in determining whether the Nasdaq can overcome its recent slump and regain its footing.

In addition to the economic factors at play, geopolitical developments and regulatory changes can also influence the Nasdaq’s performance during earnings season. For instance, trade tensions, changes in fiscal policy, or shifts in regulatory frameworks can create uncertainty, impacting investor confidence and market stability. As companies prepare to release their earnings reports, these external factors will be closely monitored for any potential impact on market sentiment.

In conclusion, the historical analysis of the Nasdaq’s performance during earnings season reveals a complex interplay of economic, financial, and geopolitical factors. As the 10-year Treasury yield reaches its highest level since July, the upcoming earnings season presents both challenges and opportunities for investors. By closely examining historical patterns and current market conditions, investors can better navigate the uncertainties and make informed decisions. Ultimately, the Nasdaq’s performance in the coming weeks will serve as a crucial indicator of broader market trends and investor sentiment, providing valuable insights into the future direction of the financial markets.

Strategies For Investors Amidst Market Volatility

As the financial markets brace for the upcoming earnings season, investors find themselves navigating a landscape marked by volatility and uncertainty. The Nasdaq, a key barometer of technology and growth stocks, has recently exerted downward pressure on the broader stock market. This decline is compounded by the 10-year Treasury yield reaching its highest level since July, a development that has significant implications for investment strategies. In such a dynamic environment, investors must adopt a proactive approach to manage risk and capitalize on potential opportunities.

The recent downturn in the Nasdaq can be attributed to a confluence of factors, including concerns over inflation, interest rate hikes, and geopolitical tensions. As technology stocks are particularly sensitive to changes in interest rates, the rise in the 10-year Treasury yield has prompted a reevaluation of growth stock valuations. Higher yields often lead to increased borrowing costs, which can dampen corporate profits and, consequently, investor sentiment. This scenario underscores the importance of diversification as a strategy to mitigate risk. By spreading investments across various asset classes, sectors, and geographies, investors can reduce their exposure to any single market segment’s volatility.

Moreover, the anticipation of the earnings season adds another layer of complexity to the investment landscape. Earnings reports provide critical insights into corporate health and future prospects, influencing stock prices and market trends. Investors should closely monitor these reports, paying particular attention to companies’ revenue growth, profit margins, and forward guidance. This information can help investors make informed decisions about which stocks to hold, buy, or sell. Additionally, it is prudent to consider the broader economic context, including consumer spending patterns and supply chain disruptions, which can impact corporate performance.

In light of these challenges, adopting a long-term investment perspective can be beneficial. Market volatility, while unsettling in the short term, often presents opportunities for patient investors. By focusing on companies with strong fundamentals, robust balance sheets, and competitive advantages, investors can position themselves to benefit from potential market recoveries. Furthermore, dollar-cost averaging, a strategy that involves regularly investing a fixed amount of money regardless of market conditions, can help mitigate the impact of market fluctuations and reduce the emotional stress associated with timing the market.

Another strategy to consider is the inclusion of fixed-income securities in an investment portfolio. With the 10-year Treasury yield on the rise, bonds and other fixed-income instruments may offer attractive returns relative to their risk. These assets can provide a stable income stream and act as a hedge against equity market volatility. However, it is essential to assess the interest rate environment and inflation expectations, as these factors can influence bond prices and yields.

In conclusion, the current market environment, characterized by the Nasdaq’s decline and rising Treasury yields, presents both challenges and opportunities for investors. By employing strategies such as diversification, long-term investing, and incorporating fixed-income securities, investors can navigate this volatility with greater confidence. As the earnings season unfolds, staying informed and adaptable will be crucial in making sound investment decisions. Ultimately, a disciplined approach, grounded in thorough research and analysis, will serve investors well in achieving their financial goals amidst market uncertainty.

The Relationship Between Bond Yields And Stock Market Trends

The intricate relationship between bond yields and stock market trends is a subject of perennial interest to investors and analysts alike. As the Nasdaq recently dragged stocks down, coinciding with the 10-year yield reaching its highest point since July, this relationship has once again come under scrutiny. Understanding the dynamics at play requires a closer examination of how bond yields influence stock market behavior, particularly as the earnings season approaches.

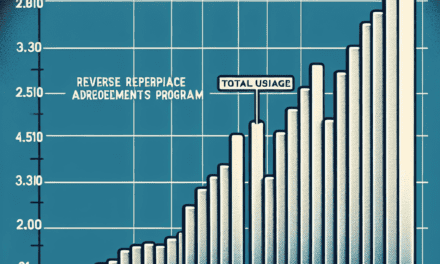

To begin with, bond yields, particularly those of government securities like the 10-year Treasury note, serve as a benchmark for interest rates across the economy. When these yields rise, borrowing costs for companies increase, potentially squeezing profit margins. This scenario can lead to a reevaluation of stock valuations, as higher interest rates often result in a higher discount rate applied to future earnings, thereby reducing the present value of those earnings. Consequently, stocks, especially those in growth sectors like technology, which are heavily represented in the Nasdaq, may experience downward pressure.

Moreover, rising bond yields can signal investor expectations of stronger economic growth and potential inflationary pressures. While economic growth is generally positive for corporate earnings, the specter of inflation can lead to tighter monetary policy from central banks, such as interest rate hikes. These actions can further elevate bond yields, creating a feedback loop that exerts additional pressure on stock prices. As the earnings season looms, companies are likely to face increased scrutiny regarding their ability to navigate these macroeconomic challenges.

In addition to these factors, the relationship between bond yields and stock market trends is also influenced by investor sentiment and risk appetite. When bond yields rise, fixed-income investments become more attractive relative to stocks, prompting some investors to rebalance their portfolios in favor of bonds. This shift can exacerbate stock market declines, particularly in sectors that are perceived as riskier or more volatile. The recent performance of the Nasdaq, with its heavy concentration of technology stocks, exemplifies this dynamic, as investors reassess the risk-reward profile of these investments in light of changing interest rate expectations.

Furthermore, the impending earnings season adds another layer of complexity to the interplay between bond yields and stock market trends. Investors will be keenly watching corporate earnings reports for insights into how companies are managing cost pressures, supply chain disruptions, and other challenges. Strong earnings could provide a counterbalance to the negative impact of rising bond yields, offering reassurance to investors about the resilience of corporate America. Conversely, disappointing earnings could amplify concerns about the sustainability of current stock valuations, particularly in an environment of rising interest rates.

In conclusion, the relationship between bond yields and stock market trends is multifaceted and influenced by a variety of economic and psychological factors. As the Nasdaq’s recent performance illustrates, rising bond yields can exert significant downward pressure on stocks, particularly in growth-oriented sectors. However, the upcoming earnings season presents an opportunity for companies to demonstrate their ability to thrive in a challenging economic landscape. Investors will need to carefully weigh these considerations as they navigate the complex interplay between bond yields and stock market trends in the weeks ahead.

Sector Analysis: Which Industries Are Most Affected By Rising Yields?

As the financial markets brace for the upcoming earnings season, the Nasdaq has recently experienced a downturn, exerting downward pressure on stocks across various sectors. This decline is occurring in tandem with a notable rise in the 10-year Treasury yield, which has reached its highest level since July. The interplay between these two factors is creating a complex landscape for investors, with certain industries feeling the impact more acutely than others. Understanding which sectors are most affected by rising yields is crucial for stakeholders aiming to navigate this challenging environment.

To begin with, the technology sector, which has been a significant driver of market growth in recent years, is particularly sensitive to changes in interest rates. Higher yields often lead to increased borrowing costs, which can dampen the growth prospects of tech companies that rely heavily on debt to finance their innovation and expansion efforts. Moreover, as yields rise, the present value of future cash flows diminishes, making high-growth tech stocks less attractive to investors. Consequently, the Nasdaq, heavily weighted with technology stocks, has been one of the first indices to reflect the strain of rising yields.

In addition to technology, the real estate sector is also feeling the pressure. Real estate investment trusts (REITs) and other property-related stocks are typically sensitive to interest rate fluctuations. As yields climb, the cost of financing new projects increases, potentially slowing down development and reducing profitability. Furthermore, higher yields can lead to a shift in investor preference from dividend-yielding stocks, like those in real estate, to fixed-income securities, which become more attractive as their returns rise. This shift can result in decreased demand for real estate stocks, further exacerbating the sector’s challenges.

On the other hand, the financial sector often benefits from rising yields, as higher interest rates can lead to improved profit margins for banks and other financial institutions. When yields increase, banks can charge more for loans relative to what they pay on deposits, thereby enhancing their net interest margins. However, this potential upside is not without its caveats. If yields rise too quickly, it could lead to a slowdown in borrowing and economic activity, which might offset the benefits of higher margins. Therefore, while financial stocks may initially appear to be winners in a rising yield environment, the broader economic implications must be carefully considered.

Transitioning to the consumer discretionary sector, companies within this category may face headwinds as rising yields can lead to higher borrowing costs for consumers. This scenario can result in reduced consumer spending, particularly on non-essential goods and services. Retailers, automakers, and other businesses that rely on consumer credit may find themselves grappling with decreased demand, which could impact their earnings and stock performance.

In conclusion, as the earnings season approaches, the dual forces of a declining Nasdaq and rising 10-year Treasury yields are shaping the investment landscape in significant ways. While technology and real estate sectors are grappling with the challenges posed by higher yields, the financial sector may find some opportunities amidst the turmoil. Meanwhile, consumer discretionary companies must remain vigilant as they navigate potential shifts in consumer behavior. Investors and analysts alike will need to pay close attention to these dynamics to make informed decisions in the weeks and months ahead.

Expert Predictions: How Will The Nasdaq Fare In The Coming Months?

As the financial markets brace for the upcoming earnings season, investors are keenly observing the movements of the Nasdaq, which has recently experienced a downturn. This decline has been influenced by a confluence of factors, including rising bond yields and investor apprehension about corporate earnings. The 10-year Treasury yield has reached its highest level since July, exerting pressure on equities, particularly those in the technology sector, which are sensitive to interest rate fluctuations. As the earnings season approaches, market experts are offering varied predictions on how the Nasdaq will perform in the coming months.

To understand the potential trajectory of the Nasdaq, it is essential to consider the broader economic context. The Federal Reserve’s monetary policy plays a crucial role in shaping market dynamics. With inflationary pressures persisting, the central bank has signaled its intent to maintain a hawkish stance, which could lead to further interest rate hikes. Such a scenario would likely increase borrowing costs for companies, potentially dampening their growth prospects. Consequently, technology stocks, which constitute a significant portion of the Nasdaq, may face headwinds as investors reassess their valuations in light of higher interest rates.

Moreover, the global economic landscape remains fraught with uncertainties. Geopolitical tensions, supply chain disruptions, and fluctuating energy prices continue to pose challenges to corporate profitability. These factors could weigh on the earnings reports of companies listed on the Nasdaq, leading to increased volatility in the index. Analysts suggest that investors should closely monitor the guidance provided by companies during their earnings calls, as this will offer insights into how businesses are navigating these challenges and their outlook for the future.

Despite these concerns, some experts remain optimistic about the Nasdaq’s prospects. They argue that the technology sector’s long-term growth potential remains intact, driven by ongoing innovation and digital transformation across industries. Companies that are at the forefront of emerging technologies, such as artificial intelligence, cloud computing, and cybersecurity, are expected to continue attracting investor interest. Additionally, the recent market correction may present buying opportunities for investors seeking exposure to high-quality tech stocks at more attractive valuations.

Furthermore, the resilience of the U.S. economy could provide a supportive backdrop for the Nasdaq. Recent economic data has shown signs of strength, with robust consumer spending and a resilient labor market. If these trends persist, they could bolster corporate earnings and, by extension, the performance of the Nasdaq. However, it is crucial for investors to remain vigilant and adaptable, as the market environment can change rapidly in response to new information.

In conclusion, the Nasdaq’s performance in the coming months will be influenced by a complex interplay of factors, including monetary policy, economic conditions, and corporate earnings. While challenges such as rising interest rates and geopolitical uncertainties pose risks, the underlying growth potential of the technology sector offers reasons for cautious optimism. As the earnings season unfolds, investors will gain a clearer picture of how companies are faring in this dynamic environment. By staying informed and considering expert predictions, market participants can better navigate the uncertainties and opportunities that lie ahead.

Q&A

1. **What caused the Nasdaq to drag stocks down?**

Concerns over upcoming earnings reports and economic uncertainties contributed to the decline.

2. **How did the 10-year Treasury yield impact the stock market?**

The 10-year Treasury yield reached its highest level since July, increasing borrowing costs and pressuring stock valuations.

3. **What sectors were most affected by the Nasdaq’s decline?**

Technology and growth-oriented sectors were particularly impacted due to their sensitivity to interest rate changes.

4. **What are investors anticipating in the upcoming earnings season?**

Investors are looking for insights into corporate profitability, cost management, and economic outlooks amid inflationary pressures.

5. **How did the broader market react to the Nasdaq’s performance?**

The broader market experienced volatility, with major indices showing mixed results as investors weighed various economic factors.

6. **What external factors are influencing investor sentiment?**

Geopolitical tensions, inflation concerns, and central bank policies are influencing market sentiment and investor decisions.

7. **What strategies are investors considering in response to these market conditions?**

Investors are considering diversifying portfolios, focusing on value stocks, and monitoring interest rate trends to mitigate risks.

Conclusion

The recent downturn in the Nasdaq, coupled with the rise in the 10-year Treasury yield to its highest level since July, underscores the market’s heightened sensitivity to upcoming earnings reports. Investors are likely bracing for potential volatility as companies disclose their financial performance, which could provide insights into the broader economic landscape. The increase in bond yields suggests a shift in investor sentiment towards fixed-income securities, possibly due to concerns over inflation or interest rate adjustments. As earnings season approaches, market participants will be closely monitoring corporate guidance and macroeconomic indicators to gauge future market direction.