“Secure the Future: Addressing the Social Security Crisis to Protect Millions of Workers”

Introduction

The stability of retirement systems is a critical concern for economies worldwide, and recent statistics have cast a worrying shadow over the future of social security for millions of workers. As populations age and economic pressures mount, the sustainability of social security programs is increasingly under threat. A startling new statistic has emerged, highlighting the precarious position of countless workers who rely on these benefits for their post-retirement livelihood. This alarming data point underscores the urgent need for policy reform and strategic planning to safeguard the financial security of future retirees. Without immediate and effective intervention, the risk to millions of workers could translate into widespread economic instability and personal financial crises, making it imperative for stakeholders to address these challenges head-on.

Understanding The Alarming Social Security Statistic: What It Means For Workers

The recent revelation of an alarming statistic concerning Social Security has sent ripples of concern through the workforce, highlighting a potential crisis that could affect millions of workers. This statistic, which underscores the precarious state of the Social Security system, serves as a wake-up call for both policymakers and the general public. Understanding the implications of this statistic is crucial for workers who rely on Social Security as a cornerstone of their retirement planning.

To begin with, Social Security has long been a fundamental component of the American social safety net, providing financial support to retirees, disabled individuals, and survivors of deceased workers. However, the system is facing significant challenges due to demographic shifts, including an aging population and a declining birth rate. These factors have contributed to a growing imbalance between the number of beneficiaries and the number of workers contributing to the system. Consequently, the Social Security Trust Fund is projected to be depleted by the mid-2030s, which could result in a reduction of benefits if no corrective measures are taken.

This alarming statistic is particularly concerning for workers who are nearing retirement age. Many individuals in this demographic have spent their careers contributing to Social Security with the expectation that it will provide a stable source of income in their later years. However, the potential depletion of the Trust Fund raises questions about the reliability of these benefits. For younger workers, the situation is equally troubling, as they may face increased payroll taxes or reduced benefits in the future to sustain the system.

Moreover, the implications of this statistic extend beyond individual workers to the broader economy. Social Security benefits are a critical source of income for millions of retirees, and any reduction in these benefits could have a ripple effect on consumer spending and economic growth. Retirees who receive less income from Social Security may be forced to cut back on their spending, which could, in turn, impact businesses and lead to slower economic growth. Additionally, the uncertainty surrounding the future of Social Security may prompt workers to save more for retirement, potentially reducing their current consumption and further affecting economic activity.

In light of these concerns, it is imperative for policymakers to address the challenges facing the Social Security system. Potential solutions include increasing the payroll tax rate, raising the cap on taxable earnings, or adjusting the formula used to calculate benefits. Each of these options has its own set of advantages and drawbacks, and finding a balanced approach that ensures the long-term sustainability of the system will require careful consideration and bipartisan cooperation.

Furthermore, workers themselves must take proactive steps to prepare for potential changes to Social Security. This includes diversifying their retirement savings through employer-sponsored plans, individual retirement accounts, and other investment vehicles. By taking a more active role in their retirement planning, workers can mitigate the risks associated with potential changes to Social Security benefits.

In conclusion, the alarming Social Security statistic serves as a stark reminder of the challenges facing the system and the potential impact on millions of workers. Understanding these implications is essential for both policymakers and individuals as they navigate the complexities of retirement planning in an uncertain future. By addressing these issues head-on, it is possible to ensure that Social Security remains a reliable source of support for generations to come.

The Impact Of Social Security Instability On Retirement Plans

The stability of Social Security is a cornerstone of retirement planning for millions of workers across the United States. However, recent statistics have raised alarms about the future of this crucial program, putting the retirement plans of countless individuals at risk. As the population ages and the workforce dynamics shift, the sustainability of Social Security has become a pressing concern. Understanding the implications of these developments is essential for both current and future retirees.

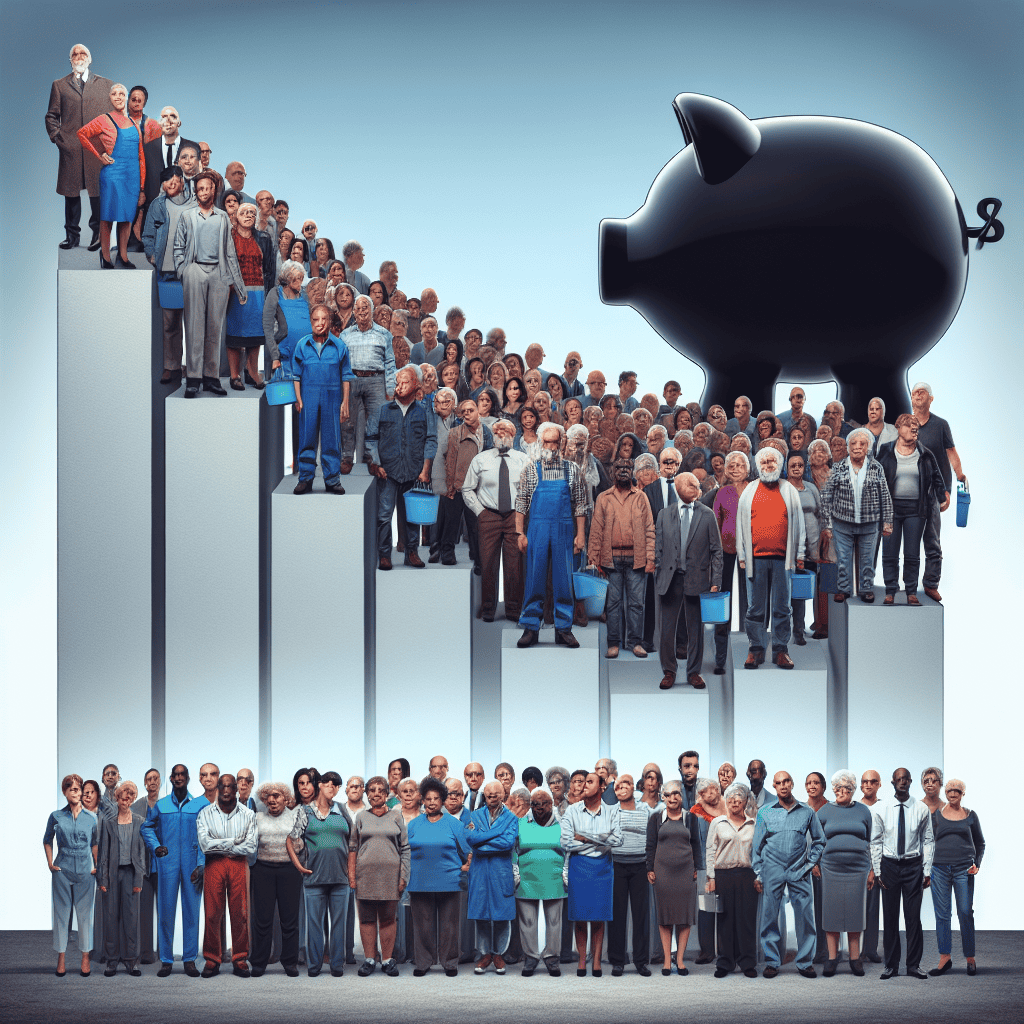

To begin with, Social Security has long been a vital source of income for retirees, providing financial support to those who have exited the workforce. It is designed to replace a portion of pre-retirement income based on lifetime earnings, thus ensuring a basic standard of living for the elderly. However, the program is facing significant challenges due to demographic changes. The aging baby boomer generation is retiring in large numbers, leading to an increased number of beneficiaries. Simultaneously, birth rates have declined, resulting in fewer workers contributing to the system. This imbalance between contributors and beneficiaries is straining the Social Security trust fund, which is projected to be depleted by the mid-2030s if no corrective measures are taken.

Moreover, the financial health of Social Security is further complicated by economic factors. Wage growth has been sluggish, and income inequality has widened, affecting the payroll tax revenues that fund the program. Additionally, longer life expectancies mean that retirees are drawing benefits for more extended periods, further exacerbating the financial strain. These factors combined create a precarious situation that threatens the reliability of Social Security as a dependable source of retirement income.

In light of these challenges, millions of workers are now facing uncertainty regarding their retirement plans. The potential reduction in Social Security benefits could significantly impact their financial security during retirement. For many, Social Security constitutes a substantial portion of their retirement income, and any cuts could lead to a lower standard of living. This is particularly concerning for low-income workers and those without substantial savings or private pensions, who rely heavily on Social Security to meet their basic needs.

To address these issues, policymakers are exploring various solutions to ensure the long-term viability of Social Security. Proposals include increasing the payroll tax rate, raising the cap on taxable earnings, and adjusting the retirement age to reflect longer life expectancies. However, these measures are often met with political resistance and require careful consideration to balance the interests of current and future beneficiaries.

In the meantime, individuals must take proactive steps to safeguard their retirement plans. Diversifying income sources, increasing personal savings, and investing in retirement accounts such as 401(k)s and IRAs can provide additional financial security. Financial literacy and planning are crucial in navigating the uncertainties surrounding Social Security and ensuring a stable retirement.

In conclusion, the instability of Social Security poses a significant risk to the retirement plans of millions of workers. As demographic and economic challenges continue to mount, it is imperative for both policymakers and individuals to take action. By understanding the implications of these alarming statistics and preparing accordingly, workers can better secure their financial futures in retirement. The path forward requires a collective effort to preserve the integrity of Social Security while empowering individuals to build resilient retirement strategies.

How Millions Of Workers Can Prepare For Potential Social Security Changes

As the landscape of retirement planning continues to evolve, millions of workers find themselves at a crossroads due to an alarming statistic regarding Social Security. Recent reports indicate that the Social Security trust fund may be depleted sooner than anticipated, potentially leading to reduced benefits for future retirees. This unsettling prospect underscores the importance of proactive financial planning to mitigate the impact of potential changes in Social Security. Consequently, workers must explore alternative strategies to secure their financial future.

To begin with, understanding the current state of Social Security is crucial. The program, which has long served as a financial safety net for retirees, is facing significant challenges due to demographic shifts and economic pressures. With an aging population and a declining worker-to-beneficiary ratio, the strain on Social Security is intensifying. As a result, the possibility of reduced benefits looms large, prompting workers to reassess their retirement strategies.

In light of these developments, diversifying retirement savings becomes imperative. Relying solely on Social Security is increasingly risky, and workers are encouraged to explore other avenues for building a robust retirement portfolio. One effective approach is to maximize contributions to employer-sponsored retirement plans, such as 401(k)s. These plans offer tax advantages and, in many cases, employer matching contributions, which can significantly enhance retirement savings over time.

Moreover, individual retirement accounts (IRAs) present another viable option for supplementing Social Security benefits. Traditional and Roth IRAs offer distinct tax advantages, allowing workers to tailor their savings strategy to their specific financial situation. By contributing consistently to these accounts, individuals can create a more secure financial cushion for their retirement years.

In addition to traditional retirement accounts, considering alternative investment vehicles can further bolster financial security. Diversifying investments across stocks, bonds, and real estate can provide a balanced approach to wealth accumulation. While these investments carry varying degrees of risk, they also offer the potential for higher returns, which can be crucial in offsetting any potential reductions in Social Security benefits.

Furthermore, delaying Social Security benefits can be a strategic move for those who are able to do so. By postponing the receipt of benefits beyond the full retirement age, individuals can increase their monthly payments, thereby enhancing their long-term financial stability. This strategy, however, requires careful consideration of one’s health, financial needs, and overall retirement goals.

In addition to financial strategies, staying informed about potential policy changes is essential. Engaging with financial advisors and staying abreast of legislative developments can provide valuable insights into how Social Security may evolve. This knowledge empowers workers to make informed decisions and adjust their retirement plans accordingly.

Ultimately, the prospect of changes to Social Security serves as a wake-up call for millions of workers. By taking proactive steps to diversify savings, explore alternative investments, and stay informed, individuals can better prepare for the uncertainties that lie ahead. While the future of Social Security remains uncertain, a well-rounded approach to retirement planning can provide a measure of security and peace of mind. As workers navigate this complex landscape, the importance of adaptability and foresight cannot be overstated.

Exploring Alternative Retirement Savings Options Amid Social Security Concerns

As concerns about the future of Social Security continue to mount, millions of workers find themselves at a crossroads, contemplating alternative retirement savings options. The alarming statistic that Social Security funds may be depleted sooner than anticipated has prompted a reevaluation of traditional retirement planning strategies. This situation underscores the importance of exploring diverse avenues to ensure financial security in one’s golden years.

The Social Security Administration has long been a cornerstone of retirement planning for countless Americans. However, recent projections indicate that the trust fund reserves could be exhausted by the mid-2030s if no legislative action is taken. This potential shortfall raises questions about the sustainability of relying solely on Social Security benefits for retirement income. Consequently, individuals are increasingly seeking alternative methods to supplement their future financial needs.

One viable option gaining traction is the employer-sponsored 401(k) plan. These plans offer employees the opportunity to contribute a portion of their salary to a tax-advantaged retirement account, often with the added benefit of employer matching contributions. By taking advantage of these plans, workers can build a substantial nest egg over time, independent of Social Security. Moreover, the tax-deferred growth of 401(k) investments allows for compounding returns, which can significantly enhance retirement savings.

In addition to 401(k) plans, Individual Retirement Accounts (IRAs) present another attractive alternative. IRAs offer flexibility in terms of investment choices and can be tailored to suit individual risk tolerances and financial goals. Traditional IRAs provide tax-deferred growth, while Roth IRAs offer tax-free withdrawals in retirement, provided certain conditions are met. This flexibility makes IRAs a valuable tool for diversifying retirement income sources and mitigating the risks associated with potential Social Security shortfalls.

Furthermore, the rise of financial technology has introduced innovative savings solutions, such as robo-advisors and micro-investing platforms. These digital tools democratize access to investment opportunities, allowing individuals to start saving with minimal initial capital. By leveraging technology, workers can automate their savings and investment strategies, ensuring consistent contributions toward their retirement goals. This approach not only simplifies the process but also empowers individuals to take control of their financial future.

While exploring these alternative options, it is crucial for individuals to consider their unique financial circumstances and retirement objectives. Consulting with a financial advisor can provide valuable insights and help tailor a comprehensive retirement plan that aligns with personal needs and aspirations. Advisors can also assist in navigating the complexities of tax implications, investment strategies, and risk management, ensuring a well-rounded approach to retirement savings.

In conclusion, the looming uncertainty surrounding Social Security necessitates a proactive approach to retirement planning. By diversifying income sources and exploring alternative savings options, individuals can safeguard their financial well-being in the face of potential Social Security challenges. As the landscape of retirement planning evolves, embracing a multifaceted strategy will be essential for securing a comfortable and sustainable future. Through informed decision-making and strategic financial planning, workers can mitigate the risks posed by alarming Social Security statistics and confidently navigate the path to a secure retirement.

The Role Of Government In Addressing Social Security Challenges

The role of government in addressing Social Security challenges has become increasingly critical as millions of workers find themselves at risk due to alarming statistics surrounding the program’s sustainability. Social Security, a cornerstone of the American social safety net since its inception in 1935, is designed to provide financial support to retirees, disabled individuals, and survivors of deceased workers. However, recent reports indicate that the Social Security Trust Fund is projected to be depleted by the mid-2030s, potentially leading to significant reductions in benefits if no corrective measures are taken. This looming crisis underscores the urgent need for government intervention to ensure the program’s long-term viability and protect the financial security of millions of Americans.

To address these challenges, the government must first acknowledge the demographic shifts that are placing unprecedented strain on the Social Security system. The aging population, characterized by the retirement of the baby boomer generation, has resulted in a higher number of beneficiaries relative to the number of contributing workers. This imbalance is further exacerbated by increased life expectancy, which extends the duration over which benefits are paid. Consequently, the government must explore strategies to recalibrate the system in response to these demographic realities.

One potential approach is to adjust the payroll tax rate, which funds Social Security. Currently, both employees and employers contribute a percentage of wages up to a certain income cap. By either increasing the tax rate or raising the income cap, the government could bolster the program’s financial reserves. However, such measures require careful consideration of their economic impact, as higher taxes could affect disposable income and consumer spending.

In addition to tax adjustments, the government could consider modifying the benefits structure. This might involve gradually increasing the full retirement age, reflecting longer life expectancies and encouraging individuals to remain in the workforce longer. Alternatively, implementing a means-tested approach to benefits could ensure that resources are directed toward those most in need, thereby preserving funds for future beneficiaries. While these options present viable solutions, they also pose challenges in terms of public acceptance and potential political ramifications.

Moreover, the government can play a pivotal role in fostering public awareness and understanding of Social Security’s challenges. By engaging in transparent communication and education efforts, policymakers can help demystify the complexities of the system and garner public support for necessary reforms. This involves not only highlighting the program’s current financial status but also outlining the potential consequences of inaction. Through informed dialogue, the government can build consensus around the need for change and encourage collective responsibility in safeguarding Social Security’s future.

Furthermore, the government must also consider the broader economic context in which Social Security operates. Economic growth, employment rates, and wage levels all influence the program’s financial health. Therefore, policies that promote economic stability and job creation can indirectly support Social Security by increasing the number of contributors and enhancing the program’s revenue base. By adopting a holistic approach that integrates Social Security reform with broader economic strategies, the government can address the program’s challenges more effectively.

In conclusion, the alarming statistics surrounding Social Security necessitate proactive government intervention to protect the financial well-being of millions of workers. By considering a range of policy options, from tax adjustments to benefits restructuring, and fostering public awareness, the government can navigate the complexities of Social Security reform. Ultimately, ensuring the program’s sustainability requires a concerted effort to balance demographic realities with economic considerations, thereby securing a stable future for all beneficiaries.

The Future Of Social Security: Predictions And Implications For Workers

The future of Social Security is a topic of growing concern, particularly as recent statistics reveal that millions of workers may be at risk. As the backbone of retirement planning for many Americans, Social Security provides crucial financial support to retirees, disabled individuals, and survivors of deceased workers. However, the sustainability of this program is increasingly in question, prompting discussions about its long-term viability and the implications for the workforce.

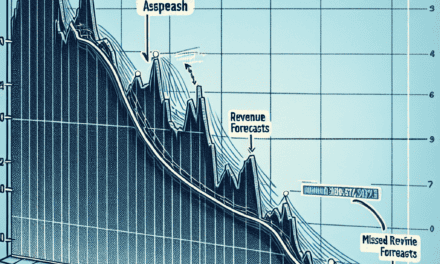

To understand the gravity of the situation, it is essential to examine the alarming statistic that has captured the attention of policymakers and economists alike. According to the latest projections from the Social Security Administration, the trust funds that support the program are expected to be depleted by 2034 if no legislative action is taken. This depletion would result in a significant reduction in benefits, potentially affecting millions of workers who rely on Social Security as a primary source of income during retirement.

The reasons behind this impending shortfall are multifaceted. One contributing factor is the demographic shift occurring in the United States. As the baby boomer generation continues to retire, the ratio of workers paying into the system compared to beneficiaries drawing from it is decreasing. This imbalance places additional strain on the program’s financial resources. Furthermore, increased life expectancy means that individuals are drawing benefits for longer periods, further exacerbating the financial challenges facing Social Security.

In light of these developments, it is crucial to consider the potential implications for workers. For many, Social Security represents a significant portion of their retirement income. A reduction in benefits could lead to financial insecurity for retirees, forcing them to rely more heavily on personal savings or continue working well into their later years. This scenario underscores the importance of proactive retirement planning and the need for individuals to diversify their sources of retirement income.

Moreover, the uncertainty surrounding Social Security’s future may also influence the behavior of current workers. Younger generations, in particular, may question the reliability of the program and adjust their savings strategies accordingly. This shift in mindset could lead to increased participation in employer-sponsored retirement plans, such as 401(k)s, or a greater emphasis on personal investment portfolios. While these strategies can provide additional financial security, they also place a greater burden on individuals to manage their retirement savings effectively.

In response to these challenges, policymakers are exploring various solutions to bolster the sustainability of Social Security. Potential reforms include increasing the payroll tax rate, raising the cap on taxable earnings, or adjusting the full retirement age. Each of these options carries its own set of advantages and drawbacks, and finding a consensus on the best path forward remains a contentious issue.

Ultimately, the future of Social Security is a complex and pressing concern that demands attention from both policymakers and the public. As discussions continue, it is imperative for workers to stay informed about potential changes to the program and to take proactive steps in planning for their financial futures. By understanding the risks and preparing accordingly, individuals can better navigate the uncertainties surrounding Social Security and secure a more stable retirement.

Personal Finance Strategies To Mitigate Social Security Risks

Millions of workers across the United States are facing an uncertain future due to an alarming statistic regarding Social Security. As the backbone of retirement planning for many Americans, Social Security is a critical component of financial stability in one’s later years. However, recent reports indicate that the Social Security trust fund may be depleted sooner than anticipated, potentially leading to reduced benefits for future retirees. This unsettling prospect necessitates a proactive approach to personal finance, urging individuals to explore strategies that can mitigate the risks associated with potential Social Security shortfalls.

To begin with, diversifying income sources is a prudent strategy to counterbalance the uncertainty surrounding Social Security. Relying solely on Social Security benefits can be precarious, especially if future payouts are reduced. Therefore, individuals should consider building a robust retirement portfolio that includes a mix of investments such as stocks, bonds, and real estate. By doing so, they can create multiple streams of income that can provide financial security independent of government programs. Moreover, contributing to employer-sponsored retirement plans like 401(k)s or individual retirement accounts (IRAs) can offer tax advantages and compound growth over time, further enhancing one’s financial resilience.

In addition to diversifying income sources, it is essential to adopt a disciplined savings approach. Establishing a habit of regular savings can significantly impact one’s financial future. Setting aside a portion of each paycheck into a high-yield savings account or a retirement fund can accumulate substantial wealth over the years. Furthermore, automating these savings can ensure consistency and reduce the temptation to spend rather than save. This disciplined approach not only prepares individuals for retirement but also provides a financial cushion in case of unexpected expenses or economic downturns.

Another effective strategy is to delay claiming Social Security benefits. While individuals are eligible to start receiving benefits at age 62, postponing claims until full retirement age or even later can result in significantly higher monthly payments. This increase is due to the delayed retirement credits that accrue for each year benefits are deferred. By waiting, individuals can maximize their Social Security income, which can be particularly beneficial if other retirement savings fall short.

Moreover, staying informed about Social Security policies and potential legislative changes is crucial. As the government grapples with the challenges facing the Social Security system, policy adjustments may occur. Being aware of these changes allows individuals to adapt their financial strategies accordingly. Consulting with a financial advisor can also provide personalized guidance tailored to one’s unique circumstances, ensuring that retirement plans remain on track despite external uncertainties.

Lastly, considering alternative income opportunities during retirement can further mitigate Social Security risks. Part-time work, freelancing, or starting a small business can supplement retirement income and provide a sense of purpose and engagement. These activities not only contribute financially but also offer social and mental benefits, enhancing overall well-being in retirement.

In conclusion, while the prospect of reduced Social Security benefits is concerning, individuals can take proactive steps to safeguard their financial future. By diversifying income sources, adopting disciplined savings habits, delaying benefit claims, staying informed about policy changes, and exploring alternative income opportunities, workers can mitigate the risks associated with potential Social Security shortfalls. These strategies empower individuals to take control of their financial destiny, ensuring a more secure and fulfilling retirement.

Q&A

1. **Question:** What is the alarming statistic related to Social Security?

**Answer:** The alarming statistic is that Social Security is projected to deplete its trust fund reserves by 2034, potentially leading to reduced benefits for millions of workers.

2. **Question:** How many workers are potentially at risk due to this statistic?

**Answer:** Millions of workers, particularly those who are currently paying into the system and expect to rely on Social Security for retirement, are at risk.

3. **Question:** What could happen to Social Security benefits if the trust fund is depleted?

**Answer:** If the trust fund is depleted, Social Security benefits could be reduced by about 20-25% unless legislative action is taken to address the shortfall.

4. **Question:** What are some proposed solutions to address the Social Security shortfall?

**Answer:** Proposed solutions include increasing the payroll tax rate, raising the cap on taxable income, reducing benefits, or a combination of these measures.

5. **Question:** How does the aging population affect Social Security’s financial health?

**Answer:** The aging population increases the number of beneficiaries while the ratio of workers to retirees decreases, putting additional financial strain on the Social Security system.

6. **Question:** What role does life expectancy play in the Social Security issue?

**Answer:** Increased life expectancy means that individuals are drawing benefits for a longer period, which contributes to the financial challenges facing Social Security.

7. **Question:** How might changes in the workforce impact Social Security’s future?

**Answer:** Changes such as lower birth rates, reduced immigration, and shifts in employment patterns can affect the number of workers contributing to Social Security, impacting its sustainability.

Conclusion

The alarming statistic regarding Social Security highlights a significant risk for millions of workers who may face financial insecurity in retirement. With the potential depletion of Social Security funds, many individuals could experience reduced benefits, leading to increased reliance on personal savings and other retirement plans. This situation underscores the urgent need for policy reforms to ensure the sustainability of Social Security and protect the financial well-being of future retirees. Additionally, it emphasizes the importance for workers to proactively plan and diversify their retirement savings to mitigate potential shortfalls.