“Wall Street Adjusts: Strong Data Dims Hopes for Fed Rate Cuts”

Introduction

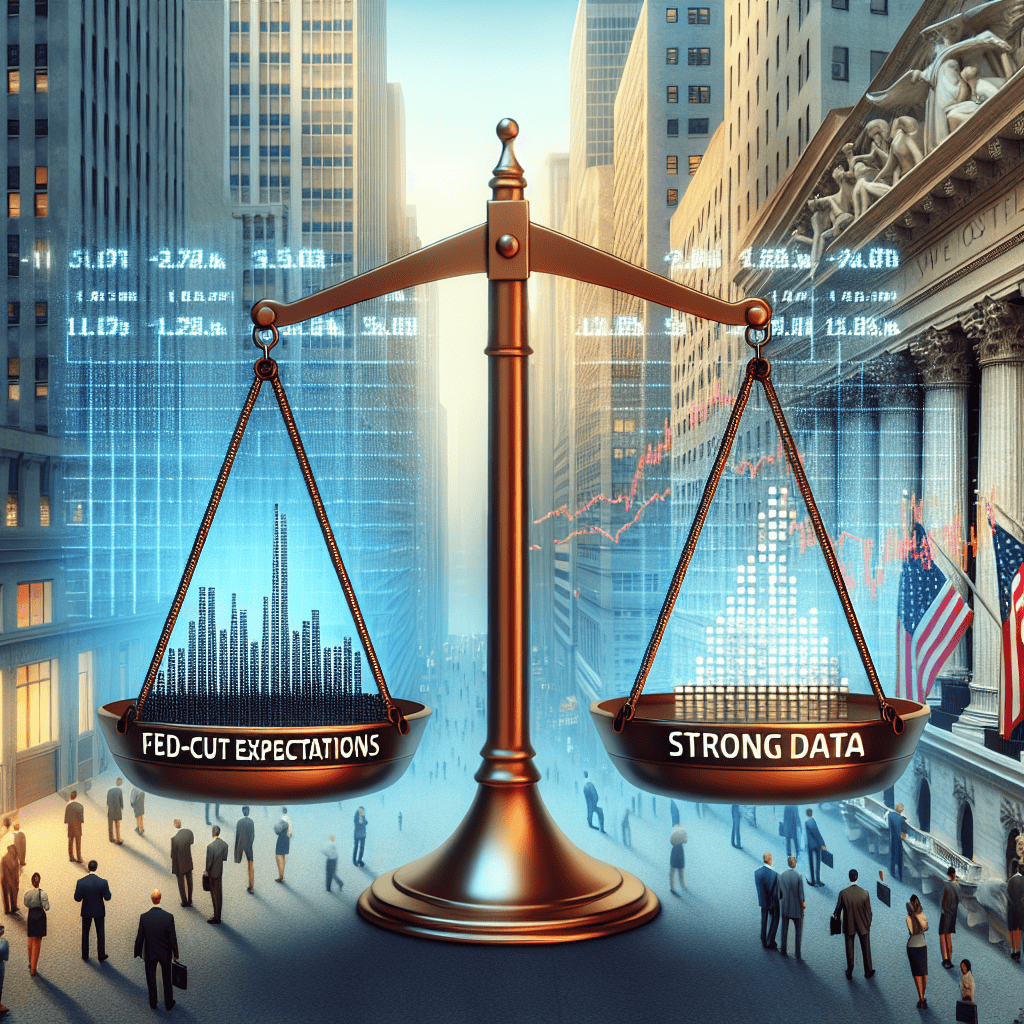

In recent developments, Wall Street has adjusted its expectations regarding potential interest rate cuts by the Federal Reserve, driven by a series of robust economic data releases. The recalibration comes as indicators such as employment figures, consumer spending, and manufacturing output suggest a resilient U.S. economy, diminishing the likelihood of imminent monetary easing. This shift in sentiment reflects a broader reassessment of economic conditions, as investors and analysts weigh the implications of sustained economic strength against the backdrop of ongoing inflationary pressures. The evolving market outlook underscores the dynamic interplay between economic indicators and monetary policy expectations, highlighting the complexities faced by policymakers in navigating the current economic landscape.

Impact Of Strong Economic Data On Wall Street’s Fed-Cut Expectations

In recent weeks, Wall Street has been closely monitoring economic indicators, and the latest data releases have prompted a reassessment of expectations regarding potential interest rate cuts by the Federal Reserve. The robust economic performance, as evidenced by key metrics, has led investors and analysts to recalibrate their forecasts, reducing the likelihood of imminent rate cuts. This shift in expectations underscores the dynamic interplay between economic data and monetary policy decisions, highlighting the importance of data-driven analysis in financial markets.

To begin with, the labor market has shown remarkable resilience, with unemployment rates remaining at historically low levels. This sustained strength in employment figures suggests that the economy is operating near full capacity, thereby reducing the urgency for the Federal Reserve to implement rate cuts as a stimulus measure. Furthermore, wage growth has been steady, contributing to increased consumer spending, which is a critical driver of economic growth. As consumer confidence remains high, the demand for goods and services continues to bolster economic activity, further diminishing the need for immediate monetary easing.

In addition to the labor market, inflation data has also played a pivotal role in shaping market expectations. Recent reports indicate that inflation is gradually approaching the Federal Reserve’s target, alleviating concerns about deflationary pressures. This development is significant because it suggests that the economy is on a stable trajectory, reducing the necessity for aggressive rate cuts to spur inflation. Consequently, market participants have adjusted their outlook, anticipating a more measured approach from the Federal Reserve in terms of monetary policy adjustments.

Moreover, the manufacturing sector has shown signs of recovery, with production levels rebounding after a period of contraction. This resurgence is indicative of a broader economic recovery, as manufacturing is often considered a bellwether for overall economic health. The improvement in manufacturing output has been supported by strong domestic demand and a gradual easing of supply chain disruptions, which have plagued the sector in recent years. As these challenges subside, the manufacturing sector’s positive momentum further diminishes the case for immediate rate cuts.

While the strong economic data has led to a reduction in Fed-cut expectations, it is important to note that the Federal Reserve remains vigilant in its assessment of economic conditions. Policymakers have emphasized their commitment to data dependency, indicating that future decisions will be guided by incoming economic information. This approach ensures that monetary policy remains flexible and responsive to changing economic dynamics, allowing the Federal Reserve to address potential risks as they arise.

In conclusion, the recent wave of strong economic data has prompted Wall Street to reassess its expectations regarding potential interest rate cuts by the Federal Reserve. The resilience of the labor market, coupled with steady inflation and a recovering manufacturing sector, has reduced the perceived need for immediate monetary easing. As a result, market participants are now anticipating a more cautious approach from the Federal Reserve, with future policy decisions likely to be influenced by ongoing economic developments. This evolving landscape underscores the critical role of economic data in shaping monetary policy expectations and highlights the importance of maintaining a vigilant and adaptive approach in navigating the complexities of financial markets.

Analyzing The Shift In Wall Street’s Interest Rate Predictions

In recent weeks, Wall Street has been closely monitoring economic indicators, leading to a notable shift in expectations regarding the Federal Reserve’s interest rate policy. Initially, many investors anticipated a series of rate cuts in the near future, driven by concerns over potential economic slowdowns and geopolitical uncertainties. However, a slew of robust economic data has prompted a reassessment of these expectations, suggesting that the Federal Reserve may maintain its current rate levels longer than previously anticipated.

The catalyst for this shift has been a series of strong economic reports, which have painted a picture of resilience in the U.S. economy. Key among these indicators is the labor market, which continues to demonstrate strength with low unemployment rates and steady job creation. This robust employment landscape has bolstered consumer confidence, leading to sustained consumer spending, a critical driver of economic growth. Furthermore, recent data on manufacturing and services sectors have shown unexpected expansion, defying earlier predictions of a slowdown.

In addition to domestic factors, global economic conditions have also played a role in shaping Wall Street’s revised outlook. While concerns over international trade tensions and geopolitical risks persist, recent developments have suggested a stabilization in some areas. For instance, easing trade tensions between major economies have alleviated some of the pressures that previously threatened global supply chains. This has, in turn, contributed to a more optimistic view of global economic prospects, reducing the urgency for the Federal Reserve to implement rate cuts as a preemptive measure.

Moreover, inflationary pressures have been a significant consideration in the recalibration of interest rate expectations. Recent data indicates that inflation, while still moderate, is showing signs of picking up. This trend is particularly evident in core inflation measures, which exclude volatile food and energy prices. As inflation approaches the Federal Reserve’s target, the central bank may be less inclined to lower rates, as doing so could risk overheating the economy.

The Federal Reserve’s own communications have also influenced market expectations. In recent statements, Fed officials have emphasized a data-dependent approach, indicating that future policy decisions will be guided by incoming economic data rather than predetermined paths. This stance has reinforced the notion that the central bank is prepared to adapt its policy in response to evolving economic conditions, further diminishing the likelihood of imminent rate cuts.

As Wall Street adjusts its expectations, the implications for financial markets are multifaceted. On one hand, the prospect of stable interest rates may provide support for equity markets, as investors gain confidence in the economy’s underlying strength. On the other hand, sectors that are sensitive to interest rate changes, such as real estate and utilities, may experience increased volatility as investors reassess their positions.

In conclusion, the recent shift in Wall Street’s interest rate predictions underscores the dynamic nature of economic forecasting. As new data emerges, market participants must continuously evaluate their assumptions and adjust their strategies accordingly. While the current outlook suggests a reduced likelihood of near-term rate cuts, the ever-changing economic landscape means that investors and policymakers alike must remain vigilant, ready to respond to new developments that could alter the trajectory of monetary policy.

How Robust Economic Indicators Influence Federal Reserve Policies

In recent weeks, Wall Street has adjusted its expectations regarding potential interest rate cuts by the Federal Reserve, driven by a series of robust economic indicators. This shift in sentiment underscores the intricate relationship between economic data and monetary policy decisions. As investors and analysts digest these developments, it becomes increasingly clear how pivotal economic indicators are in shaping the Federal Reserve’s approach to interest rates.

To begin with, the U.S. economy has demonstrated remarkable resilience, as evidenced by stronger-than-expected employment figures and consumer spending data. The labor market, in particular, has shown consistent strength, with unemployment rates remaining at historically low levels. This robust job market not only boosts consumer confidence but also fuels spending, which is a critical component of economic growth. Consequently, these positive indicators have led market participants to reassess their expectations for monetary policy adjustments.

Moreover, inflation, a key concern for the Federal Reserve, has shown signs of stabilizing. While inflationary pressures have been a persistent challenge, recent data suggests that price increases are moderating. This development provides the Federal Reserve with some breathing room, allowing it to maintain a cautious stance on interest rate cuts. The central bank’s dual mandate of promoting maximum employment and ensuring price stability necessitates a careful balancing act, and current economic conditions suggest that immediate rate cuts may not be necessary.

In addition to domestic factors, global economic conditions also play a significant role in shaping Federal Reserve policies. The international economic landscape has been marked by uncertainty, with geopolitical tensions and trade dynamics influencing market sentiment. However, recent improvements in global trade relations and a more stable geopolitical environment have contributed to a more optimistic outlook. This global context further supports the notion that the Federal Reserve may opt to maintain its current policy stance rather than pursue aggressive rate cuts.

Furthermore, financial markets have responded to these economic indicators with a degree of optimism. Equity markets have experienced upward momentum, reflecting investor confidence in the underlying strength of the economy. Bond markets, too, have adjusted, with yields reflecting the reduced likelihood of imminent rate cuts. These market reactions highlight the interconnectedness of economic data, investor sentiment, and monetary policy expectations.

As the Federal Reserve navigates this complex economic landscape, it remains committed to a data-driven approach. Policymakers have emphasized the importance of closely monitoring economic indicators to inform their decisions. This commitment to data-driven decision-making ensures that the Federal Reserve remains responsive to evolving economic conditions, thereby maintaining its credibility and effectiveness.

In conclusion, the recent adjustment in Wall Street’s expectations regarding Federal Reserve rate cuts underscores the profound influence of robust economic indicators on monetary policy. As the U.S. economy continues to demonstrate resilience, with strong employment figures and stabilizing inflation, the Federal Reserve is likely to maintain a cautious approach. This measured stance is further supported by improving global economic conditions and positive market reactions. Ultimately, the Federal Reserve’s commitment to a data-driven approach ensures that it remains well-equipped to navigate the complexities of the current economic environment, balancing its dual mandate while fostering economic stability.

Wall Street’s Reaction To Economic Strength: A Closer Look

In recent weeks, Wall Street has been closely monitoring economic indicators, and the latest data releases have prompted a reassessment of expectations regarding the Federal Reserve’s monetary policy. The robust economic performance has led investors to recalibrate their forecasts, particularly concerning potential interest rate cuts. This shift in sentiment is largely driven by a series of strong economic reports that suggest the U.S. economy is more resilient than previously anticipated.

To begin with, the labor market continues to demonstrate remarkable strength, with unemployment rates remaining at historically low levels. Recent job reports have consistently exceeded expectations, indicating that employers are still hiring at a healthy pace. This sustained job growth has bolstered consumer confidence, which in turn supports consumer spending—a critical component of economic activity. As a result, the Federal Reserve may find less urgency to cut interest rates, as the economy does not appear to be in immediate need of additional stimulus.

Moreover, inflationary pressures have shown signs of stabilizing, which further complicates the case for rate cuts. While inflation remains a concern for policymakers, recent data suggests that price increases are moderating. This development provides the Federal Reserve with some breathing room, allowing it to maintain its current policy stance without the immediate need to adjust rates downward. Consequently, market participants are revising their expectations, with many now predicting that the Fed will hold rates steady for the foreseeable future.

In addition to labor market and inflation data, other economic indicators have also contributed to the reassessment of Fed policy expectations. For instance, the manufacturing sector, which had shown signs of weakness earlier in the year, is beginning to recover. Recent reports indicate an uptick in manufacturing activity, suggesting that the sector may be poised for a rebound. This improvement is likely to alleviate some concerns about a potential economic slowdown, further reducing the likelihood of imminent rate cuts.

Furthermore, the housing market has remained relatively stable, with home sales and prices holding steady despite previous concerns about affordability and rising mortgage rates. This stability in the housing sector is another factor that supports the view that the economy is on solid footing. As housing is a significant driver of economic growth, its resilience adds to the argument against the need for immediate monetary easing.

As Wall Street digests these developments, the focus is shifting towards the Federal Reserve’s upcoming meetings and statements. Investors are keenly interested in any signals from the Fed regarding its future policy direction. While the central bank has maintained a data-dependent approach, the recent strength in economic indicators suggests that it may adopt a more cautious stance on rate cuts. This evolving narrative is reflected in the financial markets, where expectations for rate reductions have been tempered.

In conclusion, Wall Street’s reaction to the recent spate of strong economic data underscores the dynamic nature of market expectations. As the economy continues to demonstrate resilience, the likelihood of near-term interest rate cuts by the Federal Reserve appears to be diminishing. Investors will continue to scrutinize forthcoming economic reports and Fed communications for further insights into the central bank’s policy trajectory. This ongoing analysis will undoubtedly shape market sentiment and influence investment strategies in the months ahead.

The Role Of Economic Data In Shaping Federal Reserve Expectations

In recent months, the financial markets have been closely monitoring economic indicators to gauge the Federal Reserve’s future monetary policy decisions. The interplay between economic data and Federal Reserve expectations is a critical aspect of market dynamics, influencing investor sentiment and asset prices. Recently, Wall Street has adjusted its expectations regarding potential interest rate cuts by the Federal Reserve, largely due to a series of robust economic data releases. This shift underscores the significant role that economic data plays in shaping monetary policy forecasts.

To begin with, economic data serves as a barometer for the health of the economy, providing insights into various sectors such as employment, inflation, and consumer spending. When data points to a strong economy, it often leads to a reassessment of monetary policy expectations. For instance, recent reports have shown a resilient labor market, with unemployment rates remaining low and job creation exceeding forecasts. Such data suggests that the economy is on solid footing, reducing the urgency for the Federal Reserve to implement rate cuts as a stimulus measure.

Moreover, inflation figures have also played a pivotal role in shaping expectations. While inflation has been a concern for policymakers, recent data indicates that price pressures are moderating, albeit gradually. This moderation in inflation reduces the immediate need for aggressive monetary easing, as the Federal Reserve aims to balance its dual mandate of promoting maximum employment and stabilizing prices. Consequently, Wall Street’s anticipation of rate cuts has been tempered, reflecting a more cautious outlook on the trajectory of monetary policy.

In addition to employment and inflation, consumer spending is another critical component influencing Federal Reserve expectations. Strong consumer spending data suggests that households remain confident in their financial prospects, further supporting the notion of a robust economy. This confidence is often reflected in increased retail sales and higher demand for goods and services, which in turn can lead to upward pressure on prices. As a result, the Federal Reserve may opt to maintain its current interest rate stance to prevent the economy from overheating.

Furthermore, the global economic landscape also plays a role in shaping Federal Reserve expectations. While domestic data is paramount, international developments can influence the central bank’s policy decisions. For example, geopolitical tensions or economic slowdowns in major economies can impact global trade and financial markets, prompting the Federal Reserve to consider external factors when formulating its policy stance. However, with recent data indicating resilience in both domestic and international markets, the impetus for immediate rate cuts has diminished.

In conclusion, the relationship between economic data and Federal Reserve expectations is a dynamic and intricate one. As recent strong data releases have demonstrated, robust economic indicators can lead to a recalibration of market expectations regarding monetary policy. Wall Street’s reduced anticipation of rate cuts highlights the importance of economic data in shaping these expectations. As investors and policymakers continue to navigate the complexities of the economic landscape, the ongoing analysis of data will remain a crucial element in forecasting the Federal Reserve’s future actions. This intricate dance between data and policy underscores the ever-evolving nature of financial markets and the critical role that economic indicators play in guiding monetary policy decisions.

Understanding The Connection Between Market Trends And Fed Decisions

In recent months, the intricate relationship between market trends and Federal Reserve decisions has become increasingly evident, as Wall Street analysts adjust their expectations in response to robust economic data. The Federal Reserve, tasked with maintaining economic stability, often finds itself at the center of market speculation, particularly regarding interest rate adjustments. As economic indicators continue to show strength, the anticipation of potential rate cuts has diminished, prompting a reevaluation of market strategies.

The connection between market trends and Federal Reserve decisions is a complex interplay of economic indicators, investor sentiment, and policy objectives. When the economy exhibits signs of strength, such as low unemployment rates, rising consumer spending, and increased industrial production, the Federal Reserve may opt to maintain or even raise interest rates to prevent overheating. Conversely, in times of economic downturn, the Fed might lower rates to stimulate growth. This dynamic creates a feedback loop where market participants continuously adjust their expectations based on the Fed’s perceived trajectory.

Recently, a series of strong economic data releases have led Wall Street to reduce its expectations for imminent rate cuts. For instance, robust job growth figures and resilient consumer spending have painted a picture of an economy that, while facing challenges, remains fundamentally sound. These indicators suggest that the Federal Reserve may not feel the urgency to lower rates as previously anticipated. Consequently, investors are recalibrating their strategies, taking into account the possibility of a prolonged period of stable or even higher interest rates.

The implications of these adjustments are far-reaching. For one, the bond market, which is highly sensitive to interest rate changes, has experienced fluctuations as traders reassess the likelihood of future rate cuts. Yields on government bonds, which move inversely to prices, have seen upward pressure as expectations for rate cuts wane. This shift in bond market dynamics can influence borrowing costs for businesses and consumers, potentially impacting investment decisions and economic growth.

Moreover, equity markets are also affected by changes in interest rate expectations. Higher interest rates can lead to increased borrowing costs for companies, which may dampen corporate profits and, in turn, affect stock valuations. As a result, sectors that are particularly sensitive to interest rates, such as real estate and utilities, may experience heightened volatility. Investors, therefore, must navigate these complexities, balancing the potential risks and rewards associated with shifting monetary policy expectations.

In addition to domestic factors, global economic conditions also play a crucial role in shaping the Federal Reserve’s decisions and, by extension, market trends. Geopolitical tensions, trade dynamics, and international economic performance can all influence the Fed’s policy considerations. As such, market participants must remain vigilant, monitoring not only domestic indicators but also global developments that could sway the Fed’s approach.

In conclusion, the relationship between market trends and Federal Reserve decisions is a dynamic and multifaceted one, influenced by a myriad of economic indicators and global factors. As Wall Street adjusts its expectations in light of strong economic data, the implications for both bond and equity markets are significant. Investors must remain agile, continuously reassessing their strategies to align with the evolving economic landscape. Understanding this intricate connection is essential for navigating the complexities of today’s financial markets, ensuring informed decision-making in an ever-changing environment.

Wall Street’s Changing Outlook On Interest Rates: Key Factors

In recent weeks, Wall Street has been closely monitoring economic indicators to gauge the Federal Reserve’s future monetary policy moves. The prevailing sentiment among investors has shifted, with many now reducing their expectations for imminent interest rate cuts. This change in outlook is primarily driven by a series of robust economic data releases that suggest the U.S. economy remains resilient despite previous concerns of a slowdown. As a result, market participants are recalibrating their strategies, taking into account the possibility that the Federal Reserve may maintain its current interest rate levels for a longer period than previously anticipated.

One of the key factors influencing this shift in expectations is the strength of the labor market. Recent employment reports have consistently shown solid job growth, with unemployment rates remaining near historic lows. This sustained labor market strength has bolstered consumer confidence, leading to increased spending and economic activity. Consequently, the Federal Reserve may perceive less urgency to cut interest rates as a means of stimulating the economy, given that consumer spending accounts for a significant portion of economic growth.

In addition to the robust labor market, inflation data has also played a crucial role in shaping Wall Street’s outlook on interest rates. While inflation has been a concern for policymakers, recent data indicates that price pressures are moderating. The Federal Reserve’s preferred measure of inflation, the Personal Consumption Expenditures (PCE) price index, has shown signs of stabilizing, suggesting that inflationary pressures may not be as persistent as once feared. This development provides the Federal Reserve with some breathing room, allowing it to adopt a more cautious approach to rate adjustments.

Moreover, the global economic landscape has also contributed to the evolving expectations regarding Federal Reserve policy. Despite geopolitical tensions and trade uncertainties, the global economy has demonstrated resilience, with key trading partners showing signs of recovery. This global stability reduces the likelihood of external shocks that could necessitate immediate monetary easing by the Federal Reserve. As a result, Wall Street analysts are increasingly factoring in the possibility that the central bank may prioritize maintaining its current policy stance to support continued economic expansion.

Furthermore, financial markets have responded to these developments with notable adjustments. Bond yields have risen as investors reassess the likelihood of near-term rate cuts, reflecting a recalibration of risk and return expectations. Equity markets, on the other hand, have experienced increased volatility as investors weigh the implications of a potentially prolonged period of stable interest rates. This dynamic underscores the interconnectedness of economic indicators and market sentiment, highlighting the importance of closely monitoring data releases and Federal Reserve communications.

In conclusion, Wall Street’s changing outlook on interest rates is a reflection of the complex interplay between economic data, market sentiment, and Federal Reserve policy. As strong economic indicators continue to emerge, investors are adjusting their expectations, recognizing that the central bank may opt for a more measured approach to interest rate adjustments. This evolving perspective underscores the importance of remaining vigilant and adaptable in the face of shifting economic conditions. As the Federal Reserve navigates this intricate landscape, market participants will continue to scrutinize data releases and policy statements, seeking to anticipate the central bank’s next moves in an ever-changing economic environment.

Q&A

1. **Question:** What recent data has influenced Wall Street’s expectations regarding Federal Reserve rate cuts?

– **Answer:** Strong economic data, such as robust employment figures and higher-than-expected GDP growth, has influenced Wall Street’s expectations.

2. **Question:** How has the strong economic data affected the stock market?

– **Answer:** The strong economic data has led to a reduction in expectations for Federal Reserve rate cuts, which has caused some volatility and declines in the stock market.

3. **Question:** What sectors have been most impacted by the change in Fed-cut expectations?

– **Answer:** Interest rate-sensitive sectors, such as real estate and utilities, have been most impacted by the change in Fed-cut expectations.

4. **Question:** How have bond yields reacted to the reduced expectations for Fed rate cuts?

– **Answer:** Bond yields have generally increased as investors adjust to the possibility of fewer rate cuts by the Federal Reserve.

5. **Question:** What is the Federal Reserve’s current stance on interest rates?

– **Answer:** The Federal Reserve has maintained a cautious stance, indicating that future rate decisions will be data-dependent and that they are monitoring economic indicators closely.

6. **Question:** How have investors adjusted their portfolios in response to the strong economic data?

– **Answer:** Investors have shifted towards more growth-oriented stocks and away from defensive sectors, anticipating continued economic strength.

7. **Question:** What are analysts predicting for the Federal Reserve’s next move?

– **Answer:** Analysts are predicting that the Federal Reserve may hold off on rate cuts in the near term, given the strong economic data, but remain open to adjustments if conditions change.

Conclusion

The recent market update indicates that Wall Street has adjusted its expectations regarding potential interest rate cuts by the Federal Reserve, driven by stronger-than-anticipated economic data. This shift suggests that investors are recalibrating their outlook on monetary policy, anticipating that the Fed may maintain higher interest rates for a longer period to manage inflation and sustain economic growth. The robust data points, likely reflecting improvements in employment, consumer spending, or industrial output, have led to a reassessment of the economic landscape, influencing market sentiment and investment strategies. As a result, the anticipation of immediate rate cuts has diminished, highlighting the dynamic interplay between economic indicators and monetary policy expectations.