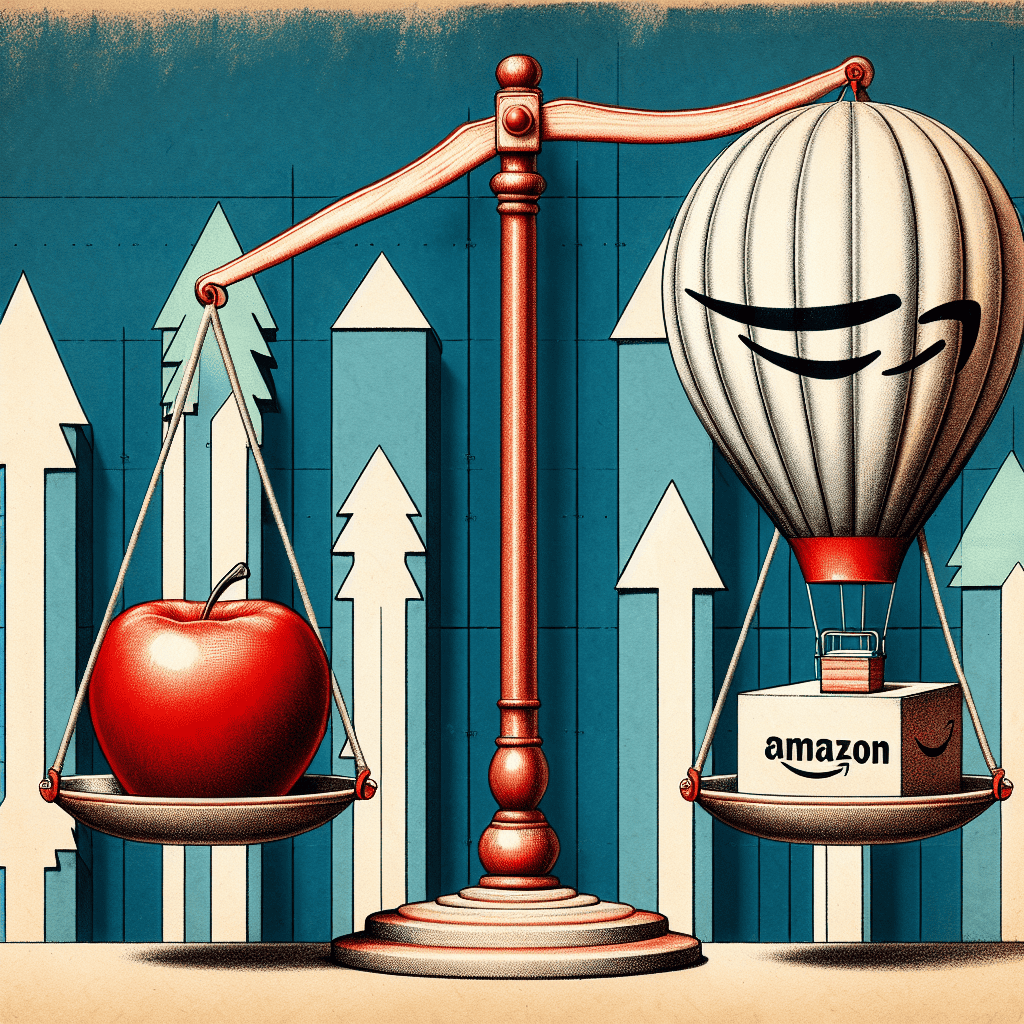

“Tech Titans Tussle: Apple Dips, Amazon Soars in a Volatile Market Dance”

Introduction

In the latest market update, the stock performance of major technology companies presented a mixed picture, with Apple experiencing a decline while Amazon saw a rise. This fluctuation comes amid a broader landscape of varied stock movements, reflecting investor reactions to recent earnings reports, economic indicators, and sector-specific developments. Apple’s dip in stock value follows concerns over supply chain disruptions and regulatory challenges, whereas Amazon’s upward trajectory is attributed to strong quarterly earnings and optimistic growth forecasts. As these tech giants navigate the complexities of the current economic environment, their stock performances continue to be closely watched by investors and analysts alike, highlighting the dynamic nature of the market.

Apple Stock Decline: Analyzing the Factors Behind the Drop

In recent trading sessions, Apple Inc. has experienced a notable decline in its stock value, prompting investors and analysts to scrutinize the underlying factors contributing to this downturn. This decline comes amid a broader landscape of mixed stock performance, where some companies, such as Amazon, have seen their shares rise. To understand the dynamics at play, it is essential to delve into the specific elements influencing Apple’s current market position.

One of the primary factors contributing to Apple’s stock decline is the company’s recent earnings report, which, while robust, fell short of market expectations. Despite posting strong revenue figures, Apple’s guidance for the upcoming quarters was more conservative than anticipated, leading to investor apprehension. This cautious outlook is partly attributed to ongoing supply chain challenges that have been affecting the tech industry at large. The global semiconductor shortage, for instance, has disrupted production timelines and constrained the availability of key components necessary for Apple’s product lineup. Consequently, this has raised concerns about the company’s ability to meet consumer demand during critical sales periods.

Moreover, Apple’s stock performance has been influenced by broader macroeconomic conditions. Rising inflation rates and potential interest rate hikes have created an environment of uncertainty, prompting investors to reassess their portfolios. In such a climate, tech stocks, which are often seen as more volatile, can experience heightened sensitivity to market fluctuations. Apple’s significant market capitalization and its role as a bellwether for the tech sector mean that any shifts in investor sentiment can have pronounced effects on its stock price.

In addition to these external factors, internal company dynamics have also played a role in the recent stock decline. Apple’s ongoing legal battles, particularly its high-profile case against Epic Games, have drawn attention to the company’s App Store policies and raised questions about potential regulatory changes. The outcome of these legal proceedings could have far-reaching implications for Apple’s business model, particularly in terms of revenue generated from its services segment. Investors are closely monitoring these developments, as any adverse rulings could necessitate strategic adjustments that might impact future earnings.

Furthermore, competitive pressures within the technology sector cannot be overlooked. Rivals such as Samsung and Google continue to innovate and expand their product offerings, challenging Apple’s market share in key areas like smartphones and wearable devices. As these competitors introduce new features and technologies, Apple faces the ongoing task of maintaining its reputation for innovation and customer loyalty. This competitive landscape requires Apple to consistently deliver groundbreaking products, a challenge that becomes more pronounced in times of supply chain disruptions and economic uncertainty.

Despite these challenges, it is important to recognize that Apple’s fundamentals remain strong. The company boasts a loyal customer base, a diverse product ecosystem, and a track record of resilience in navigating market fluctuations. While the current stock decline may cause concern among investors, it is also an opportunity for the company to address these challenges head-on and reinforce its position as a leader in the tech industry.

In conclusion, Apple’s recent stock decline can be attributed to a confluence of factors, including supply chain disruptions, macroeconomic conditions, legal challenges, and competitive pressures. As the company navigates these complexities, investors will be keenly observing its strategic responses and future performance. While uncertainties remain, Apple’s history of adaptability and innovation suggests that it is well-equipped to overcome these hurdles and continue its trajectory of growth.

Amazon’s Rise: Key Drivers of Its Recent Stock Performance

In recent weeks, the stock market has exhibited a mixed performance, with some companies experiencing notable gains while others face declines. Among the most prominent movements, Amazon has emerged as a standout performer, contrasting sharply with Apple’s recent downturn. This divergence in stock performance can be attributed to several key factors that have driven Amazon’s rise, offering insights into the dynamics shaping the current market landscape.

To begin with, Amazon’s recent stock performance can be largely attributed to its robust financial results, which have exceeded market expectations. The company’s latest earnings report revealed a significant increase in revenue, driven by strong growth in its core e-commerce business and its rapidly expanding cloud computing division, Amazon Web Services (AWS). AWS, in particular, has been a major contributor to Amazon’s profitability, as businesses increasingly rely on cloud solutions to enhance their operations. This growth trajectory has instilled confidence among investors, who view Amazon’s diversified business model as a strategic advantage in an ever-evolving market.

Moreover, Amazon’s strategic investments in technology and infrastructure have further bolstered its market position. The company has consistently prioritized innovation, investing heavily in areas such as artificial intelligence, logistics, and automation. These investments have not only enhanced operational efficiency but have also positioned Amazon at the forefront of technological advancements. As a result, the company is well-equipped to capitalize on emerging trends and maintain its competitive edge, a factor that has resonated positively with investors.

In addition to its financial performance and strategic investments, Amazon’s ability to adapt to changing consumer behaviors has played a crucial role in its stock’s upward trajectory. The COVID-19 pandemic accelerated the shift towards online shopping, and Amazon was quick to respond by expanding its delivery network and enhancing its digital offerings. This adaptability has allowed the company to capture a larger share of the market, reinforcing its status as a dominant player in the retail sector. As consumer preferences continue to evolve, Amazon’s agility in meeting these demands remains a key driver of its stock performance.

Furthermore, Amazon’s commitment to sustainability and corporate responsibility has also contributed to its favorable market perception. The company has made significant strides in reducing its carbon footprint and promoting sustainable practices across its operations. Initiatives such as the Climate Pledge, which aims to achieve net-zero carbon emissions by 2040, have garnered support from environmentally conscious investors. This focus on sustainability not only aligns with global trends but also enhances Amazon’s brand reputation, attracting a broader base of investors who prioritize ethical considerations.

While Amazon’s rise is noteworthy, it is important to acknowledge the broader market context in which these developments are occurring. The stock market remains volatile, influenced by factors such as inflation concerns, geopolitical tensions, and shifts in monetary policy. In this environment, companies that demonstrate resilience and adaptability are likely to fare better, as evidenced by Amazon’s recent performance.

In conclusion, Amazon’s rise amid mixed stock performance can be attributed to a combination of strong financial results, strategic investments, adaptability to consumer trends, and a commitment to sustainability. These factors have collectively positioned the company as a leader in the market, offering valuable insights into the drivers of its recent stock performance. As the market continues to evolve, Amazon’s ability to navigate challenges and capitalize on opportunities will be crucial in sustaining its upward trajectory.

Mixed Stock Performance: What It Means for Investors

In the ever-evolving landscape of the stock market, investors are constantly seeking to understand the implications of mixed stock performances. Recently, the market has presented a particularly intriguing scenario, with tech giants Apple and Amazon moving in opposite directions. This divergence in performance underscores the complexities and nuances that investors must navigate in today’s financial environment.

Apple, a stalwart in the technology sector, has experienced a decline in its stock value. Several factors contribute to this downturn, including concerns over supply chain disruptions and increased competition in the smartphone market. Additionally, regulatory pressures and geopolitical tensions have added layers of uncertainty, impacting investor confidence. As Apple grapples with these challenges, its stock performance serves as a reminder of the inherent volatility in the tech industry. Investors, therefore, must remain vigilant, considering both macroeconomic factors and company-specific developments when making investment decisions.

Conversely, Amazon has witnessed a rise in its stock value, buoyed by strong performance in its e-commerce and cloud computing divisions. The company’s ability to adapt to changing consumer behaviors and its continued expansion into new markets have bolstered investor sentiment. Furthermore, Amazon’s strategic investments in logistics and technology have positioned it well to capitalize on future growth opportunities. This upward trajectory highlights the importance of innovation and strategic foresight in maintaining a competitive edge in the market.

The mixed performance of these two tech giants reflects broader trends within the stock market. On one hand, the market is influenced by global economic conditions, such as inflation rates, interest rate policies, and international trade dynamics. On the other hand, company-specific factors, including leadership decisions, product launches, and financial health, play a crucial role in shaping stock performance. As such, investors must adopt a multifaceted approach, balancing macroeconomic insights with detailed company analyses to make informed investment choices.

Moreover, the current market environment underscores the significance of diversification in investment portfolios. By spreading investments across various sectors and asset classes, investors can mitigate risks associated with individual stock volatility. This strategy not only provides a buffer against market fluctuations but also enhances the potential for long-term returns. In light of the mixed performances of Apple and Amazon, diversification emerges as a prudent approach for investors seeking to navigate the complexities of the stock market.

In addition to diversification, investors should also consider the role of technological advancements and innovation in shaping market dynamics. Companies that prioritize research and development, embrace digital transformation, and leverage data analytics are better positioned to thrive in an increasingly competitive landscape. As such, investors should evaluate a company’s commitment to innovation as a key factor in their investment decisions.

In conclusion, the mixed stock performance of Apple and Amazon offers valuable insights into the current state of the market. While Apple’s decline highlights the challenges and uncertainties facing the tech industry, Amazon’s rise underscores the importance of adaptability and strategic foresight. For investors, these developments emphasize the need for a comprehensive approach that considers both macroeconomic trends and company-specific factors. By embracing diversification and prioritizing innovation, investors can better navigate the complexities of the stock market and position themselves for long-term success.

Market Trends: How Tech Giants Are Shaping the Stock Market

In recent trading sessions, the stock market has exhibited a mixed performance, with notable fluctuations among major technology companies. Apple Inc., a stalwart in the tech industry, has experienced a decline in its stock value, while Amazon.com Inc. has seen a rise, reflecting the dynamic nature of market trends and investor sentiment. This divergence in performance among tech giants underscores the complexities of the current economic landscape and the factors influencing investor decisions.

Apple’s recent decline can be attributed to several factors, including concerns over supply chain disruptions and regulatory challenges. The global semiconductor shortage has continued to impact Apple’s production capabilities, leading to potential delays in product launches and a subsequent dip in investor confidence. Additionally, increased scrutiny from regulatory bodies, particularly in the European Union, has raised questions about Apple’s business practices, further contributing to the downward pressure on its stock. These challenges highlight the vulnerabilities even the most established companies face in an ever-evolving market environment.

Conversely, Amazon’s stock has been on an upward trajectory, buoyed by strong performance in its core e-commerce and cloud computing segments. The company’s ability to adapt to changing consumer behaviors, particularly the sustained shift towards online shopping, has reinforced its market position. Moreover, Amazon Web Services (AWS) continues to be a significant growth driver, as businesses increasingly rely on cloud solutions to enhance operational efficiency. This dual strength in retail and technology services has positioned Amazon favorably in the eyes of investors, who are optimistic about its long-term growth prospects.

The contrasting fortunes of Apple and Amazon illustrate the broader trends shaping the stock market, where technology companies play a pivotal role. As digital transformation accelerates across industries, companies that can effectively leverage technology to meet evolving consumer demands are likely to thrive. However, this also means that they must navigate a complex web of challenges, including regulatory scrutiny, supply chain issues, and competitive pressures. Investors, therefore, must remain vigilant and discerning, assessing not only the immediate performance of these companies but also their strategic positioning for future growth.

Furthermore, the mixed performance of tech giants like Apple and Amazon reflects broader economic uncertainties, including inflationary pressures and geopolitical tensions. These factors contribute to market volatility, as investors weigh the potential impact on corporate earnings and global trade. In this context, diversification becomes a crucial strategy for investors seeking to mitigate risks and capitalize on opportunities across different sectors.

In conclusion, the recent stock market performance of Apple and Amazon underscores the intricate dynamics at play within the technology sector. While Apple grapples with supply chain and regulatory challenges, Amazon’s robust growth in e-commerce and cloud computing highlights its resilience and adaptability. As these tech giants continue to shape the stock market landscape, investors must remain attuned to the evolving trends and challenges that influence their performance. By doing so, they can make informed decisions that align with their investment goals and risk tolerance, navigating the complexities of a rapidly changing market environment.

Investment Strategies: Navigating Volatile Market Conditions

In the ever-evolving landscape of financial markets, investors are constantly seeking strategies to navigate the complexities of volatile market conditions. Recent fluctuations in the stock market have underscored the importance of adaptability and informed decision-making. Notably, the performance of major technology stocks such as Apple and Amazon has captured the attention of investors, as these companies often serve as bellwethers for broader market trends. As Apple experiences a decline and Amazon sees a rise, understanding the underlying factors and potential strategies becomes crucial for investors aiming to optimize their portfolios.

Apple’s recent decline can be attributed to a confluence of factors, including supply chain disruptions and increased competition in the technology sector. The global semiconductor shortage has posed significant challenges for Apple, impacting its ability to meet consumer demand for its products. Additionally, the competitive landscape has intensified, with rival companies launching innovative products that vie for consumer attention. These dynamics have contributed to a cautious sentiment among investors, leading to a dip in Apple’s stock performance. However, it is essential to recognize that Apple’s robust brand loyalty and history of innovation may provide a foundation for recovery in the long term.

Conversely, Amazon’s rise in stock value highlights the company’s resilience and adaptability in the face of market volatility. The e-commerce giant has continued to expand its reach, capitalizing on the growing trend of online shopping and diversifying its revenue streams through ventures such as cloud computing and digital advertising. Amazon’s ability to leverage its vast infrastructure and technological capabilities has positioned it favorably in the current market environment. This upward trajectory serves as a reminder of the potential benefits of investing in companies with strong fundamentals and a proven track record of growth.

In light of these developments, investors are encouraged to adopt a diversified investment strategy to mitigate risks associated with market volatility. Diversification involves spreading investments across various asset classes, sectors, and geographic regions to reduce exposure to any single market event. By doing so, investors can potentially enhance their portfolio’s resilience and achieve more stable returns over time. Moreover, staying informed about macroeconomic trends and company-specific developments is crucial for making timely and informed investment decisions.

Furthermore, investors may consider incorporating a mix of growth and value stocks into their portfolios. Growth stocks, such as Amazon, offer the potential for substantial capital appreciation, driven by the company’s ability to expand its market share and increase earnings. On the other hand, value stocks, which may be undervalued by the market, present opportunities for investors seeking to capitalize on price discrepancies. Balancing these two approaches can provide a well-rounded investment strategy that aligns with individual risk tolerance and financial goals.

In conclusion, the mixed performance of stocks like Apple and Amazon underscores the dynamic nature of financial markets and the need for strategic investment approaches. By understanding the factors influencing stock movements and employing diversification, investors can better navigate volatile market conditions. As the market continues to evolve, maintaining a disciplined and informed investment strategy will be key to achieving long-term financial success. Through careful analysis and a proactive approach, investors can position themselves to capitalize on opportunities and mitigate risks in an ever-changing market landscape.

Apple vs. Amazon: A Comparative Analysis of Recent Stock Movements

In recent weeks, the stock market has witnessed a series of fluctuations, with technology giants Apple and Amazon at the forefront of these movements. Investors and analysts alike have been closely monitoring these two companies, as their performance often serves as a bellwether for the broader tech sector. While Apple has experienced a decline in its stock value, Amazon has seen a notable rise, prompting a comparative analysis of the factors influencing these divergent trends.

To begin with, Apple’s recent decline can be attributed to several key factors. One significant element is the company’s latest earnings report, which, although robust, fell short of market expectations. Despite posting strong revenue figures, Apple’s guidance for the upcoming quarters was more conservative than anticipated, leading to a cautious outlook among investors. Additionally, supply chain disruptions have continued to pose challenges for Apple, particularly in the production of its flagship products like the iPhone. These disruptions have not only affected production timelines but have also raised concerns about the company’s ability to meet consumer demand during the crucial holiday season.

Moreover, Apple’s stock has been impacted by broader market trends, including rising interest rates and inflationary pressures. As interest rates increase, the cost of borrowing rises, which can dampen consumer spending and, in turn, affect companies like Apple that rely heavily on consumer purchases. Inflation, on the other hand, has led to increased production costs, which could potentially squeeze profit margins if not managed effectively. These macroeconomic factors have contributed to a more cautious sentiment among investors, further influencing Apple’s stock performance.

In contrast, Amazon has experienced a rise in its stock value, driven by a combination of strong financial performance and strategic initiatives. The company’s recent earnings report exceeded market expectations, showcasing impressive growth in its cloud computing division, Amazon Web Services (AWS). AWS continues to be a major revenue driver for Amazon, with its robust performance offsetting slower growth in other areas of the business. Furthermore, Amazon’s focus on expanding its logistics and delivery capabilities has positioned the company well to capitalize on the ongoing shift towards e-commerce, particularly as consumers increasingly prioritize convenience and speed.

Additionally, Amazon’s strategic investments in emerging technologies, such as artificial intelligence and automation, have bolstered investor confidence. These investments are seen as long-term growth drivers that could enhance operational efficiency and open new revenue streams. As a result, Amazon’s stock has benefited from a more optimistic outlook, contrasting with the cautious sentiment surrounding Apple.

It is also worth noting that the broader market environment has played a role in shaping the performance of both companies. While tech stocks have generally faced headwinds due to macroeconomic factors, Amazon’s diversified business model has provided a degree of resilience. In contrast, Apple’s reliance on consumer electronics has made it more susceptible to fluctuations in consumer spending and supply chain challenges.

In conclusion, the recent stock movements of Apple and Amazon highlight the complex interplay of company-specific factors and broader market dynamics. While Apple’s decline can be attributed to conservative guidance, supply chain issues, and macroeconomic pressures, Amazon’s rise is driven by strong financial performance, strategic investments, and a diversified business model. As investors continue to navigate this mixed stock performance, the comparative analysis of Apple and Amazon serves as a valuable lens through which to understand the evolving landscape of the technology sector.

Economic Indicators: Understanding Their Impact on Tech Stocks

In the ever-evolving landscape of the stock market, economic indicators play a crucial role in shaping investor sentiment and influencing the performance of tech stocks. Recently, the market has witnessed a mixed performance, with Apple experiencing a decline while Amazon has seen a rise. Understanding the impact of economic indicators on these tech giants can provide valuable insights into the broader market dynamics.

Economic indicators, such as GDP growth rates, unemployment figures, and consumer confidence indices, serve as barometers of the overall health of the economy. These indicators can significantly affect tech stocks, which are often sensitive to changes in economic conditions. For instance, a robust GDP growth rate typically signals a healthy economy, which can boost consumer spending and, in turn, benefit companies like Apple and Amazon that rely heavily on consumer demand.

However, the recent decline in Apple’s stock can be attributed to several factors, including concerns over supply chain disruptions and regulatory challenges. These issues have been exacerbated by economic indicators pointing to potential slowdowns in key markets. For example, rising inflation rates have led to increased production costs, which can squeeze profit margins for tech companies. Additionally, regulatory pressures, particularly in international markets, have raised concerns about Apple’s ability to maintain its growth trajectory.

On the other hand, Amazon’s stock has risen, reflecting its resilience and adaptability in the face of economic challenges. The company’s diverse business model, which includes e-commerce, cloud computing, and digital advertising, has allowed it to capitalize on various economic trends. For instance, the shift towards online shopping, accelerated by the pandemic, has continued to bolster Amazon’s e-commerce segment. Moreover, the growing demand for cloud services has provided a steady revenue stream, insulating Amazon from some of the economic headwinds affecting other tech companies.

Transitioning to the broader market context, it is essential to consider how these economic indicators interact with investor expectations. Market participants often anticipate future economic conditions and adjust their investment strategies accordingly. For example, if investors expect interest rates to rise, they may shift their portfolios away from tech stocks, which are typically more sensitive to interest rate changes. This shift can lead to fluctuations in stock prices, as seen in the recent mixed performance of Apple and Amazon.

Furthermore, geopolitical factors and global economic trends can also influence tech stocks. Trade tensions, for instance, can disrupt supply chains and impact the cost of goods sold by companies like Apple. Similarly, changes in foreign exchange rates can affect the profitability of tech companies with significant international operations. As such, investors must remain vigilant and consider a wide range of economic indicators when evaluating the potential performance of tech stocks.

In conclusion, the recent mixed performance of Apple and Amazon underscores the complex interplay between economic indicators and tech stock valuations. While Apple’s decline highlights the challenges posed by supply chain disruptions and regulatory pressures, Amazon’s rise demonstrates the importance of a diversified business model in navigating economic uncertainties. By closely monitoring economic indicators and understanding their implications, investors can make more informed decisions and better navigate the dynamic landscape of tech stocks.

Q&A

1. **Question:** What was the overall trend in the stock market during the update?

**Answer:** The stock market experienced mixed performance.

2. **Question:** How did Apple’s stock perform in the market update?

**Answer:** Apple’s stock declined.

3. **Question:** What was the performance of Amazon’s stock in the market update?

**Answer:** Amazon’s stock rose.

4. **Question:** Were there any notable sectors that influenced the mixed stock performance?

**Answer:** The update does not specify particular sectors, but mixed performance often involves varied sector influences.

5. **Question:** Did any external factors contribute to Apple’s stock decline?

**Answer:** The update does not provide specific reasons for Apple’s stock decline.

6. **Question:** Was there any specific news or event that led to Amazon’s stock rise?

**Answer:** The update does not mention specific news or events for Amazon’s stock rise.

7. **Question:** How did the mixed stock performance affect investor sentiment?

**Answer:** The update does not detail investor sentiment, but mixed performance typically leads to cautious or varied investor reactions.

Conclusion

In the latest market update, Apple experienced a decline in its stock value, while Amazon saw an increase, reflecting a mixed performance across the stock market. This divergence highlights the varying investor sentiment and market dynamics affecting individual companies. Apple’s decline could be attributed to factors such as supply chain challenges, competitive pressures, or recent earnings reports that did not meet expectations. Conversely, Amazon’s rise might be driven by strong sales performance, positive growth forecasts, or strategic business developments. Overall, the mixed stock performance underscores the importance of analyzing company-specific factors and broader market trends when assessing investment opportunities.