“Stocks Surge as Oil Slips: A Promising Start to the Week”

Introduction

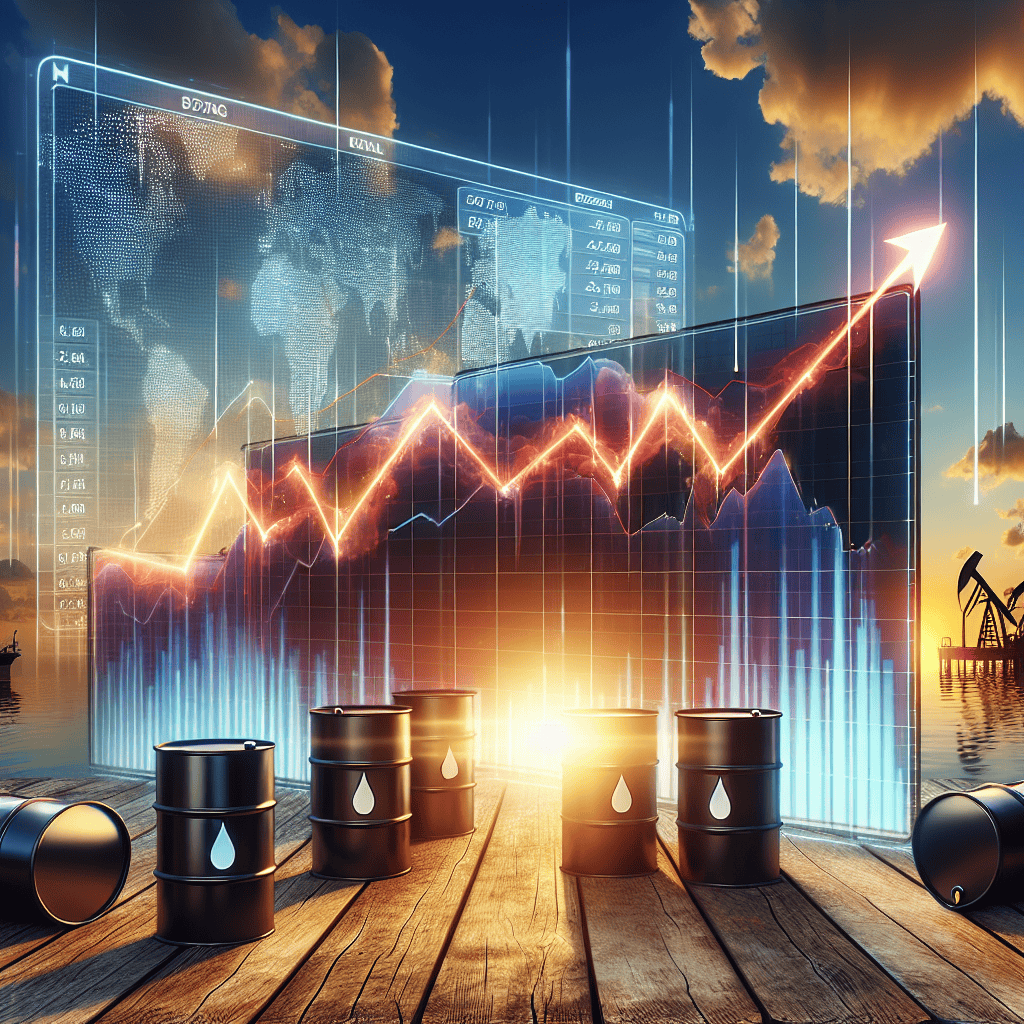

At the start of the week, global financial markets experienced a notable shift as stock indices climbed, buoyed by a significant drop in oil prices. This development provided a sense of relief to investors who have been navigating a landscape marked by economic uncertainty and fluctuating commodity prices. The decline in oil prices, driven by a combination of increased supply and easing geopolitical tensions, has alleviated some inflationary pressures, offering a more favorable environment for equities. As a result, major stock markets across the world have responded positively, with gains observed in various sectors, particularly those sensitive to energy costs. This market overview delves into the factors contributing to the rise in stock prices and the implications of falling oil prices on the broader economic outlook.

Impact Of Oil Price Fluctuations On Stock Markets

At the start of the week, global stock markets experienced a notable rise, largely attributed to a significant drop in oil prices. This development has sparked discussions among investors and analysts about the intricate relationship between oil price fluctuations and stock market performance. Understanding this dynamic is crucial, as it provides insights into broader economic trends and investor sentiment.

Oil prices are a critical component of the global economy, influencing various sectors and industries. When oil prices decrease, it often leads to reduced costs for businesses, particularly those heavily reliant on energy, such as transportation and manufacturing. Consequently, lower operational costs can translate into higher profit margins, which tend to boost investor confidence and drive stock prices upward. This positive sentiment was evident at the week’s start, as investors reacted to the decline in oil prices by increasing their stock holdings, thereby pushing market indices higher.

Moreover, the drop in oil prices can also have a direct impact on consumer behavior. Lower energy costs often result in decreased prices for goods and services, effectively increasing consumers’ disposable income. This increase in purchasing power can stimulate consumer spending, which is a significant driver of economic growth. As consumer spending rises, companies across various sectors may experience increased sales and revenue, further enhancing their stock performance. Thus, the interplay between oil prices and consumer behavior is a critical factor in understanding stock market movements.

However, it is essential to consider the broader economic context when analyzing the impact of oil price fluctuations on stock markets. While lower oil prices can benefit certain sectors, they can also pose challenges for others, particularly the energy sector itself. Companies involved in oil exploration, production, and refining may face reduced revenues and profitability when oil prices decline. This can lead to a decrease in their stock valuations, potentially offsetting gains in other sectors. Therefore, the overall impact on the stock market depends on the balance between these opposing forces.

In addition to sector-specific effects, oil price fluctuations can also influence monetary policy decisions by central banks. For instance, a sustained drop in oil prices may lead to lower inflation rates, which could prompt central banks to adjust interest rates. Lower interest rates generally encourage borrowing and investment, providing further support to stock markets. Conversely, if oil prices were to rise sharply, central banks might consider tightening monetary policy to curb inflation, which could have a dampening effect on stock market performance.

Furthermore, geopolitical factors often play a significant role in oil price movements, adding another layer of complexity to the relationship between oil prices and stock markets. Political instability in major oil-producing regions can lead to supply disruptions, causing oil prices to spike. Such events can create uncertainty in financial markets, leading to increased volatility and risk aversion among investors. Therefore, keeping an eye on geopolitical developments is crucial for understanding potential shifts in oil prices and their subsequent impact on stock markets.

In conclusion, the recent rise in stock markets at the week’s start, driven by a drop in oil prices, underscores the multifaceted relationship between these two economic indicators. While lower oil prices can boost certain sectors and enhance consumer spending, they can also pose challenges for the energy sector and influence monetary policy decisions. As such, investors must consider a range of factors, including sector-specific impacts, monetary policy, and geopolitical developments, to fully grasp the implications of oil price fluctuations on stock market performance.

Analyzing The Correlation Between Energy Prices And Market Trends

At the start of the week, financial markets experienced a notable upswing as stock prices rose in response to a decline in oil prices. This development has once again highlighted the intricate relationship between energy prices and broader market trends. Understanding this correlation is crucial for investors and analysts alike, as fluctuations in energy prices can have far-reaching implications for various sectors and the overall economy.

To begin with, the price of oil is a significant determinant of economic activity, given its role as a primary energy source. When oil prices drop, it often leads to reduced costs for businesses, particularly those in energy-intensive industries such as manufacturing and transportation. This reduction in operational costs can enhance profit margins, thereby boosting investor confidence and driving stock prices upward. Consequently, the recent decline in oil prices has been met with optimism in the stock market, as investors anticipate improved corporate earnings and economic growth.

Moreover, lower oil prices can also lead to increased consumer spending. As energy costs decrease, consumers may find themselves with more disposable income, which can be redirected towards other goods and services. This uptick in consumer spending can stimulate economic activity, further supporting stock market gains. In this context, the current rise in stock prices can be seen as a reflection of positive market sentiment, driven by expectations of heightened consumer demand and economic expansion.

However, it is important to consider the broader implications of falling oil prices on the energy sector itself. While lower prices can benefit consumers and certain industries, they can pose challenges for oil producers and related businesses. Companies involved in oil extraction and production may face reduced revenues, leading to potential cutbacks in investment and employment. This dynamic can create a complex interplay between different sectors, as gains in some areas may be offset by losses in others.

In addition to these direct effects, the correlation between energy prices and market trends is also influenced by geopolitical factors. Oil prices are often subject to volatility due to geopolitical tensions, supply disruptions, and changes in production levels by major oil-producing countries. These factors can introduce uncertainty into the market, affecting investor sentiment and leading to fluctuations in stock prices. Therefore, while the current decline in oil prices has been beneficial for stocks, it is essential to remain vigilant about potential geopolitical developments that could alter this trend.

Furthermore, the relationship between energy prices and market trends is not static and can evolve over time. Technological advancements, shifts in energy policy, and changes in consumer behavior can all impact this correlation. For instance, the growing emphasis on renewable energy sources and sustainability may alter the traditional dynamics between oil prices and market performance. As the global energy landscape continues to evolve, investors and analysts must adapt their strategies to account for these changes.

In conclusion, the recent rise in stock prices, driven by a drop in oil prices, underscores the complex and multifaceted relationship between energy prices and market trends. While lower oil prices can stimulate economic activity and boost investor confidence, they also present challenges for the energy sector and are subject to geopolitical influences. As the global economy continues to navigate these dynamics, understanding the interplay between energy prices and market trends remains a critical task for stakeholders across the financial landscape.

How Falling Oil Prices Influence Investor Sentiment

At the start of the week, global stock markets experienced a notable uptick, largely driven by a significant drop in oil prices. This development has sparked a wave of optimism among investors, who are keenly aware of the intricate relationship between oil prices and broader economic indicators. As oil prices decline, the cost of energy for businesses and consumers alike tends to decrease, which can lead to increased disposable income and higher profit margins for companies. Consequently, this scenario often results in a more favorable environment for equities, as investors anticipate improved corporate earnings and enhanced consumer spending.

The decline in oil prices can be attributed to several factors, including increased production, geopolitical developments, and shifts in global demand. When oil supply outpaces demand, prices naturally tend to fall, creating a ripple effect across various sectors of the economy. For instance, transportation and manufacturing industries, which are heavily reliant on oil, often benefit from reduced operational costs. This, in turn, can lead to higher stock valuations as investors adjust their expectations for future profitability.

Moreover, falling oil prices can also have a dampening effect on inflationary pressures. As energy costs constitute a significant portion of the consumer price index, a decrease in oil prices can help keep inflation in check. This is particularly important for central banks, which may be more inclined to maintain or even lower interest rates in a low-inflation environment. Lower interest rates generally make borrowing more attractive for businesses and consumers, potentially stimulating economic activity and further boosting investor confidence.

In addition to these economic implications, the psychological impact of falling oil prices on investor sentiment should not be underestimated. Investors often perceive lower oil prices as a sign of economic stability, as they suggest that supply chains are functioning efficiently and that geopolitical tensions are not significantly disrupting markets. This perception can lead to increased risk-taking behavior, with investors more willing to allocate capital to equities and other riskier assets.

However, it is important to note that the relationship between oil prices and stock markets is not always straightforward. While lower oil prices can be beneficial for many sectors, they can also pose challenges for oil-dependent industries and economies. For example, energy companies may face reduced revenues and profits, leading to potential job losses and decreased investment in the sector. Similarly, countries that rely heavily on oil exports may experience economic strain, which could have broader implications for global trade and financial markets.

Despite these potential drawbacks, the current decline in oil prices appears to be providing a net positive boost to investor sentiment. As markets continue to react to this development, it will be crucial for investors to remain vigilant and consider the broader economic context. While the immediate impact of falling oil prices may be favorable, longer-term trends and potential volatility in the energy sector should not be overlooked.

In conclusion, the recent drop in oil prices has played a significant role in lifting stock markets at the start of the week. By reducing costs for businesses and consumers, alleviating inflationary pressures, and fostering a sense of economic stability, lower oil prices have contributed to a more optimistic outlook among investors. As the situation evolves, it will be essential for market participants to carefully assess the ongoing interplay between oil prices and broader economic dynamics to make informed investment decisions.

Sector Performance: Winners And Losers In A Declining Oil Market

As the week commenced, financial markets witnessed a notable shift, with stocks experiencing an upswing while oil prices took a downward turn. This dynamic interplay between the stock market and the oil sector has led to varied performances across different sectors, highlighting both winners and losers in the current economic landscape. Understanding these movements requires a closer examination of the factors influencing sector performance and the broader implications for investors.

The decline in oil prices, primarily driven by increased supply and concerns over global demand, has had a profound impact on energy stocks. Companies heavily reliant on oil production and exploration have faced significant headwinds, as reduced oil prices directly affect their revenue streams. Consequently, the energy sector has emerged as one of the primary losers in this declining oil market. Major oil companies have seen their stock values dip, reflecting investor apprehension about future profitability. This downturn has prompted some firms to reassess their strategies, focusing on cost-cutting measures and diversifying their energy portfolios to mitigate risks associated with volatile oil prices.

Conversely, sectors that benefit from lower oil prices have experienced a surge in performance. The transportation industry, for instance, stands out as a clear winner. Airlines, shipping companies, and logistics firms have all reaped the benefits of reduced fuel costs, which constitute a significant portion of their operating expenses. As a result, these companies have reported improved profit margins, leading to increased investor confidence and a rise in stock prices. This positive trend underscores the interconnectedness of global markets, where fluctuations in one sector can have ripple effects across others.

Moreover, the consumer discretionary sector has also gained traction amid declining oil prices. With lower fuel costs, consumers have more disposable income, which often translates into increased spending on non-essential goods and services. Retailers, restaurants, and entertainment companies have capitalized on this trend, reporting higher sales figures and enhanced market performance. This sector’s resilience in the face of fluctuating oil prices highlights the adaptability of businesses that can swiftly respond to changing economic conditions.

In addition to these sector-specific impacts, the broader stock market has responded positively to the drop in oil prices. Lower energy costs can lead to reduced inflationary pressures, providing central banks with more flexibility in their monetary policies. This environment is conducive to economic growth, as it encourages consumer spending and business investment. Consequently, investor sentiment has improved, driving stock indices higher and fostering a sense of optimism in the market.

However, it is essential to recognize that the relationship between oil prices and market performance is complex and multifaceted. While some sectors thrive in a low oil price environment, others face challenges that require strategic adjustments. Investors must remain vigilant, considering both short-term gains and long-term implications when making investment decisions. Diversification across sectors can help mitigate risks associated with volatile commodity prices, ensuring a balanced portfolio that can weather market fluctuations.

In conclusion, the recent rise in stocks amid declining oil prices has underscored the intricate dynamics of sector performance in today’s global economy. While energy companies grapple with the challenges posed by lower oil prices, industries such as transportation and consumer discretionary have emerged as beneficiaries. As markets continue to evolve, understanding these sectoral shifts will be crucial for investors seeking to navigate the complexities of the financial landscape.

Global Economic Implications Of Dropping Oil Prices

As the week commenced, global markets experienced a notable upswing, primarily driven by a significant drop in oil prices. This development has sparked a wave of optimism among investors, who are now recalibrating their expectations for economic growth and inflation. The decline in oil prices, often seen as a barometer for global economic health, carries profound implications for various sectors and economies worldwide. Understanding these implications requires a nuanced examination of the interconnectedness of global markets and the role of oil as a critical economic driver.

Firstly, the reduction in oil prices can be attributed to a combination of factors, including increased production, geopolitical developments, and shifts in demand. As oil prices fall, transportation and manufacturing costs decrease, providing a much-needed respite for industries heavily reliant on energy. This, in turn, can lead to lower consumer prices, potentially boosting consumer spending and stimulating economic growth. For countries that are net importers of oil, the drop in prices can improve trade balances and reduce inflationary pressures, allowing central banks more flexibility in their monetary policies.

Moreover, the decline in oil prices has a direct impact on inflation rates, which have been a significant concern for policymakers globally. Lower energy costs contribute to a decrease in overall inflation, easing the burden on consumers and businesses alike. This development is particularly beneficial for emerging markets, where inflation has been a persistent challenge. By alleviating inflationary pressures, these countries can focus on fostering economic stability and growth, attracting foreign investment, and enhancing their competitiveness in the global market.

However, the implications of falling oil prices are not universally positive. For oil-exporting nations, the decline in revenue can pose significant economic challenges. These countries often rely heavily on oil exports to fund government budgets and social programs. A sustained drop in oil prices can lead to budget deficits, forcing these nations to cut spending or seek alternative revenue sources. This situation can create economic instability and social unrest, particularly in regions where oil is a primary economic driver.

In addition to the direct economic effects, the drop in oil prices also influences global financial markets. As investors anticipate lower inflation and improved economic conditions, stock markets tend to rise, reflecting increased confidence in future growth prospects. This positive sentiment can lead to higher investment levels, further fueling economic expansion. However, the volatility in oil prices can also introduce uncertainty, prompting investors to remain cautious and vigilant in their decision-making processes.

Furthermore, the environmental implications of fluctuating oil prices cannot be overlooked. Lower prices may reduce the urgency for transitioning to renewable energy sources, as cheaper fossil fuels become more attractive. This could potentially slow down efforts to combat climate change and delay the adoption of sustainable energy solutions. Policymakers must balance the short-term economic benefits of lower oil prices with the long-term goal of achieving a sustainable energy future.

In conclusion, the recent drop in oil prices has set off a chain reaction across global markets, influencing economic growth, inflation, and investment dynamics. While the immediate effects appear positive for many economies, particularly those that are net importers of oil, the broader implications are complex and multifaceted. As the global economy continues to navigate these changes, stakeholders must remain vigilant and adaptable, ensuring that short-term gains do not overshadow long-term sustainability and stability.

Strategies For Investors In Volatile Energy Markets

As the week commenced, investors observed a notable rise in stock markets, coinciding with a decline in oil prices. This development has prompted a reassessment of strategies for navigating the often volatile energy markets. Understanding the dynamics at play is crucial for investors seeking to optimize their portfolios amidst fluctuating energy prices. The interplay between stock performance and oil prices is a complex one, influenced by a myriad of factors ranging from geopolitical tensions to shifts in global demand and supply. Consequently, investors must remain vigilant and adaptable, employing strategies that account for both immediate market conditions and long-term trends.

One effective approach for investors is diversification, which serves as a buffer against the inherent volatility of energy markets. By spreading investments across various sectors, investors can mitigate the risks associated with sudden price swings in oil and other energy commodities. This strategy not only reduces exposure to any single market but also allows investors to capitalize on growth opportunities in other areas, such as technology or healthcare, which may not be directly impacted by energy price fluctuations. Moreover, diversification can be achieved not only across sectors but also geographically, thereby further insulating portfolios from region-specific disruptions.

In addition to diversification, investors should consider the role of hedging as a protective measure. Hedging involves taking positions in financial instruments that offset potential losses in the energy sector. For instance, options and futures contracts can be utilized to lock in prices or speculate on future movements, providing a degree of certainty in an otherwise unpredictable market. While hedging can be complex and may require a sophisticated understanding of financial markets, it offers a valuable tool for managing risk and ensuring portfolio stability.

Furthermore, staying informed about macroeconomic indicators and geopolitical developments is essential for investors in the energy sector. Changes in government policies, international relations, and economic forecasts can have profound effects on oil prices and, by extension, stock market performance. By keeping abreast of these factors, investors can make more informed decisions and adjust their strategies accordingly. This proactive approach not only enhances the ability to anticipate market shifts but also positions investors to take advantage of emerging opportunities.

Another strategy worth considering is the integration of sustainable and renewable energy investments into traditional portfolios. As the global economy increasingly shifts towards cleaner energy sources, investments in renewable energy companies and technologies offer promising growth potential. This transition is driven by both regulatory pressures and consumer demand for environmentally friendly alternatives, making it a compelling area for long-term investment. By incorporating sustainable energy assets, investors can align their portfolios with future market trends while also contributing to broader environmental goals.

In conclusion, the recent rise in stock markets amidst declining oil prices underscores the need for strategic planning in volatile energy markets. Through diversification, hedging, staying informed, and embracing sustainable investments, investors can navigate the complexities of the energy sector with greater confidence. As the landscape continues to evolve, these strategies will remain vital in ensuring that portfolios are resilient and well-positioned to capitalize on both current and future market dynamics. By adopting a comprehensive and adaptable approach, investors can effectively manage risk and seize opportunities in an ever-changing financial environment.

Historical Perspectives: Stock Market Reactions To Oil Price Changes

The relationship between stock markets and oil prices has long been a subject of interest for economists and investors alike. Historically, fluctuations in oil prices have had significant impacts on stock markets, often serving as a barometer for broader economic conditions. As stocks rise at the start of this week, coinciding with a drop in oil prices, it is worthwhile to explore how these two variables have interacted over time and what this might mean for future market behavior.

To begin with, it is essential to understand the fundamental reasons why oil prices influence stock markets. Oil is a critical input for a wide range of industries, from transportation to manufacturing. Consequently, changes in oil prices can affect corporate profitability, consumer spending, and inflation rates. When oil prices fall, as they have at the start of this week, it often leads to lower production costs for companies, potentially boosting profit margins. This can result in increased investor confidence, driving stock prices higher. Conversely, when oil prices rise, companies may face higher costs, which can squeeze profit margins and lead to a decline in stock prices.

Historically, the stock market’s reaction to changes in oil prices has varied depending on the broader economic context. For instance, during periods of economic expansion, a drop in oil prices is typically viewed positively by investors, as it can enhance economic growth by reducing costs for businesses and consumers. This was evident in the late 1990s and early 2000s when declining oil prices coincided with robust economic growth and rising stock markets. On the other hand, during times of economic uncertainty or recession, falling oil prices can be interpreted as a sign of weak demand, which may lead to concerns about the health of the global economy and result in stock market volatility.

Moreover, the impact of oil price changes on stock markets can also be influenced by geopolitical factors. For example, geopolitical tensions in oil-producing regions can lead to supply disruptions, causing oil prices to spike. Such events can create uncertainty in financial markets, leading to increased volatility and risk aversion among investors. Conversely, when geopolitical tensions ease, and oil prices stabilize or decline, it can restore investor confidence and contribute to a rally in stock markets.

In recent years, the relationship between oil prices and stock markets has been further complicated by the rise of alternative energy sources and changing consumer preferences. As the world transitions towards cleaner energy, the traditional link between oil prices and economic activity may weaken. However, for the time being, oil remains a crucial component of the global economy, and its price movements continue to have significant implications for stock markets.

In conclusion, the historical relationship between stock markets and oil prices is complex and multifaceted. While falling oil prices at the start of this week have contributed to a rise in stock markets, it is important to consider the broader economic and geopolitical context when interpreting these movements. As the global economy continues to evolve, the dynamics between oil prices and stock markets may change, but for now, they remain closely intertwined. Understanding this relationship can provide valuable insights for investors seeking to navigate the ever-changing landscape of financial markets.

Q&A

1. **Question:** What was the general trend in the stock market at the start of the week?

– **Answer:** Stocks rose at the start of the week.

2. **Question:** What happened to oil prices at the beginning of the week?

– **Answer:** Oil prices dropped at the beginning of the week.

3. **Question:** How did the drop in oil prices affect investor sentiment?

– **Answer:** The drop in oil prices likely boosted investor sentiment, contributing to the rise in stocks.

4. **Question:** Which sectors might have benefited from the drop in oil prices?

– **Answer:** Sectors such as transportation and consumer goods might have benefited from the drop in oil prices.

5. **Question:** What external factors could have influenced the drop in oil prices?

– **Answer:** Factors such as increased oil supply, decreased demand, or geopolitical developments could have influenced the drop in oil prices.

6. **Question:** How do changes in oil prices typically impact inflation expectations?

– **Answer:** A drop in oil prices can lead to lower inflation expectations as energy costs decrease.

7. **Question:** What is a potential risk for the stock market if oil prices continue to drop?

– **Answer:** A potential risk is that prolonged low oil prices could negatively impact the energy sector, leading to job losses and reduced capital expenditure.

Conclusion

At the start of the week, stock markets experienced an upward trend, primarily driven by a decline in oil prices. This drop in oil prices likely alleviated concerns over inflationary pressures and operational costs for businesses, providing a boost to investor sentiment. As energy costs are a significant component of expenses for many industries, the reduction in oil prices can lead to improved profit margins and economic outlooks, thereby encouraging investment in equities. Consequently, the positive movement in stock markets reflects optimism about economic stability and growth prospects, as lower oil prices may contribute to increased consumer spending and business investment.