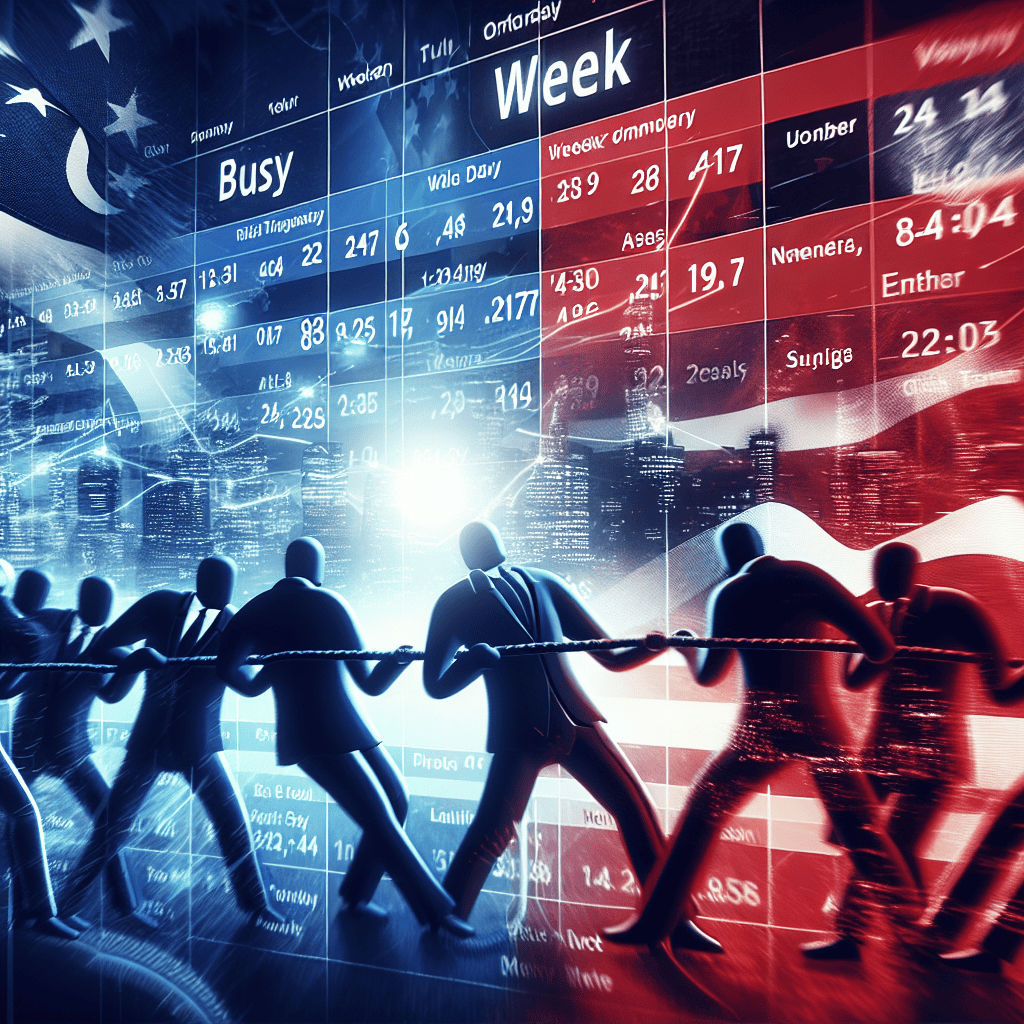

“Markets Brace for Impact: US Election Showdown Meets a Week of High Stakes”

Introduction

Markets are bracing for heightened volatility as the United States approaches a pivotal election showdown, set against a backdrop of a busy week filled with economic data releases and corporate earnings reports. Investors are closely monitoring the political landscape, aware that the election’s outcome could significantly influence fiscal policies, regulatory environments, and international trade relations. This anticipation is compounded by a flurry of economic indicators, including employment figures and inflation data, which are expected to provide further insights into the health of the U.S. economy. As companies continue to report their quarterly earnings, market participants are keenly assessing how businesses are navigating current economic challenges. The convergence of these factors is creating an atmosphere of uncertainty, prompting market strategists to advise caution while seeking opportunities amid potential market swings.

Impact Of US Election Showdown On Global Markets

As the United States approaches a pivotal election showdown, global markets are bracing for potential volatility and uncertainty. Investors worldwide are keenly observing the political landscape, understanding that the outcome could significantly influence economic policies, trade relations, and financial regulations. This anticipation is not merely speculative; historical precedents suggest that U.S. elections often have far-reaching implications on global markets, affecting everything from stock prices to currency valuations.

In the lead-up to the election, market participants are particularly focused on policy differences between the candidates, which could lead to shifts in economic strategies. For instance, differing approaches to taxation, government spending, and international trade agreements could either bolster or hinder economic growth, depending on the perspective. Consequently, investors are adjusting their portfolios to hedge against potential risks while positioning themselves to capitalize on opportunities that may arise post-election.

Moreover, the election’s impact is not confined to the United States alone. Given the interconnected nature of today’s global economy, changes in U.S. policy can ripple across borders, influencing markets in Europe, Asia, and beyond. For example, a shift in U.S. trade policy could alter supply chains, affecting manufacturing and export-driven economies worldwide. Similarly, changes in regulatory frameworks could impact multinational corporations, prompting them to reassess their global strategies.

In addition to policy considerations, the election’s outcome could also affect investor sentiment, which plays a crucial role in market dynamics. A clear and decisive result may instill confidence, encouraging investment and economic activity. Conversely, a contested or uncertain outcome could lead to heightened volatility, as investors grapple with the implications of prolonged political uncertainty. This sentiment-driven volatility can manifest in various ways, including fluctuations in stock indices, bond yields, and currency exchange rates.

Furthermore, the election coincides with a busy week for economic data releases and corporate earnings reports, adding another layer of complexity to the market landscape. Investors will be closely monitoring these indicators to gauge the health of the economy and the potential impact of election-related developments. For instance, strong corporate earnings could offset some of the uncertainty surrounding the election, providing a buffer for markets. On the other hand, disappointing economic data could exacerbate concerns, leading to increased market turbulence.

In this context, central banks and policymakers worldwide are also on high alert, ready to intervene if necessary to stabilize markets and support economic growth. The Federal Reserve, in particular, may play a pivotal role, as its monetary policy decisions could influence market reactions to the election outcome. Other central banks may also adjust their policies in response to shifts in global economic conditions, highlighting the interconnectedness of financial systems.

In conclusion, as the U.S. election showdown approaches, global markets are poised for a period of heightened uncertainty and potential volatility. Investors are carefully navigating this complex landscape, balancing the risks and opportunities associated with the election’s outcome. While the immediate impact may be uncertain, the long-term implications for global markets will depend on the policies and strategies implemented by the incoming administration. As such, market participants will continue to closely monitor political developments, economic indicators, and central bank actions in the weeks and months ahead.

Key Economic Indicators To Watch During Election Week

As the United States approaches a pivotal election week, market participants are bracing for a potential showdown that could significantly impact economic indicators. The anticipation surrounding the election is palpable, with investors keenly observing how political developments might influence financial markets. In this context, several key economic indicators are poised to play a crucial role in shaping market sentiment and guiding investment decisions.

To begin with, the labor market remains a focal point for analysts and investors alike. The release of the monthly employment report, which typically occurs around election week, will be scrutinized for insights into the health of the job market. A robust employment report could bolster confidence in the economy’s resilience, potentially offsetting any election-related uncertainties. Conversely, weaker-than-expected job growth might exacerbate concerns about economic stability, particularly if political tensions rise.

In addition to employment data, inflation figures are expected to garner significant attention. With inflationary pressures having been a persistent concern throughout the year, any new data on consumer prices will be critical. Investors will be eager to assess whether inflation is showing signs of moderation or if it continues to accelerate. This information will not only influence market expectations regarding future interest rate decisions by the Federal Reserve but also impact consumer sentiment and spending patterns.

Moreover, the release of GDP figures during this period will provide a comprehensive overview of the economy’s performance. As a broad measure of economic activity, GDP data will offer valuable insights into growth trends and potential vulnerabilities. A strong GDP reading could serve as a counterbalance to election-related volatility, while a weaker figure might amplify concerns about the economic outlook.

In the realm of monetary policy, the Federal Reserve’s actions and statements will be closely monitored. Any indications of shifts in policy direction, particularly in response to evolving economic conditions or political developments, could have far-reaching implications for financial markets. Investors will be particularly attentive to any signals regarding interest rate adjustments or changes in the Fed’s asset purchase programs, as these could influence borrowing costs and liquidity conditions.

Furthermore, consumer confidence indices released during election week will provide a snapshot of public sentiment. These indices are crucial for understanding how political events and economic conditions are affecting consumer behavior. A decline in consumer confidence could signal potential headwinds for retail sales and broader economic activity, while an uptick might suggest resilience in the face of uncertainty.

As election week unfolds, geopolitical developments and trade relations will also be in the spotlight. Any significant changes in international relations or trade policies could have immediate repercussions for global markets. Investors will be particularly vigilant for any announcements or developments that might alter the current trade landscape, as these could impact supply chains, corporate earnings, and overall market stability.

In conclusion, as the US election week approaches, market participants are preparing for a period of heightened volatility and uncertainty. By closely monitoring key economic indicators such as employment data, inflation figures, GDP readings, and consumer confidence indices, investors can gain valuable insights into the underlying health of the economy. Additionally, keeping an eye on Federal Reserve actions and geopolitical developments will be essential for navigating the complex landscape that lies ahead. As these factors converge, they will undoubtedly shape market dynamics and influence investment strategies in the weeks and months to come.

How Political Uncertainty Affects Investor Sentiment

As the United States approaches another pivotal election, the financial markets are bracing for a period of heightened volatility and uncertainty. Political events have long been recognized as significant influencers of investor sentiment, and the upcoming election is no exception. Investors are keenly aware that political uncertainty can lead to fluctuations in market confidence, affecting everything from stock prices to currency valuations. This week, in particular, is poised to be a busy one, with numerous economic indicators set to be released alongside the intensifying political discourse.

Political uncertainty often leads to increased market volatility as investors grapple with the potential implications of election outcomes. Historically, markets tend to react negatively to uncertainty, as it complicates the ability to forecast future economic policies and their impacts. For instance, changes in government leadership can lead to shifts in fiscal policy, regulatory environments, and international trade agreements. These potential changes create a cloud of uncertainty that can cause investors to adopt a more cautious approach, often resulting in reduced investment activity and increased demand for safe-haven assets such as gold and government bonds.

Moreover, the anticipation of an election showdown can exacerbate these effects. As political campaigns intensify, investors closely monitor candidates’ platforms and proposed policies, attempting to gauge their potential impact on various sectors. For example, a candidate advocating for increased regulation in the technology sector may cause tech stocks to experience heightened volatility. Similarly, discussions around healthcare reform can lead to fluctuations in the stock prices of pharmaceutical companies and healthcare providers. Thus, the political landscape becomes a critical factor in shaping investor sentiment and market dynamics.

In addition to the direct impact of political uncertainty, the current week presents a confluence of economic events that could further influence market behavior. Key economic indicators, such as employment data, inflation rates, and consumer confidence indices, are scheduled for release. These data points provide valuable insights into the health of the economy and can either mitigate or amplify the effects of political uncertainty. For instance, strong employment figures may bolster investor confidence, offsetting some of the apprehensions related to the election. Conversely, disappointing economic data could exacerbate concerns, leading to increased market volatility.

Furthermore, the global context cannot be ignored. The interconnectedness of global markets means that political developments in the United States can have far-reaching implications. International investors, who often view the US as a bellwether for global economic trends, may adjust their portfolios in response to perceived risks associated with the election. This can lead to fluctuations in foreign exchange markets and impact international trade dynamics. Consequently, the ripple effects of US political uncertainty are felt across the globe, influencing investor sentiment in diverse markets.

In conclusion, as the US election approaches, the interplay between political uncertainty and investor sentiment becomes increasingly pronounced. The anticipation of potential policy changes and their economic implications creates a complex environment for investors to navigate. This week, with its combination of political developments and key economic data releases, serves as a microcosm of the broader challenges faced by investors during election periods. As markets anticipate the election showdown, the delicate balance between political uncertainty and economic indicators will continue to shape investor sentiment and market behavior.

Strategies For Navigating Market Volatility During Elections

As the United States approaches another pivotal election, market participants are bracing for a period of heightened volatility. Historically, elections have been a source of uncertainty, and this year is no exception. Investors are keenly aware that political outcomes can significantly influence economic policies, regulatory environments, and international relations, all of which have direct implications for financial markets. Consequently, developing strategies to navigate this volatility is crucial for both individual and institutional investors.

One effective approach to managing market volatility during election periods is diversification. By spreading investments across various asset classes, sectors, and geographic regions, investors can mitigate the risks associated with any single political outcome. Diversification helps cushion portfolios against sharp declines in specific areas that may be adversely affected by election results. For instance, if a particular sector is expected to face regulatory challenges under a new administration, having exposure to other sectors can help offset potential losses.

In addition to diversification, maintaining a long-term perspective is essential. Elections, while impactful, are just one of many factors that influence market dynamics. Short-term market reactions can often be driven by emotion and speculation rather than fundamental changes in economic conditions. By focusing on long-term investment goals and maintaining a disciplined approach, investors can avoid making impulsive decisions based on temporary market fluctuations. This strategy not only helps in weathering the storm of election-induced volatility but also positions investors to capitalize on opportunities that may arise once the dust settles.

Moreover, staying informed about the potential policy changes associated with different election outcomes can provide a strategic advantage. Understanding the implications of proposed policies on various sectors and industries allows investors to make more informed decisions. For example, if a candidate is advocating for increased infrastructure spending, sectors such as construction and materials may benefit, presenting potential investment opportunities. Conversely, if there is a push for stricter regulations in a particular industry, investors might consider reducing exposure to that sector.

Another strategy involves the use of hedging techniques to protect portfolios from downside risk. Instruments such as options and futures can be employed to offset potential losses in the event of adverse market movements. While these tools can be complex and may not be suitable for all investors, they offer a way to manage risk during uncertain times. Consulting with financial advisors or investment professionals can help determine the appropriateness of these strategies based on individual risk tolerance and investment objectives.

Furthermore, maintaining liquidity in a portfolio can provide flexibility during volatile periods. Having a portion of assets in cash or cash-equivalents allows investors to take advantage of buying opportunities that may arise from market dislocations. This liquidity can also serve as a buffer against unforeseen expenses or financial needs, reducing the pressure to sell investments at inopportune times.

In conclusion, while elections inevitably introduce a degree of uncertainty into financial markets, adopting a strategic approach can help investors navigate this volatility effectively. By diversifying portfolios, maintaining a long-term perspective, staying informed about policy implications, utilizing hedging techniques, and ensuring liquidity, investors can position themselves to manage risks and seize opportunities. As the election showdown unfolds, these strategies will be invaluable in guiding investment decisions and achieving financial objectives amidst the market’s ebbs and flows.

Historical Market Reactions To US Elections

As the United States approaches another pivotal election, market participants are keenly observing historical patterns to anticipate potential market reactions. Historically, U.S. elections have been significant events for financial markets, often leading to increased volatility and shifts in investor sentiment. Understanding these historical market reactions can provide valuable insights into what might be expected in the upcoming election showdown.

Traditionally, U.S. elections have been characterized by heightened uncertainty, which tends to influence market behavior. In the months leading up to an election, markets often experience increased volatility as investors grapple with the potential implications of different electoral outcomes. This uncertainty is typically reflected in fluctuating stock prices, as market participants attempt to price in the possible policy changes that could arise from a new administration. For instance, during the 2016 presidential election, markets were initially volatile as investors reacted to the unexpected victory of Donald Trump, which led to a significant rally in the stock market in the weeks following the election.

Moreover, the impact of U.S. elections on markets is not limited to domestic equities. Global markets also tend to react to U.S. elections, given the country’s significant influence on the global economy. The interconnectedness of global financial systems means that changes in U.S. policy can have far-reaching effects, influencing everything from currency exchange rates to commodity prices. For example, the 2008 election, which resulted in the election of Barack Obama amid the global financial crisis, saw global markets respond positively to the prospect of economic recovery measures and regulatory reforms.

In addition to equities, other asset classes such as bonds and currencies also exhibit notable reactions to U.S. elections. The bond market, for instance, often reflects investor expectations regarding future interest rates and fiscal policies. During election periods, bond yields may fluctuate as investors adjust their portfolios in anticipation of potential changes in monetary policy. Similarly, currency markets can experience volatility as traders react to the perceived economic implications of different electoral outcomes. The U.S. dollar, being a global reserve currency, is particularly sensitive to shifts in investor sentiment during election periods.

Furthermore, it is important to consider the role of policy uncertainty in shaping market reactions to U.S. elections. Elections often bring about discussions on key policy areas such as taxation, healthcare, and trade, which can have significant implications for various sectors of the economy. Investors closely monitor candidates’ policy proposals and their potential impact on specific industries. For instance, sectors such as healthcare and energy are often particularly sensitive to election outcomes due to the potential for regulatory changes.

In conclusion, while historical market reactions to U.S. elections provide a framework for understanding potential market behavior, it is crucial to recognize that each election is unique, with its own set of circumstances and variables. As markets anticipate the upcoming U.S. election showdown amid a busy week, investors will likely continue to analyze historical patterns while remaining vigilant to new developments. By doing so, they aim to navigate the complexities of election-related market dynamics and make informed investment decisions. As always, the interplay between political events and market reactions underscores the importance of staying informed and adaptable in an ever-evolving financial landscape.

The Role Of Media In Shaping Market Expectations

As the United States approaches another pivotal election, the role of media in shaping market expectations has become increasingly significant. In a week bustling with economic data releases and corporate earnings reports, investors are keenly attuned to the narratives spun by various media outlets. The media’s influence on market sentiment is profound, as it not only informs but also interprets and sometimes amplifies the potential impacts of political developments on financial markets.

To begin with, media coverage provides investors with essential information about the political landscape, which is crucial for making informed decisions. News outlets offer insights into candidates’ policies, potential regulatory changes, and geopolitical implications, all of which can sway market dynamics. For instance, a candidate’s stance on taxation or trade can lead to anticipatory movements in stock prices, as investors adjust their portfolios in response to perceived risks or opportunities. Thus, the media serves as a conduit through which market participants receive and process information that could affect their investment strategies.

Moreover, the media plays a critical role in shaping public perception and, by extension, market expectations. Through editorials, opinion pieces, and expert analyses, media outlets can influence how investors interpret political events. This interpretative function is particularly evident during election cycles, where the framing of a candidate’s chances or the potential outcomes of an election can lead to significant market volatility. For example, if the media portrays an election as highly contentious or uncertain, it may heighten investor anxiety, leading to increased market fluctuations as traders seek to hedge against potential risks.

In addition to providing information and interpretation, the media also acts as a catalyst for market movements by amplifying certain narratives. In the age of digital media, where news spreads rapidly across platforms, the amplification effect can be swift and far-reaching. A single headline or breaking news alert can trigger a cascade of reactions in financial markets, as algorithms and high-frequency traders respond instantaneously to new information. This phenomenon underscores the power of media narratives in shaping market behavior, as even the perception of a political shift can lead to tangible financial consequences.

Furthermore, the media’s role in shaping market expectations is not limited to traditional news outlets. Social media platforms have emerged as influential players in the dissemination of information and the formation of market sentiment. Platforms like Twitter and Facebook allow for real-time updates and discussions, enabling investors to gauge public opinion and sentiment more dynamically. This democratization of information has added a new layer of complexity to how market expectations are formed, as investors must now consider a broader array of voices and perspectives.

In conclusion, as the US election showdown looms amid a busy week for markets, the media’s role in shaping market expectations is more crucial than ever. By providing information, interpreting political developments, and amplifying narratives, the media influences how investors perceive and react to the political landscape. As such, understanding the interplay between media coverage and market dynamics is essential for navigating the complexities of today’s financial environment. As investors brace for potential volatility, the media will undoubtedly continue to play a pivotal role in shaping the expectations and strategies of market participants.

Sector-Specific Impacts Of Election Outcomes On Markets

As the United States approaches another pivotal election, markets are bracing for potential shifts that could significantly impact various sectors. Investors are keenly aware that election outcomes can lead to policy changes, regulatory adjustments, and shifts in government spending priorities, all of which can have profound effects on market dynamics. Consequently, understanding the sector-specific impacts of these potential changes is crucial for stakeholders aiming to navigate the uncertain terrain ahead.

To begin with, the healthcare sector often finds itself at the center of election-related discussions. Depending on the political party that gains control, policies regarding healthcare reform, drug pricing, and insurance coverage could see substantial changes. A government favoring more regulation and public healthcare expansion might lead to increased scrutiny on pharmaceutical companies and healthcare providers, potentially affecting their profitability. Conversely, a more market-oriented approach could ease regulatory pressures, fostering a more favorable environment for innovation and growth within the sector.

Transitioning to the energy sector, the election outcomes could dictate the future of energy policy in the United States. A government prioritizing renewable energy and climate change initiatives might accelerate the transition towards sustainable energy sources, benefiting companies involved in solar, wind, and other renewable technologies. On the other hand, a focus on traditional energy sources such as oil and gas could bolster those industries, potentially leading to increased exploration and production activities. The direction of energy policy will not only influence domestic markets but also have global implications, given the United States’ significant role in the global energy landscape.

In the financial sector, regulatory frameworks are often subject to change following elections. A government inclined towards deregulation might ease restrictions on banks and financial institutions, potentially boosting their profitability and encouraging more aggressive lending practices. Conversely, a more regulatory-focused administration could impose stricter oversight, impacting the sector’s operational flexibility. Additionally, tax policies, which are often a focal point of election campaigns, can have direct implications for corporate earnings and investment strategies within the financial industry.

The technology sector, a significant driver of economic growth, also stands to be affected by election outcomes. Issues such as data privacy, antitrust regulations, and international trade policies are often influenced by the political landscape. A government advocating for stricter data protection laws and increased scrutiny of tech giants could lead to operational challenges for major technology firms. Conversely, policies promoting innovation and reducing trade barriers could enhance the sector’s growth prospects, particularly in emerging technologies such as artificial intelligence and 5G.

Moreover, the defense sector is closely tied to government spending priorities, which can shift dramatically based on election results. A government emphasizing national security and defense might increase military spending, benefiting defense contractors and related industries. Conversely, a focus on diplomatic solutions and reduced military engagement could lead to budget cuts, impacting the sector’s growth trajectory.

In conclusion, as markets anticipate the US election showdown, stakeholders across various sectors are preparing for potential shifts in policy and regulation that could reshape the economic landscape. By understanding the sector-specific impacts of election outcomes, investors and businesses can better position themselves to navigate the complexities of a post-election market environment. As the election draws nearer, the interplay between political developments and market reactions will undoubtedly remain a focal point for analysts and investors alike.

Q&A

1. **What are the key market concerns related to the US election showdown?**

– Investors are worried about potential volatility and uncertainty in financial markets due to contested election results or delayed outcomes.

2. **How might the election impact stock market performance?**

– Stock markets may experience fluctuations based on election outcomes, with sectors like healthcare, energy, and technology potentially being affected by policy changes.

3. **What role do economic indicators play during this busy week?**

– Economic indicators such as employment data, GDP growth, and consumer confidence reports can influence market sentiment and investor decisions.

4. **How are bond markets reacting to the election anticipation?**

– Bond markets may see changes in yields as investors seek safe-haven assets amid election uncertainty, impacting interest rates and borrowing costs.

5. **What strategies are investors using to navigate this period?**

– Investors might diversify portfolios, hedge against risks, or increase cash holdings to manage potential market volatility.

6. **How could international markets be affected by the US election?**

– Global markets may react to US election outcomes due to the interconnectedness of economies, with potential impacts on trade policies and international relations.

7. **What are analysts predicting for market trends post-election?**

– Analysts suggest that markets may stabilize once election results are clear, but long-term trends will depend on policy implementations and economic recovery efforts.

Conclusion

The anticipation of a US election showdown amid a busy week has created a climate of uncertainty and volatility in the markets. Investors are closely monitoring political developments, economic indicators, and corporate earnings reports to gauge potential impacts on financial markets. The heightened political tension and its implications for fiscal and regulatory policies are key factors influencing market sentiment. As a result, market participants are likely to adopt a cautious approach, balancing risk management with strategic positioning to navigate the complexities of this pivotal period.